Pro Tip: Listen to the podcast below and while you’re listening follow along with the charts below. Then, when you’re done, copy the  Scenario

Scenario

Welcome to the Real Estate Financial Planner™ Podcast. I am your host, James Orr. This is Episode 16.

Today we’re going to continue with  Norm and Norma’s

Norm and Norma’s

When we last left  Norm and Norma

Norm and Norma Norm

Norm

Surely, there must be a way to get the benefits of Nomading™ like the zero of small down payment or the significantly better owner-occupant interest rate without having to move into each property and live there for a year.

Well, there is sort a way. In order to get the better owner-occupant financing someone does need to be the owner-occupant, but it technically does not need to be you.

For example, if  Norm and Norma

Norm and Norma

When someone else is moving in on your behalf when Nomading™ we call this Nomad™ by Proxy.

So, if that were a possibility for  Norm and Norma

Norm and Norma

But, there are other variations of Nomad by Proxy™ that might be a possibility for them. For example, Norma’s parents who are divorced would be willing to move into properties.

Now, Norm, Norma and her parents would need to connect with their lender and work out how to structure these… it usually requires that Norm, Norma and the parent moving into the property all be on the title to the property. And, they’d also want to figure out who is responsible for down payment, how is ownership defined, what happens when one or more of them dies… basically, everything you’d need to negotiate in any partnership.

For the sake of  Norm and Norma

Norm and Norma

Remember,  Norm and Norma

Norm and Norma

And, since there is two of them, technically they can buy two in one year provided they have the down payment, closing costs, income and debt-to-income to be able to qualify to buy two.

If you really step back and think about it, with enough other people to move into properties for you, Nomad™ by Proxy can look like they’re investing in rental properties with putting just 5% down. They even get to “rent” the properties out in the first year to whoever is living in the property. In this case, Norma’s parents are paying what looks like rent to help cover the costs to own the property.

The reality of implementing it is much messier though: they’ll need to negotiate the terms of the partnership aspect of having someone co-purchase properties with them. Which, we cover in more detail in the Nomad™ by Proxy class.

Financial Independence

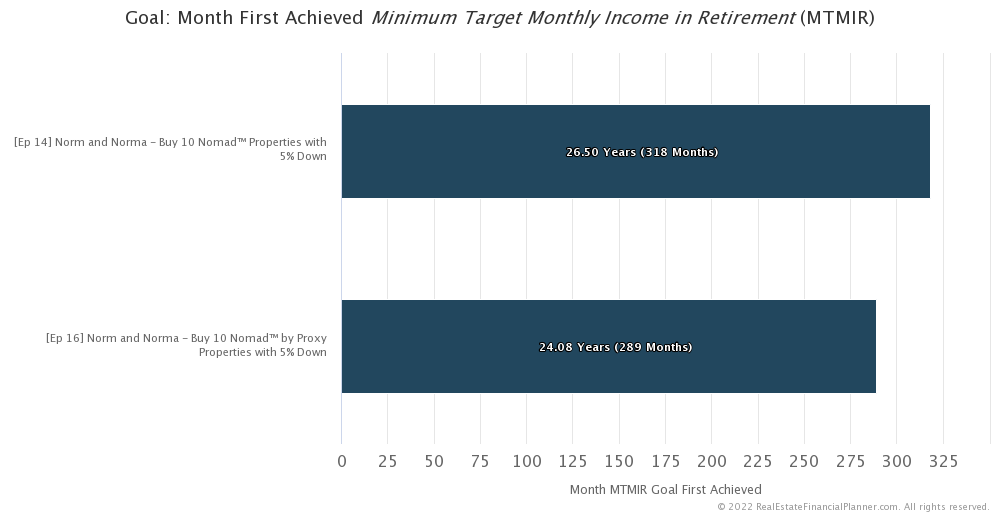

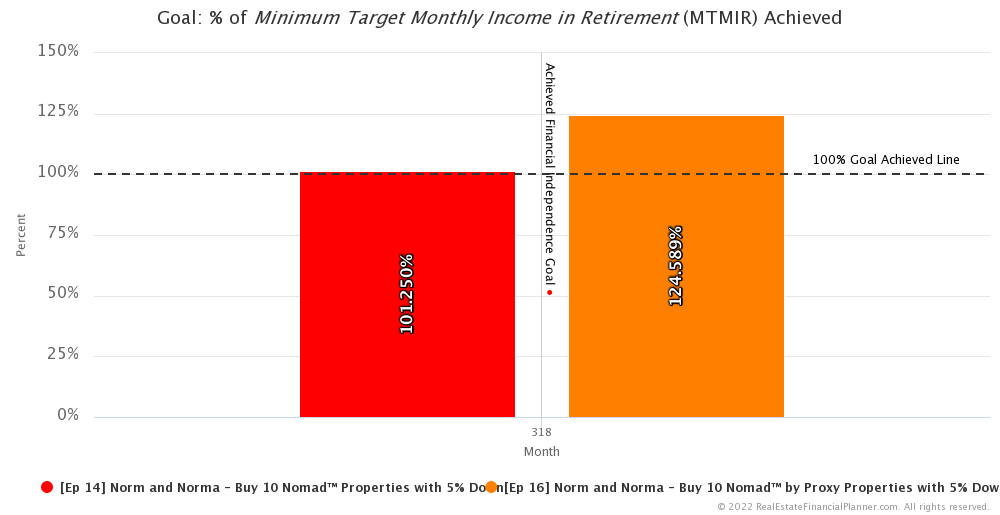

So, how does  Norm and Norma

Norm and Norma

It turns out that by having Norma’s parents move instead of  Norm and Norma

Norm and Norma

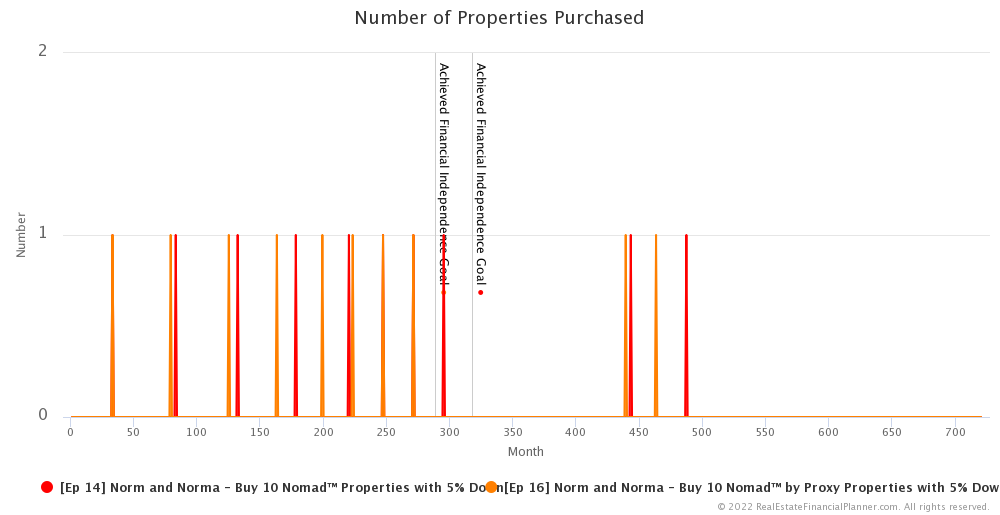

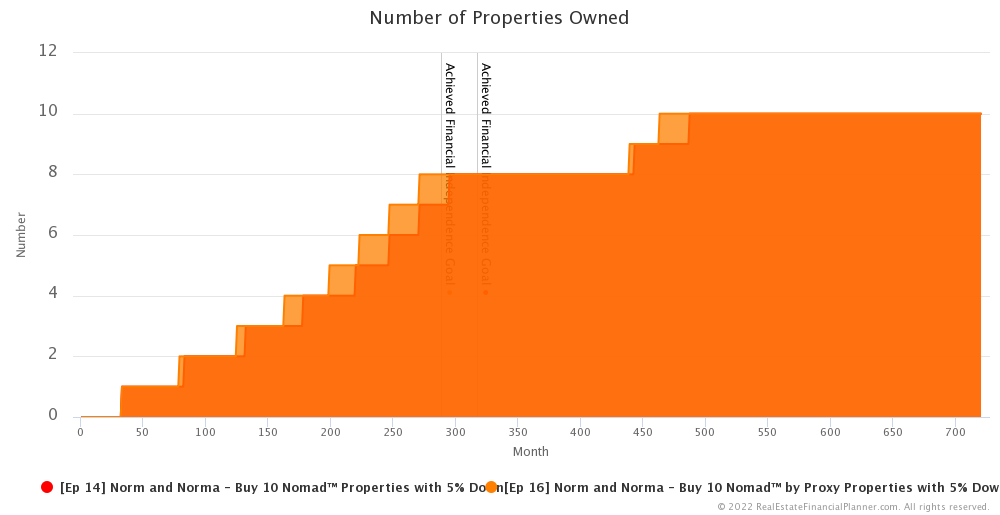

Properties Purchased

Part of what allows them to be financially independent faster is that they buy properties a little faster. They end up buying each property after the first one consistently a little faster.

One of the reasons they’re able to buy the properties a little faster is that they’re continuing to rent themselves. That means they’re saving a little bit more money each month when Nomading™ by Proxy.

Additionally, living in a rental with a slightly lower rent than what they’d be paying on a mortgage if they bought a property to live in also means their debt-to-income is a little better.

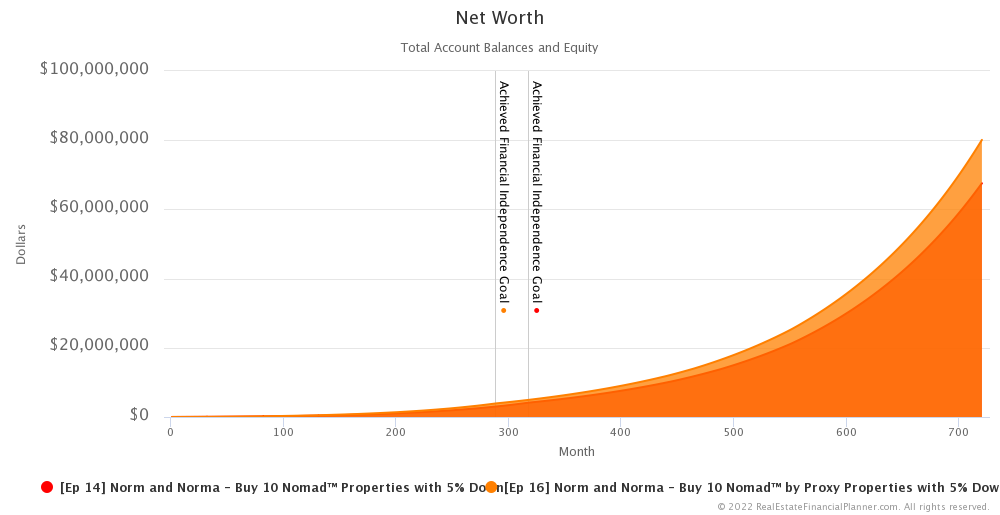

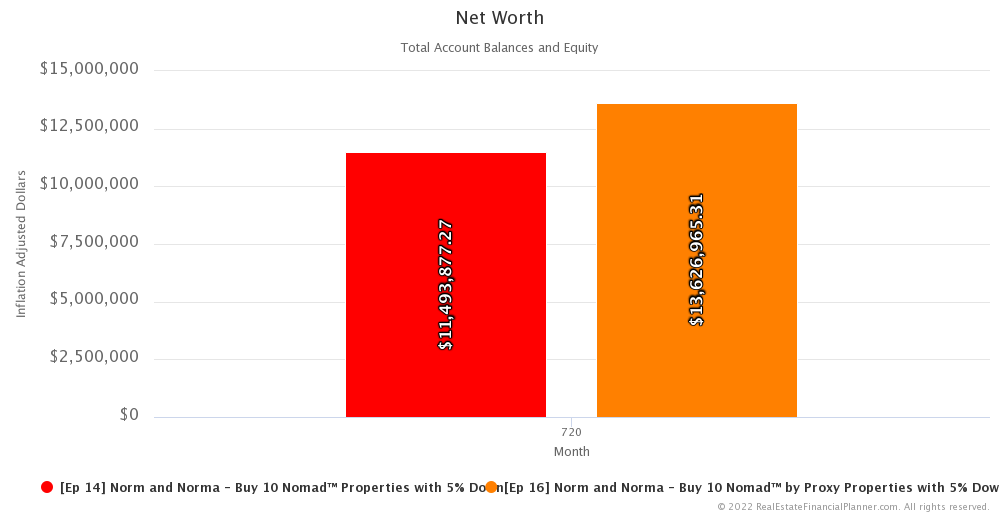

Net Worth

Buying properties faster also gives them a higher overall net worth. Of course, if they had to pay their proxy a fee or reduced rent or some other benefit, some of this additional net worth would disappear.

However, since it is Norma’s parents and their OK to do it without compensation to them in this unusually simplified example, they end up with over $80 million in net worth by year 60 compared to about $67.5 million as a traditional Nomad™.

That’s in inflated future dollars.

If we adjust back to today’s dollars, it is more like a difference of $2 million dollars. Still significant in my opinion. Instead of $13.6 million when they Nomad™ by Proxy they’d have a net worth of *only* $11.5 as a traditional Nomad™.

I emphasize “only” because I question when did creating a net worth of $11.5 million dollars on a combined income of $72,000 per year not become a huge victory?

Standard of Living

How does doing Nomad™ by Proxy impact their standard of living? Well, instead of living in a home they own, they’re still renting. But, otherwise, by month 318 when they achieved financial independence with traditional Nomad™, they be able to sustain a 25% higher standard of living by doing Nomad™ by Proxy instead.

Instead of living on about $5,000 per month, they could be living on about $6,250 per month in today’s dollars.

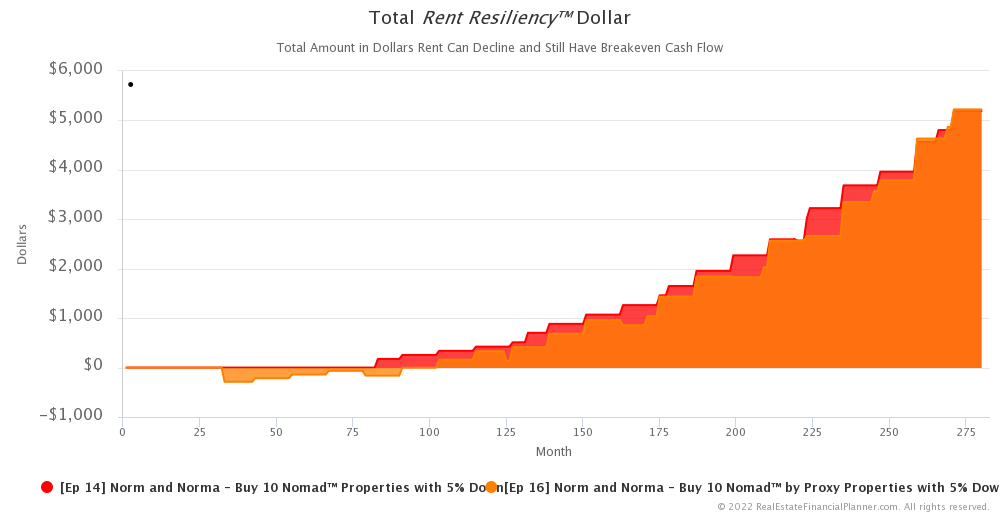

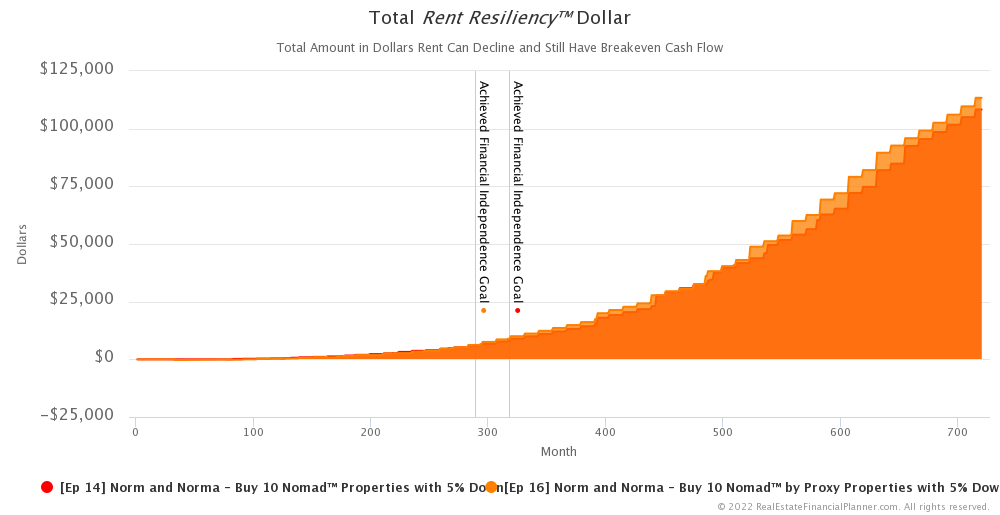

Rent Resiliency™

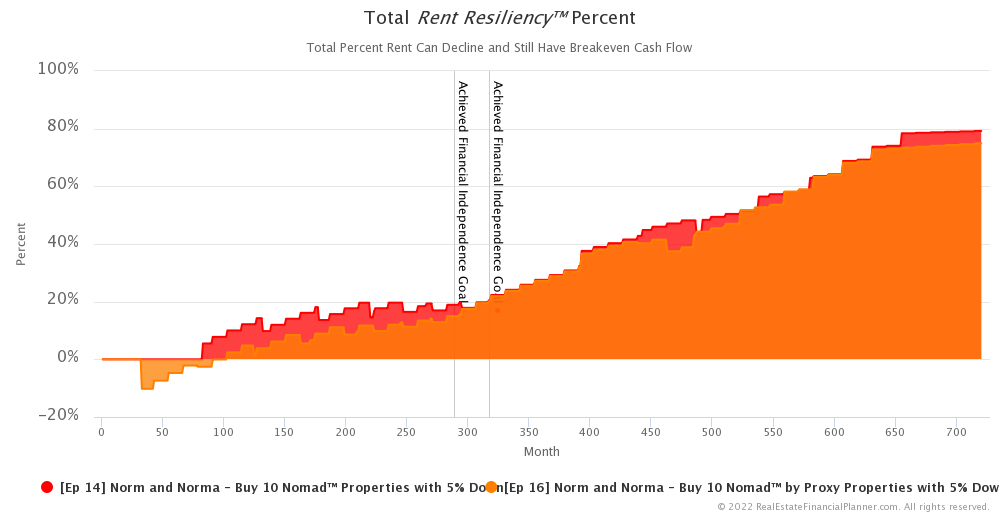

But what about measuring risk like Rent Resiliency™? In other words, how much can rent drop before they have negative cash flow?

Well, at first it is slightly riskier to do Nomad by Proxy™, but that’s because with traditional Nomad™ they live in the property for at least a year before it gets converted to a rental. So, they have at least a year to let rents creep up and that means that they’re slightly less likely to have negative cash flow.

However, because they acquire rentals a little faster, eventually they have more rentals and more positive cash flow sooner and that slightly improves their Rent Resiliency™ with Nomad™ by Proxy in terms of dollars.

In terms of what percent rents can decline before they have negative cash flow… what we call Rent Resiliency™ Percent, traditional Nomad™ is typically less risky.

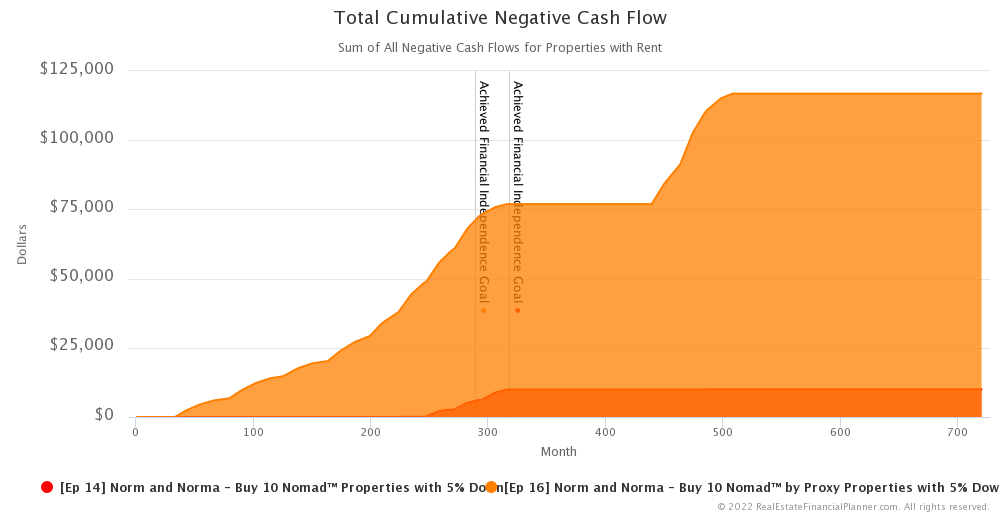

Negative Cash Flow

By renting properties the first year to Norma’s parents means they have more negative cash flow.

Compare that to living in the property for the first year with traditional Nomading™ where they get to wait at least a year for rents to improve slightly before they convert an owner-occupant property to a rental. That helps to eliminate some of the negative cash flow.

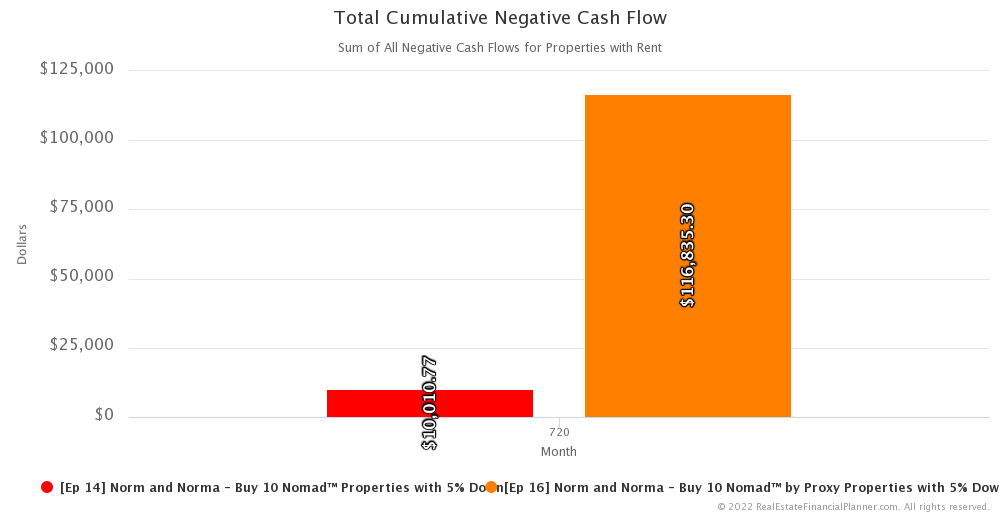

And the difference in negative cash flow adds up… they end up having almost $117,000 in negative cash flow when doing Nomad™ by Proxy compared to just over $10,000 with traditional Nomad™.

Now, I do need to point out that with Nomad™ by Proxy we’re talking about 10 rentals versus just 9 rentals with traditional Nomad™. That’s because with traditional Nomad™ for this particular set of modeling assumptions, they continue to live in the 10th property they bought. Of course, if  Norm and Norma

Norm and Norma

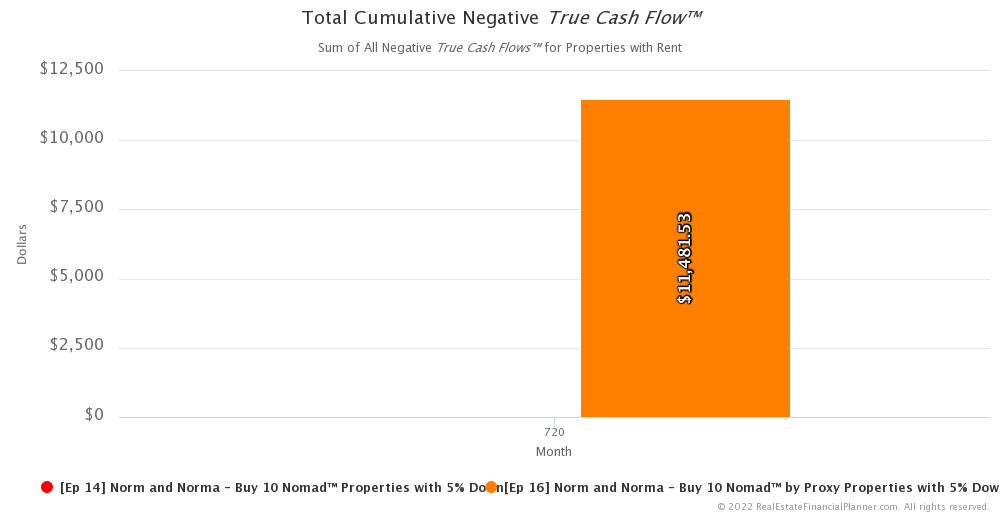

Total Cumulative Negative True Cash Flow™

If that negative $116,000 in negative cash flow scares you, realize that’s ignoring the tax benefits of depreciation.

If we take into account the Cash Flow from Depreciation™ as well when we calculate cash flow, we call that True Cash Flow™.

The total cumulative negative True Cash Flow™ for all rental properties is less than $12,000 when doing Nomad™ by Proxy. And, there is zero negative True Cash Flow™ for traditional Nomad™.

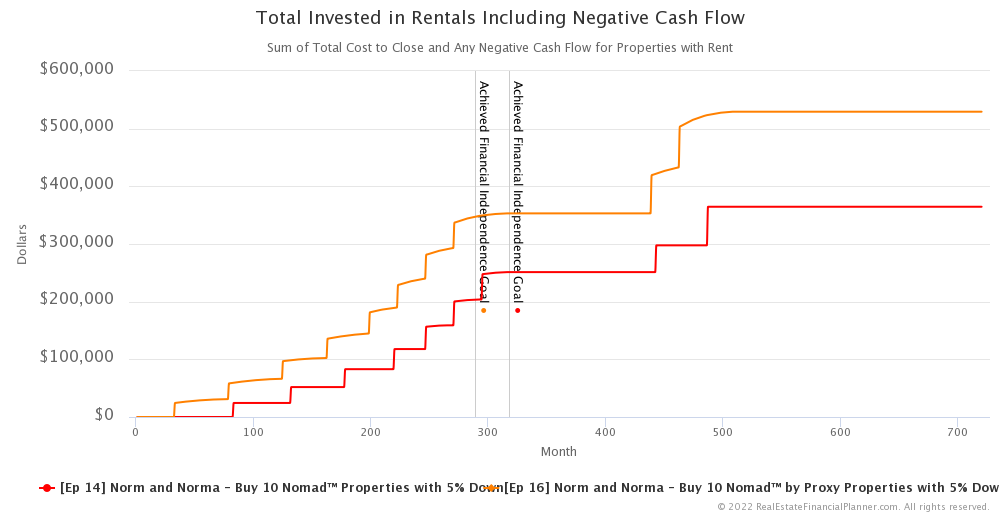

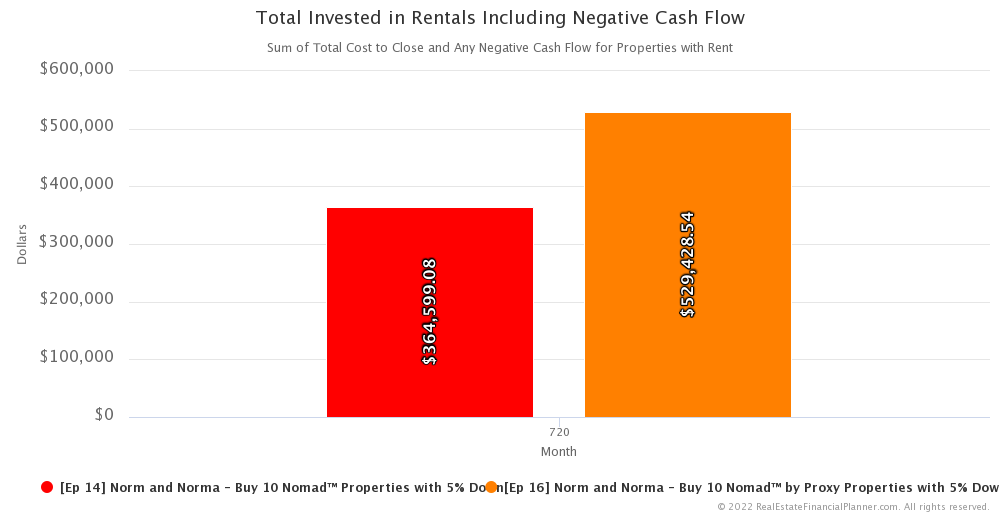

Total Invested in Rentals Including Negative Cash Flow

For Nomad by Proxy™,  Norm and Norma

Norm and Norma

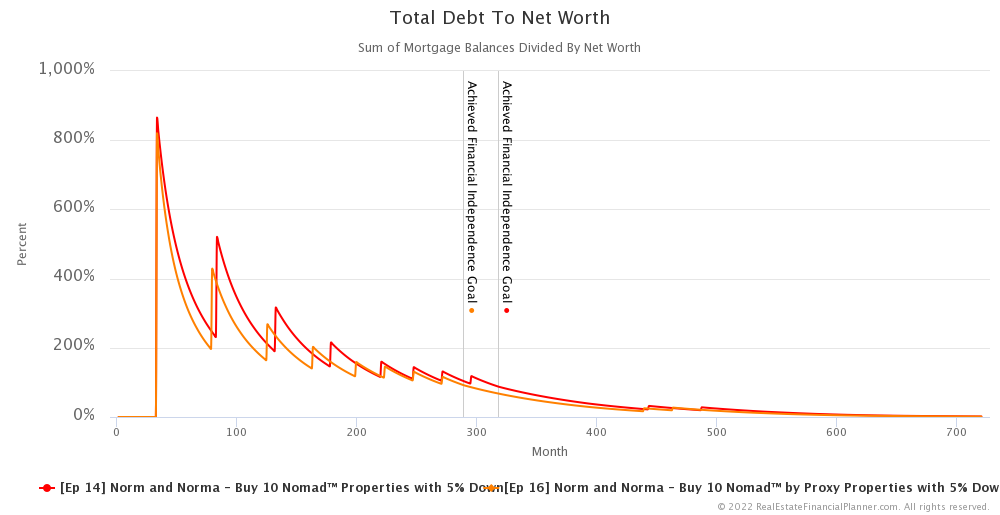

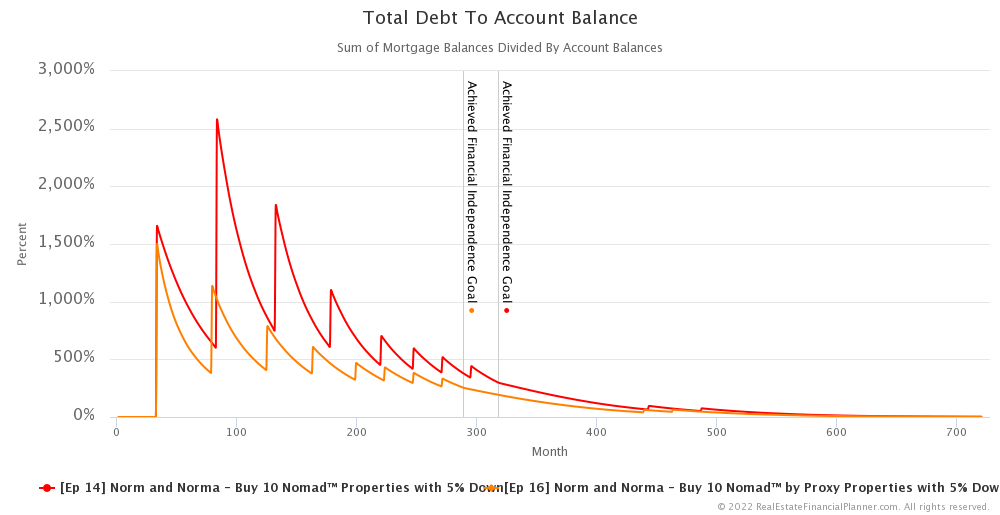

Debt to Net Worth

If we look at a couple other of my favorite ways to measure risk, you can see that Nomad™ by Proxy is ever-so slightly less risky than traditional Nomad™.

The risk is reduced even more when we measure debt to liquid net worth… what we call debt to account balances.

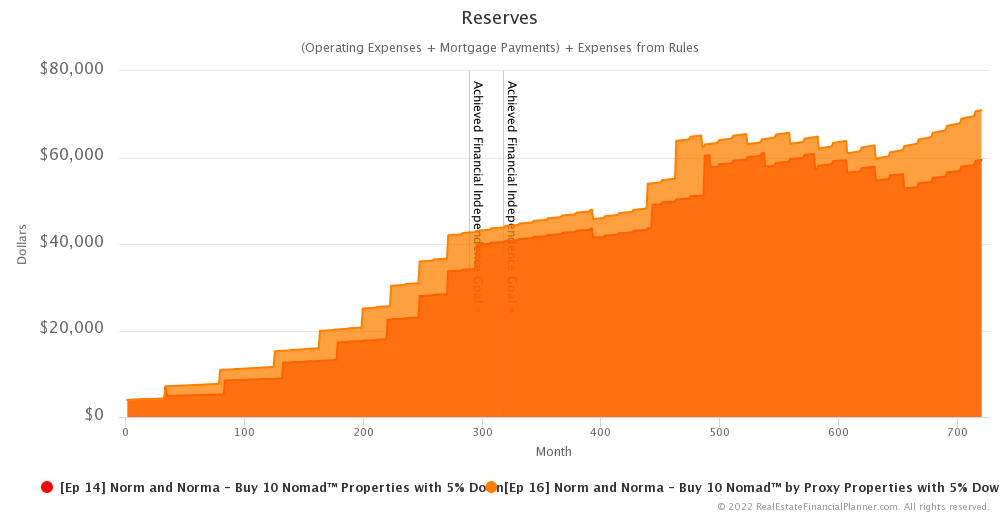

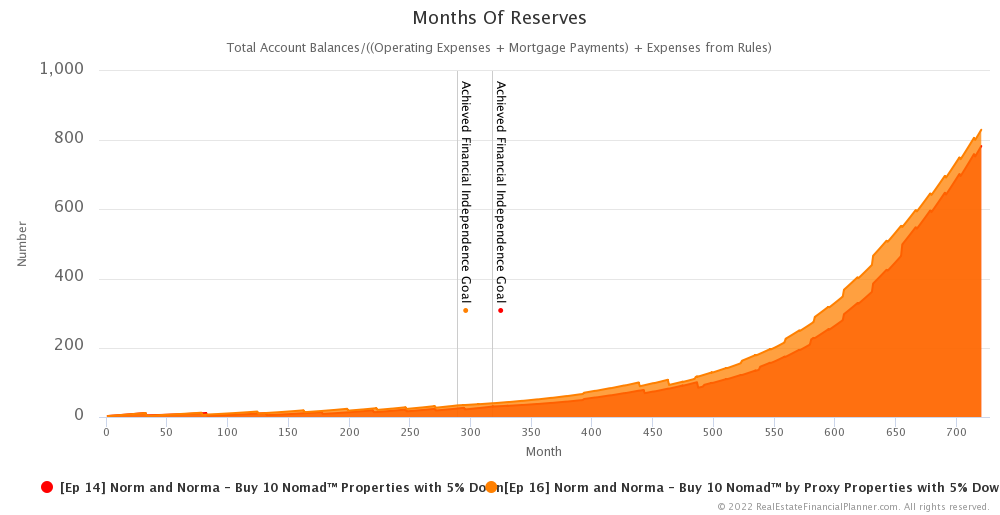

Reserves

But what about reserves?

They need to have more in reserve when they own more properties sooner.

But, they end up having more months of reserves when Nomading by Proxy™ than when doing traditional Nomad™ in our modeling.

Conclusion

In conclusion, if  Norm and Norma

Norm and Norma Norm and Norma

Norm and Norma

They can achieve financial independence faster than traditional Nomad™ where  Norm and Norma

Norm and Norma

Nomad by Proxy™ does produce more negative cash flow. However, if you also consider Cash Flow from Depreciation™ it is a reasonable amount… less than $12,000 total for all 10 rental properties.

Nomad by Proxy™ seems to be more susceptible to declines in rent but otherwise appears to be overall less risky in a couple key measures of risk.

Next Episode

Norm and Norma

Norm and Norma

Could they do Nomad™ to acquire properties with very attractive owner-occupant financing with great rates and low down payments and once they’ve fulfilled their occupancy requirements after at least a year, they could convert the properties to short-term rentals instead of converting them to long-term rentals.

They wonder how that might impact their ability to achieve financial independence. We’ll find out in the next episode.

Also, be sure to check out the Advanced Real Estate Financial Planner™ Podcast to see how having variable property appreciation rates and rent appreciation rates, variable mortgage interest rates, variable inflation rate and variable stock market rates of return impacts  Norm and Norma

Norm and Norma

I hope you have enjoyed this episode about  Norm and Norma

Norm and Norma

Get unprecedented insight into  Norm

Norm Norma’s

Norma’s Scenario with dozens of detailed, interactive charts.

Scenario with dozens of detailed, interactive charts.

Inside the Numbers

Watch the Inside the Numbers video to see exactly how we set up their  Scenario

Scenario

Nomad™

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 14 Norm and Norma - Buy 10 Nomad™ Properties with 5% Down with 2

Ep 14 Norm and Norma - Buy 10 Nomad™ Properties with 5% Down with 2  Accounts, 1

Accounts, 1  Property, and 6

Property, and 6  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Fixer-Upper Nomad™

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 16 Norm and Norma - Buy 10 Nomad™ by Proxy Properties with 5% Down with 2

Ep 16 Norm and Norma - Buy 10 Nomad™ by Proxy Properties with 5% Down with 2  Accounts, 1

Accounts, 1  Property, and 6

Property, and 6  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Podcast Episodes

The following are the podcast episodes for variations of  Norm

Norm Norma’s

Norma’s

More posts: Norm Episode