Pro Tip: Listen to the podcast below and while you’re listening follow along with the charts below. Then, when you’re done, copy the  Scenario

Scenario

Welcome to the Real Estate Financial Planner™ Podcast. I am your host, James Orr. This is Episode 11.

Today we’re going to continue with  Norm and Norma’s

Norm and Norma’s

In the last 3 episodes,  Norm and Norma

Norm and Norma

- In Episode 8, they bought 20% down payment rentals.

- In Episode 9, they saved up more and bought 25% down payment rentals.

- In Episode 10, they tried to speed up the process by buying 15% down payment rentals.

As renters, they were saving about $1,000 per month from their combined income of $72,000 per year.

But, as we discussed in detail in Episode 7 when  Norm and Norma

Norm and Norma

There was some nuance to this that we discussed in episode 7 and that I won’t cover again here, but if you have not listened to episode 7, I’d strongly encourage it.

In this episode, we will discuss 3 Scenarios for  Norm and Norma

Norm and Norma

But, the difference between the 3 will be the down payments for the rentals:

- 15% down payments

- 20% down payments

- 25% down payments

Financial Independence

So,  Norm and Norma

Norm and Norma

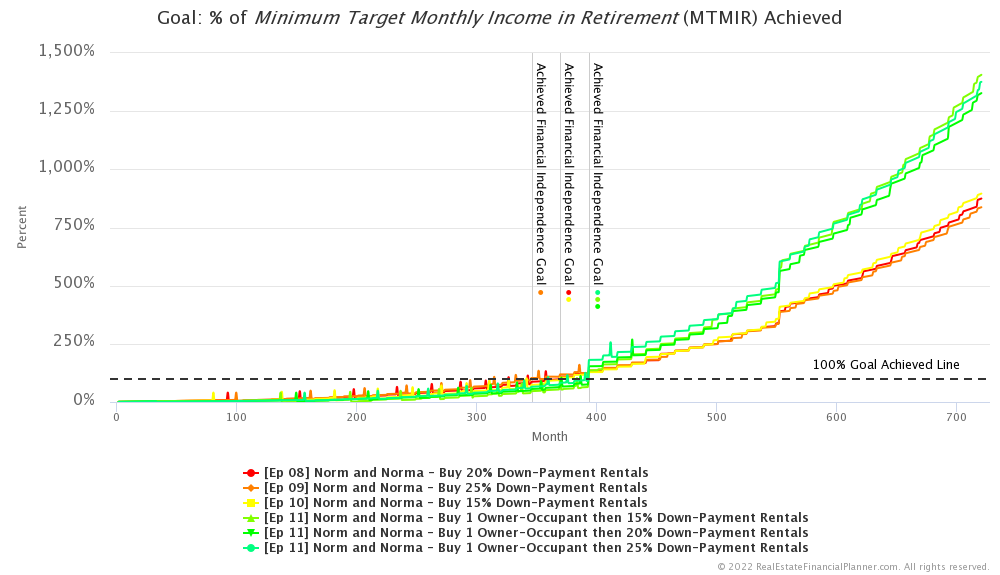

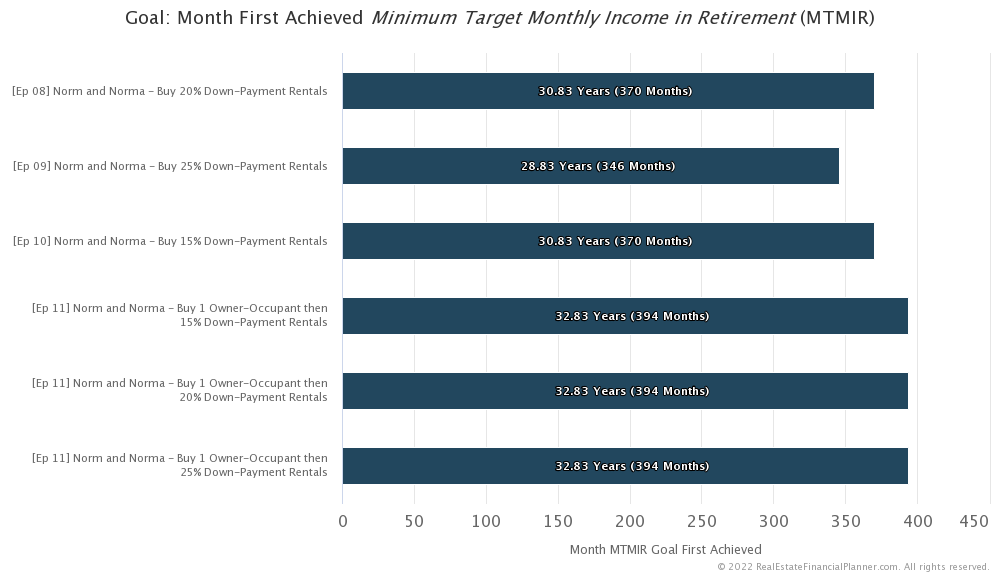

Well, I’ll jump right to the punchline: whether they put 15% down, 20% down or 25% down… if they buy an owner-occupant property first, they all achieve financial independence at the same time: just under 33 years… in month 394.

Why?

It is for the same reason that we previously discussed in episode 7… when you pay off your owner-occupant property, it reduces how much you need to be considered financially independent. And, in all three scenarios, they pay off their owner-occupant property in the same month, month 393. The very next month, they’re considered financially independent.

So, how does that compare to them renting? In all three cases, it takes them longer to achieve financially independence to buy a home to live-in.

- With 15% down and 20% down, it is two years faster to be a renter than an owner-occupant.

- With 25% down it is 4 years faster to be a renter.

Buying Properties

Let’s walk through the differences between the scenarios, but be sure to check out the show notes to see charts for what I am discussing here to get more details.

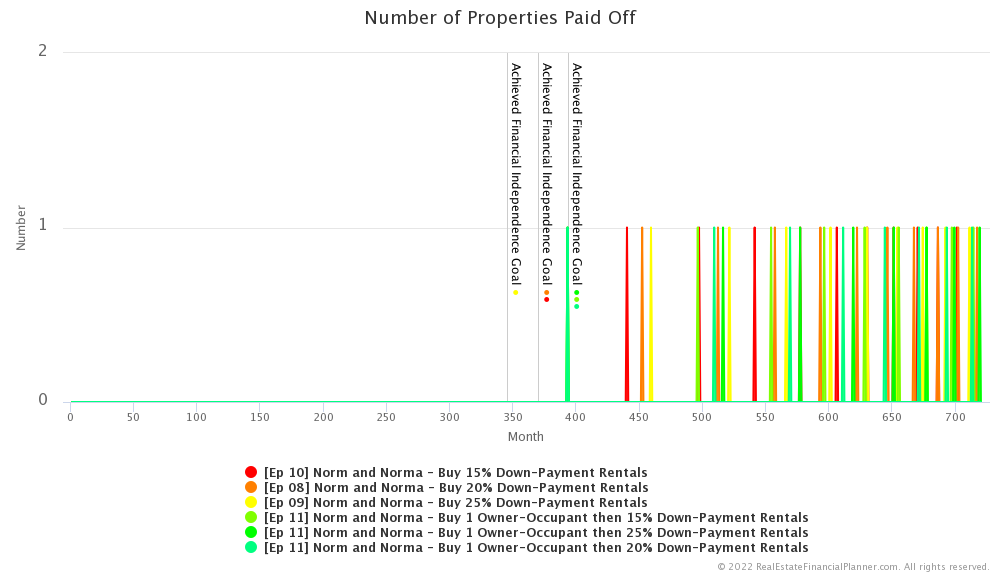

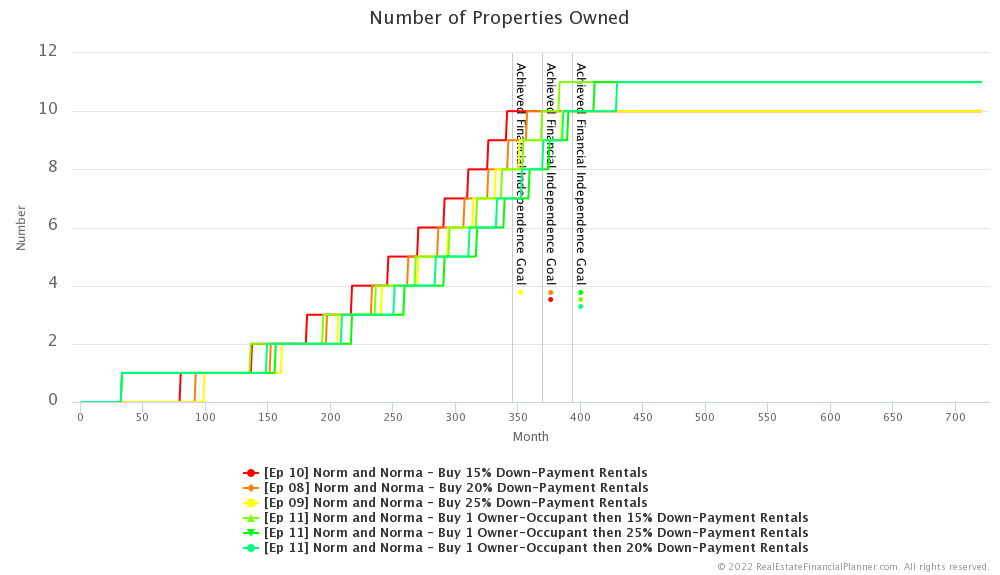

OK. In general, buying an owner-occupant property means they delay when they can start buying rental properties. They start buying rental properties later.

This means that they end up paying off rental properties later and don’t quite get to the boost in cash flow you get when you no longer have a mortgage until much later. I’ll talk about cash flow in a moment.

But, buying properties later also means that they end up paying a little bit more for their rental properties, which means they end up having slightly higher mortgage balances and… because they bought them later… higher mortgage balances later in the modeling.

One interesting thing to mention is that we modeled it with them buying an owner-occupant property AND 10 rental properties… 11 properties total. Previously when they were renters, they only bought the 10 rentals, so they only owned 10 properties total.

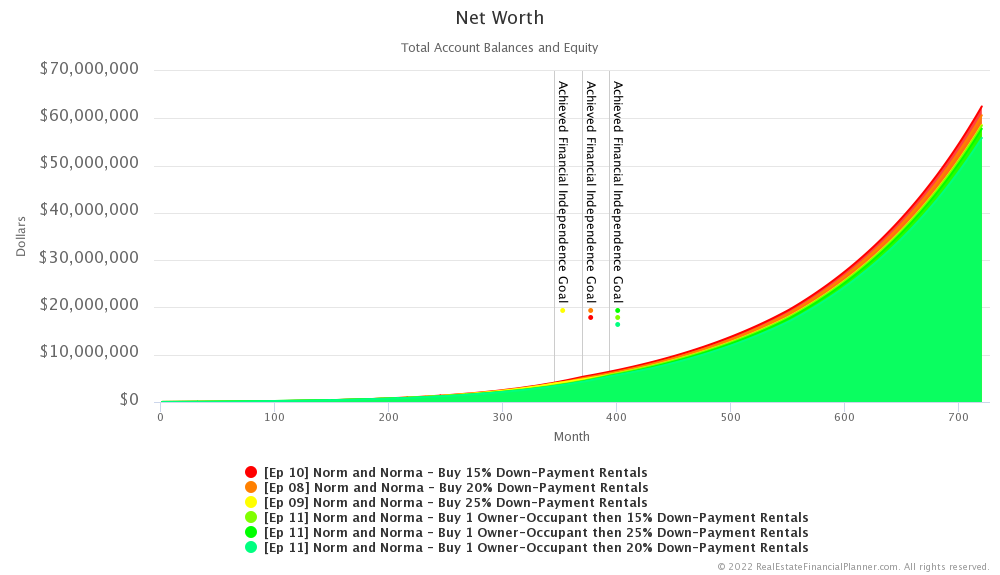

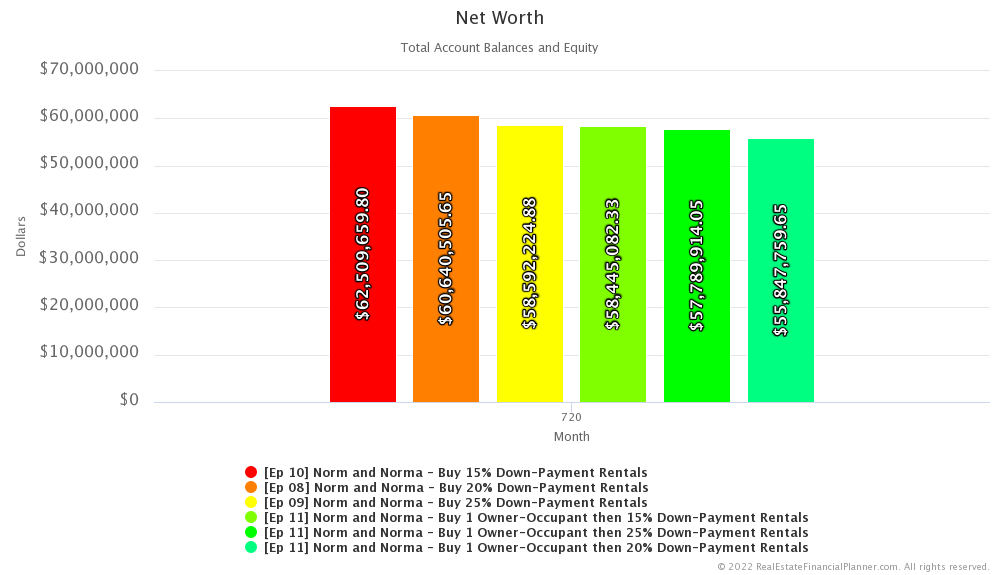

Net Worth

How does buying an owner-occupant property early impact their net worth?

You might be wondering if purchasing a property quickly with 5% down means their net worth would be a little bit higher. You might be thinking… the returns from owning a property to live in from appreciation and paying down on the mortgage would be better than the return they would otherwise earn in the stock market.

It seems like a reasonable hypothesis since that’s sort of what happened when we bought rentals with 15% down payments in the last episode.

But, unfortunately, it doesn’t quite work out that way.

In fact, buying the rental properties and remaining a renter results in higher overall net worth after 60 years.

- Putting 15% down would mean a $4 million dollar higher if they remained a renter. $62.5 million versus $58.4 million.

- Putting 20% down would be almost $4.8 million dollar higher net worth: $60.64 million versus $55.85 million.

- And putting 25% down would be about a $800 thousand dollar higher net worth: $58.6 versus $57.79 million.

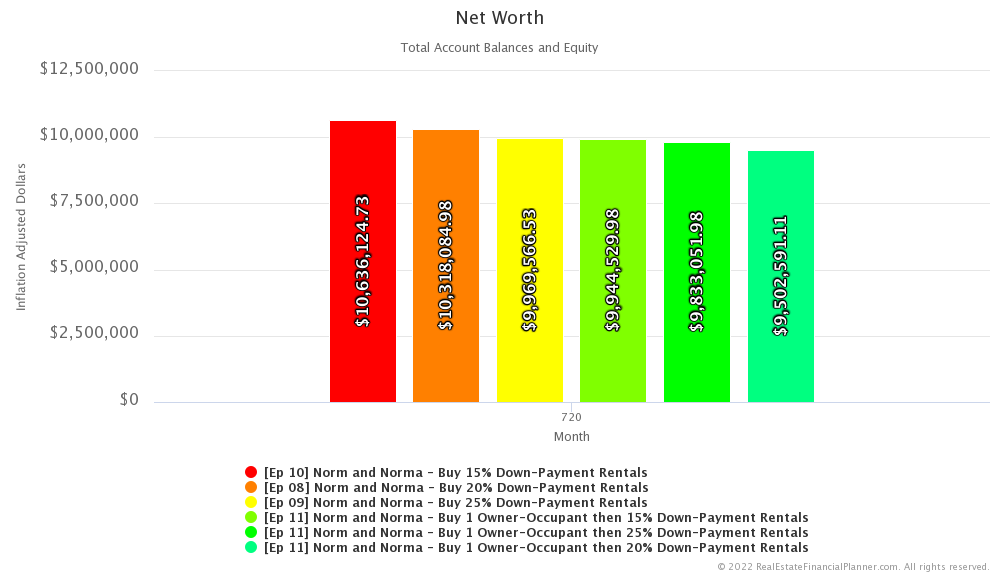

These are all 60 years from now in inflated future dollars.

The differences are much less significant if we adjust back to today’s dollars. For example:

- About $700K difference in net worth for 15% down.

- About $800K difference for 20% down.

- And, about $140K for 25% down.

And the net worth values are all in the $9.5 million to $10.6 million range in today’s dollars.

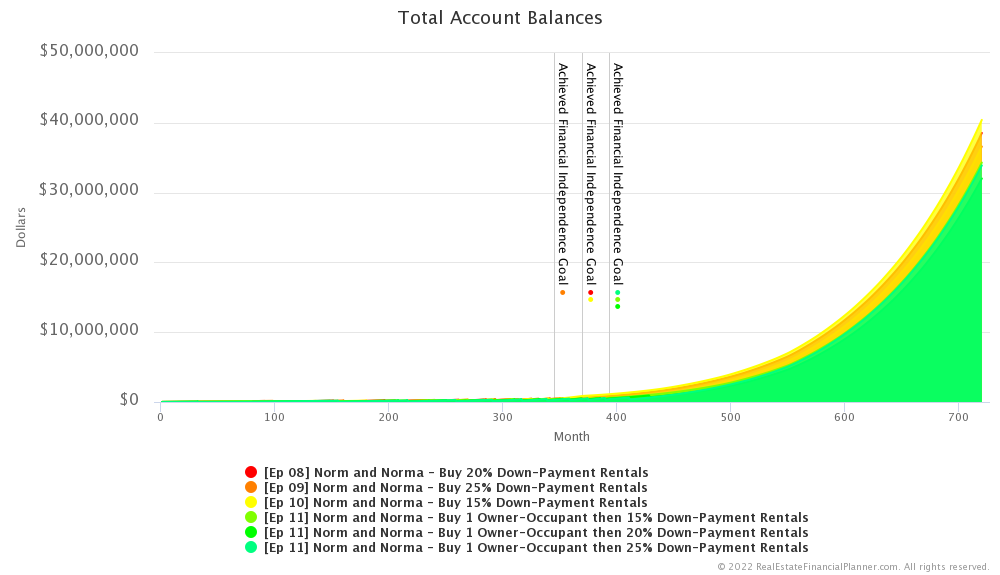

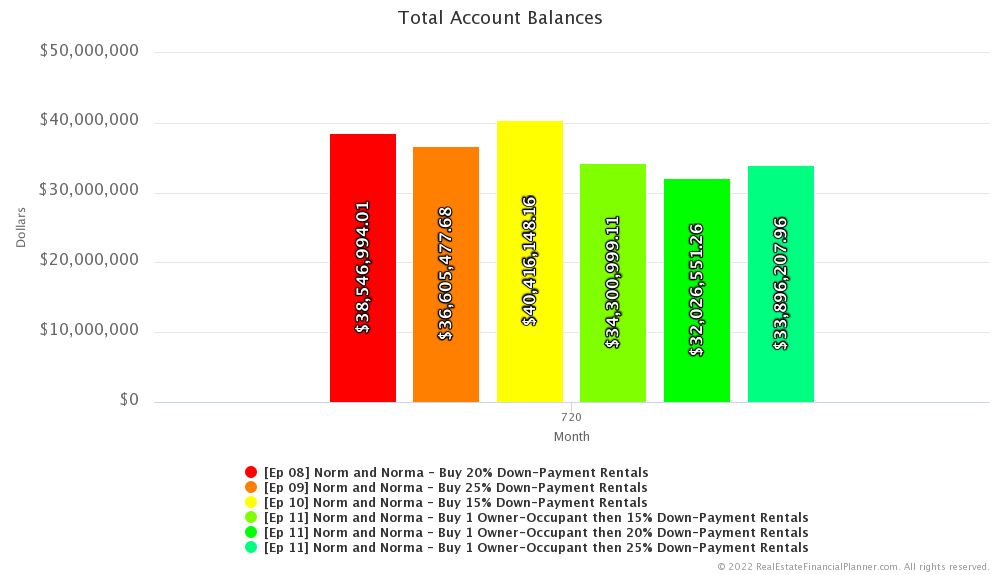

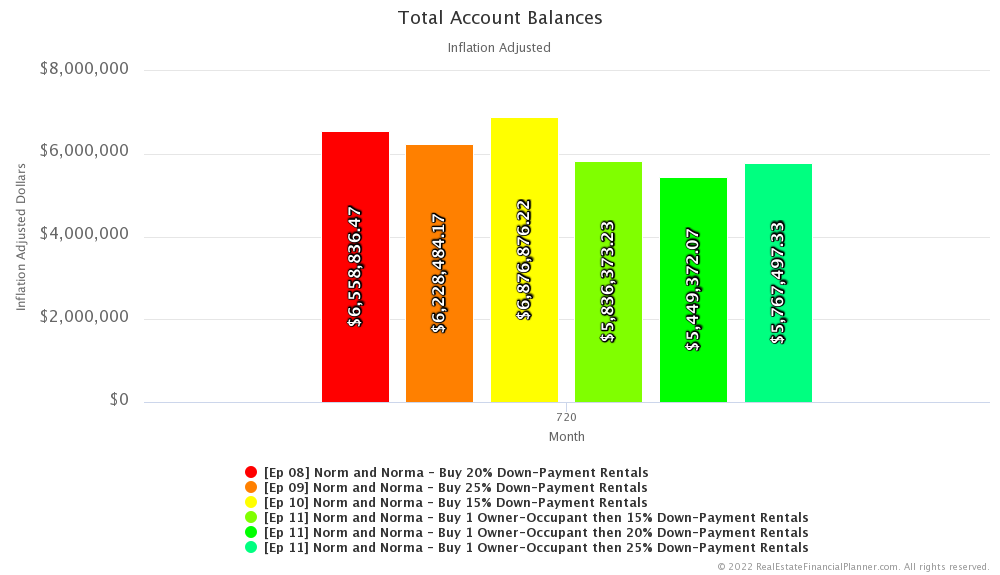

Account Balances

Net worth includes account balances and equity in properties. But, what if we just wanted to look at account balances?

Norm and Norma

Norm and Norma

And, we’re talking significant differences in the millions of dollars… in future inflated dollars. And that’s true even for 25% down payments.

If we adjust back to today’s dollars… the difference is still over a million dollars for 15% and 20% down payments. Although it is not a million dollar difference in account balance for the 25% down payment comparison.

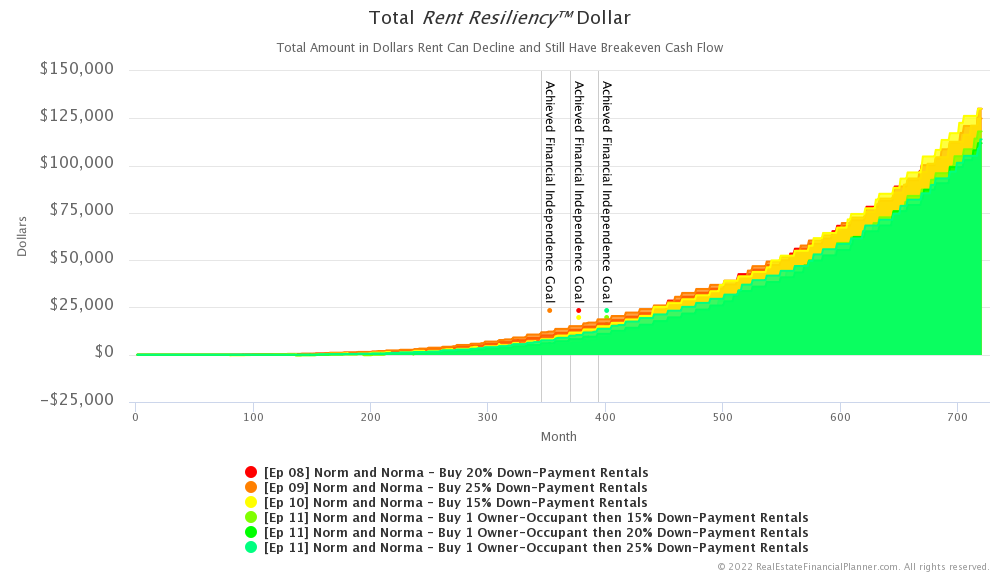

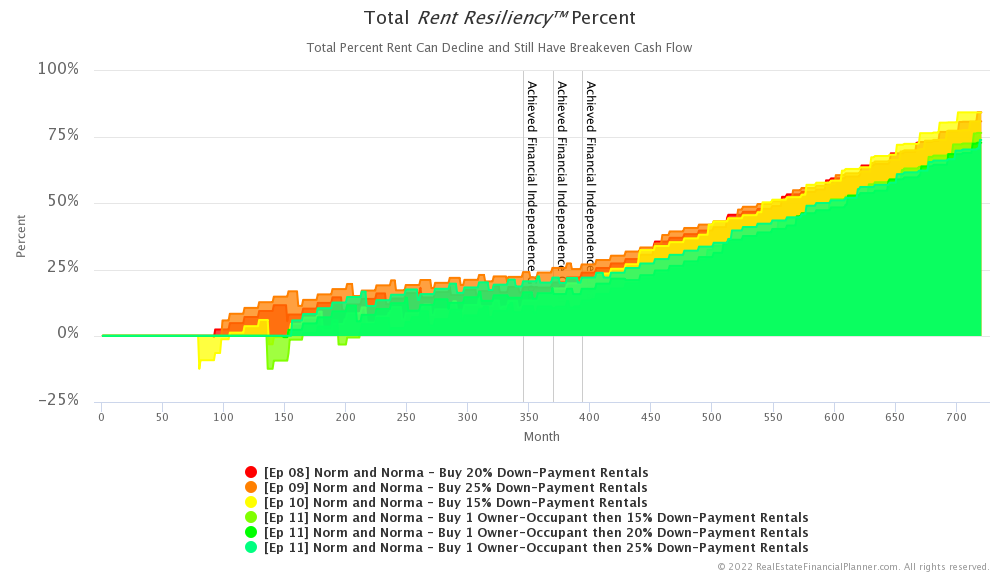

Rent Resiliency™

Let’s move on to discussing risk.

Is it riskier for  Norm and Norma

Norm and Norma

Well, there’s easily quantifiable risk measures like Rent Resiliency™, debt-to-income, months of reserves, debt to net worth and debt to account balances, but then there’s some other risks that are harder to measure.

For example, by buying a property to live in, they eliminate the risk of having the rent they are paying to their landlord go up. Sure, they take on the new, different risks of home ownership instead like the risk of repairs required on their property, increasing taxes and property insurance.

For now, let’s focus on some of the more easily measured forms of risk and let’s start with Rent Resiliency™.

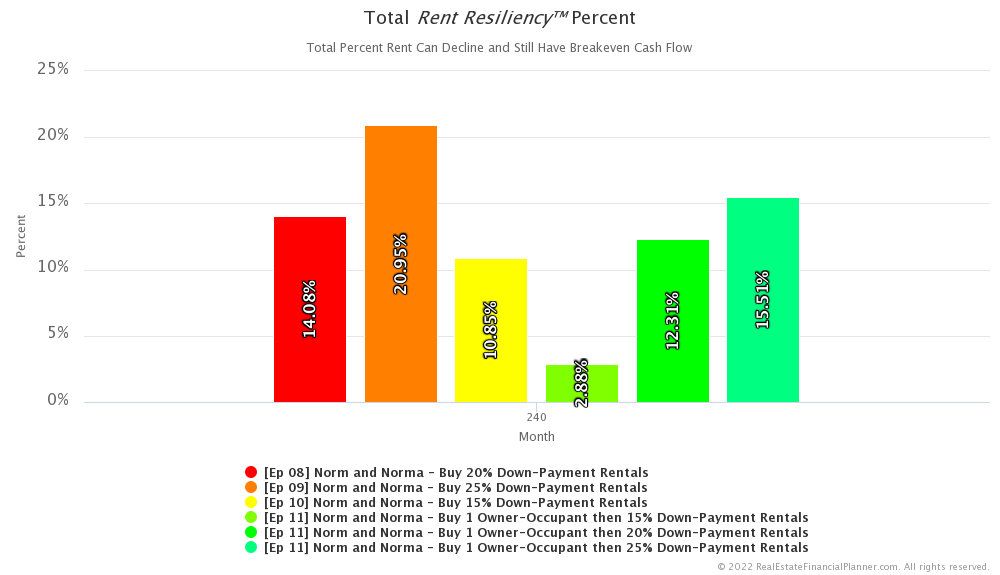

In general, there are two forces impacting Rent Resiliency™.

First, the more you put down the more resilient you are to drops in rent before you have negative cash flow. So, when  Norm and Norma

Norm and Norma

Second, the sooner you acquire properties and have rentals you own with rents going up while mortgage expenses are fixed the more resilient you are to rents dropping. So, buying rental properties sooner is also better.

For example, if we take a snapshot in time at, let’s say, year 20… we might see the following. The Rent Resiliency™ as a percentage… that means the percent that rents can drop on all rental properties before  Norm and Norma

Norm and Norma

- About 11% if they remain a renter and buy properties with 15% down payments compared to just under 3% if they buy an owner-occupant property.

- About 14% if they rent and put 20% down compared to about 12% as a homeowner.

- Or, about 21% as a renter putting 25% down compared to 15.5% as a homeowner.

So, while it is better for them to buy rentals earlier as a renter, putting 25%… even if they buy an owner-occupant property to live in is better than everything else except where they rent and also put 25% down.

That means… in general it is more risky… with this specific measure of risk… Rent Resiliency™… for them to buy an owner-occupant property.

Debt-To-Income

But Rent Resiliency™ is just one measure of risk. Another measure of risk is their total debt-to-income. This measure of risk is the one most often used by lender to qualify them for mortgages.

When they buy a property where the mortgage payment is greater than the rent they are paying that negatively impacts their debt-to-income ratio at least in the short-term. Over time the principal and interest part of the mortgage payment remains fixed and it actually helps them to have a lower overall housing cost compared to someone renting.

Debt to Net Worth

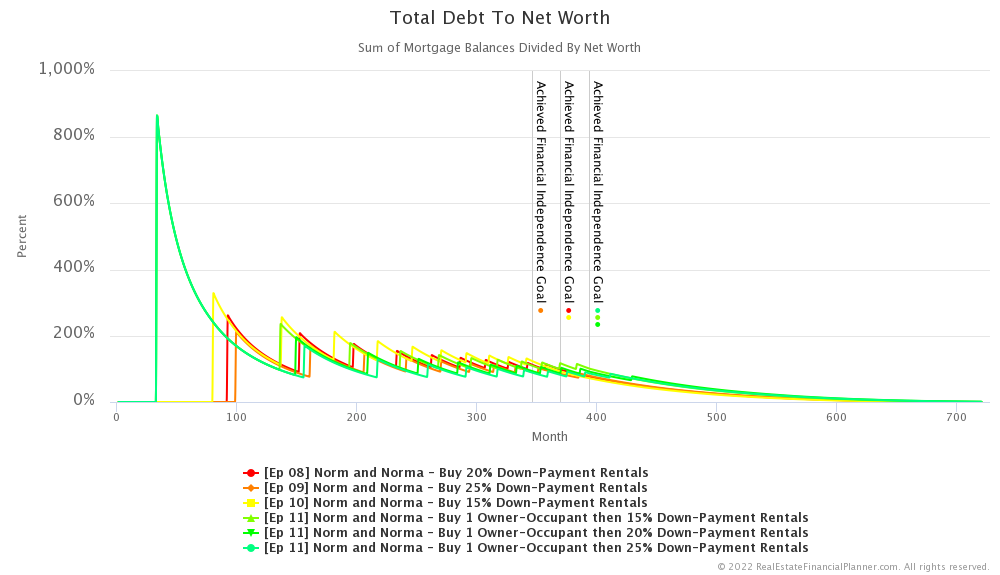

Another way we measure risk is to look at how much debt  Norm and Norma

Norm and Norma

When  Norm and Norma

Norm and Norma

But, the extra equity they have in their owner-occupant property eventually helps them keep this measure of risk down as they acquire additional rental properties later.

That means, in terms of this specific measure of risk… debt to net worth… buying an owner-occupant property is much riskier earlier on but tends to slightly reduce risk later one with subsequent purchases.

Now the earlier on risk is really high… over about 865% compared to the highest risk they’d see as a renter of about 320% when they buy their first 15% down payment property.

In general, the more they put down, the lower their risk.

And, generally, once they get past the first few years of owning their owner-occupant property their risk tends to be lower by having purchased an owner-occupant property.

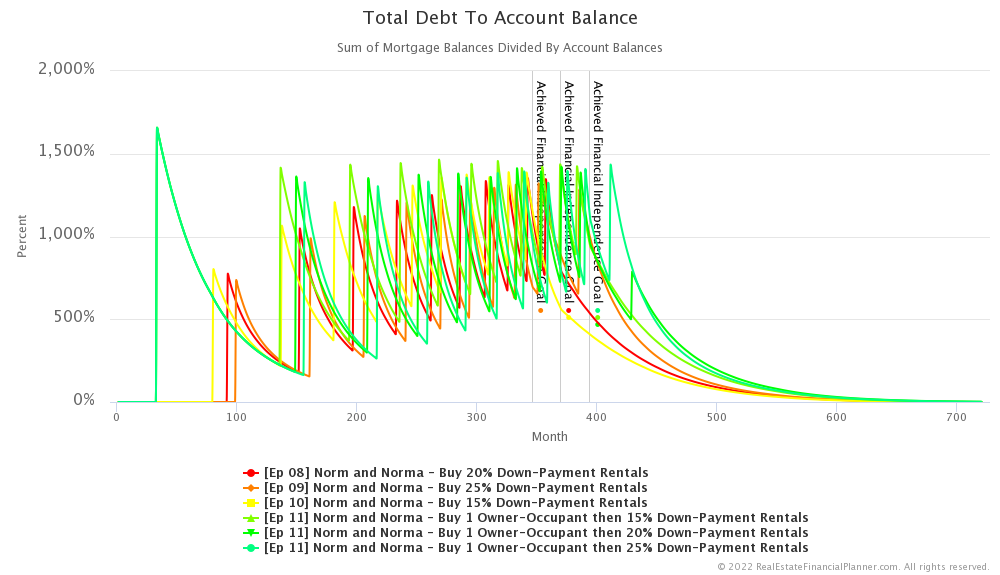

Debt to Account Balance

Measuring debt to net worth is one way of measuring risk associated with debt, but it is not the only way. In fact, I often prefer this second measure of risk where we measure how much debt they have compared to how much they have in their accounts… in other words… their liquid net worth not consisting of property equity.

When we look at this measure of risk, buying an owner-occupant properties spikes early again when they buy that property to live in. Although this is not as extreme in relative terms as we saw when we measured debt to net worth. It is extreme comparing the first owner-occupant purchase to the first rental purchase, but not compared to the subsequent additional rental property purchases.

In general, as you probably expected, buying an owner-occupant property with 5% down is slightly more risky than renting and just buying rental properties.

And, in general, putting more down means you have slightly less risk as well. So, putting 25% down tends to have less risk than putting 15% or 20% down.

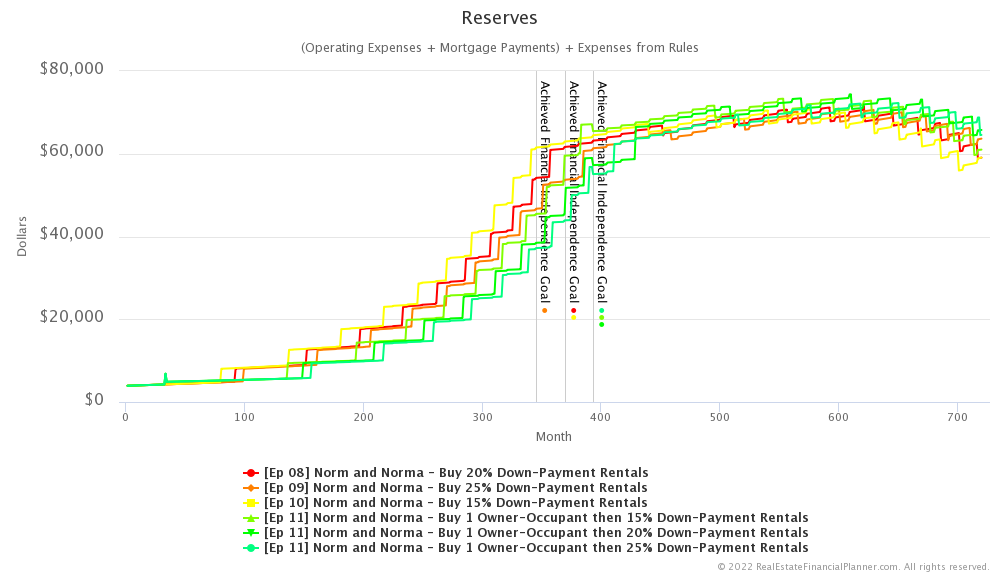

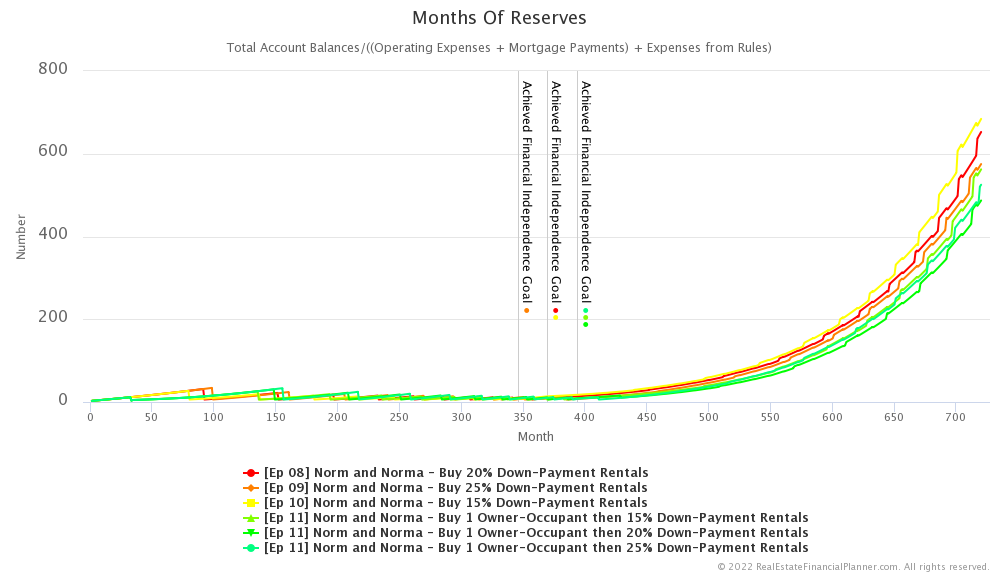

Reserves

Another way to measure risk is to look at reserves.

I’d like to look at reserves in two ways. First, the dollar amount they’d need to have for a single month of reserves. It would include all their personal expenses including rent or a personal mortgage payment with taxes and insurance on their home plus all the expenses for each rental property including mortgage, taxes, insurance, property management and so on.

In general, buying an owner-occupant property means they have a lower dollar amount that they need to keep in reserves. This is a combination of buying rental properties slower and having a fixed principal and interest payment for their owner-occupant property that does not increase with inflation over time.

Later in the scenarios this trend reverses.

But once we know how much in dollars it takes to have a single month of reserves, we can measure risk related to having adequate reserves by looking at how many months of this single month of reserves they have. In other words, if they had no income from their job or rents or other investments, how many months could they continue to pay all the expenses on their personal stuff and rentals?

Early on in each Scenario, it turns out we tend to artificially keep this around 6 months by requiring they have 6 months of reserves before they can buy their next property. So, the number of months builds up as they save up for their next down payment and then once they buy their next property, it drops down to about 6 months for all scenarios as a renter and homowner.

But, after they’re done acquiring properties which scenario tends to have more reserves? It turns out that they tend to have more months of reserves as a renter than as a homeowner. This is likely caused by them buying properties earlier and having those properties paid off and generating more cash flow which deposits more money in their accounts for reserves.

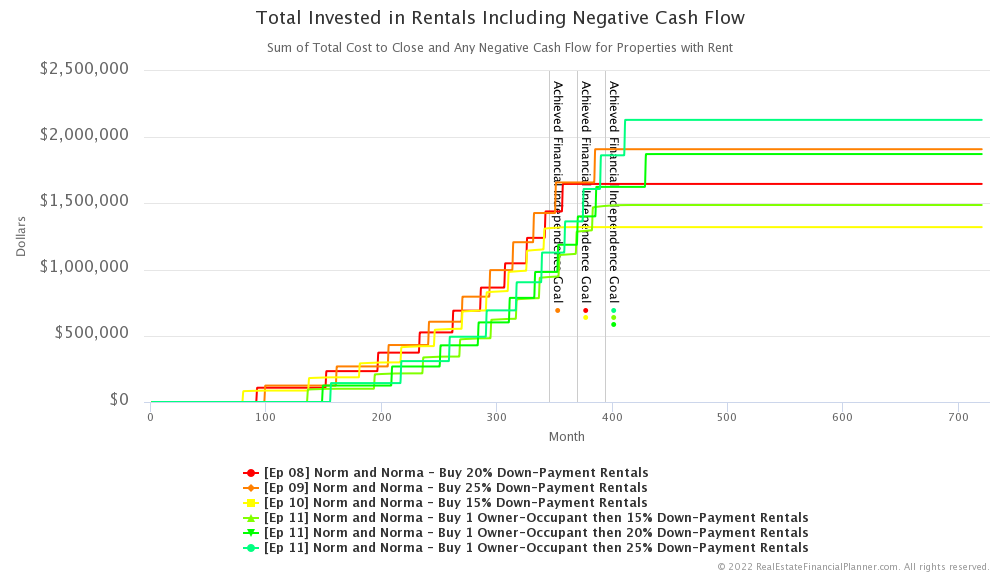

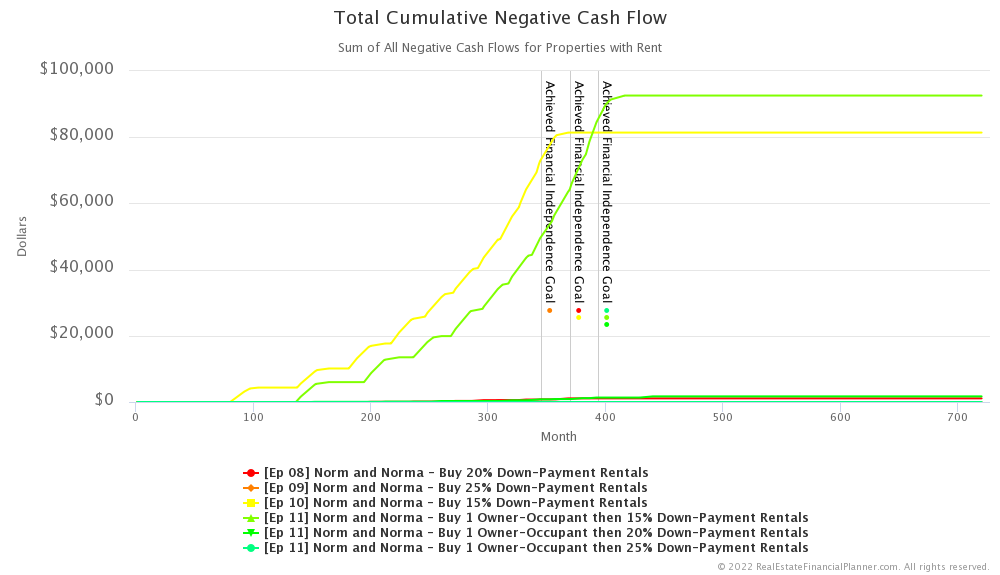

Total Invested in Rentals Including Negative Cash Flow

Now that I’ve talked about reserves, I did want to discuss a few more things before we wrap up this episode.

Let’s talk about how much they needed to invest in down payments and how much they needed to invest in any negative cash flow.

In general, by being able to purchase properties early, they’re able to purchase properties at slightly lower prices, which means that when buying rentals as a renter themselves they tend to invest less in down payments.

In both cases when buying 15% down payment properties, they also have some negative cash flow. More negative cash flow when they buy an owner-occupant property by about $11,000. A little over $81,000 as a renter themselves compared to a little over $92,000 as a homeowner buying 15% down payment rentals.

They also have a very small amount of negative cash flow when buying 20% down payment properties in both cases with about $600 more for when they buy an owner-occupant property. But overall, this amount is less than $2,000 for all rental properties over the entire 60-year period total.

There is no negative cash flow if they put 25% down payments on rentals.

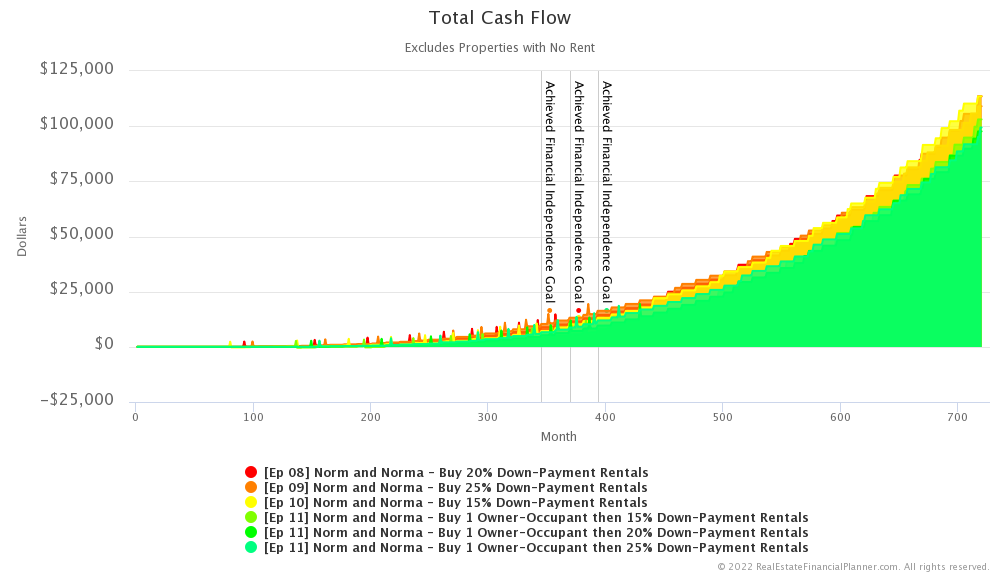

Cash Flow

Speaking of cash flow… although not negative cash flow anymore… just regular positive cash flow… in general because they’re able to buy rental properties sooner, they tend to have better cash flow as a renter.

They also tend to have better cash flow the more they put down.

Conclusion

In conclusion,  Norm and Norma

Norm and Norma

And, it seems to be slightly more risky for them in most of the measures of risk that we have.

Plus, they end up with less cash flow and less net worth.

So, why bother?

Well, maybe they’d prefer to own their own home and have some inflation protection against a landlord raising rents. And, in those cases, it may not be the right question to ask why they might do it, but instead it might be better to ask: if they are going to do it, what is the cost to them of making that decision.

Norm and Norma

Norm and Norma

Next Episode

You know, up to this point,  Norm and Norma

Norm and Norma

Also, be sure to check out the Advanced Real Estate Financial Planner™ Podcast to see how having variable property appreciation rates and rent appreciation rates, variable mortgage interest rates, variable inflation rate and variable stock market rates of return impacts  Norm and Norma

Norm and Norma

I hope you have enjoyed this Episode about  Norm and Norma

Norm and Norma

Get unprecedented insight into  Norm

Norm Norma’s

Norma’s Scenario with dozens of detailed, interactive charts.

Scenario with dozens of detailed, interactive charts.

Compare “renter versus homeowner” in pairs by down payment when buying rental properties:

Or, compare all of them together. Please be aware that with 6 variations on the same chart, they can be a bit cluttered and harder to interpret.

Inside the Numbers

Watch the Inside the Numbers video to see exactly how we set up their  Scenario

Scenario

They’re Renters Buying Rental Properties

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 10 Norm and Norma - Buy 15% Down-Payment Rentals with 2

Ep 10 Norm and Norma - Buy 15% Down-Payment Rentals with 2  Accounts, 1

Accounts, 1  Property, and 6

Property, and 6  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 08 Norm and Norma - Buy 20% Down-Payment Rentals with 2

Ep 08 Norm and Norma - Buy 20% Down-Payment Rentals with 2  Accounts, 1

Accounts, 1  Property, and 6

Property, and 6  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 09 Norm and Norma - Buy 25% Down-Payment Rentals with 2

Ep 09 Norm and Norma - Buy 25% Down-Payment Rentals with 2  Accounts, 1

Accounts, 1  Property, and 6

Property, and 6  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

They’re Homeowners Buying Rental Properties

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 11 Norm and Norma - Buy 1 Owner-Occupant then 15% Down-Payment Rentals with 2

Ep 11 Norm and Norma - Buy 1 Owner-Occupant then 15% Down-Payment Rentals with 2  Accounts, 2

Accounts, 2  Properties, and 7

Properties, and 7  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 11 Norm and Norma - Buy 1 Owner-Occupant then 20% Down-Payment Rentals with 2

Ep 11 Norm and Norma - Buy 1 Owner-Occupant then 20% Down-Payment Rentals with 2  Accounts, 2

Accounts, 2  Properties, and 7

Properties, and 7  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 11 Norm and Norma - Buy 1 Owner-Occupant then 25% Down-Payment Rentals with 2

Ep 11 Norm and Norma - Buy 1 Owner-Occupant then 25% Down-Payment Rentals with 2  Accounts, 2

Accounts, 2  Properties, and 7

Properties, and 7  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Podcast Episodes

The following are the podcast episodes for variations of  Norm

Norm Norma’s

Norma’s

More posts: Norm Episode