Real estate investing is risky. Learn how to reduce your risk in this special class for Nomads™ on how to reduce risk taught by James:

This class was taught on December 9, 2020 via webinar.

Here’s what I taught in the class.

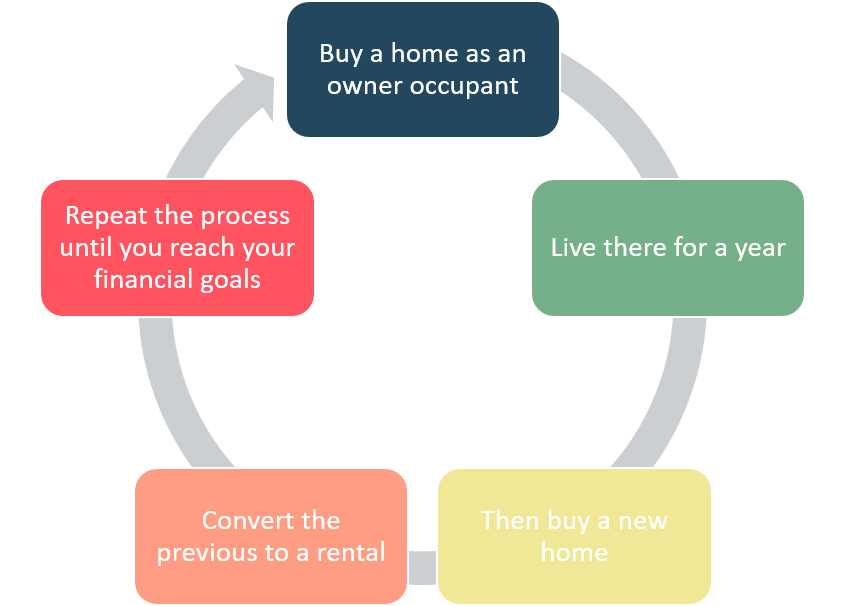

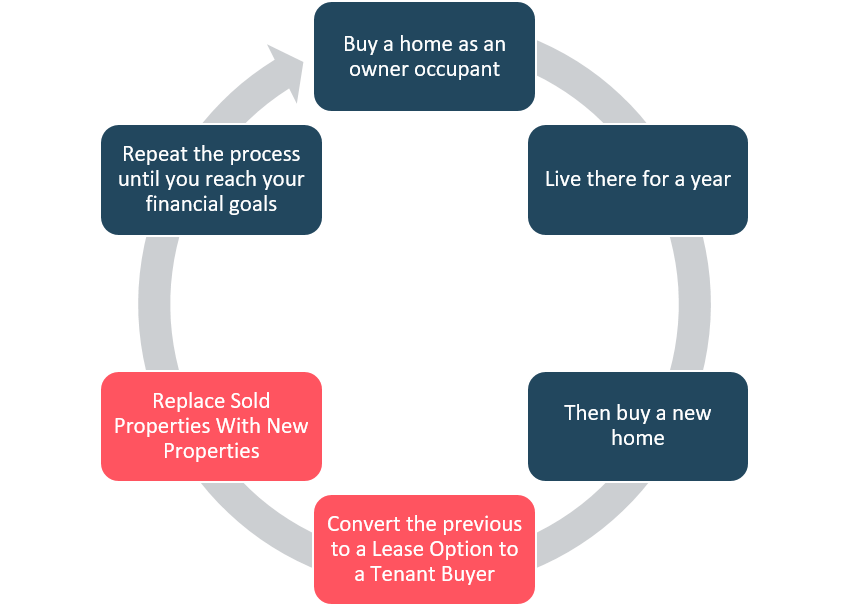

What Is Nomad™

Since this class is about the Nomad™ investing strategy, I took a moment to go over what Nomad is:

Next, I share a quote from general George S Patton on fear and acting through fear.

“The time to take counsel of your fears is before you make an important battle decision. That’s the time to listen to every fear you can imagine! When you have collected all the facts and fears and made your decision, turn off all your fears and go ahead!”

─ George S Patton

Problems

If you’re walking down the street and you notice your shoe has become untied, you just bend over and tie your shoe.

If you go into your refrigerator and you notice you’re out of milk, you just go buy more milk.

For most of us, these are simple solvable problems. Ones we can address with little or no fuss.

I might suggest a goal should be to make more of your problems solvable with little or no fuss.

You know your furnace will need new filters regularly. Budget and plan for it. Then, replace them when they need replacing.

Your furnace will need to be serviced. Budget and plan for that too. Do it when it needs doing.

Similarly, you know the furnace will need to be replaced. Budget for that. When it happens just do it with little or no fuss.

Many real estate “problems” are things you should reasonable expect to happen. You should plan for them by keeping adequate reserves.

Dan Sullivan, founder of Strategic Coach, says:

Strive to be able to solve any real estate problem that is likely to come up as easily and stress-free as tying your shoes or replacing milk.

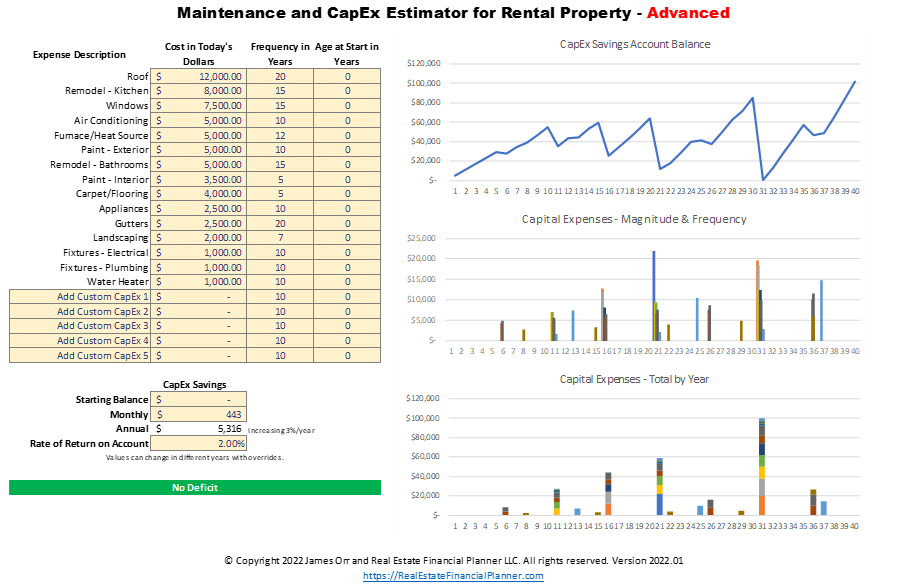

Plan for Capital Expenses

You know that you’re going to need to replace a roof and gutters on your rental property. You know you’ll need to paint the interior and exertior. ACs and furnaces need maintenance and to, eventually be replaced. Appliances stop working and need repair or replacement.

In the The Ultimate Guide to CapEx on Rental Property class James provides two new spreadsheets for calculating and planning for CapEx.

If you’re not already planning for regular maintenance on your property, you really need to.

Likewise, if you’re not already planning for capital expenses, you really need to budget and plan for those as well.

Reserves for Real Estate Investors

You need reserves.

It may be obvious, but I’ll say it: to get reserves you need to save money.

You can save money by reducing expenses and/or increasing income. You should do both.

Do this with both your personal income and expenses as well as your business income and expenses.

All the content we have (including classes) on improving cash flow and reducing expenses applies here. Implement everything that is appropriate for your situation.

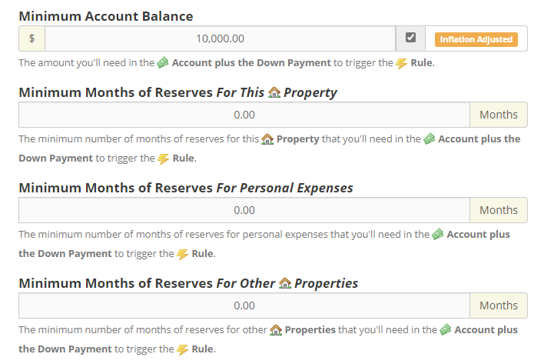

Better Modeling of Reserves in the Real Estate Financial Financial Planner™

In anticipation of this class we added some new and improved ability to model keeping reserves when buying properties with the Real Estate Financial Planner™ software.

Previously, with the  Buy

Buy  Property

Property Account

Account

You could say, I want to have $10K (inflation adjusted) in my account plus the down payment and closing costs before buying a property.

Now, you can still set a dollar amount for the account, but you have three additional options in addition to any amount you set in the account.

You can require a user-defined number of months of reserves for the property you’re about to buy too. This allows you require you have 6 months or 12 months (or any number you specify) of reserves before being able to buy the property.

And, you can require a user-defined number of months of reserves for personal expenses before being able to buy the property. This determines your personal expenses (from  Rules

Rules

And, finally, you can also set the number of months of reserves for all other properties you already own that is required to buy the next property.

All of these are cumulative. It will add the minimum account balance, months of reserves for this property, months of reserves for personal expenses and months of reserves for other properties… all in addition to the closing costs and down payment required to buy the property before allowing you to buy a property.

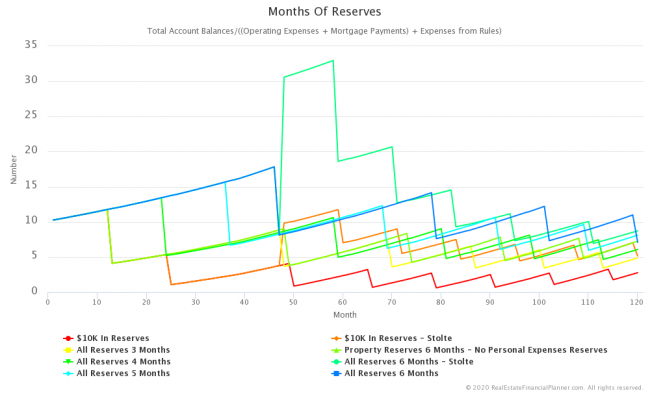

Months of Reserves

Plus, as you model your different real estate investing strategies, you can compare how many months of reserves you have for different plans.

Considering buying more properties? How does that impact your reserves? Considering selling properties? Compare it to other plans and see how that impacts your reserves.

This  Chart

Chart Scenarios

Scenarios

Return in Dollars Quadrant™ for Typical Northern Colorado Nomad™

I was not willing to reteach the entire Everything You Learned About Deal Analysis is Wrong – ROIQ+R™ class where I explained in detail the new quadrants, but I did take some time go over a few quadrants for a $400K Nomad™ property with $2,200 per month in rent. This is a representative example of what you can currently purchase in Northern Colorado.

The following shows the raw dollars of return for buying this property as a Nomad™ in year 1.

You can see these quadrants for any property that you’re analyzing with the Real Estate Financial Planner™ software at the bottom of the edit page for the property.

Return on Investment Quadrant™ for Typical Northern Colorado Nomad™

If we take each return and divide by the total amount required to purchase the property (closing costs and down payment), we can see the return on investment for each area (and the total in the center).

RIDQ+R6™ and ROIQ+R6™ for Typical Northern Colorado Nomad™

If we account for keeping 6 months of reserves and calculate the return in dollars and return on investment, that becomes the Return in Dollars Quadrant™ + 6 Months Reserves and Return on Investment Quadrant™ + 6 Months Reserves respectively. We abbreviate those as RIDQ+R6™ and ROIQ+R6™.

Here’s what it looks like for this property.

First, the RIDQ+R6™:

And, the ROIQ+R6™:

12 Months of Reserves, The ROIQ+R12™

What if you kept 12 months of reserves instead of 6 months? That’s the ROIQ+R12™ shown here:

Not Unique to Nomad™

While we’ve been discussing the importance of reserves and how you need to save for both the expected (and the unexpected), these expenses are not unique to Nomad™.

You could put 0% down with a VA Loan or USDA loan, 3.5% down with a FHA loan, or the most common 5% down with conventional financing as a Nomad™. Or, you could put 15% down, 20% down, 25% down or more as a non-owner-occupant investment property.

Regardless of which you choose, we still set aside money for things like vacancies, property management, maintenance and capital expenses when we analyze deals.

Furthermore, these numbers don’t vary with the amount you put down. Vacancy allowance is the same whether you put nothing down or 50% down. Same with property management, maintenance and capital expenses.

Where some folks might get confused is that with Nomad™, you may be choosing to “finance” part of your down payment.

Financing Down Payment

Nomad™ is designed to let you invest with adequate reserves without producing 20%/25% down and 6-12 months of reserves.

Instead, you can invest with 0%/3.5%/5% down and 6-12 months of reserves if you are OK with “financing” the rest of your down payment.

Here’s an example with a $400K property.

If you bought a property as a Nomad™, you might need $20K in down payment + $14K in reserves + closing costs. That might equal about $39K.

For that property you might have a True Cash Flow™ of -$243/year or about -$20/month.

Or, if you bought a property with 20% down payment, you might need $80K as down payment + $13.5K in reserves + closing costs. That’s about $98.5K.

True Cash Flow™ for the 20% down payment purchase of the same property might be about $829/year or about $69/month.

As a third option, you might consider putting 25% down. That would be about $100K in down payment + $12.5K in reserves + closing costs. That’s about $117.5K total required to invest.

True Cash Flow™ on the 25% purchase might be about $2,894/year or about $241/month.

As you can see with the numbers above, the Nomad™ purchase requires you be willing to “finance your down payment”.

The difference in monthly cash flow between the Nomad™ purchase and the 20% down payment purchase is $89/month.

So, instead of putting $59,500 more down to get to 20% down, you choose to spend $89 per month more.

How long can you pay $89 per month before you’ve put out $59,500? Turns out you could pay $89/month for 668 months (that’s 55 years) to produce the same $59,500.

So, instead of putting $59,500 more down, you’re choosing to “pay” $89 per month.

You still get the other returns: debt paydown (which is actually a little better with Nomad™ with a higher loan balance and better interest rate), tax benefits of depreciation and appreciation.

Plus, rents will very likely increase well before 668 months so you’re really not even paying the $89 per month for anywhere near the 668 months.

Nomad™ is Not Permission To Be Stupid

I softened the language in the presentation, but this is really what it should have said: Nomad™ is not permission for you to be stupid.

Just because Nomad™ allows you to acquire properties with lower down payments and better interest rates does not mean you can use it to invest without reserves. Investing without reserves is stupid.

Nomad™, with its lower down payment, should make it easier for you to invest with reserves. With a lower down payment requirement, it is easier for you to save up reserves before investing.

Having reserves to handle expected “problems”… ones you know you’re going to see like vacancy, reductions in rents and price, maintenance, capital expenses… is not only prudent but should also be expected. Remember the Dan Sullivan quote above?

So, it begs the question… how can we boost your reserves when Nomading™ to make sure you have enough reserves so that you don’t have a problem?

Lease-Options

One strategy that could be used to generate reserves is lease-options. While I mention some things related to lease-options here, you really should check out the full series of lease-option classes to learn more about them.

I explained how the traditional Nomad™ strategy works above visually with an image. Here’s how doing lease-options with Nomad™ looks.

Sitting down with lunch with Daryl Stolte (who taught the class on using Lines of Credit for real estate investing) we were discussing Nomads™ and the risks to Nomads™.

Specifically the riskiest part of the plan for many Nomads™ is early on when they have the highest debt to net worth, the lowest cash flow and the lowest reserves. I told him that I have a solution for that: lease-options.

So, I refer to this strategy as the Stolte Method (since I came up with it while discussing it with Daryl).

Here’s basically how it works: implement your desired strategy (for example Nomad™). However, instead of converting the first property to a rental, convert the first property to a lease-option to a tenant-buyer.

Benefits of Stolte Method and Lease-Options

The first benefit of using lease-options when Nomading™ is that you get an option fee when tenant-buyer moves in. This immediately boosts reserves.

The second benefit is that the tenant-buyer has ownership mentality and is likely to take better care of property. This could lead to possibly lower maintenance costs.

Another benefit? You’re likely to get the top end of the rent range. That means better cash flow. Better cash flow means you can save more for reserves.

Let’s walk through what it might look like if the tenant-buyer purchases the property from you in year 4. You lived in the property for 1 year then offered it to a tenant-buyer. They occupied the property for 3 years before buying it from you.

If you sell it to the tenant-buyer, you have no closing costs because your agreement has them paying for closing costs when they buy.

You have no sales costs or commissions because you’re not using a real estate agent to sell the property. Instead you are offering the property “For Sale By Owner” to the tenant-buyer after they’ve rented it for 3 years.

You have 4 years of appreciation and debt-paydown on the property.

If we assume you have 3% per year in appreciation, that might be about 12% from appreciation. Add in an estimate for debt paydown and you’re likely to gross about $100K combined between the two.

You must pay long-term capital gains (15%) on the profit above your purchase price. Plus, you need to pay depreciation recapture (25%) on the tax benefits of depreciation that you had while you rented the property. Between long-term capital gains and depreciation recapture, that might cost you about $16K combined.

That means you’re likely to net about $80K from the sale to the tenant-buyer at the end of year 4. Whatever you received from the option fee when the tenant-buyer moved in was an advance on this amount. So, the amount you get at the end of year 4 is really about $80K minus whatever you already received from upfront option fee. So, if you got $5K as an option fee upfront when the tenant-buyer moved in, you really are seeing about $75K at the time of sale. You had the $5K (that you could use as reserves) three years prior.

What would $80K mean to your reserves? I think for many Nomads™ that would be a significant boost to your reserves.

This is an example of you doing it once, but you could repeat this more than once with additional properties if you desired.

Just realize that you’re selling properties and that does not lead to long-term passive wealth building. So, you may want to replace properties you sell to tenant-buyers with new properties. This may requires additional moving if you’re Nomading™ to acquire them.

Over-Simplified Stolte Method Math

Here’s some over-simplified math on what the Stolte Method may look like for a Nomad™ utilizing it.

If the typical expenses on a $400K rental property are $2K per month, then 6 months reserves is equal to $12K reserves per property.

If you sell a $400K property today on a lease-option (a la the Stolte Method) and net $80K in about 4 years.

$80K/$12K per property = reserves for about 6.5 properties.

For many folks, 6 free and clear properties is enough to achieve financial independence.

So, you could fully fund your reserves using the Stolte Method once.

Doing it a second time, could fund 3-4 down payments for Nomad™ purchases. That’s based on $80K from one sale via the Stotle Method divided by $20K down payment per property.

Doing the Stolte Method 3 times could fund your reserves and down payments for 6 properties.

WARNING: In my mind, this is extremely aggressive and vastly over-simplified plan.

More Info On The Stolte Method

Realize that the Stolte Method really is a simplified version of the How to Acquire a Multi-Million Dollar Real Estate Portfolio Starting with Just $3,000 classes I’ve taught previously. There’s even a full book on the strategy I wrote as well (which is really just a written out version of the class).

If you’re interested in implementing the Stolte Method, you may want to really study those classes and all the material on lease-options.

Warning: The Dangers and Risks of Real Estate Investing

Toward the end of the class, I asked the attendees if they’d rather I continue with teaching some key excerpts from a previous class I taught called Warning – The Dangers and Risks of Real Estate Investing or just make the previous recording available (for a limited time).

Real Estate Investing Classes

If you’re interested in other real estate investing classes, check out our list of free real estate investing classes.