Pro Tip: Listen to the podcast below and while you’re listening follow along with the charts below. Then, when you’re done, copy the  Scenario

Scenario

Welcome to the Real Estate Financial Planner™ Podcast. I am your host, James Orr. This is Episode 8.

Today we’re going to continue with  Norm and Norma’s

Norm and Norma’s

In the previous episode, Episode 7,  Norm and Norma

Norm and Norma

We discovered… I think to the surprise of some listeners… that even though they cut the amount they were saving and investing each month from $1,000 to about $420 per month… that they still ended up achieving financial independence faster.

Remember  Norm and Norma

Norm and Norma

10 20% Down Payment Rentals

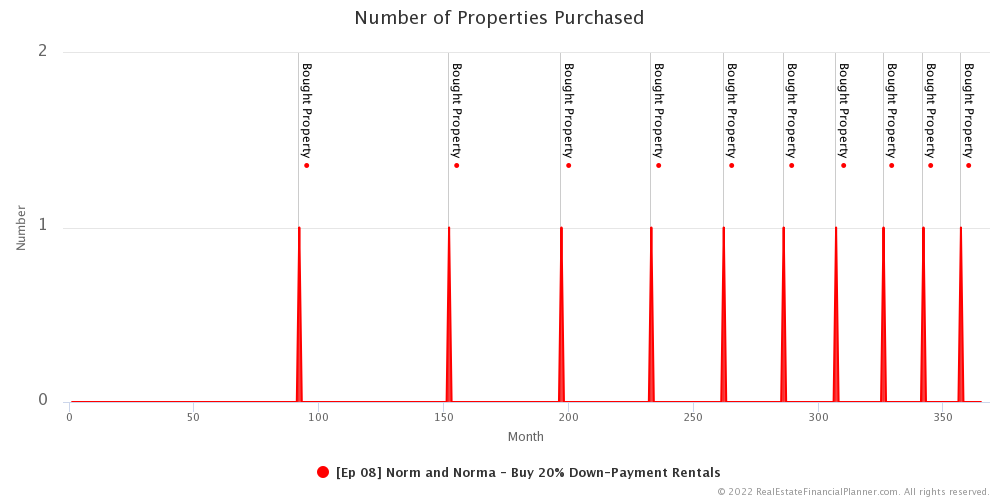

With that in mind, in this episode they will consider buying up to 10 rental properties with 20% down payments while they continue to rent themselves.

For the sake of our modeling, we’re assuming this is the same property they bought as an owner-occupant in the last episode with 5% down payment. Except now, they are buying it as a non-owner-occupant with a 20% down payment investor loan.

They’ll be saving up for their first down payment and while they’re doing that the property value will be increasing each month… at a rate of 3% per year. Rents will also be increasing a little bit each month… at the same 3% per year rate.

So, the first property they buy will be less expensive than the second property. Each one they buy will be more expensive and getting a little bit more in rent.

Buying First Rental

The property was worth $375,000 at the start but by the time they save up 20% down payment plus closing costs plus 6 months of reserves, it takes them over 8 and half years.

By then, the properties are worth and selling for almost $470,000…. that’s almost $100,000 more than the price when they started. So, that’s the price they pay for their first rental property.

Buying Second Rental

With some cash flow coming in from the first rental property, they’re able to save up 20% down and 6 months reserves… including reserves for the rental they own… and buy their second rental property in less than an additional 8 years.

They buy their second rental property about 5 years later… about 13 and half years from when they started… and they end up paying over $540,000 to purchase that property. That’s about $70,000 more than the last property they purchased 5 years earlier.

Equity Not Directly Used for Financial Independence

But the good news is that since they owned one of those properties, they captured $70,000 in equity.

I think this is as good a time as any to remind you how we calculate whether they’ve achieved financial independence and explain why… even though the equity gain is great… it does NOT help them achieve financial independence in this particular set of assumptions.

Financial independence is when they generate enough passively to cover their target income.

So, how do we calculate that?

Well, we look at three things:

- Passive income from things like social security, pensions and annuities.

- Net cash flow after all expenses on rental properties, and

- Their invested assets times their safe withdrawal rate.

So, for  Norm and Norma

Norm and Norma

That means… they’re not benefiting at all from the first group until after they have achieved financial independence and then it is only from social security.

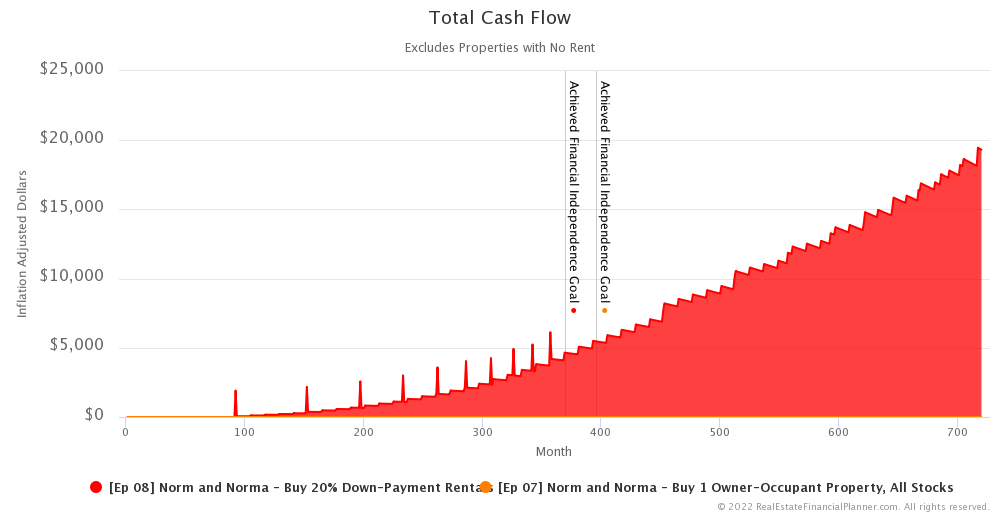

What about net cash flow from rental properties? Yes… as they buy 20% down payment rentals, they’re seeing positive cash flow and that is helping them achieve financial independence.

What about the money they have invested in stocks? Yes… any money they have invested in stocks… multiplied by their safe withdrawal rate is counting toward their financial independence goal.

And that’s it. You’ll notice that property equity is not included in that calculation.

If they pay off a property completely then they no longer have a mortgage payment and cash flow improves. And that would contribute toward their goal of financial independence, but equity does not.

Now… we’re not really discussing this in this Scenario, but… there are things they could do with their equity. These are things we will cover in future episodes of the Real Estate Financial Planner™ Podcast, but we’re not going to go into detail about in this episode.

For example:

- They could sell off some of their properties and use that money to pay off other properties to improve cash flow and ultimately achieve financial independence, or

- They could sell off properties and use that money to invest in stocks or annuities or something else where they could generate cash flow from it.

- They could do a cash out refinance and use the equity to pay off other properties or buy other investments.

We will cover these ideas in future episodes, but for this episode realize that  Norm and Norma

Norm and Norma

So let’s get back to our story.

Norm and Norma

Norm and Norma

Buying Additional Rental Properties

They continue to save with the help of the two rentals and eventually are able to have enough for 20% down payment, closing costs and reserves for their properties and personal expenses a little less than 4 years later.

They buy their third rental property for a little over $600,000.

Each one they buy improves their cash flow and makes it easier to save for the down payment, closing costs and reserves for the next property.

For example, the next one takes 3 years then 2 and a half then 2 then about 21 months and so on.

It takes a little over 30 years to acquire all 10 properties.

The last property they buy was for just over $900,000.

Out of an abundance of clarity, they paid $900,000 for it but it was essentially the same house they were considering for $375,000 30 years earlier. The house prices were just going up at the same rate as inflation, 3% per year, for 30 years.

So, if we adjusted back for inflation to today’s dollars, it worth $375,000. In fact, each house… adjusted back to today’s dollars is worth $375,000 but in future, inflated dollars they are each worth about $900,000.

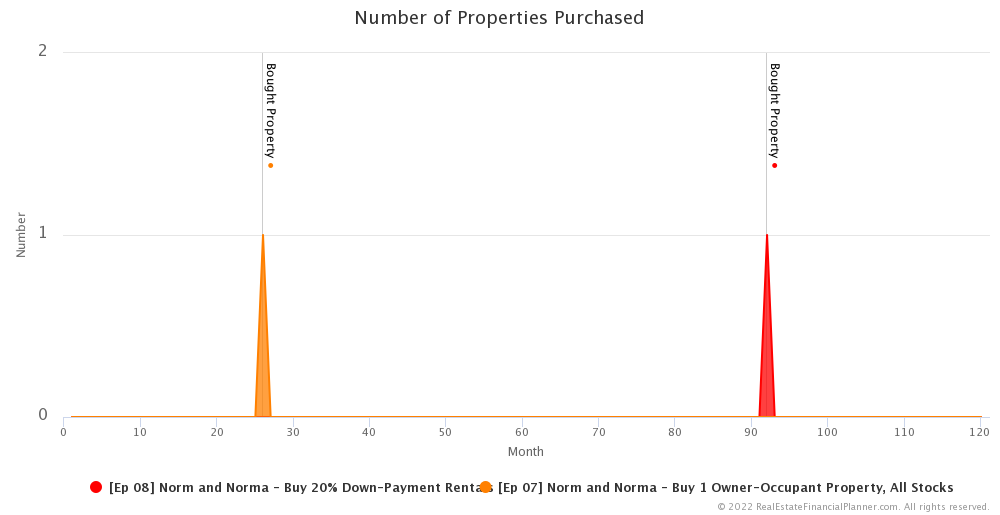

One thing I did also want to mention is how long it took to buy the first property and how that compares to how long it took to buy the first property in the previous episode.

In this episode, it took just over 7 and a half years to buy their first property… a 20% down payment rental property. In our last episode when they were buying just an owner-occupant property with just 5% down payment, it took just over 2 years to save up for the down payment and closing costs.

Speed of acquiring properties is a major advantage of strategies with lower down payments like the Nomad™ real estate investing strategy. But, we will talk about that a lot more in future episodes where  Norm and Norma

Norm and Norma

In the last episode, they only bought the one owner-occupant property, but in this episode they’re buying 10 20% down rental properties.

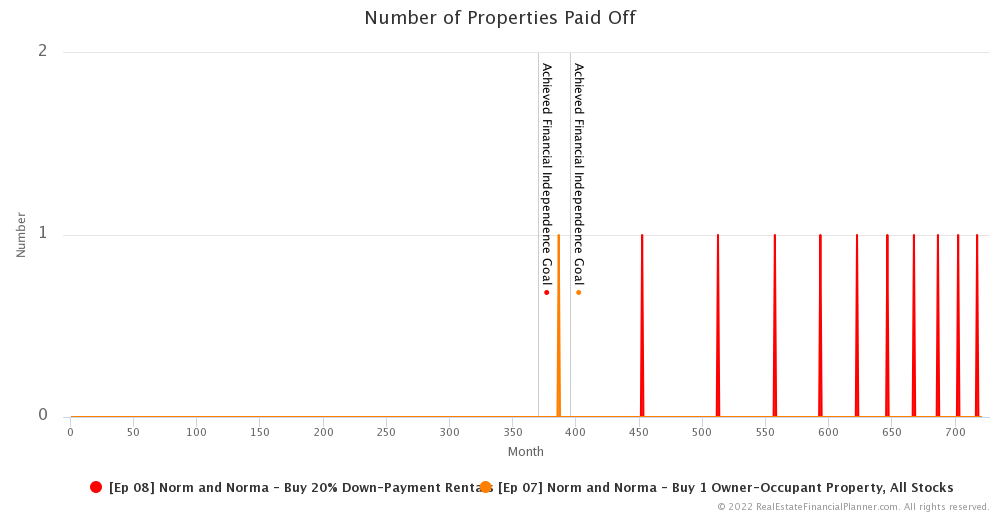

This is going to sound obvious, but I’ll say it anyway: if you buy a property early, you end up paying it off earlier. And, that’s what happened in the last episode.

In the last episode  Norm and Norma

Norm and Norma

In this episode, it is not the paying off of their rentals that allows them to achieve financial independence. Instead, it is mostly brute force cash flow.

They achieve financial independence before they pay off even the first rental property. This is interesting because, as we will see, that means that when they do start to pay off properties and cash flow from their rentals really increases they will be able to support a much higher standard of living.

Financial Independence

So, how long does it take  Norm and Norma

Norm and Norma

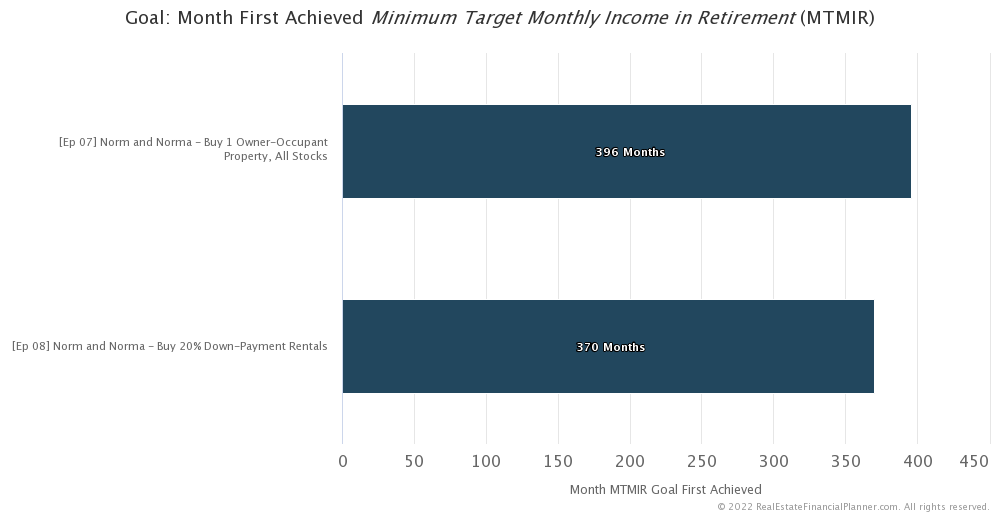

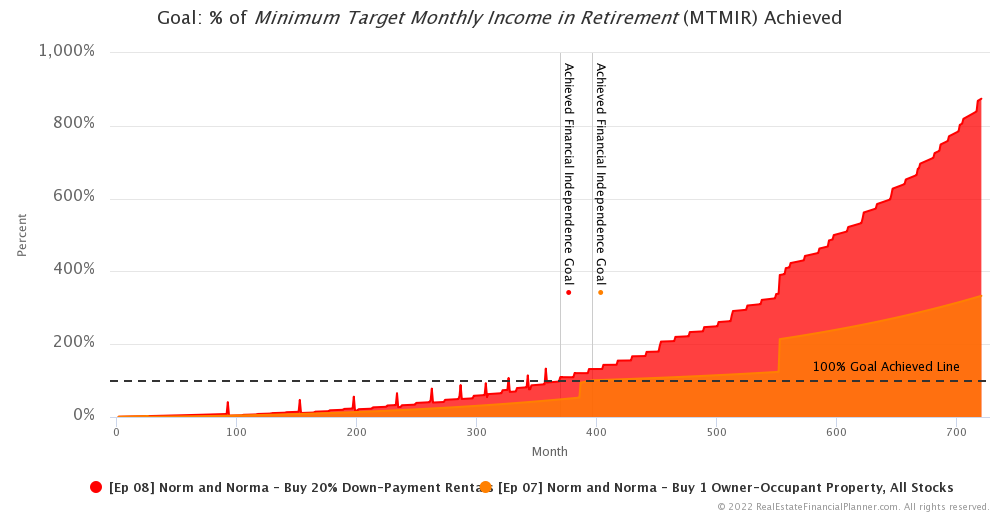

They meet the definition of being financially independent in month 370… that’s just under 31 years. Compared to 33 years if they just bought their owner-occupant property and invested in stocks instead. That’s a little more than 2 years faster by buying 10 20% down payment rentals.

But there’s another consideration. Do you remember I just told you that they achieve financial independence even before they pay off a single rental property?

Well, as they move beyond first achieving financial independence, rents on their properties keep creeping up with inflation and even though taxes, insurance, maintenance and vacancy costs increase with inflation too… their increases are just a small fraction of what rents are increasing at and therefore cash flow is going up faster than inflation.

And, when they do pay off a property, their cash flow on that property increases by what the principal and interest payment on that property was. So, they get nice bumps to cash flow with each property that is paid off.

That means that as cash flow increases, they could be living at a much higher standard of living than just the inflation adjusted $5,000 per month they were first targeting. In fact, they’re able to live on an inflation adjusted $10,000 per month by just before year 38… 7 years later.

It takes them 16 and a half years more to get to the same point in the last episode just buying an owner-occupant property with stocks.

It is around that same time… within a few months… where they could be living on an inflation adjusted $20,000 per month… more than 4 times their minimum or twice their ideal standard of living… by buying 10 20% down payment rentals.

In fact, by the end of our modeling… in year 60… the inflation adjusted cash flow from the rentals is almost $20,000 per month… net of all expenses like taxes, insurance, maintenance and vacancy. So, they could almost support a $20K per month lifestyle without considering their stock investments or social security at all by then.

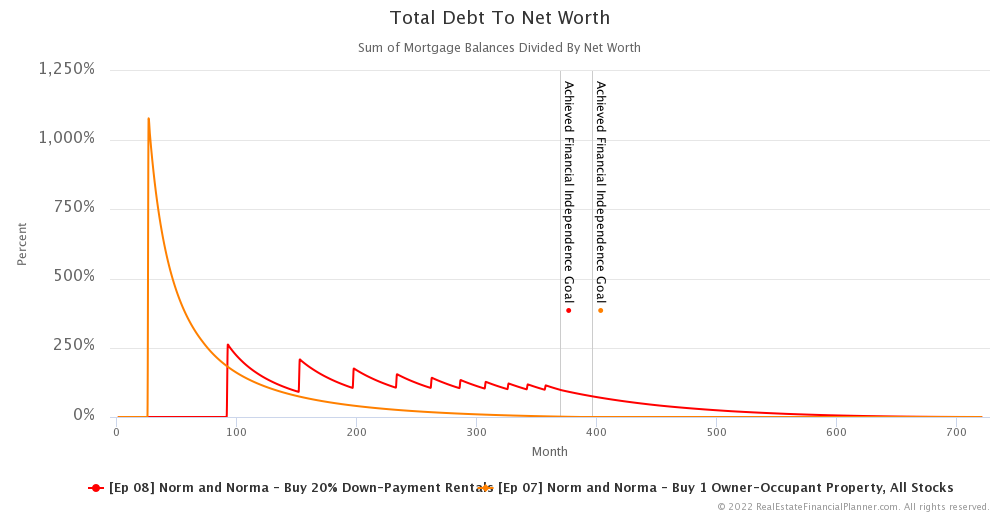

Risk

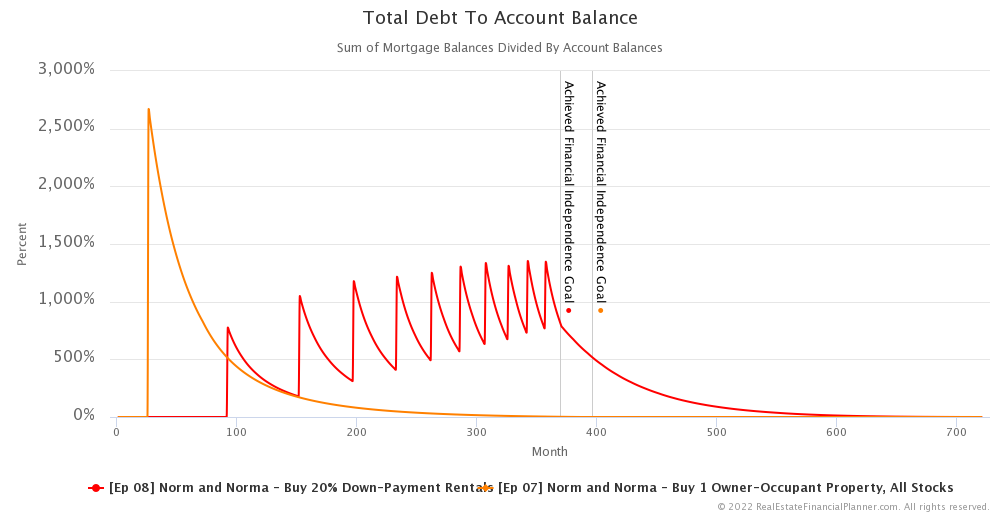

But, does investing in rental properties add risk? Yes. Not only does it increase risk in several ways that we like to measure… including debt to net worth and debt to liquid net worth… which we call debt to account balances… but it also changes the characteristics of risk as well.

In the previous episode, they just had their owner-occupant property and the rest of their risk was stock market risk.

In this episode, they still have stock market risk as they save for down payments and keep that money invested in the stock market as well as after they’re done acquiring properties and invest in the stock market. But…  Norm and Norma

Norm and Norma

People have different beliefs about which risk… the stock market or the real estate market… is greater and I’ll leave that for you to contemplate… at least for now… but you should realize that this is not a pure apples to apples comparison. It is an apples to oranges comparison or more appropriately a bowl of all apples with one orange to a bowl of some apples and 10 oranges.

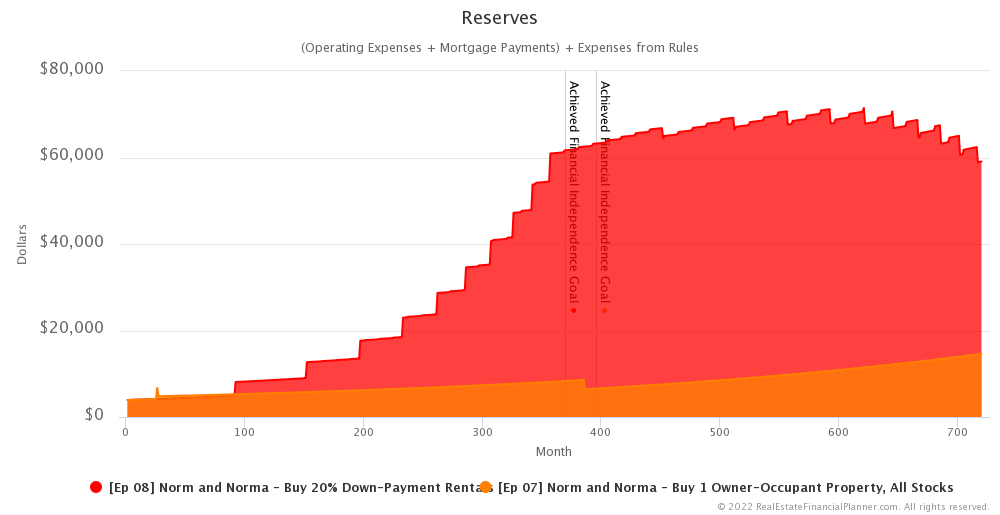

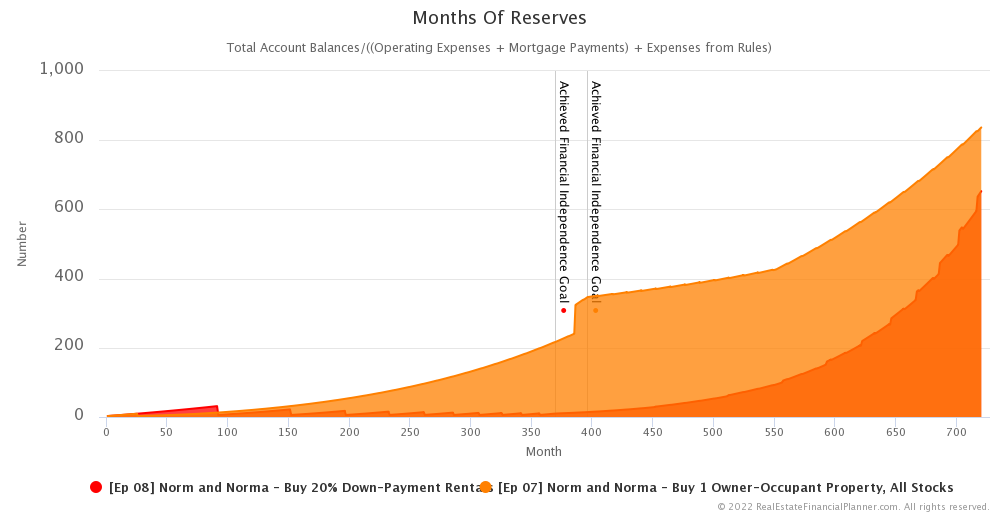

Reserves

I’d like to end our discussion by talking a little bit about reserves… which is another way I like to look at risk.

In my opinion, in general, the more reserves you have the lower your risk.

When buying 10 20% down payment rental properties the amount you need for a single month of reserves is much higher than buying just one owner-occupant property. I mean you need to have reserves for each mortgage payment, each property’s taxes and insurance plus your own personal expenses.

But, if you recall from earlier,  Norm and Norma

Norm and Norma

So, even though they have a lot more months of reserves for the overwhelming majority of the time just buying the one owner-occupant property, they still have at least 6 months of reserves at all times. At least that’s true with our static assumptions… it won’t always be that way in the advanced modeling we do in the Advanced Real Estate Financial Planner™ Podcast episodes.

Next Episode

If  Norm and Norma

Norm and Norma

Also, be sure to check out the Advanced Real Estate Financial Planner™ Podcast to see how having variable property appreciation rates and rent appreciation rates, variable mortgage interest rates, variable inflation rate and variable stock market rates of return impacts  Norm and Norma

Norm and Norma

I hope you have enjoyed this Episode about  Norm and Norma

Norm and Norma

Get unprecedented insight into  Norm

Norm Norma’s

Norma’s Scenario with dozens of detailed, interactive charts.

Scenario with dozens of detailed, interactive charts.

Inside the Numbers

Watch the Inside the Numbers video to see exactly how we set up their  Scenario

Scenario

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 07 Norm and Norma - Buy 1 Owner-Occupant Property, All Stocks with 2

Ep 07 Norm and Norma - Buy 1 Owner-Occupant Property, All Stocks with 2  Accounts, 1

Accounts, 1  Property, and 6

Property, and 6  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 08 Norm and Norma - Buy 20% Down-Payment Rentals with 2

Ep 08 Norm and Norma - Buy 20% Down-Payment Rentals with 2  Accounts, 1

Accounts, 1  Property, and 6

Property, and 6  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Podcast Episodes

The following are the podcast episodes for variations of  Norm

Norm Norma’s

Norma’s

More posts: Norm Episode