Are you wanting a powerful real estate investing strategies that funds its own growth? A strategy where the last property you bought provides the down payment for the next property you buy without tapping into equity with a loan?

Get ready to discover Nomad™ with Lease-Option Exits, a game-changing strategy that’s revolutionizing the way investors build wealth through real estate with limited or no down payments.

Nomad™ with Lease-Option Exits isn’t your average investment approach.

It’s a unique blend of the Nomad™ strategy and lease-option agreements, allowing you to build wealth faster and with potentially higher returns.

Here’s what sets Nomad™ with Lease-Option Exits apart:

- Accelerated wealth building – Instead of converting properties to rentals, you offer lease-options to tenant-buyers, potentially capturing appreciation and additional income faster.

- Unlimited Down Payments – The previous property you bought provides the down payment for the next property you buy. Plus, when tenant-buyers cash you out of the property, you can redeploy your profits into buying additional rentals or other investments and maximize return on equity.

- Competitive financing – Leverage owner-occupied loan rates for improved cash flow, just like traditional Nomad™, while setting up future exits and reducing the often-devastating impact of capital expenses.

- Reduced landlord responsibilities – With tenant-buyers aiming for ownership, you may face fewer day-to-day landlord duties compared to traditional rentals.

You’re building a portfolio of properties, each secured with a small down payment and offering strong wealth-building potential through lease-option agreements. That’s Nomad™ with Lease-Option Exits.

In this guide, we’ll explore how Nomad™ with Lease-Option Exits stands out from conventional strategies and traditional Nomad™. You’ll discover its unique benefits, financing possibilities, and potential challenges.

Whether you’re a seasoned pro or new to real estate investing, Nomad™ with Lease-Option Exits opens up exciting avenues for growing your wealth more rapidly.

By the time you finish reading, you’ll have a clear grasp of how Nomad™ with Lease-Option Exits could fit into your investment strategy and potentially accelerate your path to financial freedom.

Ready to unlock the secrets of becoming a successful Nomad™ with Lease-Option Exits investor? Let’s begin this exciting journey into a new realm of real estate investing.

What is Nomad™ with Lease-Option Exits?

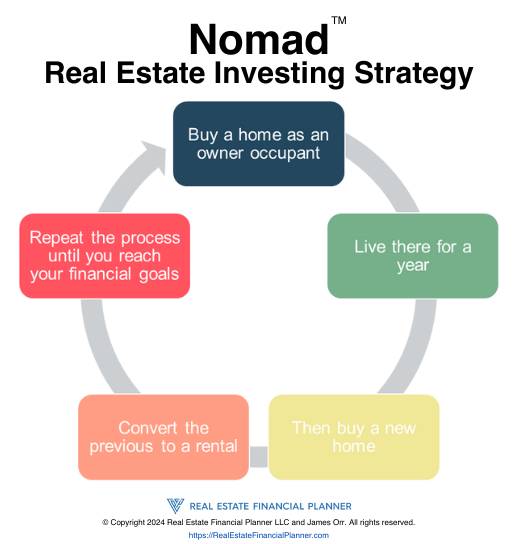

Let’s first review the traditional Nomad™ strategy before exploring how Nomad™ with Lease-Option Exits differs.

The traditional Nomad™ real estate investing strategy involves:

- Purchasing a home as an owner-occupant with low or no down payment owner-occupant financing.

- As an owner-occupant, you benefit from lower mortgage interest rates, which can improve cash flow.

- You must move into the property to comply with the lender’s requirements.

- You sign an agreement to live in the property for at least one year. Failure to move in—which lenders do verify—constitutes loan fraud, potentially resulting in fines and imprisonment.

- Staying longer than a year is permissible.

- During this period, you can “house hack” by renting to roommates or leasing other units in multi-family properties (duplexes, triplexes, or fourplexes).

- After fulfilling your one-year occupancy agreement, you can purchase a new owner-occupant property and move into it.

- You then convert the previous property into a rental.

- Repeat this process until you’ve acquired your desired number of rental properties.

- Each property is purchased with low or no down payment loans.

- Each property benefits from lower mortgage interest rates, enhancing cash flow.

In the traditional Nomad™ strategy, you convert each property to a traditional long-term rental after you move out.

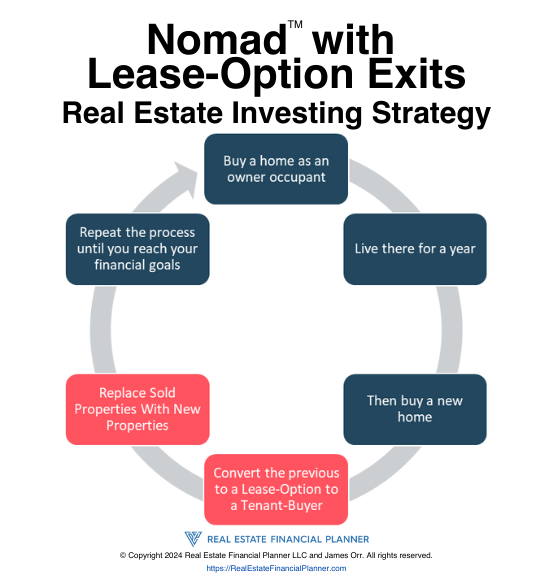

With Nomad™ with Lease-Option Exits, however, you offer the property to a tenant-buyer on a rent-to-own—with either lease-option or lease-purchase.

You collect a non-refundable option fee from the tenant-buyer before they move in which you use as the down payment for purchasing the property you’re moving into.

Some of the tenant-buyers will choose to exercise their option to buy the property and when they do you collect the rest of your profit from the sale without having to pay any real estate commissions and minimal closing costs. You can then use those profits to buy additional investments including traditional long-term buy and hold rentals or whatever your preferred real estate investing strategy is.

Financing Nomad™

Financing plays a crucial role in the Nomad™ with Lease-Option Exit strategy.

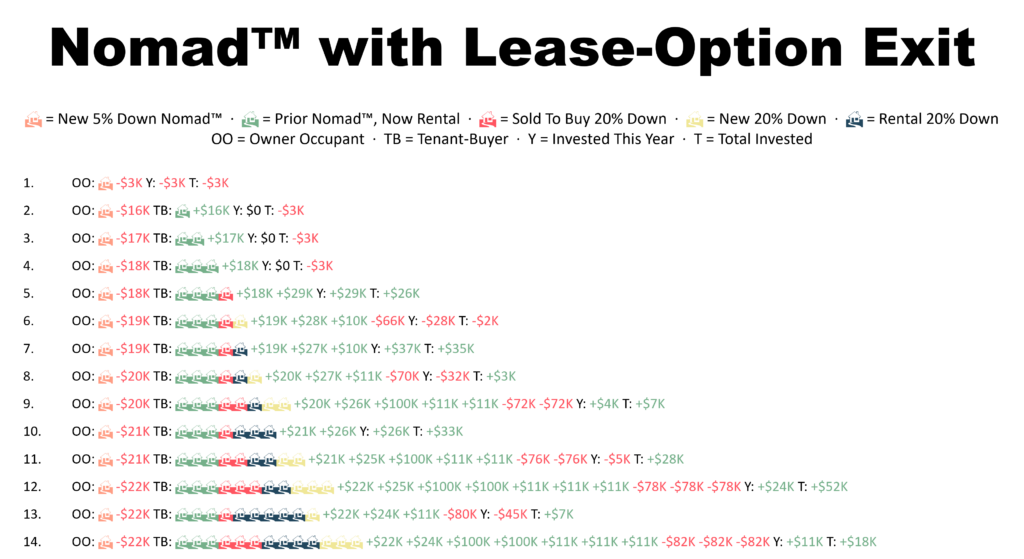

You’ll often use the non-refundable option fee from your tenant-buyer—who’s moving into the property you’re leaving—as the down payment for your next property purchase.

While having an extra down payment to front the costs can simplify timing, it’s entirely possible to implement this strategy using just the tenant-buyer’s option fee. If you can provide the initial down payment and then get reimbursed by the tenant-buyer’s fee, it can make the process smoother, but it’s not necessary.

Most Common Financing

The primary financing method for Nomad™ with Lease-Option Exits is Traditional Owner-Occupant Loans.

As tenant-buyers exercise their options and purchase properties from you, you may later opt to acquire additional properties using Traditional Non-Owner-Occupant (investor) loans, reinvesting the profits you’ve collected.

But the most common financing strategy for Nomad™ with Lease-Option Exits is Traditional Owner-Occupant Loans:

- Nothing Down Options – United States Department of Agriculture (USDA) and Veterans Affairs (VA) loans still offer 0% down payment options for eligible borrowers. This means you can potentially start your Nomad™ with Lease-Option Exits journey without a significant upfront investment. Once you get a single property, you unlock unlimited down payments by collecting a non-refundable option fee from your tenant-buyer, which you can use as a down payment on your next property.

- Low Down Payment Choices – Conventional loans with as little as 3% or 5% down, and Federal Housing Administration (FHA) loans with 3.5% down remain available. These low down payment options make it easier for you to get started with Nomad™ with Lease-Option Exits, allowing you to build your portfolio faster.

- Private Mortgage Insurance (PMI) – With down payments less than 20%, you’ll typically need to pay PMI. While this adds to your monthly costs, it allows you to start building your real estate portfolio sooner. The likely increased cash flow profits from lease-option exits can help offset this expense.

Remember, a key advantage of Nomad™ with Lease-Option Exits is using owner-occupant loans to secure better interest rates and terms compared to investment property loans. This can significantly improve your cash flow and long-term profitability, while the lease-option strategy provides potential for quicker equity capture.

As you explore these options for Nomad™ with Lease-Option Exits, consider speaking with a mortgage professional who understands this unique strategy. They can help you navigate the specifics of each loan type, ensure compliance with owner-occupant requirements, utilizing option-fees as down payments and find the best fit for your situation.

More Unusual Methods

While traditional owner-occupant loans are the most common financing method for Nomad™ with Lease-Option Exits, there are some alternative approaches worth exploring. These options can provide additional flexibility and potentially more favorable terms in specific scenarios, enhancing the strategy’s effectiveness.

Let’s explore a few of these alternatives:

- Larger down payment conventional financing – Sometimes, putting more money down can be advantageous. A larger down payment might secure a lower interest rate, eliminate Private Mortgage Insurance (PMI), improve cash flow, enhance your debt-to-income ratio, and reduce risk—all of which could benefit your overall investment.

- Creative financing options– All creative financing strategies remain viable. For instance, if you discover a property with an assumable mortgage at an attractive rate, you could take over the existing loan. This approach is particularly valuable in a high-interest-rate environment. Moreover, many other creative financing methods can be effective, especially given your plan to exit the property using lease-options.

- Fronting the Down Payment Then Getting Reimbursed– There are two variations of Nomad™ with Lease-Option Exits:

- If you have multiple down payments available: Great! This simplifies the strategy. You can front the down payment for your next property, then reimburse yourself with the non-refundable option fee from your tenant-buyer.

- If you don’t have multiple down payments: No problem—you’ll get there. For now, require the tenant-buyer to provide the option fee before moving in, and use that as your down payment. If a potential tenant-buyer can’t do this, find one who can. Once your first property sells, you’ll have the funds to front your own down payments and get replenished by subsequent non-refundable option fees.

Holding

Nomad™ with Lease-Option Exits is a dynamic strategy that combines the benefits of traditional Nomad™ with the potential for faster wealth accumulation. Here’s a breakdown of its key features:

- More active than traditional Nomad™ – You move annually, but with a strategic twist. Each move sets up a potential lease-option exit, requiring more engagement in tenant-buyer selection and agreement structuring.

- Hands-on from the start – While you’re still handling property acquisition and financing, you’re also actively marketing to tenant-buyers and negotiating lease-option agreements. This approach demands more involvement during the owner-occupant phase.

- Increased workload over time – As years pass, some tenant-buyers will exercise their option to buy the property, while others won’t and will move out. For those who exercise their options, you’ll coordinate the sale and collect your profits. You’ll then need to reinvest these profits. For those who don’t exercise their option and move out, you’ll either convert the property to a traditional long-term rental, find another lease-option tenant-buyer and collect another non-refundable option fee, or sell the property. This increased activity makes Nomad™ with Lease-Option Exits a more hands-on strategy than traditional Nomad™.

- Reduced property management – On the plus side, tenant-buyers who plan to purchase the property often have more of an owner’s mentality, potentially requiring less day-to-day property management than traditional renters.

Duration

The duration of holding Nomad™ with Lease-Option Exit properties differs from most other Nomad™ variations. In this strategy, you acquire properties but aim to sell them to a tenant-buyer on a lease-option almost immediately after the first year. Typically, Nomad™ with Lease-Option Exit investors hold properties for 2 to 5 years.

After selling, investors redeploy the profits. This often involves purchasing the yearly Nomad™ property while simultaneously acquiring other properties intended for long-term holding.

As you approach financial independence, you might transition from lease-options to a more passive, less active strategy—which may or may not involve real estate investments. Some investors use lease-option exits to convert their profits into a simplified investment portfolio as they near financial independence.

This simplification could involve:

- Completely exiting real estate investing (perhaps opting for stocks or annuities)

- Reducing your portfolio to fewer, but better cash-flowing properties

- Shifting to less hands-on investments (like moving away from lease-option exits)

Nomad™ with Lease-Option Exit investors enjoy two significant, often-overlooked benefits:

- The strategy of continually selling properties and reinvesting the proceeds optimizes return on equity, maintaining maximum “rocket booster” type returns.

- By selling properties before facing significant capital expenses, you save considerable money and see vastly improved cash flow and profit on sale.

These two advantages can yield substantial benefits over time.

Exit Channels

The exit channel for Nomad™ with Lease-Option Exit is inherent to the strategy itself: you use lease-options to enable tenant-buyers to purchase properties from you after they’ve lived there for one to three years.

Typically, you don’t sell these properties through traditional methods because you often rely on the tenant-buyer’s option fee to finance your next purchase.

If a tenant-buyer chooses not to exercise their option, you have several alternatives:

- Convert the property to a more traditional rental strategy (long-term, medium-term, or short-term)

- Find another tenant-buyer to purchase the property via a lease-option and collect another non-refundable option fee

- Sell the property using conventional methods (through an MLS listing with an agent, For Sale By Owner, or at auction)

Nevertheless, due to the core nature of this strategy, you’ll primarily utilize lease-option exits.

Exit Financing

When tenant-buyers exercise their option to purchase the property from you as part of their lease-option agreement, they typically finance the purchase in one of two ways:

- Traditional Owner-Occupant Loans – These buyers often qualify for owner-occupant financing, which may include:

- No-down-payment loans (VA and USDA)

- Conventional loans with 3% or 5% down

- FHA loans with 3.5% down

- Cash – Some buyers opt to purchase your property outright with cash. Since you’ve already agreed on the price when negotiating the original lease-option terms, there’s typically less pressure to reduce the price in exchange for a cash offer.

Investor/Entrepreneur

Real Estate Investors typically invest money, expecting a return on that investment. Real Estate Entrepreneurs, however, invest both time and money, anticipating returns on both.

How does Nomad™ with Lease-Option Exit fit into this framework?

While you might fund the first purchase—sometimes with no down payment—you’ll typically rely on non-refundable option fees to fund down payments for subsequent purchases.

This approach, however, demands an active strategy: finding tenant-buyers with substantial option fees (around 5%) to cover your next property’s down payment.

Additionally, you’ll face extra responsibilities:

- Facilitating the sale if tenant-buyers exercise their option

- Reinvesting profits from the sale

- Securing another tenant-buyer if the option isn’t exercised

These factors make Nomad™ with Lease-Option Exit a more entrepreneurial venture.

Money Required

A key advantage of Nomad™ with Lease-Option Exit is its minimal or zero down payment requirement. This is achievable because you often fund new purchases using proceeds from the property you’re vacating.

While we’ll explore both common and less common money requirements, it’s crucial to note that these funds typically come from your previous property.

Having money available to front undoubtedly streamlines the process. Even a modest amount of capital can significantly ease the strategy’s implementation.

Most Common

Here are the typical money requirements:

- Down Payment – You’ll need 0% (for VA or USDA loans), 3% (for some conventional loans), 3.5% (for FHA loans), or 5% (for most conventional loans) of the purchase price.

- If you’re aiming for zero down, you’ll likely start with a 0% down loan for your first purchase. Then, use the non-refundable option fee from your first tenant-buyer to buy your next property, probably with a 3.5% FHA loan. For subsequent properties, you’ll likely use 5% down conventional loans. If you always aim for—at least—6% from your tenant-buyer in a non-refundable option fee, you can get grow your war chest when you buy your second property with a 3.5% FHA loan. Once your first property sells to a tenant-buyer, you’ll be in a much better financial position for buying subsequent properties.

- Closing Costs – These typically range from 2% to 5% of the purchase price, covering fees for appraisal, title insurance, and loan origination. Since you’re selling these properties to tenant-buyers quickly, you may prefer to finance these costs into the loan by negotiating seller concessions and accepting a slightly higher mortgage payment instead of paying out of pocket.

- Rent-Ready Costs – Budget for minor repairs or upgrades to prepare the property for tenants. Alternatively, target attractive properties that require no work and will appeal to your tenant-buyers.

- Cumulative Negative Cash Flow – While the traditional Nomad™ strategy might initially result in negative cash flow due to low down payments, this is less likely with a lease-option tenant-buyer. You’re more likely to command top-tier rent for a rent-to-own property. If you do experience negative cash flow, consider it a deferred down payment. Had you put more money down initially, you wouldn’t face this issue. By opting for a lower down payment, you might need to cover this shortfall through slightly negative cash flow. The total negative cash flow is usually less than what you’d need for positive cash flow upfront. Setting aside this amount when you first invest is a conservative approach. Be prepared to cover this shortfall until rents increase enough to eliminate the negative cash flow.

- Reserves – Aim for at least 6 months of mortgage payments and other operating expenses as a safety net.

- Marketing Costs– While free marketing can help you find tenant-buyers for rent-to-own properties, investing strategically in paid advertising may attract higher-quality tenant-buyer prospects more quickly. This targeted approach can streamline your search for the ideal tenant-buyer. You won’t need this money until you’re closer to moving into the next property, so you’ll have some time to save for it.

- Legal Fees – Have an attorney prepare your lease-option paperwork, especially for your first transaction. You can often incorporate this cost into the rent-to-own agreement. After reaching consensus on the basic terms, inform your tenant-buyer that it will cost $X for an attorney to draft the document properly, protecting both parties. This expense can be covered by a portion of the option fee.

Less Common

Here are some less common needs for money with this strategy:

- Tenant Turnover Costs – Not all tenant-buyers will exercise their option and buy the property from you. Some will move out. Just like with any real estate investing strategy, you might need to find another tenant or tenant-buyer for the property. You don’t have to hold out for the largest option fees when you’re replacing a tenant-buyer who opted not to purchase the property. But getting a larger one does help build your capital base for your next purchase.

- Option Fee Refunds – While you will insist that option fees are non-refundable, there may be times—due to extenuating circumstances—where you might opt to refund some or all of an option fee on a property. It is extremely rare, but something to be aware of.

Money From Tenant-Buyer

Since you’re often getting the money required for this strategy from your tenant-buyers, let’s discuss them.

First, if you’re concerned that a tenant-buyer will have 5% or more for a non-refundable option fee, I might remind you that we’re not catering to folks that have nothing down. Let them go to a traditional lender and get one of the nothing down loan programs and buy someone else’s property.

Second, the median down payment for all people buying a home was 15% according the 2024 National Association of Realtors Home Buyers and Sellers General Trends Report. That means that half of the buyers had more than 15% down. Half of the buyers had less than 15%.

Even for the age group with the lowest median down payment percentage—the 25 to 33 year-olds—their median was 10%. That means that half of them had more than 10% to put down. Half of them had less than 10%.

You might need a 6% non-refundable option fee from a tenant-buyer. That money will count as their down payment (or part of it if they put down more when they buy) if they exercise their option and buy the property from you.

There are plenty of buyers that have at least 6% to put down towards buying their house.

And, you just need one per year. Hold out until you find the one. It won’t take nearly as long as you think.

At least half of all home buyers have more than 15% and even the poorest, youngest group half of them have more than 10%.

Credit Required

When it comes to credit requirements for the Nomad™ with Lease-Option Exit strategy, you’ll typically need to qualify for traditional “Owner-Occupant Financing.” This is crucial because you must actually move into the property – failing to do so could be considered loan fraud.

Most lenders require a minimum credit score of 620 for Nomad™ investors using this strategy. However, there are some exceptions:

- FHA or VA loans – These may allow credit scores as low as 580, which can be beneficial for one of your earlier Nomad™ properties.

- Better credit scores – These often lead to more favorable interest rates and lower Private Mortgage Insurance (PMI) costs, which can improve your cash flow.

Keep in mind that you’ll usually need to live in the property for at least a year, as per the document you sign at closing to secure your loan. This aligns well with the Nomad™ with Lease-Option Exit strategy, as you’ll typically live in the property for 1-2 years before offering it as a lease-option.

If you’re buying a property with cash, your credit score won’t be a factor. However, this is less common in the Nomad™ with Lease-Option Exit strategy, as one of its advantages is leveraging owner-occupant financing.

IMPORTANT NOTE: Credit requirements can change over time. It’s always best to check with your local lender for the most up-to-date information on credit requirements, especially for owner-occupant loans that you’ll be using in this strategy.

Remember, your credit score is just one piece of the puzzle when qualifying for loans in the Nomad™ with Lease-Option Exit strategy. Lenders will also consider your income, debt-to-income ratio, and employment history when deciding whether to approve your loan.

If you’re concerned about your credit, consider working with a credit counselor. A better credit score can help you secure more favorable terms which will improve cash flow and make it easier to qualify for additional properties.

Skills Required

The Nomad™ with Lease-Option Exit strategy requires a unique set of skills for successful implementation. Let’s explore the key abilities you’ll need to develop:

- Deal Analysis for Lease-Options – You must evaluate properties not just for their traditional rental potential, but also analyze them as a lease-option exit.

- Finding Lease-Option-Friendly Deals – Identifying properties suitable for lease-options is crucial. You’re looking for properties that will be desirable for tenant-buyers.

- Acquisition Financing – Understanding owner-occupant loans is essential. Knowledge of underwriting guidelines for sourcing down payments will be helpful. You’ll need to navigate the mortgage process and maintain good credit to qualify for multiple properties over time.

- Lease-Option Structuring – You’ll need to become an expert in structuring lease-option deals, including setting appropriate non-refundable option fees, purchase prices, and terms.

- Marketing to Tenant-Buyers – Develop skills in attracting and screening potential tenant-buyers. This includes creating compelling listings and conducting effective showings.

- Legal Knowledge – Familiarize yourself with local laws regarding lease-options. Consult with a real estate attorney to ensure your agreements are drafted correctly to protect you and the tenant-buyer and are legally sound.

- Negotiation Skills – You’ll need to negotiate effectively with both sellers when purchasing properties and tenant-buyers when structuring lease-options.

- Liquidation Financing – Understanding the financing that your tenant-buyer will be using to purchase the property from you will be helpful when you sell. Understanding what you need to document regarding their non-refundable option fee and how that will be used for their down payment will also be helpful.

Don’t worry if you’re not an expert in all these areas from the start. Many successful Nomad™ investors using the Lease-Option Exit strategy hone their skills over time. The key is to begin with a solid understanding of the basics and maintain a willingness to learn and adapt as you go.

Stability

Shane Parrish’s concept of active versus passive stability provides valuable insights for real estate investing. In the real estate world, most strategies are actively stable. However, Nomad™ with Lease-Option Exits takes this a step further, requiring even more active management than typical strategies.

This approach demands significantly more involvement than a traditional rental or even a standard Nomad™ strategy. You’re not just managing a property; you’re orchestrating lease-options and potentially facilitating sales when tenant-buyers decide to exercise their options. It’s a hands-on strategy that keeps you actively engaged in every step of the process.

Scalability

The Nomad™ with Lease-Option Exit strategy offers a unique approach to scaling your real estate portfolio.

Here’s how it enhances scalability:

- Accelerated Acquisition – Unlike traditional Nomad™, which typically limits you to one property per year, this strategy allows for faster expansion. As tenant-buyers exercise their options, you can reinvest profits into additional non-owner-occupant properties, rapidly growing your portfolio.

- Reduced Capital Requirements – This approach typically requires only about 25% of the down payment compared to traditional Buy and Hold (5% vs. 20%). The down payment often comes from your previous property via non-refundable option fees from tenant-buyers and, later, with subsequent investments funded by profits from tenant-buyers exercising their options.

- Favorable Financing – Owner-occupant interest rates are generally better, improving your debt-to-income ratio. This eases loan qualification and boosts cash flow for future investments.

- Enhanced Cash Flow – Rent-to-own properties often command premium rents, improving cash flow. This allows for increased savings and easier qualification for additional loans.

- Minimized Sales Costs – By selling directly to tenant-buyers and negotiating for them to cover closing costs, you significantly reduce sales expenses. This increases your profit margin and reinvestment potential.

- Optimized Return on Equity – The constant turnover of properties through lease-options maintains a high return on equity, providing “rocket booster” type returns.

- Lower Capital Expenditures – Shorter holding periods significantly reduce long-term capital improvements, enhancing cash flow and profitability compared to traditional long-term hold strategies.

Risk Exposure

While the Nomad™ with Lease-Option Exit strategy offers unique benefits, it’s crucial to understand the potential risks involved. This variation of the Nomad™ strategy carries a medium risk rating, similar to traditional Nomad™.

Here are the key risks to consider:

- Amplified returns – The smaller down payments in Nomad™ with Lease-Option Exit can lead to magnified returns, both positive and negative. Your potential gains could be higher, but so could your losses.

- Potential for negative cash flow – Smaller down payments may result in negative cash flow, especially in the early years. However, this is often offset by the higher rents typically associated with lease-options.

- Market volatility – You’re exposed to the risk of property value declines during ownership, which could impact the sale to your tenant-buyer and your equity position.

- Rent fluctuations – There’s a risk of rent declines during ownership, potentially affecting your cash flow and overall returns. This risk is often mitigated by the premium rents associated with lease-options.

- Credit risk – Your credit is at stake with each property you finance. Late payments or defaults could significantly impact your credit score and future borrowing ability.

- Property management challenges – You’ll face typical property management risks, including potential property damage and maintenance issues. However, these tend to be less severe with tenant-buyers, who often adopt an owner’s mentality.

While these risks exist, many can be mitigated through careful planning, thorough due diligence, and proper management. It’s essential to have a solid understanding of the lease-option structure and local real estate laws to navigate this strategy successfully.

Profit Speed

When it comes to Nomad™ with Lease-Option Exit strategy, understanding the speed at which you can generate profits is crucial. This strategy offers unique advantages in terms of profit speed and potential returns.

Let’s break down the primary returns you can expect from your Nomad™ with Lease-Option Exit investment property:

- Appreciation – The increase in your property’s value over time, which you can partially benefit from even when your tenant-buyer is living there depending on how the deal is structured.

- Cash Flow – The monthly income you receive after covering all expenses, which often includes a premium rent from your tenant-buyer.

- Option Fee – An upfront, non-refundable fee paid by the tenant-buyer for the option to purchase the property. Some investors mentally consider this cash flow while others may consider it receiving part of the appreciation from your property up-front in advance of a possible sale.

- Debt Paydown – The reduction of your mortgage balance as your tenant-buyer pays rent, essentially paying down your loan.

- Tax Benefits – Advantages like depreciation deductions that can lower your tax liability while you rent the property.

You also get returns on the reserves you’ve set aside while renting the property.

Now, let’s dive into how quickly you can start seeing these returns with the Nomad™ with Lease-Option Exit strategy.

Speed of Returns

With Nomad™ with Lease-Option Exit, you’ll start benefiting from appreciation and debt paydown almost immediately after purchasing the property even while you’re living in it.

Cash flow often begins right away after you’ve converted the property to a rent-to-own. Tenant-buyers typically pay premium rents which improves cash flow. You’ll also receive an upfront option fee, providing an immediate boost to your returns. You’ll usually use the option fee to fund additional purchases like a down payment on your next Nomad™ property.

The real acceleration comes when the tenant-buyer exercises their option to purchase. This can result in a lump sum profit, often within 2-5 years of your initial purchase. Reinvest this profit into additional deals (maybe even some non-owner-occupant properties in parallel to your Nomad™ model) to compound your returns.

Size of Returns

The size of your returns is often calculated as a percentage of your initial investment, typically expressed as Return on Investment (ROI).

Nomad™ with Lease-Option Exit can potentially offer higher returns due to premium rents, option fees, and the ability to lock in a future sales price that’s higher than the current market value.

Remember, the Cash Flow from Depreciation™ applies as you rent the property to the tenant-buyer. This can provide you with extra cash flow through tax savings.

Always structure your Nomad™ with Lease-Option Exit agreements carefully.

It’s wise to document your agreement in writing, preferably with the help of a real estate attorney familiar with lease-options.

Finding Deals

Finding the right properties for your Nomad™ with Lease-Option Exit strategy requires a combination of traditional and creative approaches.

Let’s explore both common and less common, more unsual methods to help you secure the perfect property for your Nomad™ with Lease-Option Exit journey.

Most Common Methods

Here are some tried-and-true methods for finding properties suitable for Nomad™ with Lease-Option Exit:

- Multiple Listing Service (MLS) – This remains your primary resource. Use the MLS to set up alerts for properties that meet your specific criteria, focusing on those with potential for both owner-occupancy and future lease-option appeal.

- For Sale By Owner (FSBO) – Actively Marketed – These properties, sold directly by owners, can often be negotiated more flexibly. Look for FSBO listings that could accommodate your initial occupancy and later transition to a lease-option arrangement.

- FSBO – Hidden Opportunities – Some property owners are open to selling but haven’t listed yet. To uncover these gems:

- Targeted Marketing – Send out mailers or run ads in your desired areas. Your message could be: “Looking to buy a home I can live in now and potentially offer as a rent-to-own later. Are you considering selling?”

- Network Networking – Network with people you know to uncover properties that are not yet listed for sale by the owners.

More Unusual Methods

A more unusual, uncommon source for finding deals suitable for Nomad™ with Lease-Option Exits is wholesalers. These real estate professionals often have access to off-market properties that aren’t listed publicly. By tapping into their network, you might uncover unique opportunities that align well with your investment strategy.

Analyzing Deals

When analyzing Nomad™ with Lease-Option Exit properties, we highly recommend using The World’s Greatest Real Estate Deal Analysis Spreadsheet™. This powerful tool is designed to work for all Nomad™ variations, including Nomad™ with Lease-Option Exit, making it an invaluable resource for your investment journey.

You can download this spreadsheet for free at:

https://RealEstateFinancialPlanner.com/spreadsheet

It’s a comprehensive tool that allows you to input various property details and financial parameters to get a clear picture of your potential Nomad™ with Lease-Option Exit investment.

Here’s why it’s particularly useful for Nomad™ with Lease-Option Exit:

- Return calculations – The spreadsheet shows you various return on investment and return on equity calculations, helping you understand the potential of your Nomad™ with Lease-Option Exit strategy, including the impact of premium rents and option fees.

- Long-term tracking – You can track your investment performance over time, not just at the point of purchase. This is crucial for Nomad™ with Lease-Option Exit as you transition from owner-occupancy to a lease-option arrangement.

- Customizable inputs – The spreadsheet’s intuitive dashboard is simple to use, yet extremely powerful. You can override almost any value for any year in the overrides tab, allowing you to account for various lease-option scenarios and potential exit timelines.

- Future projections – It provides long-term projections, giving you a clear view of your Nomad™ with Lease-Option Exit investment’s potential over time, including after your tenant-buyer exercises their option to purchase.

- Option fee analysis – In the overrides tab, you can input and analyze the impact of non-refundable option fees, helping you determine optimal fee structures for your lease-option agreements.

Download the spreadsheet for free and use it to analyze your Nomad™ with Lease-Option Exit deals. It’s an essential tool for making informed decisions in this unique investment strategy, helping you maximize your returns through strategic lease-option exits.

Market Conditions

When utilizing the Nomad™ with Lease-Option Exit strategy, market conditions play a crucial role in your success.

Let’s explore both ideal and challenging market conditions to help you make informed decisions about this unique approach to real estate investing.

Ideal Market Conditions

In the best-case scenario for Nomad™ with Lease-Option Exit, you’ll want to look for markets that offer:

- Strong cash flow potential – These markets allow your properties to generate positive cash flow from when you put a tenant-buyer in the property. It helps that you’re typically at the top end of the range of rents with rent-to-own properties.

- Robust appreciation – Look for areas where property values are steadily increasing over time. This helps build your equity faster and makes the lease-option more appealing to potential tenant-buyers.

- Healthy rent appreciation – Ideally you want to be buying properties where rents are going up. This becomes slightly less important with lease-options since you’re typically selling the property, but still part of an ideal market to do this strategy.

- High demand for rentals – Areas with a strong rental market often correlate with a pool of potential tenant-buyers who are interested in transitioning from renting to owning.

- Favorable local regulations – Some markets have landlord-friendly laws and regulations that support lease-option agreements, making it easier to structure and execute your exit strategy.

Challenging Market Conditions

On the flip side, some market conditions can make the Nomad™ with Lease-Option Exit strategy more difficult:

- Significant negative cash flow – Markets where properties consistently produce negative cash flow can make this strategy harder to implement.

- Stagnant or declining property values – Areas with no appreciation or even negative appreciation can make it difficult to set an appealing future purchase price for your tenant-buyer, potentially reducing the attractiveness of your lease-option offer.

- Flat or decreasing rents – If rents aren’t keeping pace with inflation or are declining, it can impact the perceived value of your lease-option agreement and make it less appealing to potential tenant-buyers.

- Oversaturated rental markets – Too much competition in the rental market might indicate an oversupply of housing, which could make it more challenging—but still usually possible—to find qualified tenant-buyers interested in a lease-option arrangement.

- Strict local regulations – Some areas have laws that make lease-option agreements complex or risky, potentially increasing your legal and financial risks when implementing this strategy. In a small number of markets, you may not be able to do lease-options at all and you’ll need to discuss with your attorney alternative ways to structure them to achieve the same result.

Remember, no market is perfect, and conditions can change over time. It’s crucial to thoroughly research and analyze potential markets before investing in a Nomad™ with Lease-Option Exit arrangement. Your success with this strategy often depends on your ability to navigate these market conditions effectively, from your initial purchase through to your lease-option exit.

Accessibility/Availability

The accessibility and availability of Nomad™ with Lease-Option Exit properties can vary depending on market conditions and your specific situation:

- MLS Listings – In many markets, you’ll find plenty of suitable properties listed on the Multiple Listing Service (MLS) that can work well for your initial occupancy and later lease-option arrangement. In these markets, you’re really just selecting the best of a wide range of options.

- Careful Selection – Some markets may require more careful sifting to identify deals that align with your Nomad™ with Lease-Option Exit strategy.

- Challenging Conditions – Challenging market conditions like poor price to rent ratios or declining values might make it difficult to find properties that will cash flow during the lease-option period and where a tenant-buyer may want to buy the property on a rent-to-own.

Interest rates play a significant role in determining the viability of properties for Nomad™ with Lease-Option Exit. Keep in mind:

- Owner-Occupant Rates – You can take advantage of owner-occupant rates for your initial purchase, which can provide better terms compared to investor loans and improve cash flow.

- Local Regulations – Always verify local regulations regarding lease-option agreements and eventual property sale before purchasing a property you intend to use for Nomad™ with Lease-Option Exit.

Using Retirement Account

You typically can’t use retirement accounts to buy Nomad™ with Lease-Option Exit properties since you’re owner-occupying the property initially.

However, it may be worthwhile to consider liquidating part of your retirement account and paying the penalty to utilize these funds for your Nomad™ with Lease-Option Exit strategy:

- Early Withdrawal – You could potentially access your retirement funds by paying the associated penalties and taxes to use them for your Nomad™ with Lease-Option Exit investment.

- High Returns Potential – The potential gains from your Nomad™ with Lease-Option Exit strategy, including premium rents and option fees, might outweigh the penalties and taxes incurred from early withdrawal.

- Careful Analysis Required – It’s crucial to run the numbers and consider all factors before making this decision.

Conclusion

The most significant advantage of Nomad™ with Lease-Option Exit is its potential for continuous growth. You can use non-refundable option fees from previous properties as down payments for new purchases.

This creates a cycle of essentially unlimited down payments. It allows you to expand your real estate portfolio more rapidly than traditional methods.

With careful execution, you can leverage this strategy to accelerate your wealth-building journey. Each property becomes a stepping stone to the next investment.

Remember, success in real estate investing comes from informed decisions and strategic action. Nomad™ with Lease-Option Exit offers a unique path to achieve your financial goals.

Start small, learn from each experience, and watch your real estate empire grow.