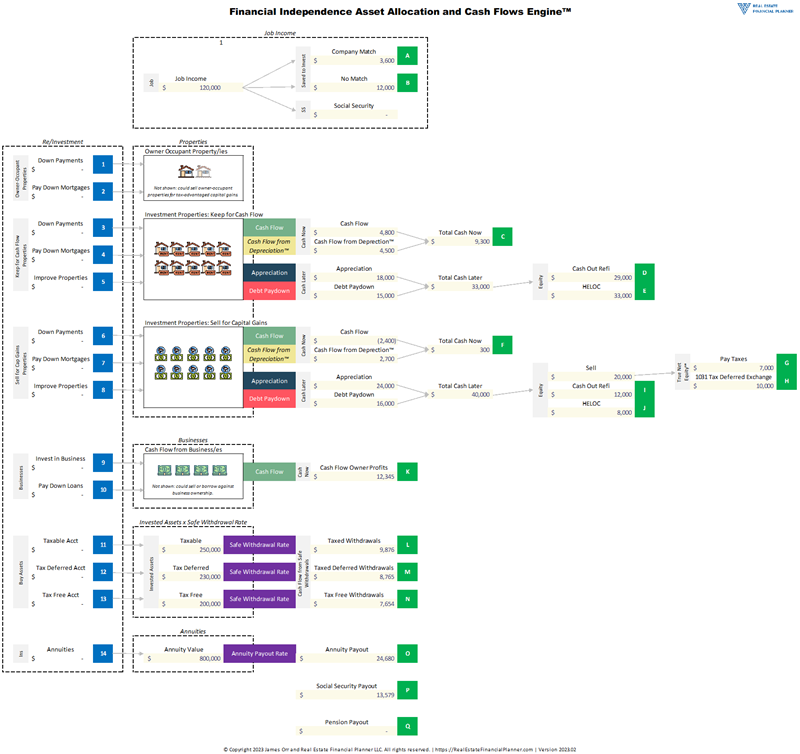

Financial Independence Asset Allocation and Cash Flow Engine™

Introduction: Understanding the Engine’s ArchitectureThe Financial Independence Asset Allocation and Cash Flow Engine™ isn’t just another budgeting spreadsheet. It’s a comprehensive wealth-building operating system that transforms how you think about, track, and optimize every dollar flowing through your financial life.Traditional financial planning treats money linearly: earn, save, invest, retire. The Engine reveals a multi-dimensional approach … Read more