Hey there! Ready to dive into real estate investing in 2024? Great choice! Real estate can be a fun way to make money and build your future. It’s like going on a treasure hunt where the treasure is not just gold, but a future full of possibilities. Whether you’re looking to buy your first property or dreaming of building a big portfolio, you’re in the right place. Let’s take this step together and turn those dreams into reality. Get excited, because we’re about to start an awesome adventure in real estate investing!

Understanding Real Estate Investing

First things first, let’s talk about what real estate investing is. It’s more than just buying houses. It’s a smart way to create income and wealth. Imagine having a house or apartment that someone else pays you to live in. That’s what we’re aiming for! But don’t worry, I’ll make it easy to understand.

- Types of Real Estate Investments: There are many ways to invest in real estate. You can buy a house or apartment and rent it out, which is called a rental property. Or you can buy a place, fix it up, and sell it for more than you paid, which is known as flipping. There are also real estate investment trusts (REITs), which let you invest in real estate without owning the property directly. Cool, right?

- Risks and Rewards: Every adventure has its ups and downs. Investing in real estate can bring you good money, especially if you’re patient and smart about it. But there are risks, like unexpected repairs or times when you can’t find tenants. It’s all about being prepared and making wise choices. See Ultimate Guide to Real Estate Risk for Real Estate Investors for detailed info on the risks of investing in real estate and how to mitigate those risks.

Real estate investing is a journey full of learning and growing. With each step, you’ll get better and closer to your goals. Let’s keep moving forward, shall we?

Types of Real Estate Investing

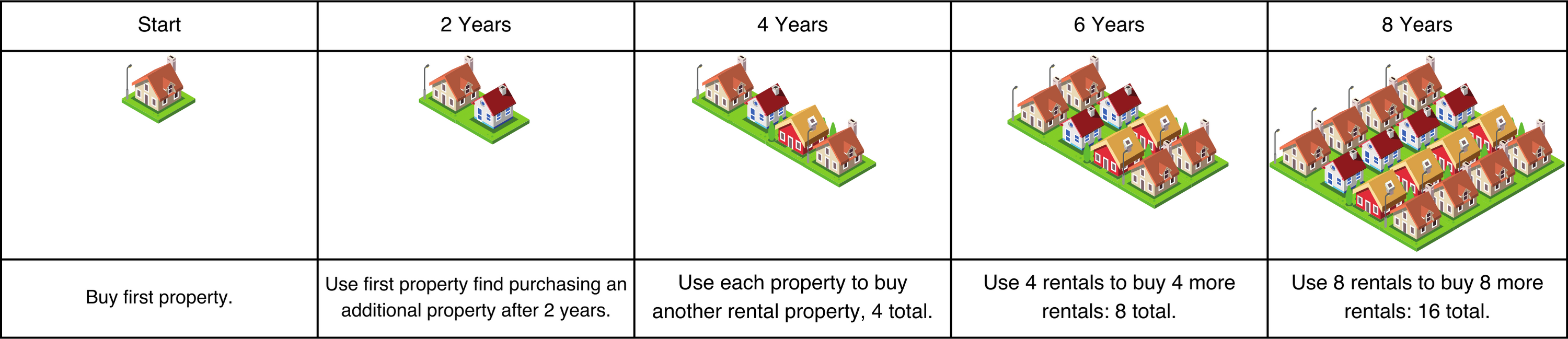

There are many exciting ways to invest in real estate. Each has its own path to success. Here’s a quick guide to help you find the one that fits you best or check out The Ultimate Guide to the Best Real Estate Investing Strategies:

- Buy, Rehab, Rent, Refi, and Repeat (BRRRR strategy): This strategy involves buying a property, fixing it up, renting it out, refinancing it for more than the purchase price, and then repeating the process.

- Buy and Hold: This is all about buying a property and holding onto it for a long time, usually to rent out and earn steady income.

- Fix and Flip: This involves buying a property in need of repair, fixing it up, and then selling it for a profit.

- House Hacking: Live in part of your property and rent out the rest. This can help you live for free or at a reduced cost.

- Lease-Option: You lease a property with the option to buy it later. This can be a good way to get into real estate with less money down.

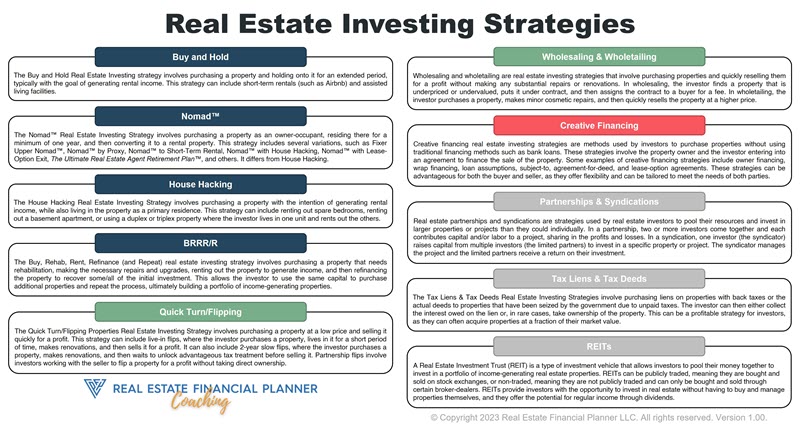

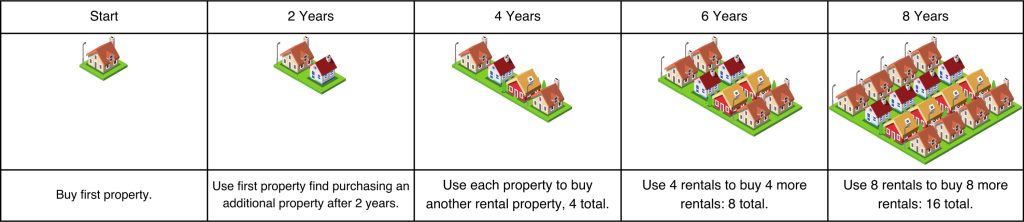

- Nomad™: This unique strategy involves moving into a new property each year, renting out the previous ones as you go.

- Options: You secure the right to buy a property at a set price, without the obligation to buy, which you can then sell for a profit.

- Partnerships: Join forces with others to invest in real estate, sharing the costs and the profits.

- REITs (Real Estate Investment Trusts): These are companies that own or finance income-producing real estate, and you can invest in them like stocks.

- Real Estate Entrepreneurship: This involves starting a business related to real estate, such as a property management company or a real estate brokerage.

- Creative Financing: Using non-traditional methods to fund your real estate investments, like seller financing or lease options.

- Short-Term Rentals: Renting out a property on a short-term basis, often as a vacation rental.

- Syndications: A group investment where you pool money with other investors to buy a property.

- Tax Liens/Deeds: Investing in tax lien certificates or tax deeds, which can be a way to acquire property at a lower cost.

- Wholesaling: You find a property below market value, get it under contract, and then sell the contract to another investor for a profit.

Each of these strategies has its own set of advantages and challenges. The key is to find the one that matches your goals, resources, and risk tolerance. Happy investing!

Setting Your Real Estate Goals

Having goals is like having a map. It shows you where you want to go. Without goals, it’s easy to get lost. Let’s make some goals that are big, exciting, and totally possible for you to achieve!

- Figure out what you want to achieve with real estate investing. Do you want to make quick cash, build long-term wealth, or maybe both? Think about what success looks like to you.

- Set short-term and long-term goals. Short-term goals can be something like buying your first property within the next year. Long-term goals might be earning enough rental income to quit your day job. Remember, it’s okay to start small and dream big!

- Make a plan to reach those goals. This could involve learning more about real estate, saving money for a down payment, or networking with other investors. Break your goals down into steps that you can start taking today.

Remember, your goals are like your personal treasure map in the world of real estate investing. They keep you focused and motivated. And with each goal you achieve, you’ll be one step closer to finding your treasure. Let’s set sail towards your dreams!

How to Find the Right Properties

Finding the right property is like finding treasure. It’s not always easy, but when you do, it’s incredibly rewarding. I’m here to share secrets on how to spot the best properties that can turn into gold mines!

Be sure to use The World’s Greatest Real Estate Deal Analysis Spreadsheet™ (a free download) to analyze your deals to make sure you’re finding one with the best returns.

- Researching the Market: The first step is to understand the market. Look for areas with growing job markets, good schools, and amenities. Properties in these areas are more likely to appreciate in value and attract tenants.

- Tools and Resources: Use online real estate marketplaces, local property listings, and real estate agents to find available properties. Don’t forget about public records and auctions for potential deals.

- Networking: Sometimes, the best deals aren’t listed. Talk to other investors, join real estate investment groups, and make connections. You never know who might give you a tip about your next big investment.

- Doing Your Due Diligence: Before making an offer, research the property thoroughly. Check for any legal issues, the condition of the property, and its potential for income. This step can save you from costly mistakes.

Finding the right property takes time and patience, but with the right approach, you’re sure to find something that fits your goals. Keep an open mind, stay persistent, and don’t be afraid to ask for help. Your perfect investment property is out there waiting for you!

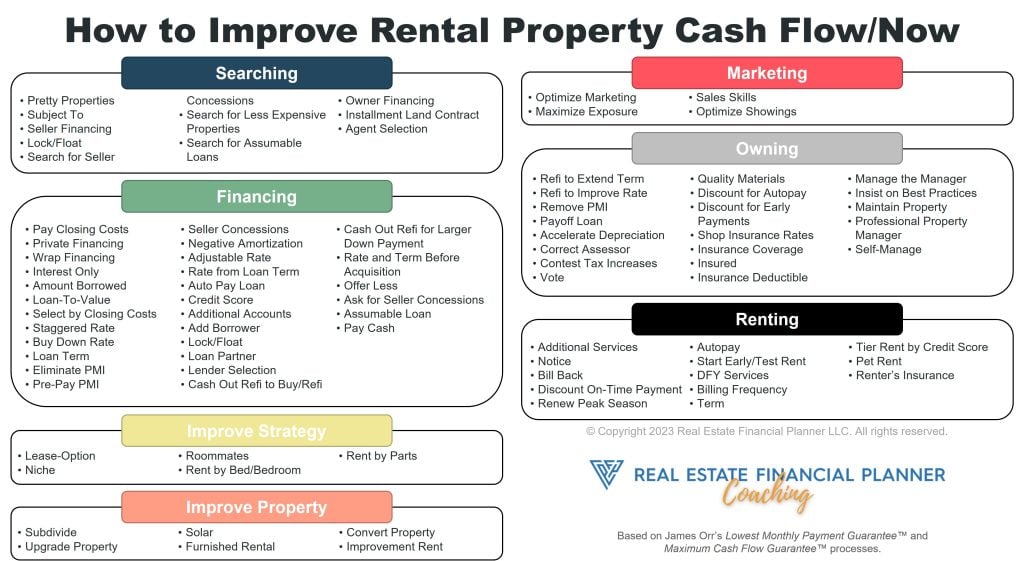

Optimize For Cash Flow

If you’re going to be buying properties to hold as rentals, you’ll want to optimize and improve cash flow in every way that you can. Use our proprietary list of 88 strategies to improve cash flow to make sure you’re getting every last penny of profit from your real estate investment’s cash flow.

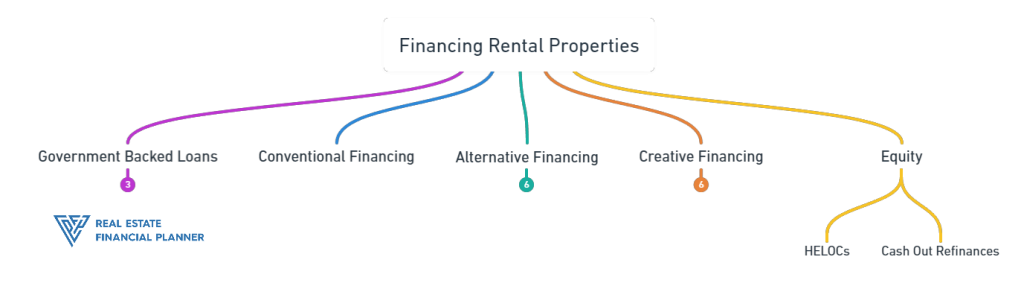

Financing Your Investment

Don’t let the word “financing” scare you. It sounds complicated, but there are smart ways to handle money that can help you buy your first property. Whether you’re buying your properties for all cash like a boss or trying to finance a property utilizing one of the low and nothing down financing strategies, let’s break it down into simple steps. You got this! And you can always dig deeper with The Ultimate Guide to Financing Rental Properties for more information.

- Saving for a Down Payment: The first step is saving for a down payment. It might seem tough, but with a good plan, you can do it. Cut back on unnecessary expenses, set a savings goal, and maybe even find a side hustle. Every little bit helps!

- Getting a Loan: Most investors need a loan to buy property. Look into different types of loans, like conventional loans, FHA loans, or even special investor loans. Each has its own requirements and benefits.

- Understanding Financing Options: Besides traditional bank loans, there are other ways to finance your investment. This could include seller financing, private lenders, or partnerships. Explore all your options to find the best fit for your situation. Check out The Ultimate Guide to Creative Financing for more information about creative financing options.

- Building a Strong Credit Score: A good credit score can make a big difference in getting a loan with favorable terms. Pay your bills on time, reduce your debt, and check your credit report regularly for any errors. Check out The Ultimate Guide to Credit Repair for Real Estate Investors for more info on improving and maximizing your credit score.

Financing your first real estate investment might seem daunting, but it’s definitely achievable with the right approach and a bit of patience. Remember, every successful investor started with their first property. Why not you?

Managing Your Property

Once you have a property, you need to take care of it. But don’t worry, it’s not as hard as it sounds. Being a great property manager is all about staying organized and keeping your tenants happy. Let me show you how.

- Finding Tenants: Your property needs tenants to earn income. Advertise your rental online, in local newspapers, or through a real estate agent. Make sure to screen your tenants carefully to find reliable people who will take good care of your property.

- Maintenance and Repairs: Keeping your property in top shape is key to happy tenants and a valuable investment. Handle repairs quickly, and consider a regular maintenance schedule to prevent bigger issues down the line.

- Understanding Landlord-Tenant Laws: Know the laws in your area about renting properties. This includes how much you can charge for a security deposit, when you can enter a tenant’s unit, and how to handle evictions if necessary.

- Setting the Right Rent: Charge too much, and you might struggle to find tenants. Charge too little, and you could lose money. Look at similar rentals in your area to set a competitive and fair price.

- Collecting Rent: Decide how you want to collect rent. Online payment systems can make the process easier for you and your tenants. Always be clear about when rent is due and the consequences of late payments.

Managing your property can be a rewarding part of real estate investing. It’s your chance to provide a great home for someone and see the value of your investment grow. With a little effort and care, you can be a top-notch property manager.

90 Day Plan to Get Started Investing in Real Estate

First 30 Days: Laying the Foundation

- Educate Yourself: Dive into books, podcasts, and online courses about real estate basics and investment strategies.

- Define Your Goals: Clearly outline what you want to achieve with real estate investing (cash flow, capital appreciation, etc.).

- Budget Planning: Assess your financial situation and determine how much you can afford to invest without overextending.

- Market Research: Start exploring different real estate markets to identify areas with high growth potential.

Second 30 Days: Knowledge & Networking

- Build a Network: Connect with real estate professionals, join local real estate investment groups, and attend webinars.

- Narrow Your Focus: Choose a specific real estate niche based on your goals and market research (single-family homes, multi-family units, etc.).

- Analyze Deals: Learn how to analyze potential deals using key investment metrics like ROI, cap rate, and cash flow.

- Preparation for Action: Get your financing in order, whether it’s through savings, loans, or partnerships.

Last 30 Days: Taking Action

- Property Search: Start actively searching for properties that fit your criteria using online platforms, your network, or a real estate agent.

- Make Offers: Begin making offers on properties that meet your investment goals, being prepared for negotiation.

- Due Diligence: Upon having an offer accepted, thoroughly inspect the property, review all documents, and ensure the investment’s viability.

- Close the Deal: Finalize the purchase with the necessary paperwork and start the journey of property management or renovation as planned.

Conclusion

Starting in real estate investing in 2024 is an exciting journey. You’re on the path to building wealth, creating income, and achieving your financial goals. Remember, every big achiever in real estate started with a single step. Whether it’s saving for your first down payment, learning about different types of investments, or managing your first property, each step you take is a move towards success.

Don’t be afraid to start small and dream big. Real estate investing is a journey filled with learning, growing, and sometimes, unexpected surprises. But with patience, persistence, and a positive attitude, you can navigate the ups and downs and make your investment dreams come true.

So, what are you waiting for? The best time to start is now. Let’s take this exciting journey together. Here’s to your success in real estate investing!