Buying down your mortgage interest rate can be a great strategy for real estate investors looking to maximize their cash flow. By paying an upfront fee to lower your interest rate, you can potentially save thousands of dollars over the life of your loan. But is it always worth it? And how do you know when to buy down your rate and when to use that money for other investments?

Buying Down Your Rate

First, let’s look at how buying down your interest rate works. When you apply for a mortgage, your lender will give you a quote for a certain interest rate based on your credit score, income, and other factors. However, you may have the option to pay an additional fee, known as “buying down” the rate, to get a lower interest rate. This can improve your cash flow by reducing your monthly mortgage payment.

Alternatively, you could have received a small credit from the lender that you could use to help offset your closing costs by voluntarily taking a higher mortgage interest rate (and making cash flow worse).

Cost to Buy Down Your Mortgage Interest Rate

But how much does it cost to buy down your interest rate, and how much will you save? The answer depends on a few factors, such as how much you’re borrowing, how long you plan to hold the property, and the current interest rate environment. It’s important to calculate the cost of buying down your rate and compare it to the potential savings in cash flow.

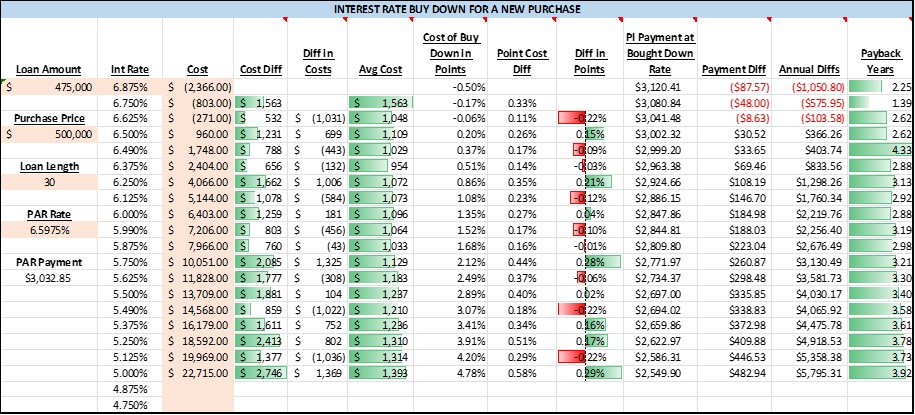

You can find out the costs by asking your lender. For example, here is what my lender sent me.

One way to do this is to use a spreadsheet, such as the one offered by the Real Estate Financial Planner™. This tool allows you to input your loan details and see how much it will cost to buy down your rate, as well as the potential increase in cash flow and return on investment. You can compare different interest rates and loan terms to find the best option for your investment strategy.

For example, here’s Brian’s spreadsheet for calculating your return from buying down your rate and comparing it to, alternatively, using the same amount as additional down payment.

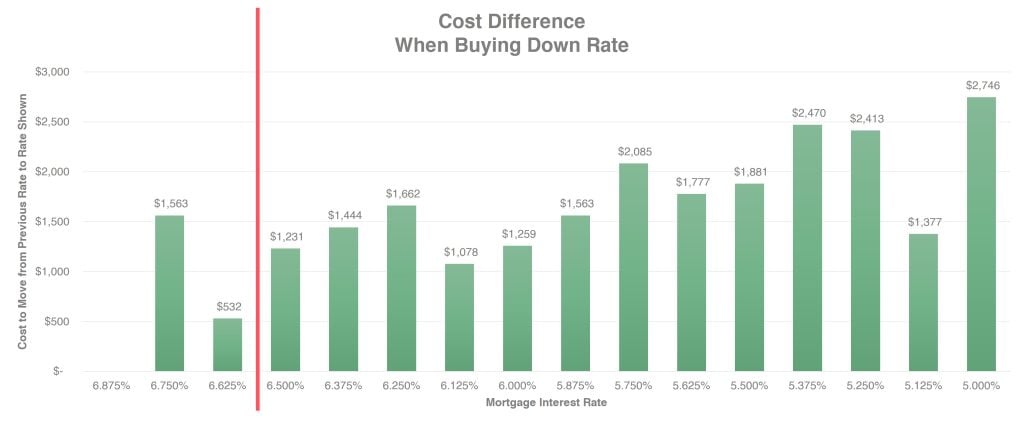

These numbers change daily and based on your credit score and lender, but with the spreadsheet you can easily see the cost difference when between buying down rates to various mortgage interest rates. For example, here’s the difference in cost buying down rates based on what my lender sent me. Yours will undoubtedly be different.

More Down Instead of Buying Down Rate

Another factor to consider is whether buying down your rate is the best use of your money. For example, if you have extra cash on hand, you may be able to put it towards a larger down payment, which can also improve your cash flow. Or, you may want to use that money to invest in another property or asset class. It’s important to weigh the potential returns of each option and choose the one that aligns with your overall investment goals.

Average Cost

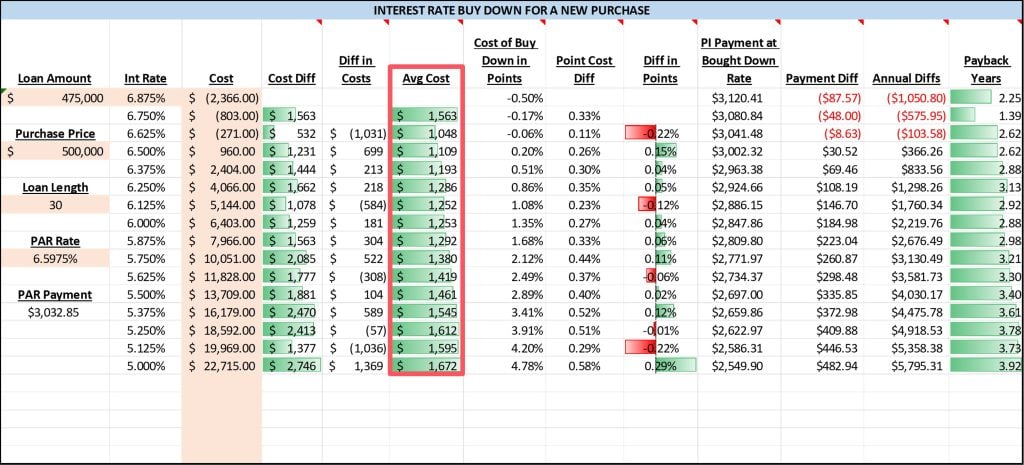

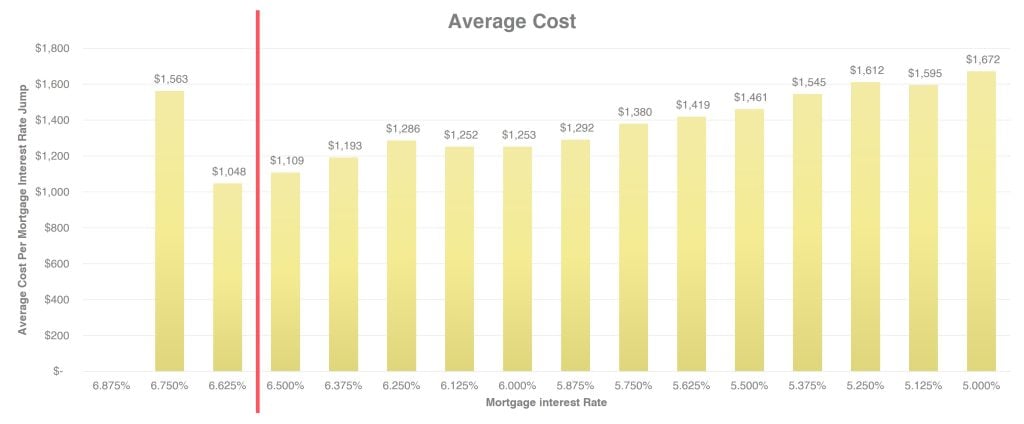

Ultimately, you’ll want to decide which rate you buy down. One consideration is to look for inefficiencies in pricing different buy down amounts.

For example, you can look at where it is relatively inexpensive to buy down compared to buying down to other interest rates by looking at the average cost for each 1/8 point buydown. This section on the spreadsheet is highlighted below.

It might be easier if we show a chart of these numbers. Here’s an example of that…

Return on Investment on Cost to Buy Down

Another consideration for how much to buy down is to look at the return you’re earning by the amount of money spent to buy down your mortgage interest rate.

The spreadsheet also does these calculations for you. For example, here you can see both the simple return on investment as well as the compounding return on investment for a variety of holding periods.

Just select the time period you expect to hold the property for and see the expected return on investment on the amount you had to spend to buy down the rate to that level. Use this compared to other options you could invest in to determine whether it is best to spend money buying down your rate to improve cash flow or to invest that money elsewhere.

Compare to Putting More Down

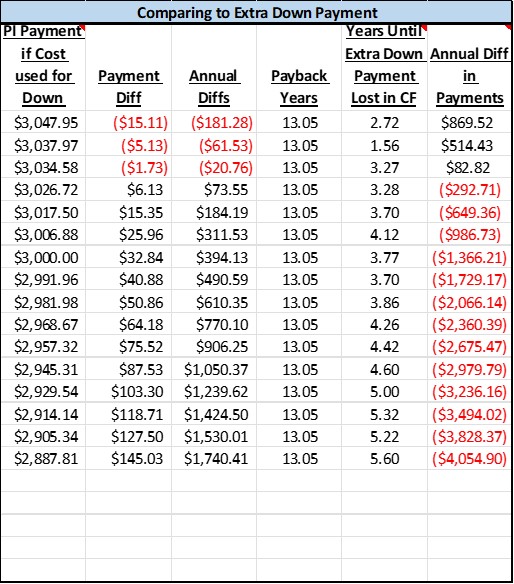

The spreadsheet also allows you to see how much better it would be to buy down the rate versus putting that same amount down in extra down payment.

Not Just Improved Cash Flow

Buying down your interest doesn’t just impact cash flow. It also impacts how much of the loan you pay down with each payment. Lower interest rates pay off more in principal with each monthly payment than a mortgage of the same amount but with a higher interest rate. So, buying down your rate also increases how quickly your equity in the property grows too.

If you were to use the money you earmarked for buying down the rate as additional down payment instead, this also impacts how quickly your equity changes. Why? Because when you put more down, you’re borrowing less. That means there’s less to pay down over the life of the loan.

When we consider whether we should buy down the rate or put more down, we should consider the impact on both cash flow and equity growth in the rental property.

Don’t worry though, the spreadsheet does this calculation for you as well. The following shows you how much better buying down the rate or putting the same amount as additional down payment would have on you buying the rental property.

This allows you to see how much better it might be depending on which strategy you choose and your expected holding period for that property/mortgage.

Download The Spreadsheet

The spreadsheet download is available, with instructions on how to use it, on our substack.

Conclusion

In general, buying down your interest rate may be a good strategy if you plan to hold the property for a long time and prioritize cash flow. However, it’s important to do the math and make sure the cost of buying down your rate is worth the potential savings in cash flow. By using tools like a spreadsheet and consulting with your lender and real estate agent, you can make an informed decision and maximize your returns on your real estate investments.