It’s a question as old as real estate investing itself: should I sell my rental?

In this brand new class, James will give you unparalleled insight into whether you should keep your rental or sell it.

The Setup

You’ve been acquiring properties over time.

When you acquire properties, we’ve typically used Return on Investment (ROI) as a primary decision-making metric.

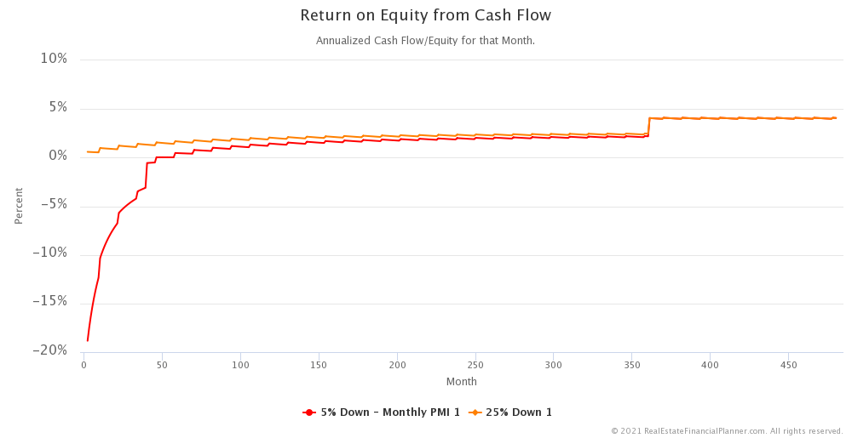

Some investors will focus more on cash flow and use Cash on Cash Return on Investment (which is just the “Cash Flow” portion of my Return on Investment Quadrants™).

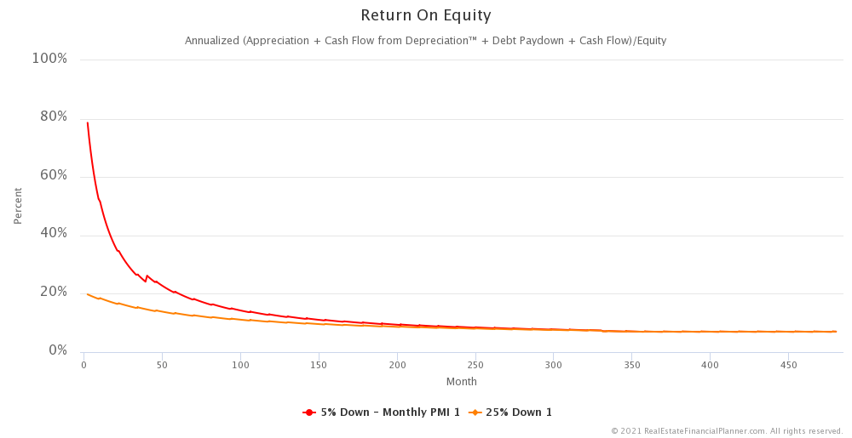

Once you acquire the property, many folks switched over to thinking terms in of Return on Equity.

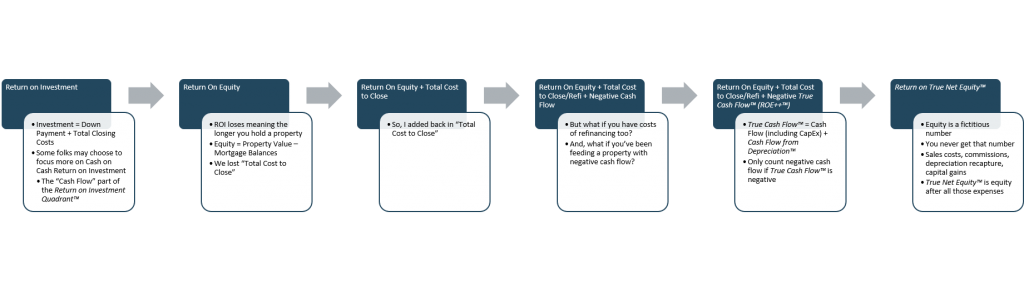

Evolution of My Thinking

- Return on Investment

- Investment = Down Payment + Total Closing Costs

- Some folks may choose to focus more on Cash on Cash Return on Investment

- The “Cash Flow” part of the Return on Investment Quadrant™

- Return On Equity

- ROI loses meaning the longer you hold a property

- Equity = Property Value – Mortgage Balances

- We lost “Total Cost to Close”

- Return On Equity + Total Cost to Close

- So, I added back in “Total Cost to Close”

- Return On Equity + Total Cost to Close/Refi + Negative Cash Flow

- But what if you have costs of refinancing too?

- And, what if you’ve been feeding a property with negative cash flow?

- Return On Equity + Total Cost to Close/Refi + Negative True Cash Flow™ (ROE++™)

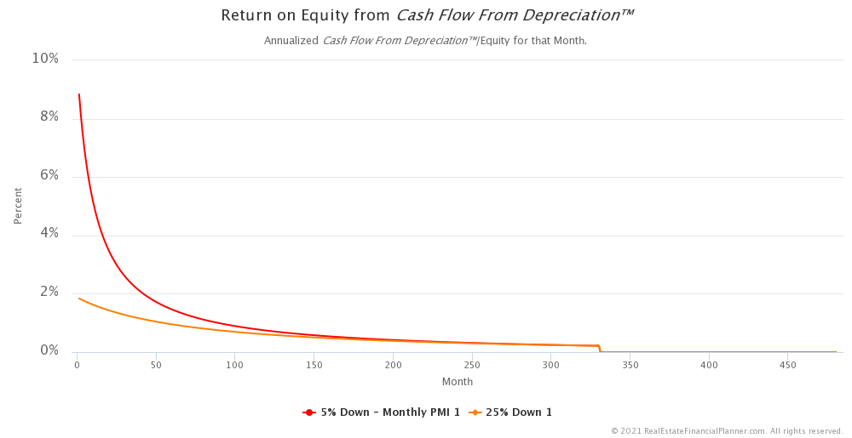

- True Cash Flow™ = Cash Flow (including CapEx) + Cash Flow from Depreciation™

- Only count negative cash flow if True Cash Flow™ is negative

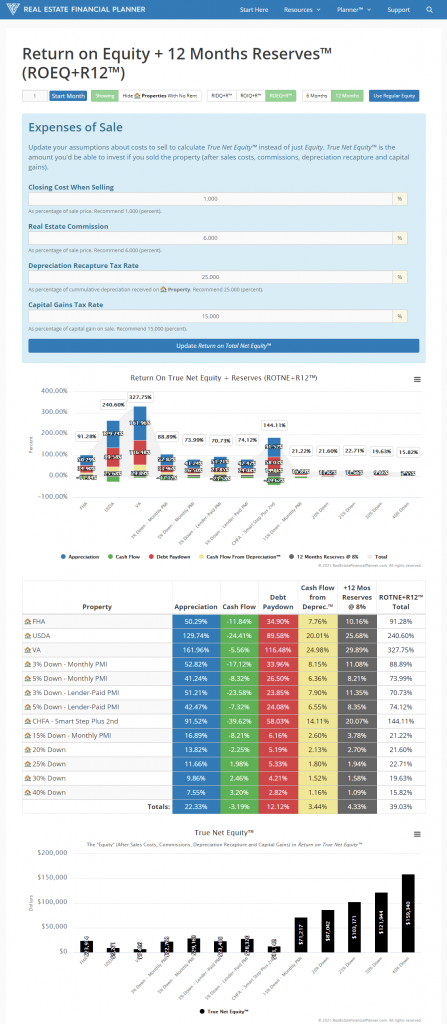

- Return on True Net Equity™

- Equity is a fictitious number

- You never get that number

- Sales costs, commissions, depreciation recapture, capital gains

- True Net Equity™ is equity after all those expenses

The Setup – Continued

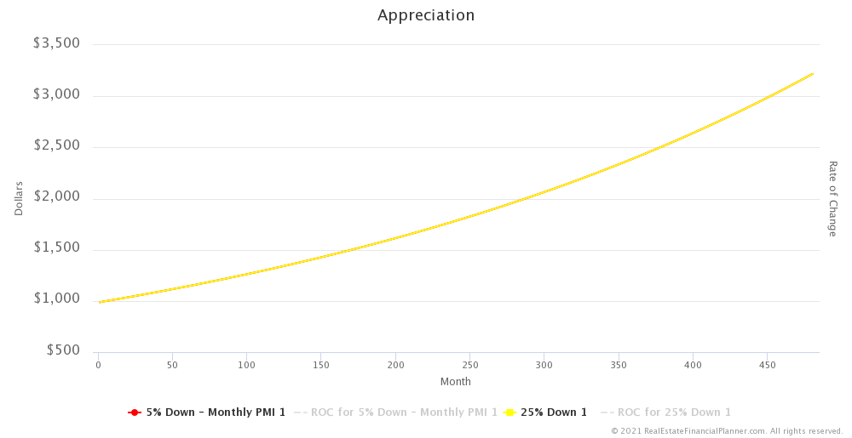

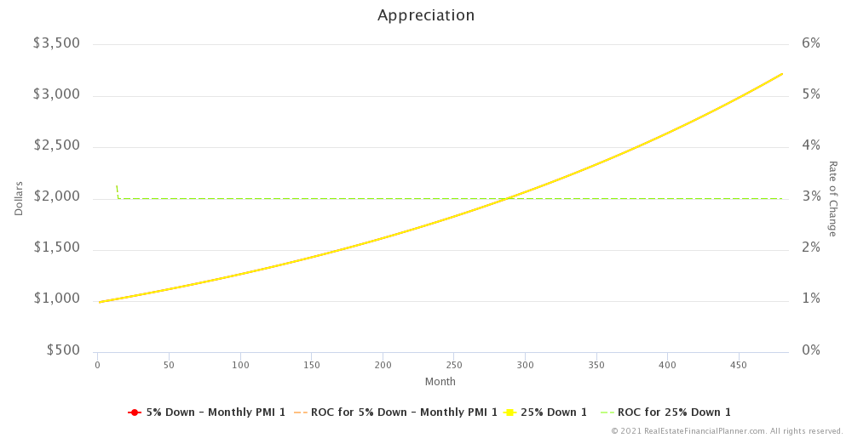

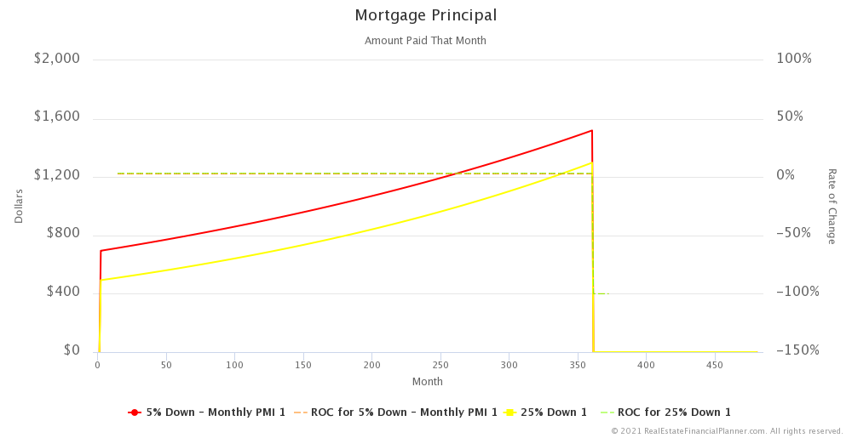

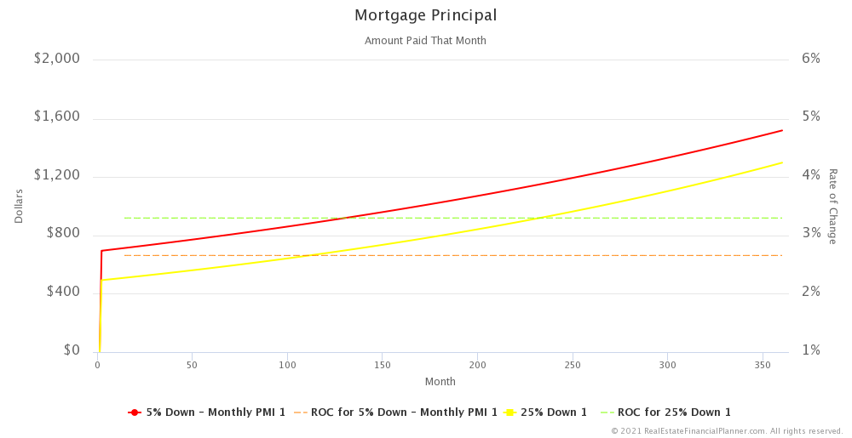

As property values rise and mortgages get paid off, your equity grows.

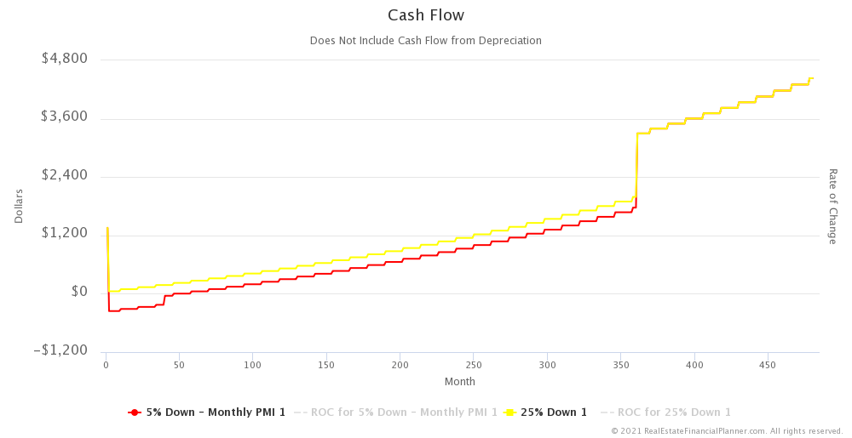

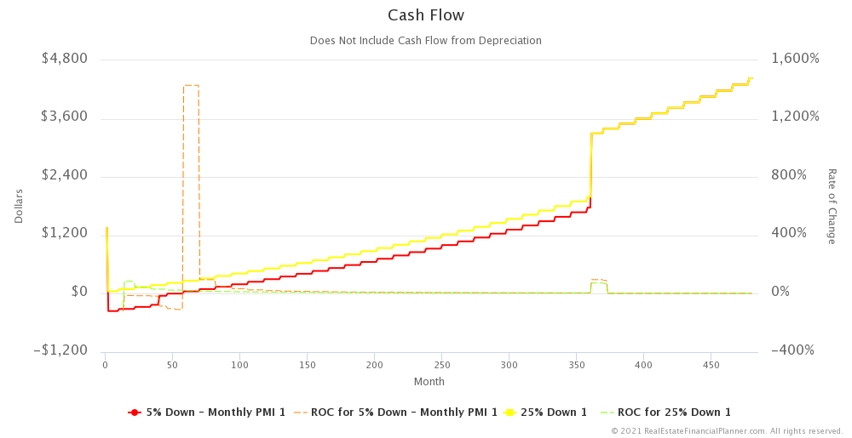

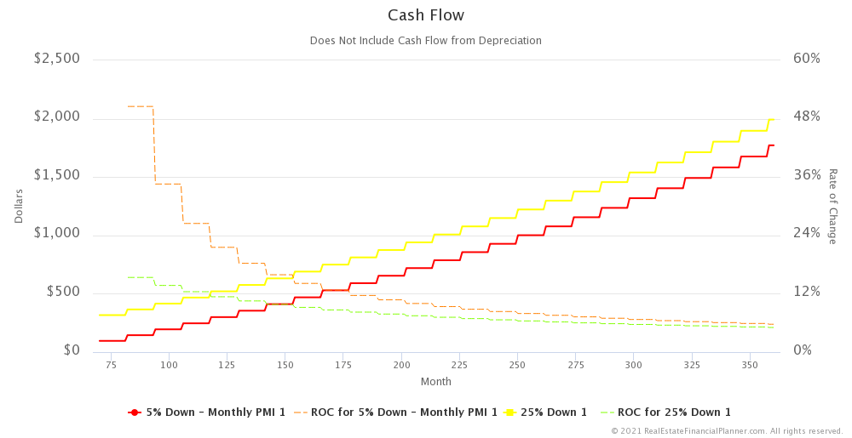

Dollar amounts for returns combined are going up:

- Appreciation typically going up

- Cash Flow typically going up

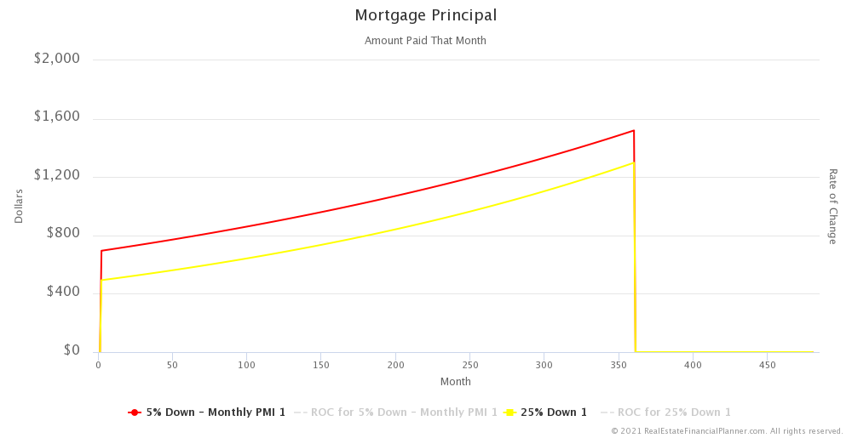

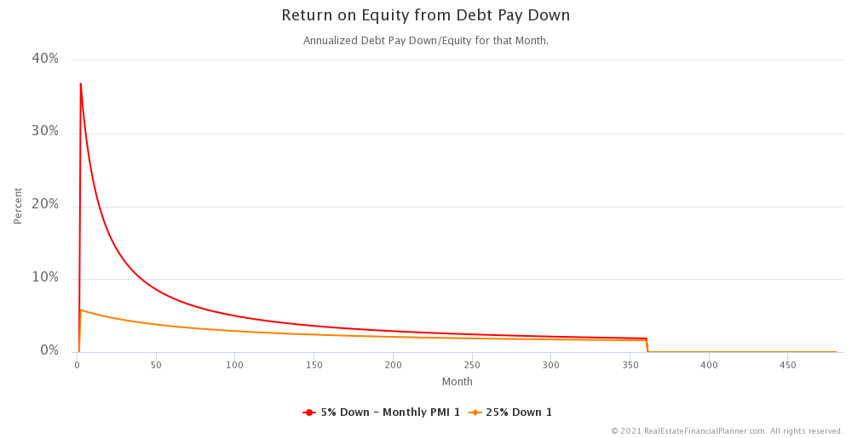

- Debt Pay Down typically going up (for duration of amortizing loan)

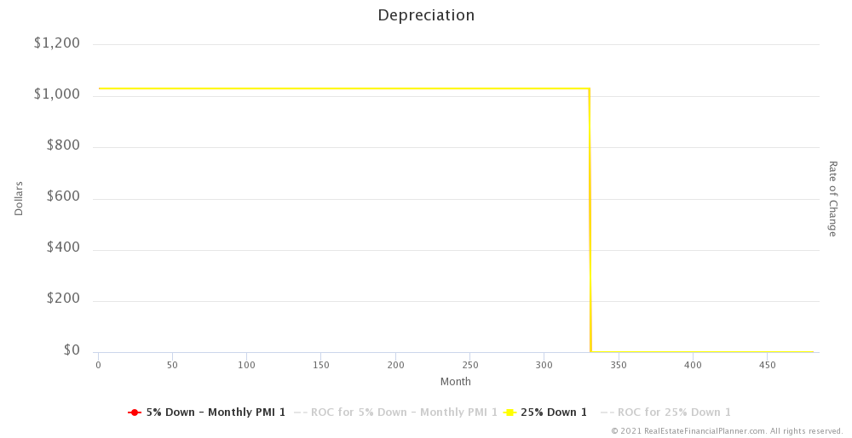

- Depreciation/Cash Flow from Depreciation™ typically constant for 27.5 years

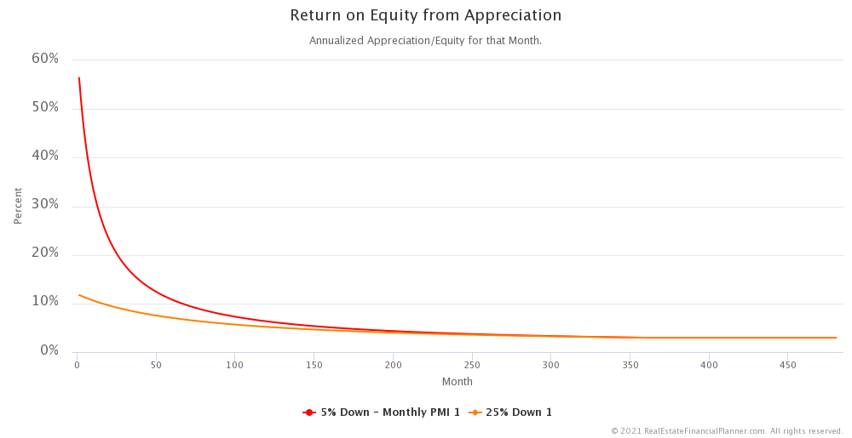

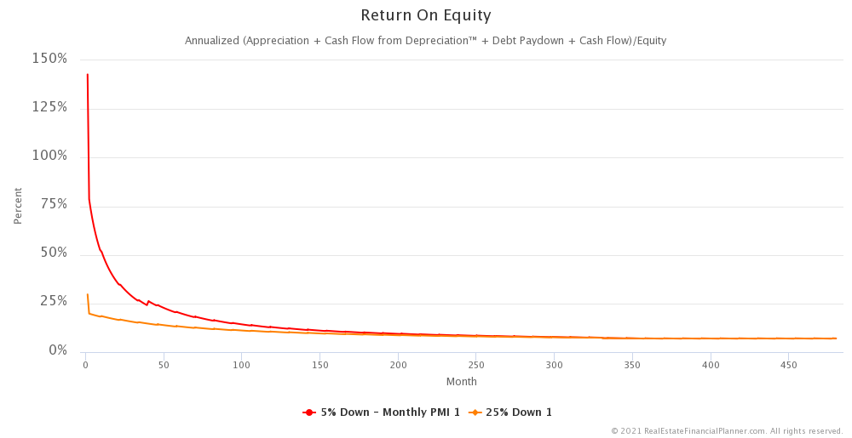

However, equity is often going up faster.

With fixed appreciation rates and amortizing loans:

- Equity grows fastest earliest on

- Equity growth slows over time

Returns and Equity in Dollars

Returns/Equity as Percent

Eventually… Return On Equity

Eventually…

- You pay off the loan and your return from Debt Pay Down goes to zero

- 27.5 passes and you no longer can depreciate the property and your Depreciation/Cash Flow from Depreciation™ goes to zero

That means, you’re left with UNLEVERAGED cash flow and appreciation.

- Cash Flow is the property’s Capitalization Rate (NOI/Value) because there’s no loan.

- Appreciation is the appreciation rate.

So, if you are buying a 5% Cap Rate property in a 3% Appreciating market, then Return on Equity = 8%.

Equity

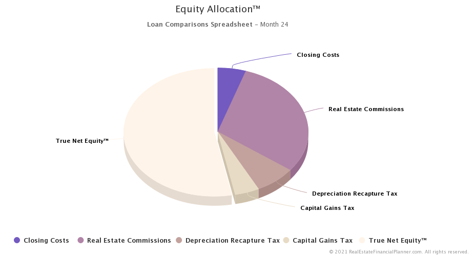

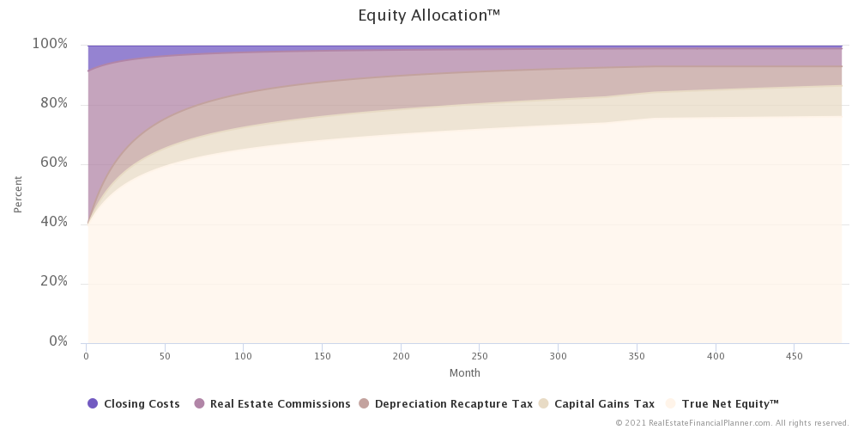

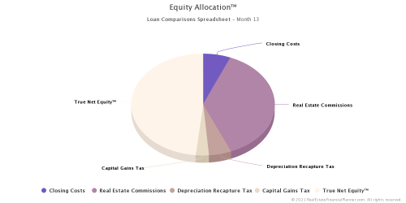

But part of “your” equity belongs to others:

- Closing Costs – attorney, title companies, county (transfer fees)

- Real Estate Commissions – real estate agents/brokers

- Depreciation Recapture Taxes – Internal Revenue Service (IRS)

- Capital Gains Taxes – IRS

So, what you thought was your equity, may or may not be yours…

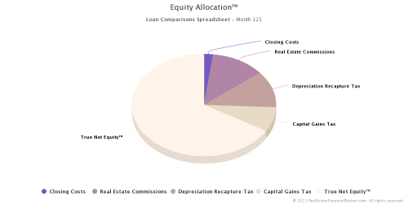

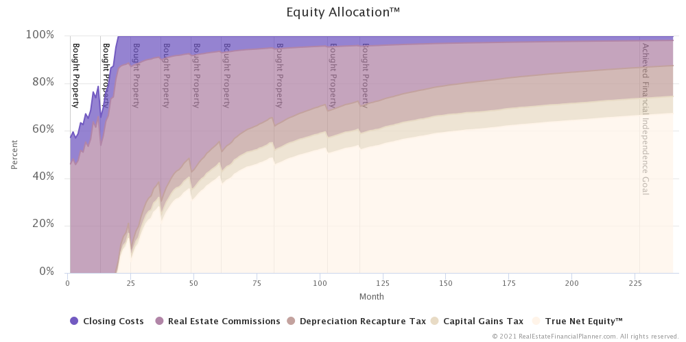

Equity Allocation™

Where does your equity go?

- Closing Costs

- Real Estate Commission

- Depreciation Recapture

- Capital Gains

True Net Equity™ – your equity after all your expenses.

This allocation changes over time.

Two time period examples.

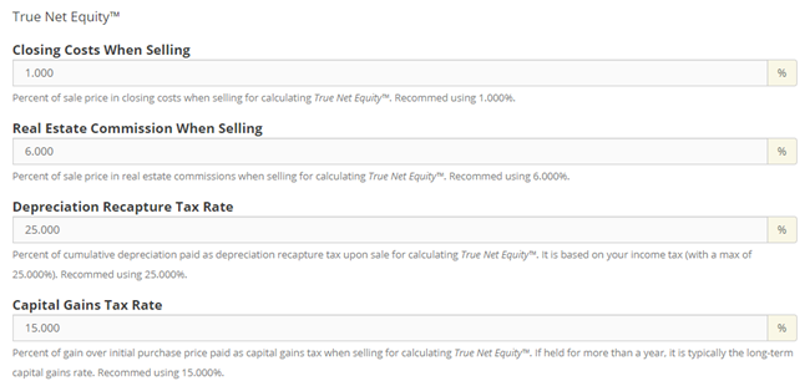

You can edit the costs for each  Property

Property

Equity Allocation™

In general, it costs you more (as a percentage of your True Net Equity™ to sell earlier.

However, your overall Return on Equity tends to decline over time.

Optimizing Expenses At Sale

Total Cost To Close

- Market and offer dependent but might be about 1% of sale price

- Sell where the Buyer pays your closing costs (i.e. Lease Option)

Real Estate Commission

- Negotiated but might be about 6% of sale price

- Sell where you are not paying a real estate commission (i.e. Lease Option)

Depreciation Recapture Tax

- Ordinary income tax rate with a 25% cap

- You can DEFER these taxes using 1031 exchanges

- You still need to pay them unless you die and your heirs have stepped-up basis

- If you’re in a lower tax bracket in a particular year you can reduce your Depreciation Recapture Tax Rate

Capital Gains Tax

- Talk to your CPA but for:

- Long-term capital gains (longer than 1 year) it may be 0%, 15% or 20% depending on your income level and how you file

- Short-term capital gains (shorter than 1 year) it may be at your ordinary income tax rate

- You can DEFER these taxes using 1031 exchanges

- You still need to pay them unless you die and your heirs have stepped-up basis

- If you’re in a lower tax bracket in a particular year you may be able reduce your Capital Gains Tax Rate

If You NEED To Sell

If you NEED the money for something then you NEED to money.

NEED: there are not an objective, rational discussions about whether it makes sense to sell.

However, you may consider the COST to access your equity. The ratio of your cost to the amount of money you get access to.

And, if you have other options with lower cost to access the same money you might consider those other options (first).

However, if you don’t NEED to sell… but rather WOULD CONSIDER selling… here’s a rational discussion of things to consider/questions to ask…

Should I Sell My Rental?

And how do you know when the right time to sell is?

- Is this a property you still want to hold in your portfolio long-term?

- Are you still willing/able to manage the property and/or property manager?

- Are the long-term economics for the market still favorable?

- Market Timing

- Is your decision based on current market conditions?

- Hot market, easier to sell (especially helpful with a property that could otherwise be hard to sell)

- Soft market, harder to sell (will it need to be vacant and will the time to market it eat into profits)

- Or, speculative guesses about the future: what you think the market will do (especially in the short-term)?

- Is the tenant moving out?

- Is it going to need work before the next tenant?

- Expiring tax benefits of selling now?

- Owner-occupant for 2 out of the last 5 years

- Low income tax rate for depreciation recapture this year

- Low income tax rate for long-term capital gains this year

- Financing Pressure

- Do you have financing pressure to sell sooner than later? Balloons, Adjusting Interest Rates

- Do you have financing pressure to sell later than sooner? Pre-Payment Penalties

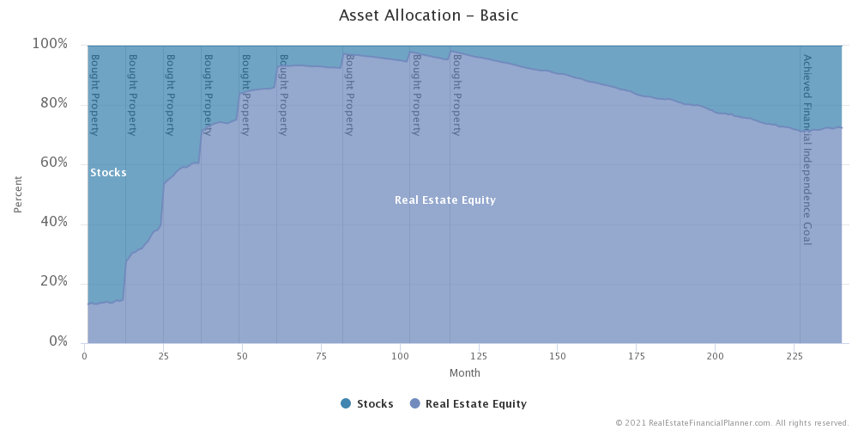

- Are you trying to adjust your asset allocation?

- The current return you’re getting on the property? This is one that we will focus on.

- Do you have another investment to move the proceeds into?

Return On Equity

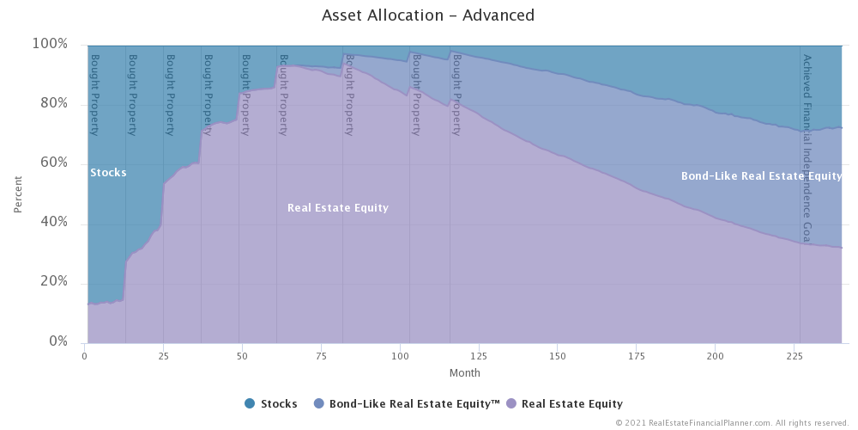

Asset Allocation: Bond-Like Real Estate Equity™.

Selling to re-leverage up and improve ROE changes the asset allocation characteristics of your investment.

Moves from Bond-like Real Estate Equity™ (arguably a more conservative position) to higher loan-to-value real estate equity.

You may be going from better cash flow to worse cash flow but higher overall return (from appreciation, debt paydown, tax benefits).

Cash Flow to Cash Flow

When selling rentals/leveraging up, consider comparing your current “Cash Now” half (cash flow and Cash Flow from Depreciation™) to your new portfolio’s “Cash Now” to see how your “Cash Now” position changes.

How does cash flow compare? Has it improved? Declined? Is it more volatile? Less volatile to changing rents and expenses?

Nomad™

Not All Real Estate Equity Is The Same

Two parts: the equity you CAN’T EASILY borrow against and the equity you CAN EASILY borrow against.

If you could have EASILY gone to a lender and borrowed the money, then you are acting like the lender and loaning yourself the money at whatever mortgage interest rates are.

In most cases, it is easy to do a cash-out refinance for up to 75% Loan-To-Value.

Any equity over 75% loan-to-value is true real estate equity. Higher risk, more volatile, first to lose value in a market decline.

Any equity between 0% LTV and 75% loan-to-value is Bond-Like Real Estate Equity™ with you as the bond holder (the lender). Lower risk, less volatile, more protected in a market decline.

Lower “return” proxy (mortgage interest rates).

If You Sell Properties…

You often get rid of some Bond-Like Real Estate Equity™ (lower risk, less volatile, more protected in a market decline).

If you buy replacement properties you often increase your regular real estate equity (higher risk, more volatile, first to lose value in a market decline).

Return on True Net Equity™

This report is available for your properties inside the Real Estate Financial Planner™ software.