Welcome to the Ultimate Guide to Real Estate Risk for Real Estate Investors! If you’re looking to dive into the world of real estate investing, you’re in for an exciting journey. But like any adventure, there are risks along the way. Understanding these risks is key to navigating the market successfully.

This guide is designed to give you a clear overview of the different types of risks you might encounter. From insurable risks like fire and theft to market-driven challenges like interest rate increases and neighborhood decline, we’ll cover it all. Our goal is to prepare you, not scare you. By knowing what to expect, you can plan better and make smarter decisions.

Remember, every successful investor started somewhere, and they faced these same risks. The difference between success and failure often comes down to knowledge and preparation. So, let’s get started on your path to becoming a well-informed and confident real estate investor. Together, we’ll explore how to identify, manage, and mitigate the risks associated with real estate investing.

Be encouraged! With the right strategies, you can overcome these challenges and build a thriving investment portfolio. Let’s dive in!

Insurable Risks

One of the first steps in protecting your real estate investment is understanding insurable risks. These are risks that you can protect against by purchasing insurance. It’s like putting on armor before heading into battle. Let’s look at the most common insurable risks and a few that are less common but equally important.

- Fire, Lightning, Hail: These natural events can cause significant damage to your property. Insurance helps cover repair or rebuilding costs.

- Theft, Vandalism: Unfortunately, properties can be targets for theft and vandalism. Insurance can help cover the cost of stolen items and repairs.

- Personal Injury, Liability: If someone gets hurt on your property, you could be held responsible. Liability insurance protects you from legal and medical bills.

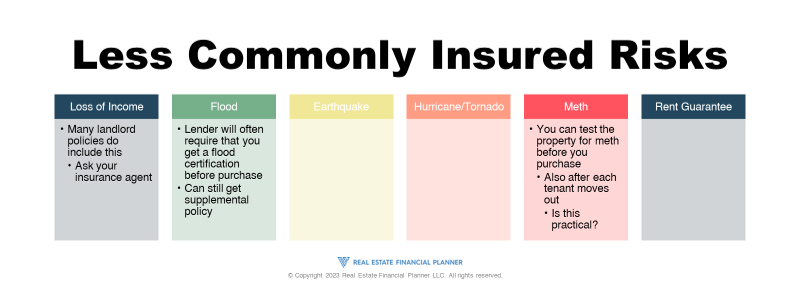

- Loss of Income: If your property becomes uninhabitable due to a covered event, this insurance can help replace lost rental income.

- Flood, Earthquake: These natural disasters require separate policies. They’re crucial in high-risk areas to protect against catastrophic loss.

- Meth Contamination: Cleaning up meth contamination is expensive. Some insurance policies offer coverage for this.

- Rent Guarantee: This insurance protects your income if tenants fail to pay rent, helping you maintain cash flow.

Choosing the right insurance policies involves understanding the specific risks your investment faces. Consider the location, type of property, and potential hazards when deciding on coverage. While insurance is an additional expense, the protection it offers can be invaluable in mitigating financial losses from unforeseen events.

Remember, the goal of insurance is not to eliminate risk but to manage it effectively. By securing coverage for these insurable risks, you’re taking a proactive step towards safeguarding your investment. It’s all about peace of mind, knowing that you’re prepared for what might come your way.

Risk of Down Payment Size

The following as an excerpt from our Risk Radar series about the risk of down payment size.

This is an image from that class recording.

When it comes to real estate investing, the size of your down payment plays a big role in your investment’s risk and potential return. It’s a balancing act. A larger down payment might reduce your mortgage payments and interest costs, but it also ties up more of your cash upfront. On the other hand, a smaller down payment frees up cash for other investments or expenses but increases your mortgage payments and interest costs over time.

Smaller Down Payments: Going small can seem appealing because it leaves you with more cash on hand. This strategy can be beneficial if you’re investing in a market where property values are rapidly increasing, or if you plan to flip the property quickly. However, it also means taking on more debt, which increases your monthly obligations. Plus, lenders often require private mortgage insurance (PMI) for down payments less than 20%, adding to your costs.

Larger Down Payments: Making a larger down payment reduces your loan amount, which can lead to lower monthly mortgage payments and less interest paid over the life of the loan. This can make your investment more resilient to fluctuations in rental income or property values. However, it also means less liquidity, as more of your money is tied up in the property. This can be risky if you encounter unexpected expenses or opportunities and need quick access to cash.

Deciding on the size of your down payment is a crucial step in managing the financial risk of your real estate investment. It’s important to consider your overall investment strategy, cash flow needs, and the current real estate market conditions. There’s no one-size-fits-all answer, but being informed and thoughtful about your down payment can help you strike the right balance between risk and return.

Remember, every investor’s situation is unique. What works for one person might not work for another. Consider your financial goals, risk tolerance, and the specifics of your investment property when deciding how much to put down. A well-considered down payment can set the stage for a successful and profitable real estate investment.

Risk of Rental Property Expenses Increasing

As a real estate investor, it’s crucial to be aware that the expenses associated with your rental property can increase over time. These expenses can eat into your profits and affect your investment’s overall performance. Understanding and planning for these potential increases can help you manage your property more effectively and maintain your investment’s profitability.

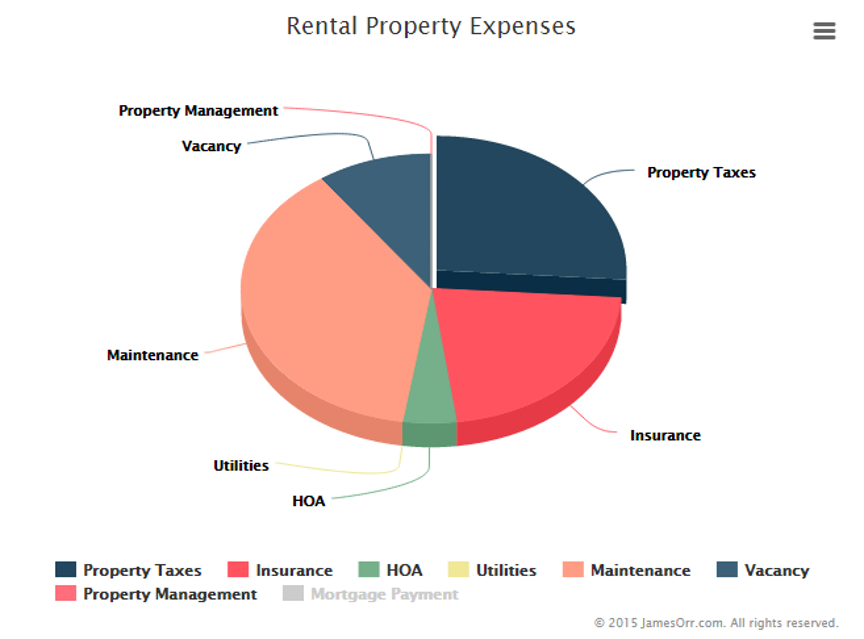

- Taxes and Insurance: Property taxes and insurance premiums can rise, often due to changes in property values or policy rates. These are significant expenses that can impact your bottom line.

- Maintenance and HOA Fees: The cost of maintaining a property and any Homeowners Association (HOA) fees can also increase. Regular maintenance costs can creep up as properties age, and HOA fees can rise due to inflation or special assessments.

- Utilities and Vacancy: If you’re covering any utilities for your tenants, those costs can fluctuate, especially with changes in energy prices. Additionally, vacancy rates can affect your income, and preparing for turnover can lead to unexpected expenses.

One way to mitigate these risks is through careful financial planning and budgeting. Setting aside a portion of your rental income for future expenses can provide a financial cushion. Additionally, conducting regular property assessments can help you anticipate maintenance needs and address them before they become more costly.

Another strategy is to periodically review your rental rates. If your expenses are increasing, you may need to adjust your rental prices to reflect these changes. However, it’s important to balance this with the need to remain competitive in the rental market.

Being proactive about managing and anticipating increases in rental property expenses can help you maintain a healthy cash flow and ensure the long-term success of your real estate investment. It’s all about staying informed, planning ahead, and being prepared to adjust your strategy as needed.

Risk of Variable Rate Mortgages

Variable rate mortgages can be tempting for real estate investors due to their initially lower interest rates compared to fixed-rate mortgages. However, they come with the risk of interest rates—and consequently, your mortgage payments—increasing over time. This change can significantly impact your cash flow and the overall cost of your investment.

Payment Fluctuations: The most direct risk of a variable rate mortgage is that your payments can go up (or down) with changes in interest rates. If rates rise significantly, your payments could increase to a level that is difficult to cover with your rental income, squeezing your profit margins.

Long-term Planning Challenges: The uncertainty of future payment amounts makes it harder to plan for the long term. You may find it challenging to predict your cash flow and returns accurately, making it difficult to make informed decisions about your property or portfolio.

To mitigate these risks, consider the following strategies:

- Interest Rate Caps: Look for mortgages with caps on how much the interest rate or the monthly payment can increase, offering some protection against dramatic rises.

- Refinancing: Keep an eye on the market. If fixed-rate mortgages become more attractive, refinancing could lock in a lower, stable rate, reducing your risk.

- Financial Cushion: Maintain a financial cushion to absorb potential increases in payments. This can help you avoid cash flow problems if interest rates rise.

Ultimately, whether a variable rate mortgage is right for you will depend on your financial situation, risk tolerance, and investment strategy. While it offers the potential for lower initial payments, the unpredictability of future rates requires careful consideration and planning. Being prepared and understanding the potential for payment changes can help you manage this risk effectively and ensure the long-term success of your investment.

Risk of Loan Being Called Due

Real estate investors often face the risk of a loan being called due, particularly with balloon mortgages or when buying properties subject to the existing mortgage. This situation occurs when a lender demands full repayment of the loan before the end of the agreed-upon term. It can create significant financial strain, potentially forcing the sale of the property to satisfy the loan.

Balloon Mortgages: These loans have low monthly payments for a set period, ending with a large lump-sum payment. If you’re unable to make the balloon payment when it’s due, you may need to refinance the loan or sell the property. However, refinancing is not guaranteed and depends on your financial situation and market conditions at the time.

Subject To Existing Mortgage: When purchasing a property “subject to” its existing mortgage, you’re not formally assuming the loan; the original borrower’s name remains on it. While this can be an effective investment strategy, there’s a risk if the lender finds out and decides to enforce the “due on sale” clause, requiring full repayment upon transfer of property ownership.

To mitigate these risks, consider the following strategies:

- Thorough Planning: Understand the terms of your loan agreement fully and plan for the balloon payment or potential calling of the loan. This may involve setting aside funds over time or having a refinancing plan in place.

- Communication with Lenders: Maintain open lines of communication with your lender. If you foresee difficulties in meeting payment obligations, discussing your situation with them early on may provide options for renegotiation or extension.

- Legal and Financial Advice: Consulting with real estate and financial professionals can provide strategies for managing these risks, including structuring deals to minimize the likelihood of a loan being called due unexpectedly.

The risk of a loan being called due is a significant one that can impact your investment strategy and financial stability. By understanding the terms of your loans and planning accordingly, you can better prepare for and mitigate this risk. Always be proactive in managing your investments to ensure their long-term success.

Risk of Neighborhood Decline

Investing in real estate comes with the understanding that the value of your property is not just tied to the building itself but also to the neighborhood it’s in. A decline in the neighborhood can lead to decreased property values and rental rates, affecting your investment’s profitability and viability.

Factors Contributing to Decline: Several factors can contribute to a neighborhood’s decline, including increases in crime, loss of major employers, deterioration of infrastructure, and changes in demographic trends. These changes can reduce the demand for housing in the area, leading to vacancies and a decrease in potential rental income.

To mitigate the risk of neighborhood decline, consider the following strategies:

- Research Before Investing: Conduct thorough research into the neighborhood’s history, current trends, and future development plans before making an investment. This can help you identify areas with strong growth potential or signs of possible decline.

- Diversify Your Investments: Spreading your investments across different neighborhoods or types of real estate can reduce the impact of a decline in any one area on your overall portfolio.

- Active Community Involvement: Being involved in the community and supporting initiatives that improve the neighborhood can help protect your investment. This might include participating in local business associations or community development programs.

While it’s impossible to predict the future with certainty, being informed and proactive can help you navigate the risks associated with neighborhood decline. By choosing your investment locations wisely and engaging in strategies to support community resilience, you can better safeguard your real estate investments against this risk.

Risk of Rental Demand Declining

Rental demand is a critical factor in the success of your real estate investment. When demand is high, you enjoy low vacancy rates and the potential for higher rents. However, the risk of rental demand declining can significantly impact your income and property value.

Causes of Decline: Several factors can lead to a decrease in rental demand, including economic downturns, increased competition from new housing developments, changes in population demographics, and shifts in employment opportunities. An oversupply of rental properties in the market can also lead to lower rents and higher vacancies.

To mitigate the risk of rental demand declining, consider the following strategies:

- Market Research: Stay informed about the local real estate market, economic trends, and demographic shifts. This knowledge can help you anticipate changes in rental demand and adjust your strategy accordingly.

- Property Upgrades: Keeping your property well-maintained and up-to-date with desirable features can make it more attractive to potential tenants, even in a competitive market.

- Flexible Pricing: Be prepared to adjust your rental rates based on current market conditions. Setting competitive prices can help attract tenants even when demand is lower.

- Diverse Property Portfolio: Investing in different types of properties or in multiple locations can spread your risk. If demand declines in one area or property type, others may remain stable or even increase.

Understanding the factors that affect rental demand and being proactive in managing your property can help you navigate through periods of lower demand. By staying adaptable and informed, you can minimize the impact on your investment and maintain a steady income over time.

Risk of Functional Obsolescence

Functional obsolescence occurs when a property loses value due to features that are outdated, no longer desirable, or not functional for current standards and expectations. This can significantly impact your ability to rent or sell the property at a competitive price.

Examples of Functional Obsolescence: Outdated layouts, like homes with too few bathrooms or large, single-purpose rooms that don’t meet modern living standards. Lack of modern amenities, such as air conditioning or energy-efficient windows, can also contribute to a property becoming functionally obsolete.

To mitigate the risk of functional obsolescence, consider the following strategies:

- Regular Updates: Keep your property up to date with regular renovations and upgrades. This can include modernizing fixtures, improving energy efficiency, or reconfiguring spaces to meet current market demands.

- Research Market Trends: Stay informed about the latest trends in real estate and home design. Understanding what tenants and buyers are looking for can help you make informed decisions about updates and renovations.

- Flexibility in Use: Consider ways to make the property more adaptable to different uses or lifestyles. For example, a room that can easily be used as a home office or a bedroom can appeal to a wider range of tenants.

Addressing functional obsolescence proactively can help maintain or even increase your property’s value and attractiveness to tenants and buyers. By investing in timely updates and being aware of changing market trends, you can ensure your property remains competitive and desirable in the real estate market.

Risk of Massive Foreclosures

The risk of massive foreclosures in the real estate market can have a significant impact on property values and investment returns. A surge in foreclosures typically occurs during economic downturns, leading to an increase in the supply of available properties. This can drive down home prices and rental rates, making it harder for investors to sell or rent their properties at profitable prices.

Impact on the Market: Massive foreclosures flood the market with low-priced homes, which can attract buyers but also significantly reduce the overall market value of properties. This situation can be particularly challenging for investors holding properties in the affected areas, as it may lead to decreased equity and rental income.

To mitigate the risk of massive foreclosures affecting your investment, consider the following strategies:

- Diversification: Spread your investments across different geographic areas and property types. This can help protect your portfolio from being heavily impacted by foreclosures in a single market.

- Financial Resilience: Maintain a strong financial position with adequate reserves. This can help you weather periods of lower rental income or property values until the market recovers.

- Market Research: Stay informed about economic indicators and real estate market trends. Understanding the factors that lead to foreclosures can help you anticipate market shifts and make informed investment decisions.

While the risk of massive foreclosures is largely influenced by external economic factors beyond individual control, adopting a proactive and strategic approach to real estate investment can help mitigate its impact on your portfolio. By planning for market fluctuations and maintaining flexibility in your investment strategy, you can navigate through challenging times and position yourself for long-term success.

Risk of Emotionally Stigmatized Properties

Emotionally stigmatized properties are those that have been associated with negative events or circumstances, such as crimes, deaths, or paranormal activities. These stigmas can deter potential buyers or renters, affecting the property’s value and desirability. While the physical condition of the property may be unaffected, the emotional stigma can pose a significant challenge for investors.

Impact on Value and Demand: The main issue with emotionally stigmatized properties is their impact on marketability. Some potential tenants or buyers may avoid these properties altogether, leading to longer vacancy periods and the need for reduced pricing to attract interest.

To mitigate the risk associated with emotionally stigmatized properties, consider the following strategies:

- Full Disclosure: Being transparent about the property’s history can help build trust with potential buyers or renters. Some jurisdictions require disclosure of certain stigmas, so it’s important to be aware of local laws.

- Focus on the Positive: Highlighting the property’s features, upgrades, and potential can help shift focus away from its stigma. Emphasizing the future possibilities of the property can appeal to practical considerations over emotional reactions.

- Targeted Marketing: Some buyers or renters may be less sensitive to the stigma associated with a property. Identifying and targeting these groups can help find the right audience for your property.

While emotionally stigmatized properties can present unique challenges, they also offer opportunities for investors willing to navigate these issues thoughtfully. By understanding the nature of the stigma and employing strategic approaches to marketing and disclosure, investors can successfully manage these properties and mitigate potential impacts on their investment’s value and desirability.

Risk of Tenant Trashing the Property

One of the risks landlords face is the possibility of a tenant causing significant damage to the rental property. This can go beyond normal wear and tear, resulting in costly repairs and renovations, not to mention potential loss of rental income during the repair period. Such situations can significantly impact your investment’s profitability and long-term value.

Strategies to Mitigate This Risk: While it’s impossible to completely eliminate the risk of a tenant damaging your property, there are several strategies you can employ to minimize its likelihood and impact:

- Thorough Tenant Screening: Conducting comprehensive background and credit checks can help you identify responsible tenants with a history of respecting rental properties.

- Regular Inspections: Periodic inspections of the property, with proper notice to tenants, can help identify and address minor issues before they become major problems.

- Clear Lease Agreements: Ensure your lease agreements clearly outline what constitutes acceptable and unacceptable behavior regarding property care. Include specifics about the consequences of property damage.

- Security Deposits: Collecting a security deposit upfront can provide financial protection against damages. It also incentivizes tenants to maintain the property to ensure their deposit is returned.

Despite these precautions, it’s also wise to have a financial plan in place for dealing with property damage, including maintaining a reserve fund and carrying appropriate insurance coverage. By being proactive and prepared, you can better manage the risk of tenant damage and protect your real estate investment.

Risk of Interest Rates Rising

Rising interest rates pose a significant risk to real estate investors, particularly those holding variable rate mortgages or considering refinancing. Higher interest rates can lead to increased borrowing costs, affecting cash flow and the overall cost of holding real estate investments. Additionally, rising rates can cool the housing market, making it more challenging to sell properties at a profit.

Impact on Investment Strategy: An increase in interest rates can reduce the appeal of real estate investment in two main ways. First, it can increase monthly mortgage payments for investors with variable rate loans, squeezing profit margins. Second, as borrowing becomes more expensive, potential buyers may be priced out of the market, leading to a decrease in property values.

To mitigate the risk of rising interest rates, consider the following strategies:

- Locking in Fixed Rates: If you have variable rate loans, consider refinancing to a fixed rate mortgage. This can protect you against future interest rate increases, providing stability in your financing costs.

- Building a Financial Cushion: Maintain reserves to cover potential increases in interest expenses. This can help you manage through periods of rising rates without immediate financial strain.

- Focus on Long-Term Holds: Adopting a long-term perspective can help mitigate the impact of interest rate fluctuations. Real estate is typically a long-term investment, and values can appreciate over time, offsetting periods of higher interest costs.

While no one can predict future interest rate movements with certainty, being aware of the potential risk and planning accordingly can help you navigate the challenges they present. By taking proactive steps, you can protect your real estate investments and continue to thrive in a changing economic environment.

Risks of Tenant Not Paying Rent

One of the most immediate risks landlords face is tenants not paying rent. This scenario can quickly impact your cash flow, making it difficult to cover mortgage payments, property maintenance, and other expenses associated with your rental property. Non-payment can arise from various reasons, including financial difficulties faced by the tenant or dissatisfaction with the property or landlord.

Strategies to Mitigate This Risk: Reducing the risk of rent non-payment requires a proactive approach to tenant management and lease enforcement:

- Thorough Tenant Screening: A comprehensive screening process, including credit checks, employment verification, and references, can help identify reliable tenants.

- Clear Lease Terms: Ensure your lease agreements clearly outline payment obligations, due dates, and the consequences of non-payment, including late fees and eviction procedures.

- Open Communication: Establishing open lines of communication with tenants can help you understand and possibly resolve issues leading to non-payment before they escalate.

- Rental Insurance: Consider requiring tenants to purchase rent guarantee insurance, or explore it yourself as a landlord, to protect against loss of income.

- Legal Preparedness: Understand the eviction process in your area and be prepared to take legal action if necessary, recognizing that this should be a last resort.

While it’s impossible to eliminate the risk of rent non-payment entirely, implementing these strategies can significantly reduce its likelihood and impact on your investment. Maintaining a balance between being a understanding landlord and enforcing your lease terms is key to managing this risk effectively.

Risk of Missing Stuff on Inspection

Overlooking issues during a property inspection can lead to unexpected expenses and headaches for real estate investors. Whether it’s a minor maintenance issue that turns into a major repair or an unnoticed legal encumbrance, missing something on inspection can significantly impact your investment’s profitability and viability.

Consequences of Overlooked Issues: Unidentified problems can range from structural damage, outdated electrical systems, plumbing issues, to issues with the property’s title. These can require costly repairs and legal actions, potentially undermining your investment’s value and your income from it.

To mitigate the risk of overlooking issues during inspections, consider the following strategies:

- Hire Professionals: Engaging experienced inspectors and legal consultants to review the property and its documents can help uncover hidden problems.

- Conduct Thorough Due Diligence: Take your time during the inspection process. Review all available property records, permits, and zoning restrictions.

- Use Checklists: Employ comprehensive checklists that cover all aspects of the property, from structural integrity to legal compliance, to ensure nothing is missed.

- Plan for Contingencies: Always factor in a contingency budget for unexpected repairs and issues that might arise after purchase.

While it’s impossible to anticipate every potential issue, thorough preparation and professional assistance can significantly reduce the risk of costly surprises. Taking these steps can help protect your investment and ensure a more stable and profitable real estate venture.

Risk of Inadequate Reserves

One crucial aspect of real estate investing that can sometimes be overlooked is the importance of maintaining adequate financial reserves. Without sufficient reserves, investors may find themselves in a precarious situation, unable to address unexpected expenses or market downturns. Inadequate reserves can jeopardize the sustainability of your investment, leading to potential financial distress or the forced sale of assets at inopportune times.

Importance of Financial Reserves: Adequate reserves are essential for covering unforeseen costs such as emergency repairs, sudden increases in operating expenses, vacancies, or legal issues. They also provide a buffer during economic downturns when rental income may decrease or when it becomes challenging to sell properties.

To mitigate the risk of inadequate reserves, consider implementing the following strategies:

- Calculate Reserve Requirements: Assess your properties and determine the appropriate level of reserves based on factors like property age, condition, rental market stability, and your overall financial situation.

- Regular Contributions: Treat contributions to your reserve fund as a non-negotiable expense. Consistently setting aside a portion of rental income can help build and maintain your reserves over time.

- Review and Adjust Reserves Periodically: Regularly review your reserve levels in the context of your portfolio’s performance and market conditions. Adjust contributions as necessary to ensure adequacy.

- Liquidity of Reserves: Ensure that your reserves are kept in easily accessible, liquid forms of investment. This allows you to quickly respond to any financial needs without significant delays or penalties.

Maintaining adequate reserves is a critical component of successful real estate investing. It not only safeguards your investment against unforeseen challenges but also provides peace of mind, knowing that you are prepared for various financial scenarios. By prioritizing the creation and maintenance of a robust reserve fund, you can enhance the resilience and longevity of your real estate portfolio.

Liquidity Risk

Liquidity risk in real estate investment refers to the challenge of quickly converting property into cash without significant loss in value. Unlike stocks or bonds, which can be sold relatively quickly, selling real estate typically takes time. This delay can be problematic in situations where you need access to cash quickly, whether for personal reasons or to capitalize on another investment opportunity.

Factors Affecting Liquidity: Several factors can influence the liquidity of real estate investments, including market conditions, property location, and the property’s condition. For example, properties in high-demand areas may sell faster than those in less desirable locations. Similarly, properties in good condition are likely to attract buyers more quickly than those that require significant repairs.

To manage liquidity risk, consider the following strategies:

- Diversification: Spreading your investments across different types of assets (not just real estate) can provide more liquidity options.

- Equity Line of Credit: Establishing a line of credit based on the equity in your property can provide access to funds when needed without requiring you to sell the property.

- Strategic Selling: Keeping an eye on market trends and selling properties during peak demand periods can help ensure a quicker sale and potentially higher profits.

- Lease Options: Offering lease-to-own options can provide an exit strategy that also generates income during the transition period.

Understanding and planning for liquidity risk is crucial for real estate investors. While real estate is generally considered a solid long-term investment, being aware of and preparing for potential liquidity needs can help ensure financial stability and flexibility, enabling you to make the most of your investments.

Zoning and Regulatory Changes

Zoning and regulatory changes can significantly impact real estate investments, affecting how properties can be used, developed, or valued. Local governments may change zoning laws to reflect new urban plans, environmental policies, or community needs. Such changes can restrict or enhance what you can do with your property, impacting its potential profitability and value.

Impacts of Changes: For example, a zoning change could increase a property’s value by allowing more profitable uses, such as commercial development on previously residential land. Conversely, new restrictions might limit development opportunities or reduce a property’s value by imposing stricter environmental or building standards.

To navigate the risks associated with zoning and regulatory changes, consider the following strategies:

- Stay Informed: Regularly check for any proposed changes in local zoning laws or regulations that could affect your property. Attend planning meetings or subscribe to local government newsletters.

- Engage with Planners: Building relationships with local planning officials can provide early insights into potential zoning changes and allow you to voice concerns or support for proposals.

- Diversification: Diversifying your investment portfolio across different types of properties and locations can reduce the impact of regulatory changes on your overall investment performance.

- Contingency Planning: Develop strategies for your properties that account for possible regulatory changes, such as adaptable building designs or alternative use plans.

By actively managing the risk of zoning and regulatory changes, real estate investors can better protect their investments and adapt to the evolving legal and economic landscape. Proactive engagement and planning are key to navigating these changes successfully.

Over-leveraging

Over-leveraging occurs when investors borrow too much money to finance their real estate investments, increasing their debt to a level that may be unsustainable in the long run. While leveraging (using borrowed capital for investment) can amplify returns, it also amplifies risks, especially if the market takes a downturn or if rental income fails to cover mortgage payments and other expenses.

Risks of Over-leveraging: The primary risk of over-leveraging is the potential for financial distress or even foreclosure if investors are unable to meet their loan obligations. High levels of debt can also limit investors’ flexibility to manage or invest in other opportunities, as much of their income may be tied up in debt repayment.

To avoid the pitfalls of over-leveraging, consider the following strategies:

- Prudent Borrowing: Only borrow what you reasonably expect to repay, taking into account potential fluctuations in income and expenses. Use conservative estimates for rental income and factor in vacancy rates and maintenance costs.

- Maintain Reserves: Keep a reserve fund to cover unexpected expenses or periods of vacancy. This can provide a buffer that helps you stay on top of loan payments even when cash flow is tight.

- Regularly Review Finances: Continuously monitor your property’s financial performance and your overall debt levels. This can help you identify issues early and make adjustments before they become bigger problems.

- Consider Fixed-Rate Mortgages: Fixed-rate mortgages can provide stability in your financing costs, protecting you against rising interest rates that could increase your debt burden.

By carefully managing debt and being cautious with leverage, real estate investors can mitigate the risk of over-leveraging. This prudent approach can help ensure long-term financial stability and success in real estate investing.

We discuss the impact and a way to measure this in Rent and Price Resiliency for Real Estate Investors.

Poor Property Management

Poor property management is a significant risk that can undermine the success of real estate investments. Effective management involves more than just collecting rent; it encompasses tenant screening, maintenance, repairs, and compliance with legal and regulatory requirements. Inadequate management can lead to decreased property value, higher vacancy rates, and legal problems, significantly impacting your investment’s profitability.

Consequences of Poor Management: Neglecting tenant satisfaction can result in high turnover rates and difficulty attracting new tenants. Failing to maintain the property can lead to costly repairs and diminish the property’s appeal. Additionally, inadequate knowledge of landlord-tenant laws can result in legal disputes and financial penalties.

To mitigate the risks associated with poor property management, consider implementing the following strategies:

- Hire Professional Property Managers: If managing property is not your strength, consider hiring a professional property management company. Look for firms with a strong track record and positive reviews from other landlords.

- Regular Inspections: Conduct regular inspections of your property to ensure it is well-maintained and address any issues promptly. This can prevent minor problems from becoming major expenses.

- Effective Tenant Screening: Implement a thorough tenant screening process to find reliable and responsible tenants. This can reduce problems related to non-payment of rent and property damage.

- Stay Informed: Keep up to date with changes in local landlord-tenant laws to ensure compliance and avoid legal issues. Consider attending workshops or joining landlord associations for updates and advice.

Effective property management is crucial for maximizing the return on your real estate investment. By taking proactive steps to ensure your property is well-managed, you can maintain its value, keep tenants happy, and protect your investment over the long term.

Check out The Ultimate Guide to Property Management.

Tenant Turnover

Tenant turnover refers to the process of one tenant moving out and another moving in. While some turnover is inevitable, high turnover rates can be costly for real estate investors. Expenses related to advertising, tenant screening, property repairs, and the potential loss of rental income during vacancy periods can significantly impact your investment’s profitability.

Strategies to Reduce Tenant Turnover: Minimizing tenant turnover is crucial for maintaining steady cash flow and reducing operational costs. Here are effective strategies to keep your tenants happy and reduce turnover:

- Maintain Open Communication: Regularly communicate with your tenants and address their concerns promptly. This can help build a positive landlord-tenant relationship and encourage long-term tenancies.

- Keep the Property Well-Maintained: Ensuring the property is in good condition can significantly impact tenant satisfaction and encourage them to stay longer.

- Offer Incentives: Consider offering incentives for lease renewals, such as small upgrades to the living space or discounts on rent. This can make tenants feel valued and more likely to renew their lease.

- Understand the Market: Keep rental prices competitive by understanding the local market. Overpriced units are more likely to lead to vacancies and tenant turnover.

- Screen Tenants Thoroughly: A thorough screening process can help you find stable and reliable tenants who are more likely to stay for longer periods.

By implementing these strategies, you can reduce tenant turnover, which in turn can lower your operational costs and enhance the profitability of your real estate investment. Keeping tenants happy is not just good practice; it’s a smart investment strategy.

Fraud and Scams

Fraud and scams can pose significant risks to real estate investors, ranging from fake rental listings to mortgage fraud. These deceptive practices can lead to financial losses, legal issues, and damage to your reputation. Being aware of common scams and taking proactive steps to protect yourself is crucial.

Common Types of Fraud: Some scams target investors purchasing properties, such as wire fraud during the closing process, where scammers intercept communication and direct funds to fraudulent accounts. Others involve property management, like collecting deposits on properties not owned by the scammer.

To mitigate the risks of fraud and scams, consider the following strategies:

- Verification: Always verify the identities of all parties involved in a transaction and the ownership of the property. Use trusted platforms and professionals for transactions.

- Secure Communications: Be cautious with your communication methods, especially when sending sensitive information. Use secure, encrypted platforms for financial transactions.

- Educate Yourself: Stay informed about the latest real estate scams and tactics used by fraudsters. Knowledge is your best defense against becoming a victim.

- Professional Help: Work with reputable professionals, including real estate agents, attorneys, and property managers. They can help identify potential scams and provide advice on safe practices.

- Insurance: Consider purchasing insurance that covers certain types of fraud or financial loss. This can provide an additional layer of protection for your investments.

By staying vigilant and implementing these protective measures, you can significantly reduce your risk of falling victim to fraud and scams in the real estate industry. Protecting your investments requires both caution and due diligence.

Conclusion

Navigating the risks associated with real estate investing is a crucial part of achieving success in this field. From managing the financial implications of liquidity risk and over-leveraging to understanding the impacts of poor property management and tenant turnover, investors must be vigilant and proactive. Recognizing the potential for fraud and scams, as well as the importance of strategic planning to mitigate these risks, is essential.

By implementing the strategies outlined in this guide, such as thorough market research, maintaining adequate reserves, diversifying your investment portfolio, and engaging with professional property managers, you can protect your investments and enhance their profitability. Staying informed and prepared for the challenges of real estate investing will empower you to make decisions that align with your financial goals and risk tolerance.

Remember, real estate investing offers tremendous opportunities for wealth creation and passive income. However, success requires more than just purchasing property; it involves careful planning, ongoing management, and a commitment to learning and adapting. By understanding and managing the risks involved, you can navigate the complexities of real estate investing and build a strong, resilient investment portfolio.

Keep pushing forward, stay informed, and let your investments thrive. The journey of real estate investing is filled with learning opportunities and potential rewards. With the right approach, you can achieve your financial objectives and enjoy the benefits of a well-managed real estate portfolio.