Welcome to a world where your career can pave the way to your retirement dreams! If you’re a real estate agent, you’re in a unique position to turn your day-to-day job into a powerful retirement strategy. Imagine a future where you’re not just living off savings or waiting for social security checks, but instead, you’re enjoying a steady flow of income from properties you’ve smartly invested in over the years. This isn’t a far-off dream; it’s a very achievable reality with The Ultimate Real Estate Agent Retirement Plan™.

In this guide, we’ll show you how combining the Nomad™ real estate investing strategy with your real estate license can create a retirement plan that is both robust and rewarding. Whether you’re just starting out or looking to optimize your current investments, this plan is designed to grow with you, offering flexibility, savings, and a solid path to financial freedom. So, let’s dive in and explore how your career today can secure your tomorrow.

What is the Nomad™ Real Estate Investing Strategy?

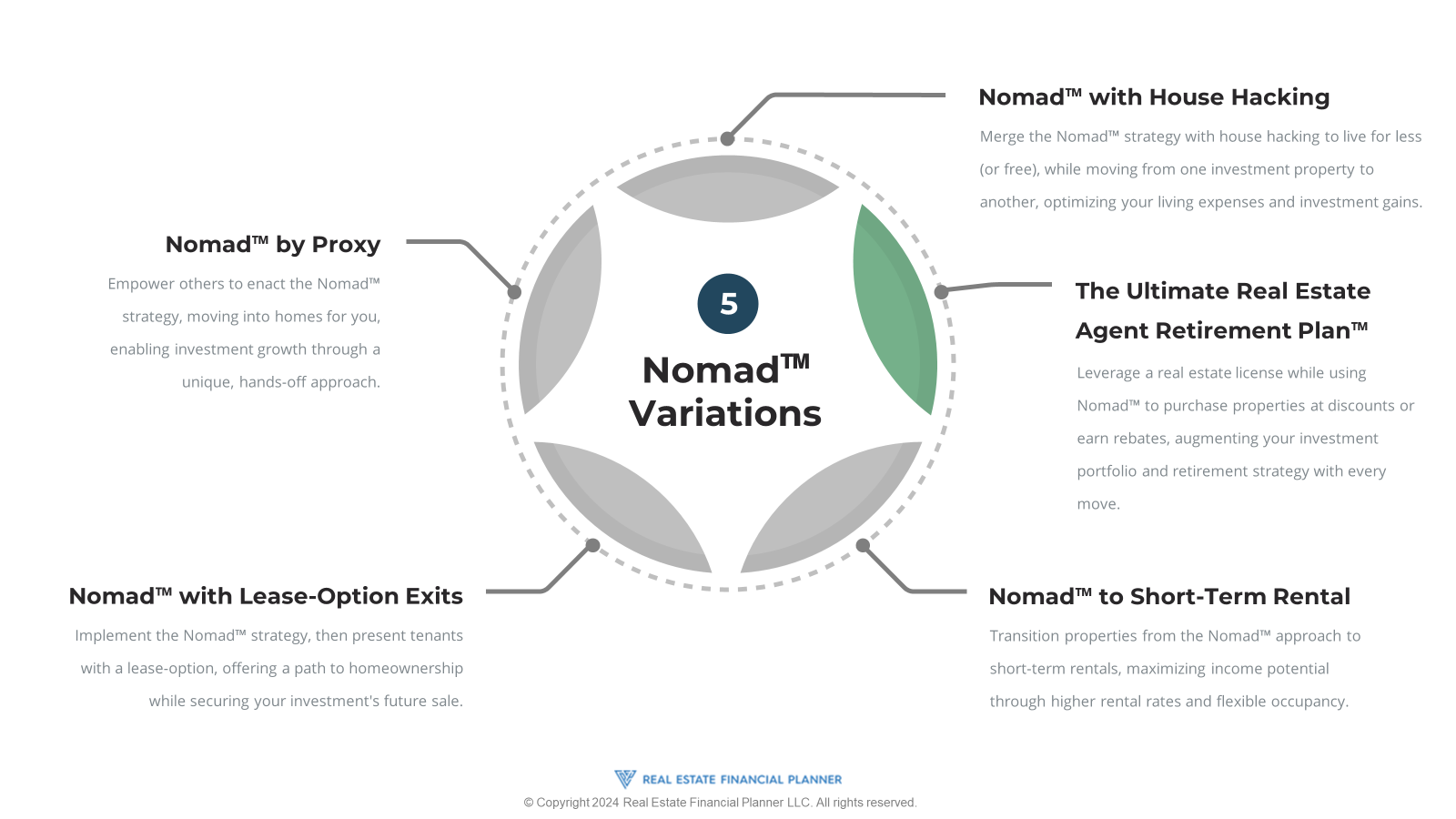

The Nomad™ real estate investing strategy is a powerful approach to building wealth that turns the traditional idea of homebuying on its head. Instead of purchasing a home to live in indefinitely, the Nomad™ method involves buying a property, living in it for a while, and then moving on to buy another home. The previous home is then turned into a rental property. This cycle is repeated, gradually building a portfolio of rental properties over time. It’s a smart way to use your primary residence not just as a place to live, but as the first step in an investment journey.

One of the key benefits of the Nomad™ strategy is that it allows investors to take advantage of owner-occupied financing, which often comes with lower down payments and better interest rates compared to investment property loans. This strategy is particularly accessible for first-time buyers or those who might not have a large amount of capital to start investing in real estate. By living in each property for at least a year, you meet the requirements for owner-occupied loans, all while setting the stage for your future investments.

This approach requires patience, planning, and a willingness to move more frequently than the average homeowner. However, for those who commit, it can lead to significant wealth accumulation through real estate. Not only do you build equity in each property as you pay down the mortgage, but you also benefit from potential property appreciation and rental income, creating multiple streams of income over time.

What is The Ultimate Real Estate Agent Retirement Plan™?

with a real estate license.

The Ultimate Real Estate Agent Retirement Plan™ elevates the Nomad™ real estate investing strategy by incorporating the unique advantages of being a real estate agent. This plan is essentially the Nomad™ strategy, but with a twist: as a licensed agent, you can either buy properties at a discount by forgoing your commission or receive a rebate on your down payment through earning a commission when you buy a house for yourself. This approach supercharges your investment strategy by maximizing your financial benefits and leveraging your professional skills and knowledge.

As a real estate agent, you have the insider’s advantage of understanding the market, knowing when and where to buy, and having access to listings before they hit the general market. This plan allows you to utilize these advantages to build your personal real estate portfolio. Whether you choose to forgo your commission to lower the purchase price or use it to cover your down payment, you’re effectively reducing your initial investment and increasing your returns on each property.

This strategy also opens the door to a broader range of investment opportunities. With the commission savings or rebates, you might be able to invest in properties that would have been just out of reach financially or accelerate the pace at which you can acquire new properties. Additionally, by acting as your own agent, you streamline the process, saving time and ensuring the best deals align with your investment goals.

The Ultimate Real Estate Agent Retirement Plan™ is not just about buying and selling; it’s about strategic investment moves that set you up for long-term success and financial independence. By leveraging your professional skills and the benefits of the Nomad™ strategy, you can create a robust portfolio that provides passive income and grows in value over time, securing your retirement and beyond.

Why Do The Ultimate Real Estate Agent Retirement Plan™?

Embarking on The Ultimate Real Estate Agent Retirement Plan™ offers numerous benefits that extend far beyond the traditional approaches to saving for retirement. This strategy is not just about building a real estate portfolio; it’s about creating a sustainable, long-term income stream that can support you well into your retirement years. Here are several compelling reasons to consider this plan:

- Financial Savings: As a real estate agent, using your commission to buy properties reduces your initial investment costs. This unique advantage allows you to save on down payments or purchase prices, making property acquisition more accessible and frequent.

- Passive Income: By turning homes into rental properties, you establish a consistent source of passive income. This income can grow over time as you add more properties to your portfolio, providing financial security and freedom.

- Market Knowledge: Your expertise as a real estate agent gives you an edge in finding, buying, and managing properties. This insider knowledge can lead to better deals, increasing the profitability of your investments.

- Equity Growth: Each property in your portfolio not only generates rental income but also grows in equity. This increase in value over time can significantly boost your net worth and financial stability.

- Tax Benefits: Real estate investment comes with various tax deductions, including mortgage interest, property taxes, and expenses related to property maintenance and management. These benefits can further enhance your financial gains.

- Flexibility and Control: This plan gives you control over your investments and financial future. You decide when and where to invest, how to manage your properties, and when to sell. This flexibility is key to adapting and growing your portfolio according to your personal and financial goals.

Ultimately, The Ultimate Real Estate Agent Retirement Plan™ is about leveraging your unique position as a real estate agent to build a solid, profitable investment portfolio. It’s a proactive approach to retirement planning that empowers you to take control of your financial future, offering both immediate and long-term rewards.

Pros and Cons

While The Ultimate Real Estate Agent Retirement Plan™ offers significant advantages, it’s important to consider both sides of the coin. Here’s a balanced look at the pros and cons:

Pros

- Financial Savings: Save on down payments and purchase prices by leveraging your commission, making it easier to grow your portfolio.

- Passive Income: Generate a steady stream of income through rental properties, providing financial stability and security.

- Expertise Utilization: Use your real estate knowledge and skills to identify the best deals, manage properties efficiently, and maximize profits.

- Equity and Wealth Building: Benefit from property appreciation and equity growth over time, increasing your net worth and investment power.

- Tax Advantages: Take advantage of various tax deductions related to owning and managing real estate investments.

- Control and Flexibility: Enjoy the freedom to make strategic decisions about your investments, tailoring your portfolio to your goals.

Cons

- Market Risks: Real estate markets can fluctuate, potentially affecting property values and rental incomes.

- Property Management: Managing rental properties requires time, effort, and sometimes dealing with challenging tenants or maintenance issues.

- Initial Capital Requirement: Despite savings on commissions, initial investments are still required for down payments and property preparations.

- Liquidity: Real estate is not as liquid as other investments, meaning it can take time to sell properties or access your money.

- Legal and Regulatory Hurdles: Navigating zoning laws, rental regulations, and property codes can be complex and time-consuming.

- Financial Leverage Risks: Using loans to purchase properties increases leverage, which can amplify losses if the market turns.

Choosing The Ultimate Real Estate Agent Retirement Plan™ involves weighing these pros and cons against your personal and financial goals. While the benefits can be substantial, it’s crucial to approach this strategy with a clear understanding of the potential challenges and a plan to mitigate them.

Examples

To illustrate the potential of The Ultimate Real Estate Agent Retirement Plan™, let’s look at a few hypothetical examples. These stories highlight how real estate agents have successfully implemented this strategy to build wealth and secure their retirement.

Example 1: Sarah’s Starter Home Strategy

Sarah, a new real estate agent, buys her first home with a small down payment, taking advantage of her commission as a rebate. After living there for two years, she moves into a second home, renting out the first. This first rental property covers its mortgage and generates extra monthly income. Over ten years, Sarah repeats this process, eventually owning five rental properties, all acquired with favorable financing and her commission savings. This portfolio now generates substantial passive income, supplementing her agent commissions.

Example 2: Mike’s Mixed-Use Investment

Mike, an experienced agent, targets a mixed-use property combining residential and retail spaces. Using his commission to secure a better deal, he renovates the property to increase its value and rental income. The commercial tenants provide a steady income stream, while the residential units are popular with long-term tenants. This strategic investment diversifies Mike’s portfolio and minimizes vacancy risks, contributing significantly to his retirement savings.

Example 3: Linda’s Luxury Flip

Linda leverages her extensive market knowledge to purchase a luxury property in a prime location at a below-market price, again using her commission advantage. She lives in the property while making high-end upgrades. After two years, she sells the property for a substantial profit, which she then reinvests into two additional properties, kick-starting her portfolio with higher-value investments. This approach accelerates Linda’s path to financial freedom through strategic flipping and reinvestment.

These examples demonstrate the versatility of The Ultimate Real Estate Agent Retirement Plan™. Whether starting with modest homes, investing in mixed-use properties, or targeting luxury markets, the plan can be adapted to fit various goals and market niches. By leveraging their unique position, real estate agents can use this strategy to build a diversified, income-generating portfolio tailored to their retirement vision.

Spreadsheet to Analyze the Deals

Spreadsheet to Analyze the Deals

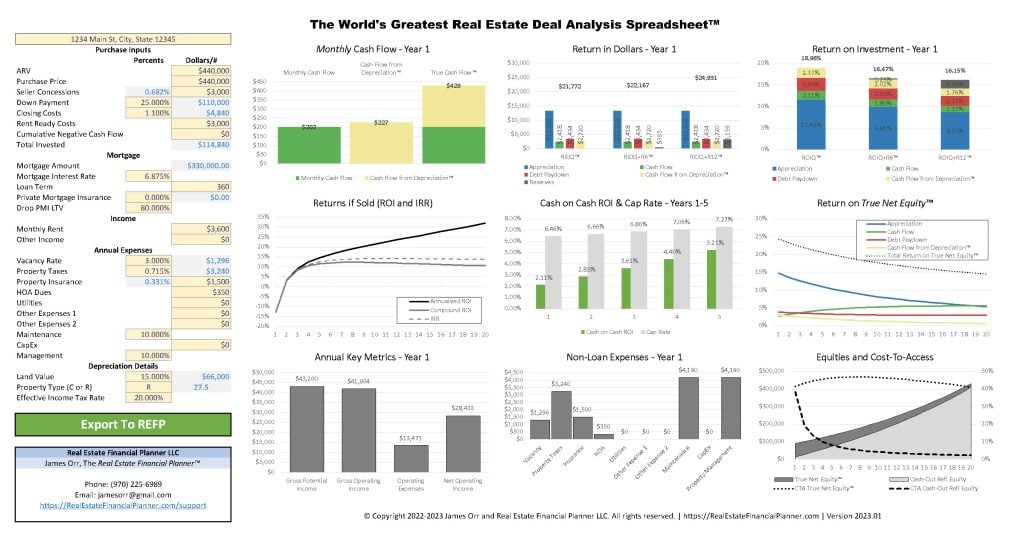

Success in The Ultimate Real Estate Agent Retirement Plan™ hinges on your ability to evaluate investment opportunities accurately. That’s where The World’s Greatest Real Estate Deal Analysis Spreadsheet™ comes into play. This free tool is designed to empower you to analyze deals precisely, ensuring you make informed decisions about your real estate investments. Here’s how it can benefit you:

- Comprehensive Financial Analysis: Input key financial data such as purchase price, repair costs, financing details, and expected rental income to calculate cash flow, return on investment (ROI), and more.

- Rental Income Projections: Estimate potential rental income based on current market rates to evaluate if a property meets your cash flow objectives.

- Expense Management: Track mortgage, taxes, insurance, and maintenance costs to gauge the profitability of each investment.

- Performance Tracking: Monitor equity growth, property appreciation, and overall investment performance over time.

- Market Scenario Simulation: Assess the impact of market changes on your portfolio by adjusting interest rates, rental rates, and other variables.

Getting started is easy. You can download The World’s Greatest Real Estate Deal Analysis Spreadsheet™ for free. This resource includes all the necessary columns and calculations to analyze your real estate deals effectively. Whether you’re a seasoned investor or just starting out, this spreadsheet is a valuable asset for managing your real estate portfolio.

Even if you’re not familiar with advanced Excel techniques, the spreadsheet is user-friendly, with guides and tutorials to help you maximize its features. By leveraging this tool, you can ensure that every investment decision is backed by solid financial analysis, helping you to grow your portfolio confidently and strategically.

Remember, the key to successful real estate investing is informed decision-making. With The World’s Greatest Real Estate Deal Analysis Spreadsheet™, you’re well-equipped to identify profitable investment opportunities and achieve your financial goals.

Professional Market Knowledge = Better Deals

One of the most substantial benefits of The Ultimate Real Estate Agent Retirement Plan™ is the opportunity to leverage your professional market knowledge for securing better investment deals. As a real estate agent, your expertise in understanding market trends, recognizing undervalued properties, and negotiating deals gives you a distinct advantage. Here’s how your professional insights can lead to more profitable investments:

- Insider Market Insights: Your deep understanding of the real estate market, from neighborhood trends to future development plans, enables you to spot undervalued properties that have strong growth potential. This insight can significantly increase the value of your investments over time.

- Advanced Negotiation Skills: Your experience in negotiating real estate transactions can help you secure properties at lower prices, negotiate better terms, and even obtain favorable financing options. These skills can result in substantial savings and increased equity from the outset.

- Early Access to Listings: Having early or exclusive access to listings through your network and MLS access allows you to act quickly on potential deals before they become widely known to the public. This can help you avoid bidding wars and purchase properties at competitive prices.

- Network of Contacts: Your professional connections with other agents, lenders, and real estate professionals can provide you with valuable information and opportunities that are not available to the general public. Leveraging these relationships can open doors to off-market deals and partnerships that enhance your investment portfolio.

Utilizing your professional knowledge and skills not only helps you identify the best deals but also minimizes risks associated with real estate investments. By applying your expertise to your own investment strategy, you can navigate the market more effectively, make informed decisions, and ultimately secure higher-quality investments that contribute to a successful and financially stable retirement.

How To Use Your Commission

We primarily recommend you use your real estate commission to either:

- Accept a discount on the property in lieu of a commission, or

- Get a rebate (in the form of your commission) on your down payment when you buy

Even though those are the primary two recommended uses of your commission using this plan, there are alternative uses of your commission as well.

As a real estate agent engaging in The Ultimate Real Estate Agent Retirement Plan™, your commission is not just a source of income—it’s a strategic tool for building your investment portfolio. Here’s how you can smartly use your commission to fuel your real estate investments:

- Reducing Purchase Costs: Apply your commission towards the purchase price of your investment property. This lowers your initial out-of-pocket expenses and can improve your loan-to-value ratio, potentially leading to better financing terms.

- Enhancing Down Payments: Use your commission to increase your down payment. A larger down payment might qualify you for lower interest rates and reduce your monthly mortgage payments, making the investment more cash flow positive from the start.

- Covering Closing Costs: Closing costs can add up quickly. Allocating your commission to cover these costs can smooth the transaction process and preserve your cash for repairs, upgrades, or future investments.

- Investing in Property Improvements: Reinvesting your commission into the property can enhance its value and appeal, leading to higher rental rates and increased property value. This is particularly effective if you target improvements that yield the highest return on investment.

- Preparing for Vacancies and Maintenance: Set aside a portion of your commission to fund a reserve account for unexpected vacancies or maintenance issues. This financial cushion ensures that you can handle property expenses without dipping into your personal funds.

Strategically using your commission in these ways not only maximizes the financial performance of each investment but also accelerates the growth of your portfolio. By reinvesting in your real estate ventures, you leverage your position as an agent to build a sustainable and profitable investment strategy.

Remember, each investment decision should be made with your long-term financial goals in mind. Consider the potential impacts of using your commission in various ways and choose the strategy that aligns best with your objectives and the specifics of each deal.

What If The Ultimate Real Estate Agent Retirement Plan™ Isn’t For Me?

Deciding whether The Ultimate Real Estate Agent Retirement Plan™ aligns with your goals and lifestyle is crucial. This strategy is perfect for real estate agents who are ready to leverage their professional skills and commissions to build a robust investment portfolio. It’s designed for those who are proactive, financially savvy, and willing to invest time in managing and growing their real estate holdings.

However, this plan may not suit everyone. Your personal circumstances, investment preferences, and risk tolerance are key factors to consider. If you prefer a more hands-off investment strategy, or if your current financial situation doesn’t support the initial investment required, it might be worth exploring other options.

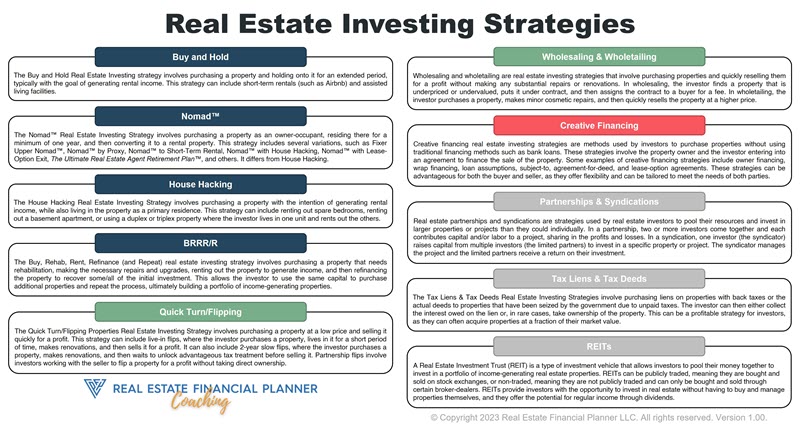

If you’re uncertain whether The Ultimate Real Estate Agent Retirement Plan™ is the right fit, don’t worry! There are plenty of other real estate investing strategies that might suit your needs better. Whether you’re interested in wholesaling, fix-and-flips, commercial real estate, or passive income streams through REITs, there’s a strategy out there for everyone.

We encourage you to check out our comprehensive list of the best real estate investing strategies at RealEstateFinancialPlanner.com. Here, you’ll find detailed information on various strategies, including buy-and-hold, BRRRR (Buy, Rehab, Rent, Refinance, Repeat), house hacking, and more. This resource can help you discover the approach that aligns best with your goals, resources, and lifestyle.

Remember, the key to successful real estate investing is finding the strategy that works best for you. Take the time to research, understand your options, and make informed decisions that will lead you to your financial goals.

Conclusion

Embarking on The Ultimate Real Estate Agent Retirement Plan™ is an exciting journey towards financial independence and a prosperous retirement. By leveraging your unique position as a real estate agent, you can maximize your investment opportunities and build a significant portfolio of rental properties. This plan combines the practicality of the Nomad™ strategy with the financial advantages of being an agent, offering a pathway to wealth that is both strategic and rewarding.

However, it’s important to remember that this journey requires dedication, smart planning, and a willingness to learn and adapt. Whether you’re reducing purchase costs with your commission, strategically selecting properties, or managing your investments for long-term growth, each step you take is an investment in your future.

If you’ve determined that The Ultimate Real Estate Agent Retirement Plan™ aligns with your goals and investment style, congratulations! You’re on your way to building a robust portfolio that will serve you well into retirement. If not, remember that the world of real estate investing is vast, with numerous strategies to explore. Our comprehensive guide to real estate investing strategies is a great place to start your search for the perfect fit.

Regardless of the path you choose, the key is to start. Every investment journey begins with a single step. With the right strategy, dedication, and resources, you can achieve your financial goals and create a future that is both prosperous and secure. Here’s to your success in real estate investing and beyond!