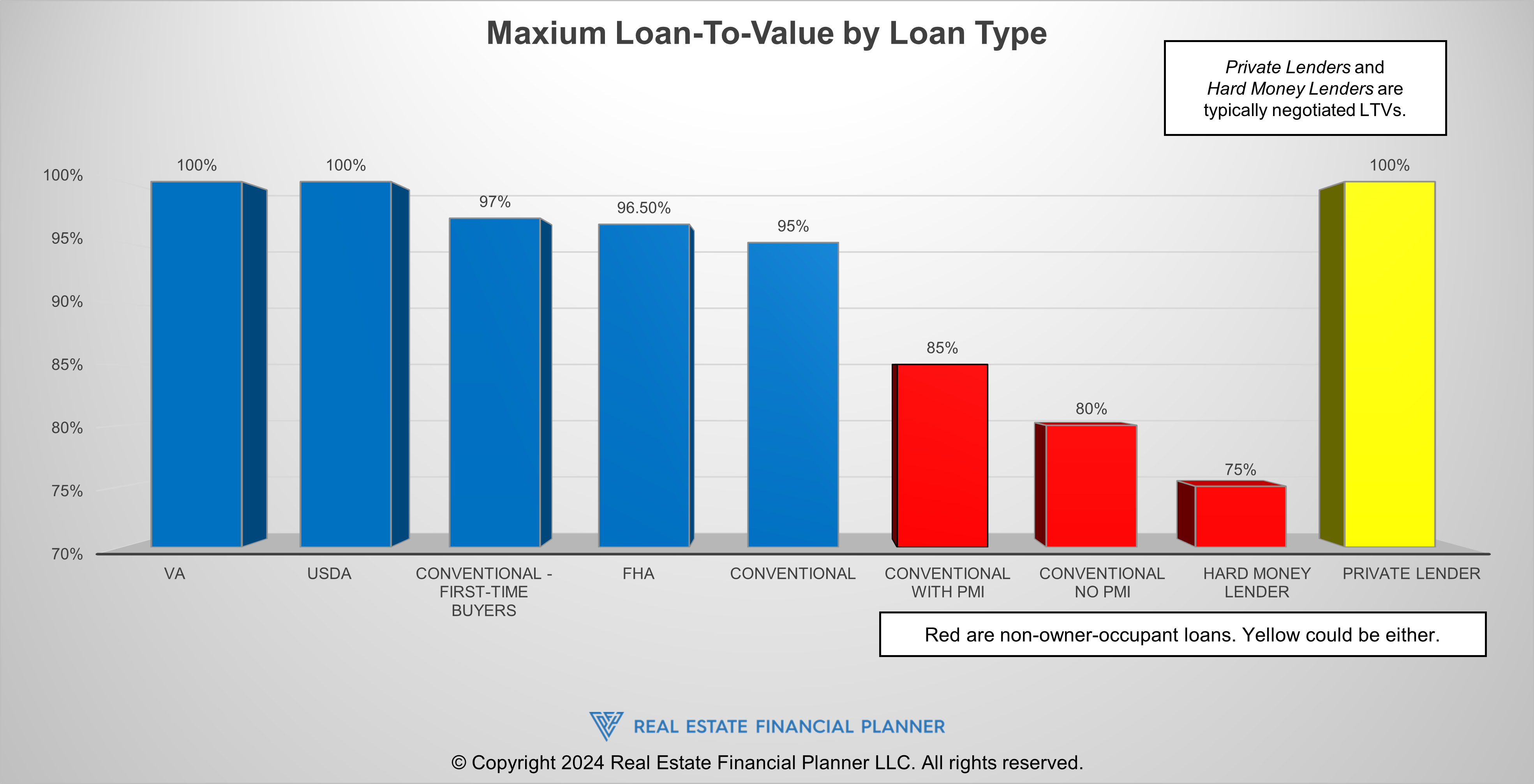

Ultimate Guide to Loan-To-Value for Real Estate Investors

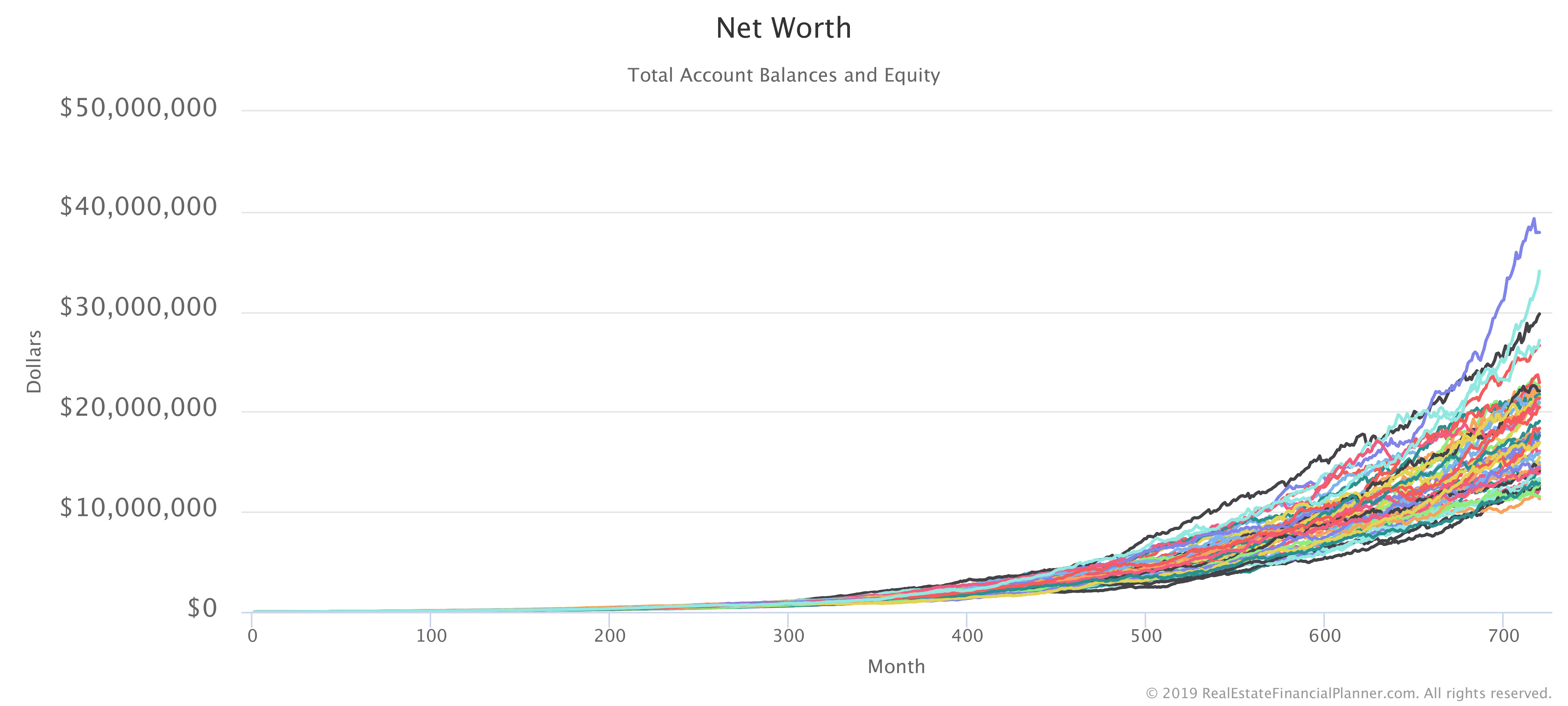

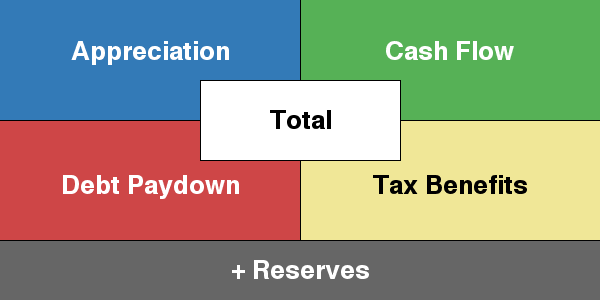

Hey there, future real estate moguls! Ready to dive into the world of properties and investments? Great! You’re about to learn about one of the most important numbers in real estate: the Loan-To-Value ratio, or LTV for short. Understanding LTV is like having a secret key that unlocks the doors to smarter investing decisions. Whether you’re buying your first rental property or adding another gem to your growing portfolio, knowing about LTV can help you navigate the seas of financing and risk management like a pro. In this guide, we’re going to break down everything you need to know about … Read more