Ultimate Guide to Monte Carlo Simulations for Real Estate Investments

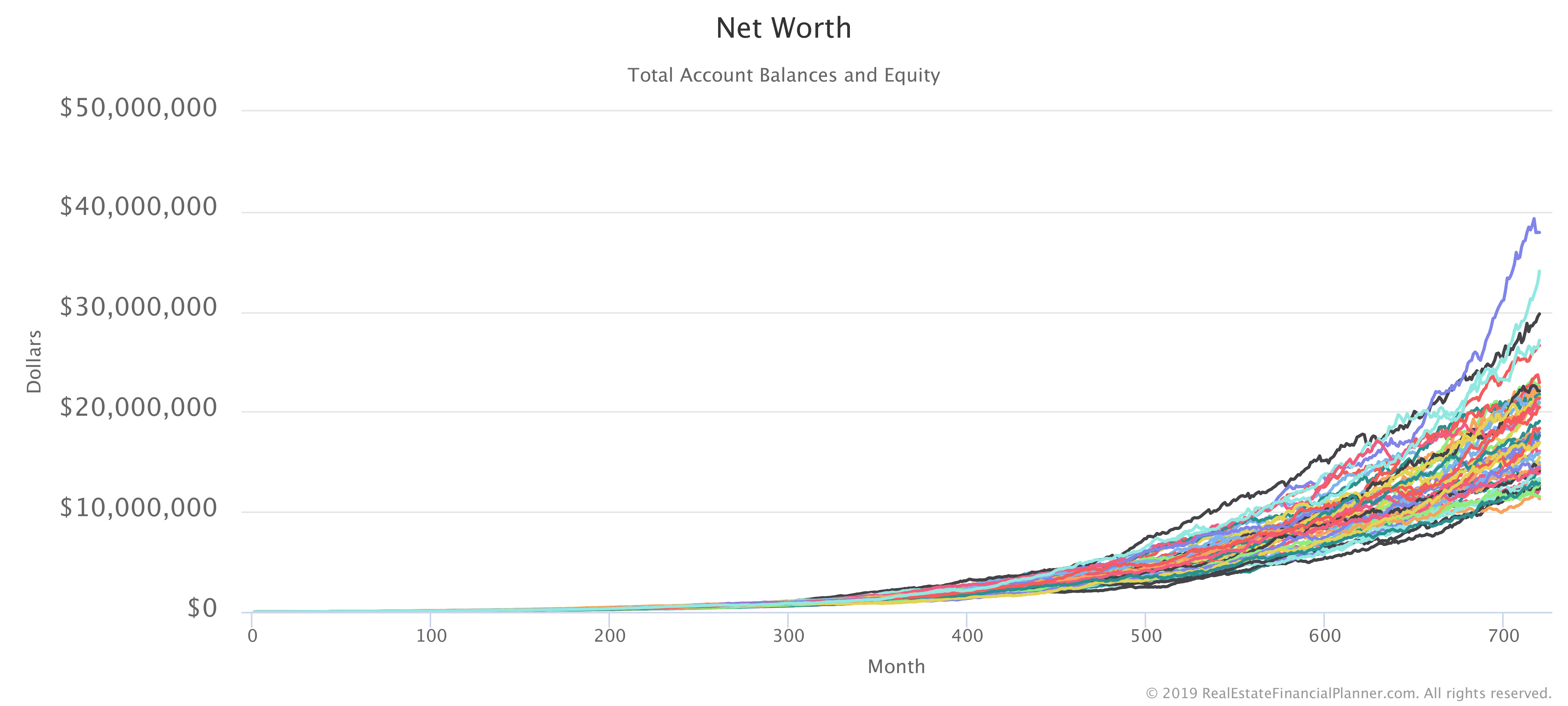

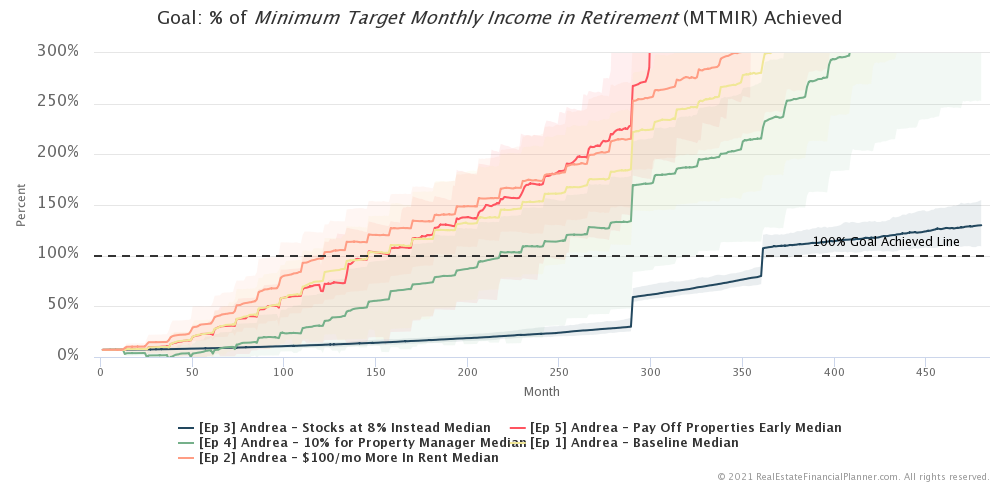

Hey there! Have you ever wished you could peek into the future of your investments? Imagine having a tool that helps you see the many paths your real estate journey could take. Well, that’s exactly what Monte Carlo simulations offer. It’s like having a video game with thousands of levels, showing you all the ways you can win at the game of investing. Monte Carlo simulations aren’t just fancy math; they’re your crystal ball into the world of real estate investments. By exploring a wide range of “what if” scenarios, these simulations can help you make smarter, more informed decisions. … Read more