Topics discussed include:

- What is resiliency?

- What is Price Resiliency™? What is Rent Resiliency™?

- The two flavors of resiliency: dollars and percent.

- Measuring resiliency on the individual property basis or the entire portfolio

- Measuring resiliency as a snapshot in time or over time

- Examples using over-simplified math:

- What happens when rents go up 10%, down 10% in two different portfolios?

- What happens when prices go up 10%, down 10% in two different portfolios?

- Resiliency is largely about leverage

- Thought experiment: what is more risky… 0% or 10% down payment?

- The 7 Ways to Measure Risk in Real Estate Investments

- How much riskier is it… a discussion of offsetting risk measures

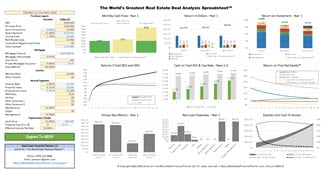

- Examples of interpreting Price Resiliency™ (charts)

- Examples of interpreting Rent Resiliency™ (more charts)

- Comparing putting 5%, 20%, 25% or 100% down – how risky are they compared to each other?

- Evaluating risk: why 20% resiliency is not twice as good as 10% resiliency

- Diversification and the role of resilience based on various levels of diversification

- The counterintuitive nature of risk and reward in real estate investing

- A brief overview of rent and price resiliency from various Scenarios we discussed in previous classes on:

- Buy and Hold Real Estate Investing

- Nomad™ Real Estate Investing Strategy

- House Hacking Real Estate Investing Strategy and

- BRRRR Real Estate Investing Strategy

- An introduction to True Price Resiliency™ and True Rent Resiliency™ and how they differ from their non-“True” counterparts.

- How Cash Flow from Depreciation™ acts when discussing Rent Resiliency™

- An introduction to Vacancy Resilience™, Property Insurance Resilience™, Property Taxes Resilience™, Maintenance Resilience™, Maintenance Resilience™ and Capital Expenses Resilience™

- The Price Resilience™ and Rent Resilience™ of James’ personal real estate portfolio.

- Plus much more

Classes Mentioned

In this presentation James mentions several other classes: