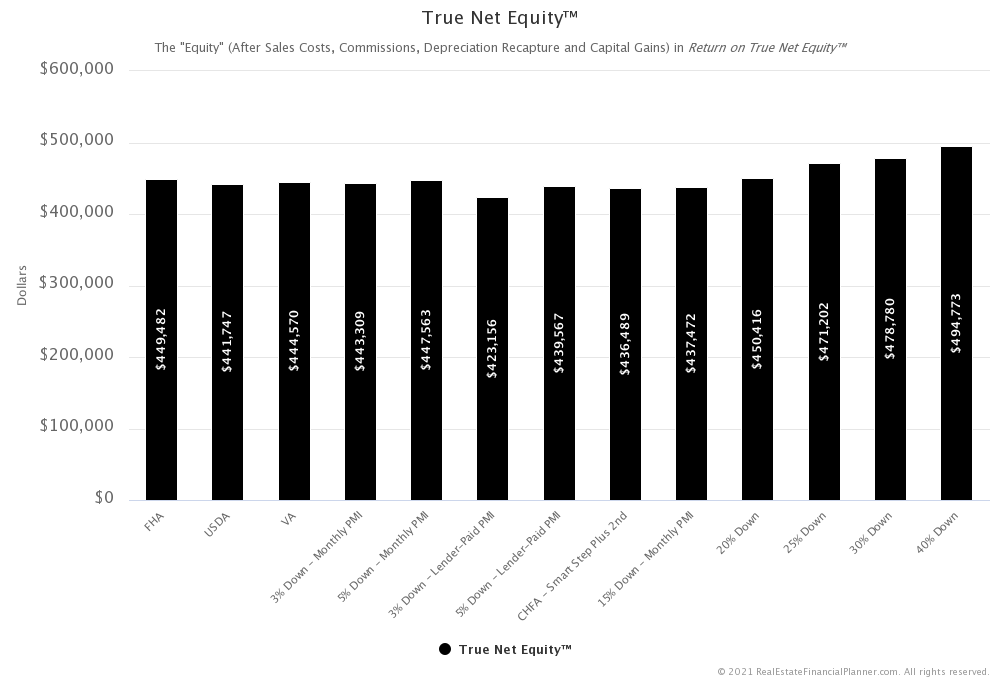

Traditionally, equity (for real estate investors) is defined as the property value – mortgage balances.

However, in almost all cases, equity defined that way means that only a portion of that equity “belongs” to the real estate investor.

To access that equity the real estate investor must either sell the property or cash-out refinance the property. In both cases, some or… possibly all of the traditional equity… is consumed by sale or refinance costs.

- In the case of a refinance, there are costs to the lender and title company to access the equity.

- In the case of a sale, there are closing costs, real estate commissions in many cases, depreciation recapture and capital gain taxes (or 1031 exchange fees if you’re kicking the tax liability down the road).

So, truth be told, the real estate investor has only a fraction of the equity many believe they have.

Enter, True Net Equity™.

Who Owns Your Equity

Real estate investors don’t own all their equity. To access the equity, other parties show up to claim a share.

For example:

- Closing Costs – attorney, title companies, county (transfer fees)

- Real Estate Commissions – real estate agents/brokers

- Depreciation Recapture Taxes – Internal Revenue Service (IRS)

- Capital Gains Taxes – IRS

In some cases real estate investors are able to eliminate or defer other party’s claim to their equity.

They may opt to sell a property For Sale By Owner and eliminate a the real estate agent/brokers claim to a real estate commission.

They may opt to do a 1031 tax-deferred exchange and delay the IRS’s claim for depreciation recapture or capital gains. In some cases, for example the eventual death of the real estate investor, they may be able to have their heirs receive their property with a stepped-up basis and wipe out the previous claim to depreciation recapture or capital gains on a property.

They may be able to convince a buyer to cover their closing costs on a sale thereby transferring the attorney’s, title company’s and other’s claim on their equity to the buyer.

But, for many real estate investors these claims against their equity is real.

It can also be significant.

If you’re wondering Should I Sell My Rental Property? you may want to consider the current return you’re earning on your True Net Equity™. This is the minimum return you need to earn by investing the net proceeds of the sale to get the same return you’re earning on the current property.

True Net Equity™ Charts

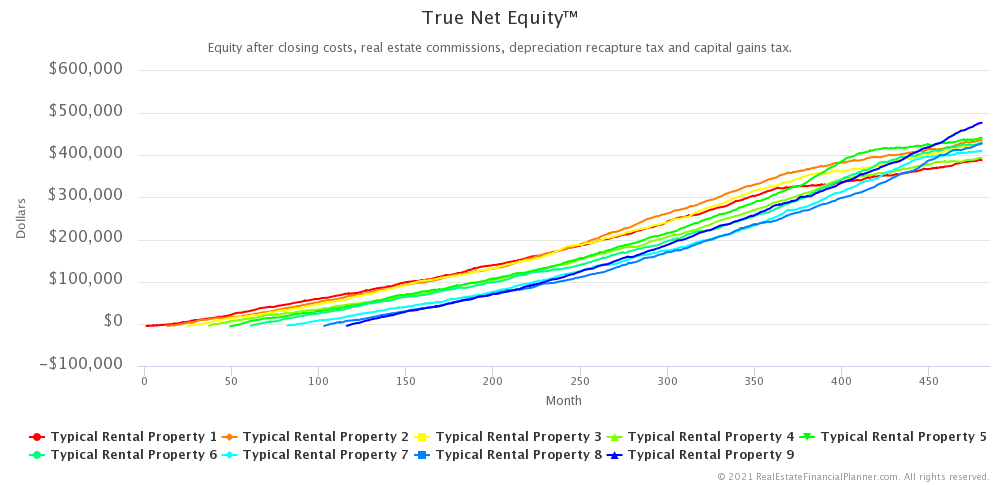

Inside the Real Estate Financial Planner™ software you can see  Charts

Charts Property

Property Scenario

Scenario

For a  Property

Property Properties

Properties Scenario

Scenario

Here’s an example from the story about Andrea,  How to Acquire 8 Rental Properties With Down Payments for Two:

How to Acquire 8 Rental Properties With Down Payments for Two:

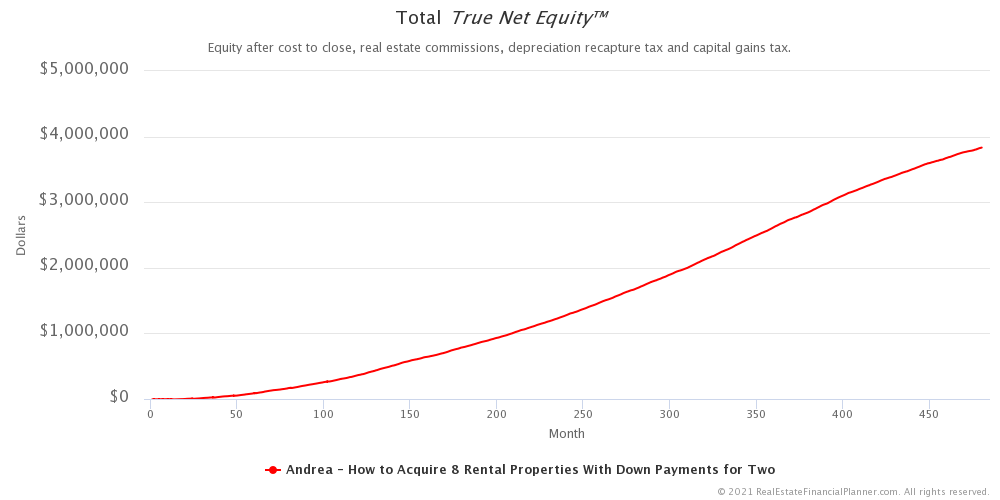

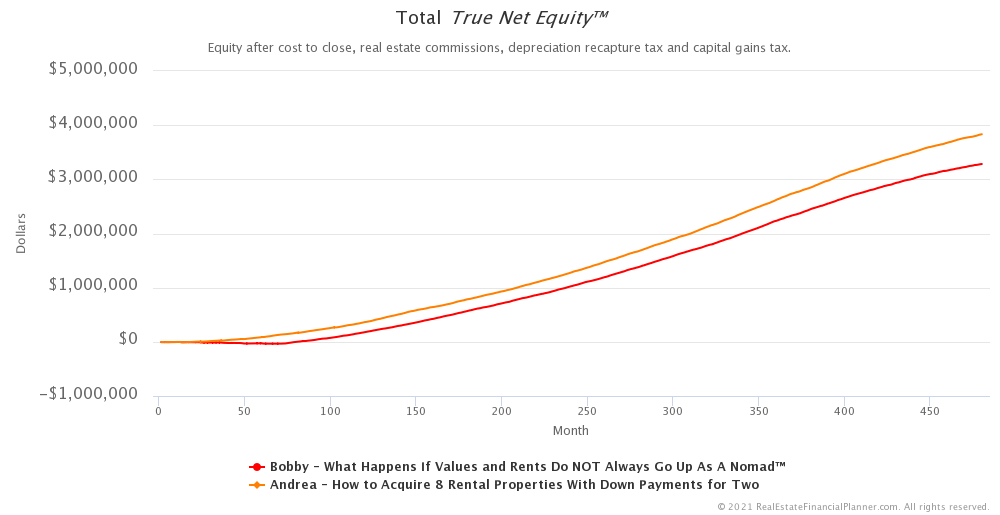

Of course, you could easily see how the Total True Net Equity™ for the entire  Scenario

Scenario

Or, compare two or more  Scenarios

Scenarios

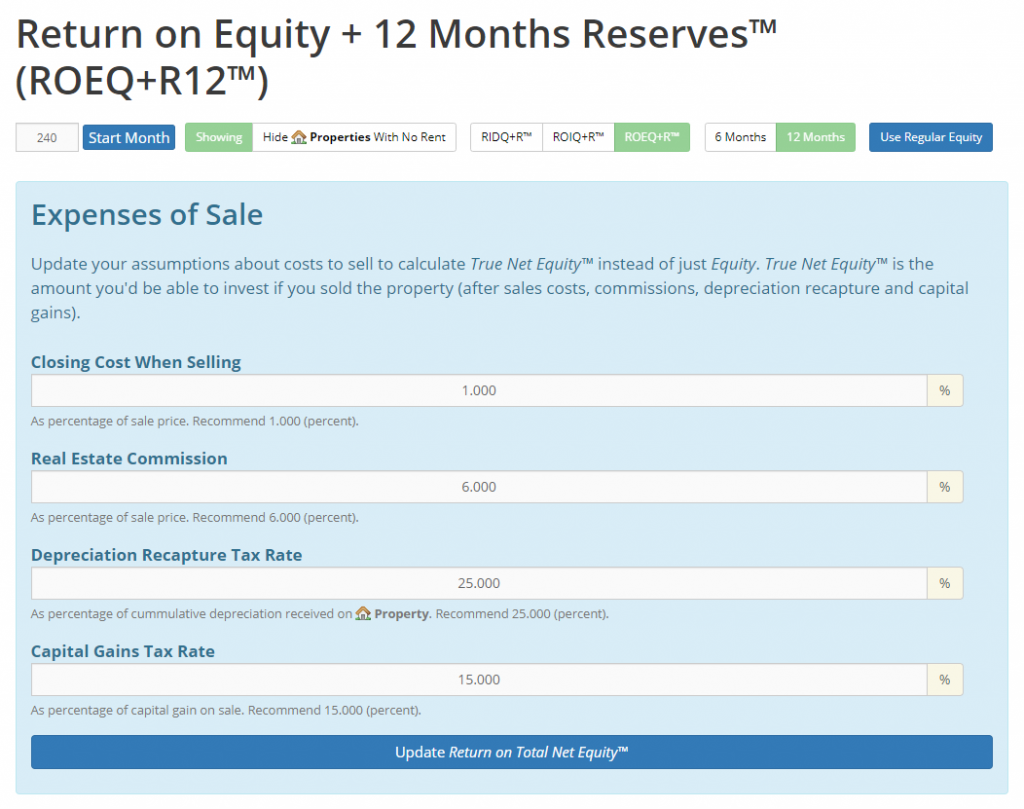

Calculating True Net Equity™

Each real estate investor can independently set the closing costs, real estate commission, depreciation recapture tax rate and capital gains tax rate for each individual  Property

Property

The software than uses these inputs to calculate the True Net Equity™.

Of course, the software also allows you to change the values for closing costs, real estate commission, depreciation recapture tax rate and capital gains tax rate over time using  Rules

Rules

Return on True Net Equity™

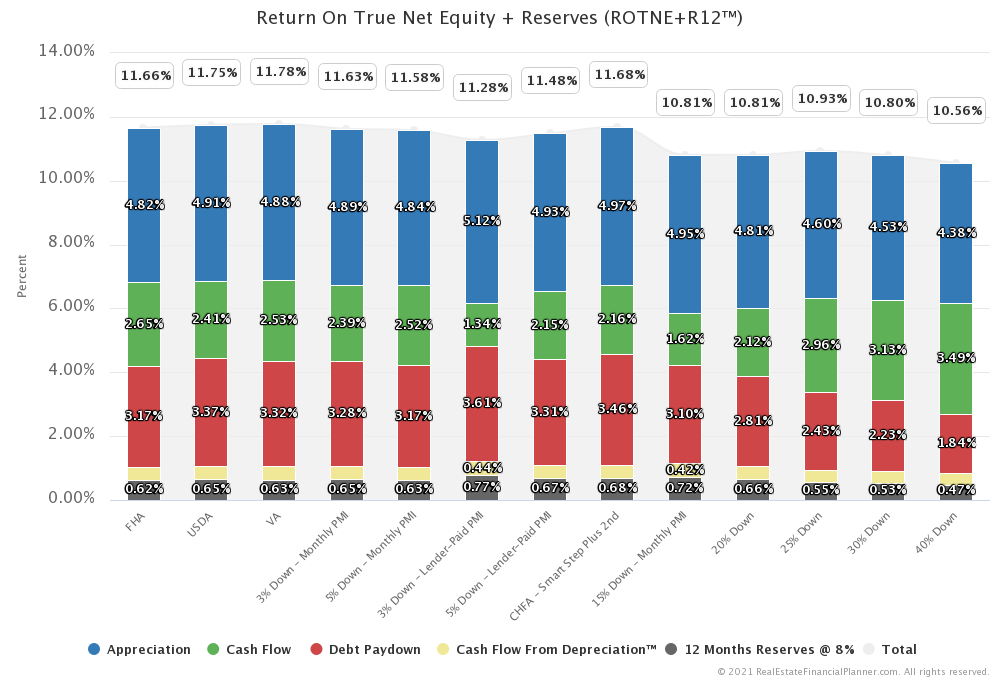

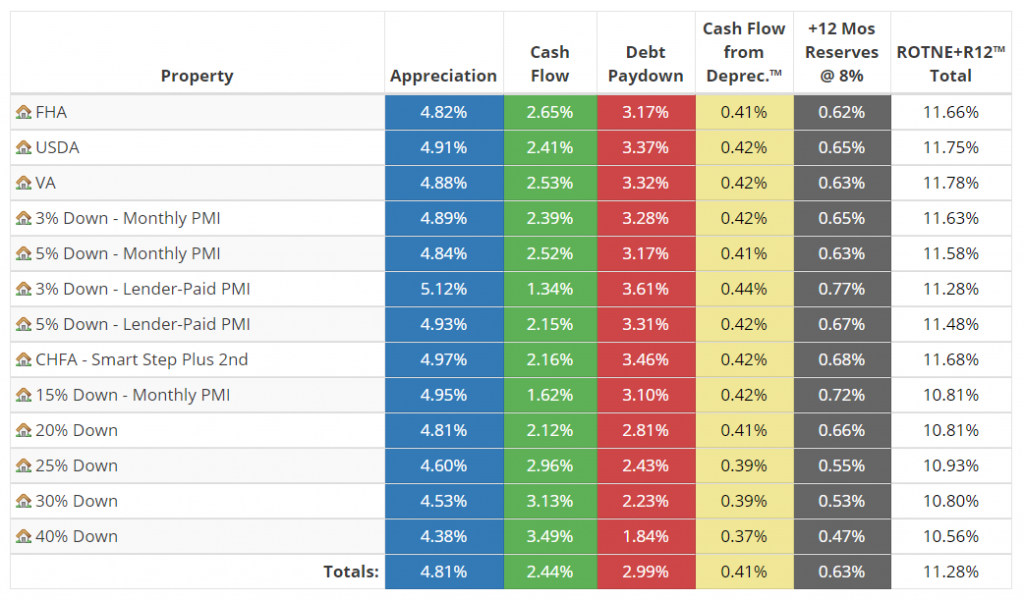

Historically, many real estate investors have opted to look at their return on equity as a means of measuring the performance of their rental property over time.

The thinking has been that you can see what returns you’re earning from appreciation, cash flow, debt pay down and depreciation/Cash Flow from Depreciation™, and reserves divided by the equity they have in their property.

At this point, you can probably anticipate the problem with this method: the return the real estate investor is earning is not really on the gross amount of equity. It really is the return they are earning on their True Net Equity™.

If the investor were to sell their rental, they’d only walk away with True Net Equity™. So, the return should be based on True Net Equity™.

Furthermore, when evaluating whether the real estate investor should sell or not, they should be comparing the return they could get elsewhere in another investment to the return they are getting on True Net Equity™.

Any other comparison is fictional and purely academic.

Return on True Net Equity™ + Reserves Reports

Once you’ve entered your  Properties

Properties Property

Property Scenario

Scenario

Then, use this report to evaluate whether to keep the  Property

Property

Enter in your assumptions:

View the component returns (appreciation, cash flow, debt paydown, Cash Flow from Depreciation™ and reserves) plus the total for the  Property

Property

Or, see the same data in table form:

Quickly see what the True Net Equity™ you’d walk away with is for each  Property

Property

Or, see the entire  Scenario

Scenario Property

Property

All of these details are available a single report to help you make a decision to keep the  Property

Property

Class on Return on True Net Equity

The following is a class I taught where I introduced the concept of Return on True Net Equity™: