There are the non-mathematical reasons for selling your rental property and then there are the mathematical considers. We will cover both, but first let’s start with the non-math based considerations.

Should I Sell My Rental Property?

The following is based on my Should I Sell My Rental Property Checklist which I cover in detail in the Should I Sell My Rental? ROTNEQ+R™ class.

You need to ask yourself: how do you know when the right time to sell is? It partially depends on a number of factors:

- Your personal situation… if you NEED the money, you NEED the money.

- The property… is this a property you want to keep or something you ultimately do not want in your portfolio?

- The market… is there something going on the in the market that makes this a particularly good or bad time to sell?

With those factors in mind, here are the questions I recommend asking yourself or discuss with your advisors:

- Is this a property you still want to hold in your portfolio long-term?

- Are you still willing/able to manage the property and/or property manager?

- Are the long-term economics for the market still favorable?

- Market Timing

- Is your decision based on current market conditions?

- Hot market, easier to sell (especially helpful with a property that could otherwise be hard to sell)

- Soft market, harder to sell (will it need to be vacant and will the time to market it eat into profits)

- Or, speculative guesses about the future: what you think the market will do (especially in the short-term)?

- Is the tenant moving out?

- Is it going to need work before the next tenant?

- Expiring tax benefits of selling now?

- Owner-occupant for 2 out of the last 5 years

- Low income tax rate for depreciation recapture this year

- Low income tax rate for long-term capital gains this year

- Financing Pressure

- Do you have financing pressure to sell sooner than later? Balloons, Adjusting Interest Rates

- Do you have financing pressure to sell later than sooner? Pre-Payment Penalties

- Are you trying to adjust your asset allocation?

- The current return you’re getting on the property? This is one that we will focus on.

- Do you have another investment to move the proceeds into?

The Math of Holding or Selling Now

I personally find the non-mathematical questions related to selling your rental property or holding onto it, more difficult than the mathematical ones. But, others… especially those with uncertain holding periods… may find it difficult to guess/estimate what the future may hold.

The difficulty in guessing or estimating what the future might do will make part of the math of determining whether to sell or not a little more challenging.

Either way, here’s the math you can either do by hand or use the Real Estate Financial Planner™ software to do the math for you.

Question You’re Really Asking

So, the mathematical question you’re really asking yourself when you’re wondering if you should sell or keep your property is…

So, first… we need to determine the current return you’re getting on this rental.

Return On What?

When trying to determine the current return… we need to determine how to measure the return.

- Are we really concerned about the return you’re getting compared to the initial amount of money you invested (the Return on Investment)?

- Or, the Cash on Cash Return on Investment (or how well it is cash flowing)?

- Or, the amount of dollars it will go up in value in the next year or so from largely speculative appreciation?

I would suggest the answer to all of these questions is: no.

Really, what you want to do know is…

Let’s break that down.

First the return you’re currently getting. I think it may be reasonable to estimate what return you’re likely to get in the next year on that property.

Predicting too far out into the future has its own challenges. But, most of us can take an educated guess on how we think the market MIGHT do in the next year or so.

If, on the other hand, you happen to be especially prescient about the future, this property or both maybe you take that into account. For example, you KNOW (like no one has ever known before) that big box retailer X is coming and will buy your property from you in 5 years or less then maybe you do take that into account.

For us less prescient mere mortals, I think looking at a year in the future seems reasonable. That’s what I mean by currently.

Continuing explaining What is the return you’re currently getting on the amount of money you’d pull out if you sold it.… what do I mean by the “the amount of money you’d pull out if you sold it”?

For the sake of this discussion, I think the only real relevant measurement of comparison for calculating a return is the return you’re getting on the amount that you would need to invest elsewhere after the sale of this property.

To do that calculation we need to determine how much you’ll walk away with after the sale.

Many people might think I mean just plain ol’ equity here. I don’t.

I mean what I call True Net Equity™.

True Net Equity™

True Net Equity™ is what remains of your equity if you were to sell the property after you take into account paying off your mortgage, your share of the closing costs, any real estate commissions you choose to pay, the depreciation recapture taxes you have to pay as well as your capital gains taxes.

There are times when you legitimately won’t have some of these expenses. For example, you might get the buyer to agree to pay all the closing costs. Or, you might sell it yourself for sale by owner and have no real estate commissions. Or, you’re selling the property that you lived in for 2 out of the last 5 years and therefore have a capital gains exemption.

There are times when you legitimately may be able to DEFER some of these expenses. For example, you may opt to pay a small fee to complete a 1031 tax deferred exchange and DELAY having to pay depreciation recapture taxes and capital gains taxes until later.

Regardless, you want to see what the return you’re getting in divided by that net amount that you will walk away with from a sale.

Estimated Future Returns for the Next Year

So, what “returns” am I talking about?

Most people would, correctly, assume I mean cash flow when discussing selling a rental property. Sure… that’s a given.

But, that’s not the only return you’re getting with a rental.

In fact there are 4 primary areas of return and the return on the reserves you should be keeping based on the Return Quadrants™.

The 4 primary areas are:

- How much do you reasonably expect the property to appreciate or go up in value in the next 12 months?

- How much do you reasonably expect the property to net in cash flow after ALL your expenses in the next 12 months?

- How much will you (or really your tenant) pay down on your loan (if you have one) in the next 12 months?

- What is your after-tax depreciation (Cash Flow from Depreciation™) benefit for holding it one more year?

It would be imprudent to invest in rental properties without reserves. So, you really need to consider the “drag” on your return by having to set aside money in reserves. But, many folks will choose to keep their reserves in an account that earns something… either a savings account earning maybe 1% or the stock market earning maybe 8%.

See my entire class Everything You Learned About Deal Analysis is Wrong – ROIQ+R™ for a much more detailed discussion on how to analyze deals correctly taking into account reserves.

Back to our discussion on whether you should your rental or not… so, we also need to consider the drag of your reserves and the return you might be earning on those reserves while they are sitting idle waiting to be used for vacancies, repairs, capital expenses, etc.

It is these 4 primary areas of return and reserves that we need to divide by the True Net Equity™ to see what we need to beat if sell this property and redeploy this capital elsewhere.

A Personal Example

Let’s walk through a personal example of a property in my portfolio to see how this works in practice. Of course, you too can use the Real Estate Financial Planner™ software to do this yourself with your own properties. All I am doing is sharing information from a report in the Real Estate Financial Planner™ software and explaining what is going on with it.

Some info on the property I am considering selling:

- $410,000 property value at the start of our modeling and it goes up at a rate of 3% per year.

- $307,361 property purchase price.

- 3.375% is the mortgage interest rate.

- $2,265 per month in rent but rent increases at a rate of 3% per year.

- 3% of the monthly income is the assumed vacancy rate.

- 10% of the monthly income is the assumed maintenance rate.

- 10% of the monthly income is the assumed property management rate.

- $300 per year for HOA fees on the property and they increases at a rate of 3% per year.

- This is a residential property and 15% of purchase price is considered the value of the land (when doing our depreciation calculation).

Based on that, I am estimating or guessing that over the next year I will earn the following on the property:

So, should I sell it? Maybe… let’s see.

If we look at plain ol’ Equity (property value – mortgage balance), here’s the Return on Equity Quadrant™ I am earning with this property.

My Equity in this property is almost $197,000. If I take the dollars in returns I showed above and divide each one by the Equity in the property, we get the following returns on Equity.

I think many folks would, incorrectly, use this as a way to estimate the return they need to beat if they sell the property.

They think to themselves… again incorrectly… that I am earning 12.04% on the equity I have in this property. If I can realistically beat that return, maybe I should sell that rental and re-invest that money elsewhere.

However, you know better, you know that we should not be using regular equity. Instead, we should be using True Net Equity™.

My True Net Equity™ on this property is not the $197,000 in equity. It is about $141,000. About $56,000 of equity ($197K – $141K) is eaten up by closing costs, real estate commissions, depreciation recapture and capital gains.

I don’t walk away with $197,000 if I sell it. I walk away with $141K.

So, really the returns on the True Net Equity™ of about $141K are:

That means I don’t need to do better than the 12.04% return on plain ol’ Equity… I need to do better than 16.75% return on True Net Equity™.

I need to find another investment where I am likely to earn, at least, 16.75% on the full amount I am walking away from a sale with.

Cash Flow Considerations

The overall return is significant consideration but sometimes you’re wanted to do some Deal Alchemy™ and move returns from one or more return quadrant and really focus on the quadrant that deals with cash flow on the rental.

This is especially important as you work toward your goal of achieving financial independence and living off the income generated by your investments (rentals or otherwise).

In that case, you may want to pay additional attention to the cash flow currently being generated by the property you’re considering selling and the cash flow generated by whatever you’re investing in.

Focusing on “cash flow”, to me, means looking at these 2 primary areas of return (cash flow and Cash Flow from Depreciation™) and the return from reserves (which is also a form of cash flow).

Selling More Than One Property

Sometimes you’re doing more than just considering selling one property. Sometimes you’re doing a more robust portfolio optimization. In those cases, you might want to consider doing a more comprehensive analysis of the changes you’re making.

Here’s what I recommend in those cases:

- Create your current holdings with your current plan in a

Scenario

Scenario - Make a copy of that

Scenario

Scenario - Edit the copy to reflect which

Properties

Properties Accounts

Accounts - Then, compare the two

Scenarios

Scenarios

By comparing your keep the  Properties

Properties Properties

Properties

Maybe one has a higher net worth. One has better cash flow. But these benefits may came from increased risk. Or, you become more sensitive to changes in rents or property values. Or, any number of other factors that it might be hard to really see without a true 360 degree perspective to compare all attributes of both  Scenarios

Scenarios

Conclusion

First, decide if you need to sell for non-mathematical reasons. For example if you NEED the money for something else, then the math might not matter.

However, if you have choice in the matter and it is a mathematical consideration to sell or not to sell, then look at the overall returns you’re receiving on your property and divide that by your True Net Equity™ to see your return hurdle you need to replace this rental property with.

Use the Real Estate Financial Planner™ software to do the math for you. In fact, the software will do all these calculations for all your properties and present it to you in a single report.

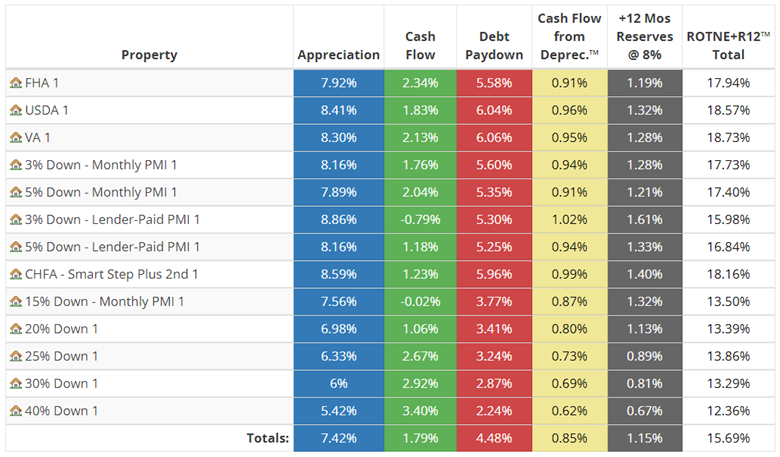

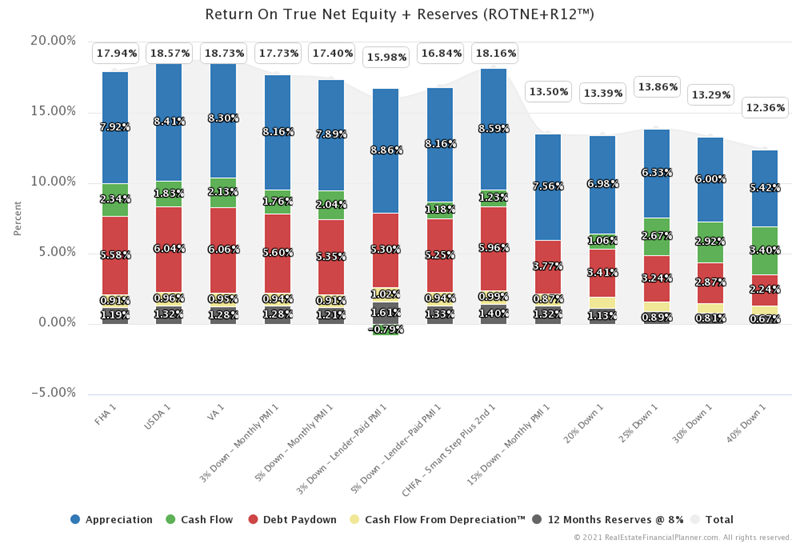

Here’s just part of the report with some sample data as an example:

And this…