In this special class, James Orr discusses whether the Nomad™ real estate investing strategy is dead.

This class was taught on June 9, 2021.

What Promoted This Class

- Several buyers purchasing from a specific neighborhood over the last several years

- All the same 4-bedroom model, same builder, go under contract well before close date (build time)

- April 2018, client purchased for $354K

- With about $10K in options… so about $344K for base price

- June 2019, client purchased for $360K

- With about $3K in options… so about $357K for base price

- About 3.77%/year increase (we typically model 3%/year)

- Rent was about $2,250 per month

- Last year, June 2020, client purchased for $376K

- With about $3K in options… so about $373K for base price

- About 4.48%/year increase

- Rent was about $2,200 per month

- This year, June 2021, same model, same neighborhood selling for $477,950 base price

- About 28.15%/year increase

- Rent about $2,300 per month

- Prices are UP… A LOT!

- Demand is UP… A LOT!

- Interest rates are DOWN, but not THAT MUCH

- Rents are UP, but not THAT MUCH

- Income is UP, but not THAT MUCH

- Signs suggest inflation is HERE and likely to continue

- Is Nomad™ Dead?!

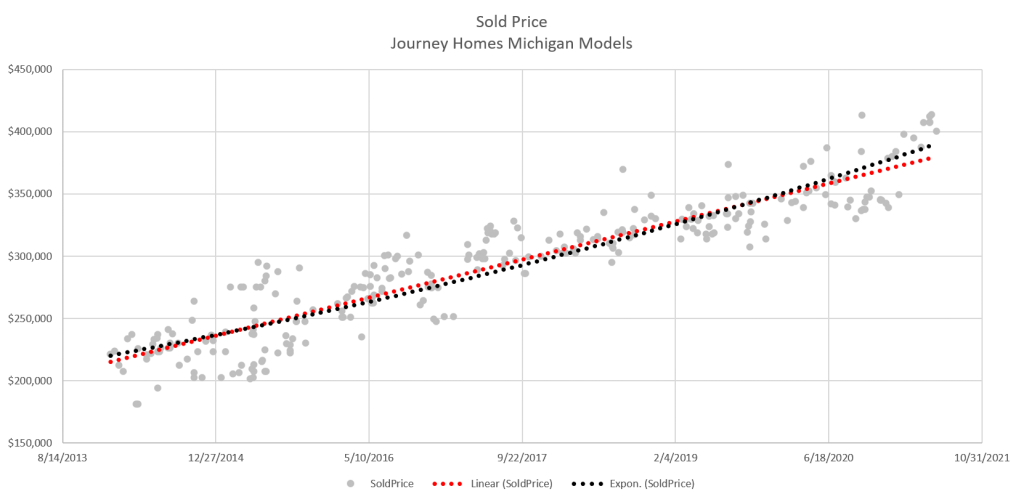

Sold Price

The following is a chart of another builder’s 4 bedroom model that many of my clients have been buying over time and how the sold price of them has changed over the last few years.

Nomad™ Then and Now

Comparing the original 2015 Nomad™ book and what the current 2021 real estate market looks like for those considering Nomading™.

2015 Original Nomad™ Book

- Purchase Price $238,875

- Interest Rate 4.5% Lender-Paid PMI with 5% Down

- Estimated PITI+HOA+PMI Payment $1,388.01

- Rent $1,545/month

2021

- Purchase Price $437,375 – 10.61% “CAGR” from 2015

- Interest Rate 3.625% Lender-Paid PMI with 5% Down

- Estimated PITI+HOA+PMI Payment $2,306.79 – 8.84% “CAGR” from 2015

- Rent $2,200/month – 6.07% “CAGR” from 2015

Do You Have a Better Investment to Make?

- Is Nomad™ Dead?

- Alternatives: stocks, bonds, commodities, 20%/25% down or other real estate, cryptocurrency… what?!

- What is the return you’re getting with Nomad™ then versus now?

- Then you can compare this to all other options you have

- Plus, remember with Nomad™ the amount of money you can put into it each year is somewhat restricted

- Inflation… having debt that is LARGELY supported by someone else (tenants) that you can pay off later with inflated dollars

You’re Not Committing to 10 Nomads™

- You’re choosing to purchase one property

- Save your money and continue to educate yourself over the next year

- Then, decide if you want to do one more

- Only repeat if it still makes sense to you

- There is power in making good decisions repeatedly (good habits), but you can get feedback to make better distinctions and improve over time

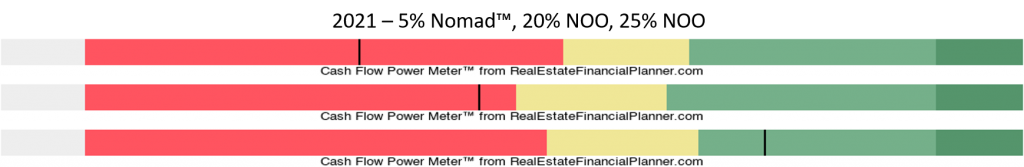

Cash Flow Power Meter™ Then and Now

Here’s a comparison of the Cash Flow Power Meter™ for Nomading™ in 2015 versus 2021.

2015 Original Nomad™ Book

2021

Cash Flow Power Meter™

And, how does the Cash Flow Power Meter™ vary in 2021 if you put 20% down or 25% down non-owner-occupant instead of just doing 5% down as a Nomad™? Here they are…

RIDQ™ Then and Now

Here’s the Return in Dollars Quadrant™ comparing 2015 to 2021.

2015 Original Nomad™ Book

2021

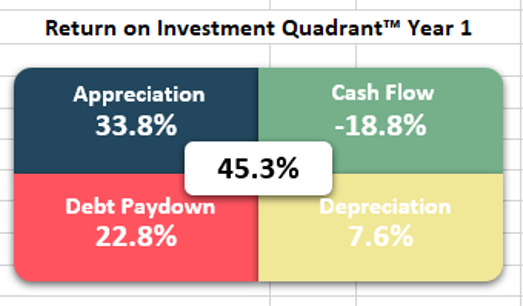

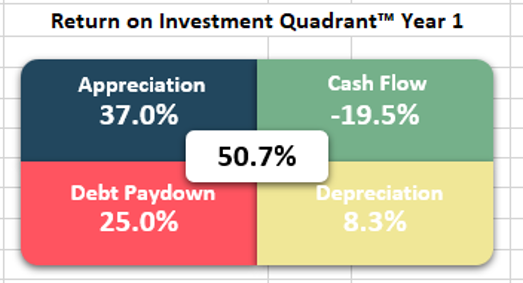

ROIQ™ Then and Now

Here’s the Return on Investment Quadrant™ comparing 2015 to 2021.

2015 Original Nomad™ Book

2021

ROIQ+R6™ Then and Now

What about the drag from reserves? Watch the full Everything You Learned About Deal Analysis is Wrong – ROIQ+R™ class to learn more, but here are the ROIQ+R6™ and ROIQ+R12™ summaries for 2015 and 2021.

2015 Original Nomad™ Book

2021

And, 12 months…

2015 Original Nomad™ Book

2021

Is Nomad™ Dead?

Ran 5 Scenarios to compare.

- Original Nomad™ with 2015 numbers

- 2021 Nomad™

- 3% inflation adjusted income from 2015

- 2021 home prices, rents and interest rates

- Scenarios:

- 10 Nomads™ (extra cash in stocks)

- 1 Owner-Occupant and All Stocks

- 1 Owner-Occupant, 9 20% Down

- 1 Owner-Occupant, 9 25% Down

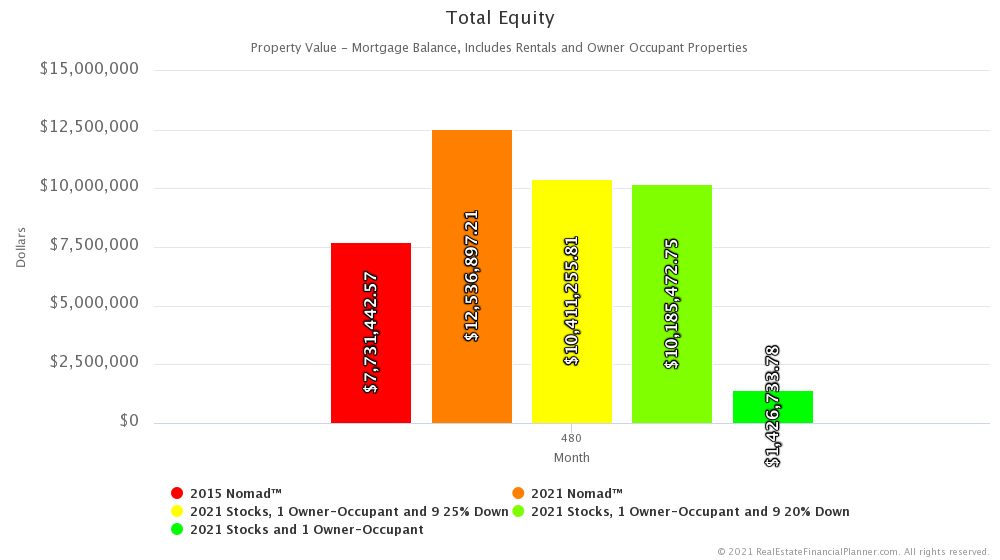

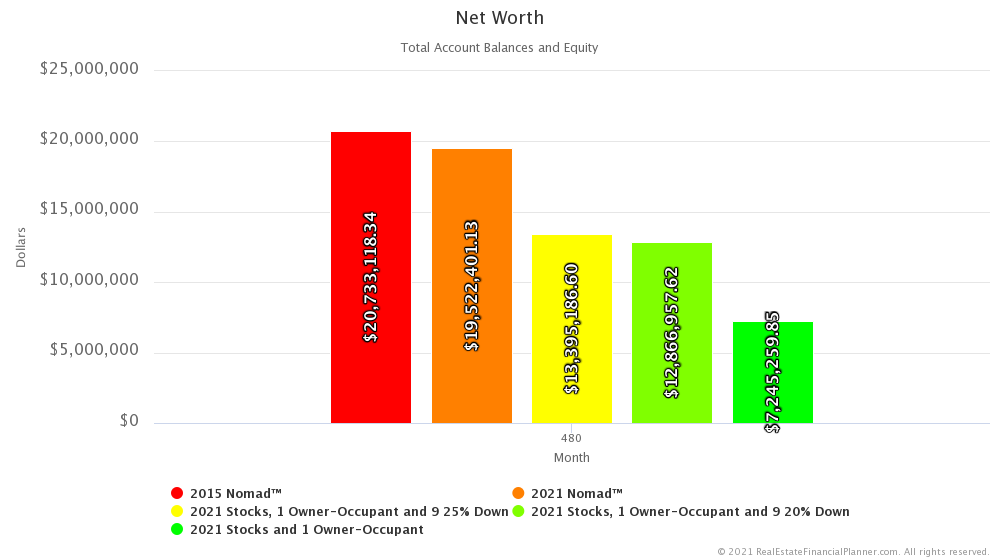

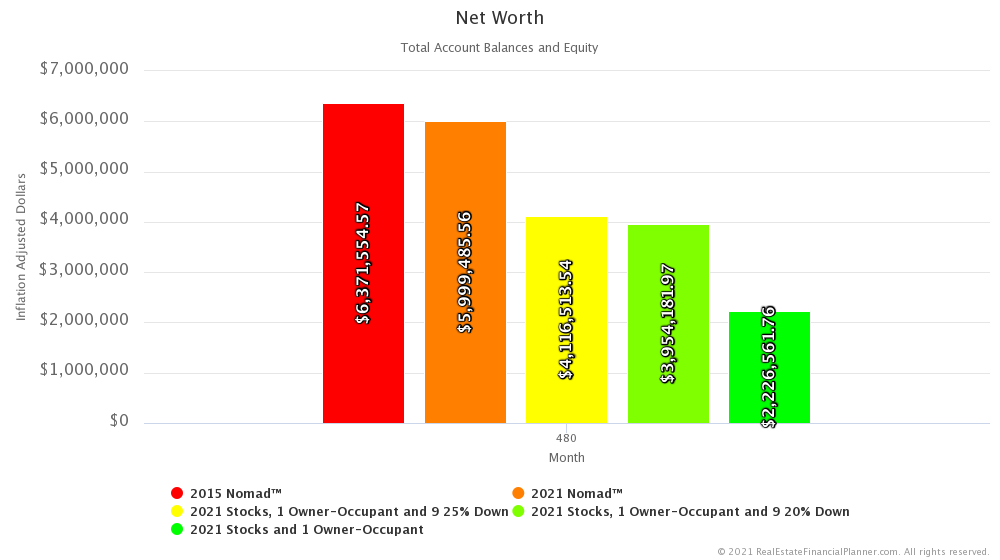

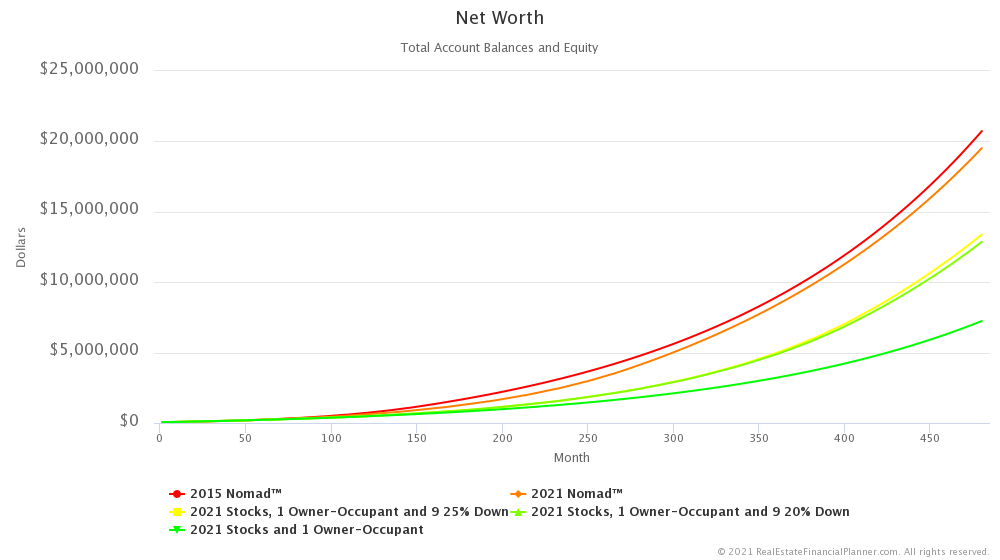

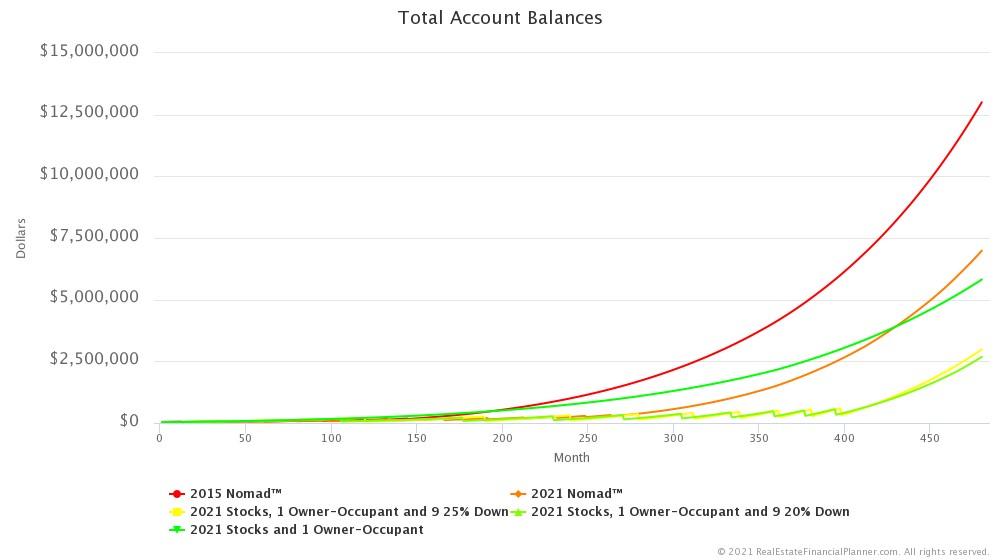

Comparing Net Worth

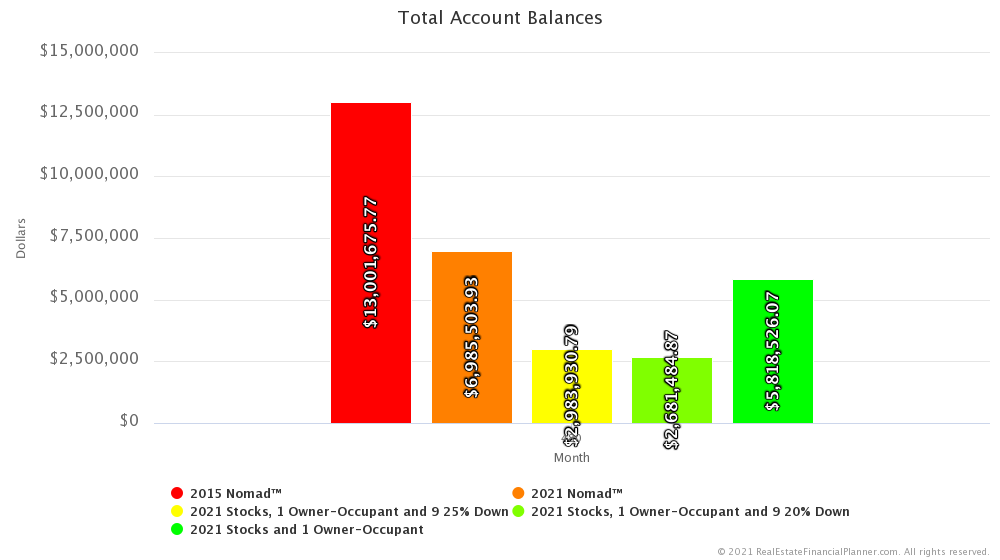

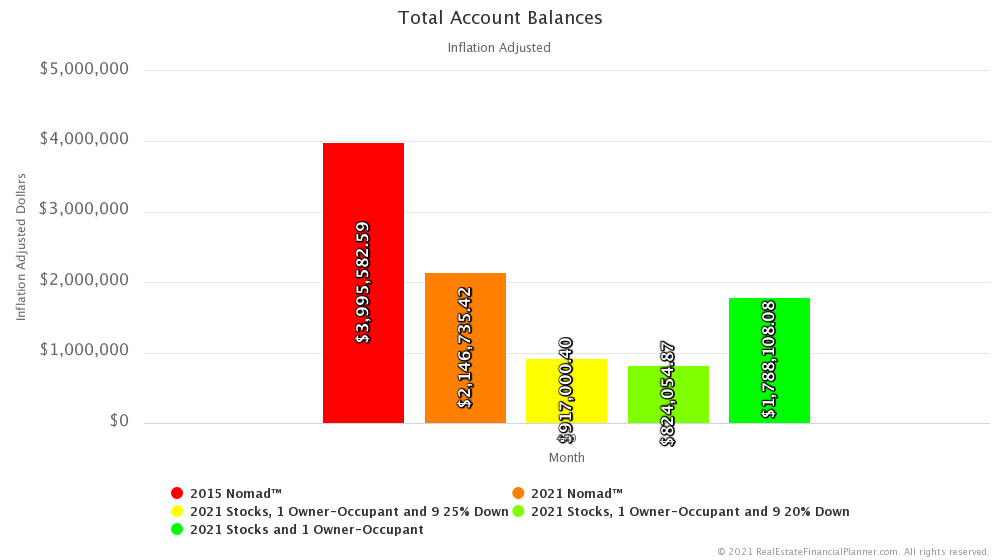

Comparing Total Account Balances

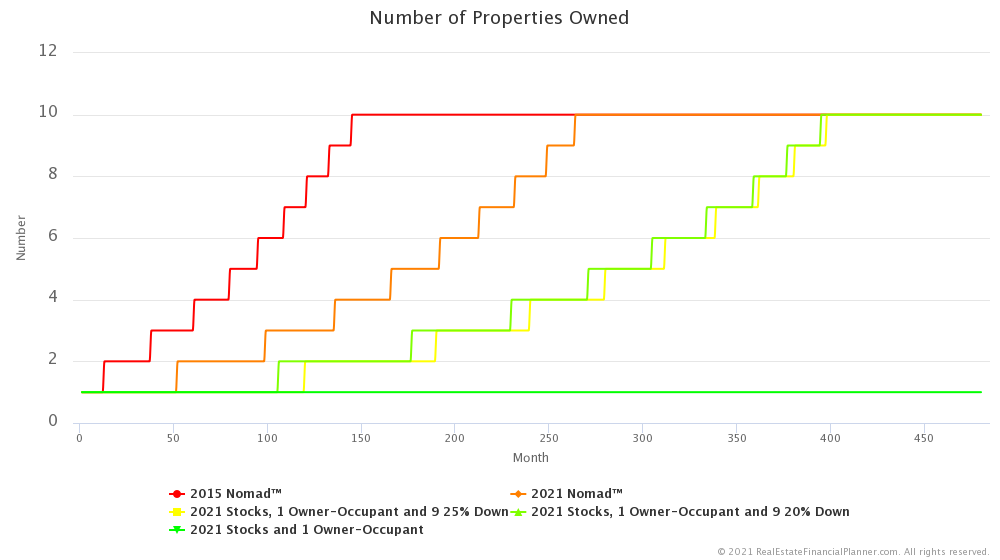

Comparing Number of Properties Owned

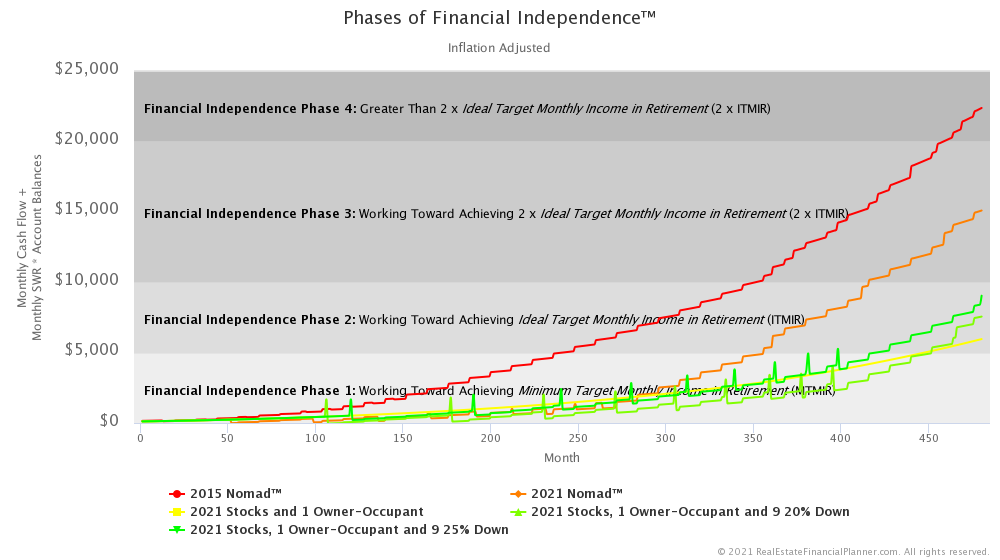

Comparing Phases of Financial Independence™

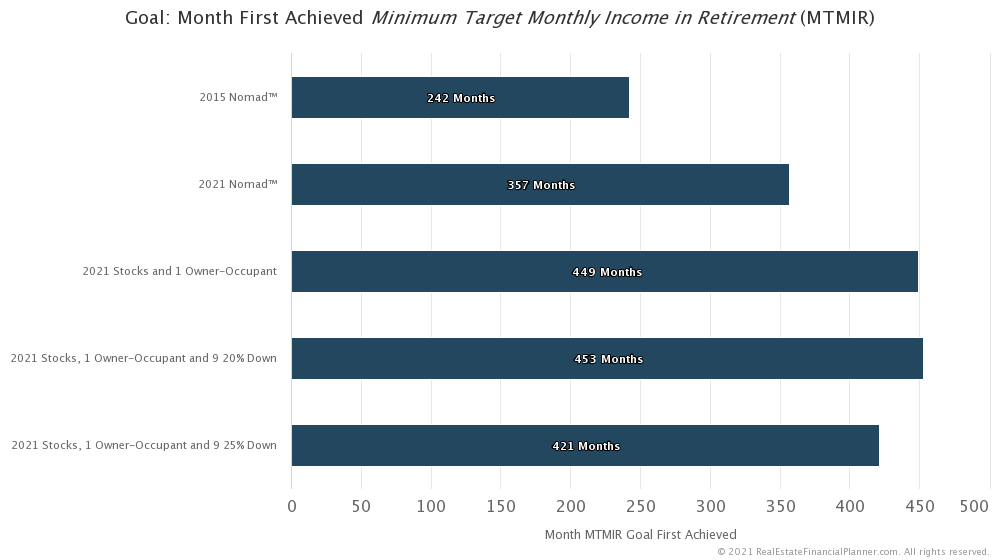

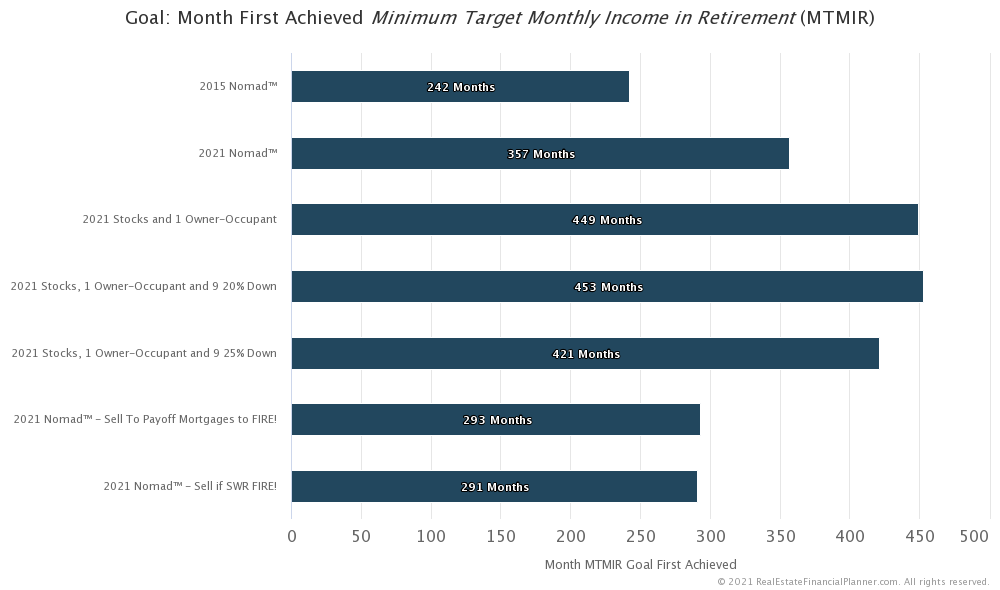

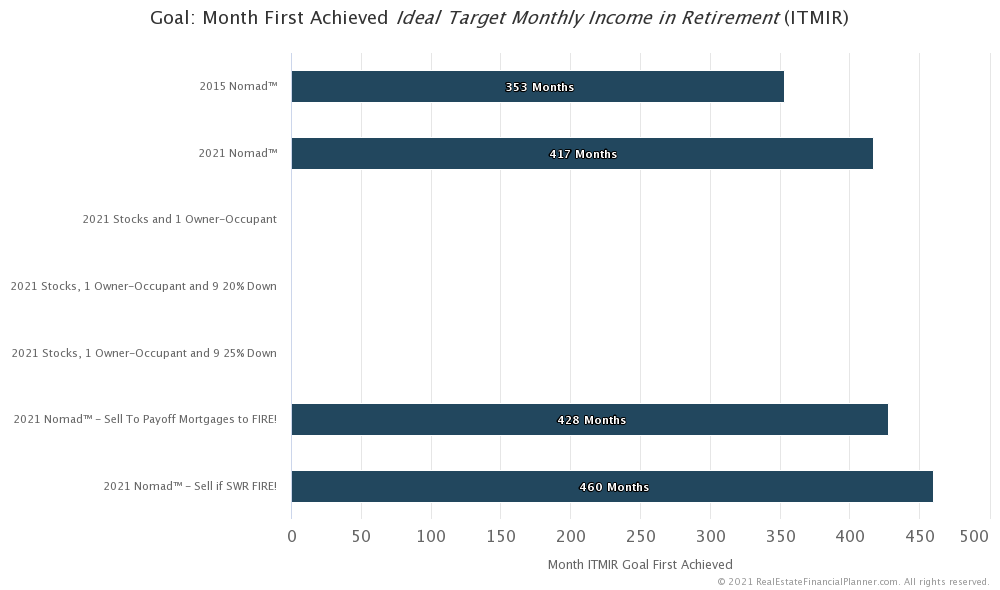

Comparing Goal of Achieving FI

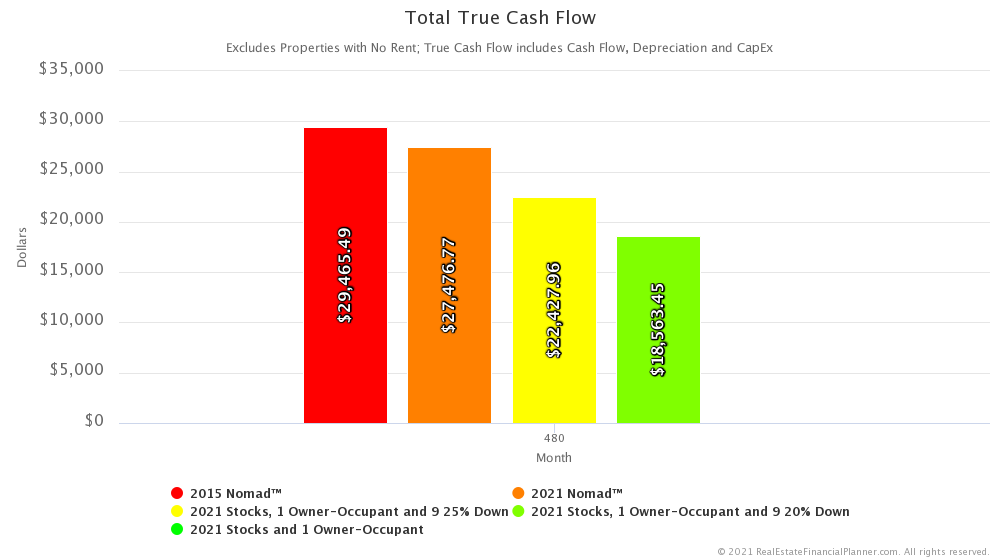

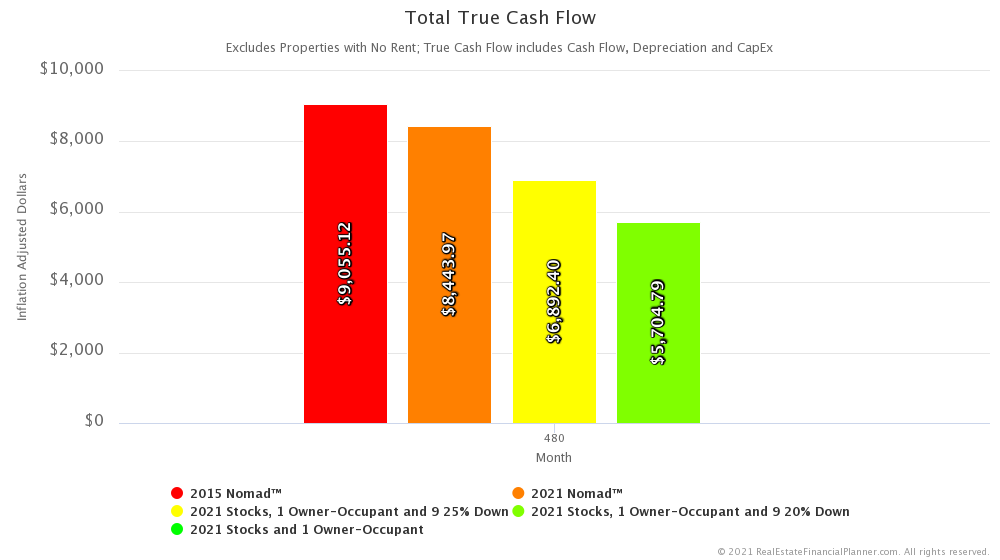

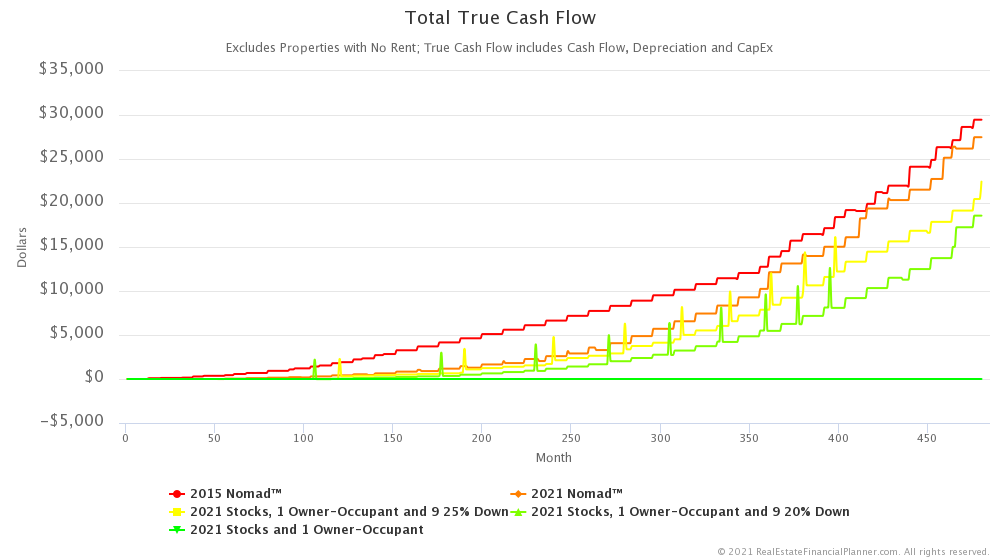

Comparing Total True Cash Flow™

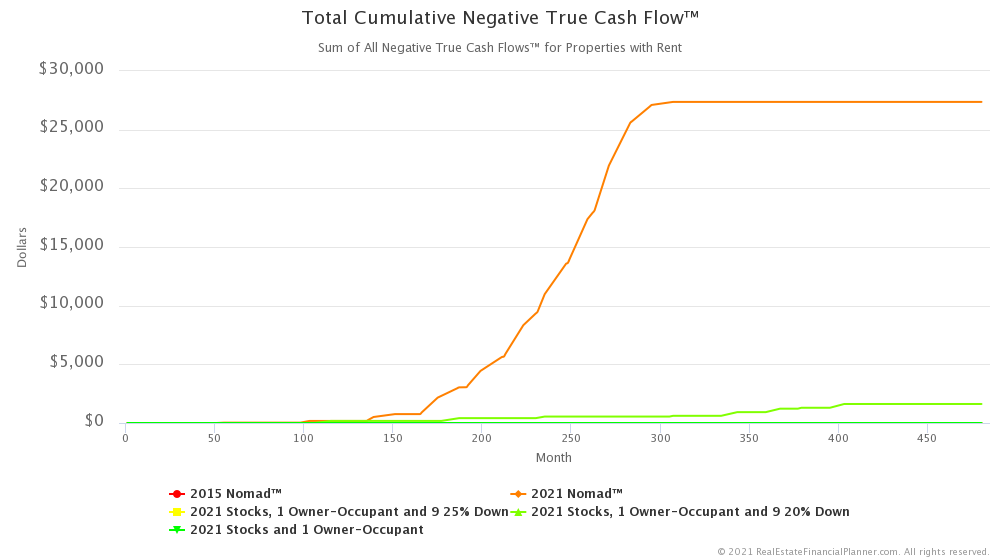

Comparing Total Cumulative Negative True Cash Flow™

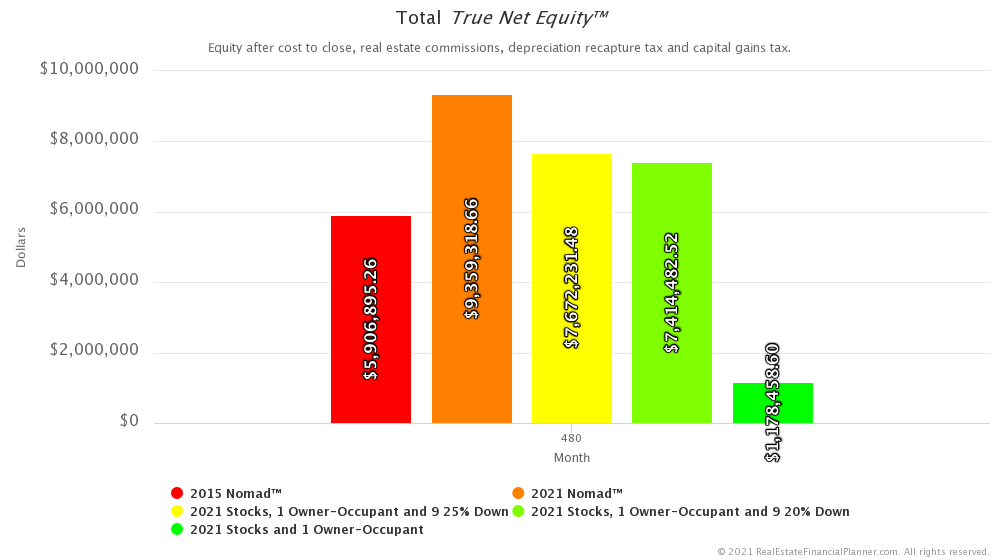

Comparing Total Equity and Total True Net Equity™

True Net Equity™ includes the expenses of accessing equity.

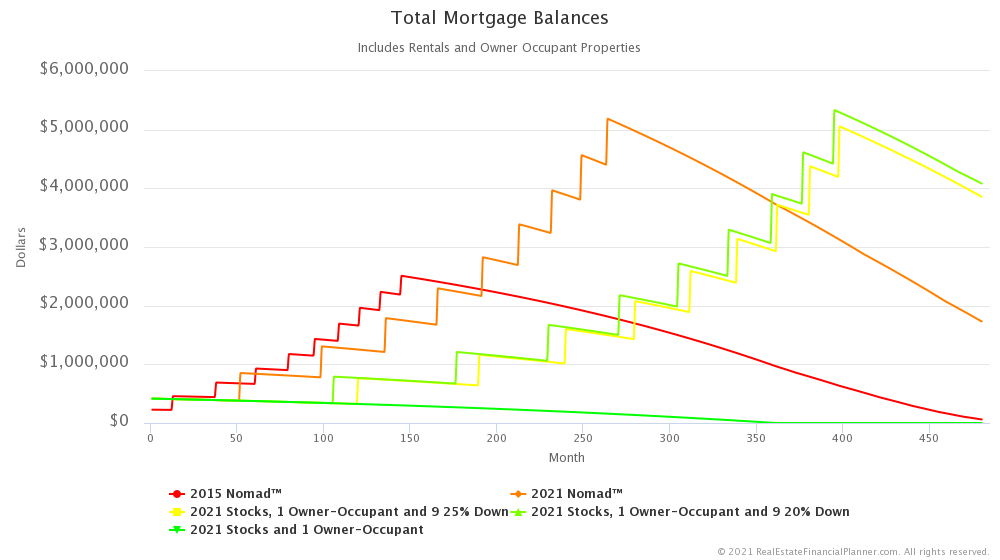

Total Mortgage Balances

Speeding It Up

This is just a sample and not intended to be a full class on how to speed up achieving FI.

Added selling some properties to pay off remaining rental property mortgages and selling properties to invest in stocks to achieve FI using Safe Withdrawal Rate.

Lower Price Nomad™

- There were 9 condos listed/sold in Fort Collins in Heatheridge in 2021 – fewer opportunities, but still possible

- 1 Bedrooms sold between $163K – $180K

- 2 Bedrooms sold between $210K – $225K

- Still negative cash flow, but still decent overall ROI

Why Nomad™?

- Lower amount needed to get started that many other real estate investing strategies

- Can do it with 0% down, but most do it with 5% down payment

- As opposed to 15%, 20%, 25% for most other traditional real estate investment strategies

- Do it once… catch your breath, evaluate, and decide if you want to do it again the next year

- Better interest rates than non-owner-occupant

- No due on sale/due on transfer clause issues (like with creative real estate investing)

- Typically acquire assets faster if you’re saving up down payments

- There are exceptions to this if you have an exceptionally high savings rate or a large asset base to start

- It will be harder/take longer to save up 15%, 20%, 25% down payments if prices rise rapidly

The Alternative

What are my alternatives to Nomading™? Are those better?

Learned Helplessness

Thinking in Probabilities

Outcomes are usually not deterministic … they’re probabilistic. But we don’t think that way. The popular definition of insanity—doing the same thing over and over and expecting a different result—that’s only true in a highly deterministic situation. If you have a probabilistic situation, which most situations are, then if you do the same thing twice, it can be quite reasonable to expect a different result.

– Elon Musk

Expected Value

- Sum of all possible values multiplied by the probability of its occurrence

- +EV does NOT guarantee success

- You can have a +EV and still lose money

- You can have a –EV and make money

- You can drive to work and get in an accident; you could die

- Most times you go to work, you arrive safely and earn wages for that day

- Regardless of your real estate investing strategy… consider what the chances are for a variety of outcomes and what the results would be for those outcomes

- Assumptions matter, but historical data suggests property values and rents… over any reasonable period go up (inflation and other factors)

- Can property values go down? Absolutely!

- When I do this math with the Real Estate Financial Planner™, the average of the Monte Carlo (EV calculation) runs tends to be overwhelmingly positive

- What’s your alternative for achieving the goal if you don’t do this?

How Do You Feel?

- Nothing I do matters… so why bother?

- I tried that already… it didn’t work

- Rising interest rates are killing all the deals

- Home prices are too high to make my plan work

- Rents aren’t high enough to make numbers work

- Sure it worked for him/her when they got started… there were deals then but there aren’t any now

- The market is moving too fast for me to make this work

- Prices or rents are going to fall

- I can’t save down payments fast enough

- I can’t find any deals