Long, long ago… we considered Cash Flow = Rent – Mortgage Payment. We all agree this was overly simplistic and WRONG.

Eventually, we began to account for all the income on the property (not just rent) and all the expenses on the property including principal, interest, taxes, insurance (collectively PITI), private mortgage insurance (PMI), landlord-paid utilities, maintenance, capital expenses and property management.

And this was better, but still WRONG.

Deal analysis evolved to discussions beyond Cash Flow to include Appreciation, Debt Paydown and the tax benefits of Depreciation.

And, I introduced you to my series of return quadrants:

It had three “flavors”:

That too was better, but even that fell short and was WRONG.

Deal Analysis Evolved

Introducing the latest step in the evolution of real estate deal analysis… RIDQ+R™, ROIQ+R™ and ROEQ+R™ and their derivatives.

Watch James and Brian in the 2 hour keynote to learn more:

The Problem

Imagine you have two investors, each with $100,000 to invest (no more, no less).

James likes to invest in stocks. Brian likes to invest in privately held real estate.

How much of the $100,000 can James invest buying (non-margined) stocks? This is not a trick question: it is $100,000.

How much of the $100,000 can Brian invest buying single family homes, duplexes, triplexes, fourplexes, apartment buildings or any other real estate investment? This is (sort of) a trick question.

Brian must hold back some of the $100,000 in reserves. If he’s getting a loan, the lender will require reserves and it would be stupid for him to buy rental property without reserves.

The problem occurs when… we calculate the return on investment (ROI) for each investment.

With the stock market investment, we’d tend to divide the return by the full $100,000 we had invested.

However, traditionally, for the real estate, we’d divide the return by the down payment and closing costs and ignored the fact that we needed the extra reserves to be able to buy the property. This is WRONG.

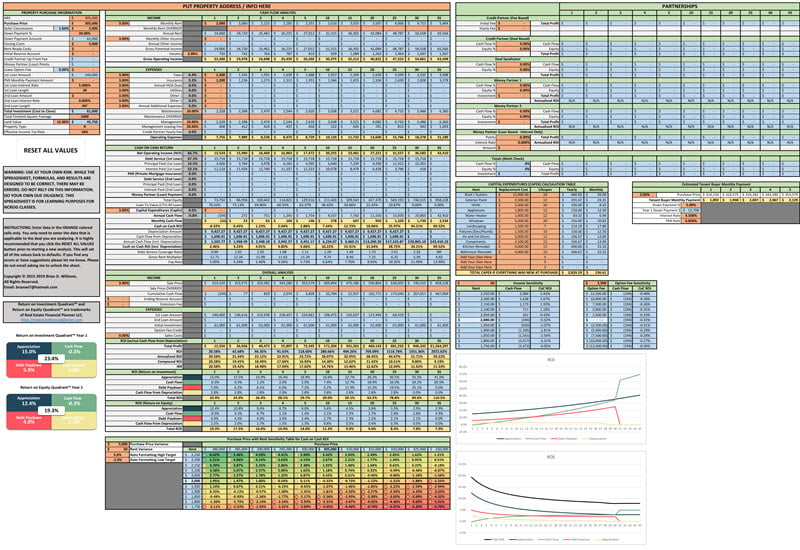

The World’s Greatest Real Estate Deal Analysis Spreadsheet™

It turns out that Brian (who created The World’s Greatest Real Estate Deal Analysis Spreadsheet™) has already provided us with the solution to this issue of reserves in his spreadsheet: the Initial Reserve Account field.

Use this field to correctly model the required reserves and… WHAMO! Then, it is mostly CORRECT!

Download the deal analysis spreadsheet to start doing your deal analysis correctly.

But, as you may have noticed, we only taught deal analysis to use this field in the real estate partnerships classes. We discuss why we think this is in the keynote video above.

Reserves

This is not intended to be an entire class on reserves (it is about the new ROIQ+R™), but we do need to touch on reserves to explain ROIQ+R™.

We recommend 6 months of reserves per rental property.

Reserves defined:

- Operating Expenses

- Taxes

- Insurance

- HOA

- Landlord Utilities

- Maintenance

- Property Management

- Credit Partner Yearly Fee (to match spreadsheet)

- Mortgage Payments

- Principal

- Interest

- Private Mortgage Insurance (PMI)

NOTE: Mortgage Payments and PMI would not exist if you owned the property free and clear. Property management could be zero if you are self-managing.

The 6 months of reserved should be liquid, easily accessible and kept in something with low/no risk. Examples might be checking account, savings account or, to a much lesser degree, money market accounts.

IMPORTANT NOTE: We strongly discourage using lines of credit as reserves. See the Lines of Credit Magic class for more information.

Introducing RIDQ+R™

Friend… meet RIDQ+R™. RIDQ+R™ meet our real estate investor friend.

RIDQ+R™ has several variations: RIDQ+R6™, RIDQ+R12™ and RIDQ+R™/RIDQ+RA™ (when we’re talking about “actual”).

When you have 6 months of reserves invested in savings, we call this the RIDQ+R6™:

- RIDQ = Return in Dollars Quadrant™

- +R = + Reserves

- 6 = 6 Months of Reserves in Savings earning 1% per year (by definition)

When you have 12 months of reserves invested in an investment like the stock market, we call this the RIDQ+R12™:

- RIDQ = Return in Dollars Quadrant™

- +R = + Reserves

- 12 = 12 Months of Reserves in the Stock Market (or equivalent) earning 8% per year (by definition)

NOTE: We assume that you’re earning 1% per year on the 6 months reserves in a savings account or equivalent and 8% per year on the 12 months of reserves in the stock market (or equivalent). These are estimates and defined using these numbers how we define the RIDQ+R6™ and RIDQ+R12™ (BY DEFINITION) so they are standardized for everyone. If you’re using the RIDQ+R™ with your actual numbers, that would be RIDQ+R™ or, even more correct, RIDQ+RA™ (where the A is for actual).

Introducing ROIQ+R™ and ROEQ+R™

RIDQ+R6™ shows the raw dollar amount of return from each of the 5 areas and a total. ROIQ+R6™ shows you the return on investment. That’s the raw dollar amount of return divided by the sum of the Total Cash To Close + 6 Months Reserves.

ROIQ+R12™ is the same except with 12 months of reserves.

ROEQ+R6™ shows the raw dollar amount of return divided by the sum of your Total Equity + 6 Months of Reserves.

As you may have guessed, ROEQ+R12™ is the same except with 12 months of reserves.