Pro Tip: Listen to the podcast below and while you’re listening follow along with the charts below. Then, when you’re done, copy the  Scenario

Scenario

Welcome to the Real Estate Financial Planner™ Podcast. I am your host, James Orr. This is Episode 6.

Today we’re going to meet  Norm

Norm Norma

Norma

Norm

Norm Norma

Norma

They graduated with bachelor’s degrees and do entry-level work in the technology department for a large healthcare company.

They’re each 21-years old.

They recently married and are both obsessed with the idea of achieving financial independence as quickly as possible so they can retire early.

They do not have any kids and… as of right now… they don’t have any serious plans of having kids.

Income

They earn $36,000 each… for a combined income of $72,000 between both of them.

For them that means they’re working about 2,000 hours per year at about $18 per hour.

For other listeners that are not earning $18 per hour… for you this could mean working slightly more than 2,000 hours per year at a slightly lower dollar per hour. For example, you could work a full-time job plus a part-time side hustle for an extra 10 hours per week for 50 weeks a year… working a total of 2,500 hours per year between both jobs at a rate of $14.40 per hour.

Savings

They’re lucky in that they do not have any other debt and have saved up $10,000 total.

As recent college graduates who have not experienced significant lifestyle creep, they’re able to live comfortably enough on the $72,000 of income that they’re able to save about $1,000 per month. That’s about $12,000 per year. That’s almost 17% of their income.

Obsessed with Achieving Financial Independence

Norm

Norm Norma

Norma

They’re not afraid of hard work.

They’re OK with keeping their expenses relatively low… living off of $5,000 per month… if it means being able to be financially free and not having to work or being able to work on things that they’re passionate about.

They want to find the best path to financial independence together. They’re open minded to considering a lot of different options to achieve their goal.

Over the next several episodes they’re going to explore a variety of strategies to see which one gets to financial independence fastest, for a reasonable amount of effort and minimizing risk.

In this episode, they’ll be considering a traditional strategy of investing the $1,000 per month they’re saving and investing it in stock market index funds.

In other episodes, they’ll consider other strategies like:

- Buy and hold rental property

- Short-term rentals

- Using the Nomad™ real estate investing strategy

- House hacking or getting a side hustle

- Utilizing the Buy Rehab Rent Refinance and Repeat… also known as the BRRRR strategy

- Flipping properties

- Creative real estate entrepreneurship

- Wholesaling properties

- Investing in Real Estate Investment Trusts

Plus, they’ll evaluate whether it makes sense for them to keep renting for $1,800 per month… and having that go up with inflation or to buy a property that will significantly increase their housing costs… but fix the principal and interest part of their payment to reduce the impact of inflation. Buying a property to live in will increase their standard of living but it will reduce the amount they’re saving each month from $1,000 per month to just over $400 per month. But, it will also reduce how much they’ll need to be financial independent when they pay the house off.

They’ll also consider add-on strategies like:

- Paying off properties early

- Selling off some properties to pay off the remaining ones

- Selling off all their properties to convert their equity into money invested in things like stocks and bonds

- Selling properties after holding it for a period of time to re-leverage up and keep their return on equity high

Ultimately,  Norm

Norm Norma

Norma

Their biggest fear is not having enough money to retire and… especially since they plan to retire early… they also fear running out of money in retirement.

Different From Andrea

Unlike Andrea in previous episodes, they’re not starting with a large lump sum of money. They’re starting with just $10,000 compared to Andrea’s $100,000.

Unlike Andrea who wanted to spend all her income on raising her two young boys,  Norm

Norm Norma

Norma

Unlike Andrea who was in a market where property values were going up at 2% per year and inflation was 3%…  Norm

Norm Norma

Norma

Unlike Andrea who focused in primarily on the Nomad™ real estate investing strategy… where she bought a property with 5% down payment as an owner-occupant, moved in and lived there for a year before converting the property to a rental after a year…  Norm

Norm Norma

Norma

Financial Independence

For this episode though, let’s start by looking how quickly  Norm

Norm Norma

Norma

They are earning $6,000 per month but living on $5,000 per month… so we’ve defined financial independence as when their investments can provide $5,000 per month… adjusted for inflation.

If you remember from previous episodes, the sources of income for financial independence come from three areas:

- Passive Income from things like social security, pensions and/or annuities.

- Net Cash Flow on rental properties after all expenses, and

- Their safe withdrawal rate times the amount they have invested in stocks, bonds, etc.

For  Norm

Norm Norma

Norma

They don’t have a pension and they do not own any annuities.

In this episode, we assume they do not have any rental properties either… so no need to worry about cash flow from rentals.

They are investing money in stocks so they’ll primarily be relying on that to generate the income to determine if they’re financially independent or not.

And, they’ve decided to use a 4% safe withdrawal rate.

So, when they eventually save and invest to the point where they have $1 million dollars in stocks and bonds… stocks for them in this model… they’ll be able to withdraw about $40,000 per year from their investments and have a low probability… from the Trinity study… of running out of money.

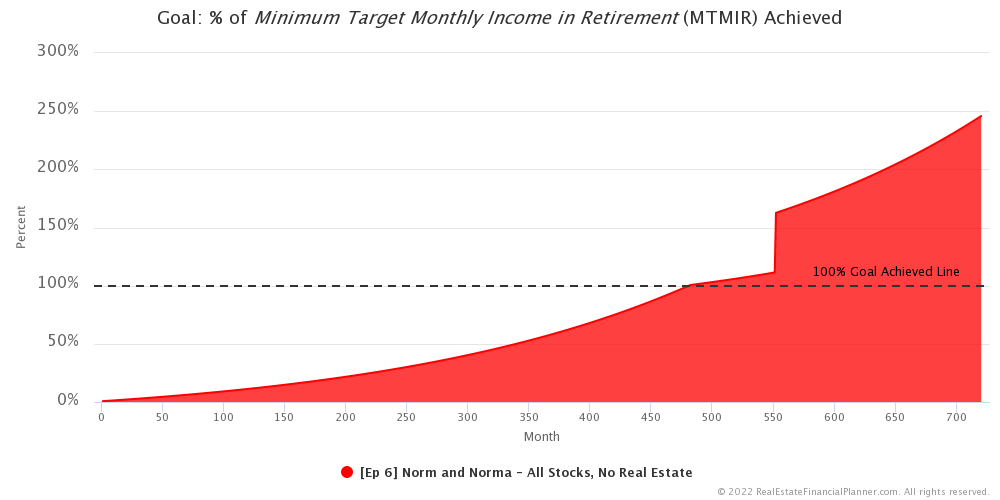

That begs the question: when do they get to the point where the total amount they invested in stocks times a 4% safe withdrawal rate gives them $60,000 per year?

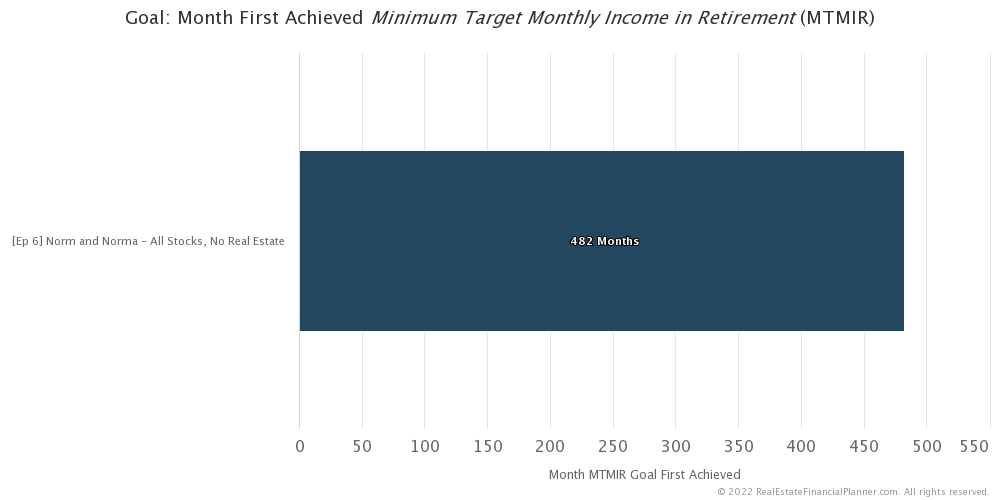

It turns out that is in month 482… or a little more than 40 years from now. At that point, they’ll be 61 years old.

When social security does kick in… at age 67… they’ll have a much higher standard of living.

Could they stop working before age 61 knowing that when social security kicks in it will provide enough for them to be considered financially independent? Sure.

But, it would more conversative… especially with a longer retirement period they need to provide income during… for them to wait until their stock investments at a reasonable safe withdrawal rate can provide them enough to qualify as financially independent.

Over the entire 60-year modeling period, they never quite get to the point where a 4% safe withdrawal rate would support a $10,000 a month lifestyle. They do get close though… and they could probably increase the amount they’re withdrawing so they are living at a higher than $5,000 per month… adjusted up for inflation… lifestyle.

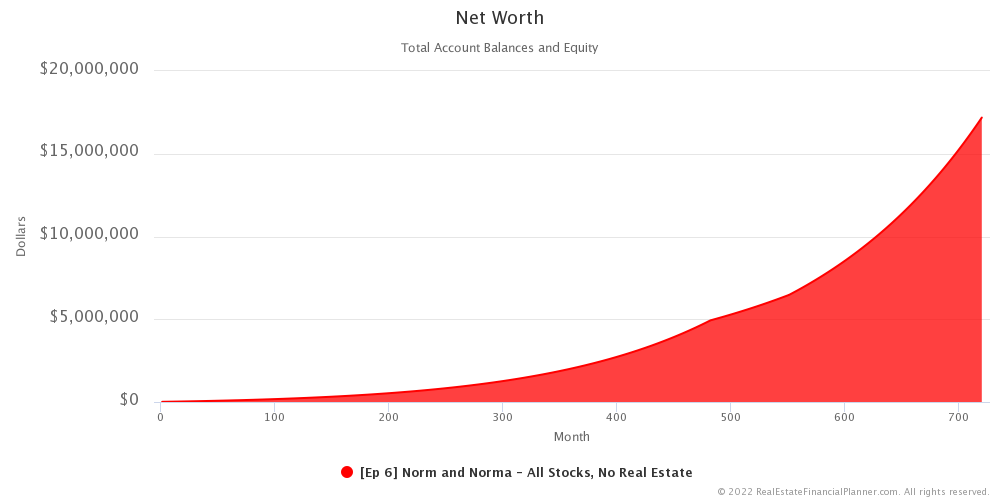

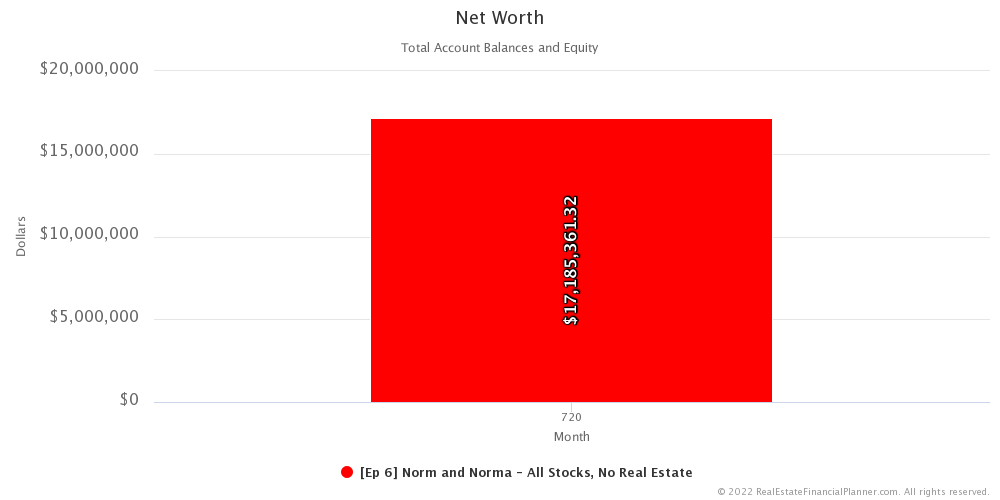

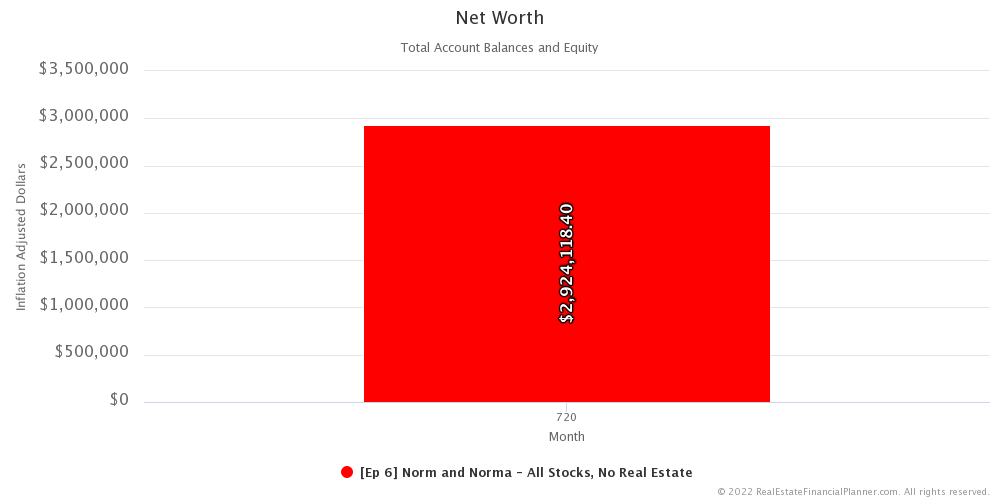

Net Worth

If they continue to spend just the $5,000 per month… adjusted up for inflation over time… they eventually end up with a net worth of over $17 million dollars sixty years from now… by about age 81.

If we adjust back to today’s dollars… that’s like having just under $3 million dollars in today’s dollars in net worth.

Next Episode

What impact does buying a house to live in while still investing in stocks have on  Norm

Norm Norma

Norma

Also, be sure to check out the Advanced Real Estate Financial Planner™ Podcast to see how having a variable inflation rate and, probably more importantly… a variable stock market rates of return impacts  Norm

Norm Norma

Norma

I hope you have enjoyed this episode about  Norm

Norm Norma

Norma

Get unprecedented insight into  Norm

Norm Norma’s

Norma’s Scenario with dozens of detailed, interactive charts.

Scenario with dozens of detailed, interactive charts.

Inside the Numbers

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 06 Norm and Norma - All Stocks, No Real Estate with 2

Ep 06 Norm and Norma - All Stocks, No Real Estate with 2  Accounts, 0

Accounts, 0  Properties, and 5

Properties, and 5  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Podcast Episodes

The following are the podcast episodes for variations of  Norm

Norm Norma’s

Norma’s

More posts: Norm Episode