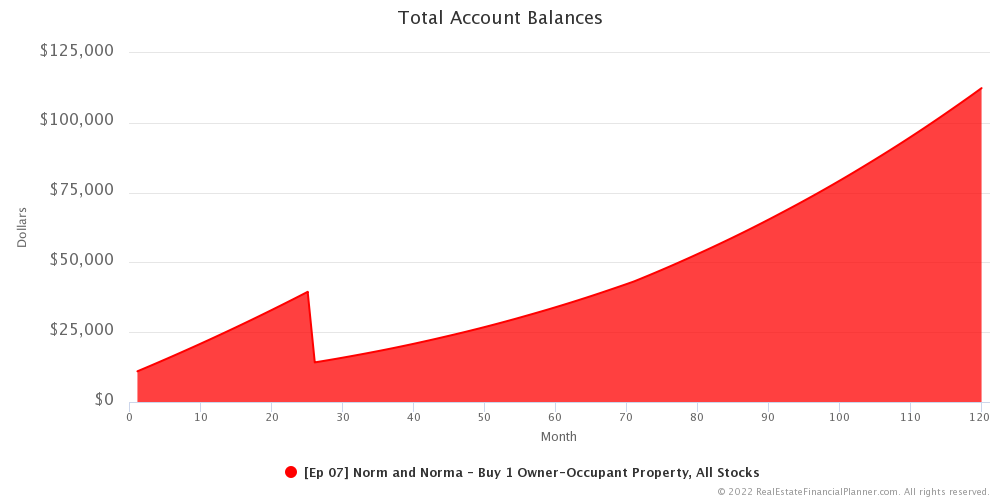

Pro Tip: Listen to the podcast below and while you’re listening follow along with the charts below. Then, when you’re done, copy the  Scenario

Scenario

Welcome to the Real Estate Financial Planner™ Podcast. I am your host, James Orr. This is Episode 7.

Today we’re going to continue with  Norm

Norm Norma

Norma

If you remember from the previous episode, Episode 6,  Norm

Norm Norma

Norma

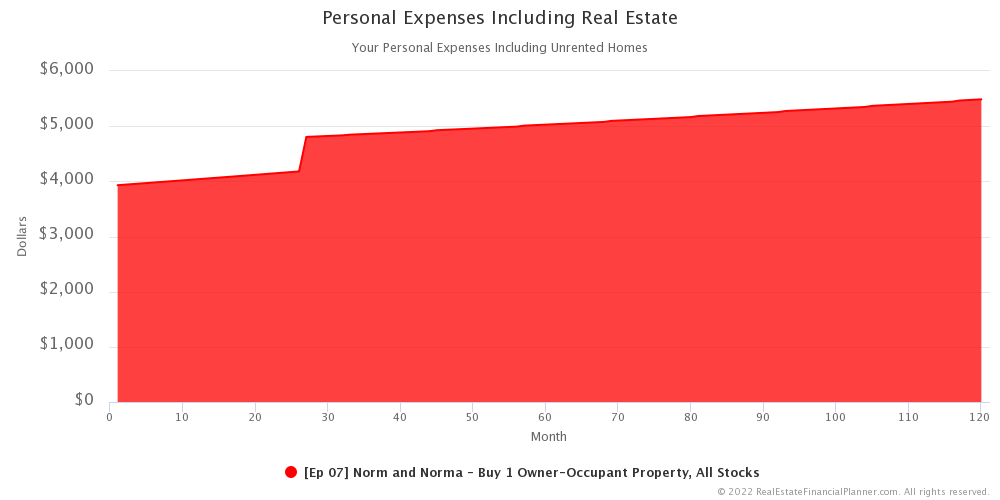

They’ve managed to save up $10,000 between the both of them.

They earn about $72,000 per year… $36,000 each.

Because they have not had significant lifestyle creep from living as college students, they’re able to save $1,000 per month of the $6,000 per month they have in combined income.

They’re both obsessed with achieving financial independence and to be able to retire early.

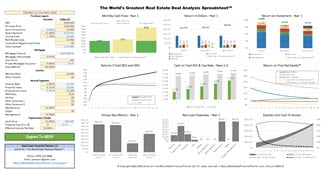

They took some time to go through The Ultimate Financial Independence Retire Early Budget™ together and determine their current budget and savings rate and, in some ways to them… more importantly… their budget for being financial independent. In fact, they determined their minimum budget for being financially independent and their ideal budget if they were living their ideal lifestyle.

By going through the The Ultimate Financial Independence Retire Early Budget™,  Norm

Norm Norma

Norma

They’ve determined that to live their ideal lifestyle, they’d ideally want to be earning $10,000 per month.

In the previous episode, we had  Norm

Norm Norma

Norma

In this episode,  Norm

Norm Norma

Norma

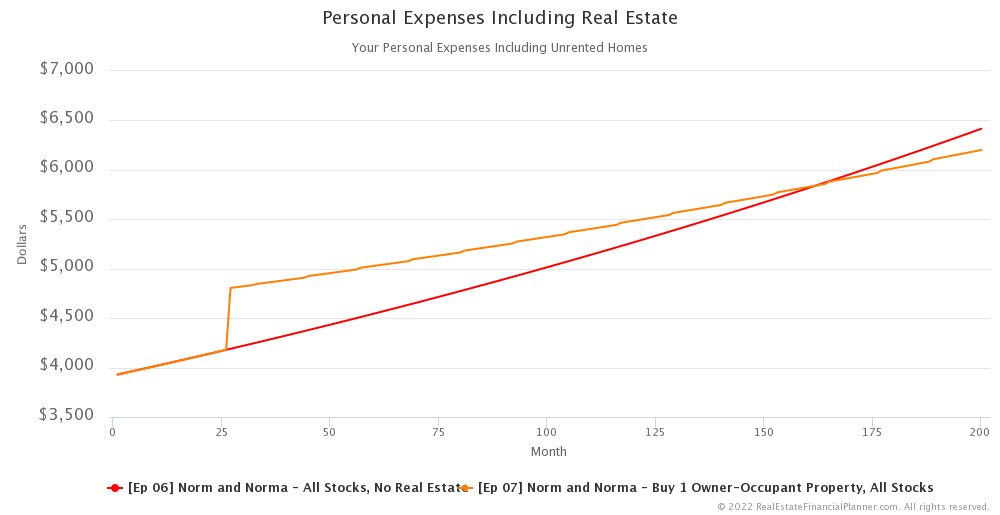

In their real estate market, by renting they are able… at least in the beginning… to save more money… because buying a home with a 5% down payment would result in them paying more than the $1,800 per month they’re currently paying in rent.

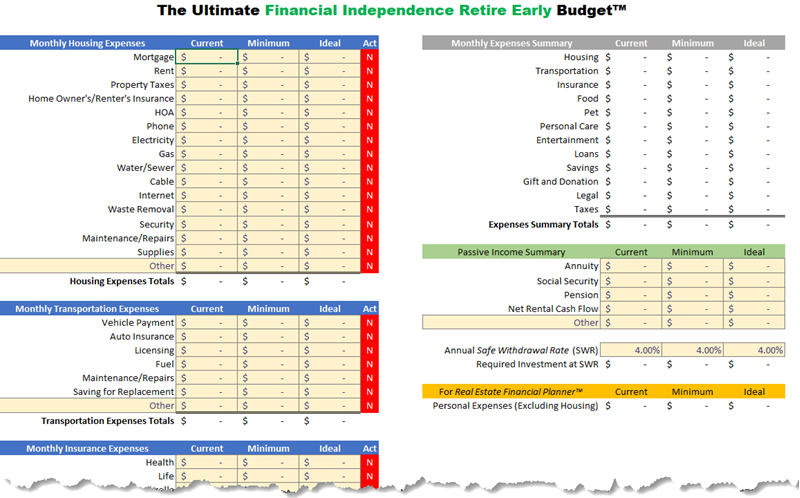

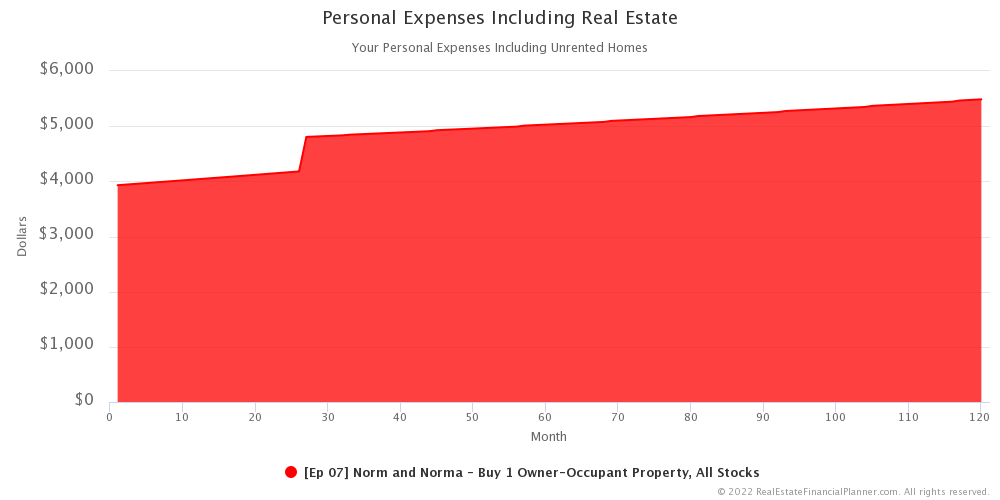

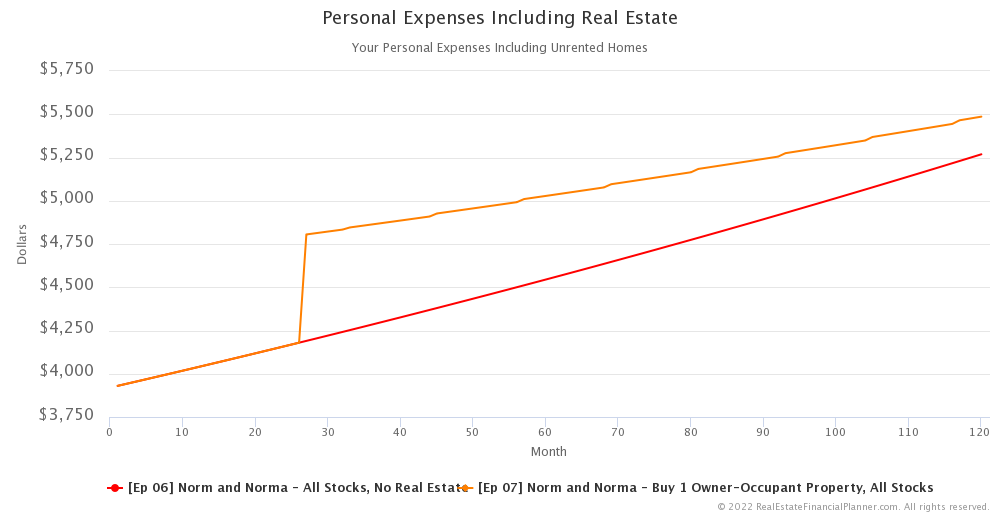

If they buy a property, it will increase their personal expenses. They go from paying about $1,800 per month in rent… adjusted up for inflation… to paying about $2,150 per month as a mortgage payment plus they will need to pay additional expenses for property taxes, insurance and some maintenance on the property.

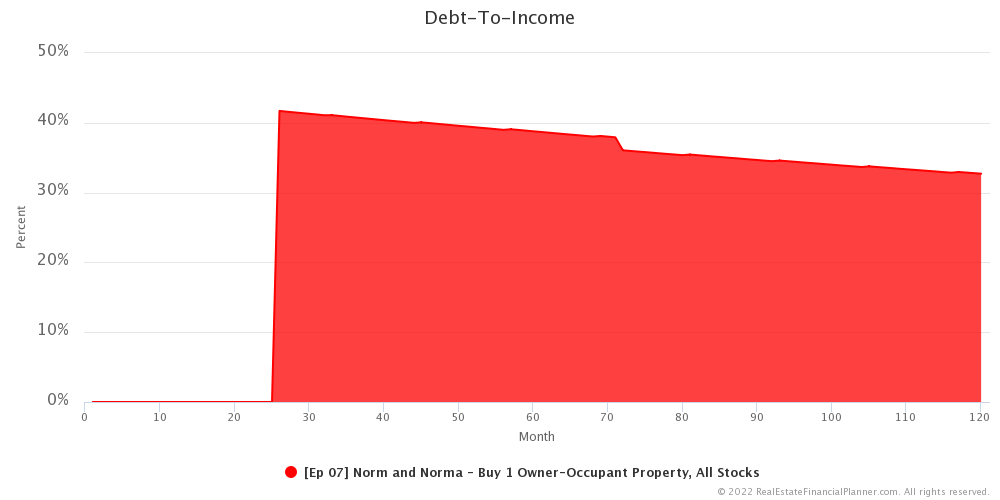

It takes them about 26 months to be able to qualify to buy an owner-occupant property.

By then, they have enough for a 5% down payment plus about 1% in closing costs… and… just as important… about 6 months of reserves for this property.

And, at that point they’ll have enough income to qualify from a debt-to-income perspective to stay well below the 45% required Debt-To-Income level as well.

But, by purchasing an owner-occupant property to live in, they go from spending about $4,180 per month in personal expenses to about $4,805 per month when they buy a property in month 26.

If we think of it in terms of today’s dollars… by adjusting back for inflation… it is like they go from having personal expenses of $3,930 per month to having personal expenses of $4,507 per month.

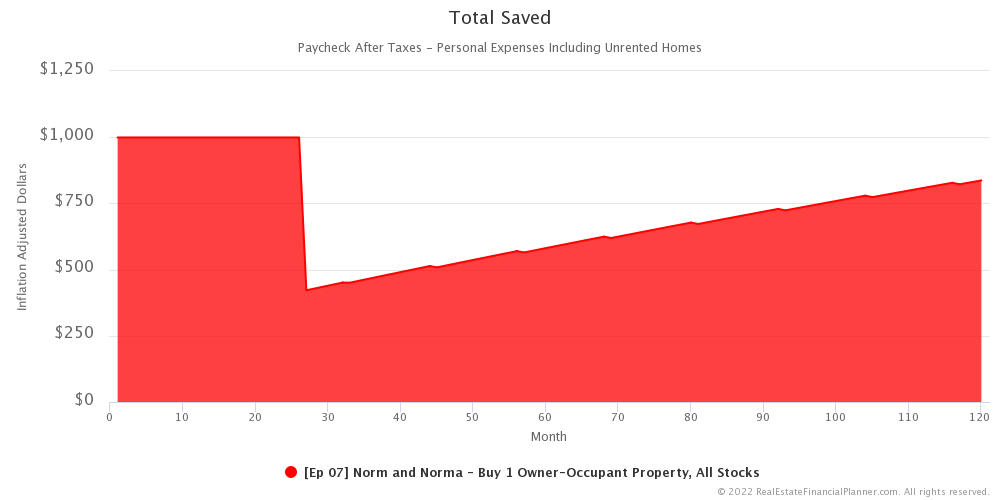

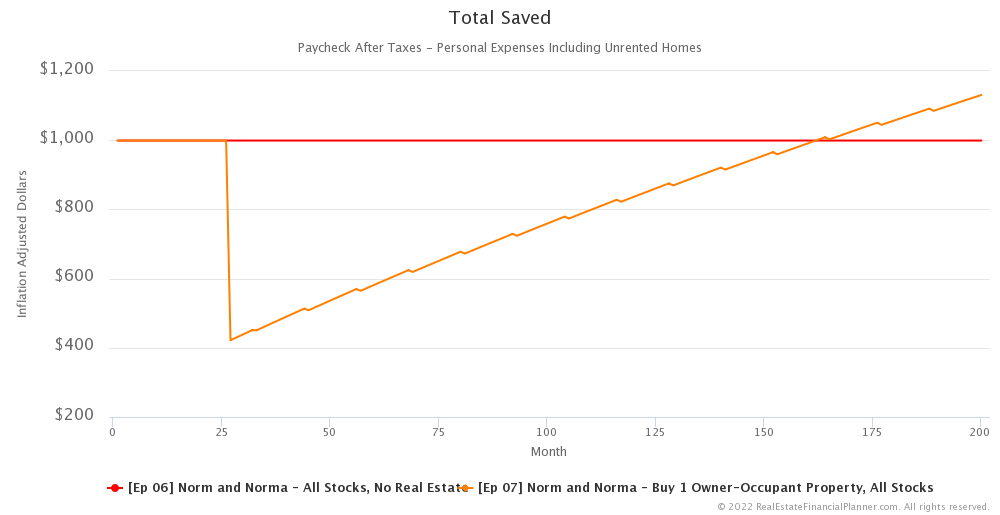

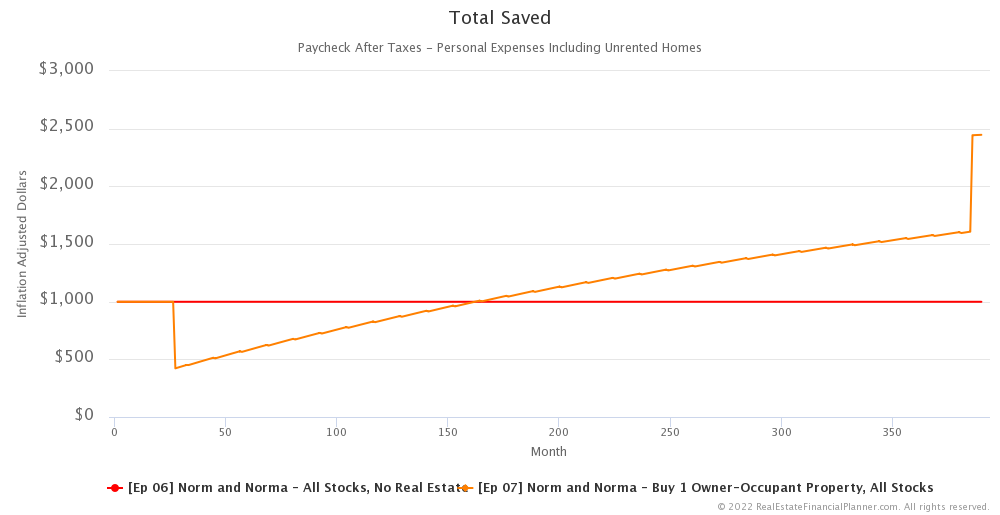

They go from saving about $1,000 per month to saving about $420 per month in today’s dollars.

A primary engine of them achieving financial independence seems to be them saving money and investing in the stock market. So, at first blush, you might think that this will slow them down on their journey toward achieving financial independence.

They’ve reduced how much they’re putting away toward retirement by more than half. It was about $1,000 per month and now it is about $420 per month… That’s $580 per month less that they’re saving for retirement. That’s got to hurt, right?

Well, not so fast.

There are two things I want to discuss with you.

First, you’re right that as soon as they purchase the property their personal expenses go up considerably over what they were paying by renting.

But, when they were renting the entirety of their personal expenses were increasing with inflation at a rate of 3% per year. Food was going up 3% per year, insurance was going up 3% per year, utilities were going up 3% per year… and the rent they were paying was going up 3% per year.

However, when they buy a property, something changes.

Sure, their food and insurance and utilities and other living expenses all still go up 3% per year, but now… the principal and interest part of their living expenses becomes fixed for 30-years. Their mortgage payment is no longer impacted by inflation.

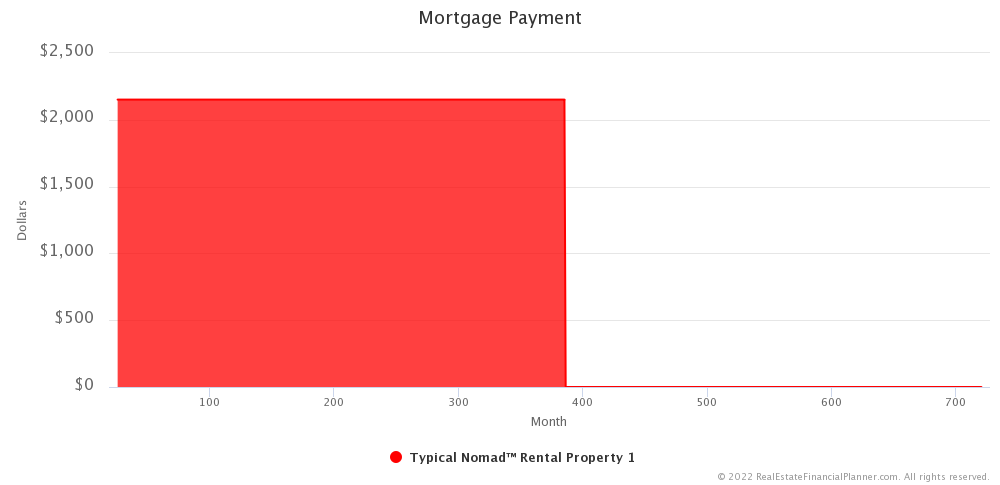

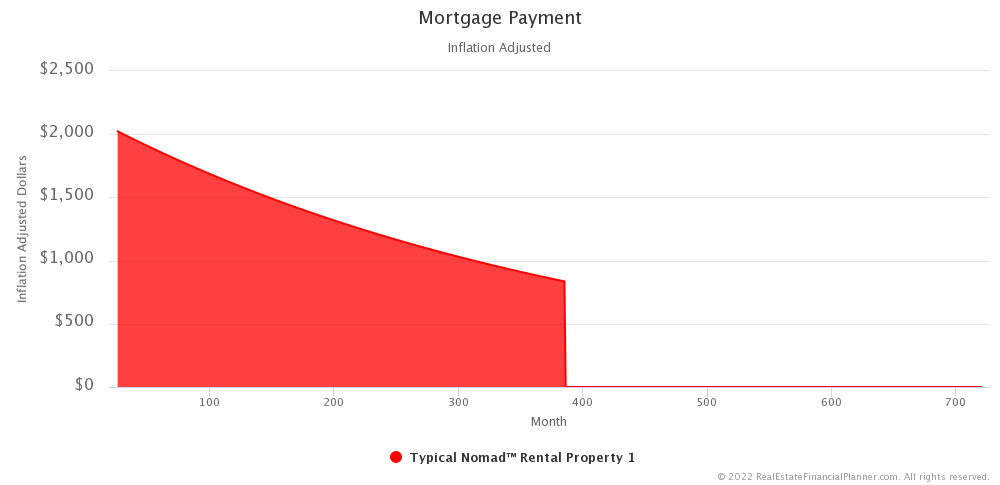

When they buy their home to live in and get their mortgage in month 26, their mortgage payment is $2,151 per month. And, until they pay it off 360 months later… it is still $2,151.

What’s interesting about that is that $1 in month 26 is worth a very different amount 360 months later… it is worth a lot less… from inflation.

In fact, if we adjust the mortgage payment for inflation, the payment amount appears to get cheaper over time. By the time they make their last payment, the last payment feels more like $837 in future inflated dollars instead of the $2,151 that it feels like when they first got the mortgage.

Now, before we get too far… I do want to point out that the property taxes and property insurance and property maintenance expenses they have by purchasing a property all are still going up with inflation over time. But, compared to the mortgage payment, those are relatively small in size.

Back to the impact of that fixed mortgage payment though on their personal expenses.

I’ve already conceded that… in the short-term… they voluntarily increase their expenses by buying an owner-occupant property.

However, over time, their personal expenses in the previous episode as a renter increase faster than the personal expenses they have in this episode as a homeowner with a fixed mortgage payment.

Eventually, in this particular case it is around month 162… about owning the property for about 11 years and change… at that point, the expenses for being a renter cross over and become more than being a homeowner.

At that point, in today’s dollars, they start saving more than $1,000 per month… and it actually continues to increase each month.

So, while in the short-term it hurts their savings rate to buy an owner-occupant property, in the long-term, it actually helps them be able to save more.

But, do you remember when I mentioned that there were TWO things that I wanted to discuss with you.

Well, the first one was this idea that the mortgage payment is fixed and benefits them over time allowing them to save more as time passes, but there’s something else.

What happens 30 years after they get that mortgage?

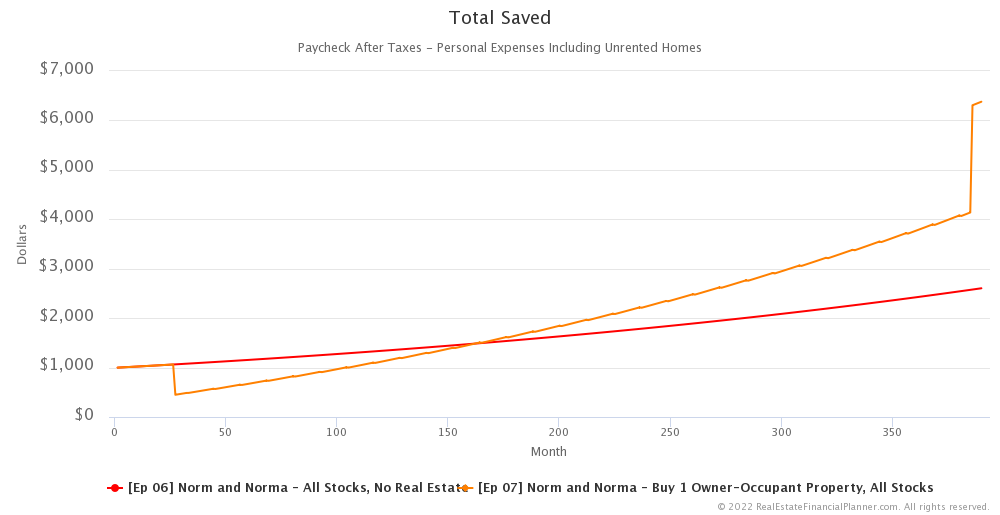

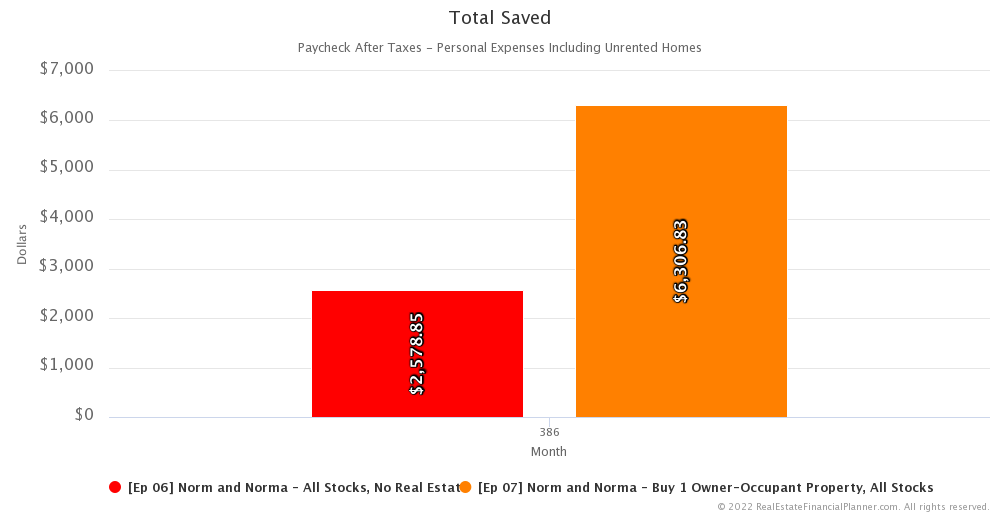

That’s right, it gets paid off and the $2,151 they once had a mortgage payment goes to zero. At that point, they still have property taxes, property insurance and property maintenance but $2,151 of their expenses goes away.

At that point, instead of saving about $1,000 per month as a renter, they’re saving the equivalent of about $2,445 per month as a homeowner.

In inflated future dollars, they’d be saving about $2,578 as a renter compared to about $6,306 as a homeowner.

And, as if that wasn’t enough… there’s another subtle but extremely important additional benefit hidden inside the definition of what makes  Norm

Norm Norma

Norma

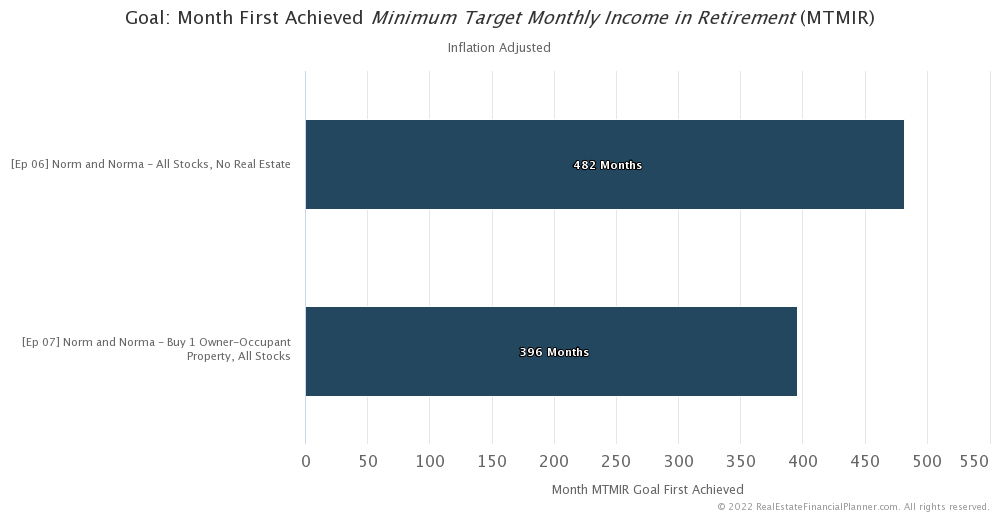

Do you remember what makes them financially independent? It is when they have that $5,000 per month to replace the minimal amount they needed to support themselves in retirement. That $5,000 per month number assumed they had a rent payment or a mortgage payment. But, they no longer have a mortgage payment at that point.

So, they really don’t need their investments to provide $5,000 per month anymore… it really is the $5,000 per month minus the mortgage payment. By paying off their home, they lower the bar required for being considered financially independent.

If they went back to The Ultimate Financial Independence Retire Early Budget™ and created a new budget, they’ll see that they no longer have a mortgage payment and that reduces their expenses by the payment amount that their mortgage was.

What does that mean for  Norm

Norm Norma

Norma

Financial Independence

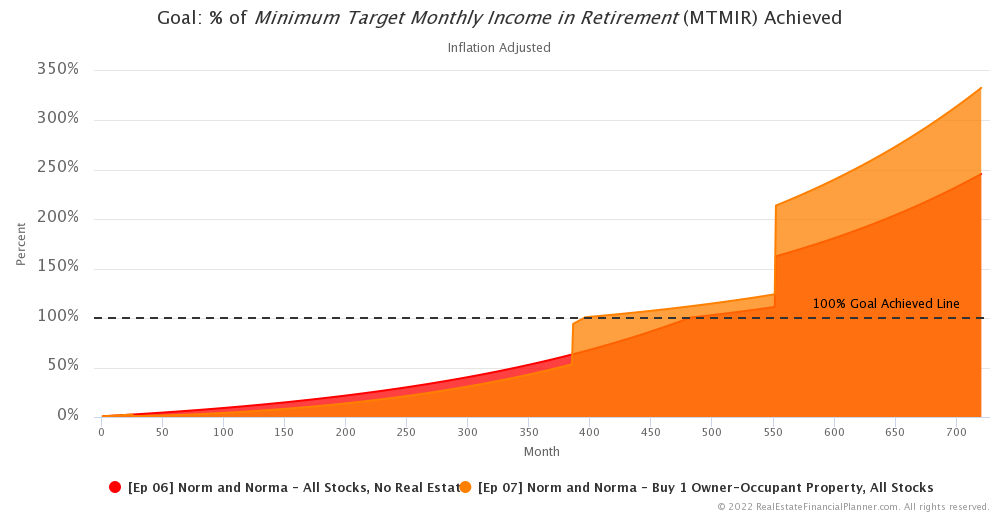

So, when do they achieve financial independence? And, is it before they pay off their mortgage or after?

It turns out they achieve financial independence a few months after they pay off their owner-occupant mortgage in month 396.

That’s about 7 years faster than they were able to achieve financial independence as a renter.

Additionally, by buying an owner-occupant property,  Norm

Norm Norma

Norma

Net Worth

Let’s talk about net worth.

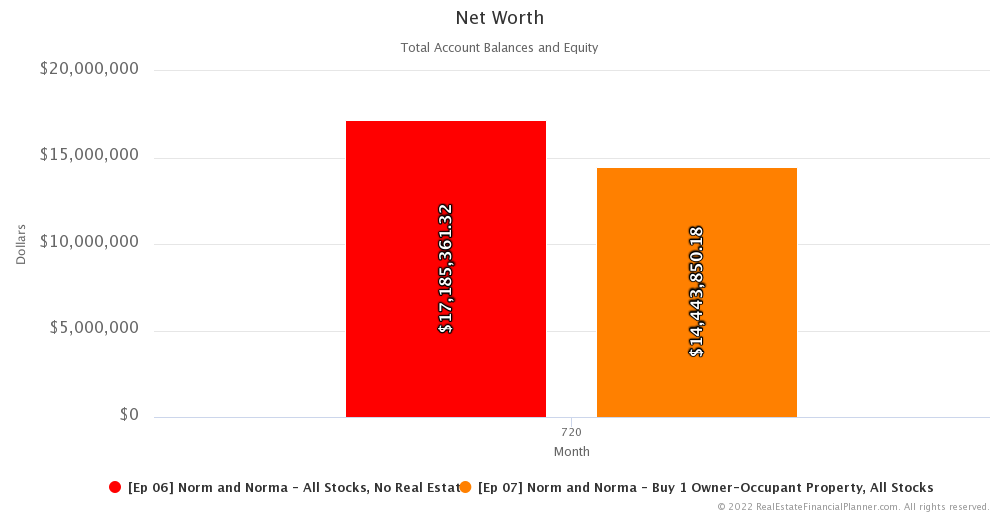

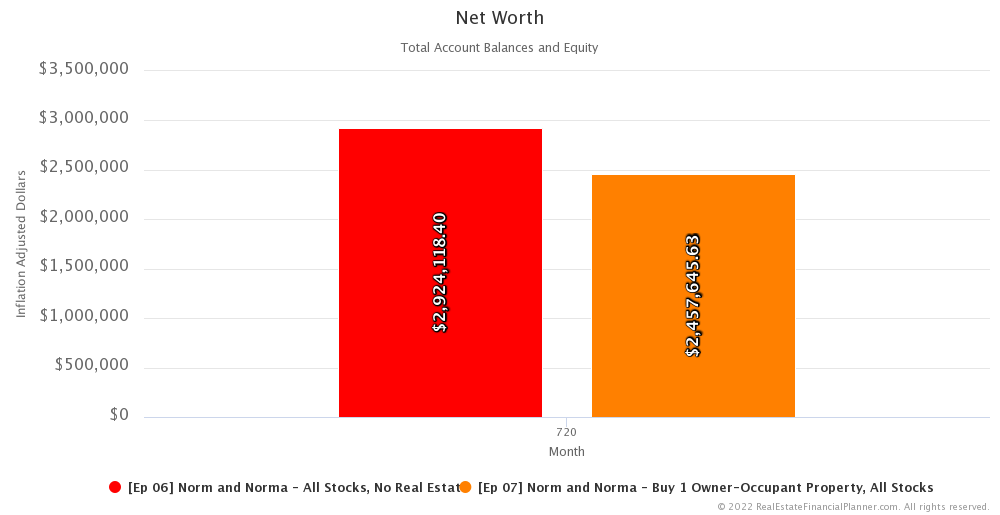

By renting they end up with a higher overall net worth. As a renter investing in stocks, they end up with a net worth of just over $17 million dollars compared to almost $14.5 million as a homeowner.

In today’s dollars, that’s like almost $3 million to almost $2.5 million or about half a million dollars difference in favor of renting.

That might seem counterintuitive after first blush… they achieve financial independence faster but have a lower net worth if they buy a home to live in. Yes… that’s correct. The homeowner got to financial independence faster not by directly out-saving and out-investing the renter.

They got there by lowering the bar to being financially independent by not having to worry about a large percentage of the housing expense once they pay off their mortgage.

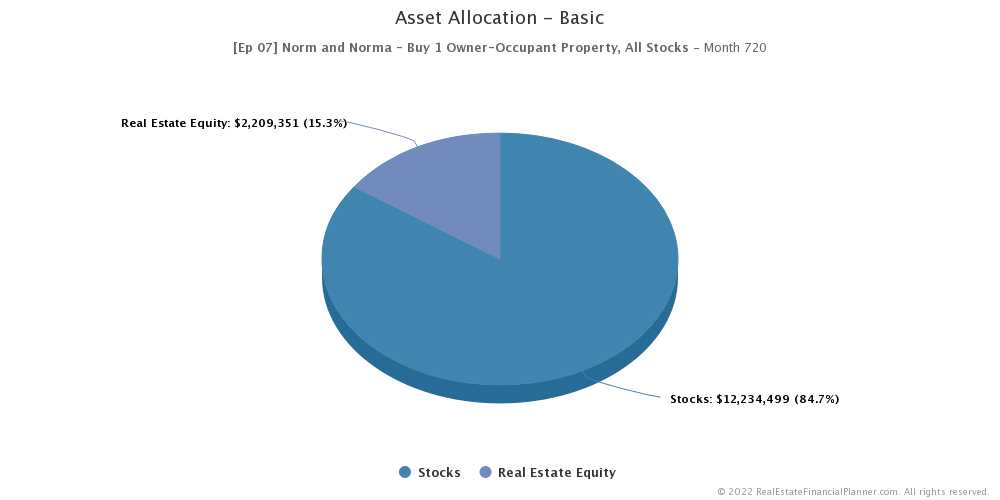

And, the house they live in… which represents a portion of their net worth is equity in their property… is going up at 3% per year. The money they have invested in the stock market is going up at 8% per year.

Next Episode

But… what if  Norm

Norm Norma

Norma

Also, be sure to check out the Advanced Real Estate Financial Planner™ Podcast to see how having variable property appreciation rates and rent appreciation rates, variable mortgage interest rates, variable inflation rate and variable stock market rates of return impacts  Norm

Norm Norma

Norma

I hope you have enjoyed this Episode about  Norm

Norm Norma

Norma

Get unprecedented insight into  Norm

Norm Norma’s

Norma’s Scenario with dozens of detailed, interactive charts.

Scenario with dozens of detailed, interactive charts.

Inside the Numbers

Watch the Inside the Numbers video to see exactly how we set up their  Scenario

Scenario

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 06 Norm and Norma - All Stocks, No Real Estate with 2

Ep 06 Norm and Norma - All Stocks, No Real Estate with 2  Accounts, 0

Accounts, 0  Properties, and 5

Properties, and 5  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 07 Norm and Norma - Buy 1 Owner-Occupant Property, All Stocks with 2

Ep 07 Norm and Norma - Buy 1 Owner-Occupant Property, All Stocks with 2  Accounts, 1

Accounts, 1  Property, and 6

Property, and 6  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Podcast Episodes

The following are the podcast episodes for variations of  Norm

Norm Norma’s

Norma’s

More posts: Norm Episode