You’ve heard of cash flow on rental properties. Basically, it is defined by taking all the income from your rentals minus all your expenses.

But, have you heard about True Cash Flow™?

True Cash Flow™ is your traditional cash flow plus Cash Flow from Depreciation™.

If you’re familiar with the Return Quadrants™, True Cash Flow™ is represented by the returns from these two sections:

Post Depreciation Period

Depreciation for a residential rental property typically lasts 27.5 years. Since True Cash Flow™ is really cash flow + Cash Flow from Depreciation™, once you own a property more than 27.5 years and you can no longer depreciate the property a couple things happen.

First, Cash Flow from Depreciation™ goes to zero. You don’t have any depreciation left to take.

Second, True Cash Flow™ is now the same as regular cash flow.

So, True Cash Flow™ is helpful thinking tool only during the depreciation period and is not helpful once you get past the period you get to take depreciation on your rentals.

True Cash Flow™ When Contemplating: Should I Refinance My Rental Property?

When contemplating whether or not you should refinance your rental property, many real estate investors will consider whether any increase in monthly payment from a refinance will be covered by the True Cash Flow™ of any properties they may purchase with cash out refinance proceeds.

If the properties they’re going to buy cannot support the extra monthly payment from the refinance then don’t refi. Of course, there are more subtle and nuanced considerations that the Real Estate Financial Planner™ software does a great job modeling.

True Cash Flow™ Charts

You can view a variety of True Cash Flow™ related  Charts

Charts

Charts

ChartsYou can view True Cash Flow™ for any  Scenario

Scenario Scenarios

Scenarios

You can also view True Cash Flow™ for any individual  Property

Property Properties

Properties Scenario

Scenario Properties

Properties

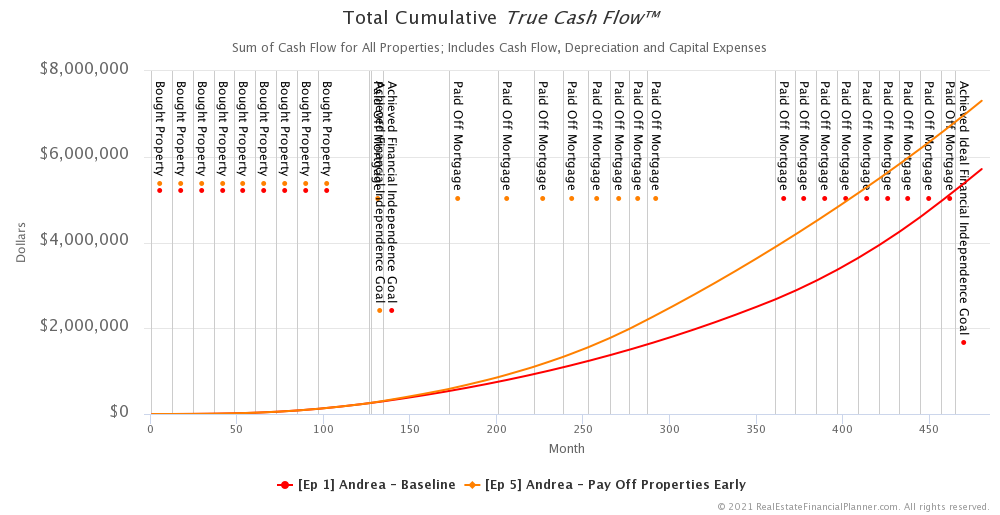

For example, here are a few from  Andrea’s situation.

Andrea’s situation.

Or, the same  Chart

Chart

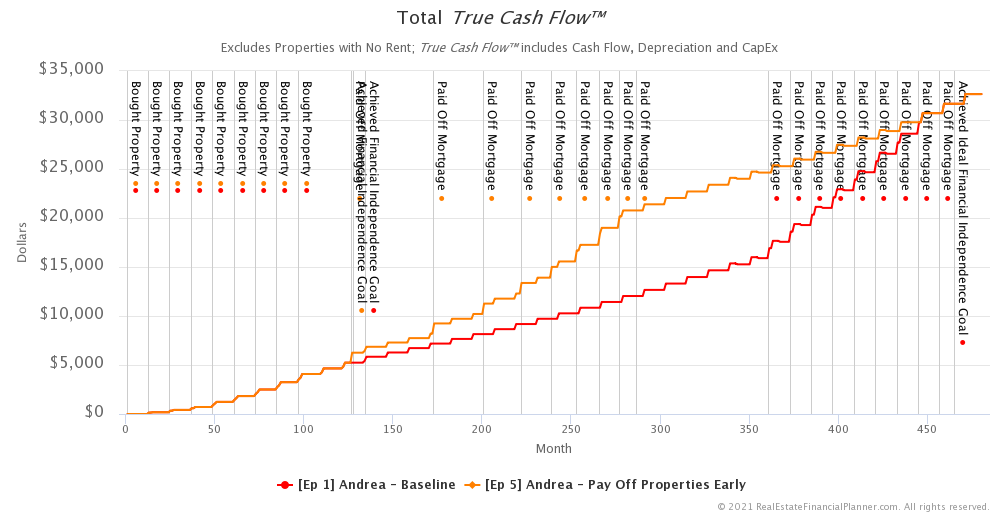

Or this one when  Andrea

Andrea

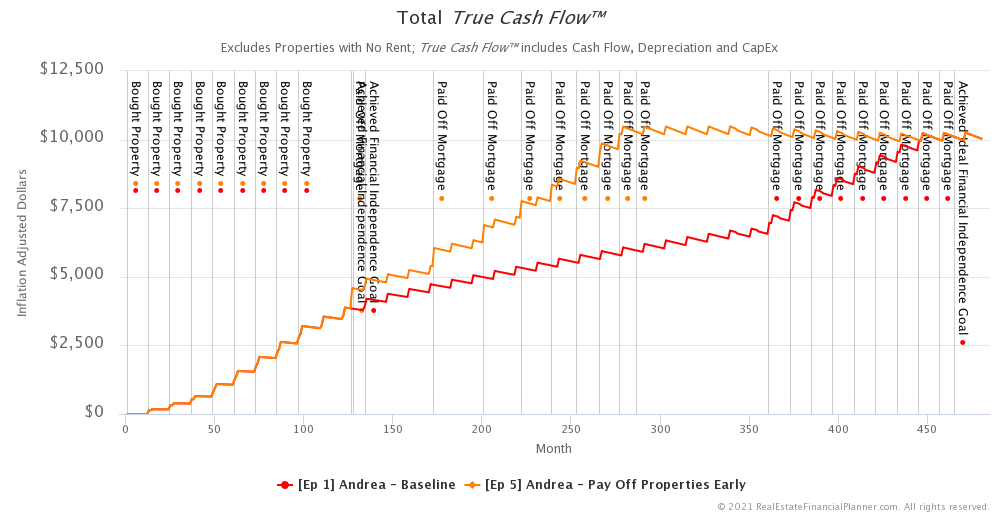

And here’s the inflation adjusted version of that same  Chart

Chart

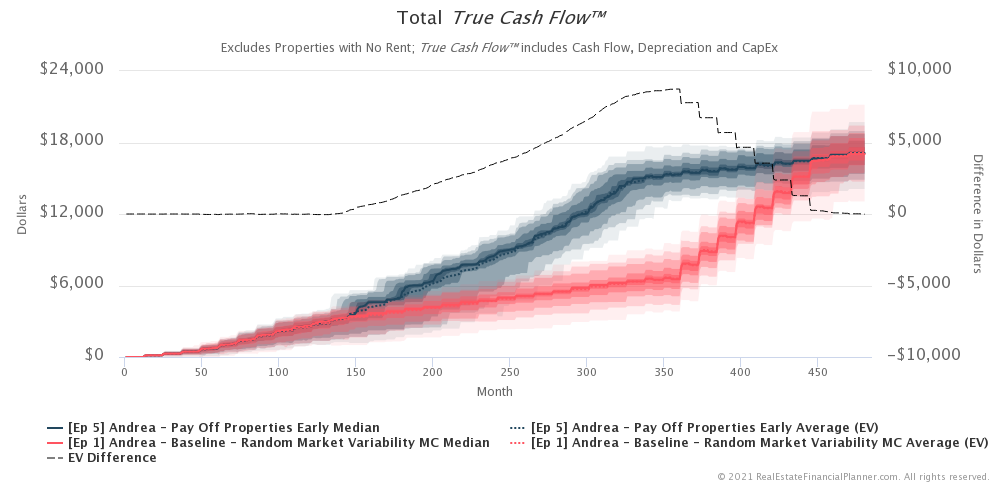

And, here’s an advanced comparison where we run monte carlo analysis and compare them.

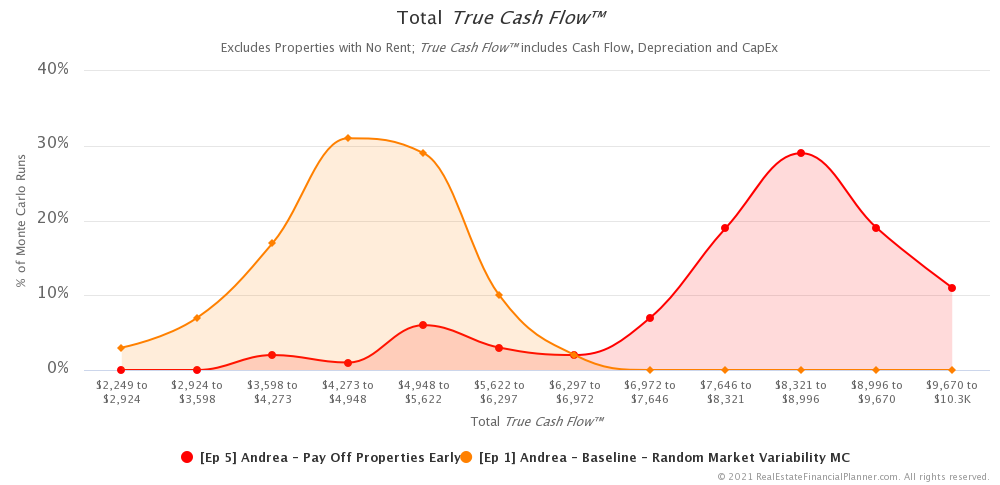

And, here’s what the probability curves look like for the monte carlo analysis for 20 years (month 240).

Want to see how much True Cash Flow™ that  Andrea

Andrea Chart

Chart

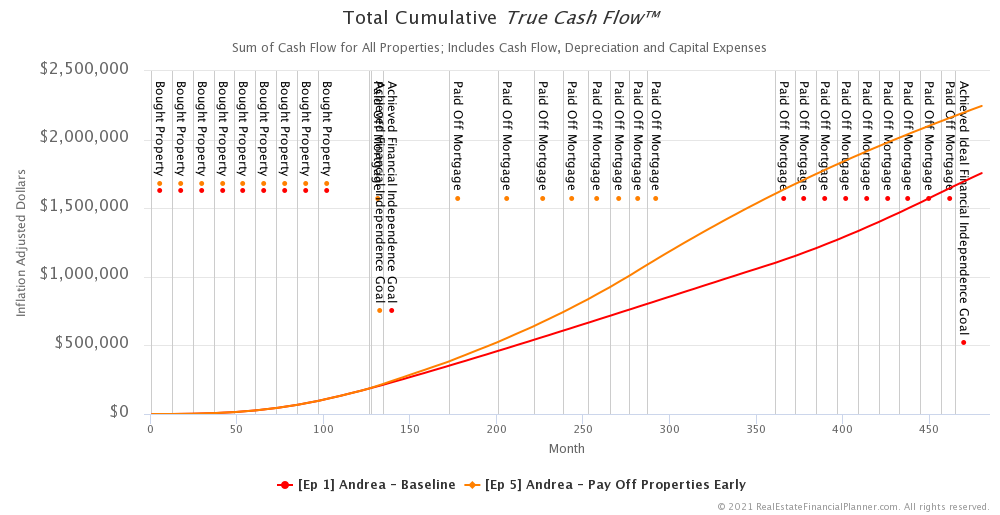

And, of course, the inflation adjusted version.

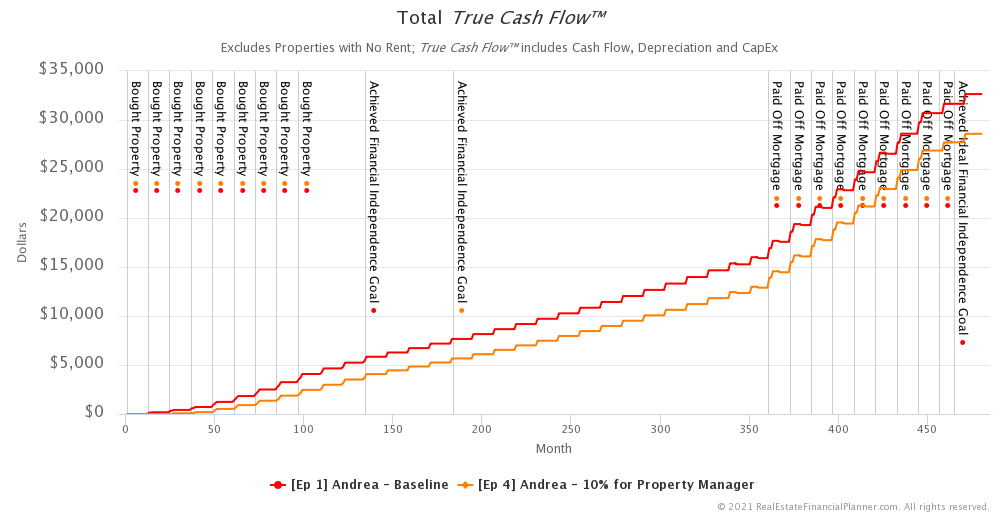

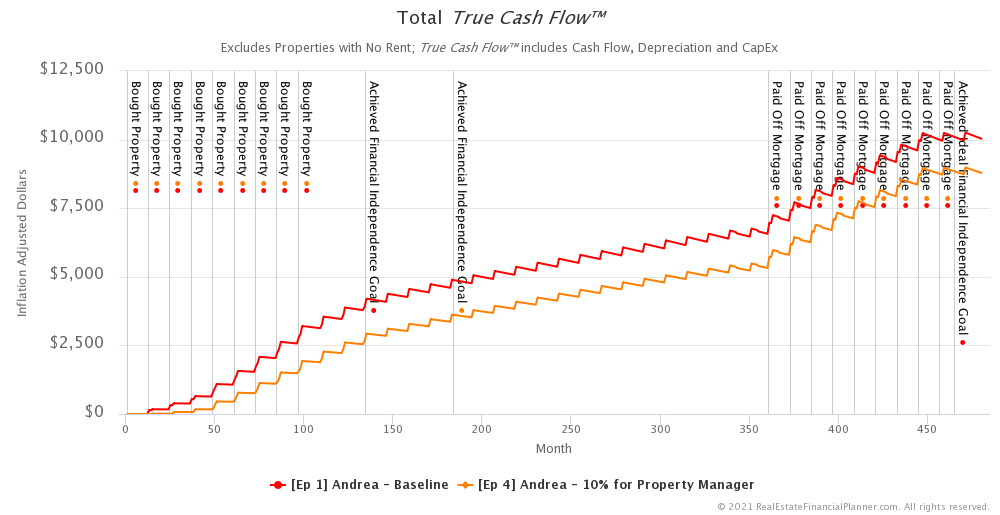

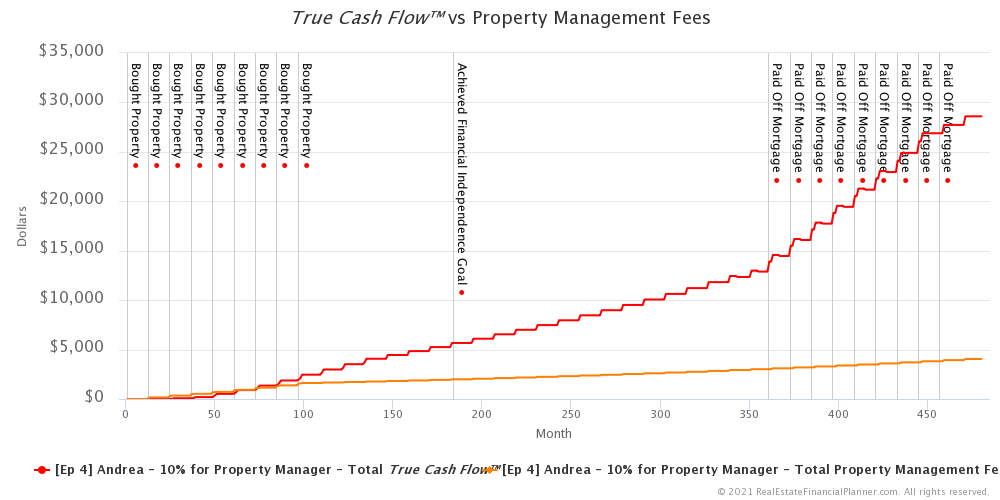

In episode 4 with  Andrea

Andrea Chart

Chart

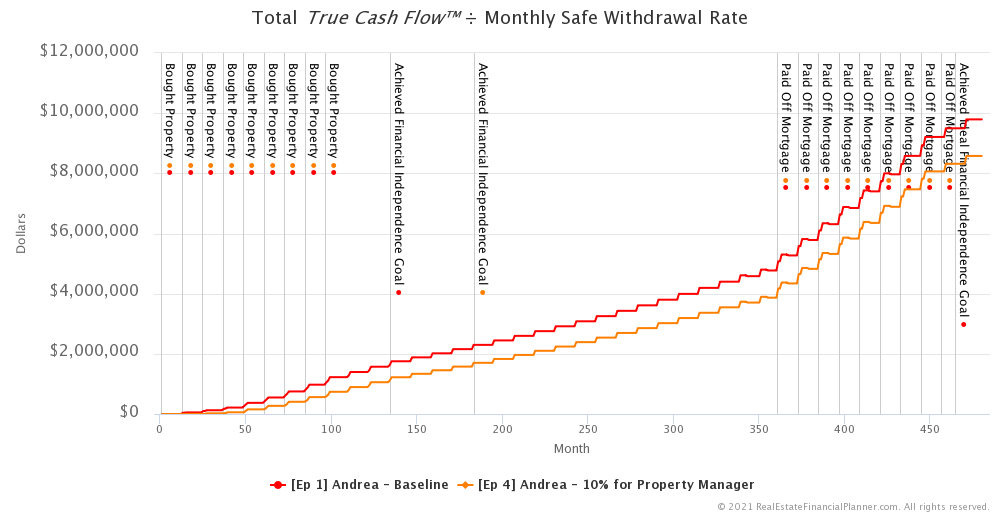

Total True Cash Flow™ ÷ Monthly Safe Withdrawal Rate

True Cash Flow™ on rental properties is similar in some ways to what we can “safely” spend if we had money invested in stocks, bonds, etc and used a safe withdrawal rate. So, as a thought exercise couldn’t we try to see what the value of the True Cash Flow™ is in terms of a lump sum invested in stocks, bonds, etc?

If we took the True Cash Flow™ and divided by the monthly safe withdrawal rate, we could see how much money we would have needed to invest in stocks, bonds, etc to generate the same cash flow. That’s the  Chart

Chart

By the way, for monthly safe withdrawal rate I mean safe withdrawal rate divided by 12 months.

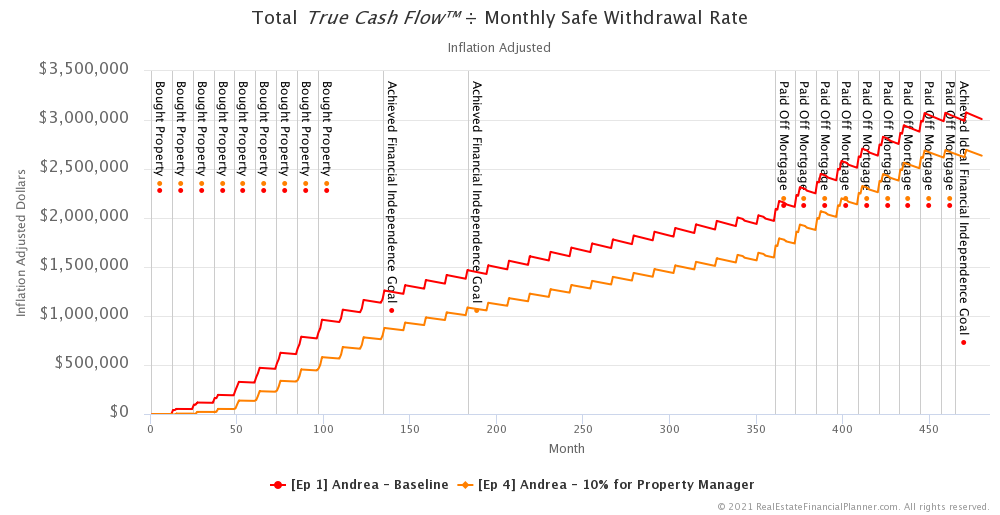

Of course, we could adjust this same chart for inflation.

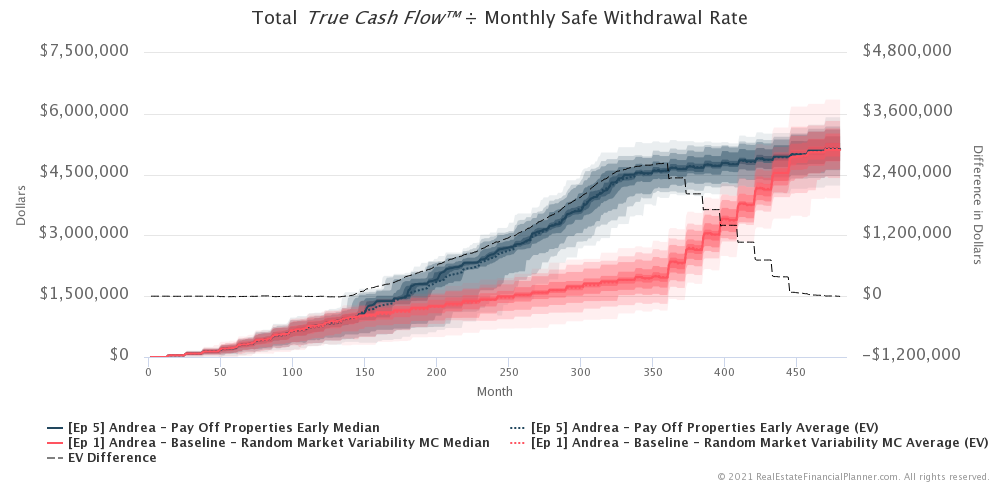

And here’s the advanced monte carlo version with a comparison of the  Expected Value

Expected Value

Class on Cash Flow Power Meter™

Here’s a class I taught on the Cash Flow Power Meter™: