Pro Tip: Listen to the podcast below and while you’re listening follow along with the charts below. Then, when you’re done, copy the  Scenario

Scenario

Welcome to the Real Estate Financial Planner™ Podcast. I am your host, James Orr. This is Episode 23.

Today we’re going to continue with  Norm and Norma’s

Norm and Norma’s

In the previous episode, Episode 22,  Norm and Norma

Norm and Norma

They took that extra cash and invested in the stock market to significantly boost their savings rate from about $1,000 per month to much higher than that depending on how many flips they did per year and how much profit they made per flip.

In this episode, we assume that  Norm and Norma

Norm and Norma

However, instead of investing these profits in the stock market, they instead use that money as down payments to buy rental properties.

We will look at them buying rental properties with 20% and 25% down payments as well as buying rental properties with 15% down payments and private mortgage insurance.

In our modeling for this episode, we assume that they continue to rent a home to live in themselves instead of buying an owner-occupant property.

Financial Independence

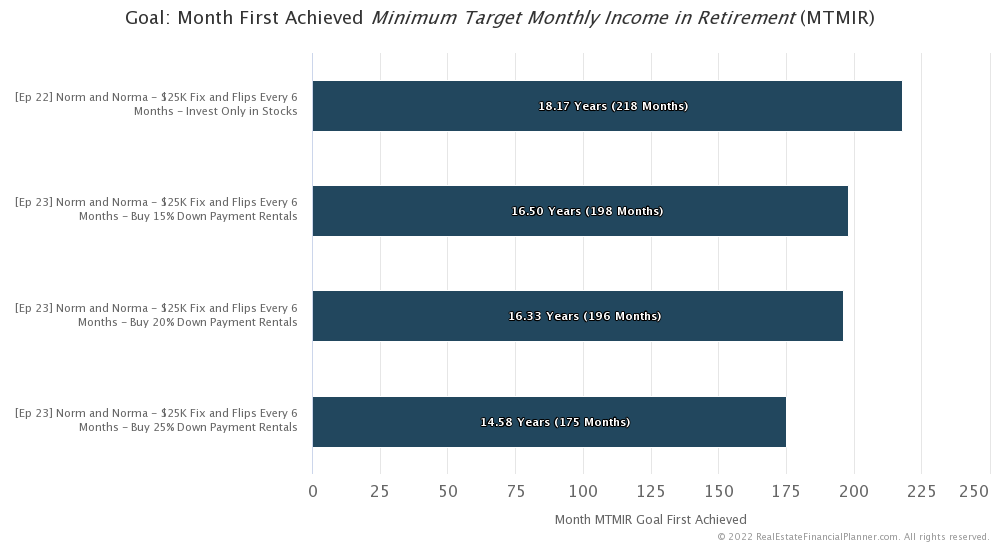

So, does buying rental properties with the proceeds for their fix and flip profits speed up their ability to be financially independent?

Come on… you know it does.

The question really is: by how much?

Well, if they do 2 fix and flips a year and make $25K per flip, but invest in stocks only, they’re financially independent in a little over 18 years.

However, if they buy 15% down payment rentals… even with the private mortgage insurance they need to pay by not putting at least 20% down… they’re financially independent in about 1 year and 8 months faster. Instead of 18.17 years, they’re financially independent in 16.5 years.

How about 20% down? That’s just two months faster than putting 15% down.

But what about 25% down payments when they buy rentals? That turns out to be quite a bit faster.

Buying 25% down payment rentals with the same profits from doing their fix and flips is a little more than 3 and a half years faster than investing in stocks: 14.58 years versus 18.17 years.

And, it is a little less than 2 years faster than putting 15% or 20% down to buy the rentals.

Net Worth

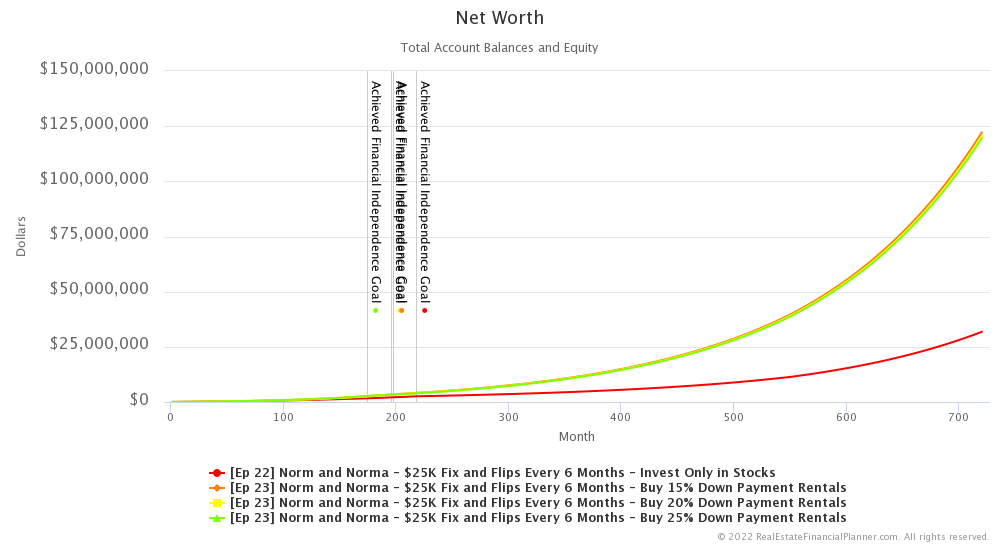

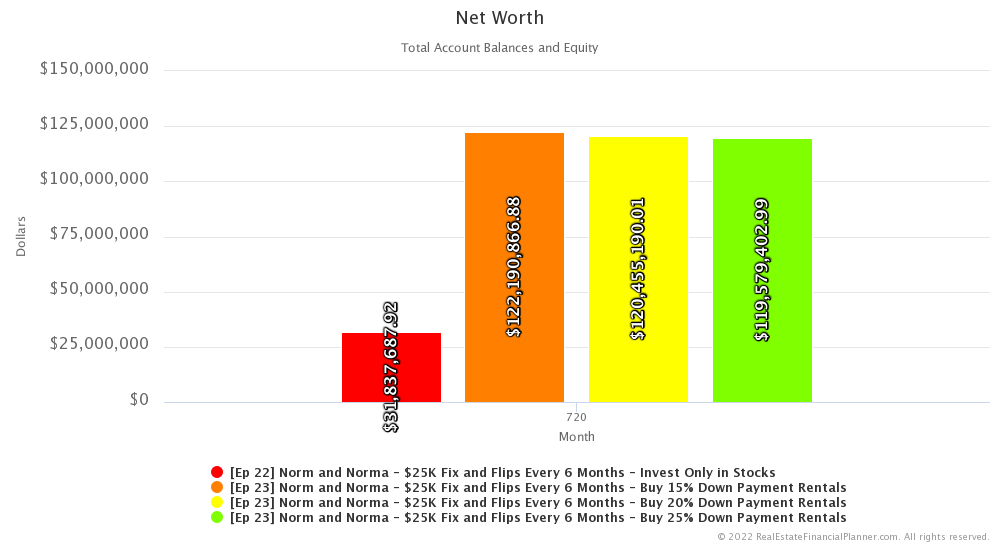

But speed is just part of the benefit of buying rentals with their fix and flip profits. In addition to it being faster, they end up with a lot higher net worth.

In future, inflated dollars, if they take their fix and flip profits and just invest in stocks they end up with a net worth of a little less than $31 million dollars by the end of our modeling, 60 years in the future.

But, if they invest their fix and flip profits in rental properties, they end up with between $119 million and $122 million depending on their down payment amount. The less they put down the higher their net worth.

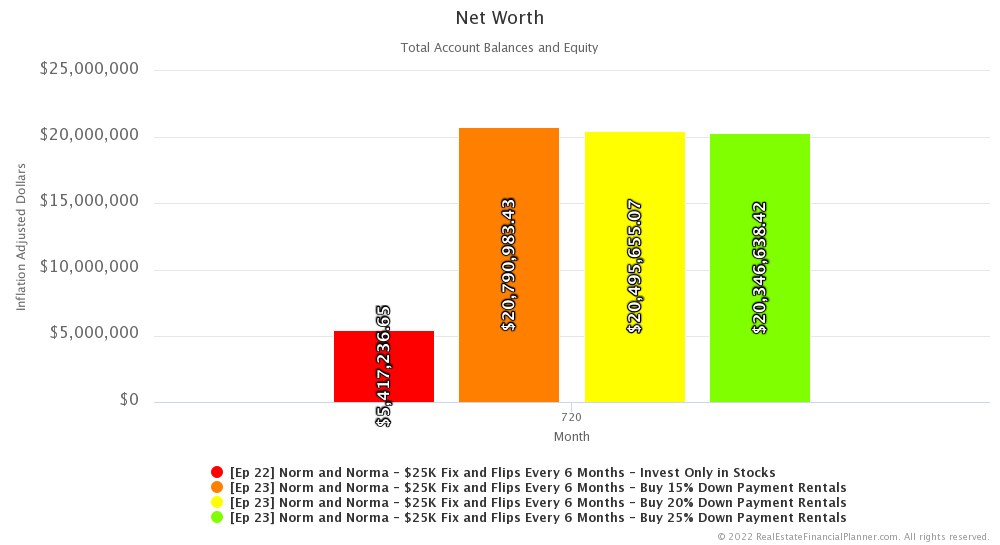

It can be hard to think of future, inflated dollars in terms of today’s dollars.

So, what are those numbers if we adjust back for inflation in today’s dollars?

Just investing their fix and flip profits in stocks is like having a net worth of about $5.4 million in today’s dollars, but 60 years in the future.

And, investing their fix and flip profits in rental properties is like having between $20 million dollars in today’s dollars… again 60 years in the future.

Standard of Living

Speed to when they first achieve financial independence is one measure. Net worth is another. But, some strategies just barely get them to financial independence, while other strategies blow right by the minimum standard of living we set to be financially independent and support a much, much higher standard of living over time.

That’s the case with buying rental properties versus investing in stocks with their fix and flip proceeds.

Buying the rental properties… over time… gives them a much, much higher standard of living.

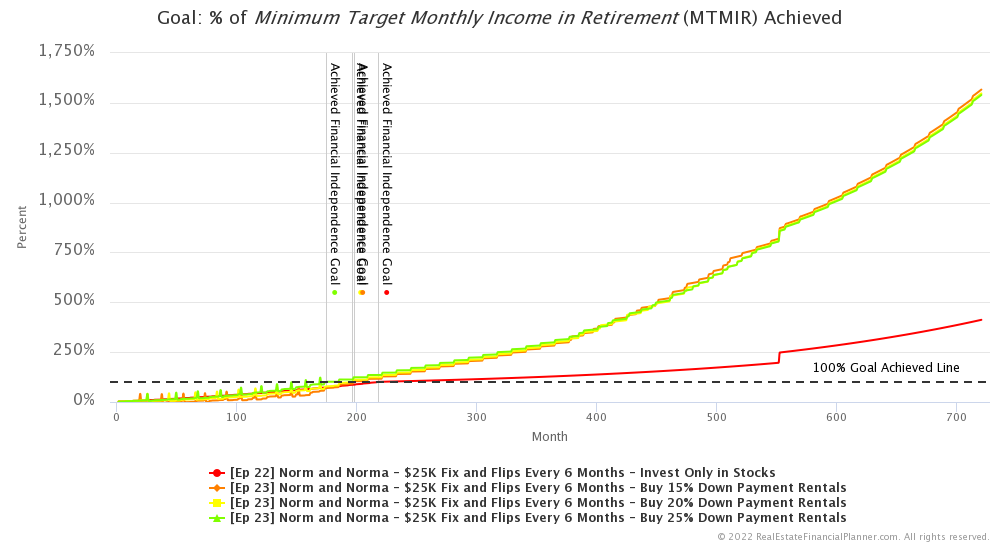

We can see this if we look at the chart of what percent of their Minimum Target Monthly Income in Retirement Achieved.

When this chart reaches 100%, that means they’ve met 100% of the money they require to be considered financially independent.

However, if this chart shows 200%, it means they’re generating 2 times the money they required to be considered financially independent. That also means they could opt to spend TWICE as much as their minimum. So, instead of living on $6,000 per month they could be living on $12,000 per month.

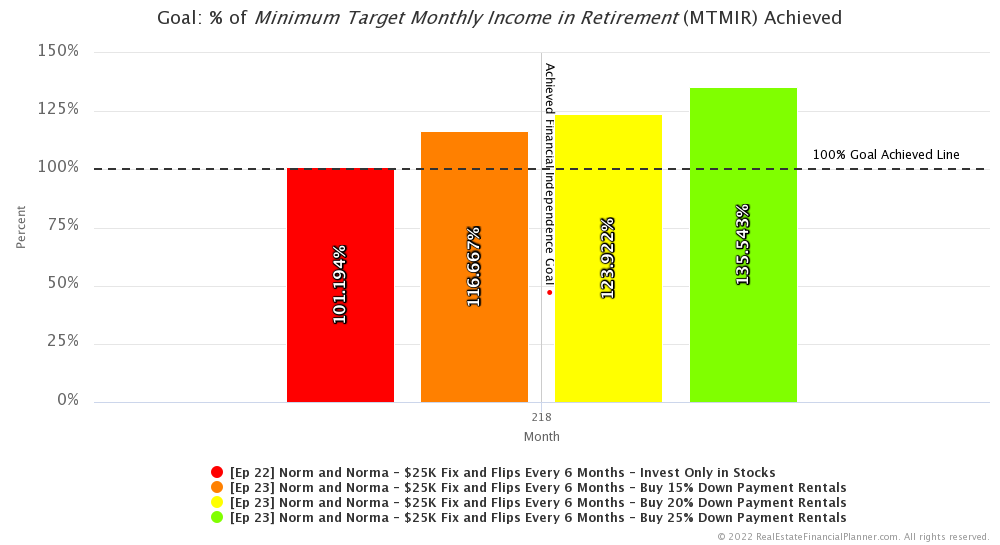

In month 218… the month where they first are financially independent taking their fix and flip profits and investing in stocks only… they can live at a standard of living between 16% and 35% higher if they bought rentals.

The higher standard of living comes from the larger down payments… so it is better for them to have put 25% down than 15% down here.

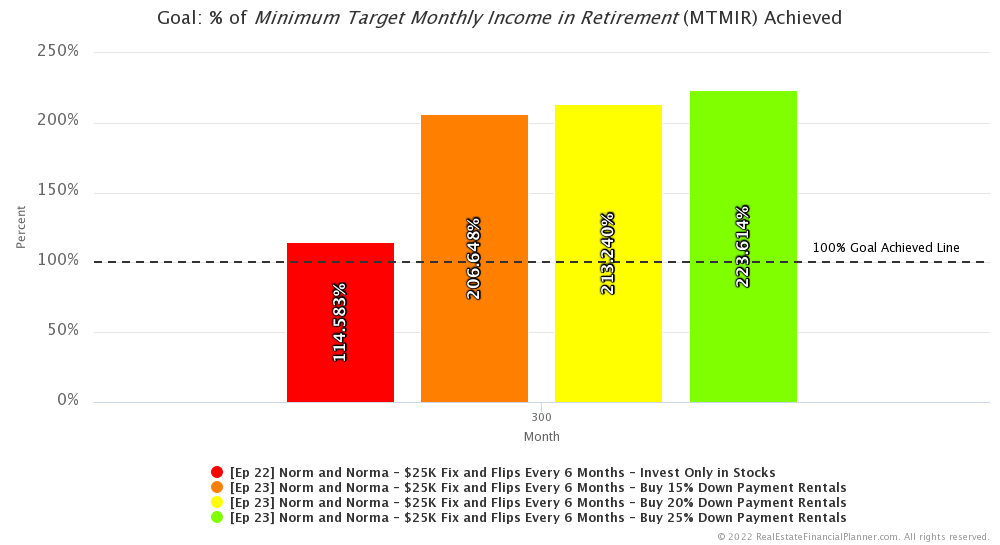

25 years from when they start, if they take their fix and flip profits and invested in stocks, they could live at a standard of living 14% higher than their minimum.

However, at that same time… 25 years from when they started… if they took their profits and invested in rental properties, they could afford a standard of living between 106% to 123% more than their minimum.

So more than double their minimum of $6,000 per month.

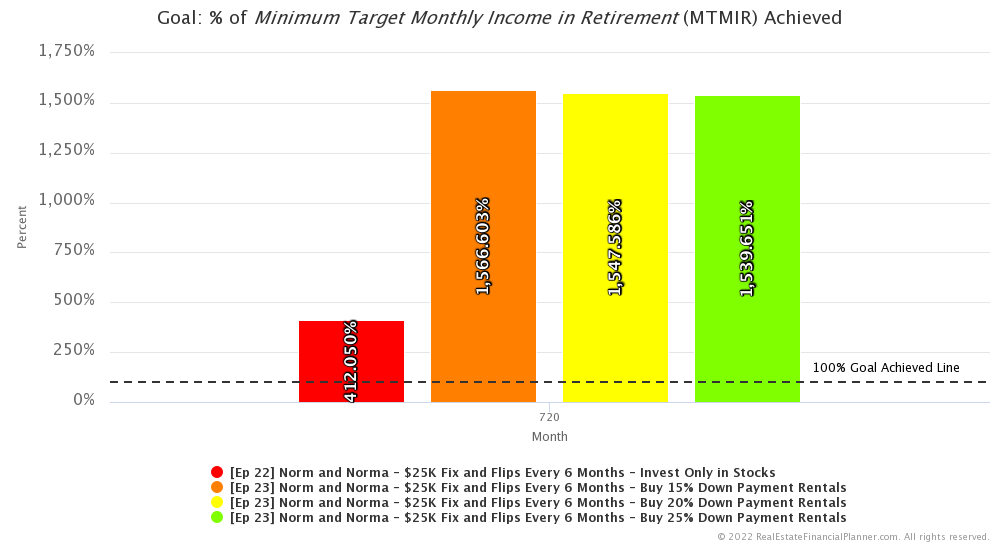

By the time we stop modeling in year 60, they could be living at a standard of living 15 times their minimum… $90,000 per month instead of just $6,000 per month. And, that’s already adjusted for inflation… so it is like $90,000 per month in today’s dollars.

Investing in stocks is over 4 times, so that’s like $24,000 instead of $6,000 per month. Again, that’s already adjusted for inflation so it is in today’s dollars.

One might ask… maybe having 10 rental properties overshot their goals. Maybe they should have bought fewer than 10 rentals. Would that be faster? Less risky? Or, maybe they should buy the 10 but be willing to sell off some of them and use the proceeds to pay off the remaining mortgages on the properties they kept. Would that be faster? Less risky? We will revisit these ideas in future episodes, so be sure to keep an eye out for those.

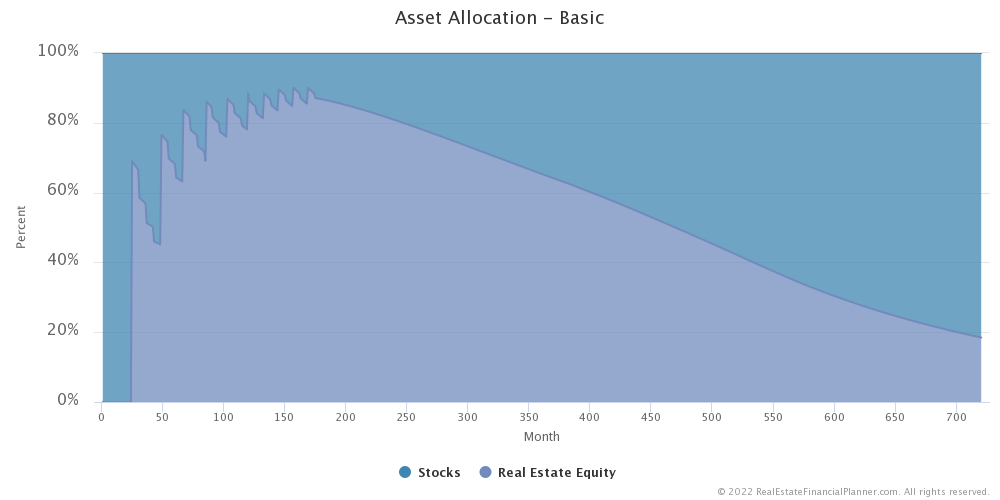

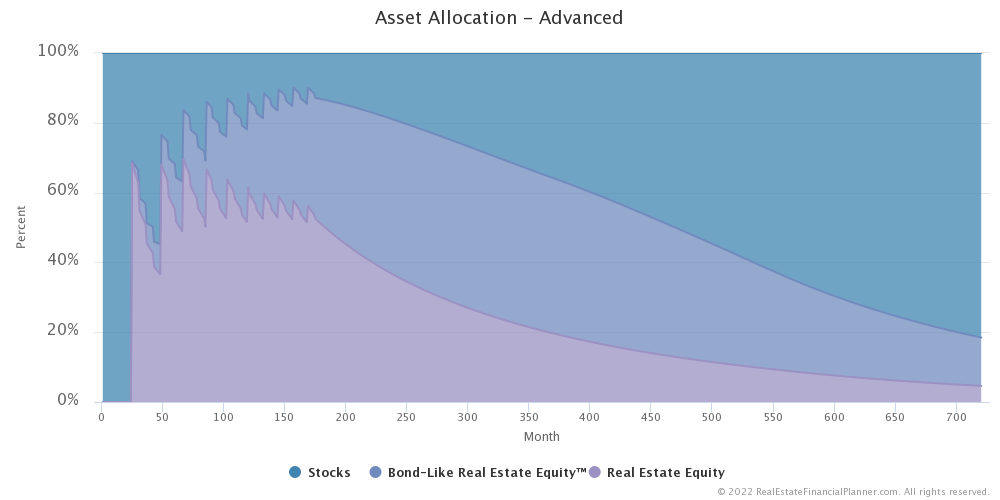

Asset Allocation

In the meantime, let’s discuss asset allocation.

Asset allocation is how  Norm and Norma

Norm and Norma

What percent of their net worth is in stocks? What percentage is in real estate equity?

If they just invest in stocks, then 100% of their assets are in stocks. Of course, we’re ignoring the fix and flips because it is a temporary project and not really something they’re counting in their net worth.

However, when we introduce buying long-term rentals, it changes their asset allocation considerably.

When they invest in rentals with their fix and flip proceeds they have 100% in stocks until they save up enough for their first down payment. Then, a significant percentage of their assets are in real estate and the reserves they have are still in stocks.

While in acquisition mode, they continue to save up down payments then add more real estate equity which then increases the percent of their net worth they have in real estate equity.

Eventually, they acquire their last rental property and their asset allocation shifts from being the highest percentage in real estate to more and more in stocks.

For those of you familiar with my ideas on Bond-Like Real Estate Equity™, you can see how that grows when buying 25% down payment properties.

Risk

Let’s briefly discuss risk before finishing up this episode.

In all the Scenarios, they have the risk of doing fix and flips which we discussed last episode.

However, when they convert fix and flip profits to leveraged rental properties they take on a significant amount of new risk that they did not have previously and reduce the risk exposure they have of having everything in stocks.

When they’re investing the profit from their fix and flips in stocks, they’re achieving financial independence by using the 4% safe withdrawal rate rule of thumb and applying it to their stock market balance.

So, if they have a million dollars invested in stocks, they can “safely” (and I say that in quotes, because there’s some debate on how “safe” a 4% safe withdrawal rate really is but we’ll need to discuss that another time)… but with a million dollars invested in stocks they can “safely” withdraw about $40,000 per year and have a relatively low likelihood of running out of money.

But, when they invest their fix and flip profits in buying rental properties, they’re reaching their financial independence goal in two ways:

1. Part of it comes from net cash flow after all expenses on their rentals, but also

2. The second part of it comes from whatever extra cash they still have invested in the stock market and that 4% safe withdrawal rate rule of thumb on that money.

I mention this because they should really consider what risks are associated with the source of the money that makes them financially independent.

When they only invest in stocks, their risk is that their stocks go down in value or don’t go up in value to keep pace with them withdrawing the $6,000 per month… adjusted up for inflation… that they need to live on.

However, when they invest in rental properties, they now have the risks of vacancies, maintenance, rents not going up, property insurance, taxes and all the other factors that impact cash flow.

And, any money they have invested in the stock market still has that same stock market risk we discussed if they only invested in stocks.

These are different risks and some folks believe that the stock market risk is greater while others believe that the real estate risks are greater.

In previous episodes… especially since we were often comparing one type of real estate investing to another… comparing measures of risk made a lot of sense. We could see how measuring the risk associated with investing with 15% down versus 25% down could be helpful.

However, when comparing stocks to investing in real estate, some of our measures of risk… especially ones measuring debt… go from no risk at all because there is no debt when investing in stocks to having risk when investing in rental properties with debt.

Next Episode

This gets  Norm and Norma

Norm and Norma

Also, be sure to check out the Advanced Real Estate Financial Planner™ Podcast to see how having variable property appreciation rates and rent appreciation rates, variable mortgage interest rates, variable inflation rate and variable stock market rates of return impacts  Norm and Norma

Norm and Norma

I hope you have enjoyed this episode about  Norm and Norma

Norm and Norma

Get unprecedented insight into  Norm

Norm Norma’s

Norma’s Scenario with dozens of detailed, interactive charts.

Scenario with dozens of detailed, interactive charts.

Compare doing fix and flips then investing in stocks to doing fix and flips then buying rentals:

- Fix and Flips Then Stocks vs Fix and Flips Then 15% Down Payment Rentals

- Fix and Flips Then Stocks vs Fix and Flips Then 20% Down Payment Rentals

- Fix and Flips Then Stocks vs Fix and Flips Then 25% Down Payment Rentals

And here’s all 4 of the  Scenarios

Scenarios

Inside the Numbers

Watch the Inside the Numbers video to see exactly how we set up their  Scenario

Scenario

$25K Fix and Flip Every 6 Months Then Invest in Stocks

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 22 Norm and Norma - $25K Fix and Flips Every 6 Months - Invest Only in Stocks with 2

Ep 22 Norm and Norma - $25K Fix and Flips Every 6 Months - Invest Only in Stocks with 2  Accounts, 0

Accounts, 0  Properties, and 6

Properties, and 6  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

$25K Fix and Flip Every 6 Months Then Invest in 15% Down Payment Rentals (with Private Mortgage Insurance)

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 23 Norm and Norma - $25K Fix and Flips Every 6 Months - Buy 15% Down Payment Rentals with 2

Ep 23 Norm and Norma - $25K Fix and Flips Every 6 Months - Buy 15% Down Payment Rentals with 2  Accounts, 2

Accounts, 2  Properties, and 7

Properties, and 7  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

$25K Fix and Flip Every 6 Months Then Invest in 20% Down Payment Rentals

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 23 Norm and Norma - $25K Fix and Flips Every 6 Months - Buy 20% Down Payment Rentals with 2

Ep 23 Norm and Norma - $25K Fix and Flips Every 6 Months - Buy 20% Down Payment Rentals with 2  Accounts, 1

Accounts, 1  Property, and 7

Property, and 7  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

$25K Fix and Flip Every 6 Months Then Invest in 25% Down Payment Rentals

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 23 Norm and Norma - $25K Fix and Flips Every 6 Months - Buy 25% Down Payment Rentals with 2

Ep 23 Norm and Norma - $25K Fix and Flips Every 6 Months - Buy 25% Down Payment Rentals with 2  Accounts, 1

Accounts, 1  Property, and 7

Property, and 7  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Podcast Episodes

The following are the podcast episodes for variations of  Norm

Norm Norma’s

Norma’s

More posts: Norm Episode