Pro Tip: Listen to the podcast below and while you’re listening follow along with the charts below. Then, when you’re done, copy the  Scenario

Scenario

Welcome to the Real Estate Financial Planner™ Podcast. I am your host, James Orr. This is Episode 15.

In the last episode, we explored how  Norm and Norma

Norm and Norma

Nomading™ was the fastest path to financial independence so far.

To recap what the Nomad™ strategy is again:

- They buy a property as an owner-occupant with 5% down and move into the property.

- They live there for at least one year. Sometimes it is more than one year if it takes them longer to save up for the next down payment, closing costs and reserves.

- They buy a replacement property to live in and keep the previous property they lived in as a rental.

- They repeat the process until they’ve acquired as many properties as they want. In this case, that’s 10 properties total: 9 rentals and one final property to continue to live in.

So, that’s what  Norm and Norma

Norm and Norma

Sweat-Equity

But Norma is handy. She’s not afraid of buying a property that needs a little bit of work and earning a little sweat-equity.

What if they could buy a property at a 10% discount that needed work but still do the Nomad™ strategy?

What impact would that have on them achieving financial independence?

For our modeling, they’re buying the property at a 10% discount, but the property requires about $12,000 in hard costs plus their labor to capture that equity.

So, they’re not really capturing 10% of equity… it is 10% of equity minus about $12,000 in hard costs. Plus, in addition, whatever the value of their labor is in fixing up the property.

So, maybe they’re really capturing about $25,000 in equity by buying a fixer-upper.

When we do our modeling we do assume that the $12,000 in fix-up costs do go up with inflation as well.

Now, to be able to buy the property, we’re assuming they need 5% for their down payment plus closing costs plus the $12,000. In other words, we don’t allow them to buy the property without first having saved the fix-up money too.

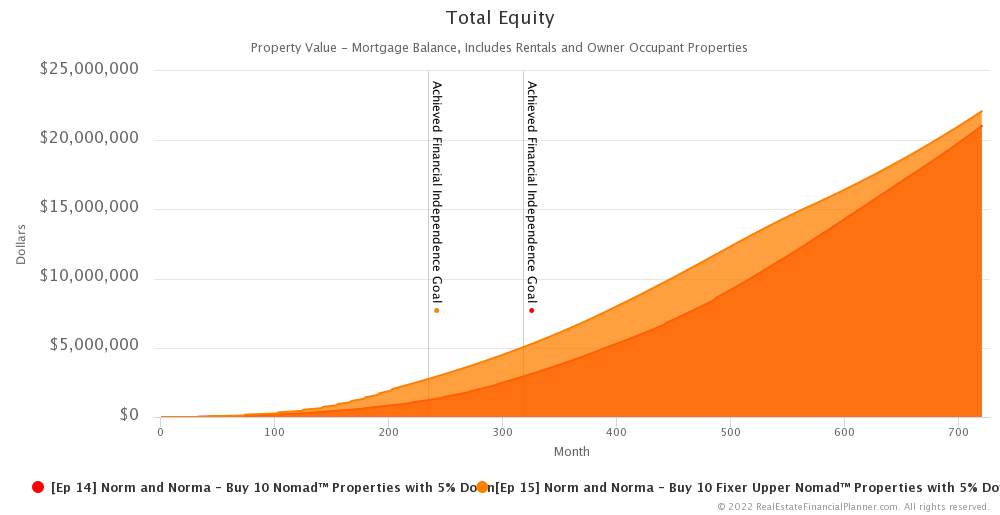

By doing this strategy, you might think that Norm and Norm would have more equity in each property they buy. And, you’d be correct. Each time they buy a property, do the work required to increase the value, they have more equity than just buying a property that did not require work.

But, equity in property does not count directly toward achieving financial independence. Sure, if they sold the property or did a cash out refinance it could help them, but just having more equity does not directly help with them qualifying as financially independent.

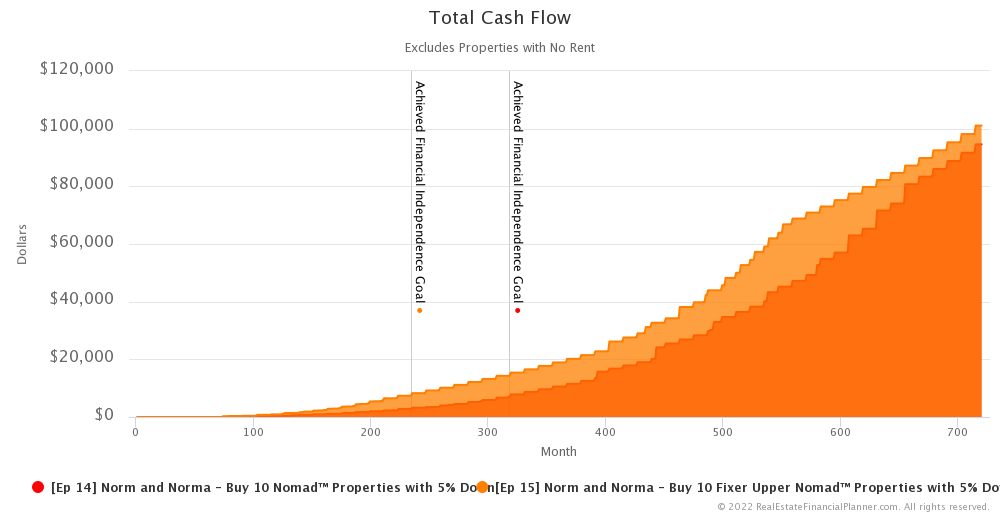

Cash Flow

Buying at a slight discount does mean their cash flow is a little better. And, that does contribute toward them being financially independent.

Plus, because they bought at a discount, it takes less time for them to qualify for private mortgage insurance to drop off when they reach 80% loan-to-value. Dropping private mortgage insurance further improves cash flow. So, dropping private mortgage insurance earlier means better cash flow sooner.

Spending money on fixing up the property buys speed to improved cash flow from paying off the private mortgage insurance.

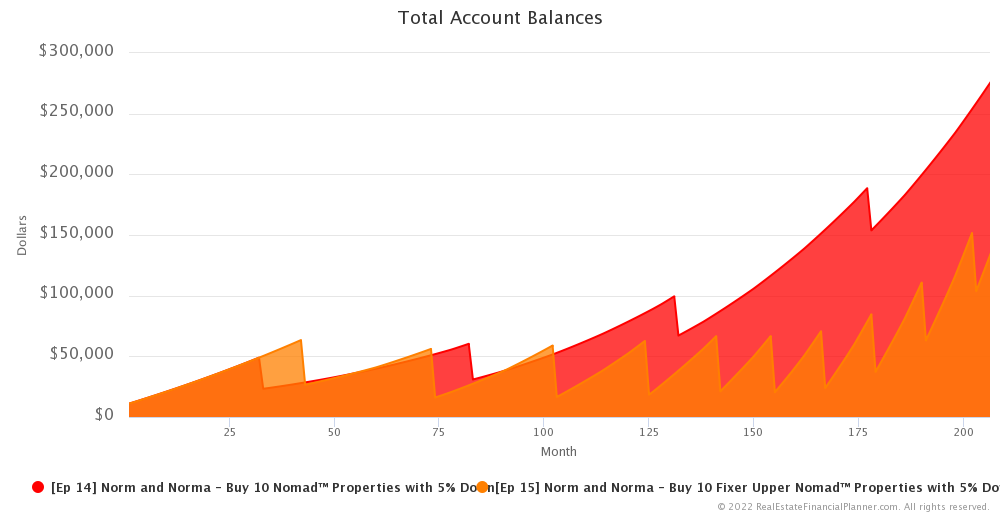

Speed of Buying Houses

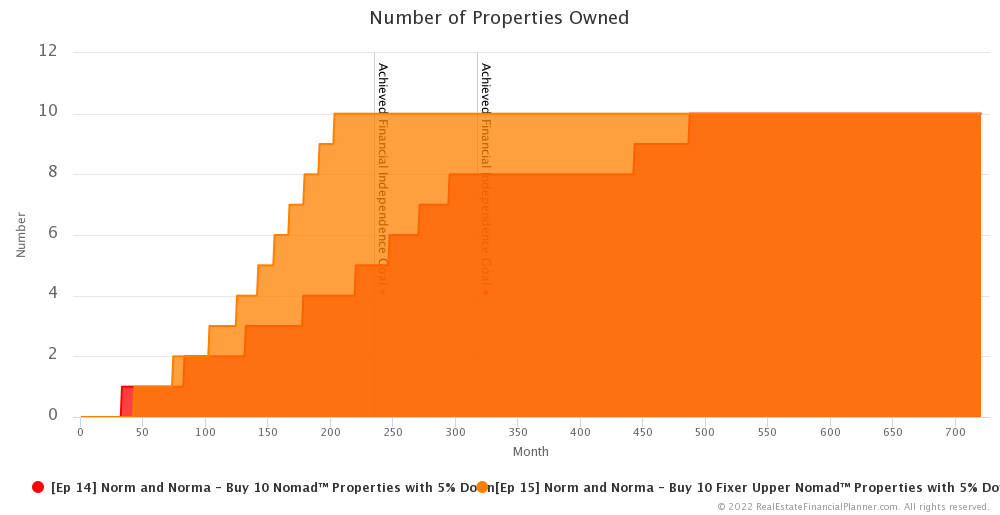

And, you might think that buying a property at a 10% discount might mean that they could buy properties faster because saving up for a 5% down payment is 10% less from the discount.

But, you got to remember that while they save 10% on a 5% down payment… which might mean saving about $1,875… they need to save up $12,000 more for the repairs before we buy the property with the modeling we do.

So, the reality is that first property they end up buying sooner if they’re not doing a fixer-upper.

However, that changes after the first property. The extra cash flow from buying the fixer-upper means that they save for the next property faster and improve their debt-to-income and that means they end up buying the second fixer-upper property sooner than buying the second non-fixer-upper property.

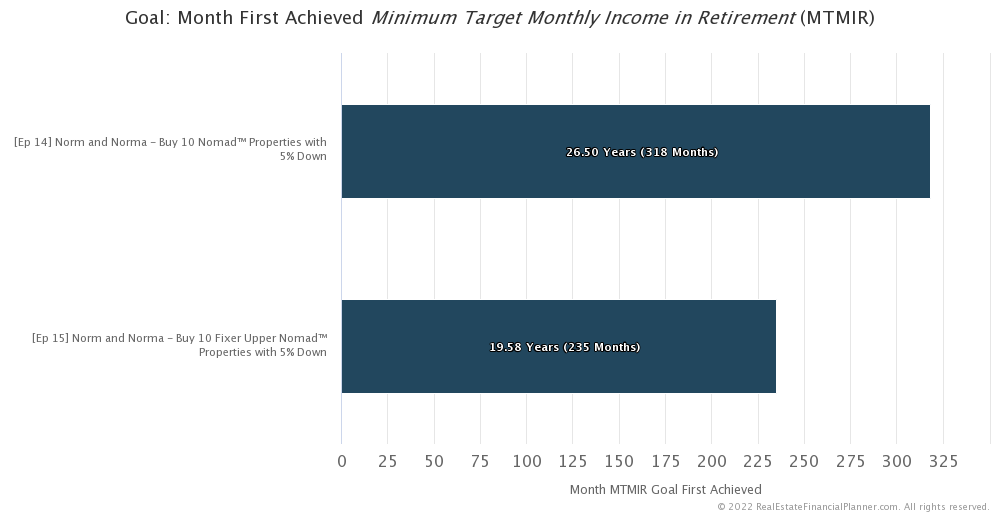

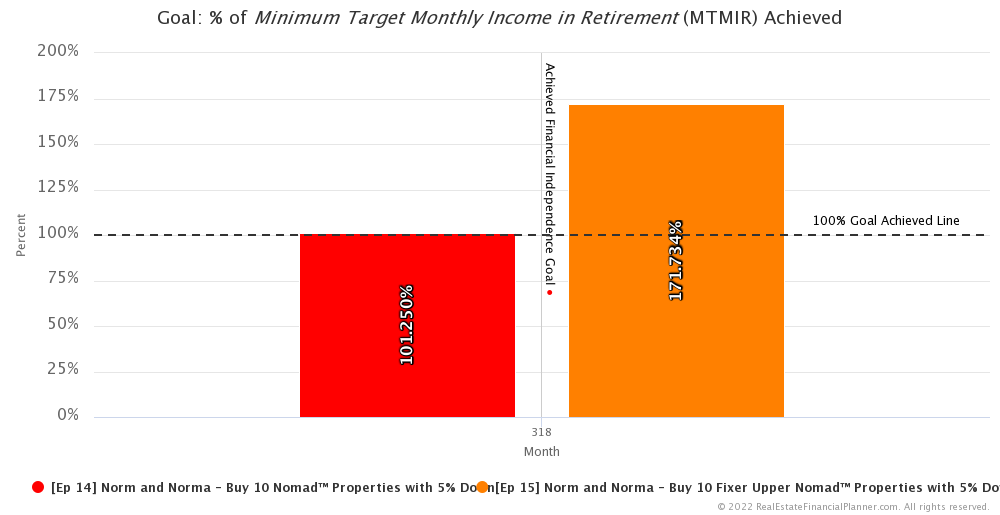

Financially Independent

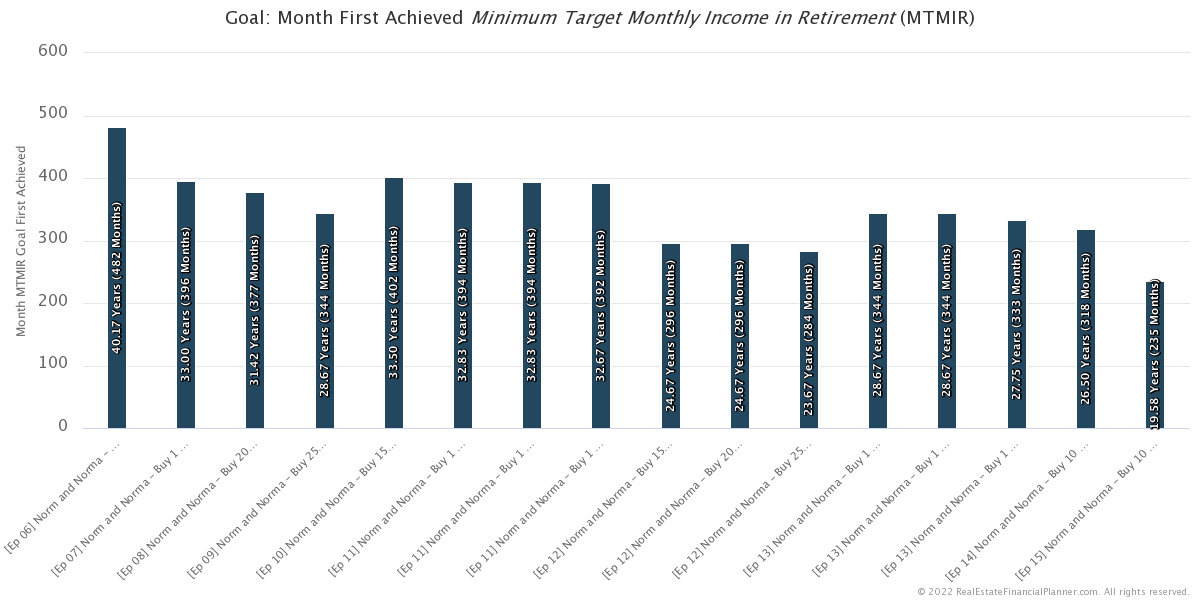

We know that doing the regular Nomad™ strategy is faster than all the previous strategies they’ve considered up to this point, but does Norma’s predilection for fixing up properties help them be financially independent faster?

Yes. Yes, it does.

By buying fixer-upper properties, they’re able to be financially independent and stop working their jobs about 7 years faster.

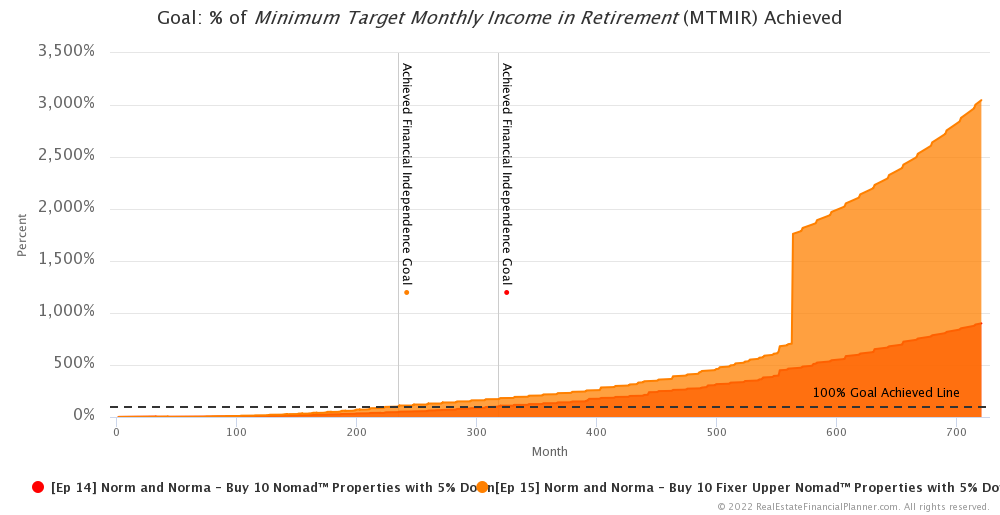

Standard of Living

Plus, because buying the fixer-upper properties gives them both extra cash flow and acquiring rentals faster, they could live at a higher standard of living sooner.

I say sooner, because ultimately… when all 10 properties are free and clear, they have the same 9 rental properties free and clear producing the same net cash flow.

But, before all the properties are paid-off,  Norm and Norma

Norm and Norma

In fact, by the time  Norm and Norma

Norm and Norma

So, instead of being able to live on $5,000 per month from their investments, they could be living on about $8,500 per month.

And because they bought their 10th property sooner… that’s one that they end up living in forever… by buying that sooner, they pay it off sooner which significantly boosts their standard of living. The full mortgage payment they were paying on that is now extra spendable cash each month if they desire to do that.

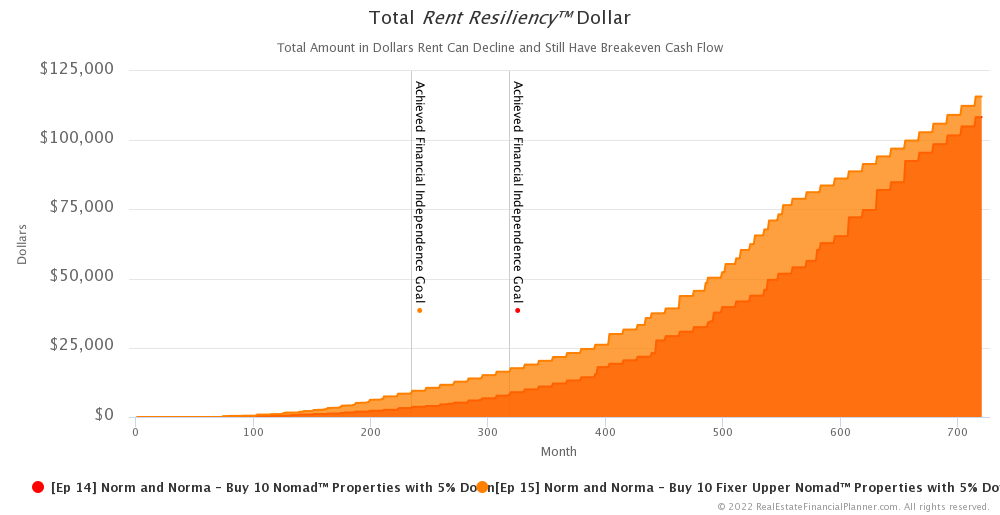

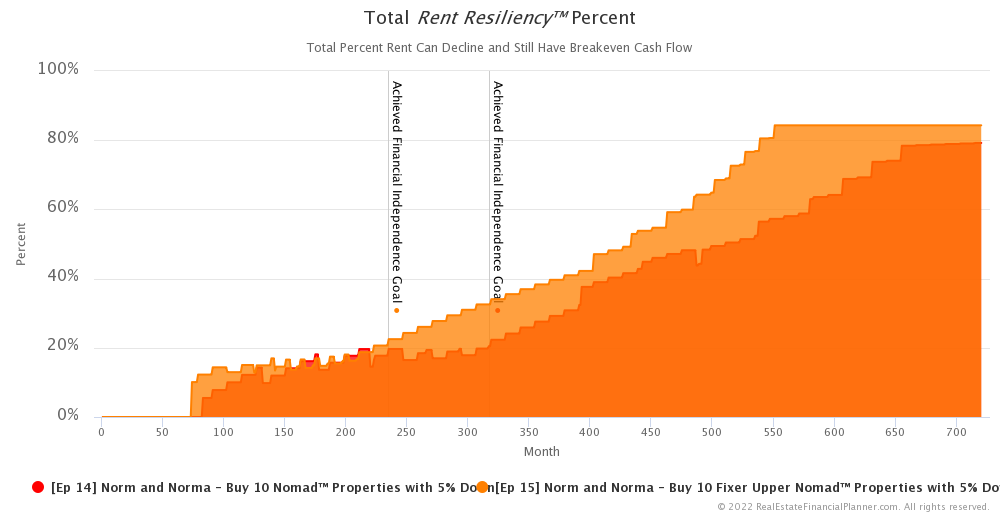

Rent Resiliency™

Buying fixer-upper properties with better cash flow also makes them more resilient to drops in rents before they’d have negative cash flow. That makes buying fixer-upper properties a slightly less risky strategy in terms of Rent Resiliency™.

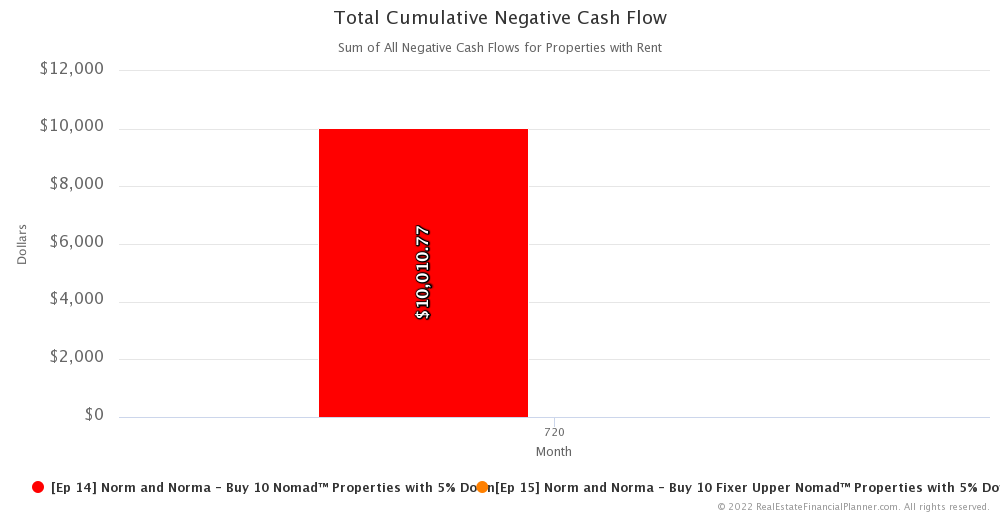

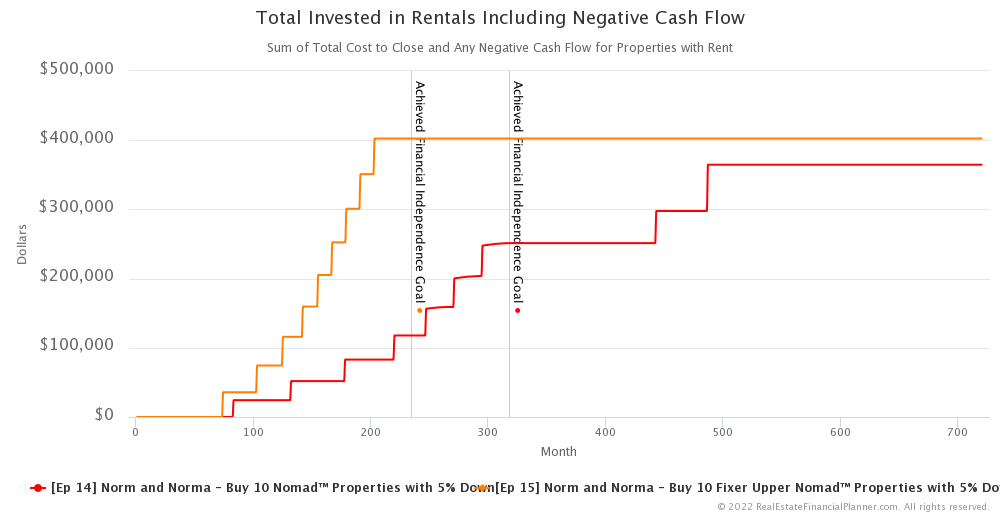

Negative Cash Flow

The extra cash flow by buying fixer-uppers helps enough that they do not have any negative cash flow when they buy fixer-uppers.

So, instead of having about $10,000 in negative cash flow doing regular Nomad™, they end up with zero negative cash flow when buying fixer-uppers.

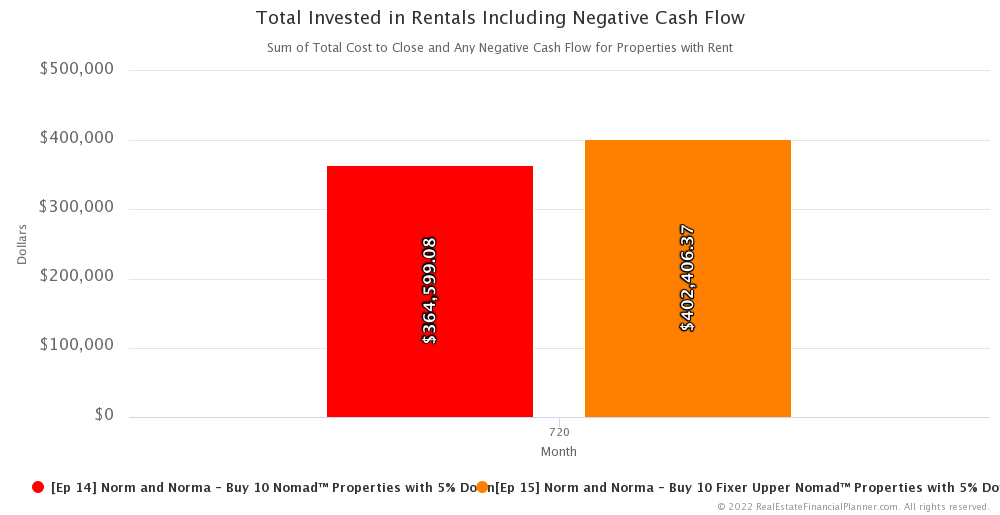

Total Invested

You might think that without the extra negative cash flow and being able to buy properties sooner with fixer-uppers means that they invest less overall to acquire the same number of rental properties. But, it turns out that’s not quite true.

Instead of investing about $365,000 to acquire the 9 rental properties… and we’re specifically ignoring the 10th property they bought and live in as an owner-occupant… instead of $365,000 they need to invest just over $402,000 because of all the extra money for repairs.

But some of this is subsidized for them by the extra cash flow. That’s partly why they can still buy properties faster even with the extra money required. The other part is improved debt-to-income.

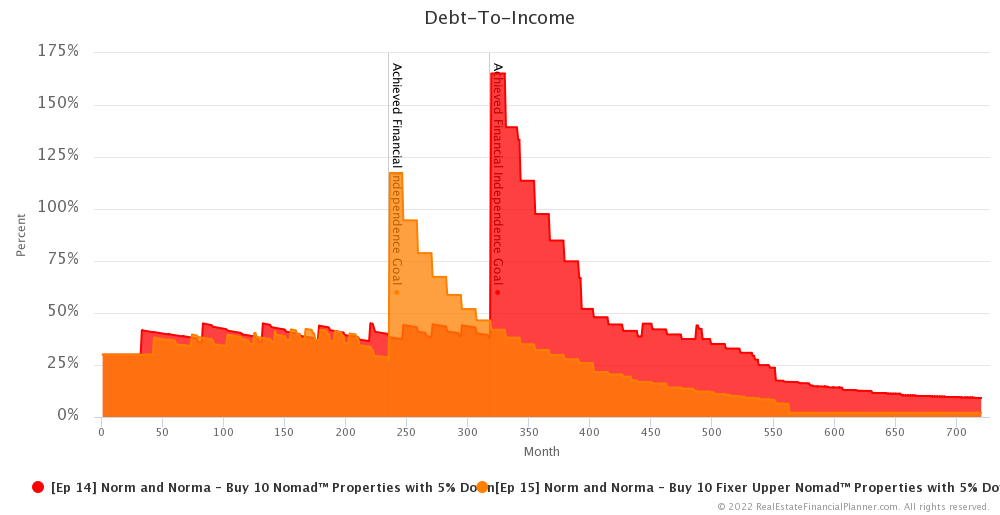

Debt-To-Income

That extra cash flow helps them with their debt-to-income ratios.

In fact, looking at their debt-to-income and their account balances, it looks like debt-to-income might be what slows down their acquisition speed more than having enough money for down payments.

They need enough income between their jobs and cash flow on their rental properties to be able to qualify for the next 5% down owner-occupant loan.

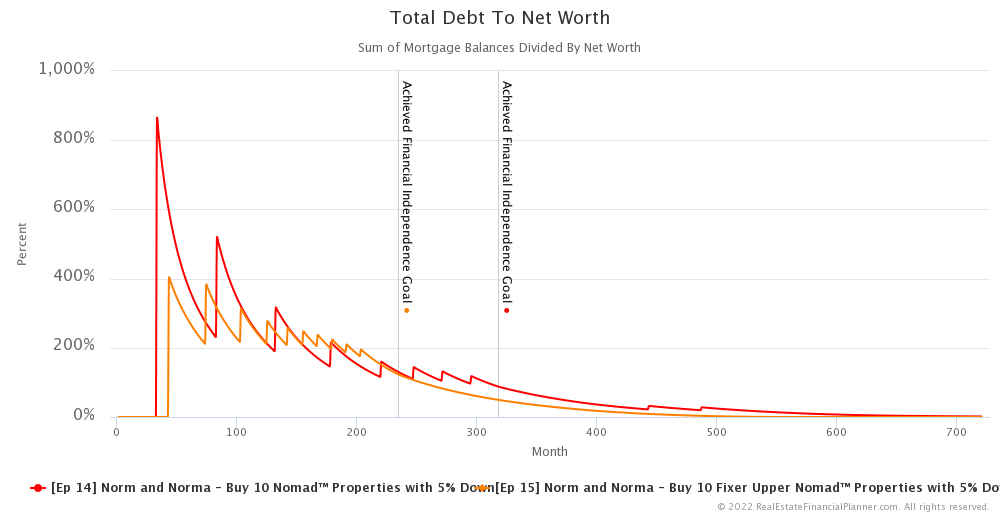

Debt To Net Worth

Besides Rent Resiliency™ and Debt-To-Income we like to also measure risk by looking at how much debt they have compared to their net worth and, separately but related, how much debt they have compared to their liquid net worth in their bank accounts.

Looking at debt to net worth, buying non-fixer-upper properties spikes their debt to net worth early and high with their first two Nomad™ purchases especially. However, buying fixer-upper properties at a discount gives them a net worth bump with each purchase reducing the amount of risk they have with this measure.

Furthermore, by buying properties faster as fixer-uppers, they end up with a lower overall risk later on then continuing to buy properties for a longer period of time when buying non-fixer-upper properties.

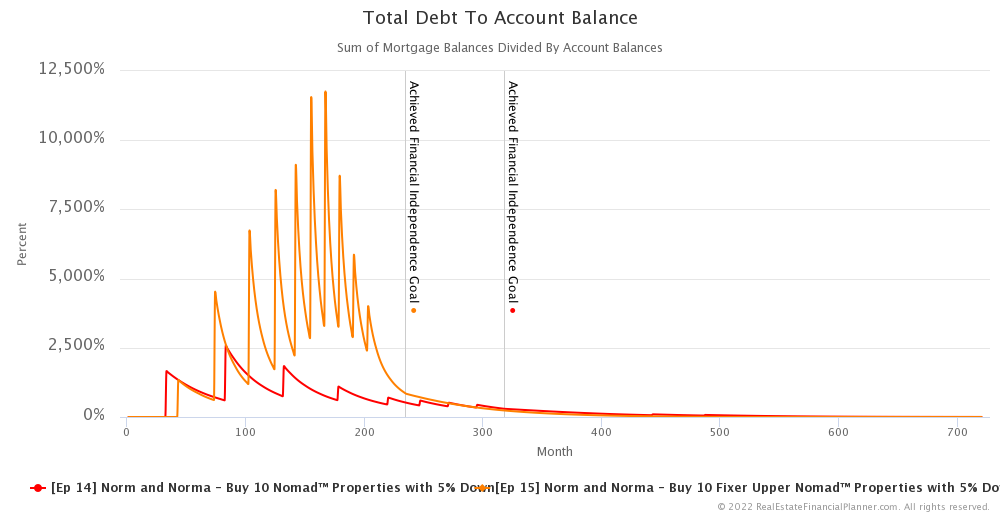

Debt to Account Balances

Now… the risk when measured as debt to account balances or debt to liquid net worth is very different than debt to net worth.

Why?

With improved cash flow buying fixer-uppers, they’re not limited by debt-to-income when buying more properties. That means their account balance is lower as they utilize it earlier for down payments to take on more debt. That means their risk as measured by debt to account balance is much higher for buying fixer-upper properties.

They have more debt… a lot more debt… compared to how much they have in their accounts.

They could help mitigate and reduce this risk by requiring more in reserves before buying their next properties, but they did not when we modeled it for this episode.

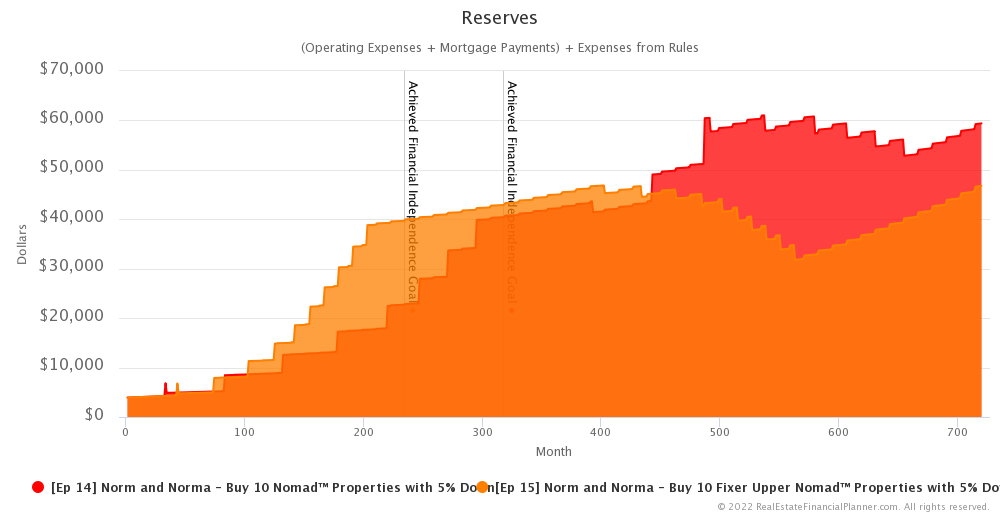

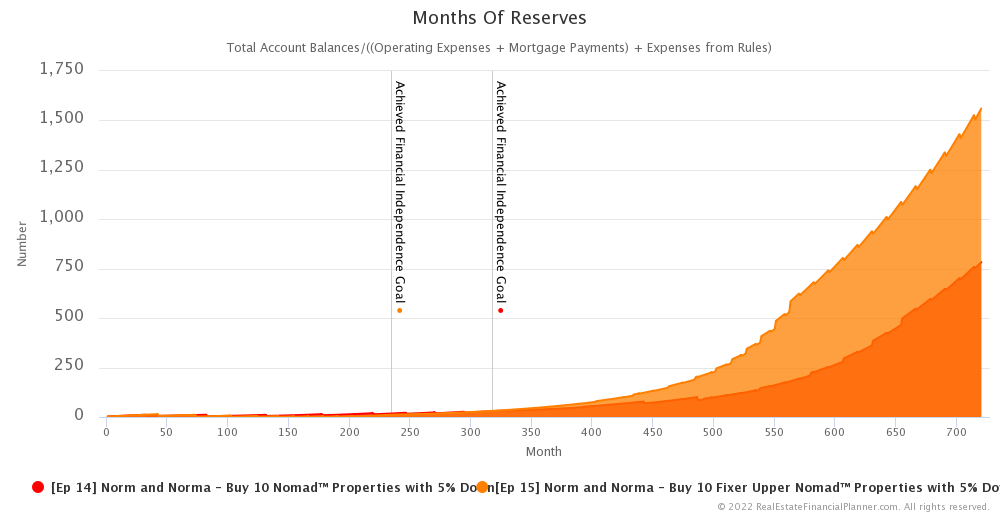

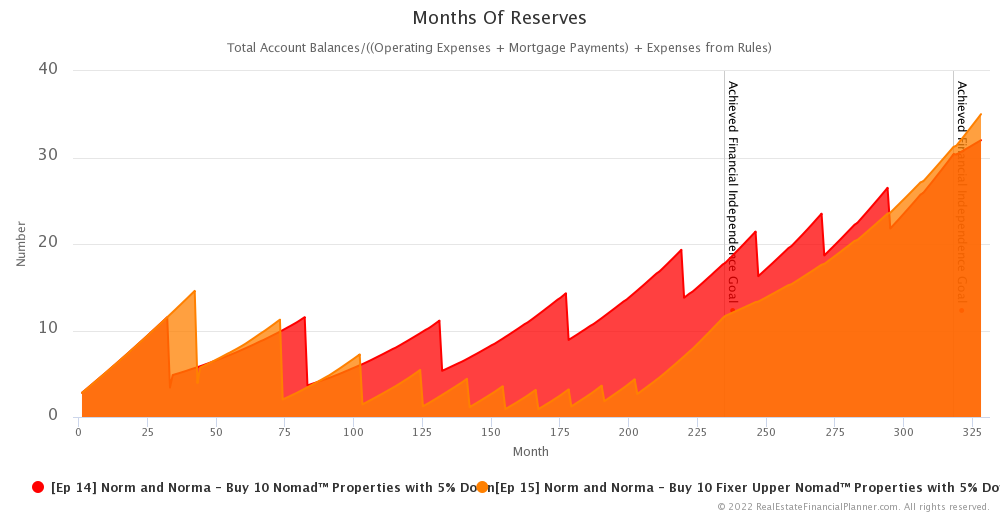

Reserves

Speaking of reserves, buying properties earlier as fixer-uppers means they should set aside more in reserves earlier than they did with traditional Nomad™ from the last episode.

But we did not model it that way.

Instead, we can see there are times when buying fixer-uppers that they end up with a small number of times when they barely have 1 month of reserves for all rental properties and personal expenses and even one instance where they have less than one-month of reserves.

If  Norm and Norma

Norm and Norma

Conclusion

In conclusion,  Norm and Norma

Norm and Norma

It does come with some increased risk, but in some other measures of risk, it is less risky.

While doing this modeling, Norm woke up one night in a cold sweat and an achy back after realizing in a nightmare that this means they’d need to move 10 times to implement this strategy.

Is moving 10 times worth being able to achieve financial independence and stop working years sooner? Maybe, but could there be a way to get the benefits of Nomading™ without having to actually Nomad™ and move themselves?

Well, there might be… come back for the next episode where  Norm and Norma

Norm and Norma

Next Episode

Also, be sure to check out the Advanced Real Estate Financial Planner™ Podcast to see how having variable property appreciation rates and rent appreciation rates, variable mortgage interest rates, variable inflation rate and variable stock market rates of return impacts Norm and Norm as they buy fixer-upper Nomads™.

I hope you have enjoyed this episode about  Norm and Norma

Norm and Norma

Get unprecedented insight into  Norm

Norm Norma’s

Norma’s Scenario with dozens of detailed, interactive charts.

Scenario with dozens of detailed, interactive charts.

Inside the Numbers

Watch the Inside the Numbers video to see exactly how we set up their  Scenario

Scenario

Nomad™

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 14 Norm and Norma - Buy 10 Nomad™ Properties with 5% Down with 2

Ep 14 Norm and Norma - Buy 10 Nomad™ Properties with 5% Down with 2  Accounts, 1

Accounts, 1  Property, and 6

Property, and 6  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Fixer-Upper Nomad™

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 15 Norm and Norma - Buy 10 Fixer Upper Nomad™ Properties with 5% Down with 2

Ep 15 Norm and Norma - Buy 10 Fixer Upper Nomad™ Properties with 5% Down with 2  Accounts, 1

Accounts, 1  Property, and 6

Property, and 6  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Podcast Episodes

The following are the podcast episodes for variations of  Norm

Norm Norma’s

Norma’s

More posts: Norm Episode