Pro Tip: Listen to the podcast below and while you’re listening follow along with the charts below. Then, when you’re done, copy the  Scenario

Scenario

Welcome to the Real Estate Financial Planner™ Podcast. I am your host, James Orr. This is Episode 13.

Today we’re going to continue with  Norm and Norma’s

Norm and Norma’s

Temporarily Reduced Savings Rate as a Homeowner

Norm and Norma

Norm and Norma

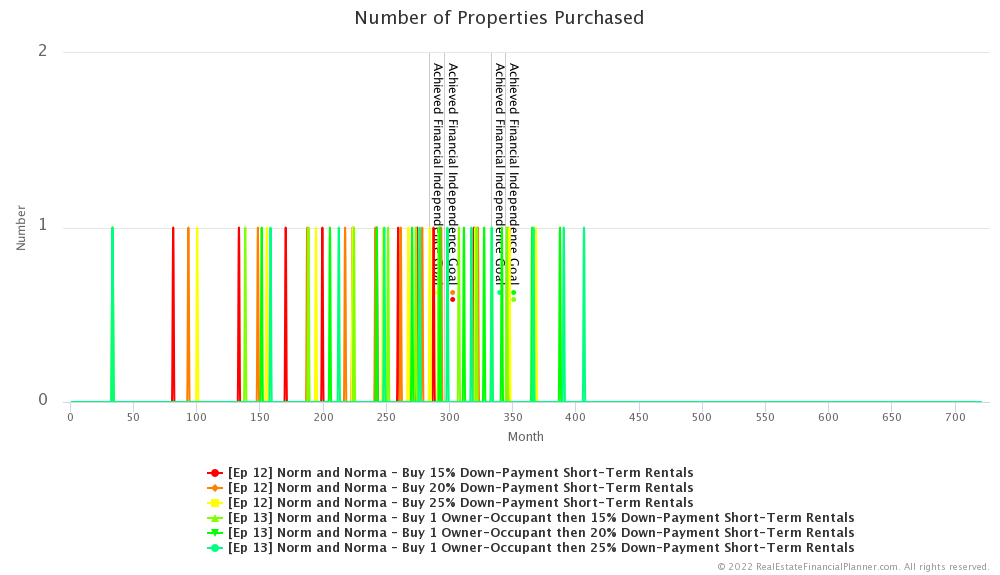

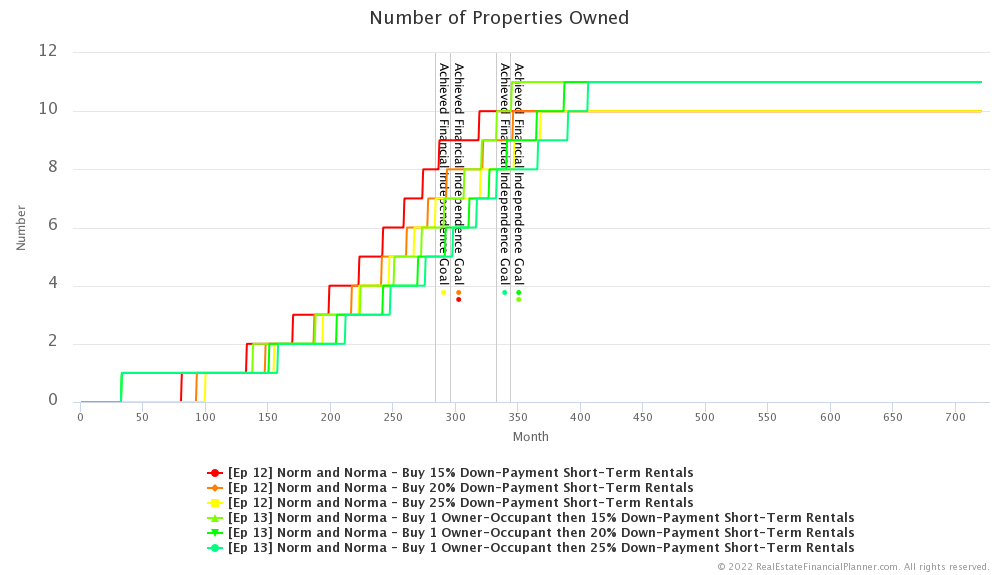

They decide to prioritize buying an owner-occupant property first by saving up a 5% down payment and some closing costs then buying an owner-occupant property to live in.

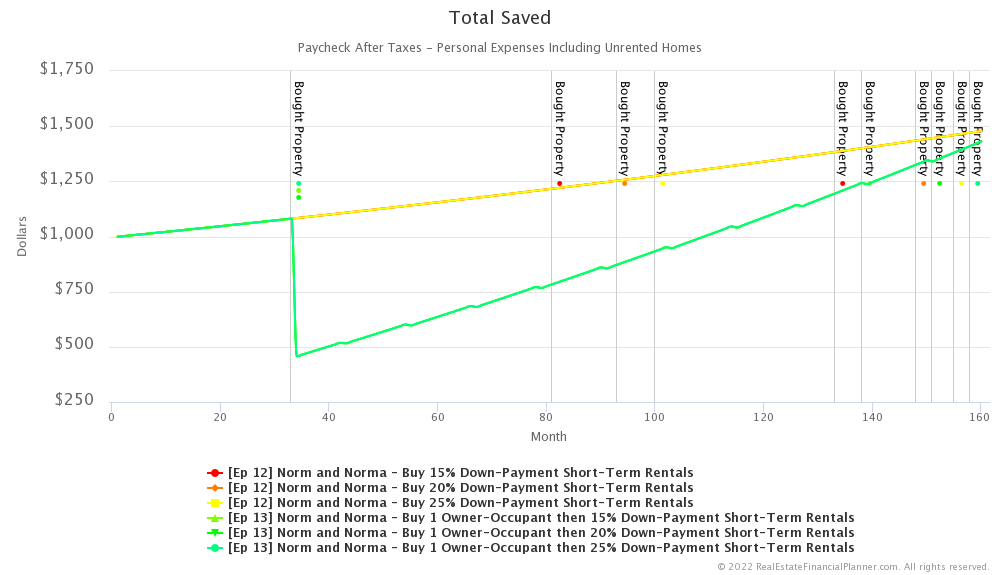

When they buy the owner-occupant property, the monthly payment to own is much higher than what they were paying in rent. It goes up so much that they go from saving about $1,000 per month from their paycheck to saving about $420 per month.

However, over time their savings rate as a homeowner increases because the mortgage payment remains fixed. Eventually, it improves so much that it even surpasses how much they were saving as a renter, but that takes almost 15 years.

Buying a Home Delays Buying First Investment Property

By buying an owner-occupant property that means that it delays when they’re able to buy their first rental property.

Why?

Well, for several reasons… two of which apply and one that could apply but technically doesn’t in their case.

First, they spend part of the down payment they could have used to buy their first rental on buying an owner-occupant property first. This does apply to them.

Second, they reduce how much they’re saving each month from their paycheck so it takes longer to save up for the down payment. This also applies to them.

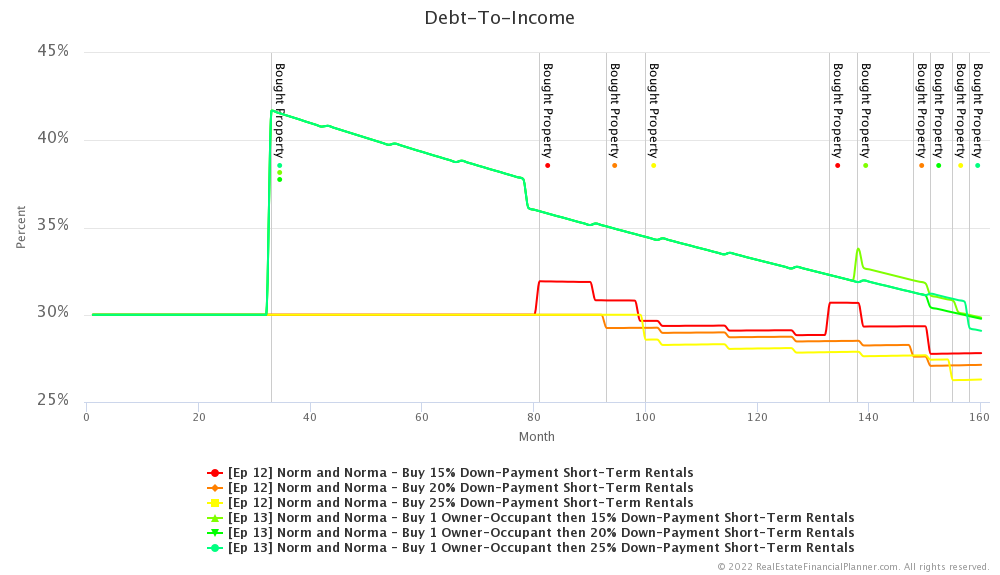

And third, their debt-to-income is higher as a homeowner than it was as a renter…. this could have limited them if they were closer to their debt-to-income limits when buying their next property, but in their case they were not close enough for it to have impacted them.

Financial Independence

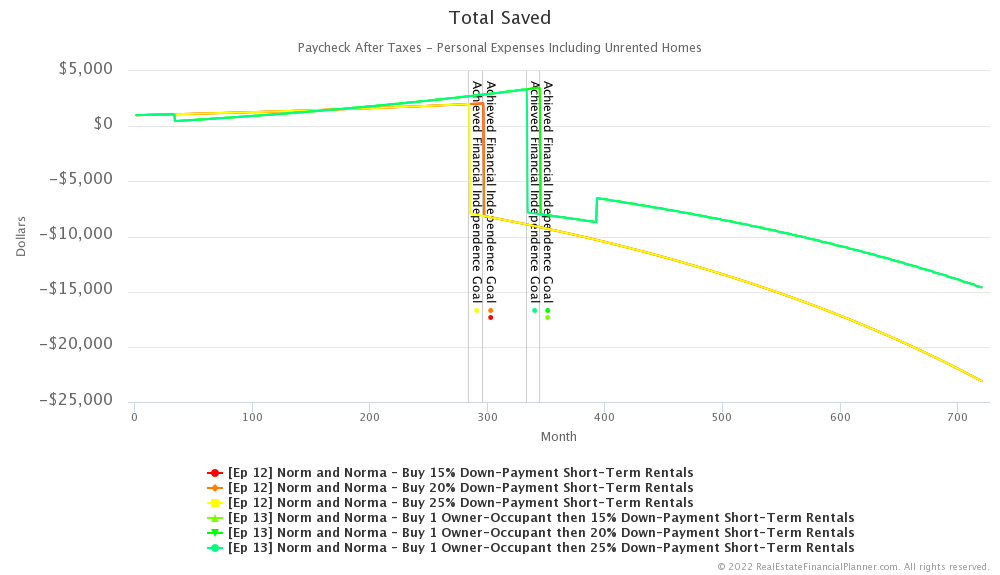

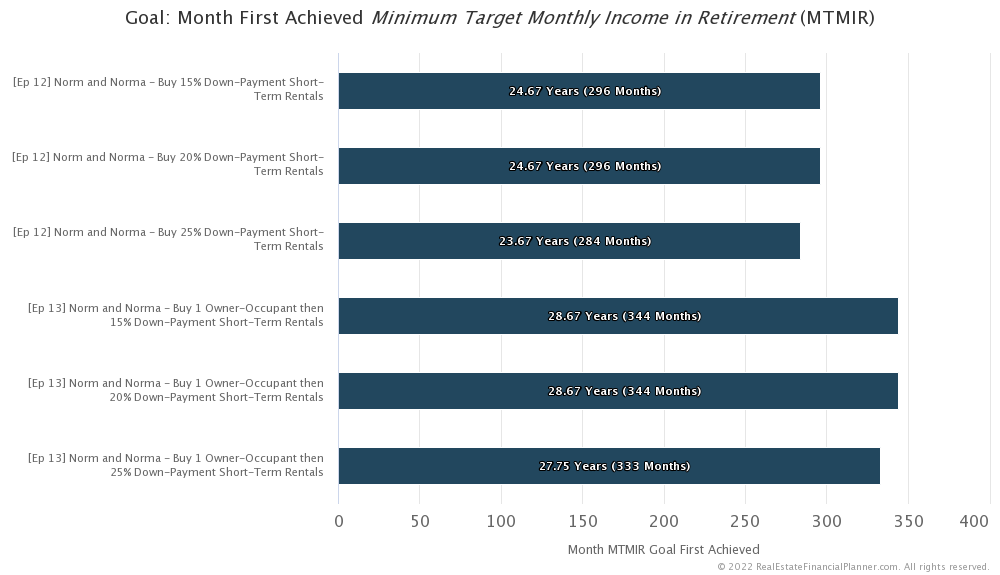

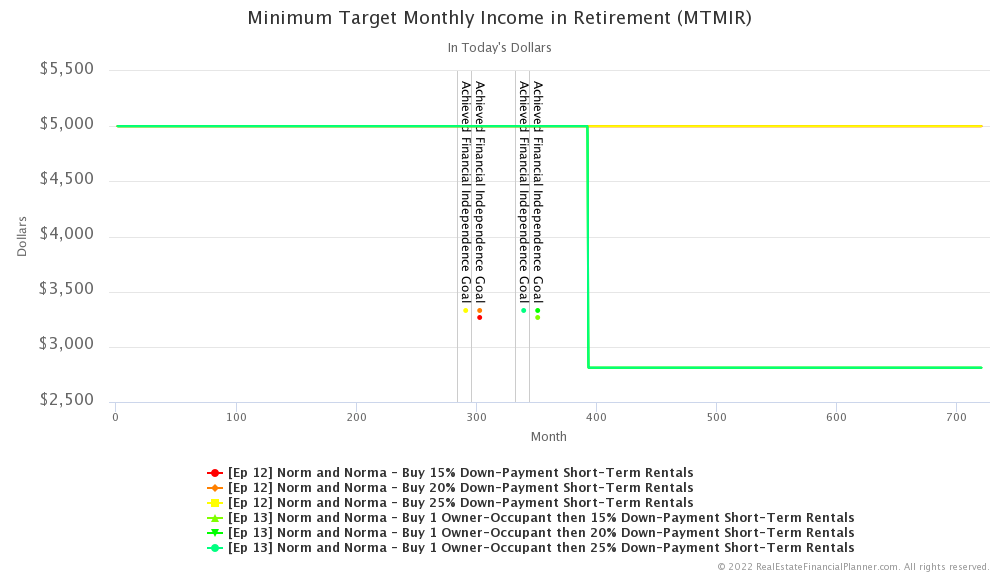

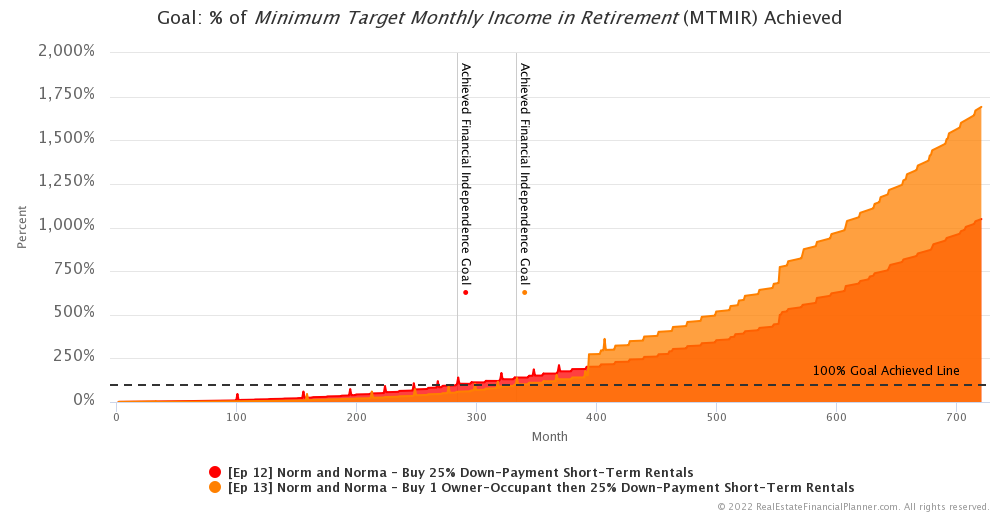

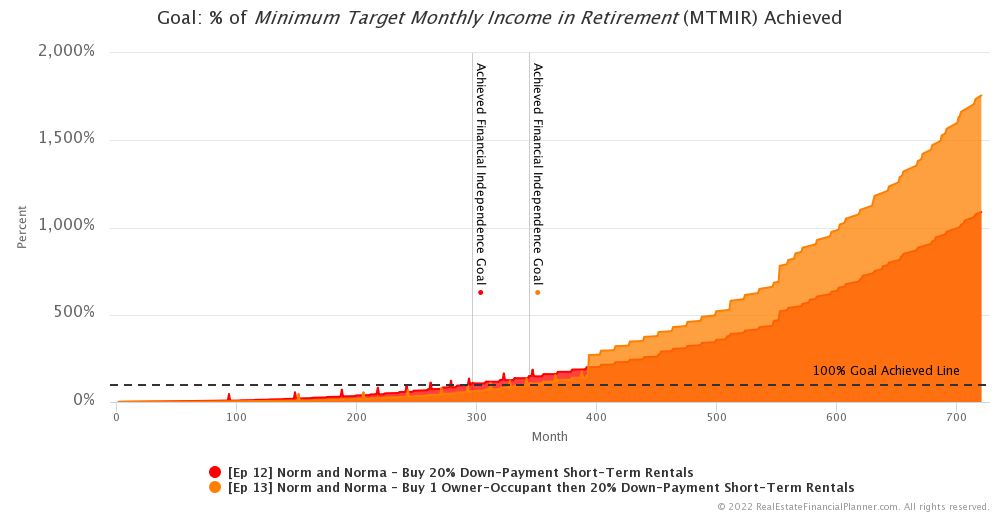

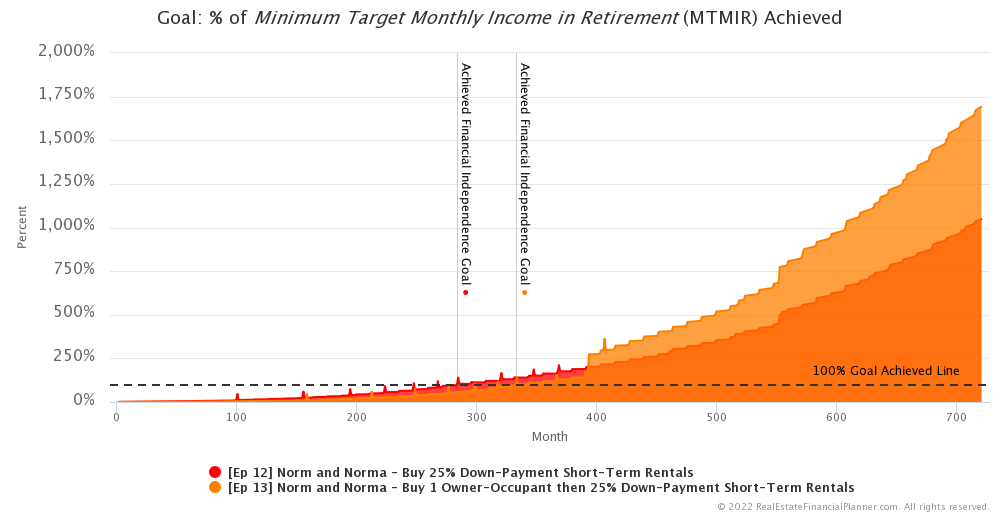

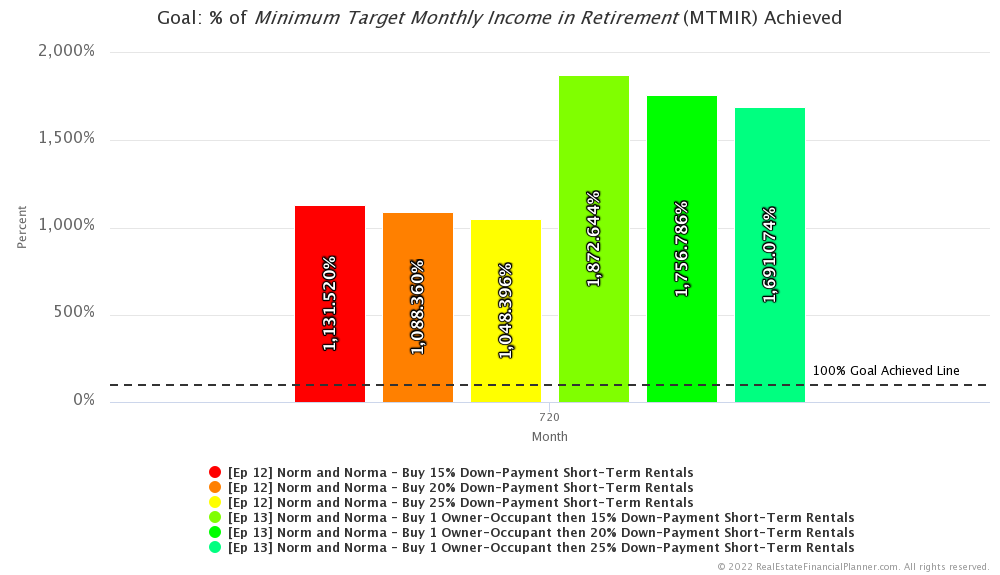

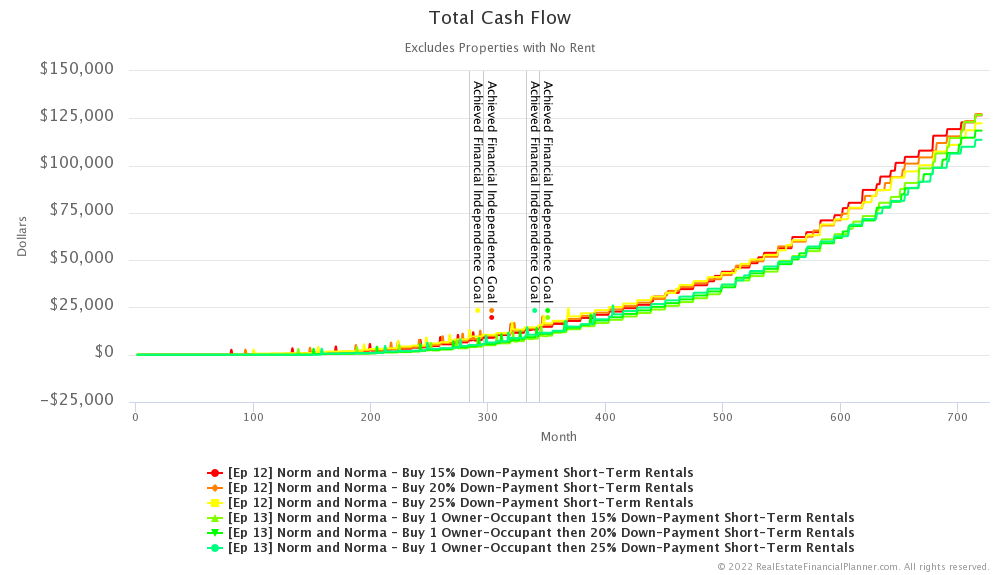

So how does buying an owner-occupant property first and delaying buying the short-term rentals impact their ability to be financially independent?

Well, it takes  Norm and Norma

Norm and Norma

What about 20% down? That’s also the same 4 years longer.

And if they put 25% down? Well, that’s just a tiny bit longer than 4 years… 49 months.

That’s really close enough that I’m going to call all of them about 4 years.

So, the “cost” in terms of delaying financial independence for them buying a home to live in first… is 4 years.

Paying Off Their Owner-Occupant Mortgage

If  Norm and Norma

Norm and Norma

However, they actually were financially independent before their mortgage on their primary residence was paid off… 30 years after they bought it… and the amount they needed to be considered financially independent dropped.

The benefit they get by paying off their mortgage is that it increases how much they can spend on other expenses. In other words, it increases their standard of living.

So, even though it takes them 4 years longer to achieve financial independence, they could… although we did not model it this way… but they could live at a higher standard of living once they pay off their owner-occupant mortgage.

And out of an abundance of clarity I mean they can live at a higher standard of living than they could if they didn’t buy an owner-occupant property but still purchased short-term rentals. I make this clarification because in both cases where they’re buying short-term rentals they can live at a much higher standard of living than what we have them living… which is just maintaining the same standard of living  Norm and Norma

Norm and Norma

For example, they could literally be sustaining a standard of living that is more than 10 times what they are currently living at if they rent and do short-term rentals at the end of our modeling. But, by that same end of our modeling in year 60, they can live at a 70% EVEN HIGHER standard of living by buying an owner-occupant property. In other words, they could live at about 17 times what they were living at.

Now, I believe in having a healthy buffer between what they COULD live at and what they do live at, but living on one-seventeenth of what you could be living on is even a little extreme for my conservative standards.

If after doing some of our advanced Alternate Universe Modeling™ with more realistic, random returns it is still super conservative, we could do some additional modeling and consider maybe some of the following options:

- Raise their standard of living so they’re not still living on what they were earning while working.

- Be a little more aggressive in moving up when they achieve financial independence by selling some of the rentals to pay off the remaining rentals.

- Reducing the work needed and converting the short-term rentals into long-term rentals or maybe even switch to a more passive investment like REITs, stocks and/or bonds by selling the short-term rentals.

- Buy fewer than 10 short-term rental properties to begin with.

These are just some ideas that we could test on this strategy and other strategies where they are living significantly below what they could support with their asset base.

But enough of my digressions, let’s get back to discussing the impact of buying an owner-occupant property and then 10 short-term rentals for  Norm and Norma

Norm and Norma

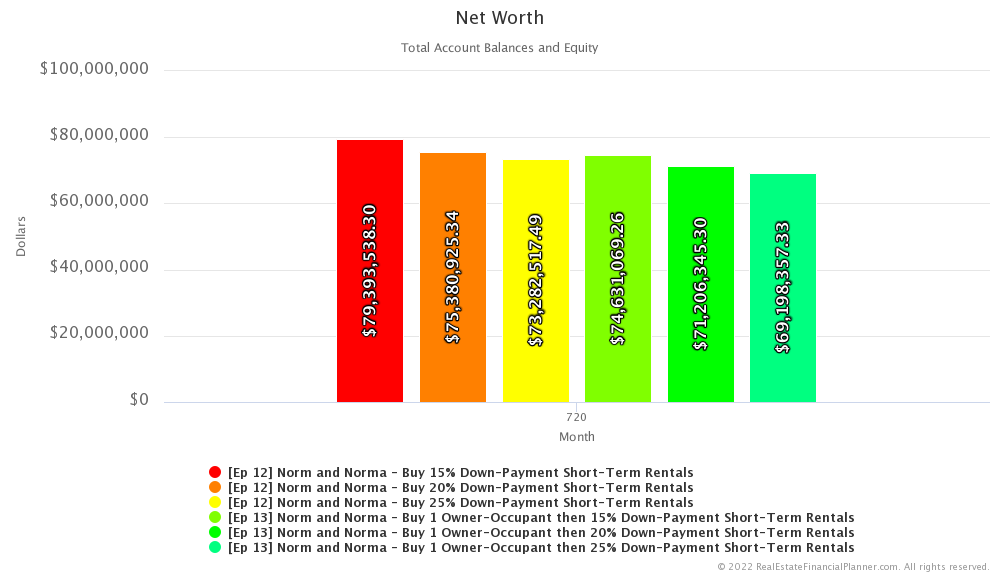

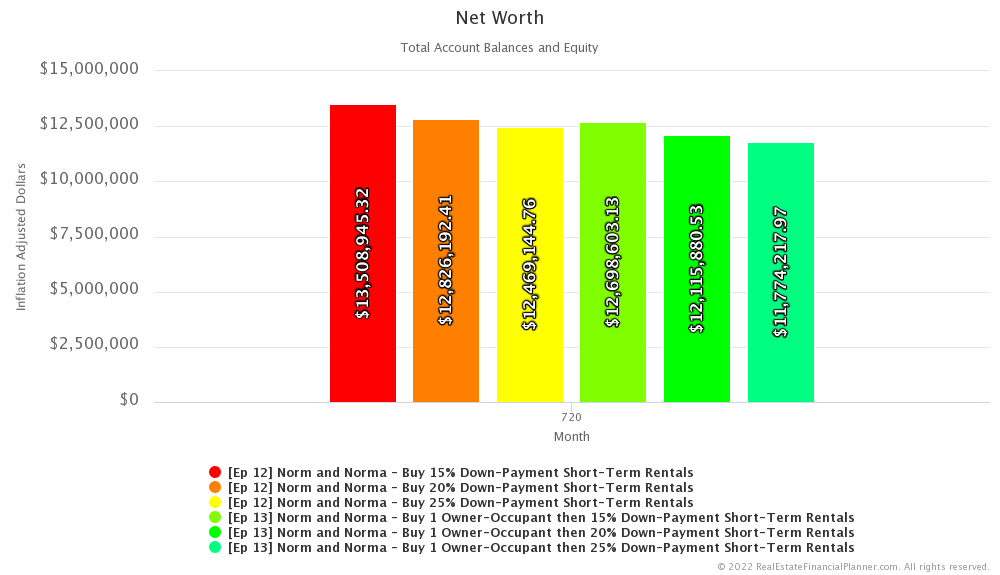

Net Worth

Let’s talk about net worth.

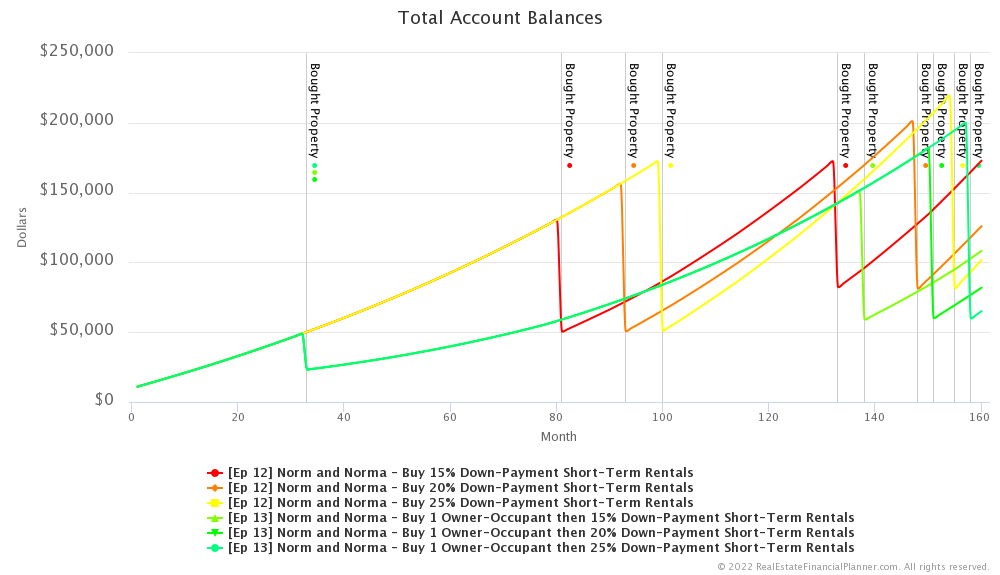

Buying an owner-occupant property results in a lower net worth.

For example, with 15% down,  Norm and Norma

Norm and Norma

If we adjust back to today’s dollars, that’s approximately an $800K difference… the difference between $13.5 million and $12.7 million. So, about 6% more net worth by renting instead of buying an owner-occupant property and working about 4 more years.

Risk

Let’s finish up this episode by taking a few moments to discuss risk.

Is it riskier for Norma and Norma to buy an owner-occupant property or to rent before buying 10 short-term rentals?

In previous episodes we’ve discussed some of the reasons related to risk where they might prefer to be a homeowner so I won’t cover those again here, but I will comment on some of our measurable risks.

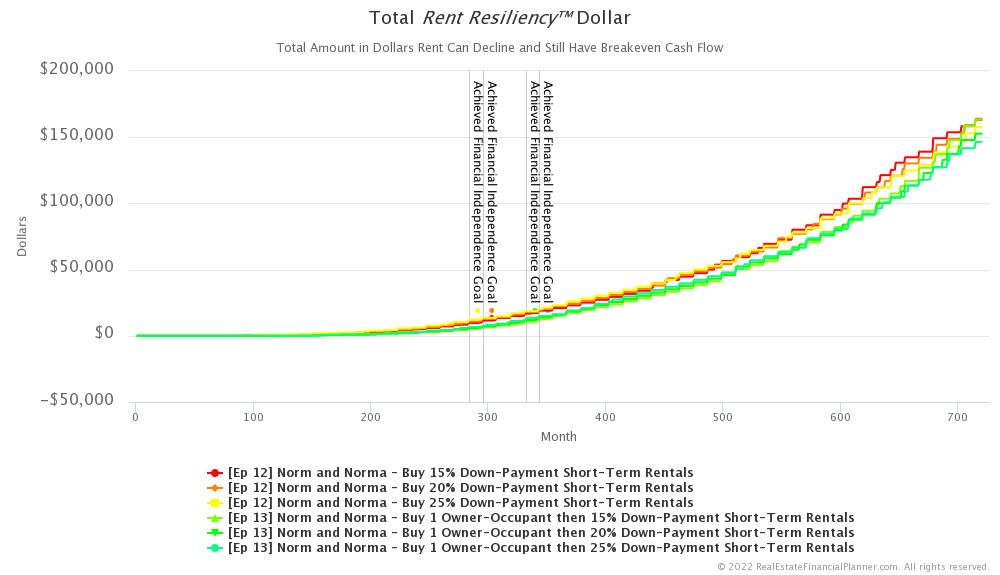

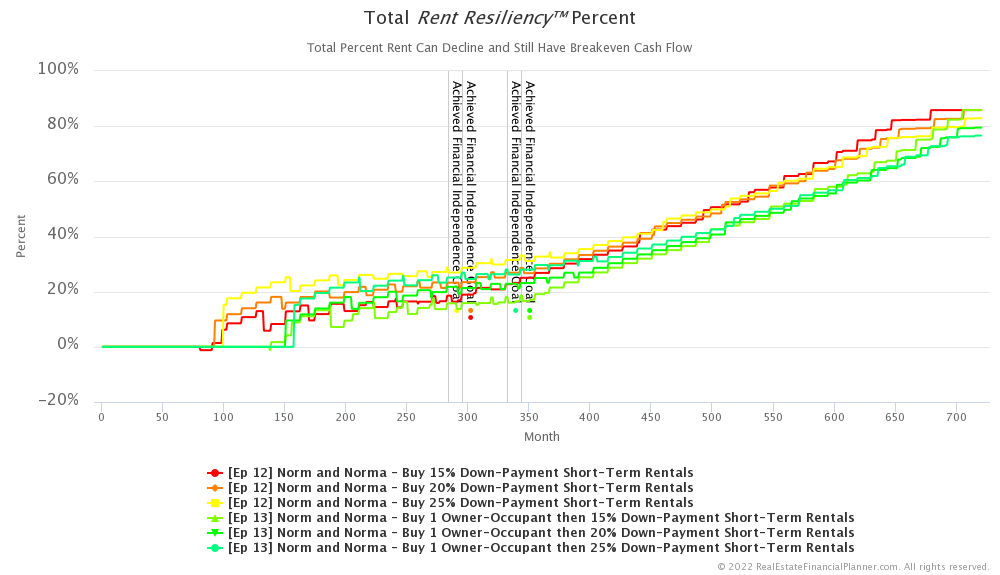

Rent Resiliency™

For example, let’s talk about how resilient they are to rents dropping which we call Rent Resiliency™.

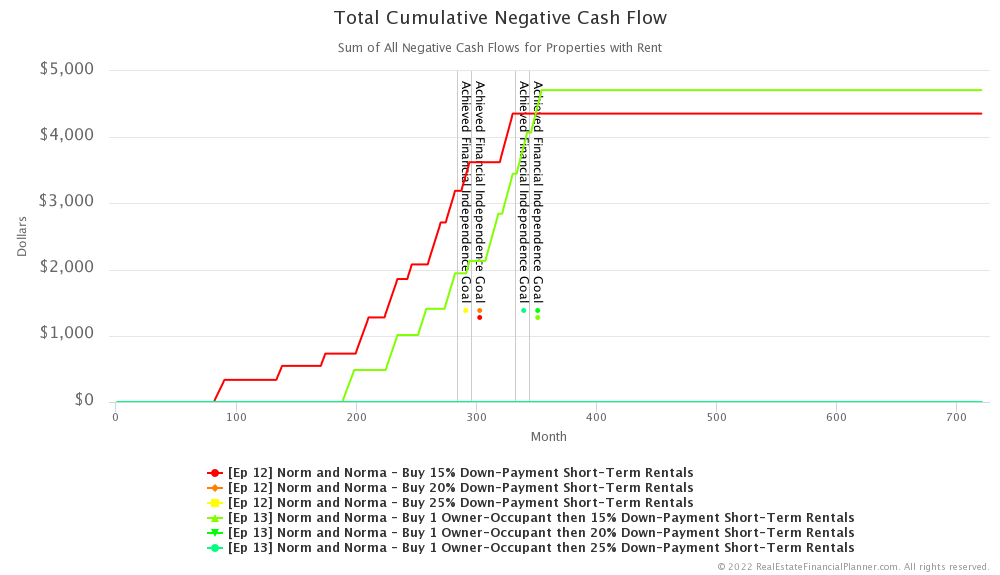

By buying an owner-occupant property, they do buy their rentals later which makes them a little more risky in terms of Rent Resiliency™.

This is really because their cash flow is shifted out later by buying the rentals later.

As an aside, this also means that the negative cash flow they’d have if they only put 15% down to buy their short-term rentals gets shifted too.

But getting back to Rent Resiliency™… really what they’re doing is just shifting their Rent Resiliency™ risk later into their model. So, they remain riskier for a little longer by buying short-term rental properties later. Similar risk profiles just shifted to later.

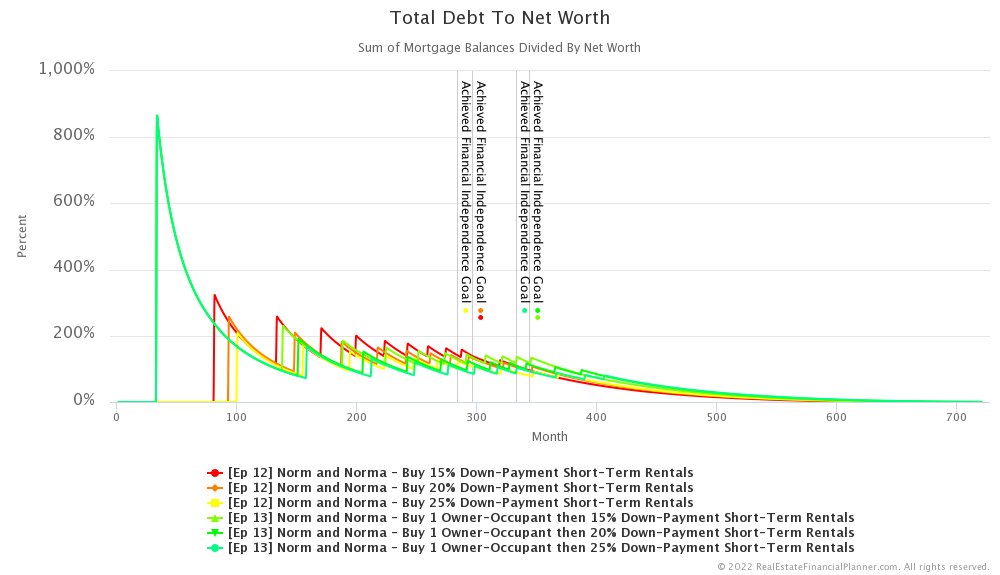

Total Debt to Net Worth

Another way to measure risk is to look at the total debt they have compared to their net worth. When we compare buying an owner-occupant property with 5% down versus renting, the risk for buying an owner-occupant property is much higher when we look at total debt to net worth.

Why?

Putting 5% down to buy a property with little else saved with this measure of risk is a high-risk activity. It spikes this risk measurement over 865% where just renting maxes out at about 325%.

All the extra risk with the debt to net worth measurement is front-loaded… it appears when they buy that first owner-occupant property with just 5% down. If they had put more down, it would have been less extreme.

And, later on in our modeling, having the equity in that owner-occupant property actually reduces the risk that  Norm and Norma

Norm and Norma

So, when buying an owner-occupant property this risk spikes early and high, but it actually reduces risk later in all but one way… by buying an owner-occupant property they end up buying their last short-term rentals later so the risk gets extended a little bit too.

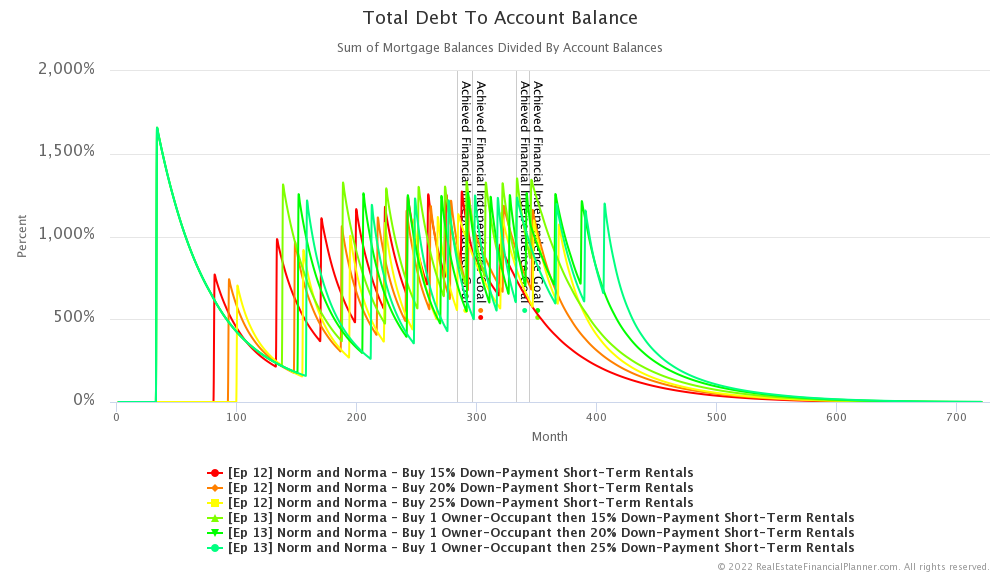

Debt to Account Balance

Everything I just said about debt to net worth can also be applied to debt to account balances… which is a better measure of how much debt they have compared to their liquid net worth.

Just like with debt to net worth, debt to account balances gives a big spike of risk when they buy an owner-occupant property with 5% down, but it helps to keep the overall risk down during the middle part of the modeling. However, since buying an owner-occupant property extends how long it takes to acquire all 10 short-term rentals, they end up having this risk remain higher for a little longer as they finish up buying the short-term rentals.

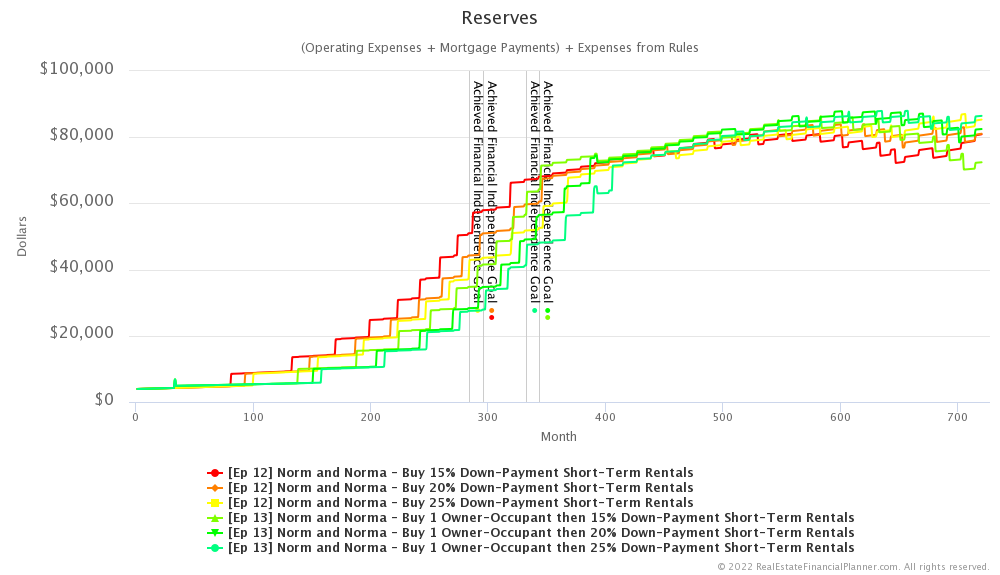

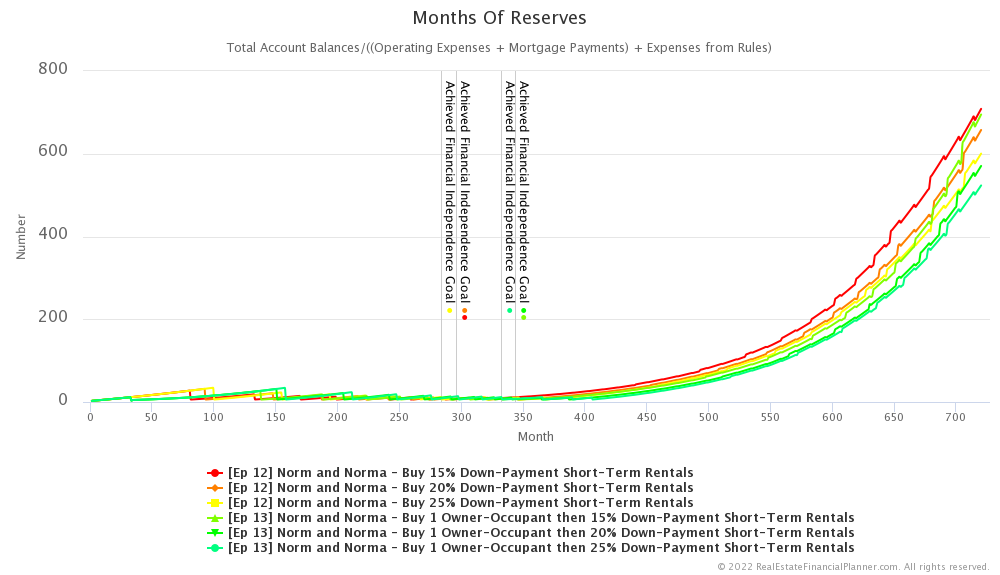

Reserves

Finally, let’s talk about reserves to wrap up our discussions about risk.

Buying rentals faster by renting instead of buying an owner-occupant property hurts them a little in that they need to have more reserves sooner. Sure, they need slightly more reserves when they first buy their owner-occupant property since it is more expensive to own than to rent, but as they acquire rentals faster, their need for reserves is slightly higher sooner.

However, once they pay off their owner-occupant mortgage… or any mortgage for that matter… their need for reserves does drop a bit with each property that is paid off.

Overall, since we require 6 months of reserves to buy the next property in all the scenarios, they tend to not drop below six months of reserves.

Eventually though, they end up with more cash in their accounts by buying rental properties earlier and therefore end up with more months of reserves by buying the short-term rentals earlier as a renter.

Conclusion

In conclusion, there is a cost to  Norm and Norma

Norm and Norma

That cost is about 4 more years of working, lower net worth and a more aggressive risk curve in several cases due to the 5% down owner-occupant loan.

But a lot of these risks are mitigated later on and there is some protection from periods of high inflation that they protect themselves from by locking in their housing costs with a fixed interest rate 30-year mortgage for the home they’re living in. They would no longer be subject to their landlord increasing rents in a high inflation environment.

The decision to buy an owner-occupant property is one they’d need to carefully consider.

Next Episode

You know, talking about them buying an owner-occupant property has got me thinking. What if they bought an owner-occupant property with 5% down and instead of waiting to have 15%, 20% or 25% down payments saved to buy a rental… what if they waited until they had another 5% down payment and bought a second home to live in and moved into that property while converting the previous to a rental. They still end up a rental and a home to live in, but they did not have to save up 5% and 15% or 20% or 25%… instead they only had to save up two 5% down payments for two owner-occupant properties.

And, you know another advantage of doing that strategy is that the interest rates for owner-occupant properties are better than the interest rates they could get for investment rental properties.

What if they repeated that process 10 times until they had 10 rental properties? They’d be able to buy 10 properties with the equivalent down payments for two and half 20% down payments.

Well, that’s what we call the Nomad™ real estate investing strategy… serially buying owner-occupant properties and then converting them to rentals and it is what we will cover in the next episode.

Also, be sure to check out the Advanced Real Estate Financial Planner™ Podcast to see how having variable property appreciation rates and rent appreciation rates, variable mortgage interest rates, variable inflation rate and variable stock market rates of return impacts  Norm and Norma

Norm and Norma

I hope you have enjoyed this episode about  Norm and Norma

Norm and Norma

Get unprecedented insight into  Norm

Norm Norma’s

Norma’s Scenario with dozens of detailed, interactive charts.

Scenario with dozens of detailed, interactive charts.

Compare “renting and buying short-term rentals versus owning and buying short-term rentals” in pairs by down payment:

Or, compare all of them together. Please be aware that with 6 variations on the same chart, they can be a bit cluttered and harder to interpret.

Inside the Numbers

Watch the Inside the Numbers video to see exactly how we set up their  Scenario

Scenario

Renting and Buying Short-Term Rental Properties

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 12 Norm and Norma - Buy 15% Down-Payment Short-Term Rentals with 2

Ep 12 Norm and Norma - Buy 15% Down-Payment Short-Term Rentals with 2  Accounts, 1

Accounts, 1  Property, and 6

Property, and 6  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 12 Norm and Norma - Buy 20% Down-Payment Short-Term Rentals with 2

Ep 12 Norm and Norma - Buy 20% Down-Payment Short-Term Rentals with 2  Accounts, 1

Accounts, 1  Property, and 6

Property, and 6  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 12 Norm and Norma - Buy 25% Down-Payment Short-Term Rentals with 2

Ep 12 Norm and Norma - Buy 25% Down-Payment Short-Term Rentals with 2  Accounts, 1

Accounts, 1  Property, and 6

Property, and 6  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Owning and Buying Short-Term Rental Properties

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 13 Norm and Norma - Buy 1 Owner-Occupant then 15% Down-Payment Short-Term Rentals with 2

Ep 13 Norm and Norma - Buy 1 Owner-Occupant then 15% Down-Payment Short-Term Rentals with 2  Accounts, 2

Accounts, 2  Properties, and 7

Properties, and 7  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 13 Norm and Norma - Buy 1 Owner-Occupant then 20% Down-Payment Short-Term Rentals with 2

Ep 13 Norm and Norma - Buy 1 Owner-Occupant then 20% Down-Payment Short-Term Rentals with 2  Accounts, 2

Accounts, 2  Properties, and 7

Properties, and 7  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 13 Norm and Norma - Buy 1 Owner-Occupant then 25% Down-Payment Short-Term Rentals with 2

Ep 13 Norm and Norma - Buy 1 Owner-Occupant then 25% Down-Payment Short-Term Rentals with 2  Accounts, 2

Accounts, 2  Properties, and 7

Properties, and 7  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Podcast Episodes

The following are the podcast episodes for variations of  Norm

Norm Norma’s

Norma’s

More posts: Norm Episode