Alternate Universe Modeling™ is our version of doing  Monte Carlo

Monte Carlo Scenarios

Scenarios

In the simplest terms you take a  Scenario

Scenario

For example, check out  Andrea

Andrea

That does NOT utilize Alternate Universe Modeling™ but we could add variability to:

- Yearly Rate of Return for money in

Accounts

Accounts - Appreciation Rate for

Properties

Properties Scenario

Scenario - Rent Appreciation Rate for

Properties

Properties Scenario

Scenario - Mortgage Interest Rates for

Properties

Properties Scenario

Scenario - Inflation Rate for the

Scenario

Scenario

Using the Real Estate Financial Planner™ software you could make almost anything variable. But these tend to be the most common ones to make variable when we do Alternate Universe Modeling™.

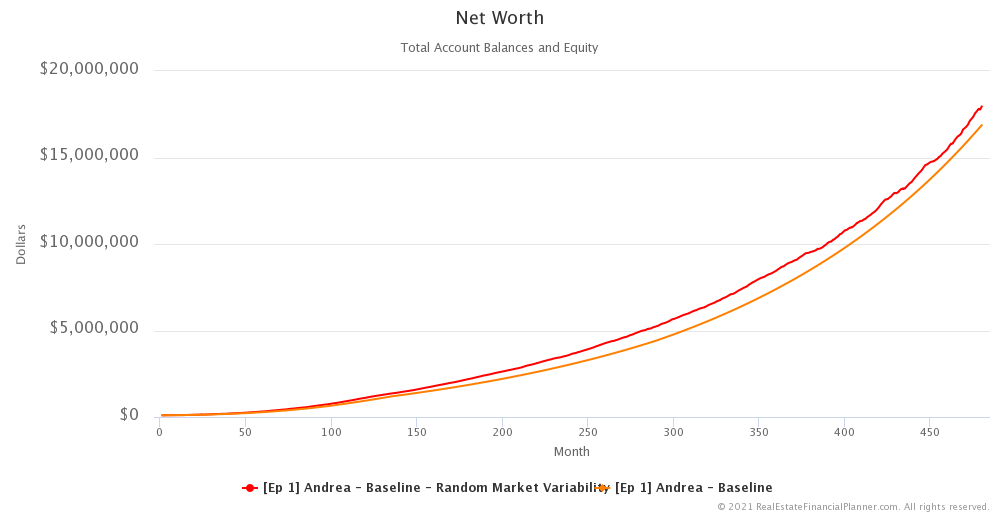

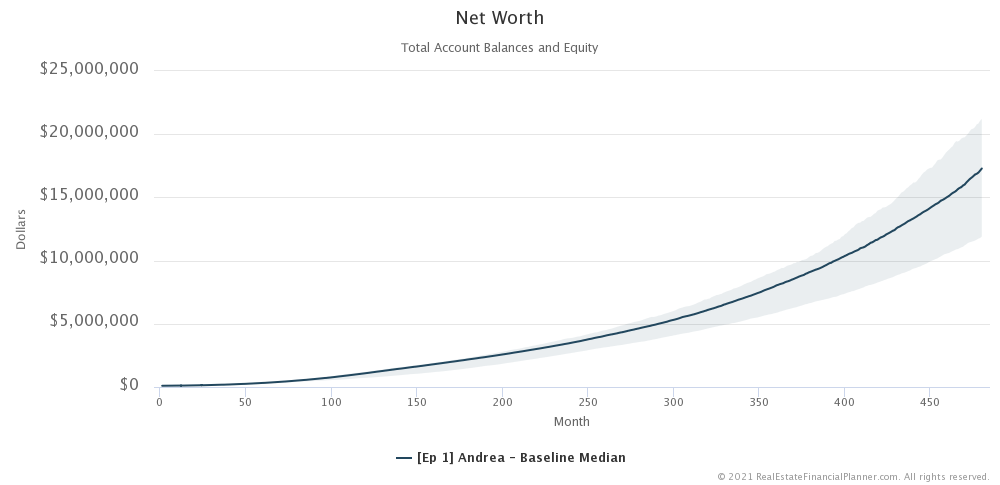

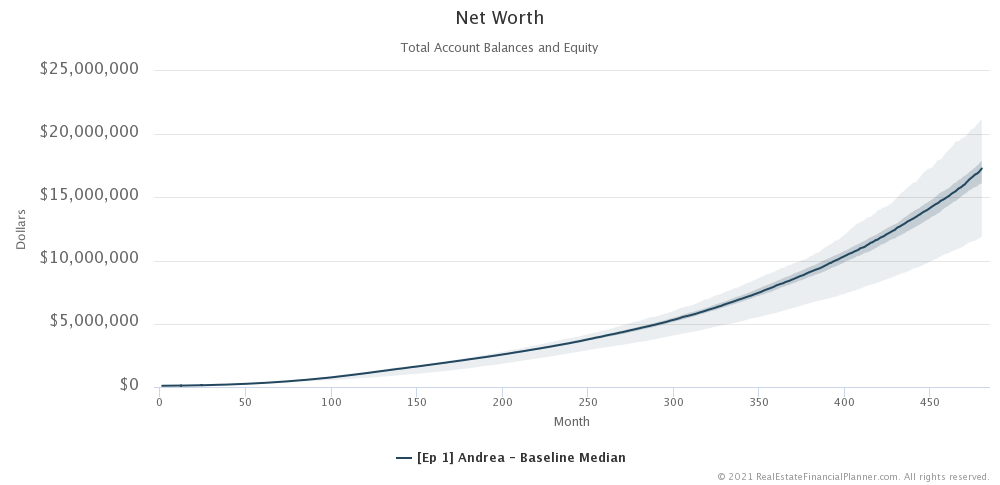

With the basic model, you tend to get relatively smooth lines. For example, here’s a chart comparing Net Worth when we have all static assumptions versus Net Worth for a single run where all the things we discussed above were variable.

If we were to run the one where everything was variable again, it would be different. Home prices would go (and maybe down) at different rates each month. Rents too. That would change Cash Flow. And, mortgage interest rates which would also impact Cash Flow.

Each time we run it, that’s an Alternate Universe where things in the future happened (slightly) differently.

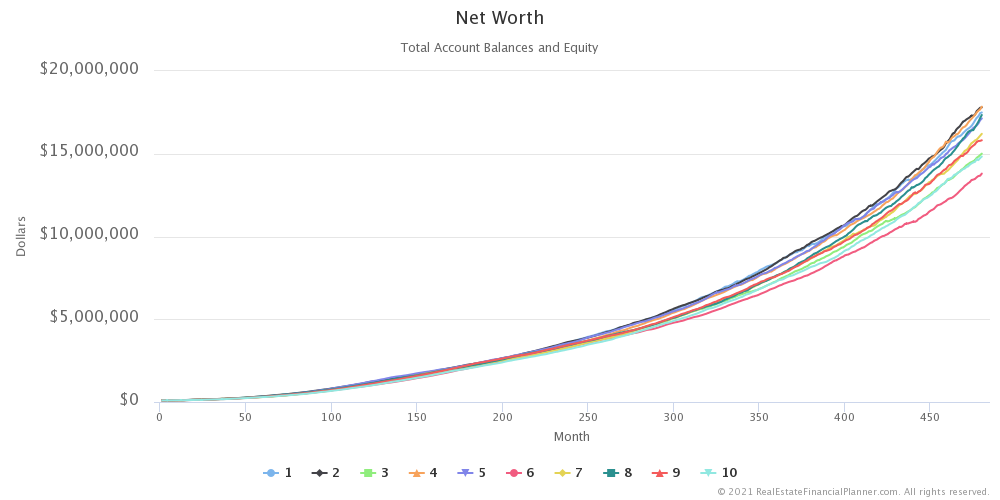

For example, here’s 10 Alternate Universes for the same Net Worth and the same  Scenario

Scenario

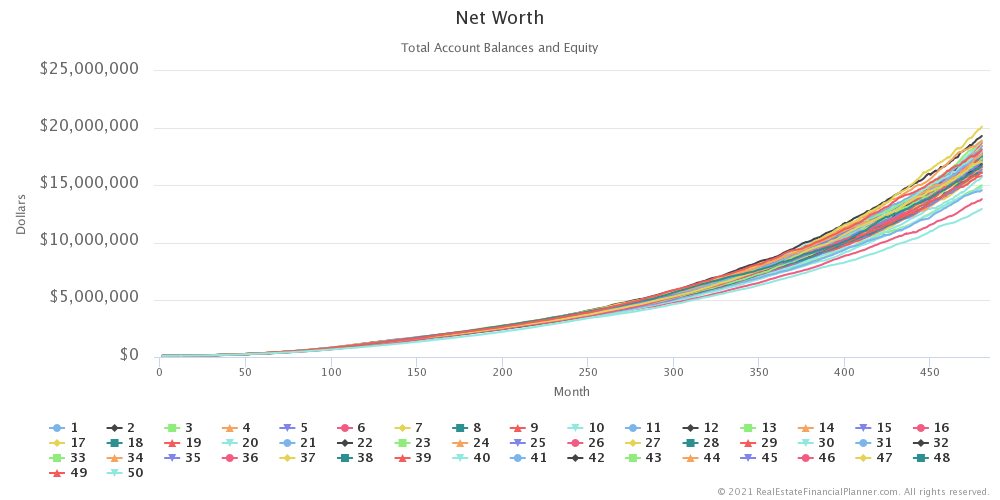

If we did it 50 times, we’d see the results for 100 different Alternative Universes.

If we run it 100 times, it actually breaks our charting application trying to export the image. And, it is really hard to see what’s going on anyway.

Instead, we tend to summarize all the runs and show the range of values. For example, here’s the 100 runs just showing the band for the best run and worst run (the extremes).

The dark blue line in the middle is the median (the middle most case). Half of the runs are better than the median. Half of the runs are worse.

I could also show you the 25th and 75th percentiles as well. The darker band of blue in the middle now represents 50% of all the runs.

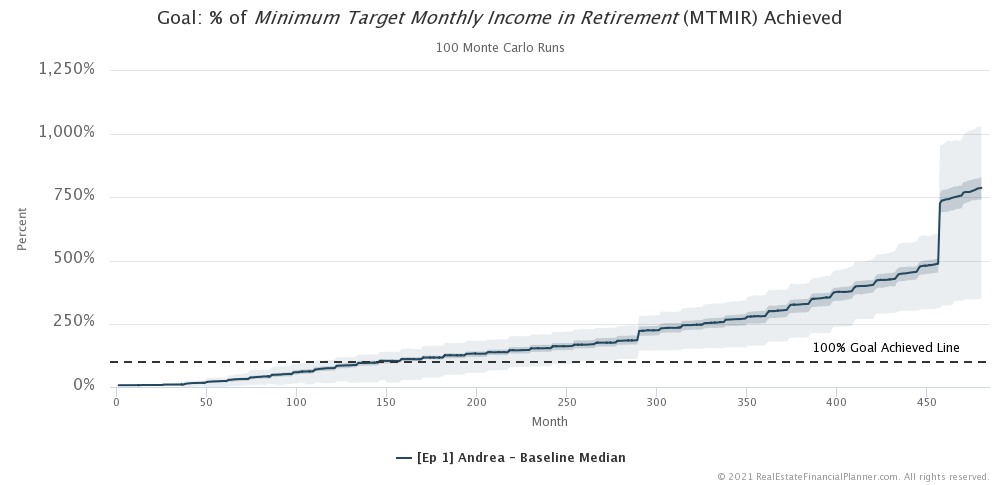

While we’ve been showing you Net Worth with our Alternate Universe Modeling™ we can show  Charts

Charts Scenario

Scenario Account

Account Property

Property

Want to see a  Chart

Chart

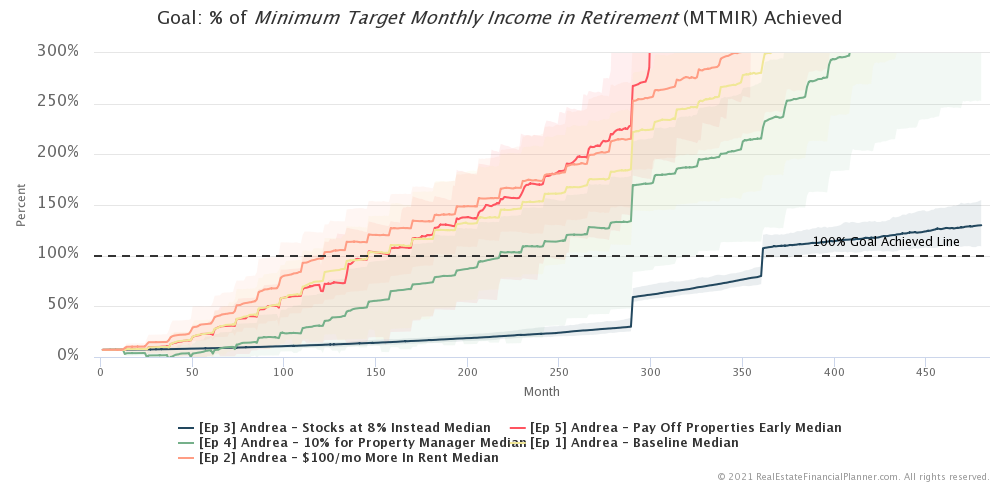

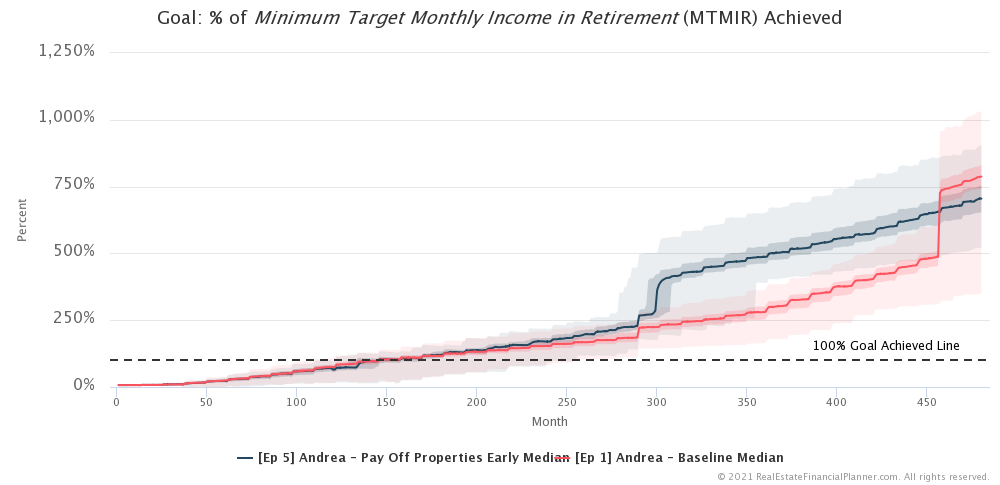

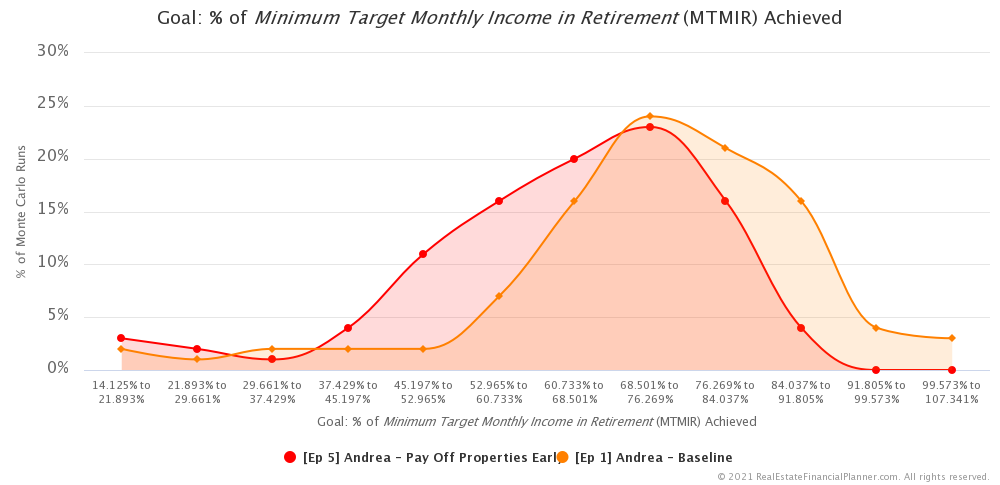

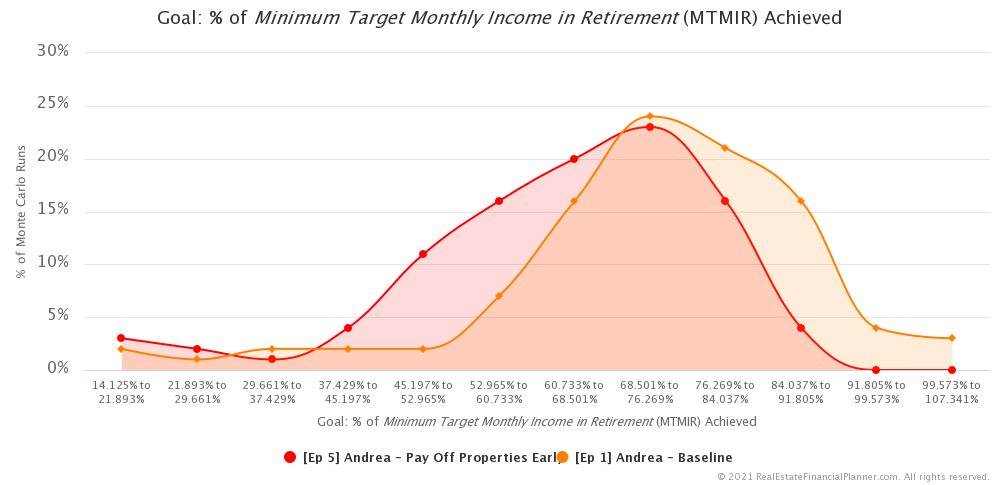

Want to compare how the strategy for  Andrea

Andrea

Yes, I thought you might. Here you go…

When we discussed this using the more basic, static returns we suggested that that paying off properties seemed to allow her to achieve financial independence a little faster. When we run it using Alternate Universe Modeling™ we see a more nuanced understanding of it.

For example, here’s a zoom into month 120 (year 10), where we see the odds of her having achieved financial independence.

She has a slightly higher chance of getting closer to financial independence by NOT paying off her properties early. Well, that’s certainly interesting.

If we add in Ep 4: Andrea Hires Professional Property Manager, we can see that… as we’d expect… that means she is less likely to achieve financial independence as fast hiring a professional property manager.

Check out our more advanced Alternate Universe Modeling™ for other  Scenarios

Scenarios