Andrea

Andrea Character

Character

Andrea’s Past

- 40 years old

- Has her accounting degree from Arizona State University

- Works in accounting for a small manufacturing business

- Earns about $4,000 per month ($48,000 per year) and that keeps pace with inflation

- Divorced, single mom with 2 small boys (age 2 and 4)

- Has $100K saved up including some of the joint proceeds from the sale of a previous home

- Money is going to be tight supporting her and two kids on just her salary so not a lot to save

- Wants to be able to provide for her family, save for retirement

- Original plan was to buy two rental properties with 20% down payment and rent while she saves up for 5% down payment for a property to live in

- If she had done that, she’d have small positive cash flow from the rentals (her savings)

- Decides to buy a home with 5% down and while talking to the lender and her real estate agent realizes that she is required to stay in the property for a year, but could covert them to rentals after a year

- This would allow her to buy more properties and have a larger asset base (less immediate cash flow)

- Income: $48,000/year ($4,000/month)

- City, State Live: Non-Specific

- City, State Invest: Non-Specific

- Primary Strategy: Nomad™

- Saving Per Month: $0

- Starting Account Balances (Saved): $100,000 from divorce proceeds

- Relationship Status: Divorced

- Kids: Two boys (ages 2 and 4 at start)

- Job Type: Accountant for Small Manufacturing Company

- Education: Bachelor’s in Accounting from ASU

- Fear: Not Being Able to Provide For Kids

- Debts: No Debts

- Real Estate Owned Prior to Start: None

- Price of Properties To Purchase: $250,000

Andrea’s Present

- Reluctant to make significant decisions quickly after the divorce. She wants to take some time to think, plan and reflect.

- She meets with her friend who is a real estate agent to discuss buying a home to live in with her two boys.

- Her real estate agent friend puts her in touch with a lender where she discusses loan options.

Andrea’s Future

Andrea is focused on providing the best life for her 2 boys (ages 2 and 4 at the start).

She is also concerned about saving enough money for retirement.

Ideally she’d spend all the money from her accounting job providing for her kids and use the $100,000 she has saved for funding her retirement. Ideally, she’d like to be able to retire early if possible.

Her job isn’t bad and she enjoys the work and the people she works with, but it is not something she’s passionate about.

Podcast Episodes

The following are the podcast episodes for variations of Andrea’s story.

More posts: Andrea Episode

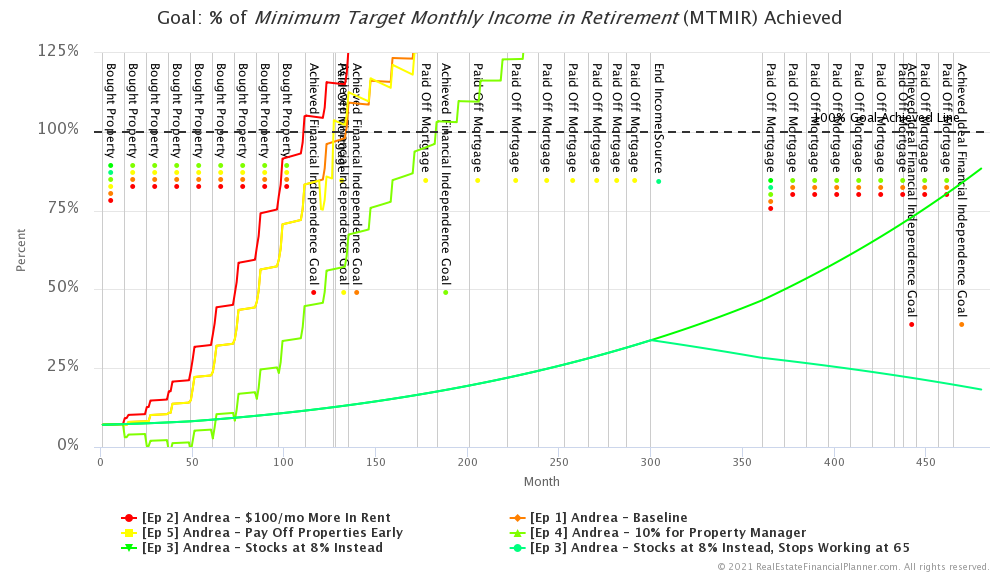

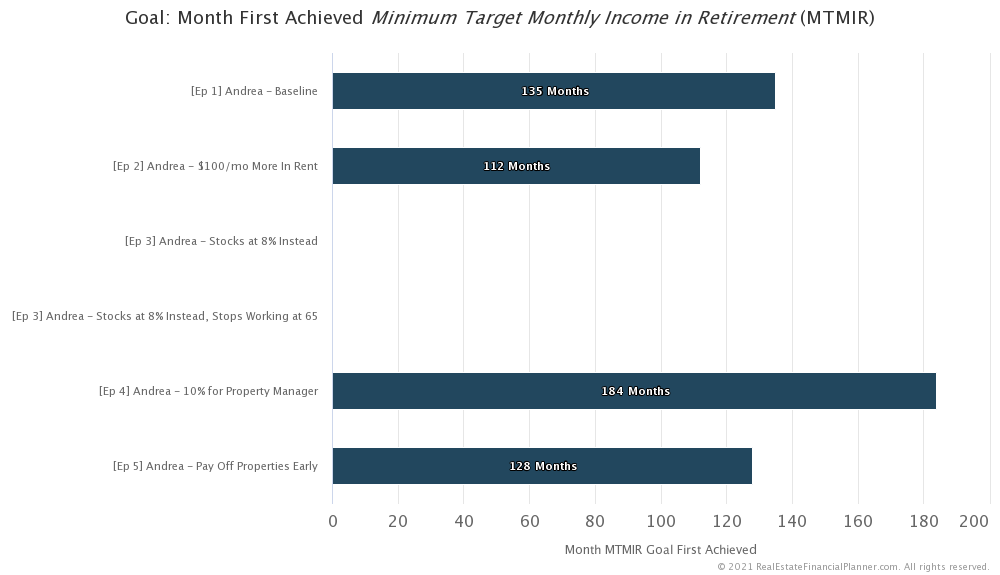

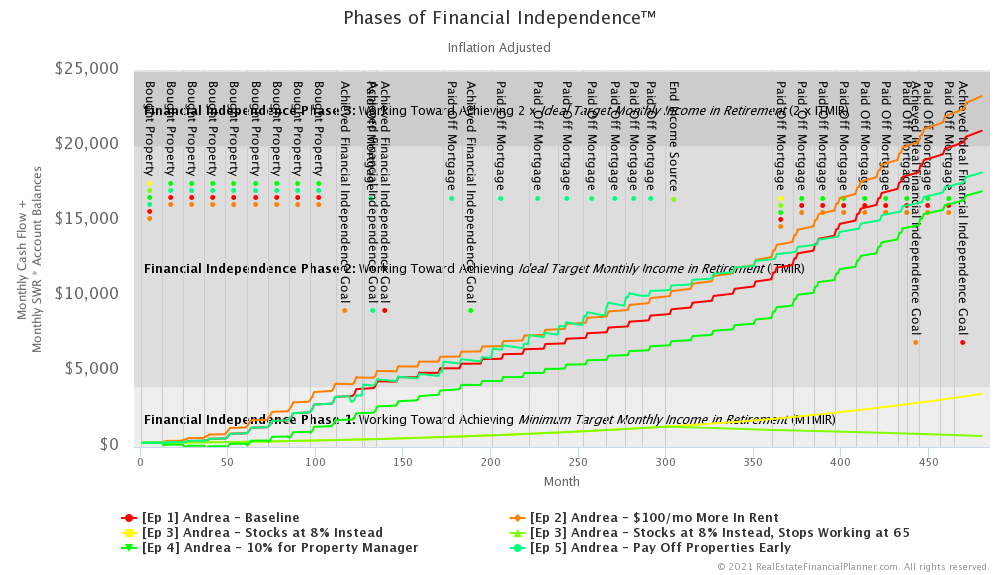

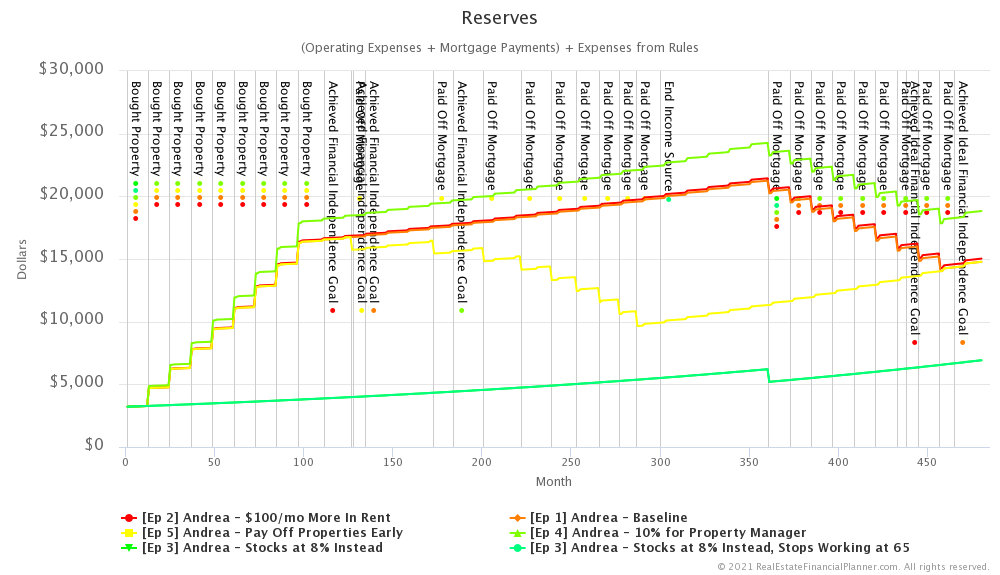

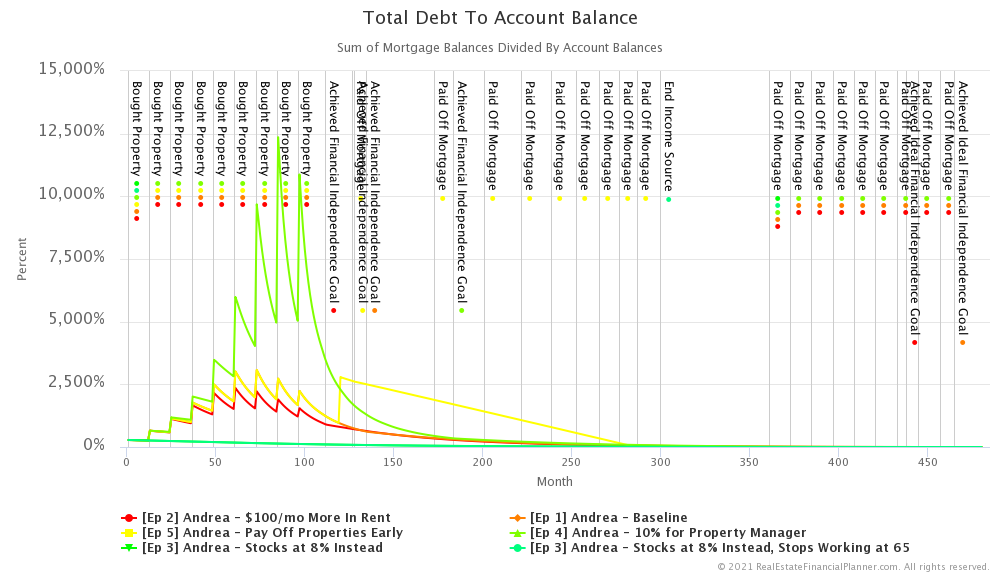

Charts

The following are just a small sampling of  Charts

Charts