Pro Tip: Listen to the podcast below and while you’re listening follow along with the charts below. Then, when you’re done, copy the  Scenario

Scenario

Welcome to the Real Estate Financial Planner™ Podcast. I am your host, James Orr. This is Episode 4.

Today we’re going to continue with  Andrea’s

Andrea’s

Previously, we had 40-year-old  Andrea

Andrea

Ultimately, she would end up with 9 properties… 8 rentals and 1 that she lives in with her two sons who were ages 2 and 4 at the start.

In the previous episodes where  Andrea

Andrea

In this episode,  Andrea

Andrea

Instead of spending time learning how to:

- Market to find tenants

- Screen tenants

- Negotiate the terms and fill out the lease and the associated paperwork for putting a tenant in the property

- Maintain a trust account for security deposits if that’s required in her real estate market

- Learn and comply with all fair housing and local landlord-tenant laws

- Manage the tenant and the lease while they’re in the property

- Bookkeeping for the property’s income and expenses

- And, oversee the maintenance on the property

Instead of taking the time to learn and do this work, she listens to the class we have on How to Get the Best Property Manager to Work For You.

She interviews and hires a property manager to do these tasks for her and she will, instead, learn the skills of managing her property manager.

As an accountant in her day job, she feels comfortable with the bookkeeping and accounting for the income and expenses on the property. Now, she’ll primarily be reviewing the monthly statements from the property manager.

She listens to the Managing Your Property Manager class and feels like she can, with some practice and experience, become a great manager of an excellent property manager.

Property Management Fees

Property management fees vary by manager and by market.

In her market, hiring a good property manager will cost her 10% of the gross monthly rents on the property.

For our modeling, she will be paying this whether she has 1 rental property with the property manager or all 8.

In the real world, it is not uncommon for a property manager to reduce their fees if you had several properties under management with them.

So, what is the impact on  Andrea

Andrea

Well, first… she is not going to be doing all the property management work. She will have more time to focus on raising her two small boys. She will still need to manage her property manager, but she is buying back time for herself and making her real estate investments much more passive.

Some of you who manage your rental properties yourself, might be thinking… managing a handful of properties really isn’t that much work. Or, maybe some of you have had a tenant or two that tested your skills as a property manager and you’re anxious to see the financial impact of  Andrea

Andrea

So, what is the financial impact of  Andrea

Andrea

- Will it slow down the ability for her to acquire properties? It turns out… yes… it does impact her ability to buy properties every 12 months.

- Will it slow down when she achieves financial independence and could stop working? Yes… it does delay when she achieves financial independence.

- Will it reduce her standard of living that she could be living when she achieves financial independence? Yes, a little bit.

- Does it affect her ultimate Net Worth? Yes, it lowers her overall Net Worth.

- Does it make her have negative cash flow when buying the rental properties? Yes, it does.

- Does she still have negative cash flow when we include the tax benefits of depreciation? Yes, but it is very small.

- Is it riskier for her to hire a property manager? It depends on how you measure risk. In some ways, it is slightly less risky. In other ways, it is more risky.

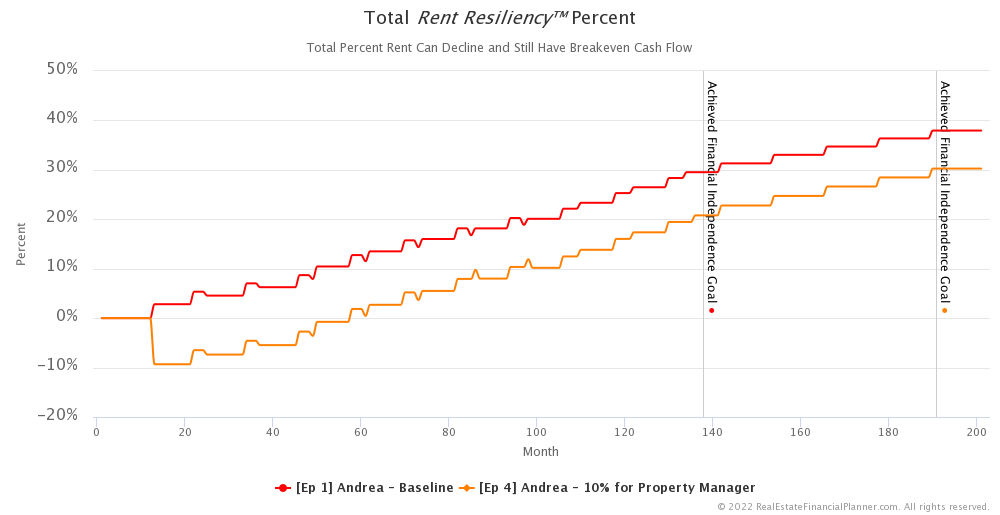

Let’s dive into these ideas as we compare  Andrea

Andrea

Acquiring Properties

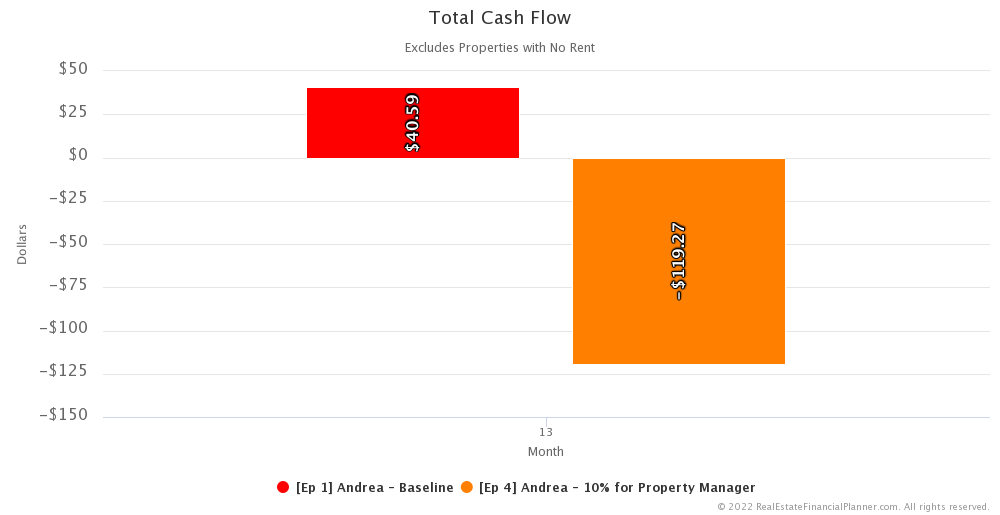

In the baseline Scenario from Episode 1,  Andrea

Andrea

However, if she hires a professional property manager that same property would now have about -$120 per month.

That means… by hiring a professional property manager… she is eating into what remains of her $100,000 from the divorce a tiny bit each month.

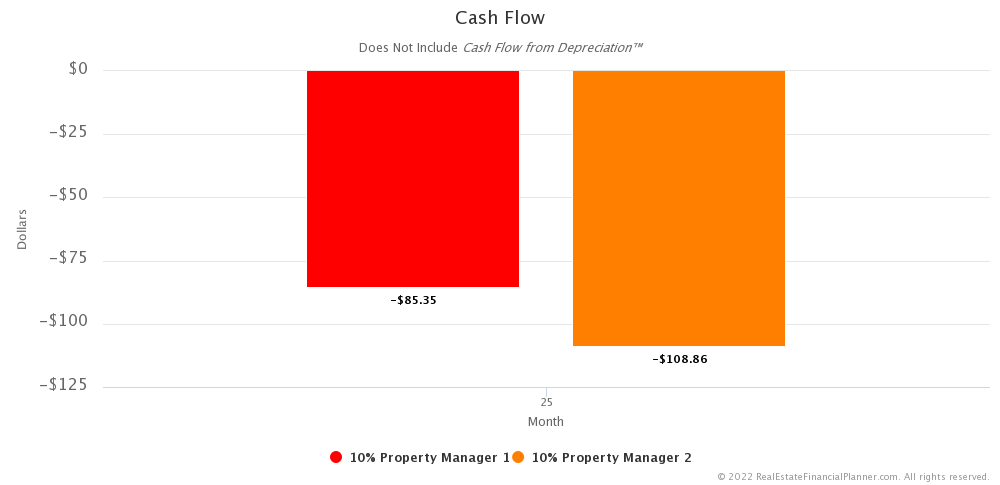

By the time she converts her second property to a rental, the first property is only about -$85 per month and the new property that she was living in, but is now being brought on as a rental has a negative cash flow of about -$108 per month.

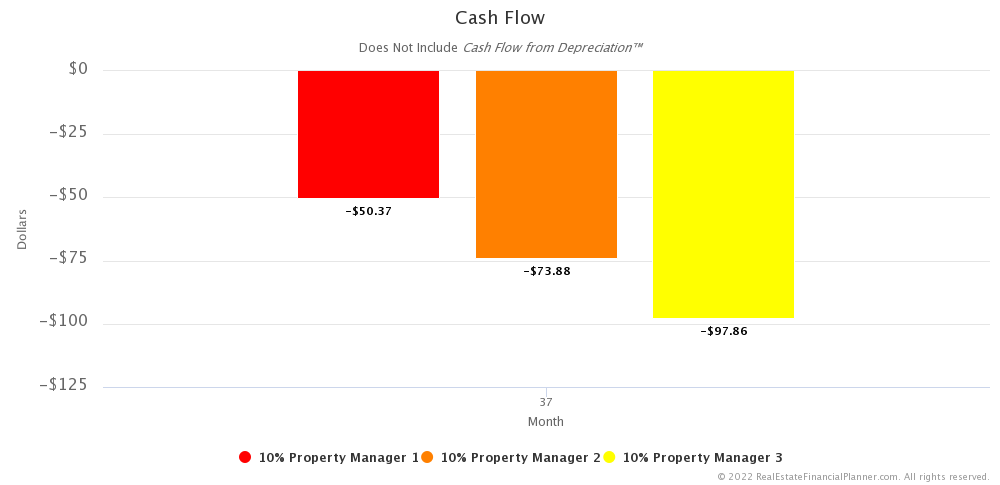

When she brings the third property on as a rental, the first property is still about -$50 per month, the second one is -$74 per month and the third on is -$97 per month.

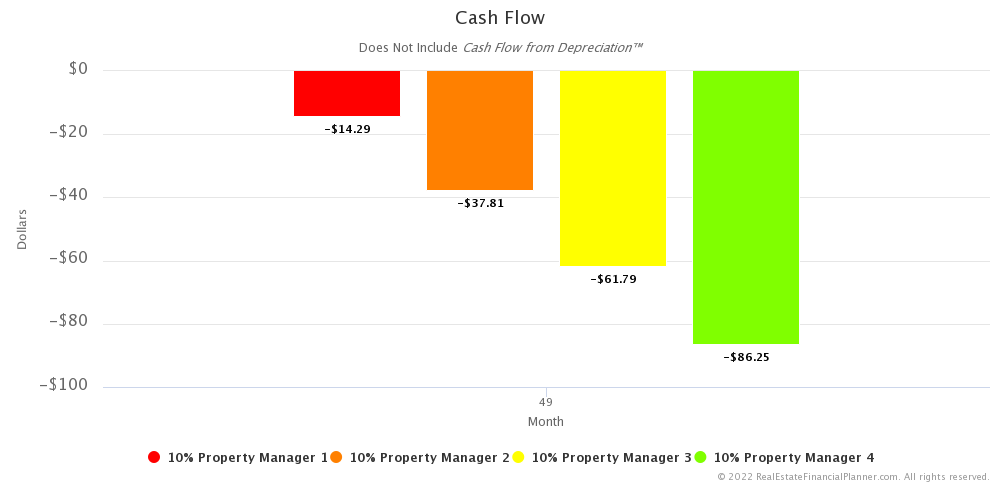

When she brings her fourth property on as a rental in month 49, the first one is just about -$14 per month, the second rental is approximately -$38 per month, the third is about -$62 and the fourth property is -$86 per month.

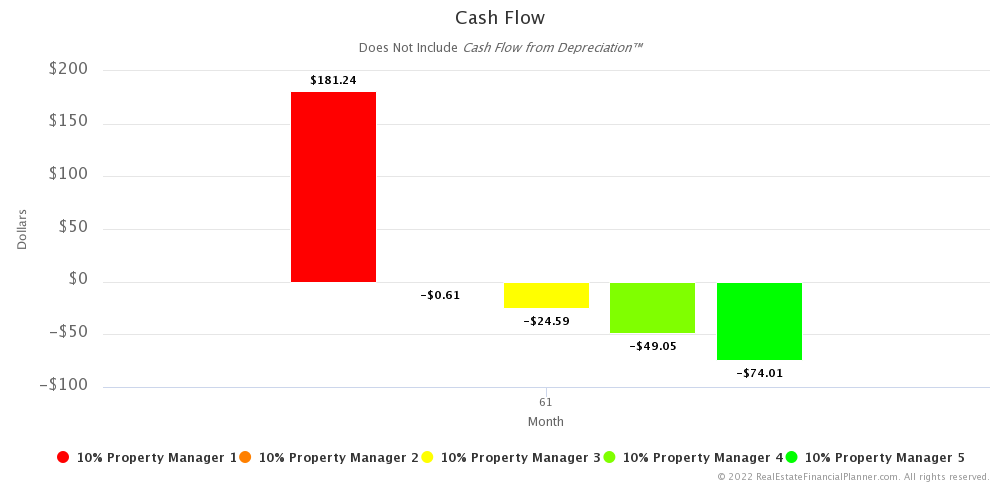

By the time she brings on her fifth rental property, the private mortgage insurance she was paying on the first property drops off and her cash flow on that property is now positive $181 per month. The cash flow on the second rental is just about break-even, the third rental is -$25 per month, the fourth is -$49 per month and the fifth is -$74 per month.

In general, you can see that she has negative cash flow on each property she converts to a rental for several years before the rents increase enough and… in some cases… private mortgage insurance drops off… where she has positive cash flow.

If she had opted to put 20% down, she could have had positive cash flow from the beginning with these rental properties even if she hired a professional property manager. But, she opted to put 5% down, move into the properties as an owner-occupant, live there for a year and then convert them to a rental.

Remember, she did this as a way to conserve her cash so she would have enough for more down payments and acquire rentals faster. Plus, the interest rates on owner-occupant loans… when she moves in… is typically lower… often significantly lower… than the mortgage interest rate she could get as a non-owner-occupant/investor mortgage.

But, when she hires a professional property manager, she does have some negative cash flow… or does she?

What about the tax benefits of owning rental property? One of the tax benefits of owning rental property is called depreciation.

You’ll want to talk to your tax advisor to get a more technical definition… I’m not a tax professional… but here’s a layman’s explanation of how depreciation works.

Andrea

Andrea

Now that she owns a rental property she can take the value of the building… not the value of the land… just the building… and depreciate that over 27.5 years. So, Let’s say she has a $250,000 property and about 15% of that is considered the value of the land. So, she has a gross depreciation benefit of about $7,700 per year.

How does that apply to  Andrea’s

Andrea’s

Well, instead of paying taxes on $48,000 per year in income… she can subtract $7,700 from her income and then pay taxes as if she only earned $40,300.

In other words, she does not need to pay taxes on $7,700 of her income.

If she was in the 15% tax bracket… which she is technically in a little bit higher tax bracket but it is more conservative to estimate using a lower number here… if she was in the 15% tax bracket that means she’d be saving $7,700 * 15% per year or about $1,155 per year.

Squint really hard… and that’s about $100 per month in… what I like to call… Cash Flow from Depreciation™.

She can either get a rebate at the end of the year if she paid too much in taxes in… or she could go to HR and increase her exemptions so she actually receives that money in her regular paychecks by paying less in tax through payroll from her job.

And, she gets that Cash Flow from Depreciation™ benefit for every rental property she owns for 27.5 years.

So, does she really have negative cash flow… if she takes into account the Cash Flow from Depreciation™ as well? A little.

Whenever I combine the cash flow from her rental property and the Cash Flow from Depreciation of her rental property into a single number, I call that True Cash Flow™. True Cash Flow™ is just cash flow… after all expenses on a rental property plus Cash Flow from Depreciation™.

When  Andrea

Andrea

And, if we’re talking about True Cash Flow™ when she converts the second property to a rental, the first one is already at positive $11 per month in True Cash Flow™ and the second property is just $10 per month negative.

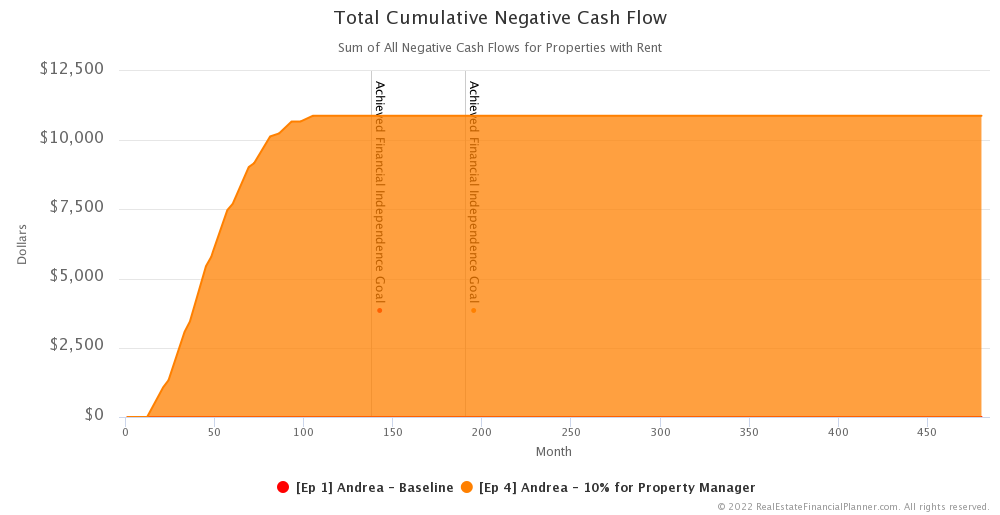

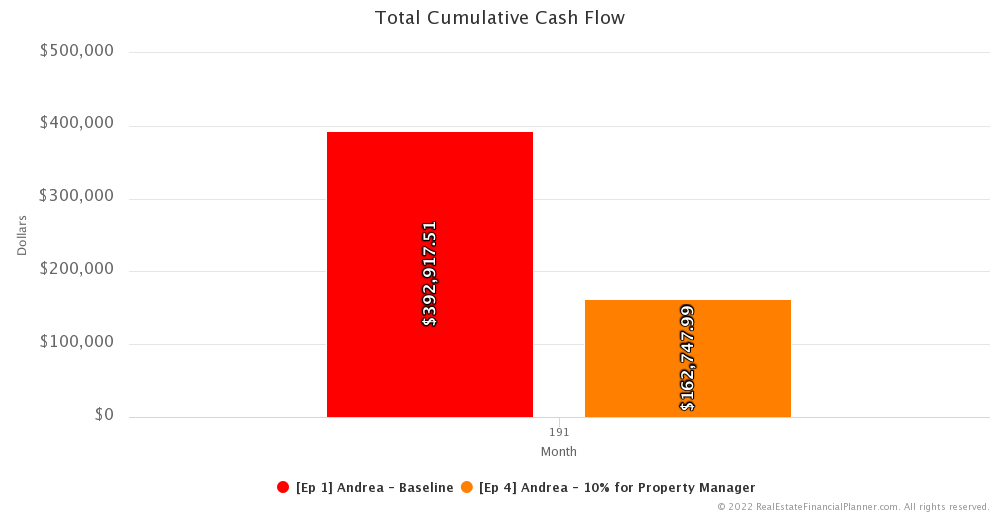

In the baseline Scenario from Episode 1 when she was managing the properties herself, she had no negative cash flow. In this episode when she decides to hire a professional property manager, she does have negative cash flow when we ignore the tax benefits of depreciation.

How much?

The cumulative total across all the months in the Scenario and all the rental properties, the total amount of negative cash flow is just under $11,000.

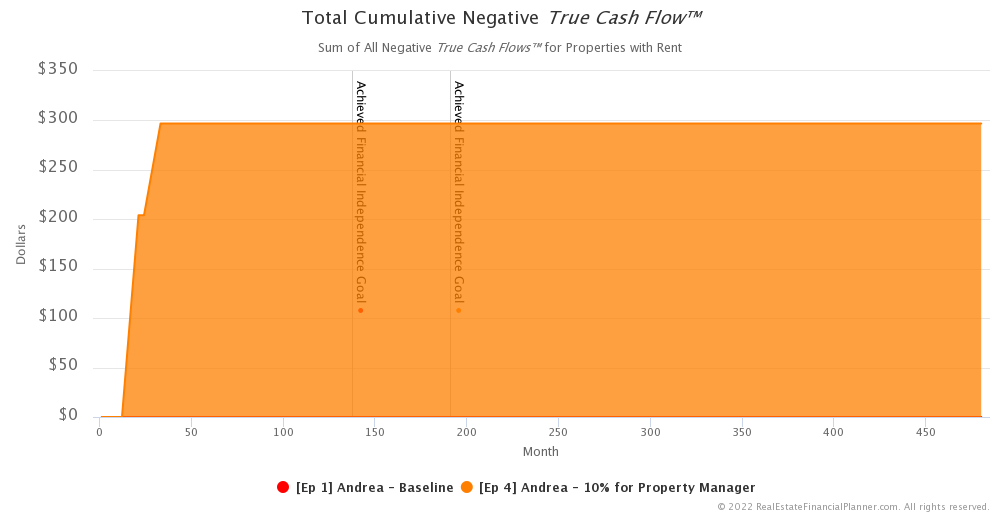

If we take into account Cash Flow from Depreciation™, the cumulative total amount of negative True Cash Flow™ for all the months in the Scenario for all the rental properties is under $300… total… for everything.

So, she technically has negative cash flow… but the amount of negative True Cash Flow™ taking into account Cash Flow from Depreciation™ is very, very small… about $300 total.

So why then, does it slow down her ability to buy properties every 12 months?

Well, in Episode 1, the positive cash flow from her rentals is what allowed her to have enough down payments to buy 9 properties… 8 rentals and 1 to live in at the end.

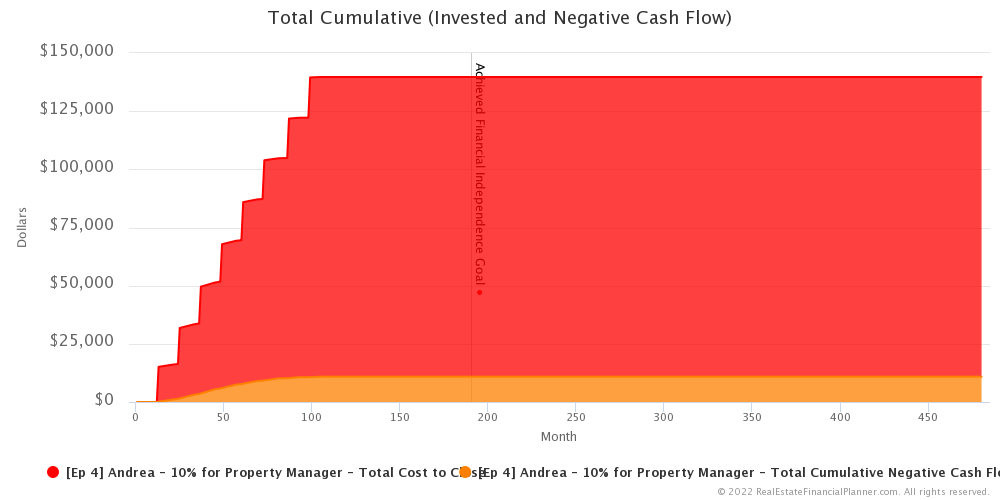

In our modeling, the $250,000 home prices are going up each year so what I am about to say is not technically correct… because it is technically more than this, but to simplify this down… to buy 9 properties, she needs 9 5% down payments.

If they were all $250,000 purchases… which they’re not… each one is slightly more expensive than the last… but if they were all $250,000… 9 5% down payments would be $112,500.

In our actual modeling, it turns out it is about $129,000 in down payments.

Plus, she wants to keep at least $10,000 in reserves.

Well, she only had about $100,000 to start with.

Even though her money is growing in the stock market, her money does not grow fast enough. And even though her True Cash Flow™ helps it doesn’t help quite enough.

In this particular case, buying her 8th property is delayed by just 2 months. Could she have decided to just live with a little less in $10K in reserves and buy property #8 after 12 months… probably. But the software followed what we told it to do and we said a full $10K in reserves (adjusted up for inflation).

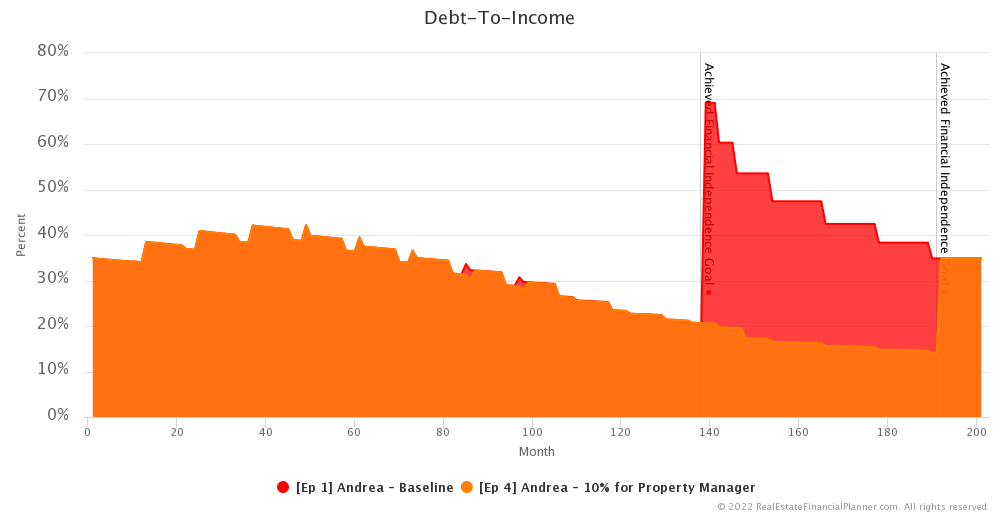

Debt-To-Income

Did  Andrea

Andrea

No, she did not. Why?

It is unusual, but you might get questioned by a mortgage underwriter if you hire a professional property manager, but typically… when qualifying for a mortgage… property management fees are not included separately when calculating Debt-To-Income. For our modeling, we have assumed it is NOT part of the Debt-To-Income calculation.

When calculating Debt-To-Income, we do include:

- Rent

- Mortgage payments

- Private mortgage insurance

- Any HOA fees

- Utilities that the landlord would need to pay

- Property taxes, and

- Property insurance

So it was not Debt-To-Income that slowed  Andrea

Andrea

Instead, it is having enough money for down payments and closing costs and reserves.

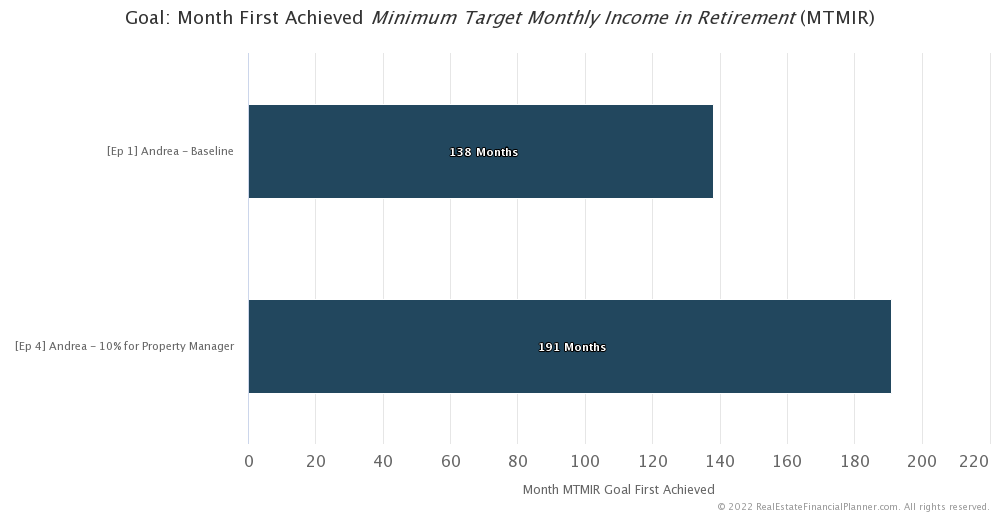

Financial Independence

So, how does her hiring a professional property manager impact her ability to achieve financial independence?

In Episode 1, she achieved financial independence in month 138… when  Andrea

Andrea

By hiring a professional property manager, she pushes financial independence back about 4.5 years to when she is about 56-years-old.

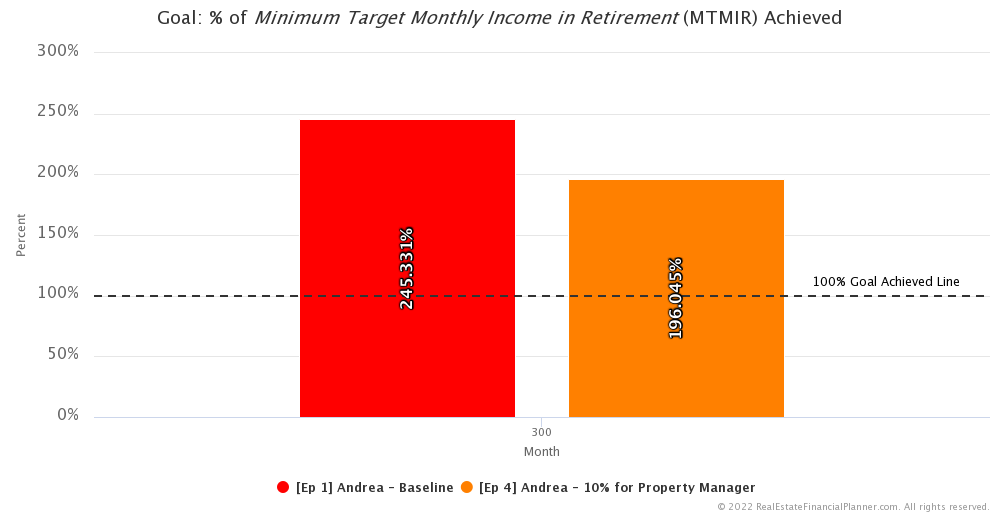

With more in expenses to run the properties from hiring a property manager, it also reduces her potentially higher standard of living.

In our modeling, we assumed she just maintained her $48K per year lifestyle, but she could have increased that. With a professional property manager, she could increase it less.

By age 65… that’s month 300… she could be living at a lifestyle of 245% of her $48,000 per year compared to just under 200% if she hired a professional property manager.

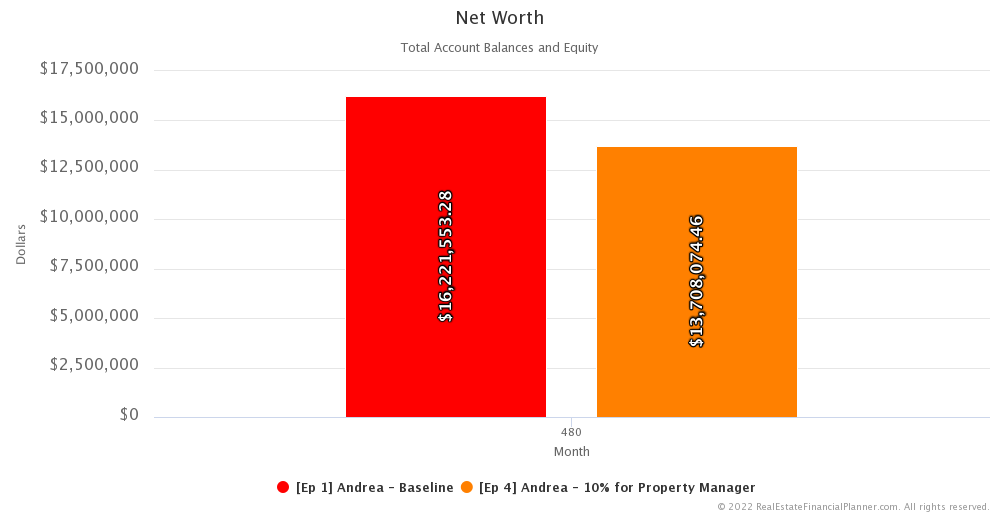

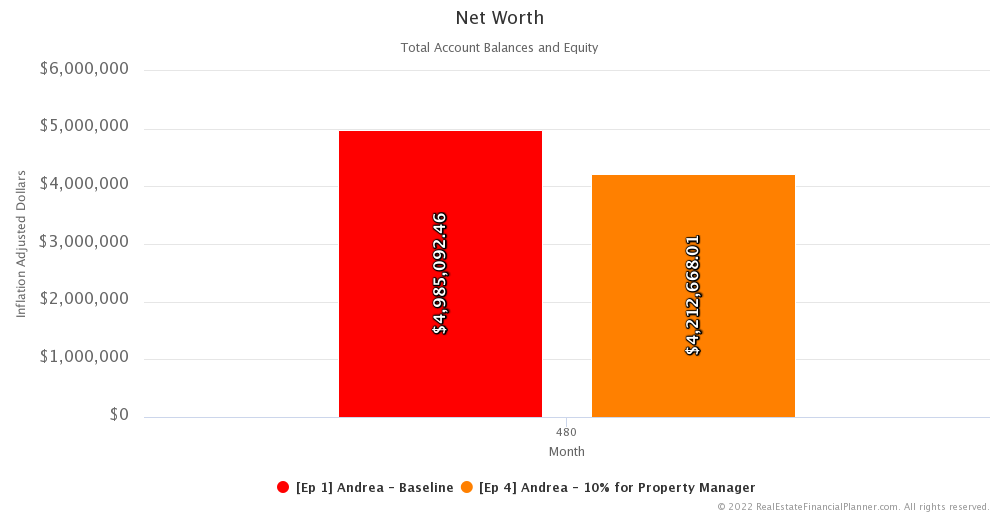

Net Worth

What about her Net Worth?

At the end of our modeling… when she’s 80-years-old, she would have about $2.5 million less in Net Worth by hiring the professional property manager… in inflated dollars.

Adjust back to today’s dollars and it is about $750K difference in Net Worth… just under $5M compared to just over $4.2 million when she hired a professional property manager.

I’ll also note here… out of an abundance of clarity… that in the baseline Scenario from Episode 1, she’s still managing her properties after she’s financial independent… through when she’s 80-years-old.

In this episode, she hires a property manager from the beginning and keeps the professional property manager throughout the entire 40-year period.

In the real world… and we did not model this, but we could… but maybe she manages the properties herself until she reaches financial independence and can afford to hire a professional property manager.

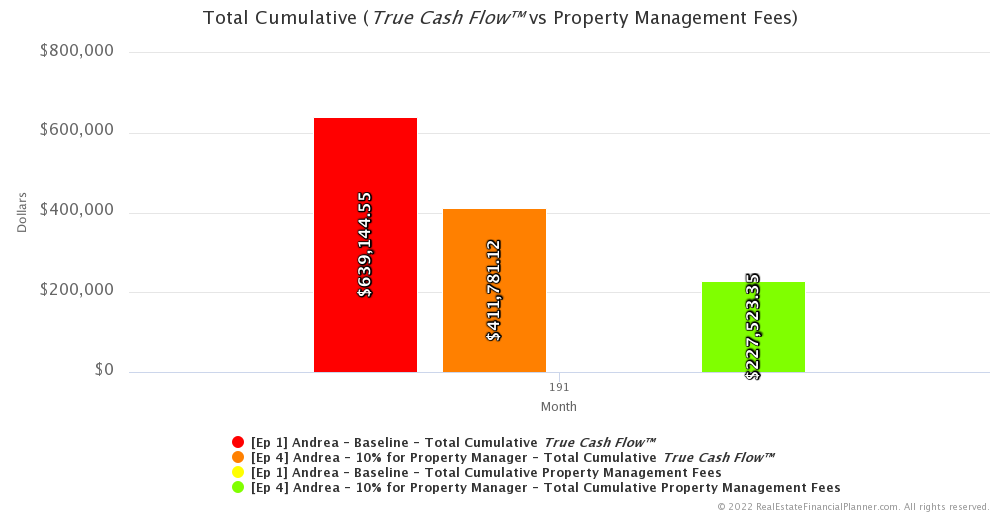

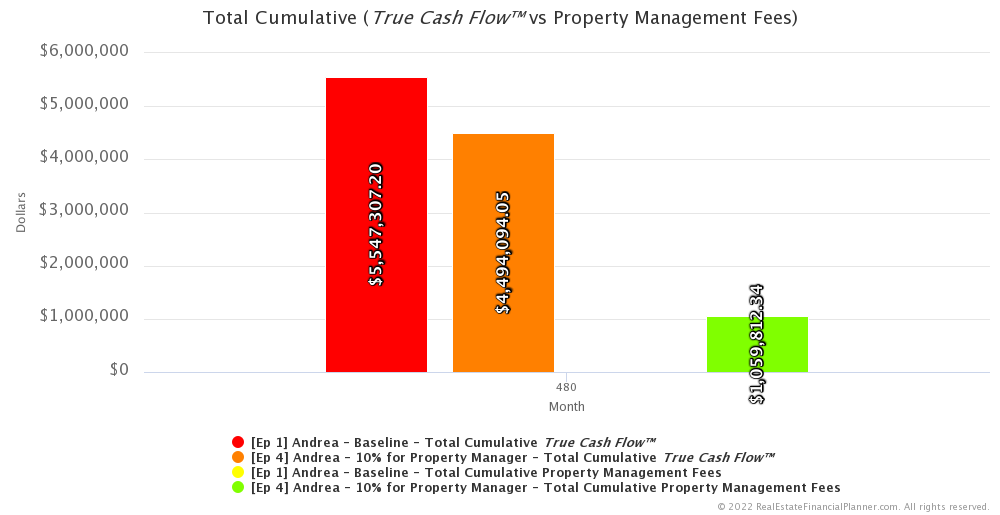

Property Management Fees vs True Cash Flow™

How well does  Andrea’s

Andrea’s

If we look at the total amount her property manager has collected in fees through when she first achieves financial independence in month 191, the property manager has made about $227,000.  Andrea

Andrea

If we ignore Cash Flow from Depreciation™, the property manager made more than  Andrea

Andrea Andrea

Andrea

However, if we do a cumulative total for the entire 40-year period…  Andrea

Andrea Andrea

Andrea Andrea

Andrea

I’ll also point out that  Andrea

Andrea

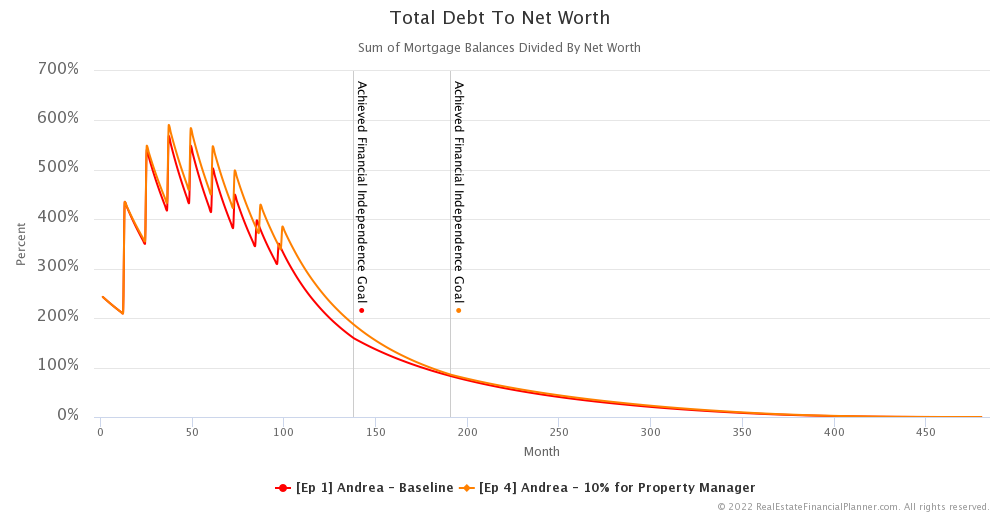

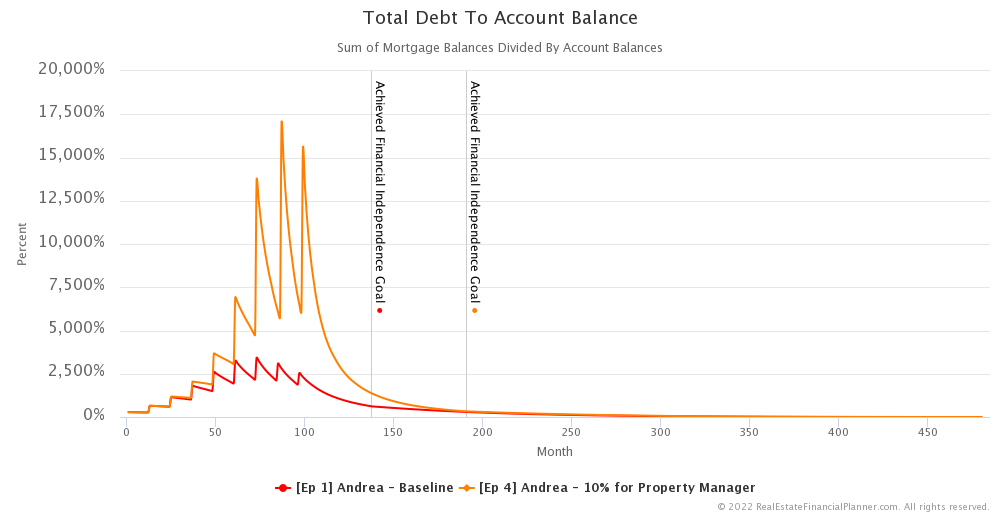

Risk

Let’s finish this episode with a very, very brief discussion of risk.

In one way, hiring a professional property manager is less risky… she is relying on a professional to keep up on the fair housing and landlord-tenant laws and keep her compliant and out of legal trouble.

On the other hand, she has less cash on hand because she is paying her property manager.

That means our measures of risk that include a comparison of debt to net worth and debt to account balances are going to be slightly more risky when she’s hired a property manager.

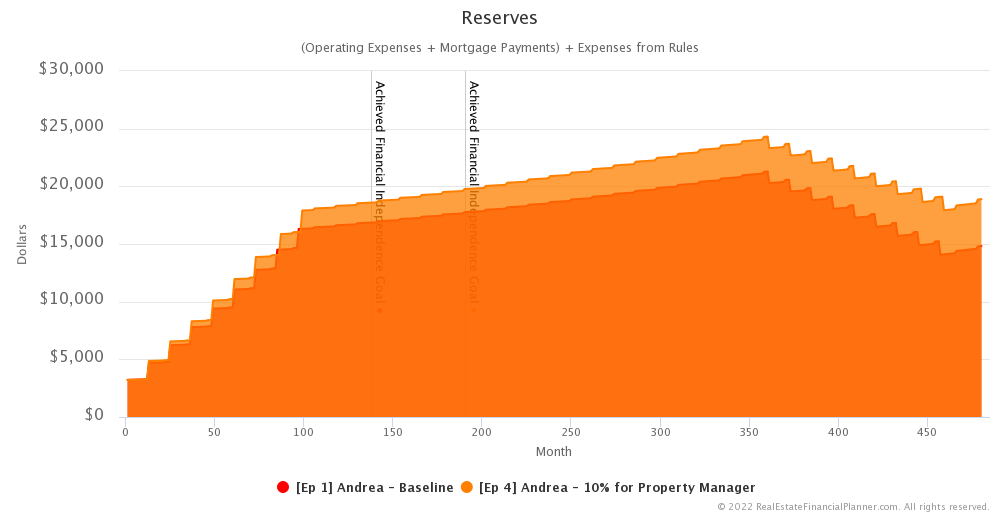

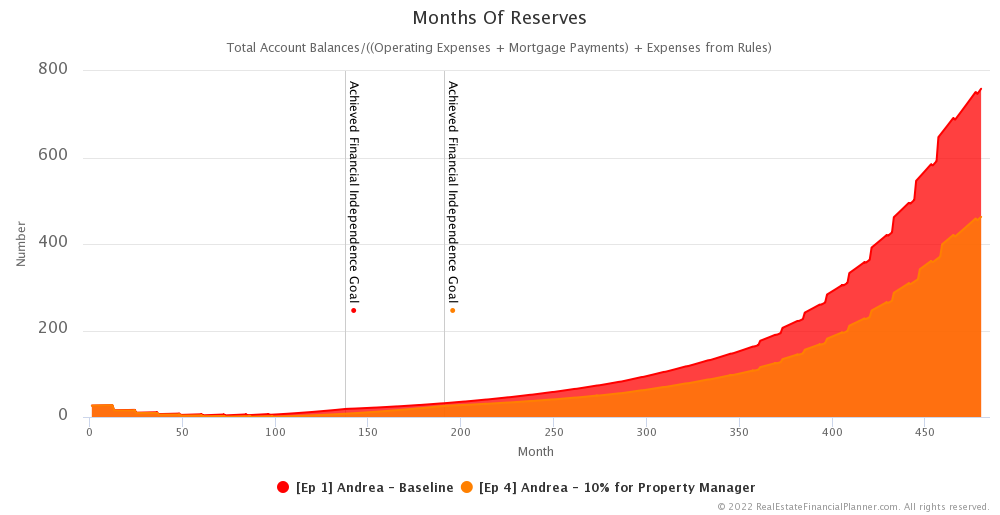

She is hit twice when we consider reserves and months of reserves.

Since we consider property management as an expense she needs to keep in reserves, the amount she needs for a single month of reserves is more when she hires a property manager than when she does not.

And, she has less in her account because she’s paying the property manager so the number of months of reserves she has is lower too.

Additionally, she is less resilient to drops in rent because she has higher expenses that make it easier for her to have negative cash flow should rents decline.

Next Episode

Is there anything else  Andrea

Andrea Andrea

Andrea

Also, be sure to check out the Advanced Real Estate Financial Planner™ Podcast to see how having variable property appreciation rates and rent appreciation rates, variable mortgage interest rates, variable inflation rate and variable stock market rates of return impacts  Andrea

Andrea

I hope you have enjoyed this episode about  Andrea

Andrea

Get unprecedented insight into how  Andrea

Andrea Scenarios.

Scenarios.

Inside the Numbers

Is your situation similar to Andrea except your property manager only charges you 9%? Or, maybe they charge you 11%? Or, maybe you just want to double check my assumptions? If you want to dive deep inside the numbers, check out my exact assumptions using the copy button for that  Scenario

Scenario

And, if you want, you can even change the assumptions by copying it your own account and changing anything you want.

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 1 Andrea - Baseline with 2

Ep 1 Andrea - Baseline with 2  Accounts, 1

Accounts, 1  Property, and 3

Property, and 3  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 4 Andrea - 10% for Property Manager with 2

Ep 4 Andrea - 10% for Property Manager with 2  Accounts, 1

Accounts, 1  Property, and 3

Property, and 3  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Podcast Episodes

The following are the podcast episodes for variations of Andrea’s story.

More posts: Andrea Episode