Pro Tip: Listen to the podcast below and while you’re listening follow along with the charts below. Then, when you’re done, copy the  Scenario

Scenario

In Episode 5,  Andrea

Andrea

Plus these related questions:

- Will paying off properties early lead to achieving financial independence earlier?

- Will it increase or decrease my net worth?

- Will that increase or decrease my risk?

- Will it give me a higher or lower standard of living in retirement?

Welcome to the Real Estate Financial Planner™ Podcast. I am your host, James Orr. This is Episode 5.

Today we’re going to continue with  Andrea’s

Andrea’s

In her original baseline Scenario from Episode 1,  Andrea

Andrea

While she is acquiring properties, her account balance is dropping as she pulls out a 5% down payment and closing costs with each new purchase each year.

But something interesting happens after her sixth property… five rental properties and the one she is living in.

After she buys her sixth property in month 61, she realizes that between the net cash flow… after all expenses… that she is getting from the 5 rental properties and the returns she is earning in the stock market… she realizes that even with the down payments and closing costs removed to purchase properties 7, 8 and 9… her account balance will continue to grow.

In other words, her lowest account balance will be when she buys that sixth property.

When she buys her last property… property number 9… 8 rentals and 1 to live in… it will be about 8 years after she started. She’ll be 48 years old.

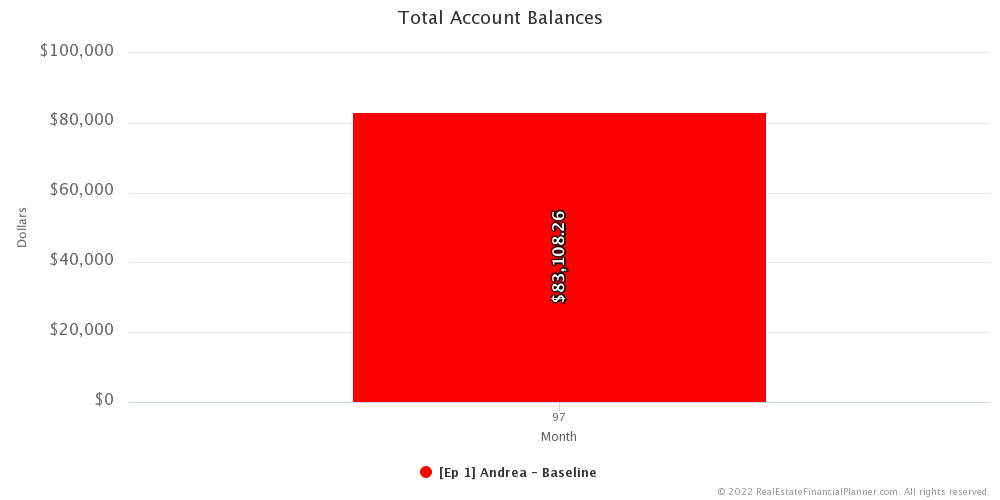

At that point in time, in month 97, her bank account balance will be about $83,000… which we assume is primarily invested in stocks earning about 8% per year.

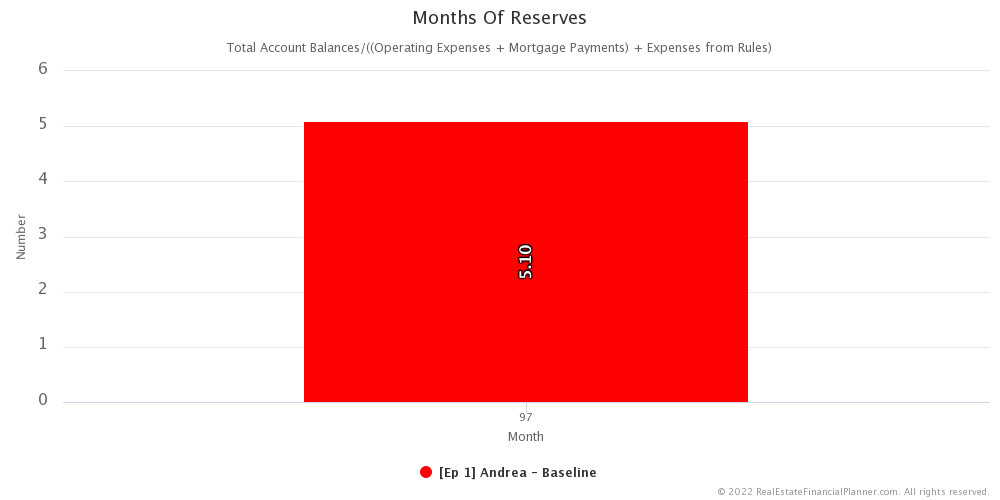

Now, for someone that has 9 properties… 8 rental properties and the one she is living in… having $83,000 represents having about 5.1 months of reserves.

The Real Estate Financial Planner™ software calculates reserves by taking the total of all the account balances and dividing it by the sum of all the operating expenses for all properties plus all the mortgage payments plus all her personal living expenses.

Let’s break that down.

First, it takes the total of all account balances… so in  Andrea’s

Andrea’s

Next, it divides the total of all account balances by the sum of three things: all the operating expenses on her properties plus all the mortgage payments plus her personal expenses.

For operating expenses, that includes:

- Property taxes

- Property insurance

- HOA

- Landlord paid utilities

- Maintenance for the properties

- Any other property expenses

- And any property management… although in this case… we assume

Andrea

Andrea

So, when calculating her need for reserves we assume that she needs to have all the operating expenses plus all the mortgage payments on her properties and all her personal expenses.

If we divide her total account balance by all the operating expenses on her properties plus all the mortgage payments plus her personal expenses we get the number of months of reserves that she has.

In this case, by the time  Andrea

Andrea

This is as good a time as any to have a brief discussion on reserves.

If  Andrea

Andrea

If she had 2 rentals, she probably still needs 6 months for each property.

To take this to an extreme example for a moment… if she had 1,000 rentals, the chance of EVERY rental having something happen all at the same time is low, she probably could get by with less than 6 months per property. Although, there are events that… COVID being a recent example… that could have impacted ALL her properties and personal living situation all at once where having a full 6 months for each property is probably still a prudent decision.

That begs the question: when… if ever… is it OK to have less than 6 months of reserves per property?

I think most investors would agree that full reserves for the first property is a given. Many, I think, would agree with full reserves for the second property. I think an increasing number of investors would want to argue that you don’t need full reserves for EVERY property as the number of properties you have increases. But, then you have events like COVID that could have impacted a large portion… if not all of  Andrea’s

Andrea’s

And… you’ll notice… I’ve been saying full reserves… even though a stopped using the specific example of 6 months of reserves. I think many accountants, CPAs, real estate agents and brokers and financial advisors might suggest 6 months of reserves as being a reasonable amount for most people in most situations.

I’ll add in that it seems reasonable for most situations if you have that six months in a safe, easily-accessible, non-volatile account… like a savings account or a good portion in a savings account and the rest in maybe a CD-ladder or bond-ladder…. ideas we’ll discuss in future episodes.

However, if  Andrea

Andrea

This is a topic we discuss in the class Everything You Learned About Deal Analysis is Wrong where I introduced the quadrants with reserves… the Return on Investment, Return on Equity and Return in Dollars quadrants with reserves.

If she decides to keep the $83,000 in the stock market where the value can dip, maybe she needs MORE than 6 months of reserves because she really wants to have a full 6 months of reserves available to her when things get ugly… and things might get ugly with the stock market and the real estate market at the same time.

So, for peace of mind, I might suggest that if you’re going to keep the majority of your reserves invested in something with higher risk, higher volatility and higher possible rates of return… something like the stock market… maybe you should have 12 months of reserves per property.

I know that for some listeners this seems extreme. I remember distinctly hearing 6 months of reserves from my accountant when I first started investing in real estate and that seemed like an excessively conservative number at the time. We will revisit this idea in future episodes… especially in the Advanced Real Estate Financial Planner™ Podcast episodes… where you can see the impact of market corrections and random market conditions and why having ample reserves will keep you in the game.

Back to  Andrea

Andrea Andrea

Andrea

But… and this is the main point of this Episode… she either does not know about the recommendation for 6-12 months of reserves per property… or chooses to ignore that recommendation… and instead opts to use excess cash flow to pay off properties earlier.

One might think… especially since we use “how much debt she has” as a measure of risk in some cases… that by paying off mortgages, she is reducing risk. We will see how that plays out.

Paying Off Loans Early

Here’s what  Andrea

Andrea

A couple points about this.

First, until she completely pays off a mortgage… making extra payments does NOT improve cash flow. Once she pays off the mortgage the payment goes away and it does improve cash flow… significantly at that point. But, just because she paid off a little bit of her mortgage does not change her mortgage payment and therefore it does not improve cash flow.

And, because it does not impact cash flow… until she pays off the mortgage in full… that does not help her achieve financial independence. Once she pays off the mortgage it helps her qualify for having achieved financial independence, but until then… she just is converting relatively liquid net worth in the form of cash invested in the stock market to relatively illiquid net worth in the form of equity in a rental property.

A second, related point. The money she has invested in the stock market is earning our assumed stock market rate of return… 8% per year. When she takes that and opts to use it to pay down her mortgage she is taking the money that was earning 8% and now is earning the mortgage interest rate that she is no longer paying. In other words, she goes from earning 8% per year to earning 3.125% per year.

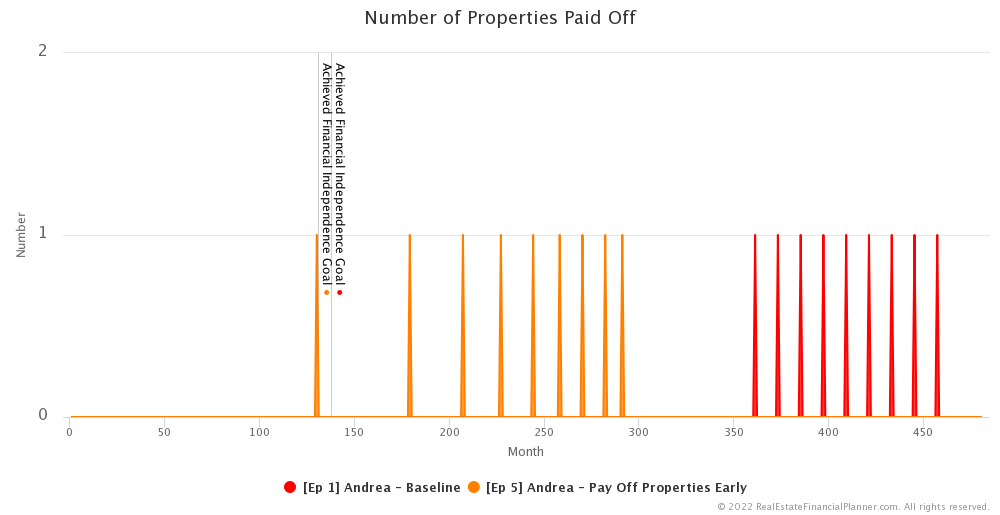

By taking any extra money over $50,000… adjusted for inflation… and using it to pay down the mortgage on the lowest balance mortgage she is able to pay off her properties much faster. Her first property gets paid off in month 131… that’s 7 months before she would have otherwise achieved financial independence in the baseline Scenario from Episode 1.

The reason I compare it to when she achieves financial independence from the baseline Scenario from Episode 1 is because by paying off the first property, she does achieve financial independence.

So, by opting to be a little more aggressive with less months of reserves, she is able to achieve financial independence about 7 months faster in this case. Of course, different people with different situations will see different results… in fact that’s the whole idea behind the podcast… showing how these types of ideas impact people in a variety of different situations.

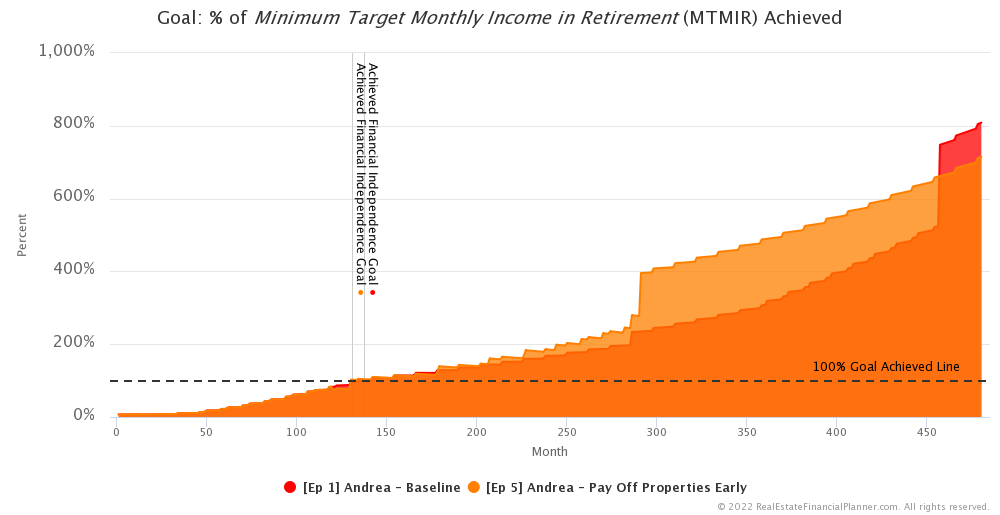

For  Andrea

Andrea

That’s because paying off the properties is slightly better than having that extra money in the stock market with a 4% safe withdrawal rate.

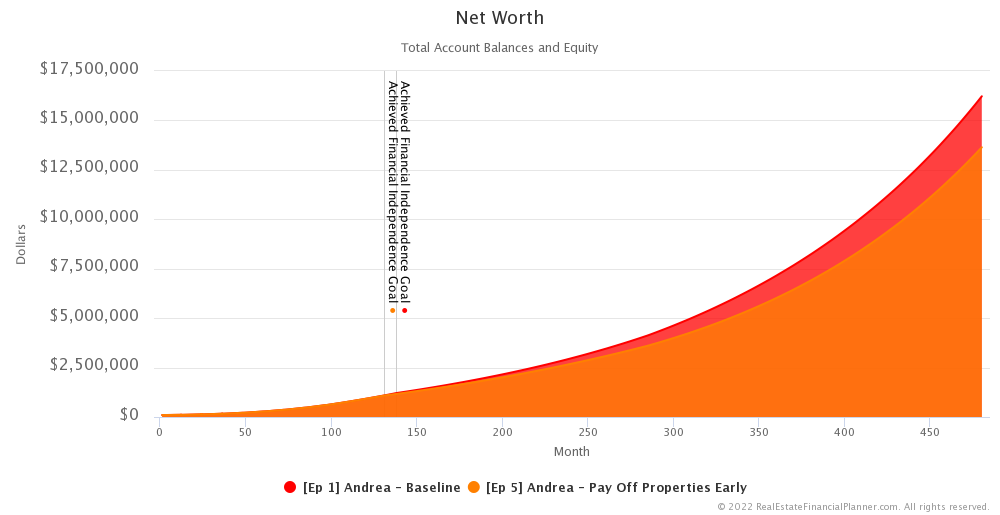

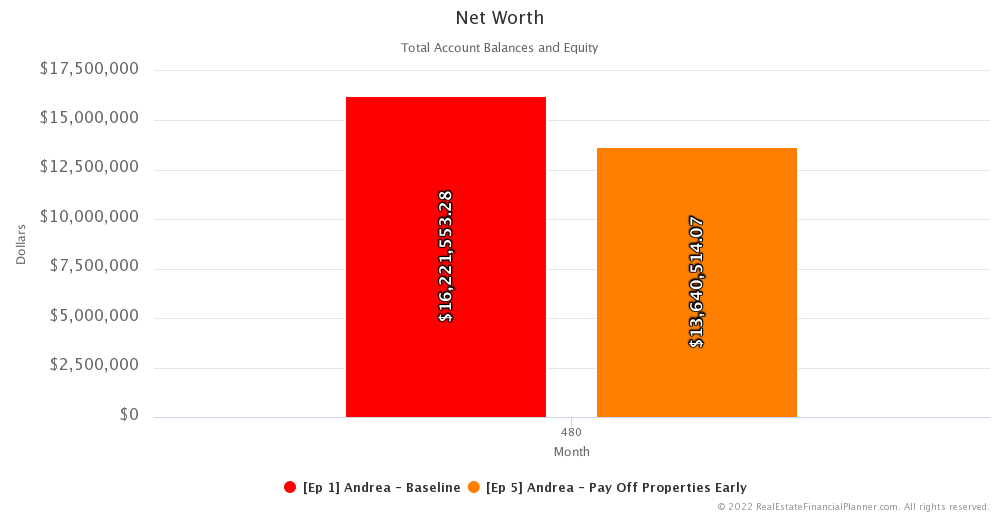

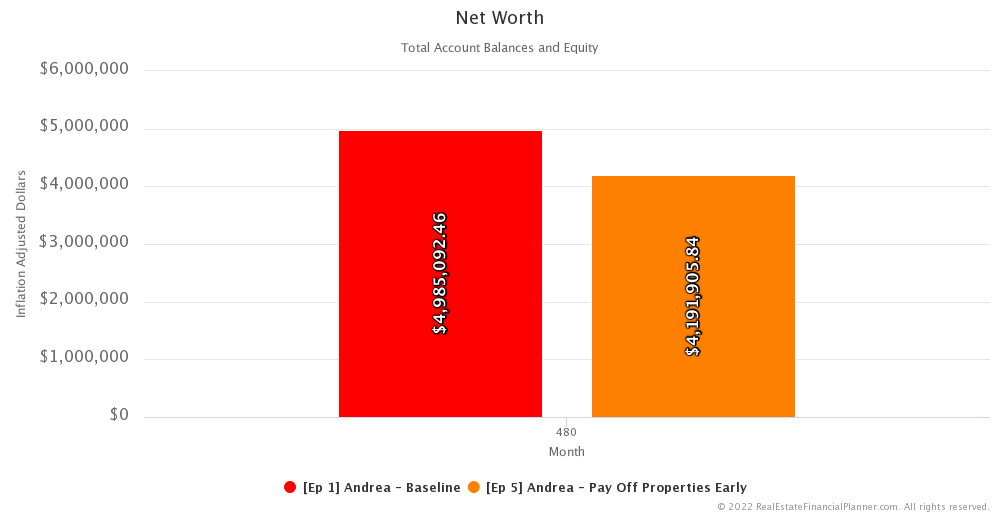

Net Worth

It is not all upside… because she took money earning 8% in the stock market to pay off 3.125% mortgage debt, her overall net worth is lower.

She would have had over $16 million in inflated net worth 40 years from now compared to about $13.6 million if she paid off the properties early.

That’s almost $5 million in today’s dollars when not paying off properties early compared to just under $4.2 million in today’s dollars if she did pay them off early. That’s about an $800,000 difference… not trivial.

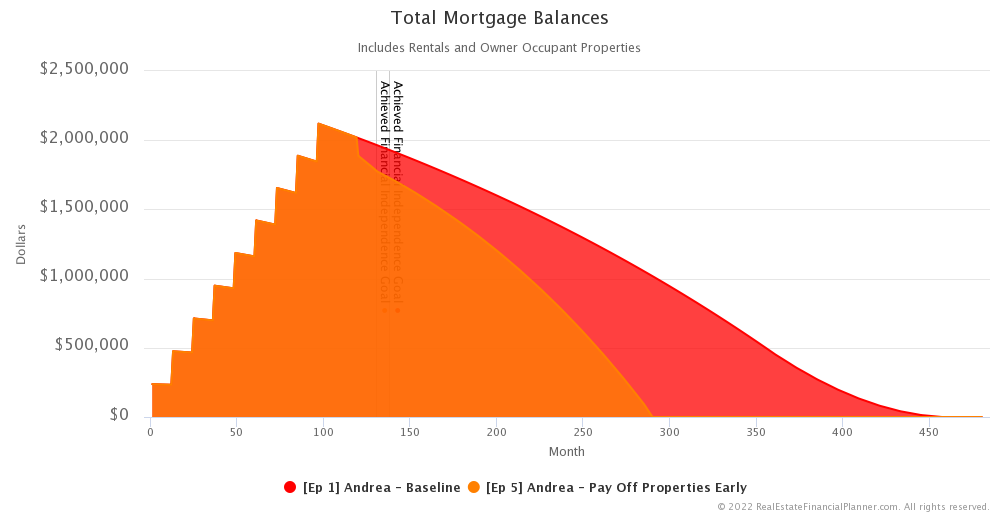

Mortgage Balances

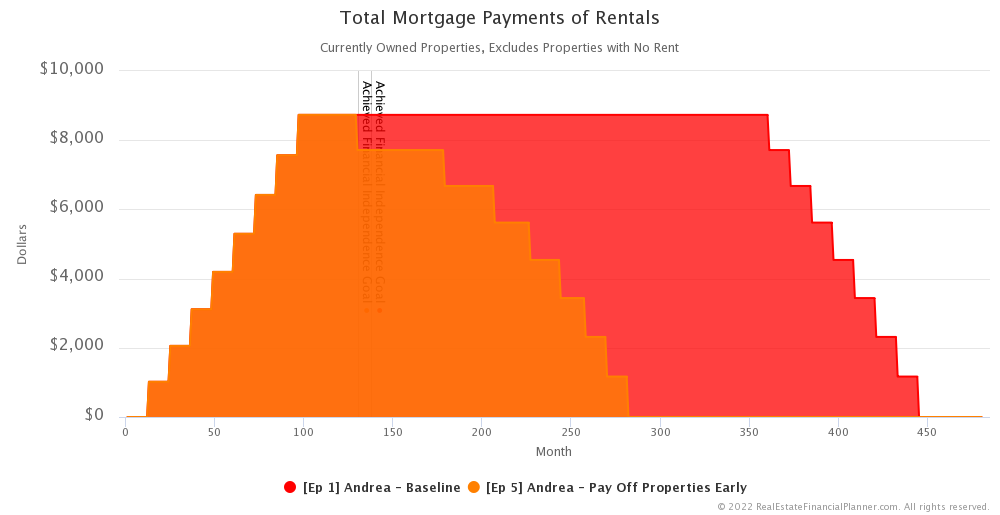

By aggressively paying down her mortgages, she has them all paid off by about month 291 compared to it taking until almost month 455 if she did not pay them off early.

Mortgage Payments

Each time she completely pays off a mortgage, that mortgage payment goes away… that means that the amount she paying on her mortgage payments is lower by that one mortgage amount.

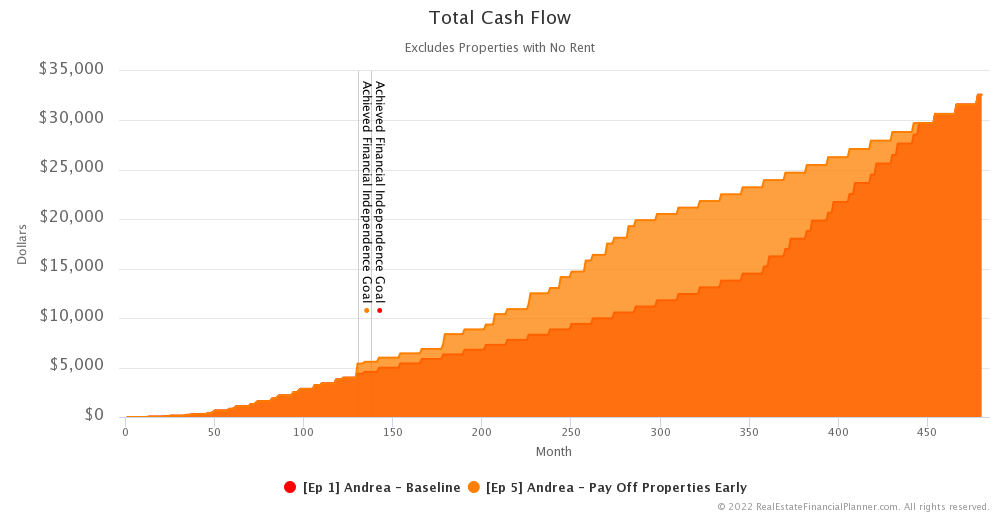

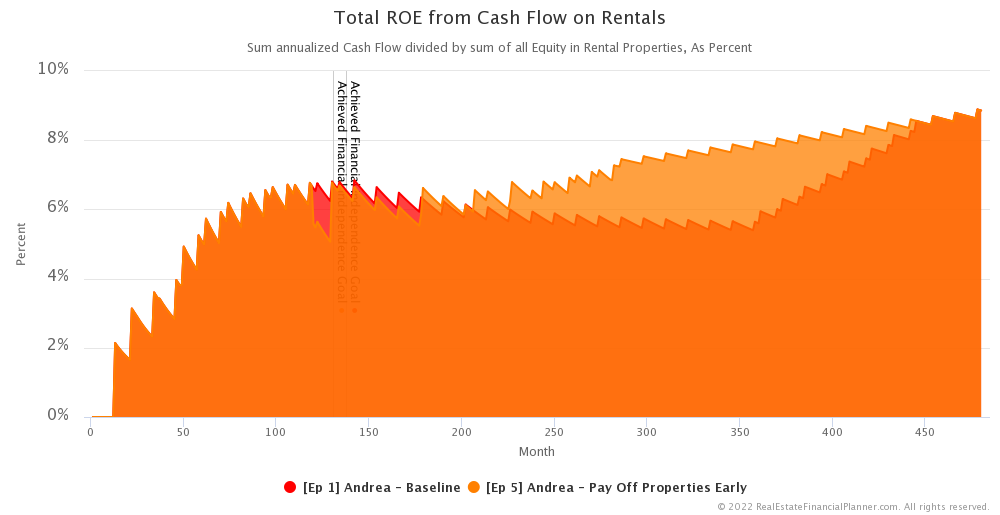

Cash Flow

It doesn’t impact the rents she is getting on properties at all, but with each mortgage payment she pays off that improves cash flow.

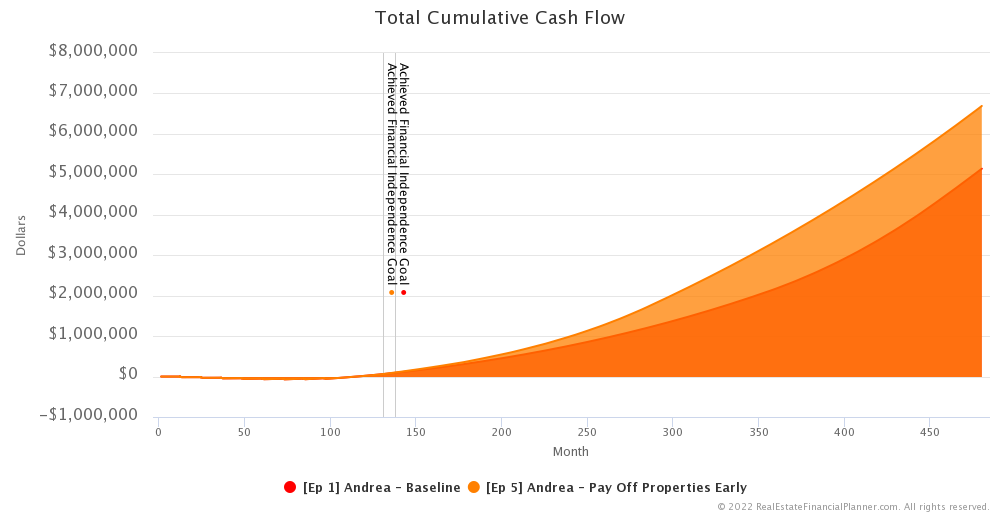

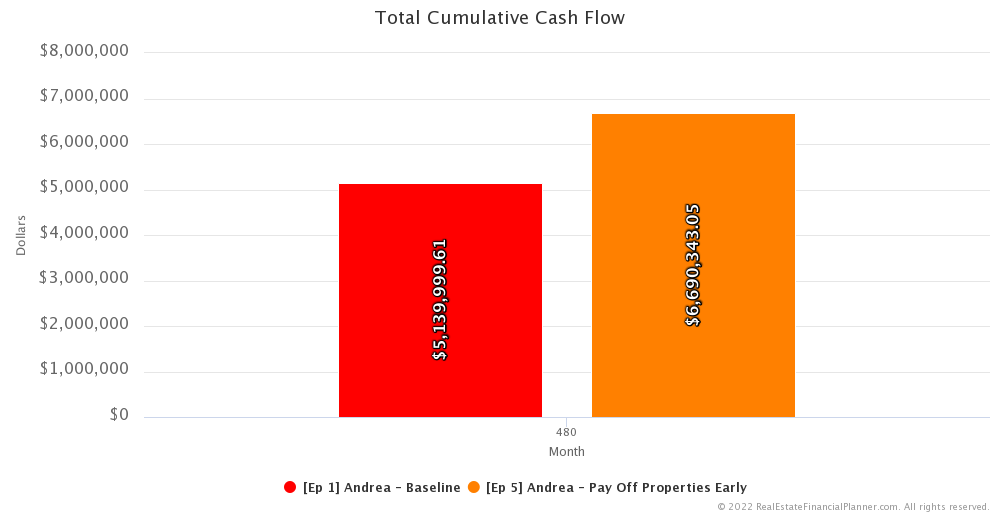

Cumulative Cash Flow

Because cash flow increases each time she pays off a mortgage that means the cumulative total amount of cash flow she’s collected over the entire Scenario is much higher when she pays off properties early.

For example, by year 40… she’s earned about $6.7 million in cumulative cash flow from all the properties… compared to just over $5.1 million if she did not pay off properties early. This is what partially makes up for the money she did not earn having it invested in the stock market. She traded some stock market return upside in exchange for improved cash flow (once she paid off the property).

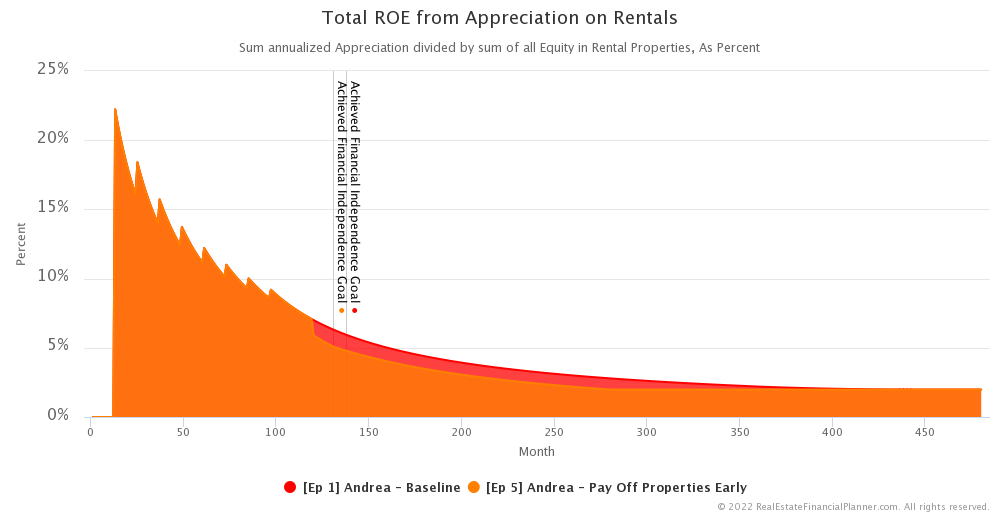

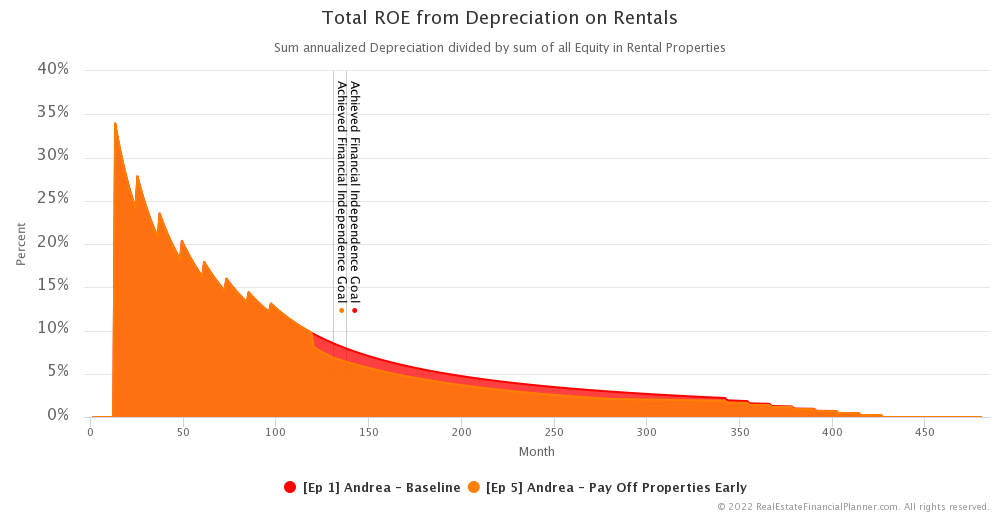

Return on Equity

By paying off properties earlier, the equity in her properties goes up. She’s taking money she had invested in the stock market and converting it to property equity after all.

Because the equity in her properties has gone up and the returns from appreciation, depreciation… and to a lesser degree cash flow… until she completely pays off a property… do not change… that means that her return on equity from appreciation, depreciation actually are worse when she pays off properties earlier. Again, it is the same dollar return but the equity has increased so the return she is earning on that equity is actually a little worse.

The same with return on equity from cash flow until she pays off the property and cash flow really increases with no mortgage.

Eventually, her return on equity from cash flow… when she has paid off properties… does improve.

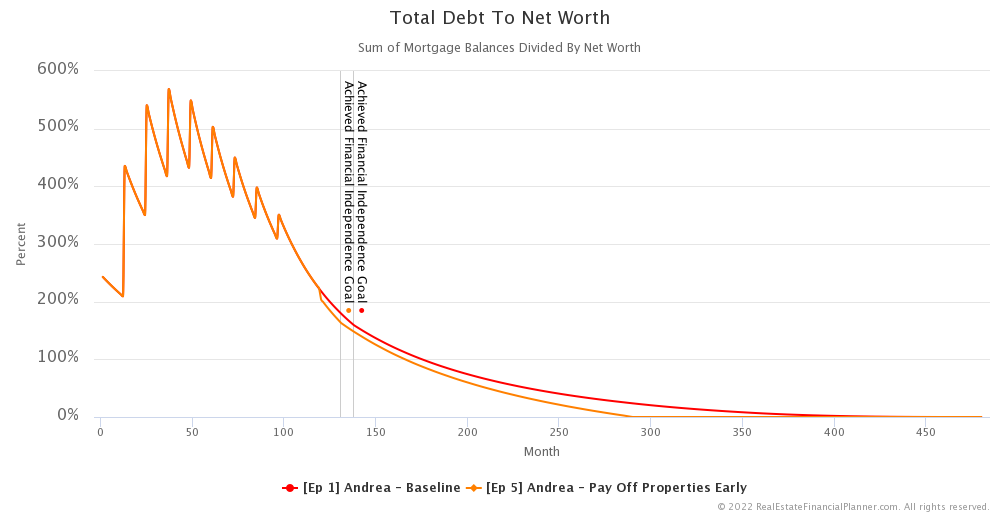

Debt To Net Worth

Let’s talk a little about risk.

Remember, one of the ways we measure risk is to look at the total debt to net worth.

Well, when Andrea is paying off debt, this improves her total debt to net worth a little bit. She has a similar amount of net worth and less debt. This makes sense.

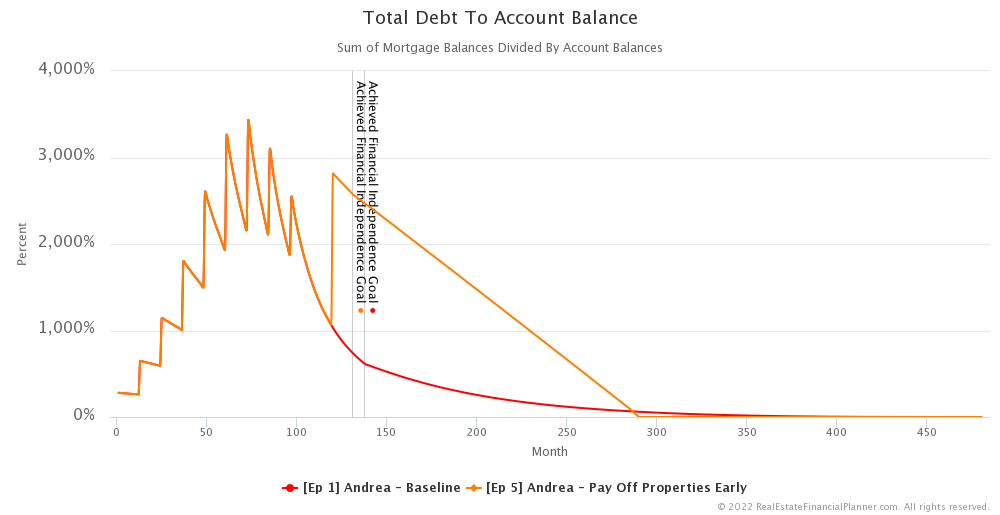

Total Debt to Account Balance

But, another way we measure risk is to look at the total amount of debt she has compared to her liquid net worth… her account balances.

Since she is using her account balances to aggressively pay off her mortgages we have conflicting forces. On the one hand, her debt load is going down, but on the other hand her account balances are going down too.

In the end, using her account balance money to pay off debt results in a significantly higher measure of risk when we look at risk through the lens of total debt to account balance.

That is until she pays off all the properties… at that point, her risk is lower by having paid off the debt. But, by that time, her debt is relatively low compared to what the baseline Scenario would have been at that point anyway.

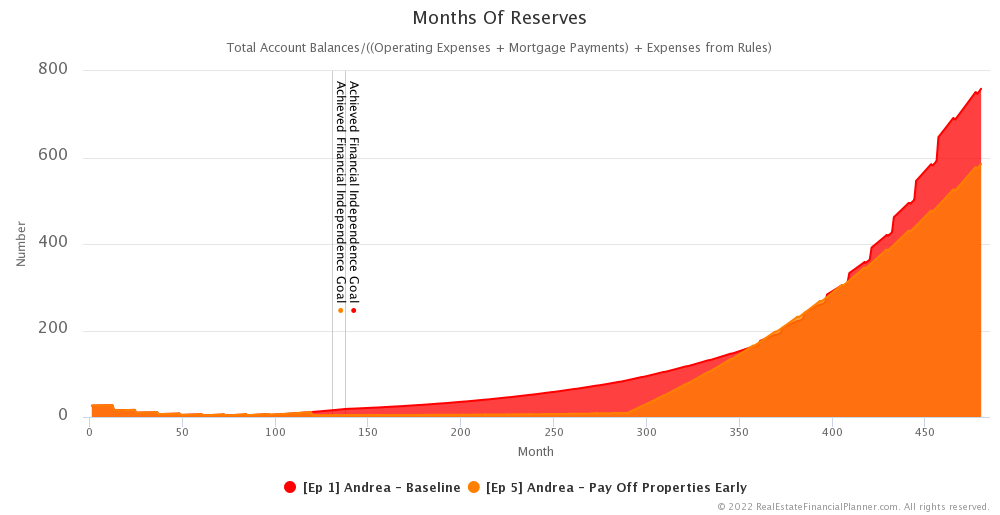

Reserves

We previously talked about reserves.

I’ll add a few more things.

First, every time she pays off a mortgage, she reduces the amount she needs in reserves because she no longer has to keep that mortgage payment in reserves. She still needs to keep all her other operating expenses for that property… and all the other properties for that matter… but she no longer needs to keep the mortgage payment for a mortgage she has completely paid off in reserves.

So, her need for reserves does go down over time faster than it does if she naturally waited for mortgages to be paid off.

But, lower account balances means she has fewer months of reserves… especially after she starts paying down on the mortgages but before she has completely paid off any of the mortgages.

The $50,000 inflation adjusted amount she is keeping in reserves works out to be a little more than 4 months of reserves.

But overall, using her account balance to pay down mortgages means she has significantly fewer months of reserves making it riskier to pay off mortgages than to just hoard the money in the stock market.

Now, there’s some nuance here because once she gets over a certain number of months of reserves, how much safer is it to have 12 more months of reserves… not much right?

Conclusion

In conclusion, having  Andrea

Andrea

It does increase her risk in some ways but reduces risk slightly when we look at total debt to net worth.

One thing we did not discuss in this episode but that we will visit in future episodes and especially in the Advanced Real Estate Financial Planner™ Podcast episodes is how she is changing the characteristics of her risk from a more volatile, less predictable stock market risk to a in quotes… “guaranteed” return of paying down a mortgage she has. She knows what return she’s getting when pays down that mortgage… it is the interest rate of the loan compared to the uncertain return… at least in real life… of the stock market.

Next Episode

In the next episode, we will meet a new set of characters: Norm and Norma and learn about their situation and their journey toward financial independence.

Also, be sure to check out the Advanced Real Estate Financial Planner™ Podcast to see how having variable property appreciation rates and rent appreciation rates, variable mortgage interest rates, variable inflation rate and variable stock market rates of return impacts  Andrea

Andrea

I hope you have enjoyed this episode about  Andrea

Andrea

Get unprecedented insight into how  Andrea

Andrea Scenarios.

Scenarios.

Inside The Numbers

Want to learn more about the assumptions and dive deep inside the numbers for the  Scenarios

Scenarios

Now you can!

Click on the button to copy either of the  Scenarios

Scenarios Blueprint™

Blueprint™ Scenario

Scenario

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 1 Andrea - Baseline with 2

Ep 1 Andrea - Baseline with 2  Accounts, 1

Accounts, 1  Property, and 3

Property, and 3  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 5 Andrea - Pay Off Properties Early with 2

Ep 5 Andrea - Pay Off Properties Early with 2  Accounts, 1

Accounts, 1  Property, and 4

Property, and 4  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Podcast Episodes

The following are the podcast episodes for variations of  Andrea’s

Andrea’s

More posts: Andrea Episode