Pro Tip: Listen to the podcast below and while you’re listening follow along with the charts below. Then, when you’re done, copy the  Scenario

Scenario

Welcome to the Real Estate Financial Planner™ podcast. I am your host, James Orr. This is Episode 2.

Today we’re going to continue with  Andrea’s

Andrea’s

Previously, in Episode 1,  Andrea

Andrea

She has no experience investing in real estate or as a landlord.

Is it possible that she was under-renting her properties?

What difference would it make if she took the time and effort to improve how much rent she was getting by $100 per month?

That’s what we will find out today.

Before we compare her baseline Scenario from Episode 1 to her getting $100 per month in improved rent in Episode 2… let’s look at some ways she could get an extra $100 per month in rent.

Andrea

Andrea

The improving cash flow class covers both how to improve income on rental properties and how to minimize expenses… both of which contribute to improving cash flow.

As you will see, she can’t do all of them as some of them directly contradict each other.

Here are some of the things  Andrea

Andrea

- Can

Andrea

Andrea - Can

Andrea

Andrea - Can

Andrea

Andrea - Could

Andrea

Andrea - Can

Andrea

Andrea - Can she offer the property to a tenant-buyer on a lease-option, lease-purchase or agreement-for-deed to increase income and reduce maintenance? Since she wants to keep the properties as long-term rentals she ultimately opts not to do this strategy.

- Can she charge pet rent for folks that have pets?

- Can she charge fence rent if the property did not have a fence and the tenant wants one?

- Or, can she charge new carpet rent if the tenant desires new carpet but she would otherwise keep the existing carpet for a little longer?

- Or, could she collect extra rent for something else the tenant desires she installs?

- Can she tier rent by credit score and/or security deposit? In other words, could she collect higher rent if credit scores are lower? Or, could she collect higher rent in lieu of collecting more security deposit? She could look at this as a risk premium for accepting a tenant with a lower credit score or with less than the ideal amount of security deposit.

- Can she change the term of the rental agreement? For example could she rent the property by the day or week like a short-term rental? Or, could she rent it month-to-month instead for a full-year at a time?

- Can she charge weekly or bi-weekly rent instead of monthly? Instead of collecting $1,600 per month… maybe she charges $400 per week as a convenience to the tenant who gets paid weekly. $1,600 per month works out to be $19,200 per year. $400 per week works out to be $20,800 per year. That works out to be $1,600 per year by charging weekly instead of monthly… that’s about $133 more per month.

- Can she include done-for-you services like lawn care, snow removal or house cleaning for an extra fee?

- Can she convert her property to a duplex, triplex or fourplex or more? Maybe she buys properties where there is a clear and easy way to do this for little money.

- Can she rent the property furnished to get more rent?

- Can she start marketing earlier and start at a higher, more aggressive rent to test market prices?

- Can she charge a fee for autopay that withdraws the money directly from her tenant’s account each month as a convenience? Or, can she charge a fee for not being on autopay to have to manually process the rent?

- Can she schedule her leases to end during peak rental seasons for her market instead of just renting during any old time of year?

- Can she target more profitable rental niches like corporate rentals?

- Can she offer a discount for on-time or early rent instead of late payments?

- Can she add solar panels and include electric in base rent?

- Can she bill-back for HOA services and utilities (like non-potable water)?

- Can she require 60-90 days notice from the out-going tenants that are not renewing? This could give her more time to market the property and possibly get higher rents.

- Can she improve landscaping and curb appeal to get higher rent? For example… she could paint the property, add/improve shutters, improve lawn care, add a nice mailbox, property address numbers, lighting? Anything to make the property stand out?

- Can she make sure the property is appropriately prepared for showings… for example… make sure it is well lit, that it smells good… that all the repairs are done… and that it is both clean and neat?

- Can she maximize exposure when marketing for tenants by advertising on all of the most popular rental websites and use large, attractive, attention-grabbing yard signs?

- Can she use professional-grade photos, a 3D tour, and videos when marketing property?

- Can she take the time to master the sales skills required for phone selling her property to tenants/tenant-buyers and in-person salesmanship to maximize what she can get for rentals and minimize vacancy?

Between all those different options… depending on the property and her situation… she may choose one or more so that she’s able to go from $1,600 per month in rent to $1,700 per month in rent.

Oh… and one subtle note here.

Many lenders will use 75% of the rental income minus the full Principal, Interest, Taxes and Insurance (including PMI) and HOA to determine if you have positive cash flow.

That means that if you’re able to increase your rent by $100… even if you have some additional expenses associated with delivering the extra service you’re charging for… you’d get the full benefit of 75% of the $100 in the calculation for determining Debt-To-Income when qualifying for a loan.

So, any increase in rents can help  Andrea

Andrea

We may see this come into play in the ADVANCED Real Estate Financial Planner™ podcast for Episode 2 since in the advanced modeling we notice that she is not always able to qualify for the 9 properties in 9 years like she is when we do the simple modeling.

Cash Flow

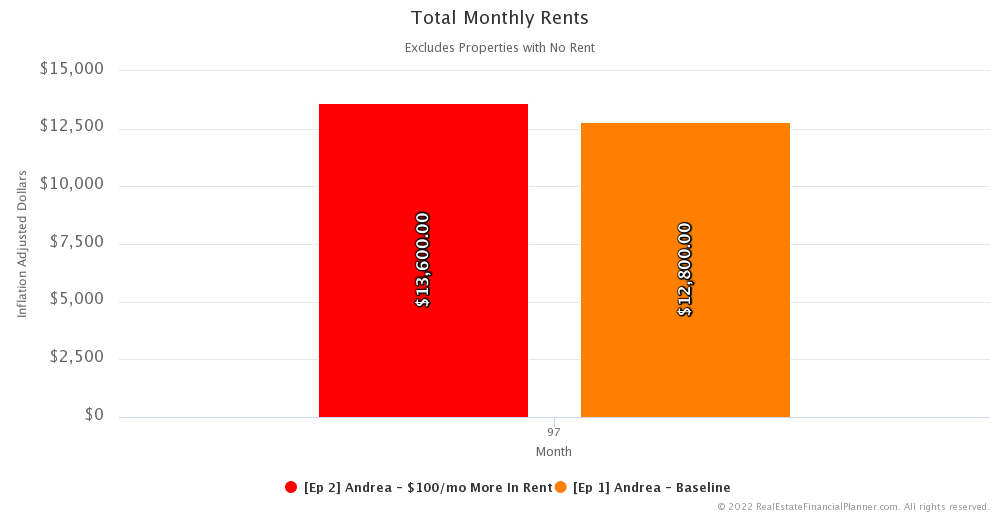

Each property she acquires has $100 more per month in rent. By the time she acquires her ninth property… 8 as rentals and the final one that she will continue to live in… then she is collecting $800 more per month in rent (in today’s dollars) or about $1,000 more in rent in future inflated dollars.

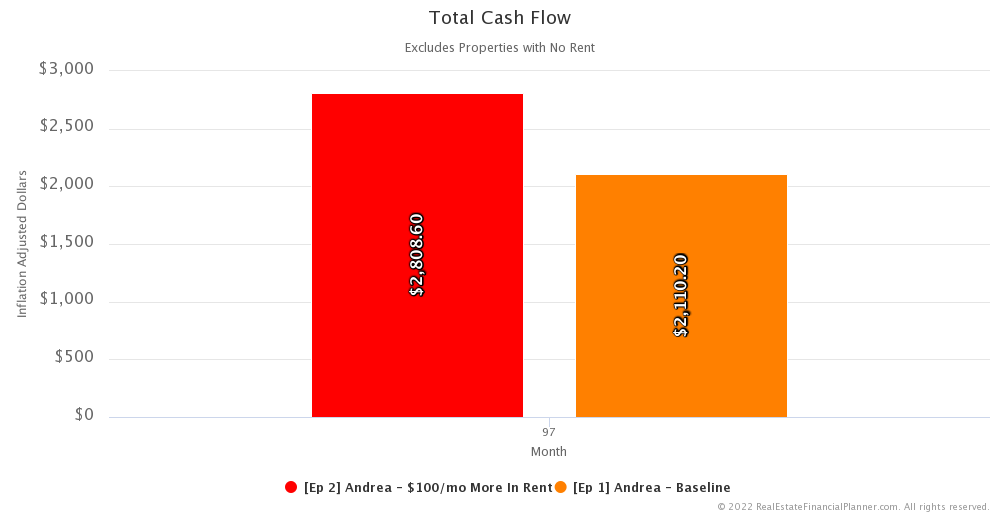

In terms of cash flow, she has about $2,100 in cash flow in today’s dollars in the baseline Scenario from Episode 1 and about $2,800 when she’s getting about $100 more in rent here. That’s about $700 more per month in cash flow… in today’s dollars.

Financial Independence

So, how does that improved cash flow impact  Andrea’s

Andrea’s

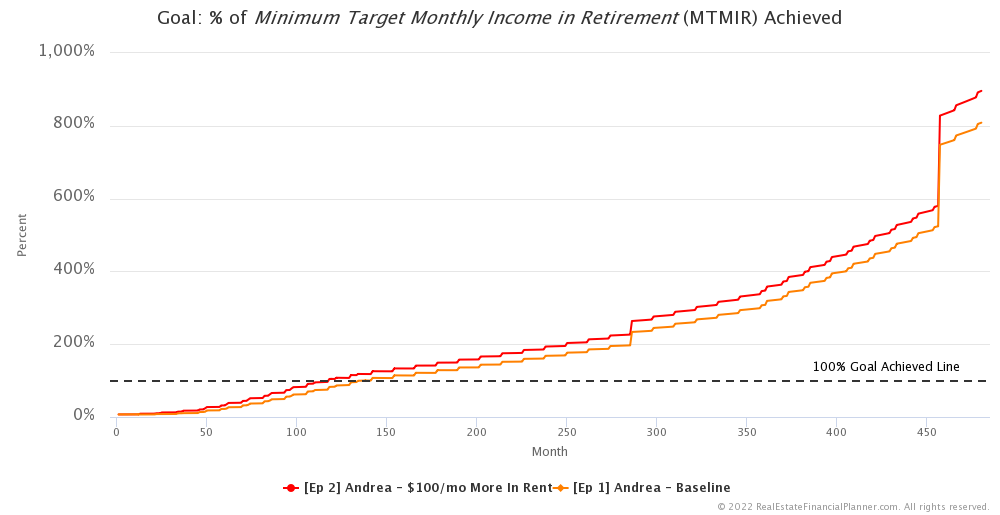

It does so in TWO ways:

- First, the improved cash flow directly impacts how much she is making from her rentals

- And, secondly, the extra cash flow means she has more invested in her stock market account… which means that the 4% safe withdrawal rate of that higher amount invested also contributes and helps toward achieving her financial independence goal

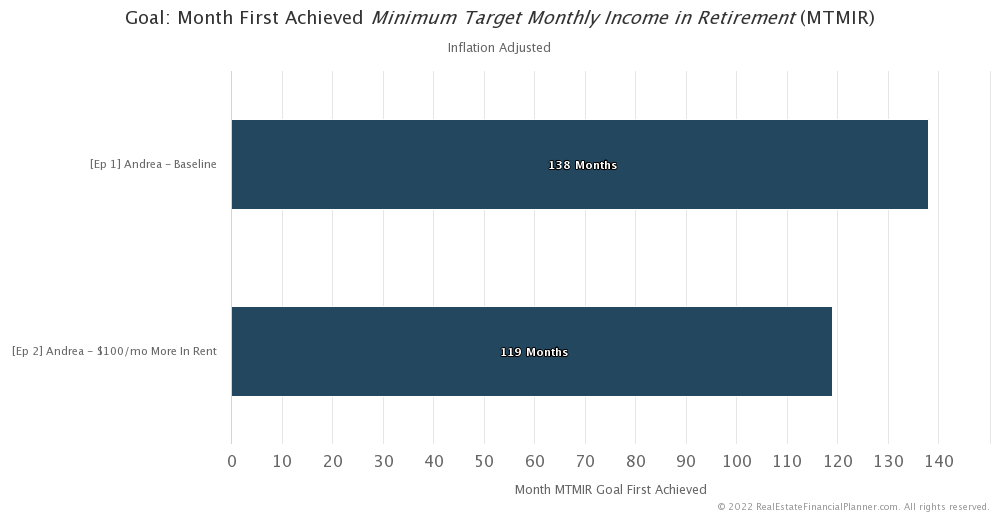

Previously in Episode, 1  Andrea

Andrea

However, by putting in the effort to get $100 more per month in rent, she is able to achieve financial independence in month 119… or about a year and a half earlier.

That’s less than 10 years from when she started. She’d be about 50 years old.

And… as you’d also imagine… getting more in rent means more cash flow which also means that she could live at a higher standard of living from her rental property income once she achieves financial independence.

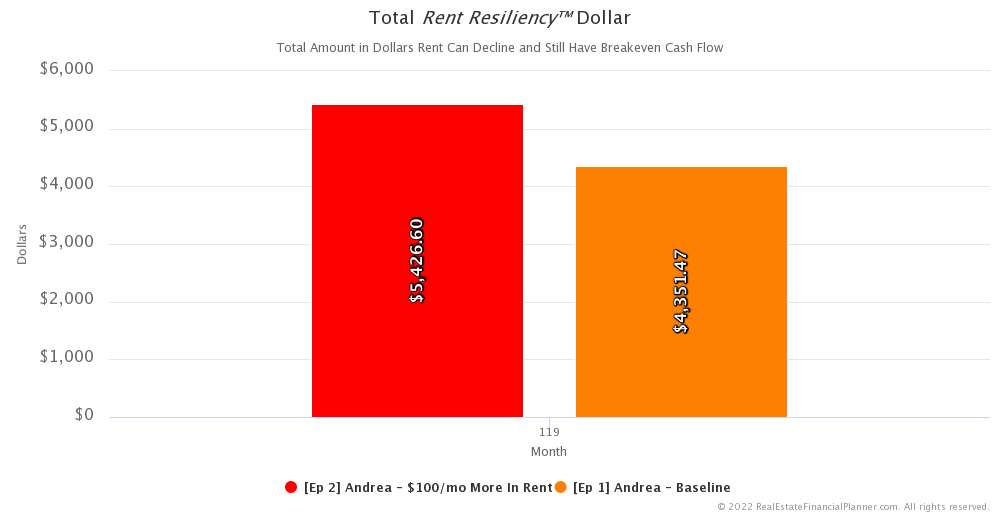

Rent Resiliency

Let’s talk about rent resiliency… in other words: how much can rent can decline before she would have negative cash flow.

This is one way to measure risk. The more rents can decline before you have negative cash flow, the more resilient you are and the less risky the investment strategy.

Obviously, collecting more rent means she has higher rent resiliency and is therefore less risky.

In terms of dollars of rent resiliency, in month 119 when she reaches financial independence with the higher rents… she has a rent resiliency of just over $5,400. In Episode 1… when she was getting $100 per month less in rent, she had a rent resiliency of just over $4,300 at the same month.

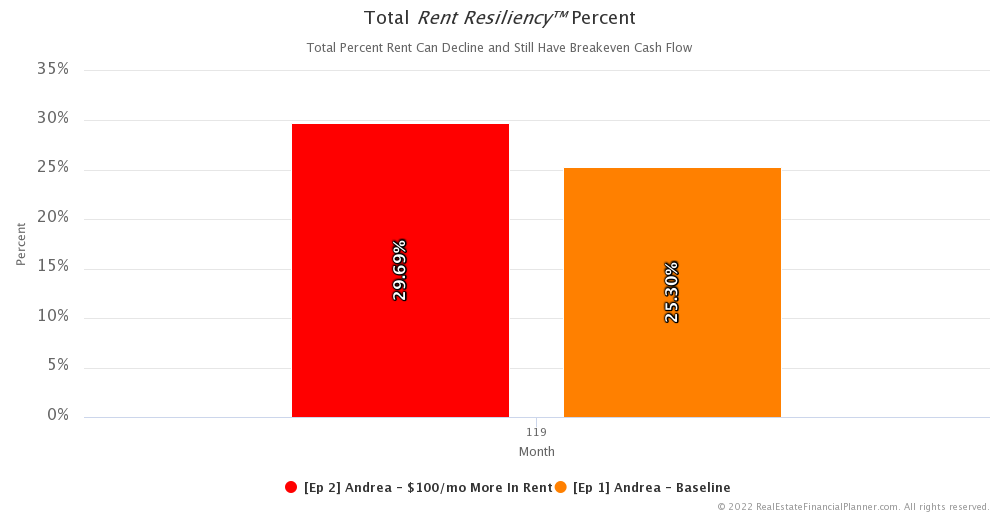

Dollars are interesting, but for rent resiliency, I often like to see what percent rents can drop before I’d have negative cash flow.

So, we can look at rent resiliency as a percentage as well.

When  Andrea

Andrea

Compare that with Episode 1 in the same month of 119 and her rent resiliency is closer to 25%. That means that rents could drop 25% and she’d still have approximately break-even cash flow.

So, getting more rent means this strategy is more resilient to drops in rents… that seems obvious… and therefore a bit less risky… the difference between being able to handle a 30% drop in rents versus a 25% drop in rents… and still have break-even cash flow.

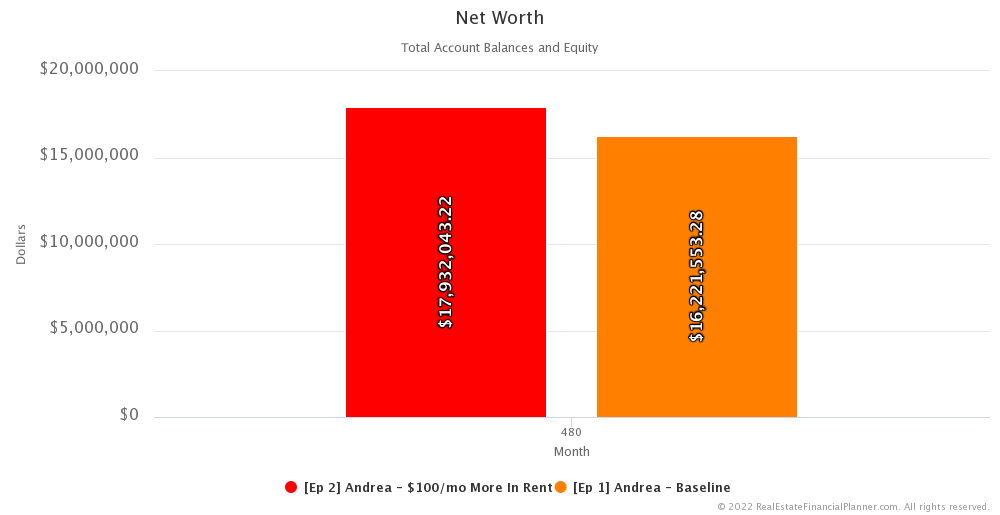

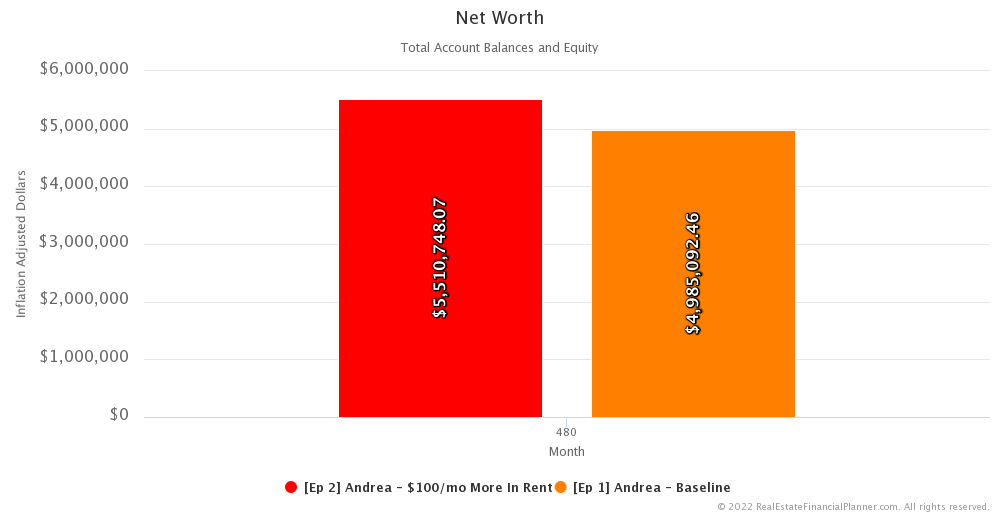

Net Worth

But how does getting an extra $100 per month in rent impact her overall net worth?

If we fast forward to 40 years in the future, she has just under $18 million in net worth by utilizing the Nomad strategy and getting an extra $100 per month in rent. Compared to a little over $16 million in net worth in Episode 1.

That’s just about a 1.7 million dollar difference 40 years from now… in inflated future dollars.

In today’s dollars, the difference feels more like half a million dollars. That’s still pretty significant.

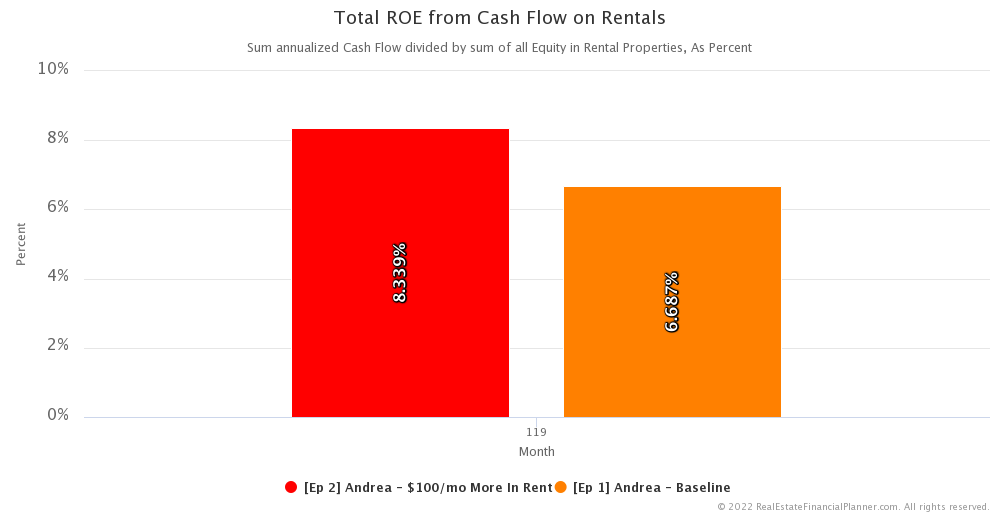

Total Return on Equity from Cash Flow

Since she is assumed to be buying the same properties in Episode 1 as she is in this episode the returns she is earning from appreciation are the same. That holds true for debt paydown and the tax benefits of depreciation as well.

However, the return she is earning from her cash flow is different because she is collecting $100 per month higher rents on each property.

The best measure of return on a property that you’ve owned for a period of time… in my opinion… is the return you earn divided by the amount of equity you have in that property.

In other words: the return on equity.

This tells you how much return you’re generating on how much you have tied up in the property.

The return on equity that  Andrea

Andrea

Compare that to 6.6% per year just from cash flow from Episode 1 in that same month 119.

Out of an abundance of clarity this does not take into account the returns from appreciation, debt paydown or the tax benefits from depreciation.

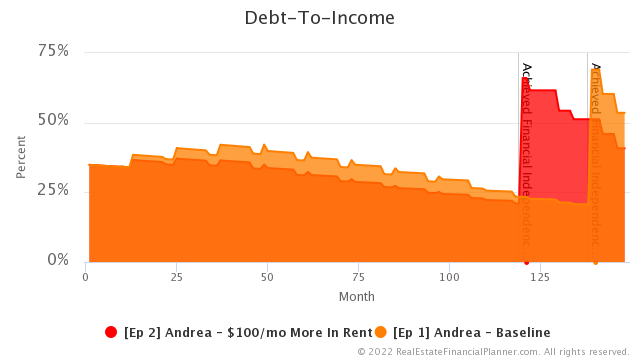

Debt-To-Income

Next, let’s talk about debt-to-income.

Debt-To-Income… often abbreviated as DTI… is a measure of risk. It is such an important measure of risk that lenders use it to determine whether you qualify for loans or not.

Earlier I hinted that getting extra money in rent helps  Andrea

Andrea

Let’s see how that works mathematically.

For  Andrea

Andrea

For her original baseline Scenario in Episode 1, her highest debt-to-income month… again… this for the period while she working as an accountant and trying to qualify to buy properties… was 42.14% and it was while she was buying her fifth property.

In both cases, she is clearly able to keep her debt-to-income below the 45% limit to qualify for many loans.

This and having down payments are what allows her to buy a property every 12 months using the Nomad™ strategy.

In the Advanced Real Estate Financial Planner™ Podcast, you’ll find us running up against the 45% debt-to-income limit and that can have a significant impact on when  Andrea

Andrea

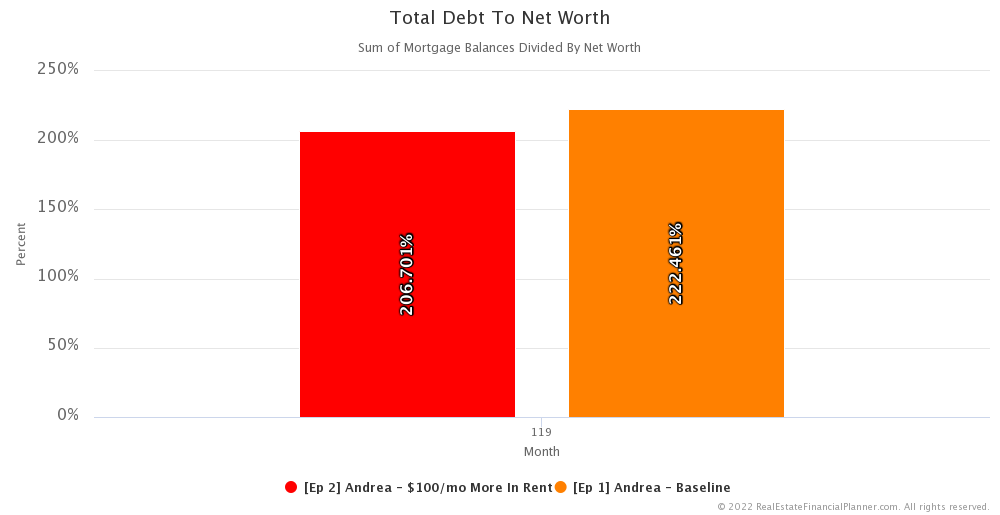

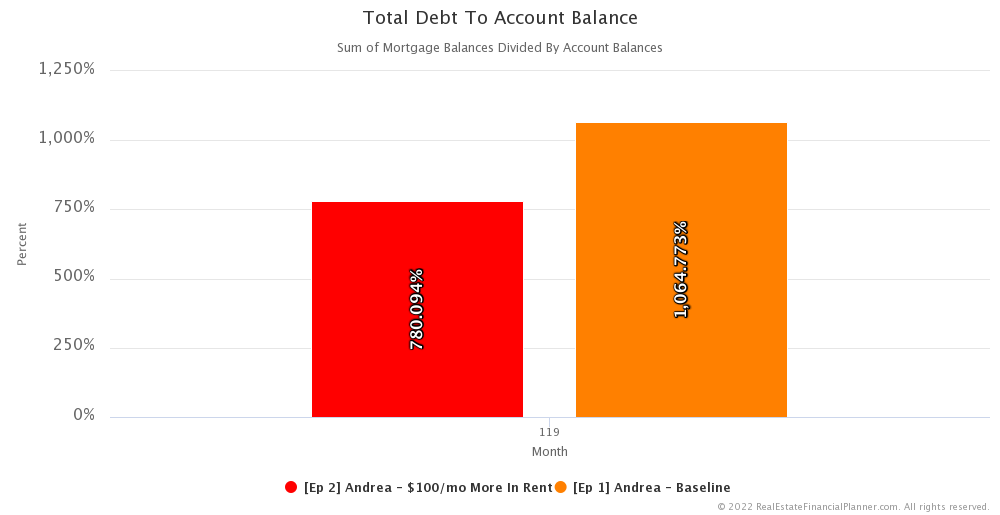

Risk

We will discuss this more in future episodes, but there are two additional ways I like to measure risk of a real estate investing strategy.

One is to measure how much debt someone has compared to their overall net worth. We call this… obviously… debt-to-net-worth.

But some or all of your net worth can be illiquid and not easily accessible. For example, it can be equity in properties. And knowing how much debt you have compared to illiquid equity in properties is not always the *best* measure of how risky an investing strategy is.

So, another way that I like to measure risk is your debt compared to your liquid net worth. In the Real Estate Financial Planner™ software we define that as your debt compared to your account balances.

This gives you a way to compare how much debt someone has compared to how liquid they are with money in their accounts.

For  Andrea

Andrea

For measuring debt to liquid net worth or debt to account balances… in month 119 it is about 780% when she is getting $100 more in rent compared to about 1,064% in the same month from her baseline Scenario. That’s about 25% less risky by keeping more cash on hand.

In both cases, getting an extra $100 per month in rent tends to make the strategy less risky for these two measures.

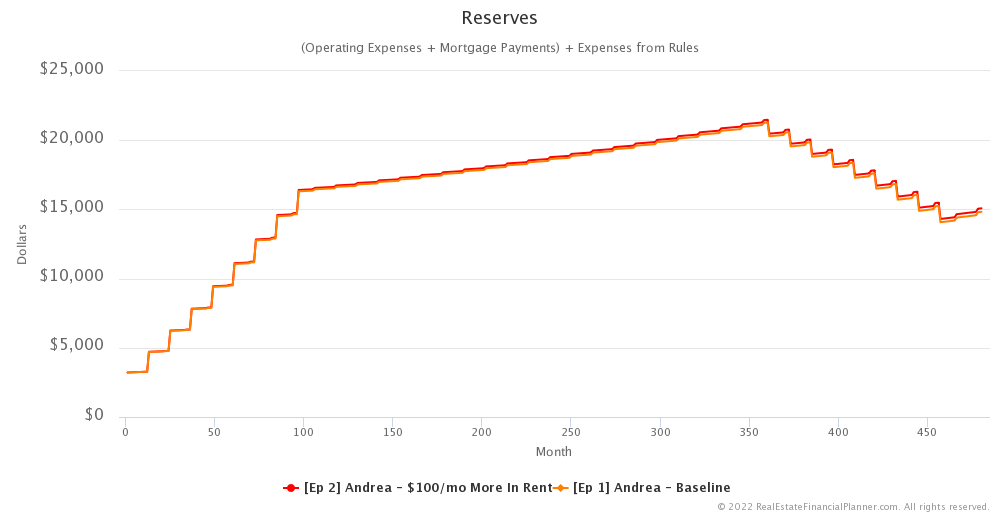

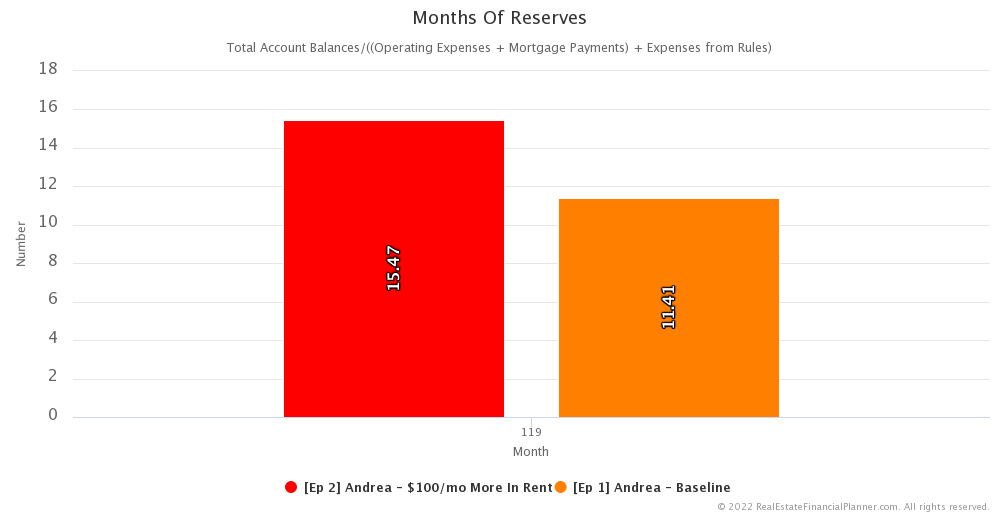

Reserves

That leads me right into a discussion on reserves. Real estate investors should keep a healthy amount in reserves. We will discuss this in more detail in future episodes.

The amount she should have for a single month of reserves for all properties is very similar whether she is getting $100 more in rent or not.

However, because she is collecting extra cash flow and only living on the $4,000 per month from her job, she is accumulating more money she could use as reserves much faster with an extra $100 per month per property.

In month 119… when she first achieves financial independence… she has a little more than 15 months of reserves when she is collecting an extra $100 per month in rent. Compare that to a little more than 11 months of reserves from her baseline Scenario from Episode 1.

Having more reserves is another measure of risk. So, getting $100 more per month in rent and saving that money is less risky than not getting $100 more per month in rent.

Next Episode

Is all this extra work to invest in real estate worth it? In the next episode, Episode 3,  Andrea

Andrea

Also, be sure to check out the Advanced Real Estate Financial Planner™ Podcast to see how having variable property appreciation rates and rent appreciation rates, variable mortgage interest rates, variable inflation rate and variable stock market rates of return impacts  Andrea

Andrea

I hope you have enjoyed this Episode about  Andrea

Andrea

Get unprecedented insight into how  Andrea

Andrea Scenarios.

Scenarios.

Inside the Numbers

What if she got $80 more per month in rent? Or, $123 more per month in rent? Check out ALL our assumptions for this  Scenario

Scenario Scenarios

Scenarios

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 1 Andrea - Baseline with 2

Ep 1 Andrea - Baseline with 2  Accounts, 1

Accounts, 1  Property, and 3

Property, and 3  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 2 Andrea - $100/mo More In Rent with 2

Ep 2 Andrea - $100/mo More In Rent with 2  Accounts, 1

Accounts, 1  Property, and 3

Property, and 3  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Podcast Episodes

The following are the podcast episodes for variations of  Andrea’s

Andrea’s

More posts: Andrea Episode