Pro Tip: Listen to the podcast below and while you’re listening follow along with the charts below. Then, when you’re done, copy the  Scenario

Scenario

Welcome to the Real Estate Financial Planner™ Podcast. I am your host, James Orr. This is Episode 1.

Today we’re going to meet  Andrea

Andrea

Andrea

Andrea

She earns about $4,000 per month… about $48,000 per year.

In the divorce, she received about $100,000 from the sale of the family home and her share of the savings and retirement funds. All of the $100,000 is after-taxes and stored in regular investment account. It is not in an IRA, 401K or other special retirement account.

Her divorce agreement has her receiving no alimony and no child-support.

She has long-since paid off her student loans. She does use a credit card as a convenience but pays the balance in full each month. She owns her car outright. She has no debt.

We’ve assumed that her $4,000 per month in income from her accounting job continues to keep pace with inflation. She will continue to get regular raises, but her raises are NOT increasing her standard of living.

Her primary concern moving forward is providing a good life for her 2 boys. Her secondary concern is to invest the $100K wisely for her retirement.

Ideally, she would like to spend all of her income from her accounting job on supporting herself and her kids.

However, when her kids are adults (in about 16 years), she could—at least in theory—take some of the money she was spending on them and use it to catch up with any retirement savings. However, 16 years from now, she’ll be 56 years old and only have about 9 years left until she is 65 years old. That’s not a lot of time for her to be able to make up a lot of lost ground. Ideally, she can grow the $100,000 she has now to provide enough for retirement.

She’s been exposed to the idea of investing in rental properties, but has no experience doing it. She’s hesitantly optimistic about the idea of investing in rentals. She still needs to learn more about it to feel comfortable. She doesn’t know what she doesn’t know… yet. She hopes real estate will help her grow her $100K to be enough to retire by, at least, age 65. Age 65 is 25 years from now.

She’d love to be able to stop working earlier than age 65.

Meanwhile, she doesn’t hate her job; it’s OK. She does like the people she works with.

After speaking with some of her family and friends, they’ve suggested—and she agrees—that maybe she should give herself a little time and space before she does anything drastic with the $100,000 she has saved.

Typical bread-and-butter rental properties in her city cost about $250,000. When buying rental properties, she figures she could put 20% down and get non-owner-occupant (investor) loans. A 20% down payment on a $250,000 property would be about $50K.

If she was not going to pause to give her some space to settle after the divorce, should could, in theory, afford two rental properties. That’s two $50K down payments. She is, temporarily, ignoring closing costs.

She does need a place to live with her 2 boys. A friend of hers is a real estate agent in her local market. Her friend refers her to a mortgage broker and they discuss buying a home for her and her two boys to live in.

After looking at all the financing options with the lender, she decides to get a 5% down owner-occupant loan. By not putting 20% down, the lender would require her to pay for private mortgage insurance (also known as PMI). PMI protects the lender in case  Andrea

Andrea

Andrea

Andrea

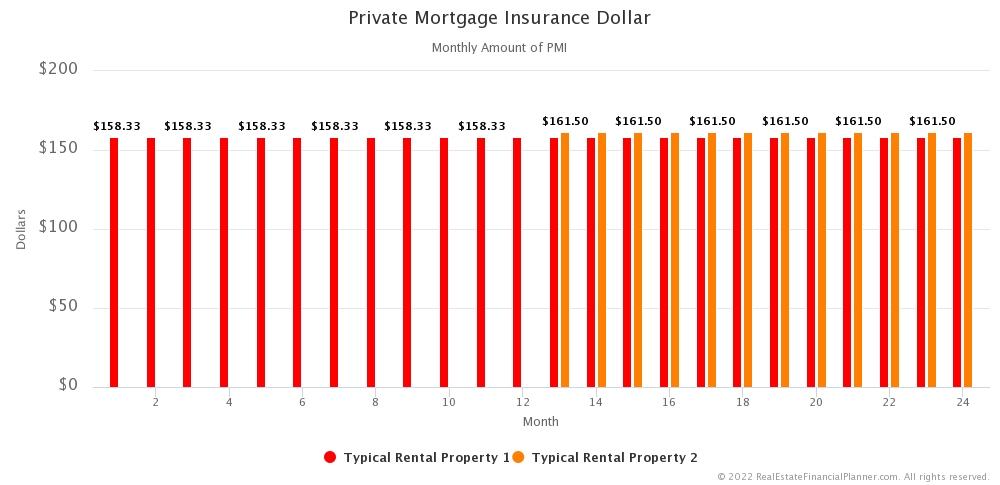

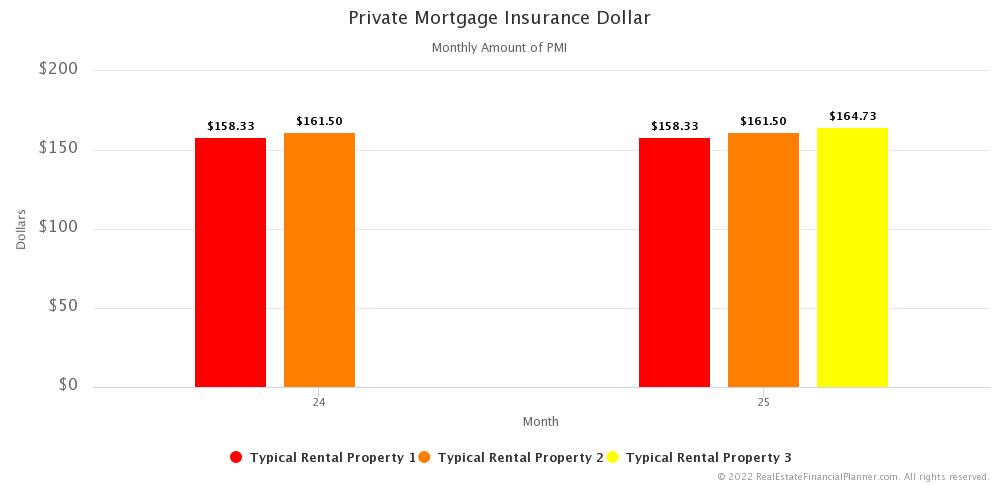

She thinks to herself: I could put 5% down (about $12,500 on a $250,000 property) and pay $8,000 over 4 years in PMI. That would total approximately $20,500. Alternatively, I could put 20% down (about $50,000) and have an extra $158 per month for the next 4 years.  Andrea

Andrea

We could almost look at the $158 per month in PMI as money she is “saving” for retirement because she did not need to dip more into the $100K for retirement.

While talking to the lender, the lender mentions to her something important. She is required to live in the property for a year to qualify for the 5% owner-occupant down payment amount and the owner-occupant interest rate. The owner-occupant interest rate—even with 5% down—is significantly better than the non-owner-occupant interest rate she could get with 20% down. She is quoted 3.125% for owner-occupant with 5% down payment and 4.5% for 20% down non-owner-occupant.

Scenarios

ScenariosShe asks the lender if… a year from now… after she fulfilled her obligation to the lender to occupy the property for a full year… if she wanted to buy another property with 5% down: could keep this property and convert it to a rental?

The lender informs her that she’d need to qualify for the new property purchase but she could also use the rent from this property to help her qualify.

Our modeling starts with  Andrea

Andrea

She keeps the remaining money from the $100K she had saved and invests in stock market index funds. For the sake of simplicity in our modeling, we assume she is earning 8% per year in the stock market.

Obviously, in the real world, these are variable. We make them (and other factors) variable in the advanced modeling we do in the REFP Advanced podcast.

Back to our story, during that first year living in the property,  Andrea

Andrea

In her spare time, she does begin to study real estate investing and is willing to try at least one rental property.

Year 2

About 2 months prior to her 1-year anniversary living in her home with her kids, she starts the process of looking for a new home to move into. She plans to buy a new home and keep the old one as a rental property.

While  Andrea

Andrea

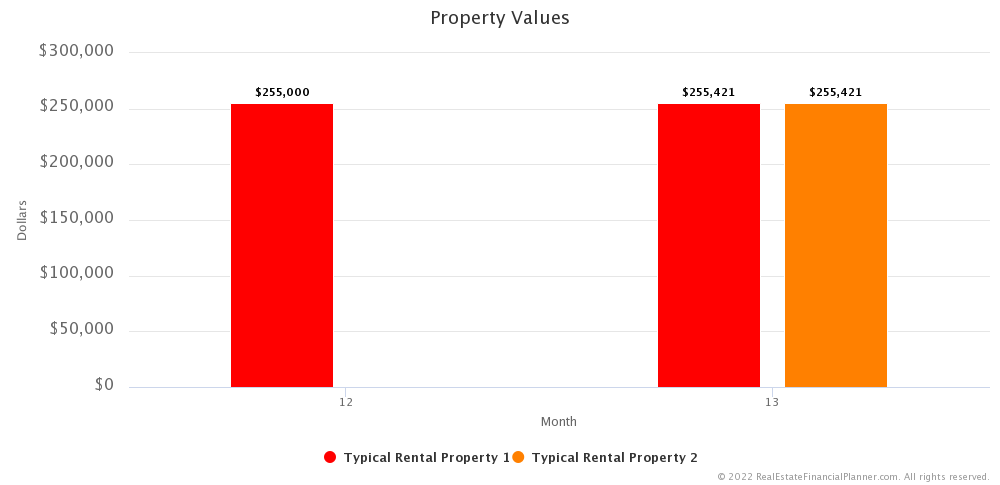

Property values during the first year have gone up a little. So, the property she bought last year is worth a little more. The property she is about to buy is also about the same price. Both were worth about $250K last year. This year they’re both worth a little more than $255K.

So, she puts 5% down and gets on owner-occupant loan. It is annoying and requires some effort, but she moves out the property she bought last year and moves into the new property.

Andrea

AndreaWe call this the Nomad™ real estate investing strategy and we have done numerous comparisons showing the different between doing this strategy versus just about every other strategy including putting 15%, 20%, or 25% down and not moving it (getting non-owner-occupant loans).

The short answer is: yes, it is annoying and a lot of extra work but there are significant financial benefits.

Because she put less than 20% down and this property, she will have PMI on this new purchase as well. And, she’s still paying PMI on the previous property as well.

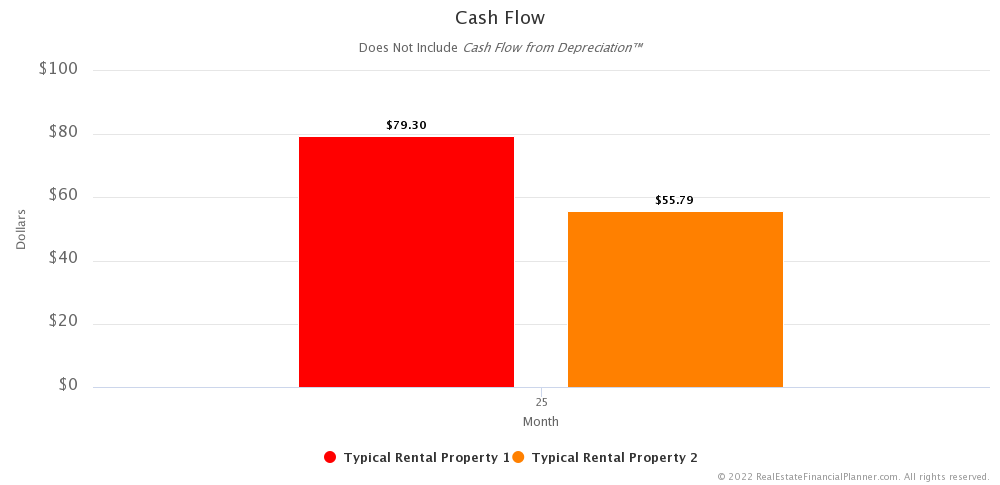

But, she is collecting rent on the previous property and even with the PMI and vacancy, property taxes, insurance, maintenance and her mortgage payment she is making about $40 per month in cash flow on that property.

Andrea

AndreaAnd, she is not taking into account the tax benefits of depreciation now that it is a rental property.

So, in month 13 from now,  Andrea

Andrea

One is a rental property that she bought as an owner-occupant and lived in for the previous year. It is now rented to a tenant for about $1,650 per month.

The other is a new property… very similar to what she was previously living in… that she bought for 5% down and is now living in with her 2 boys (now aged 3 and 5).

She continues to work at her job as an accountant at the manufacturing company. She spends her entire paycheck supporting herself and her kids. This includes the mortgage payment on the property they’re living in.

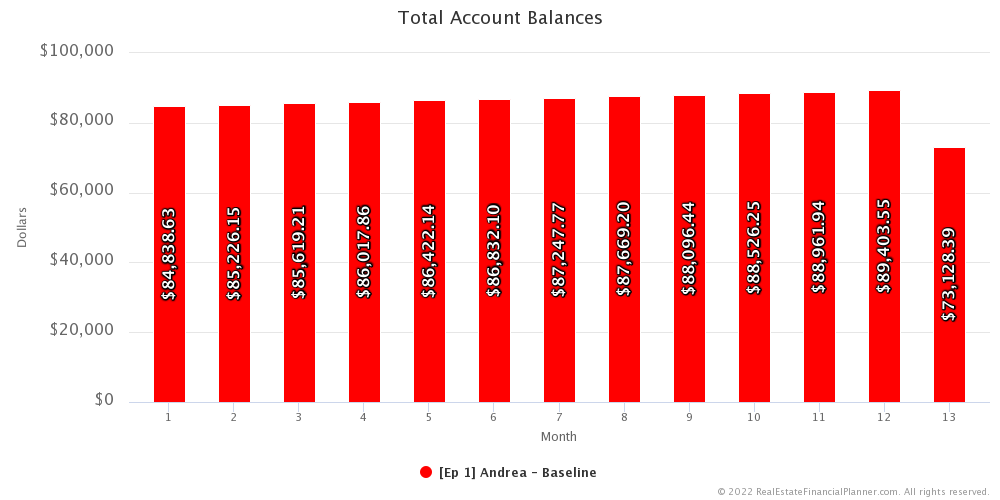

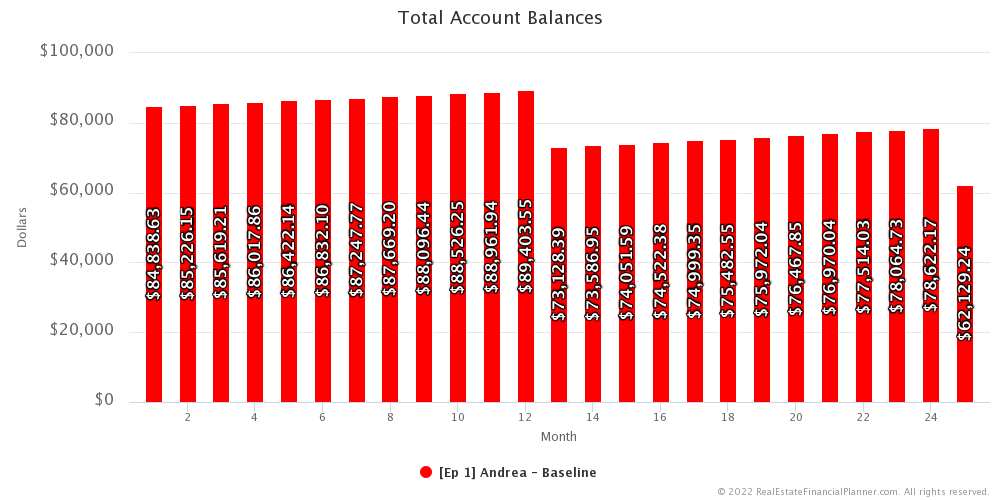

After taking out the money for her 5% down payment and closing costs to buy the new property, the money she has left over from the initial $100K is still invested in the stock market at 8% per year. In fact, it had grown some since last year. After the second down payment it has about $73K left invested in stocks.

If she had tried to put 20% down, she probably wouldn’t have any money left over after buying two properties. By purchasing properties sequentially as an owner-occupant with 5% down, she still has about $73K left over.

Year 3

She continues to study real estate investing in year 2. But she also has a rental property and she is learning through experience now with her rental.

About 2 months prior to her 1-year anniversary on her second property, she starts the process to buy the next property… her third.

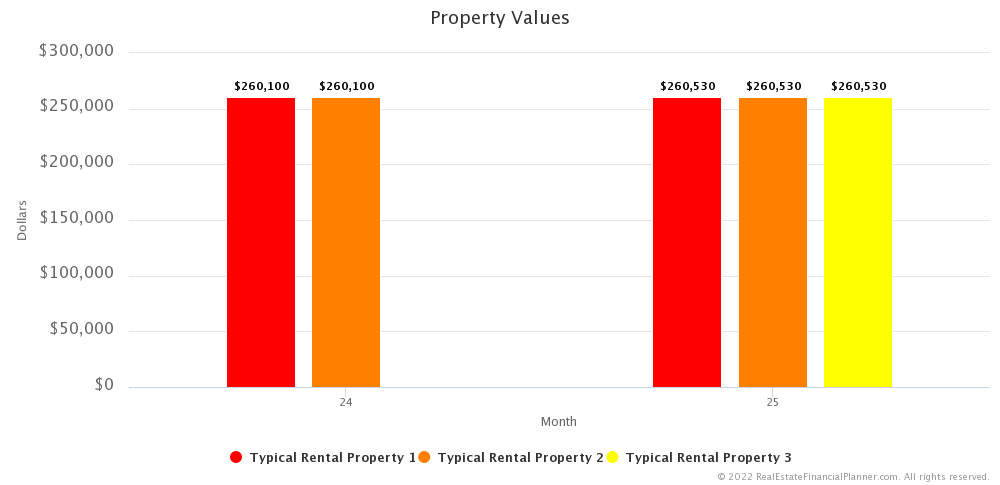

Both the properties she owns… the one she is living in and the rental… have gone up in value a little bit. She is buying the same type of property for her 3rd property so that one costs the same as the previous 2 are worth… about $261K each.

She dips into her stock market investment account for another 5% down payment and some closing costs and buys her third property as an owner-occupant.

While annoying, she moves out of the second property with her two boys (now aged 4 and 6).

She converts the second property to a rental and leases it to a good tenant.

She now has two rental properties and a home she lives in.

She bought all 3 of them with 5% down payments. All 3 of them still have PMI.

The first one she bought is currently cash flowing about $78 per month and the second one is cash flowing about $55 per month. This is after all expenses including vacancy, taxes, insurance, maintenance, mortgage payment and PMI. Since she is managing it herself she is not paying a professional property management fee.

She is still just living on the income from her accounting job while the rentals and the money she has in the stock market is contributing toward her retirement funds.

How would she determine if she has enough to retire? Well, she could use the cash flow the rental properties are generating. If the rents on the properties she owns… after all the expenses on them that we’ve previously discussed… if that cash flow is enough to exceed the amount of money she is generating from her job as an accountant… adjusted for inflation… then she is financially independent and could stop working and live off the cash flow from the rentals.

But, she also has money invested in the stock market.

If she had no rentals properties, how would she know if she had enough money invested in stocks or bonds or something else to be able to retire? She does some research and reads about this idea of the 4% rule. There are details to it, but the over-simplified explanation is she can “safely” spend 4% of the lump sum she has invested in stocks and bonds (adjusting for inflation each year). If she does that, she is not likely to run out of money over a 30-year retirement period.

We now have guidelines for rental property (cash flow) and stocks/bonds (4% rule). When does the combination of the cash flow on her rentals and 4% of her stocks—what we’ll refer to as financial independence—replace the $4,000 per month she is currently living on from her accounting job? And technically, it is $4,000 per month adjusted for inflation. That means it is really higher than $4,000 per month but the Real Estate Financial Planner™ software does that math for us.

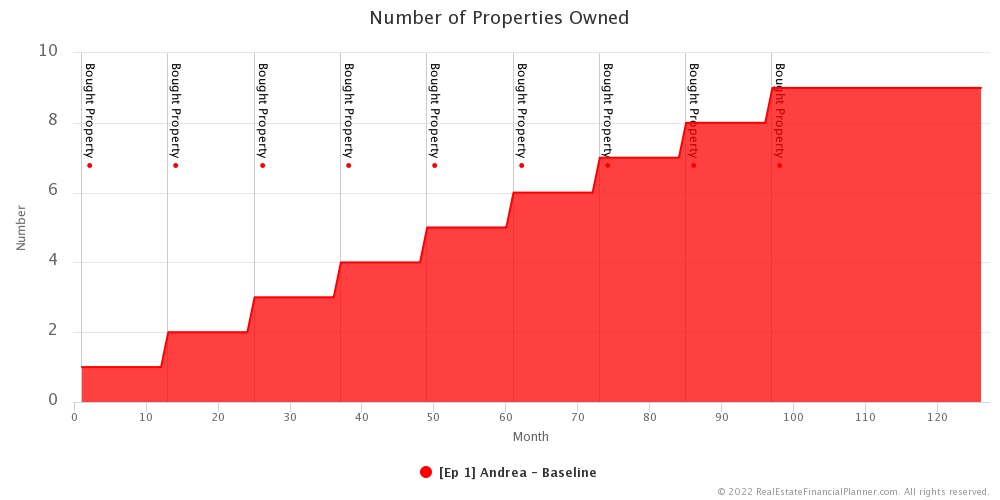

Repeat Buying Properties

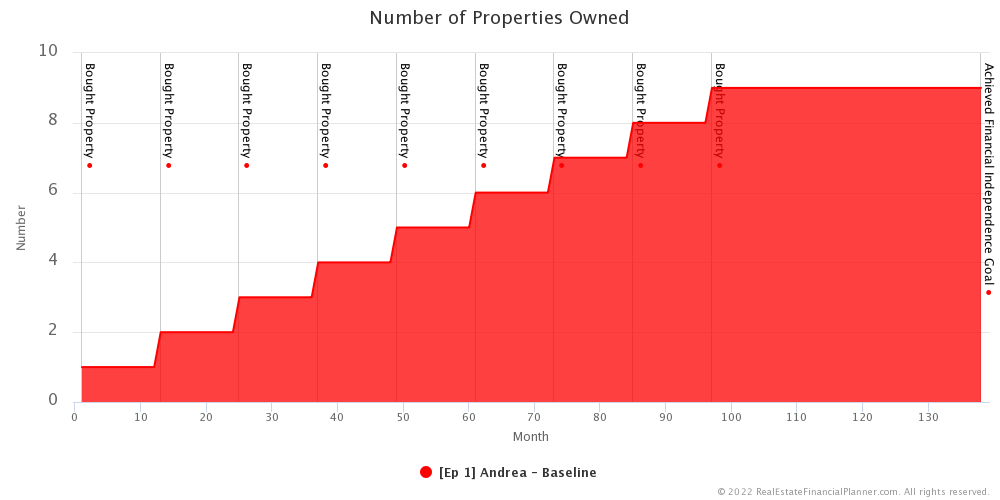

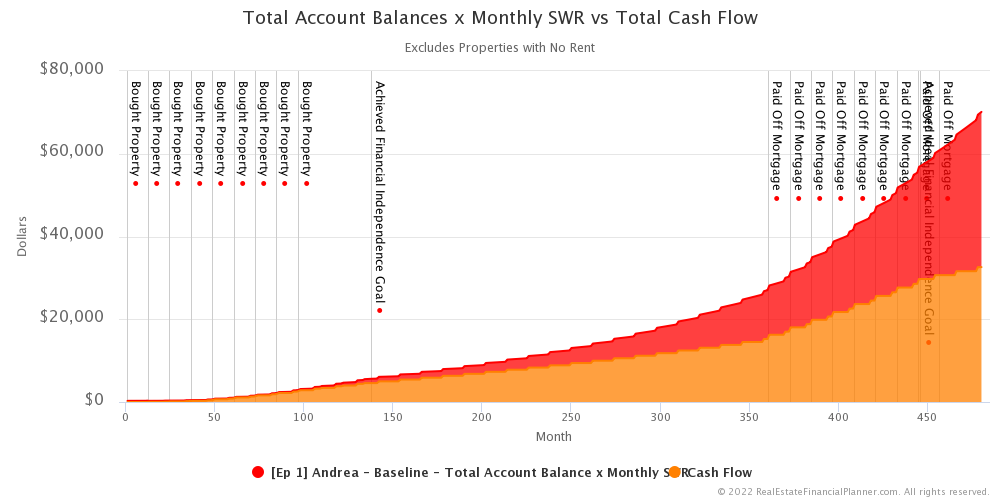

She keeps moving into a new property each year and converts the previous to a rental until she has purchased 9 properties. At that point she has 8 rentals when she really only had down payments for 2 rentals originally. And, the 9th property is the one she will live in forever. That takes over 8 years to acquire these 9 properties.

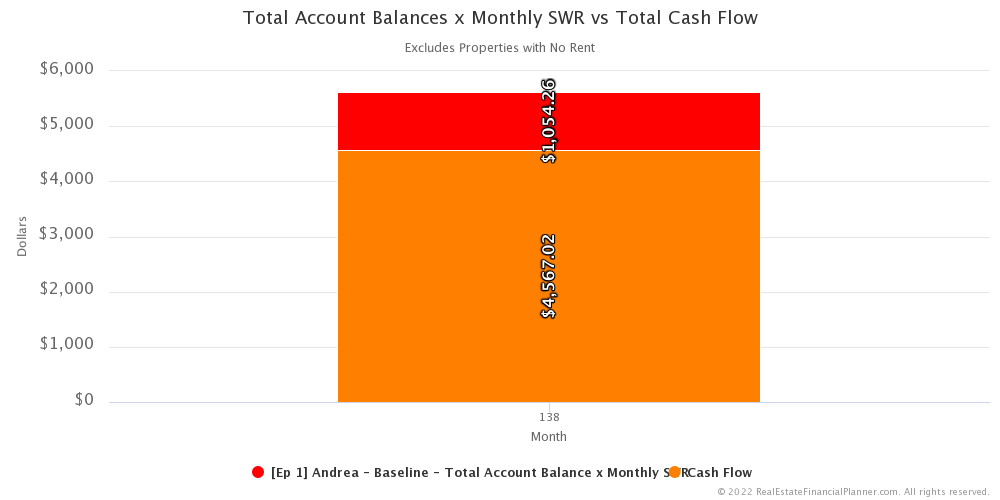

It turns out she is able to achieve financial independence and stop working 138 months into the process… that’s about 11.5 years. Her kids are 13 and 15 by then. And, she’ll be completely free to spend their teenage years with them without having to work at her accounting job.

She stops working at her accounting job at month 138 and lives off the proceeds from a combination of the cash flow from her 8 rental properties and the money she is earning from her investments in the stock market.

The majority of the money she needs to live on comes from rental property cash flow.

She is earning almost $5,600 per month.

If we adjust for inflation, it is just over $4,000 per month in today’s dollars (which is the amount she is trying to replace from her accounting job).

In fact, in retirement… as rents increase and properties get paid off, she will be able to spend a lot more than the $4,000 per month she’d been earning.

- How much cash flow does she have in X month?

- What is her debt-to-income level after she bought house 6? Or, house 8?

- Can she qualify for all those loans? The answer is yes!

- How much does she have in stocks when she reaches financial independence?

- How much equity does she have?

- What was the largest amount of negative cash flow she had at any given time?

- How low did her account balance get?

Get unprecedented insight and answers to all of these questions…

Or, if you’re like  Andrea

Andrea Andrea’s

Andrea’s Scenario

Scenario

Now, if you’re like me, you probably have questions.

- What if her inexperience meant that she was slightly under renting the properties? Or, what if she really worked hard and was able to get $100 per month more in rent each month? What difference would that make? Could she retire earlier? How much earlier?

- Does this real estate stuff make that big of a difference? What if she just kept her money investing stocks instead? When could she retire then?

- What if she hired a professional property manager? Would that slow down her ability to retire? By how much?

- What if she took her extra cash flow and decided to use it start paying off properties early? Can she retire earlier? Is this less risky? More risky?

And even some ADVANCED questions like:

- What if the stock market goes down? Or, at least, has random returns like might look like some historical returns instead of just using a fixed 8% all the time?

- What if rents go down? Or, they’re random?

- What if property values go down? Or, they’re random?

- What if mortgage interest rates go up? Or, if they are random?

- What if we see more or less inflation? Or, inflation is random?

Join us in the next episode as we look at what happens to  Andrea

Andrea

Get unprecedented insight into  Andrea’s

Andrea’s Scenario with dozens of detailed, interactive charts.

Scenario with dozens of detailed, interactive charts.

Inside the Numbers

The details are really in the assumptions that we used for  Andrea

Andrea

Go inside the numbers and find out more about exactly what we used for our assumptions by clicking on the button to copy the  Scenario

Scenario Scenario

Scenario

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 1 Andrea - Baseline with 2

Ep 1 Andrea - Baseline with 2  Accounts, 1

Accounts, 1  Property, and 3

Property, and 3  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Learn why we used the assumptions we did and how to change any of the assumptions by going “Inside the Numbers” with the video walk through below of how we setup the  Scenario

Scenario

Podcast Episodes

The following are the podcast episodes for variations of  Andrea’s

Andrea’s

More posts: Andrea Episode