If you’re interested in learning how to invest in rental properties on your journey toward financial independence, then you’ve found the right place.

Many folks seek rentals because they believe that they provide superior returns compared to other investments like stocks, bonds, notes and speculating in commodities and cryptocurrencies.

The returns you can earn buying rentals break down into four component areas that we often discuss with the Return Quadrants™. Some folks have traditional described this using the acronym that real estate is the IDEAL investment. Where:

- I = Income

- D = Depreciation (tax benefits)

- E = Equity build-up

- A = Appreciation and

- L = Leverage

We often represent these four areas of return (plus the return you earn on your reserves while waiting to use them) graphically as:

The leverage is implied in the actual numbers and not shown as a separate quadrant.

While market conditions do vary which can impact your returns in all investment types, we have proven repeatedly in our modeling, that buying rentals does speed up achieving your goal of your Target Monthly Income in Retirement.

Active Investing vs Passive Investing

Buying rentals and managing them is a more active investment than investing passively in other investments like stocks or bonds. Even hiring a property manager requires that you manage your manager.

It more akin to starting a business of having rental properties rather than just buying into an on-going business enterprise (aka buying stock in that company) or loaning money to on-going entity (aka buying a bond).

Leverage of Buying Rentals With Mortgages

You could buy rental properties for all cash and not use leverage.

However, one of the benefits (and honestly one of the risks) of buying rental properties is that you can leverage your investments.

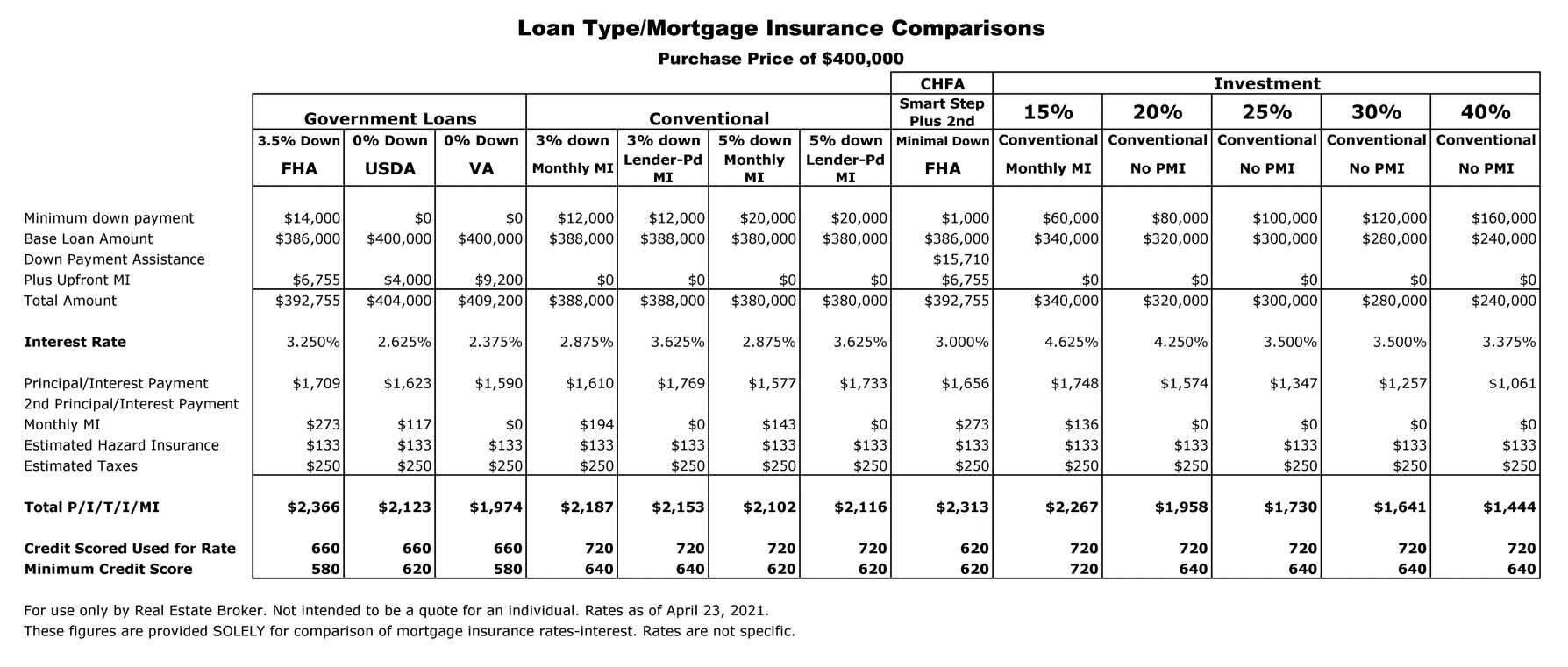

When buying non-owner-occupant properties with traditional bank financing you can purchase properties easily with 20% down. In some cases, there are loan programs that require Private Mortgage Insurance (PMI) that you can purchase non-owner-occupant rental properties with as little as 15% down.

Of course, you could choose to use other real estate investing strategies like the Nomad™ strategy that allows you to buy properties as an owner-occupant, live there for the agreed upon period required by the lender (usually a year) and then convert that property to a rental. This will allow you to acquire income producing rentals (with at least a year delay where you have to live in the property or commit loan fraud) with owner-occupant interest rates and down payments. For example, there are owner-occupant down payments as low as nothing down (VA Loans and USDA Loans) as well as 3.5% FHA financing and 5% down conventional loans.

Returns when buying a property with these smaller sized down payment amounts can be amplified significantly. However, some returns (like the top two in the Return Quadrant™… appreciation and cash flow) can be negative. Smaller down payments amplify BOTH positive and negative returns. Depending on where you are storing/investing your reserves, these can also be amplified both positively and negatively.

Other returns (like the bottom two in the Return Quadrant™… debt paydown and depreciation) are very unlikely to be negative. One of the few exceptions I can think of is if you choose to get a negatively amortizing loan on a property… and that’s both a personal choice and a bad choice (in my opinion). I’ll simplify and say that these two returns are not going to be negative. They can be amplified by small down payments, but since they aren’t negative they won’t be amplified as negative returns.

Get Started Investing in Real Estate

For more information on getting started investing in real estate, you can check out the Treasure Chest™ or other real estate investing classes.

Analyzing Deals

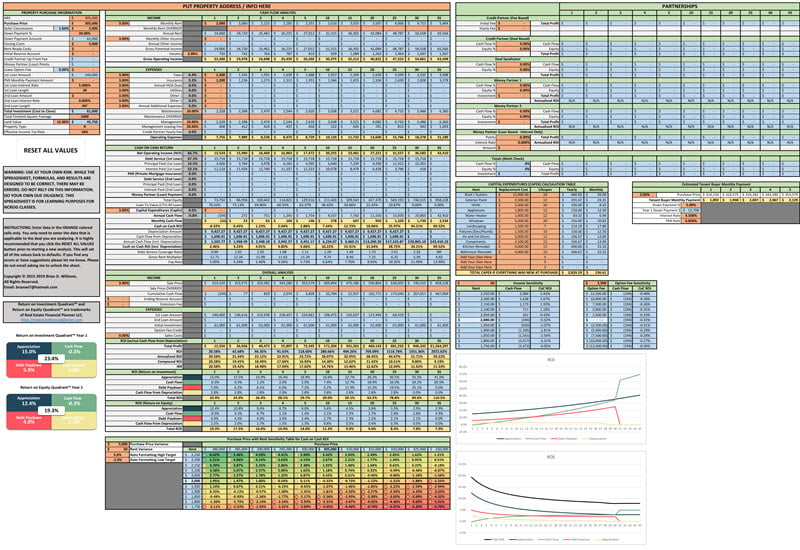

A key to success real estate investing is the ability to analyze deals. You’ll need a deal analysis spreadsheet to make it easier to do that. Here’s ours.

Also, we have a bunch of classes on analyzing deals.

Down Payments and Financing Your Deals

Coming up with a down payment and financing your real estate deals is probably the next most critical steps in the process. Here’s a quick comparison of some different loan programs from our financing classes.

Or, check out our down payment classes for more information on how to come up with down payments.

Advanced Modeling

Once you’re beyond basic deal analysis and you’re ready to really consider how likely you are to succeed in reaching your goal of financial independence, then you should look into how we use Alternate Universe Modeling™ (our special version of  Monte Carlo

Monte Carlo

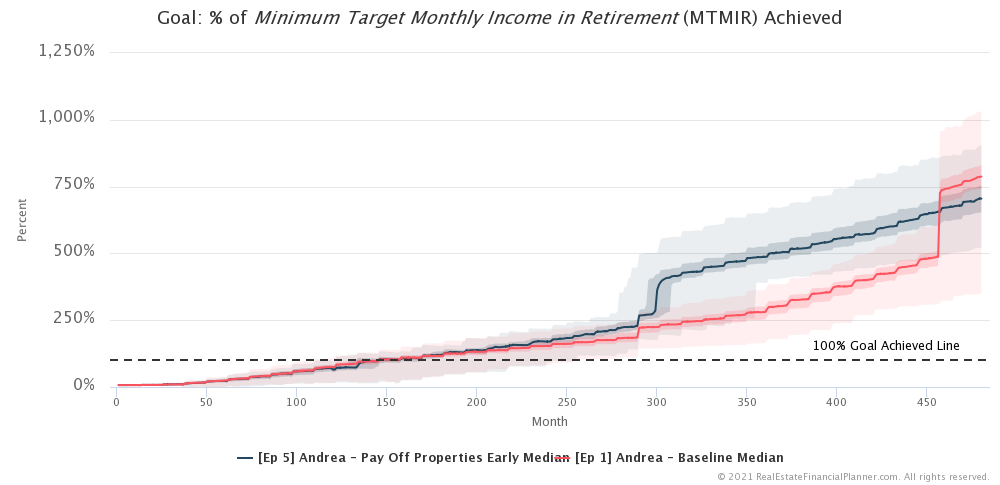

For example, here’s a chart showing how likely  Andrea

Andrea