When it comes to real estate investing, everyone has an opinion on the best strategies. Countless articles, blog posts, and podcast episodes will tell you how to approach the market. But, what if we took a more mathematical approach? That’s exactly what I intend to do here—using a comprehensive list of top real estate investing strategies and the Real Estate Financial Planner™ software to run the numbers.

Let’s dive into some of the best strategies out there:

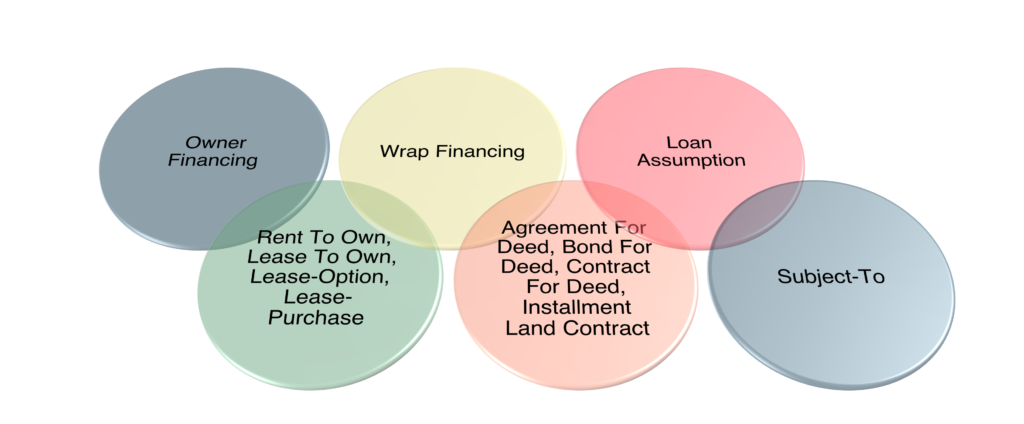

Creative Financing

- Owner Financing – The seller acts as the lender, allowing the buyer to make payments directly to them, often with flexible terms.

- Wrap Financing – A type of seller financing where the new loan “wraps” around an existing one, often used in pre-foreclosure scenarios.

- Loan Assumption – The buyer takes over the seller’s existing mortgage, usually at a lower interest rate than current market rates.

- Rent-To-Own/Lease-Option – The buyer rents the property with the option to purchase it later, often with a portion of rent applied to the purchase price.

- Agreement-For-Deed Family – A legal agreement where the buyer makes payments to the seller and receives the deed only after the full payment.

- Subject To – The buyer acquires a property subject to the existing mortgage, keeping the original loan in place.

Check out our Ultimate Guide to Creative Financing for a lot more information.

Buy and Hold

Buy and Hold Real Estate Investing is a versatile strategy where investors purchase properties to generate wealth through cash flow and property appreciation over time. Below are the different variations of the Buy and Hold strategy, each offering unique benefits and challenges.

- Traditional Rentals – A long-term strategy where investors rent out properties to generate steady cash flow and appreciation over time.

- Short-Term Rentals – Renting properties on a short-term basis, like vacation rentals, often yielding higher returns but requiring active management.

- Medium-Term Rentals – Targeting tenants who need housing for one to six months, offering a balance between stability and higher returns.

- Student Rentals – Renting to college students, often per-room, offering higher returns but with increased turnover and property wear.

- Storage Units – Investing in storage facilities, providing stable income with lower maintenance costs compared to residential properties.

- Assisted Living – Investing in properties for elderly care, offering housing and services with potential for higher returns, but requiring specialized management.

- Mixed-Use Properties – Combining residential, commercial, and/or industrial spaces in one building, allowing for diversified income streams and risk mitigation.

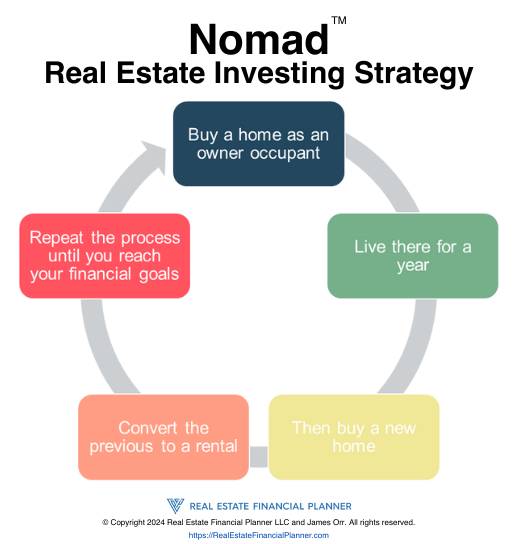

The Nomad™ Strategy

The Nomad™ strategy is a powerful, systematic approach to building wealth through real estate. You start by purchasing a property, living in it briefly to leverage owner-occupant financing, then moving out and renting it. Over time, you repeat this process with new properties, gradually creating a robust portfolio with minimal upfront costs.

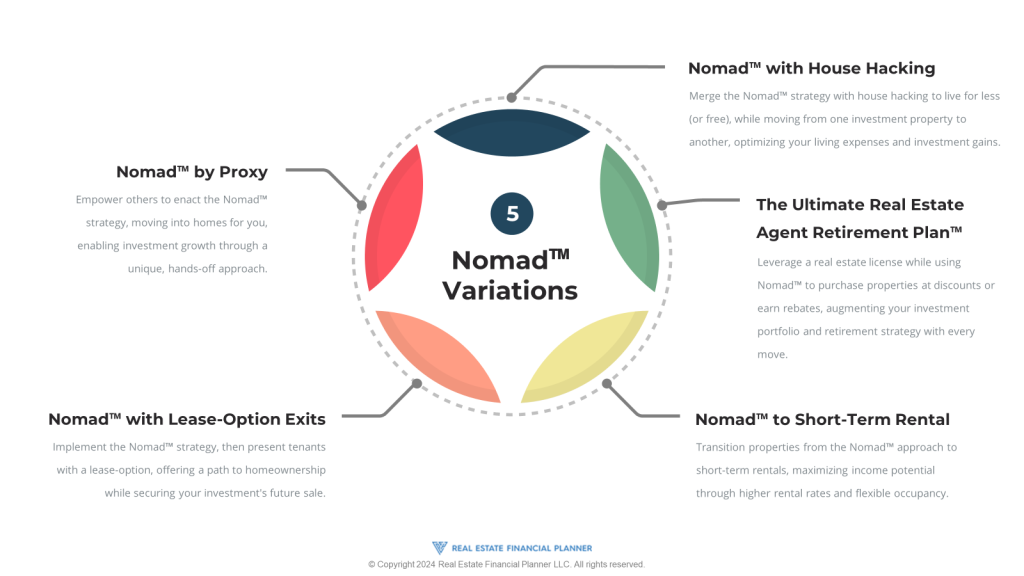

Explore these variations of the Nomad™ strategy:

- Nomad™ by Proxy – Purchase properties for others, such as family members, while still benefiting from property ownership.

- Nomad™ with House Hacking – Reside in one part of the property while renting out the rest, helping cover your mortgage and build equity faster.

- Nomad™ to Short-Term Rental – Convert your Nomad™ property into a short-term rental after moving out, maximizing income potential.

- Nomad™ with Lease-Option Exits – Provide your property as a rent-to-own option, allowing tenants to buy while you continue to grow your investment.

- The Ultimate Real Estate Agent Retirement Plan™ – Tailor the Nomad™ strategy specifically for real estate agents to create a steady income stream for retirement.

Learn more about the Nomad™ strategy and how it can accelerate your real estate investing journey.

House Hacking

If you’re looking to dive into real estate investing with minimal upfront costs, house hacking could be your golden ticket. This strategy allows you to live in a property while renting out other parts to cover your mortgage and potentially generate some extra income. It’s like living in your investment, where the rent from tenants helps pay your mortgage.

Here are some variations on the house hacking strategy:

- Traditional House Hacking – Traditional house hacking involves buying a multi-unit property, such as a duplex, triplex, or fourplex, and living in one of the units while renting out the others. The rental income can cover a portion—or even all—of your mortgage, making it an excellent way to get started in real estate investing. This approach allows you to manage your property while also gaining valuable experience as a landlord.

- Nomad™ with House Hacking – This variation of house hacking combines the Nomad™ strategy with the traditional house hacking approach. You start by buying a property as an owner-occupant, typically with favorable owner-occupant financing. You live in the property for at least a year while renting out additional units or rooms. After meeting the lender’s requirements, you move to a new property and repeat the process, turning the original property into a rental. This strategy lets you build a portfolio of rental properties with minimal down payments, all while gaining firsthand experience.

- House Hacking with Traditional Buy & Hold – In this approach, you combine house hacking with independently investing in buy-and-hold properties. You manage your house hacking property while simultaneously acquiring and managing additional rental properties using a traditional buy-and-hold strategy. These two approaches run in parallel, allowing you to build a diverse portfolio.

- House Hacking with Short-Term Rentals – For those in areas with high tourist traffic or strong demand for short-term accommodations, this variation involves renting out parts of your home on platforms like Airbnb. You might rent out a spare room, a guest house, or even the entire property while you’re away. This strategy can provide higher income than traditional rentals, but it also comes with more turnover and management responsibilities. However, it can be an excellent way to maximize your rental income while still living on the property.

House hacking is a versatile and powerful strategy for getting started in real estate investing. Whether you’re just dipping your toes into the market or looking to expand your portfolio, there’s likely a house hacking variation that fits your goals.

Short-Term Rentals

Short-term rentals can be a dynamic addition to your real estate investing portfolio, offering the potential for higher returns and flexibility. Let’s explore the exciting variations of short-term rentals that can boost your real estate investment strategy:

- Traditional Short-Term Rentals – Maximize your rental income by renting out your entire property for short stays. Attract vacationers and business travelers who are willing to pay premium nightly rates. This strategy lets you tap into the lucrative short-term rental market with flexibility and high earning potential.

- Part-Time Short-Term Rentals – Earn extra income from your primary residence whenever you’re away. Whether you’re on vacation or during local events, this approach allows you to monetize your home without fully committing to the rental market.

- House Hacking with Short-Term Rentals – Live in one part of your property while renting out another as a short-term rental. Whether it’s a spare room, basement, or guesthouse, this strategy helps you offset your living expenses with rental income while still enjoying your own space.

- Nomad™ to Short-Term Rentals – Start by living in a property as your primary residence, then transition it into a short-term rental when you move on to your next home. This approach lets you leverage owner-occupant financing while gradually building a portfolio of high-yielding short-term rentals.

- BRRRR to Short-Term Rentals – Combine the powerful BRRRR method (Buy, Rehab, Rent, Refinance, Repeat) with short-term rentals to amplify your returns. Buy a property at a discount, renovate it, and rent it out as a short-term rental to maximize cash flow. Refinance to pull out your investment, and repeat to quickly build a portfolio of profitable properties.

- Medium-Term Rentals – Offer weekly or monthly stays to cater to traveling professionals, students, or those in transition. This approach provides flexibility and potentially higher returns than traditional long-term leases, without the need for constant tenant turnover.

Learn more in our Ultimate Guide to Short-Term Rentals.

Quick Turn/Flip

Flipping properties is all about buying a property, improving it, and selling it for a profit. It’s a dynamic strategy that can be tailored to fit different situations and goals. Here are four variations of flipping that you can explore:

- Traditional Flipping – This is the most common form of flipping. You buy a property, usually one that needs significant repairs or updates, fix it up, and then sell it as quickly as possible for a profit. The key here is speed; the faster you can sell, the less you’ll pay in holding costs like mortgage payments and taxes.

- Live-in Flips – With this strategy, you buy a fixer-upper, live in it while making improvements, and then sell it. This can be a great way to turn your primary residence into a profitable investment without needing to rush the renovations. Plus, you get to enjoy the upgrades yourself while you live there.

- 2-Year Tax Advantaged Live-In Flips – This approach is a twist on the live-in flip, but with a tax advantage. If you live in the property for at least two years, you can potentially avoid paying capital gains taxes on the profit when you sell, thanks to the IRS’s primary residence exclusion. This makes it a smart long-term strategy if you’re looking to minimize tax liability.

- Seller Partnership Flips – Here, you partner with the seller, often someone who can’t afford to fix up the property themselves. You provide the funds and expertise to renovate the property, and then split the profits with the seller once the property is sold. This can be a win-win, giving you access to properties you might not otherwise find while helping the seller get more out of their property.

Learn more with our Ultimate Guide to Flipping Properties.

Buy, Rehab, Rent, Refi and Repeat (BRRRR)

The BRRRR (Buy, Rehab, Rent, Refinance, and optionally Repeat) strategy is a powerful method to build a real estate portfolio quickly. By recycling your capital through this process, you can expand your investments without needing to save up for each new property.

- Traditional BRRRR – This is the classic approach where you buy a distressed property, rehab it to increase its value, rent it out to create cash flow, refinance to pull out your initial investment, and then repeat the process with another property.

- BRRRR to Short-Term Rentals – Similar to the traditional BRRRR, but instead of long-term tenants, you rent out the property as a short-term rental (like an Airbnb). This can generate higher cash flow, though it comes with increased management responsibilities.

- Property Type Applications – BRRRR isn’t limited to just single-family homes. You can apply this strategy to duplexes, triplexes, fourplexes, apartments, and even commercial properties like industrial or retail spaces. Each property type will have its own nuances, but the core BRRRR process remains the same.

- Local vs. Remote BRRRR – You can choose to apply BRRRR locally, where you can personally oversee the rehab and management, or remotely, investing in markets outside your immediate area. Remote BRRRR might require a more hands-off approach and reliance on local teams, but it opens up opportunities in more favorable markets.

For a deep dive into the BRRRR strategy, including step-by-step guides and tips, check out The Ultimate Guide to the BRRRR Strategy.

Other Strategies

- Wholesaling – Flipping contracts rather than properties by securing a property under contract and selling it to another investor.

- Wholetailing – A hybrid of wholesaling and retailing, where the investor makes minor repairs and sells the property quickly for a profit.

- Options and Option-Auction – Acquiring the right (but not the obligation) to purchase a property within a set timeframe, often reselling that right for a profit.

- Probates, Short Sales, and Foreclosures – Buying properties at a discount due to legal or financial distress, often requiring more complex transactions.

- Tax Liens and Tax Deeds – Investing in properties by purchasing tax liens or deeds, often at auctions, with the potential to acquire the property or earn interest.

- Real Estate Investment Trusts (REITs) – Investing in real estate through shares in a trust that owns a portfolio of properties, offering diversification and liquidity.

- Hard Money Lending – Providing short-term loans to other investors, typically at higher interest rates, secured by real estate.

- Partnerships and Syndications – Pooling resources with other investors to purchase larger properties or portfolios, sharing profits and risks.

These strategies offer a variety of approaches to real estate investing, each with its own advantages and considerations. Whether you’re looking to build long-term wealth or achieve quicker returns, there’s a strategy here to suit your goals.