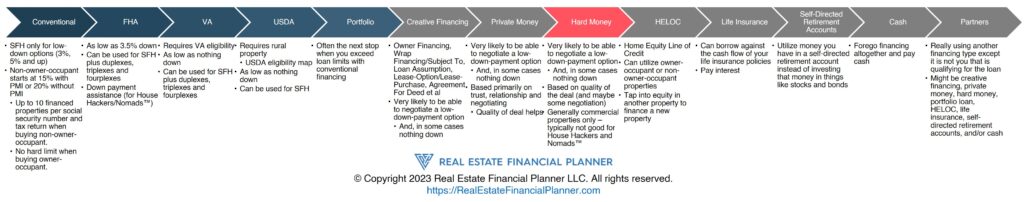

Real estate investors often utilize a variety of financing options to fund their investment properties. While traditional financing options like Conventional loans, FHA, VA, and USDA loans are popular, they may not always be the best fit for every investment strategy.

That’s where hard money loans come into play. In this post, we’ll discuss what hard money loans are, how they work, and when they’re a good option for real estate investors—especially those looking to utilizing the fix and flip strategy or BRRRR strategy.

What Are Hard Money Loans?

Hard money loans are short-term, asset-based loans that are typically used to purchase or renovate investment properties. Unlike conventional loans, hard money loans are often funded by private investors or investment groups and have higher interest rates and fees. These loans are secured by the property itself, so the borrower’s credit history and income are not always the primary factors in determining approval.

When to Use Hard Money Loans

Hard money loans are not typically used for long-term rental properties or owner-occupied properties. Instead, they are best suited for real estate investors who are looking to quickly purchase and renovate a property for resale or refinance. For example, if an investor finds a distressed property that needs significant repairs, they may use a hard money loan to purchase the property and, in some cases, cover the cost of the renovations. Once the property is renovated and sold, the investor can pay off the hard money loan.

Hard money loans are also useful for investors who may not qualify for traditional financing due to credit history or other factors. These loans are often easier to obtain than traditional loans, making them a possible option for investors who need funding quickly.

How Hard Money Loans Work

Hard money loans are typically short-term loans with terms ranging from three to twelve months. Interest rates and fees for hard money loans can vary widely and are determined by the lender. Generally, interest rates for hard money loans range from 10% to 15%, but they can be higher in some cases.

The maximum loan amount for a hard money loan is usually based on a percentage of the property’s After Repair Value (ARV). For example, if the property’s ARV is $200,000 and the lender has a maximum loan-to-value ratio of 70%, the maximum loan amount would be $140,000.

In addition to interest rates, hard money loans often come with points, which are upfront fees charged as a percentage of the loan amount. Points can range from 1% to 5% of the loan amount and are charged in addition to interest.

Some hard money lenders will allow you to finance in the points.

Conclusion

Hard money loans can be a useful financing option for real estate investors who need quick funding for property purchases or renovations. While they come with higher interest rates and fees than traditional loans, they are often easier to qualify for and can be funded much more quickly. If you’re a real estate investor in need of financing for a fix-and-flip or rehab project, a hard money loan may be worth considering. As with any financial decision, it’s important to do your research and work with a reputable lender to ensure that you’re making the best choice for your investment strategy.