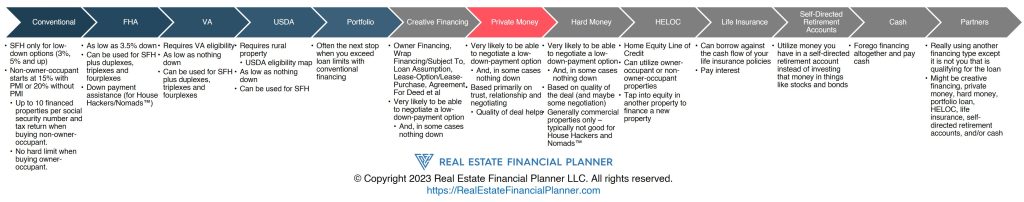

Real estate investors are always looking for financing options to fund their deals. While conventional financing is the most popular option, there are other popular traditional financing options like FHA, VA, USDA and portfolio loans.

Plus, there are also quite a few creative financing options available including owner financing, wrap financing/subject to, the lease-option/lease-purchase family and more.

In this blog post, we will discuss private money loans for real estate investors.

Private Money Loans

Private money loans are loans provided by individuals or companies who are not traditional lenders. These lenders are usually individuals who have extra money to invest and want to earn a higher return on their investment. Private money loans, in some circles, may be referred to as peer-to-peer lending.

They differ from hard money loans in that the person making the loan is not typically in the business of making loans secured by real estate. Hard money loans are typically made by those that are in the business of making those types of loans.

How Private Money Loans Work

Private money loans are typically short-term loans, ranging from 6 months to 2 years. The interest rates for private money loans are often higher than conventional loans, but they are easier to qualify for. The terms of private loans—including the interest rate and duration of the loan—are typically negotiated between the private lender and the borrower.\

Private money lenders are usually interested in the property being used as collateral for the loan rather than the borrower’s credit score, but often the true reason for making the loan is the relationship and trust between the lender and the borrower.

Private money loans are typically used by real estate investors who want to purchase and renovate a property quickly. These loans are also used to bridge the gap between the purchase of a property and the sale of an existing property or the purchase and refinance into longer-term financing options.

Licensing When Raising Private Money

If you’re going to raise private money, you will want to seek out the advice of a local attorney to make sure you are properly licensed to create these investment opportunities for your friends and family.

When I talked to my attorney, they recommended that I get a Mortgage Broker-Dealer license from my state’s Division of Securities and so I did.

Finding Private Money Lenders

Finding private money lenders can be a challenge, but there are several ways to locate them. One way is to tap into your existing network of people that already know, like and trust you.

This is different than finding hard money lenders where you might want to network with other real estate investors and attend local real estate investor club meetings in addition to searching online.

I also disclosed my licensing status for being able to create notes secured by real estate on my business cards as way of letting folks know that this was an option that might be available.

When I would talk to people about loaning me money, I also had prepared a full, 25-page private lender information packet (shown below) with information about the risks and opportunities.

Deal Analysis When Using Private Financing

It is more important than ever to make sure the deal you’re buying is solid when utilizing private financing. That’s why we always recommend you analyze your deals with a spreadsheet like The Worlds’ Greatest Real Estate Deal Analysis Spreadsheet™ (free to download and use for your personal use) before using private financing and putting your friend or family member’s money at risk.

Conclusion

Private money loans are a great financing option for real estate investors who need quick access to capital. These loans are easier to qualify for than traditional loans and can be used for a variety of real estate investment strategies. If you are a real estate investor looking for financing options, consider private money loans.