Pro Tip: Listen to the podcast below and while you’re listening follow along with the charts below. Then, when you’re done, copy the  Scenario

Scenario

Welcome to the Real Estate Financial Planner™ Podcast. I am your host, James Orr. This is Episode 22.

Today we’re going to continue with  Norm and Norma’s

Norm and Norma’s

For the last 13 episodes or so,  Norm and Norma

Norm and Norma

After considering the BRRRR method and the rehab work involved in that strategy they wonder if instead of using BRRRR to acquire rentals what if they just bought properties that they could fix up and resell for a quicker immediate profit.

What if they could find properties that need work, buy them, fix them up and resell them for $25K, $30K or more profit in a short amount of time?

In future episodes, we’ll revisit them taking the proceeds from fixing up properties and reselling them and utilizing that to acquire rental properties, but for this episode, we’ll look at the impact of fixing and flipping properties and investing that money in the stock market on their ability to achieve financial independence.

Fix and Flip is a Job

Before we get too far into modeling  Norm and Norma

Norm and Norma

Some portions of it can be outsourced.

- For example, they could get help finding the properties from real estate agents and/or wholesalers.

- They could get help lining up financing for their projects from a broker or hard money lender.

- They could get help with rehab by hiring contractors or even a general contractor who would hire the sub-contractors.

- They could get help selling the property by hiring a real estate agent to list and market the property for sale.

But even if they outsourced every part of the fix and flip process, they’d still need to oversee the folks they hired to do the work and it would eat into their profits.

They could hire someone to oversee their entire fix and flip operation, but still they’d need to lead and manage them and that too would eat into their profits.

For the sake of our modeling here, we’ve kept the amount of work they’re personally doing vague.

Instead, we just assumed they’re able to do a certain number of fix and flip projects where at the end of the project they net a certain amount.

- If they have the resources… time, money, and team… to do more projects, they could do more projects.

- If they have the ability to do more work themselves or to find more profitable deals… they could earn more per deal.

Which leads me into my next discussion.

Not All Fix and Flip Projects Are Profitable

From time to time, they may choose to take on a fix and flip project that is not profitable. They could lose money on it.

Just like some retail businesses occasionally have a product that does not sell as much as they thought it might and they end up losing money on that product…  Norm and Norma

Norm and Norma

To simplify our modeling, I’ve assumed that they earn the same amount on each flip project each time. In the real world, this is obviously not going to be true.

Profitability Per Flip

So, for our modeling we’ve assumed they make $25,000 per flip.

This is net of all expenses.

So, it is after:

- Acquisition costs to find and close on the property

- Financing costs to acquire the property

- Holding costs while they’re doing the rehab including financing costs, insurance, utilities, etc

- The rehab required

- Sales costs to sell the property

What it does not include is the taxes they owe on the profit.

They’re not holding the properties for over a year, so the profit of $25,000 is taxed as ordinary income.

If they do two per year, that’s an extra $50,000 per year added to their income so this income will be taxed at a slightly higher tax rate.

The $25,000 per flip does increase with inflation… so the second one they do is slightly more than the first one. Each one they do is a little more money. If we adjust the dollar amount back to today’s dollars to account for inflation, they’ll all be $25,000 each.

Financial Independence

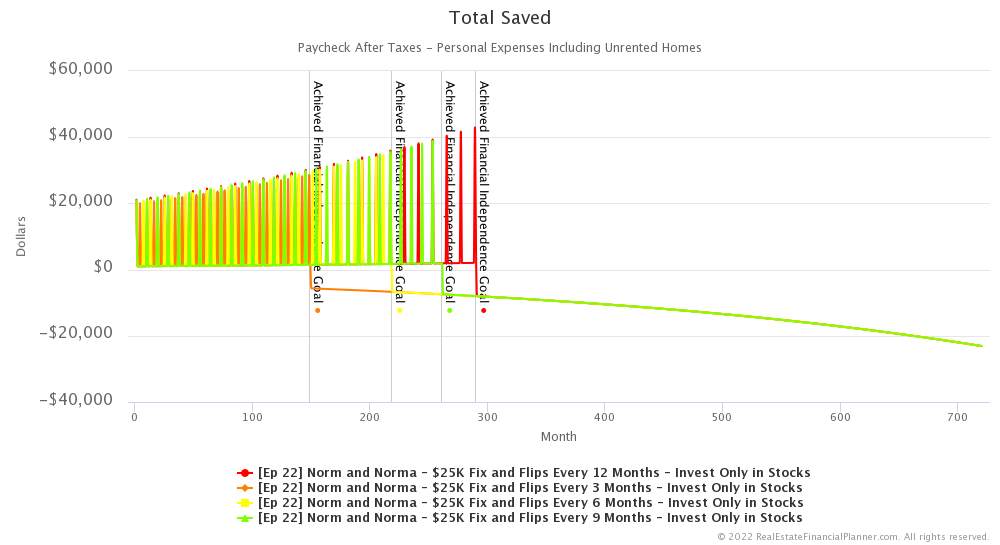

So, if they do a flip every 6 months… two per year and they make $25,000 per flip, how does that impact their ability to achieve financial independence?

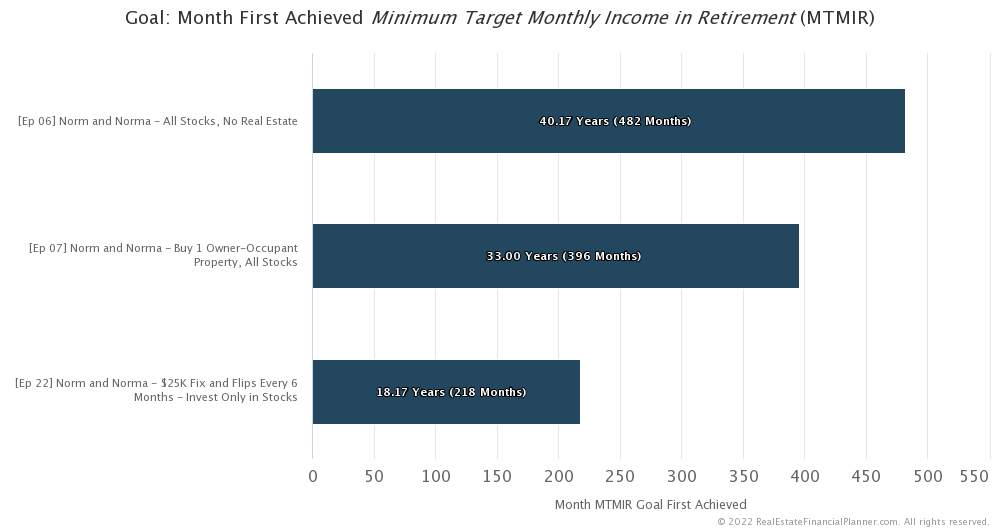

Way back in Episode 6,  Norm and Norma

Norm and Norma

When they did that, they ended up being financially independent using the 4% safe withdrawal rate rule of thumb in just over 40 years.

Now that they’ve started saving an extra $50,000 per year… that’s two $25,000 flips per year before taxes… they’ll achieve financial independence faster.

Before I get to how much faster… I want to point out that… in reality, after taxes, I’m estimating it is about $39,000 per year that they’re able to save.

But still, that’s an extra $39,000 per year in addition to the $12,000 they were saving before from their normal job income. That’s a huge difference.

It is 300% more than they were saving before. They went from saving $12,000 per year to $51,000 per year invested. So, it shouldn’t surprise us at all that they’re able to be financially independent much faster.

It’s as if they worked another job bringing in another $50,000 per year between the two of them and decided to save and invest all of it.

If it seems like that, it’s because it literally is that: they’re working the extra job of fixing and flipping properties for an extra $50K gross, before taxes, per year.

If they wanted to do ANY other job where they could each earn an extra $25,000 per year each and save that, the results would be identical. There is not something magical about fix and flips that allows them to be financially independent faster.

So, let’s get to it. How much faster are they financially independent?

A lot faster.

They’re financially independent in just over 18 years instead of just over 40 years; financially independent in less than half the time.

If you recall in Episode 7,  Norm and Norma

Norm and Norma

When they invested in stocks, but purchased a home to live in, it took them about 33 years to be financially independent.

So, if instead of buying a home to live in they fixed and flipped properties and still invested in stocks, that would be just under 15 years faster to being financially independent.

That’s non-trivial as well.

Fix and Flip Profit Size

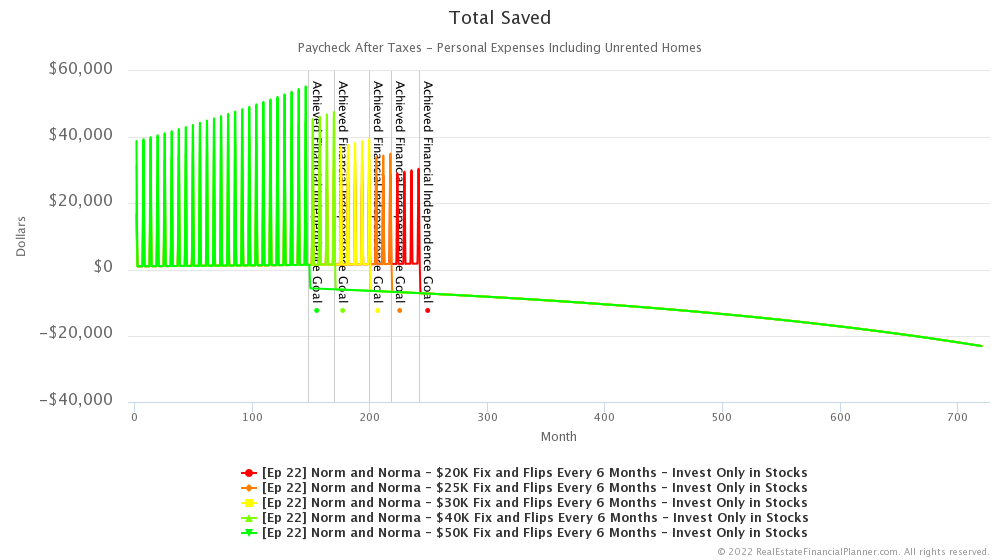

You know the $25,000 profit per fix and flip is somewhat arbitrary.

It is possible they could make a little less or a little more with each flip.

How does making a little less or a little more on each flip impact their ability to be financially independent?

We’ll still assume they’re doing a flip every six months.

Well, if they only make $20K per flip, that would add about 2 years to the time it takes them to be financially independent. Instead of it taking just over 18 years when they make $25K per flip, now it takes just over 20 years.

If they can make $30K per flip, that speeds it up by about a year and a half.

If they can make $40K per flip, that’s 4 years faster than when they’re only making $25K per flip and they’d be financially independent in just over 14 years.

And, if they’re able to consistently make $50K per flip, that’s almost 6 years faster than when they make $25K per flip. They’d be financially independent in about 12 and a third years.

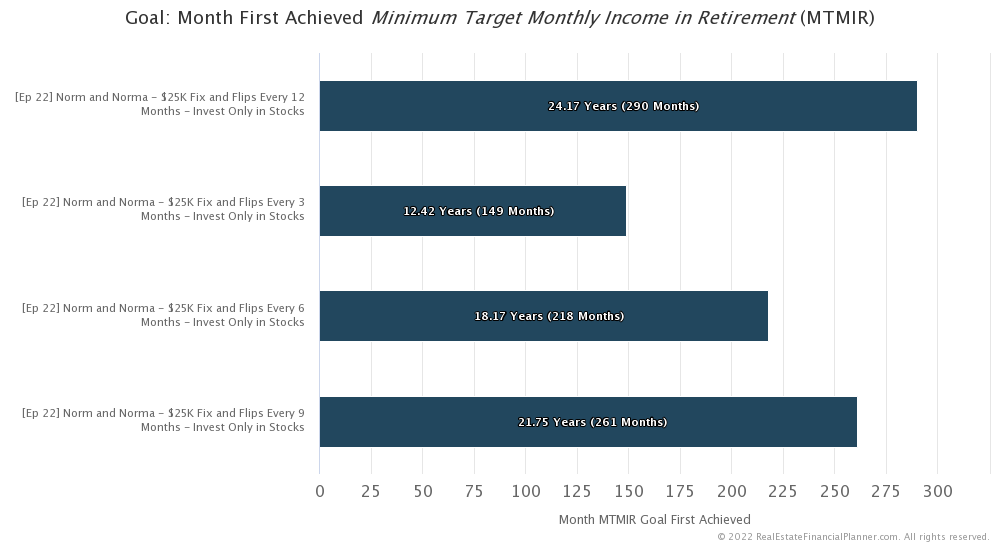

Frequency of Fix and Flips

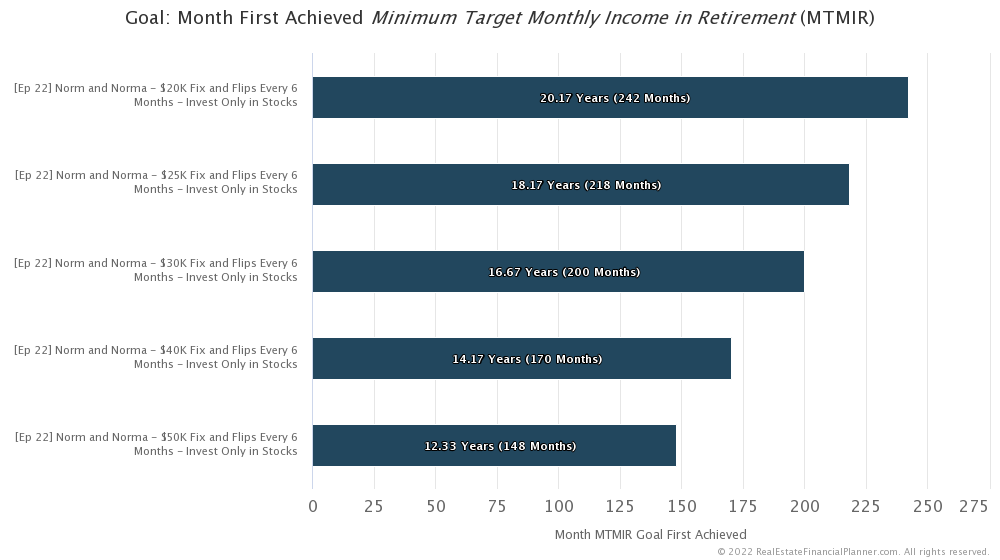

You know doing a flip every 6 months is somewhat arbitrary as well.

If they put in the time and money to find deals, they could do these fix and flips more frequently than twice a year… once every six months.

Or, if they wanted to take a more reasonable pace, they could do it less frequently.

We’ll go back to assuming that all their flips are $25,000 in profit each, but let’s see how frequently they do the flips impacts their ability to be financially independent.

If they take their time and only do a fix and flip for $25K profit every 9 months, it adds about 3 and a half years to when they’ll be financially independent.

If they take a very leisurely pace and only do one a year, that’ll take them an extra 6 years to be financially independent.

But, if they work twice as hard and do a fix and flip for $25K every 3 months instead of every 6 months, that is a little less than 6 years faster than doing one every six months. It would only take them about 12 and a half years to be financially independent versus the just over 18 years if they do one every 6 months.

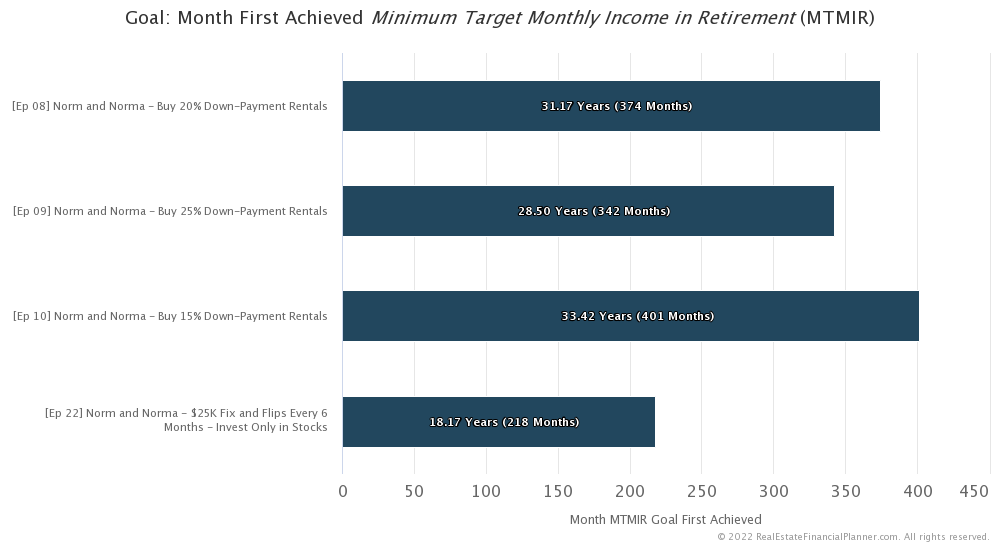

Traditional Buy and Hold

We’re going to talk about  Norm and Norma

Norm and Norma

However, I would like to discuss how doing fix and flips and investing in stocks compares to some of the other real estate investing strategies we’ve covered so far.

For example, let’s compare how  Norm and Norma

Norm and Norma

And, we’ll just focus on how long it takes them to be financially independent for now.

If the bought 15% down payment rental properties with the savings from their job as we discussed in Episode 10, it would take them almost 33 and a half years to be financially independent. So, doing a $25K fix and flip every 6 months and investing in stocks is more than 15 years faster.

Buying 20% down payment rentals as we discussed in Episode 8 is 13 years slower than doing the fix and flips with stocks.

And, buying 25% down payment rentals as we discussed in Episode 9 is just over 10 years slower.

So, it seems like doing fix and flips and investing in stocks is a faster path to financial independence then buying 15%, 20% or 25% down rental properties.

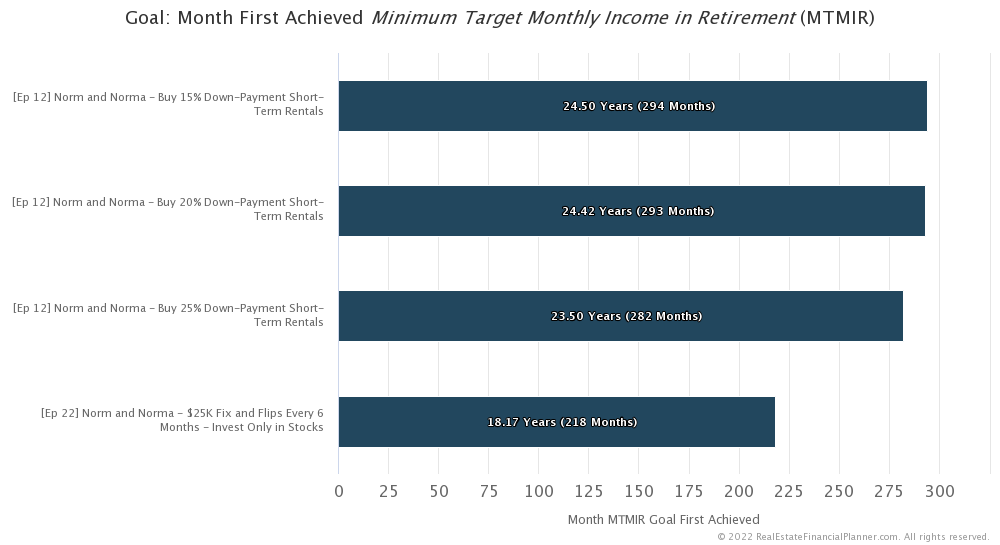

Short-Term Rentals

That’s pretty interesting, but how does it compare to doing short-term rentals like we discussed in Episode 12?

Well, it is a little more than 6 years faster to do the fix and flips then it is to do short-term rentals with either 15% or 20% down payments.

And, it is still a little more than 5 years faster to do the fix and flips than to put 25% down to do short-term rentals.

So, doing fix and flips… even only one every 6 months with $25K in profit… and then investing in stocks, will still get  Norm and Norma

Norm and Norma

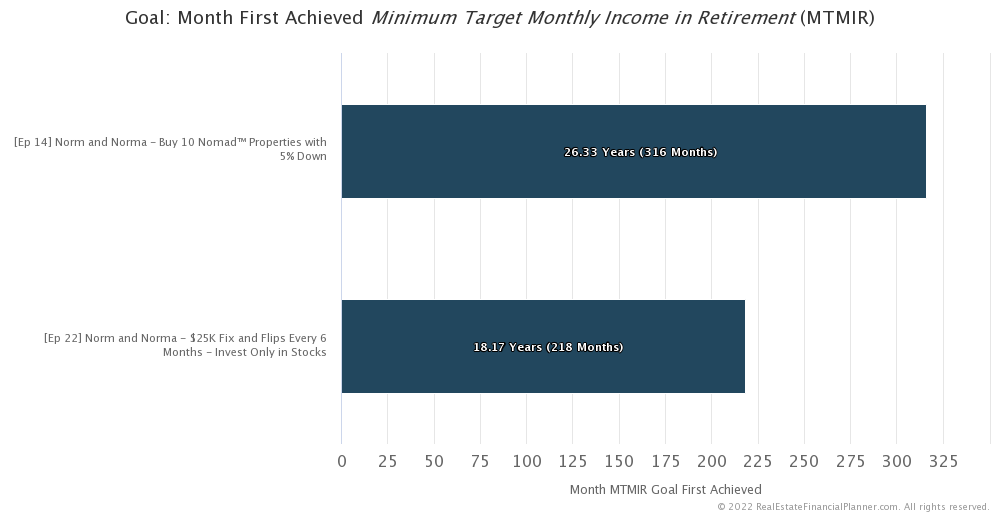

Nomad™

But what about Nomad™ like we discussed in Episode 14?

Nomad™ is a little more than 8 years slower than doing the fix and flips.

Fixer Upper Nomad™

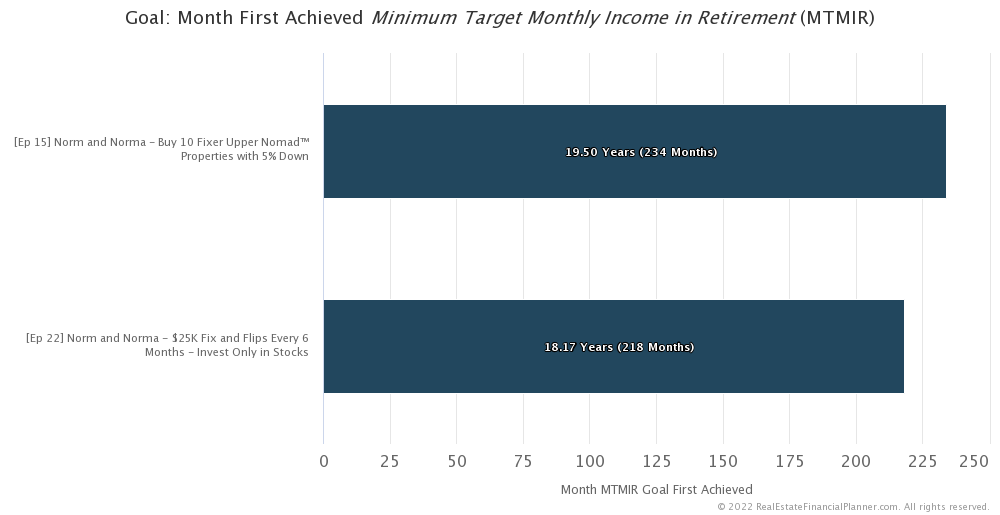

If they’re going to look for fixer upper properties to do the fix and flips, then why not do fixer upper Nomad™ and keep them as rentals like we discussed in Episode 15?

Well that’s closer, but the fix and flips and then investing in stocks is still a little more than a year faster getting to financial independence.

Nomad™ by Proxy

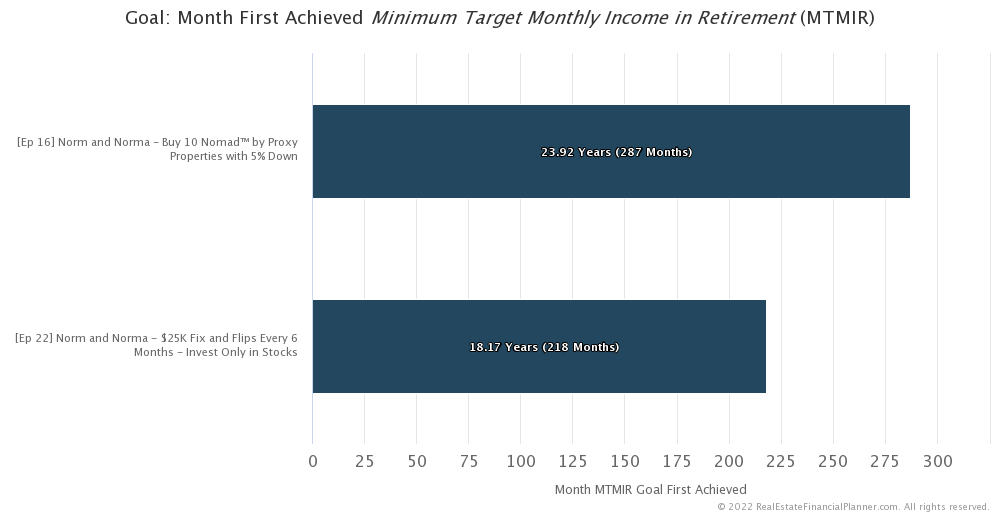

What if they were able to get someone else to move into properties and Nomad™ on their behalf… what we call Nomad™ by Proxy? We discussed this strategy in Episode 16, but how does it compare to doing fix and flips?

Well, in that case, doing fix and flips then investing in stocks is about 5.75 years faster than doing Nomad™ by Proxy.

Nomad™ then Short-Term Rentals

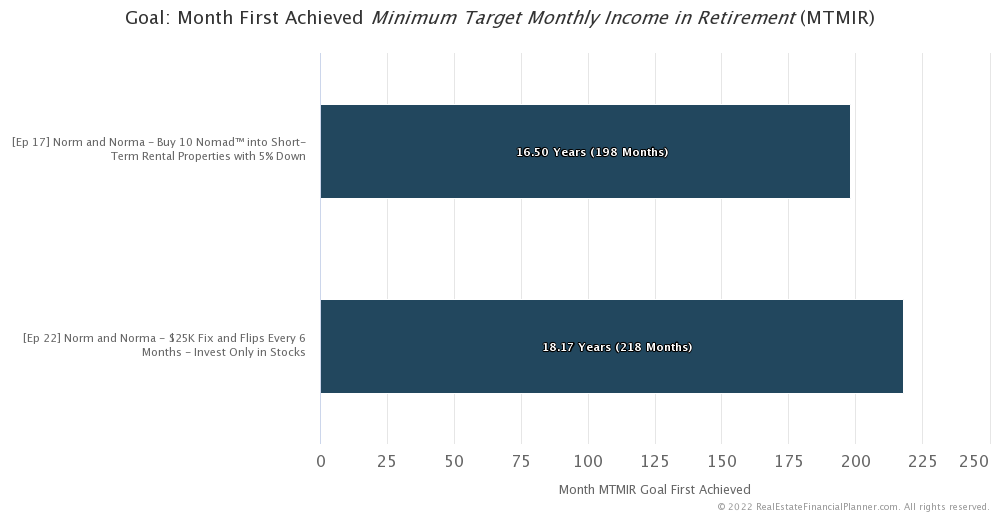

What if  Norm and Norma

Norm and Norma

That one is pretty interesting.

It turns out that if  Norm and Norma

Norm and Norma

They reach financial independence a year and two-thirds faster if they Nomad™ into short-term rentals than if they do the fix and flips.

This is the first strategy that we covered up to this point that is faster than the twice a year fix and flip strategy for $25K profit per flip. Will it be the only one that is faster?

Nomad™ with House Hack Roommates

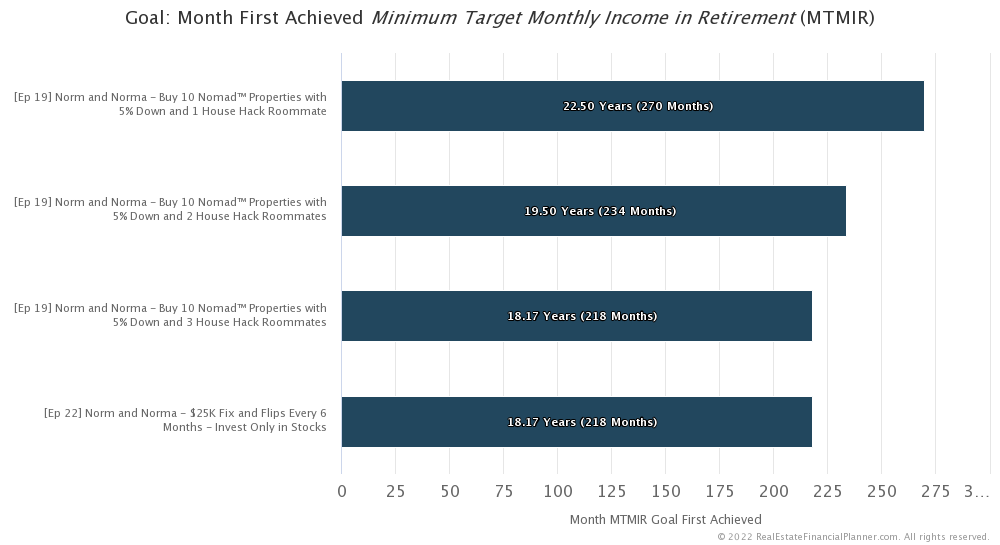

Well, in Episode 19 we looked at them doing Nomad™ but getting house hack roommates.

In that episode, we discussed them getting 1, 2 or 3 roommates.

If they only get 1 roommate, that’s more than 4 years slower than doing the fix and flips.

If they get 2 roommates, that’s a little more than 1 year slower than doing the fix and flips.

And, interestingly enough, if they get 3 house hack roommates, it takes the same amount of time to be financially independent as if they did the two fix and flips for $25K each per year.

So, 1 and 2 roommates… slower but 3 roommates and that’s competitive with doing fix and flips.

The Ultimate Real Estate Agent Retirement Plan™

In the next episode I will be discussing an interesting idea related to their fix and flip profit and getting a real estate license. So, definitely check in for that revelation.

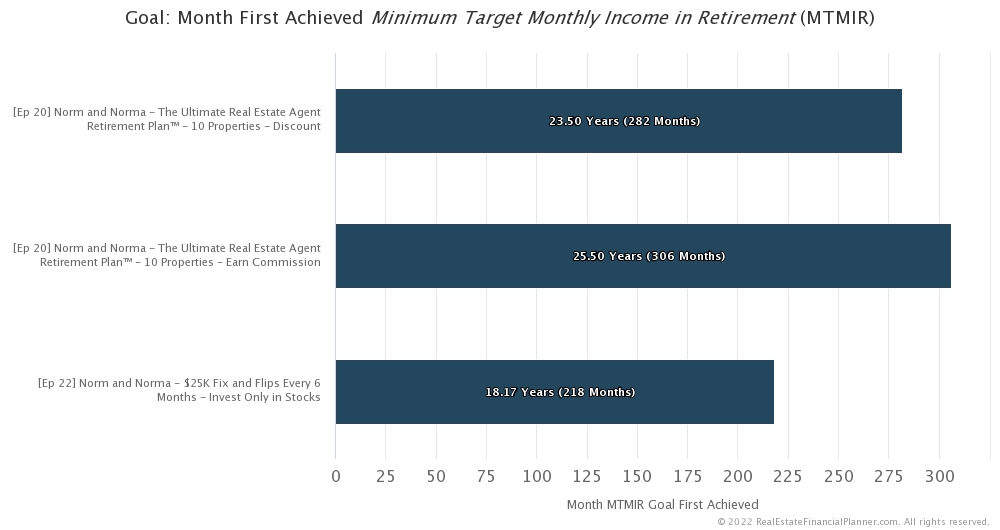

But, for this episode, I would like to compare how doing fix and flips then investing in stocks compares to them doing Nomad™ with a real estate license like we discussed in Episode 20 on The Ultimate Real Estate Agent Retirement Plan™.

In that episode we discussed two options: one where they took a real-estate-commission-sized discount on the properties they were buying and one where they took the real estate commission.

Taking a commission is 7 and a third years slower than doing the fix and flips.

And, taking a commission-sized discount is 5 and a third years slower than the flips.

BRRRR

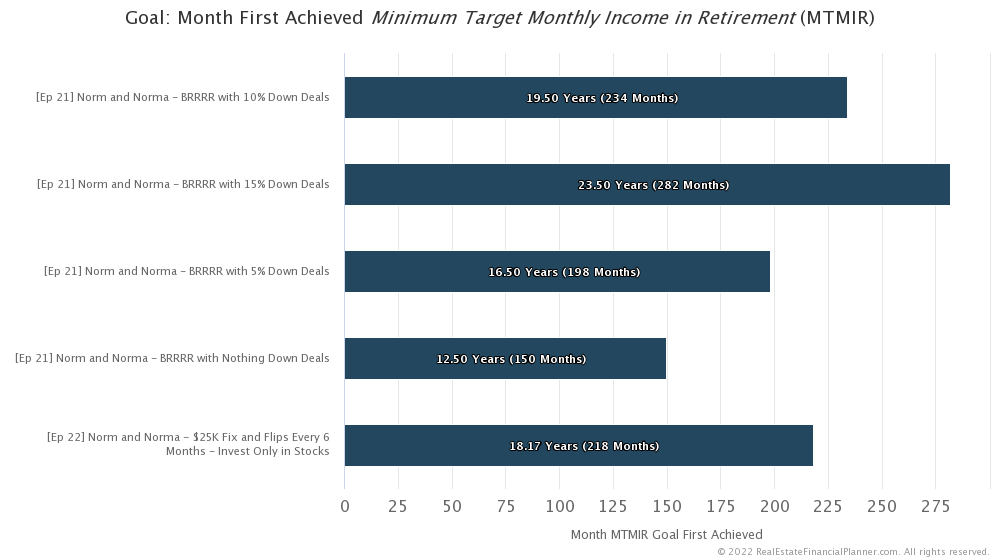

In the last episode, Episode 21, we discussed them finding deeply discounted properties where they could fix them up and leave little or nothing in the deal… a real estate investing strategy called the BRRRR Method.

- If

Norm and Norma

Norm and Norma - If they do BRRRR deals where they’re able to leave 10% in the deal, those are only a year and a third slower than doing fix and flips.

- But, if they’re able to find BRRRR deals where they only leave 5% in the deal, that’s faster than doing straight fix and flips then investing in stocks. It is a year and two-thirds faster to BRRRR leaving 5% in the deals than to do the fix and flips.

- And, if they’re fortunate enough to find amazing BRRRR deals where they leave nothing in the deals, that’s 5 and two-thirds years faster than doing fix and flips and then investing in stocks.

Risk

Often in our episodes, we compare several measures of risk.

But, many of our measures of risk when considering buying rental properties measure risk by considering relationships to how much debt  Norm and Norma

Norm and Norma

When they do fix and flips and then invest in stocks, they’re not taking on long-term debt.

Sure, they are borrowing money to do the flip, but they’re usually in and out of that debt within 6 months and usually only one at a time.

However, as I discussed in a class I taught about the Quick Turn and Flipping Properties real estate investing strategy, flipping properties has its own unique risks… just like any other real estate investing strategy has its own unique set of risks.

In that class, I listed flipping as having the following risks:

- The risks of the rehab including unexpected repairs, wrong estimations of time and money required

- The interest rate risk for your buyers while rehabbing… what happens if interest rates go up a lot while you’re rehabbing?

- A price decline during rehab? What if they thought they were going to be able to make $25K, but prices declined during the rehab period?

- And, their credit is at risk when borrowing to do the fix and flip

Of course, if we’re comparing the fix and flip strategies to other real estate investing strategies like traditional buy and hold, short-term rentals, Nomad™, house hacking and BRRRR as a few examples… each of these has their own unique risks too.

Check out the links below to be able to compare these strategies to doing fix and flips including all the normal measures of risk.

Next Episode

Throughout this episode, we’ve been assuming they’re earning 8% on the profits they make from fix and flips by investing in the stock market.

In the Advanced Real Estate Financial Planner™ Podcast we can see how having variable stock market rates of return impacts them, but  Norm and Norma

Norm and Norma

In the next episode that’s what we will discuss: what if  Norm and Norma

Norm and Norma

I hope you have enjoyed this episode about  Norm and Norma

Norm and Norma

Get unprecedented insight into  Norm

Norm Norma’s

Norma’s Scenario with dozens of detailed, interactive charts.

Scenario with dozens of detailed, interactive charts.

Compare fix and flips then stocks to several other strategies including several real estate investing strategies:

- Invest in Stocks: With and Without Fix and Flips

- Several Fix and Flips by Profit Size

- Several Fix and Flips by Frequency

- Fix and Flip Then Stocks to Traditional Buy and Hold

- Fix and Flip Then Stocks to Short-Term Rentals

- Fix and Flip Then Stocks to Nomad™

- Fix and Flip Then Stocks to Fixer Upper Nomad™

- Fix and Flip Then Stocks to Nomad™ by Proxy

- Fix and Flip Then Stocks to Nomad™ Into Short-Term Rentals

- Fix and Flip Then Stocks to Nomad™ With House Hack Roommates

- Fix and Flip Then Stocks to The Ultimate Real Estate Agent Retirement Plan™

- Fix and Flip Then Stocks to BRRRR

Inside the Numbers

Watch the Inside the Numbers video to see exactly how we set up their  Scenario

Scenario

$25K Fix and Flip Every 6 Months Then Invest in Stocks

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 22 Norm and Norma - $25K Fix and Flips Every 6 Months - Invest Only in Stocks with 2

Ep 22 Norm and Norma - $25K Fix and Flips Every 6 Months - Invest Only in Stocks with 2  Accounts, 0

Accounts, 0  Properties, and 6

Properties, and 6  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Podcast Episodes

The following are the podcast episodes for variations of  Norm

Norm Norma’s

Norma’s

More posts: Norm Episode