Pro Tip: Listen to the podcast below and while you’re listening follow along with the charts below. Then, when you’re done, copy the  Scenario

Scenario

Welcome to the Real Estate Financial Planner™ Podcast. I am your host, James Orr. This is Episode 17.

Today we’re going to continue with  Norm and Norma’s

Norm and Norma’s

Way back in Episode 12,  Norm and Norma

Norm and Norma

They figured that the extra income they could earn by doing the relatively small amount of extra work required to run a short-term rental business might be worthwhile and help them achieve financial independence faster and safer than the other strategies they were considering.

And, they were right.

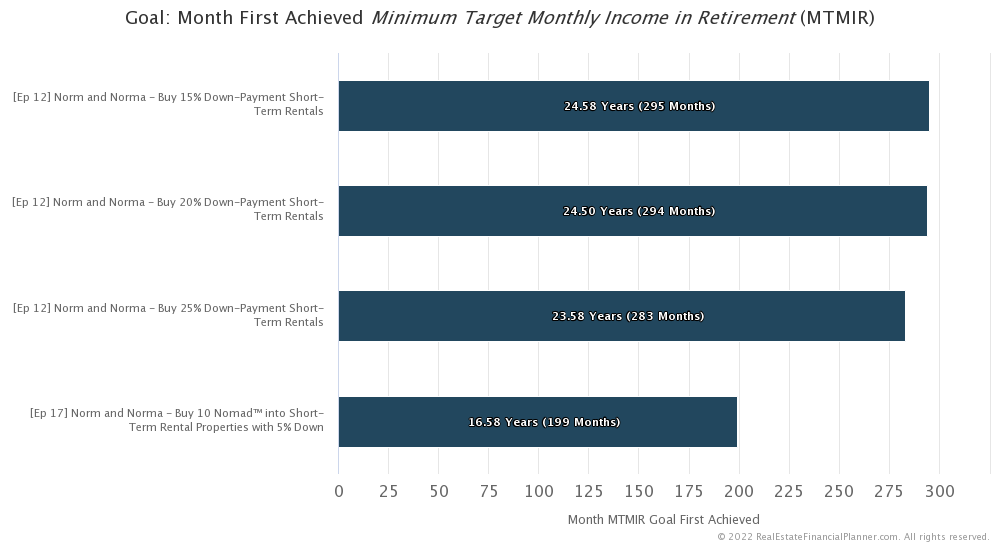

Saving up 15%, 20% or 25% down payments to buy short-term rentals were some of the fastest strategies to achieve financial independence… second only to buying fixer-upper properties.

In recent episodes they were considered utilizing the Nomad™ real estate investing strategy of buying homes as an owner-occupant with 5% down and then… after living in the property for at least a year to fulfil the obligations to the lender to get the owner-occupant financing… the convert the property to a rental and buy another 5% down payment owner-occupant property to move in. They would then repeat this process until they had acquired as many rentals as they wanted.

So, it seems only natural that they consider combining the Nomad™ real estate investing strategy with short-term rentals.

In other words, they buy a property that would ultimately make a good short-term rental as an owner-occupant property with 5% down. They live in the property for at least a year to fulfil the requirement from the lender that they signed at closing stating that they will live in the property for a year to get the 5% down payment and better interest rate financing.

But once they’ve saved up another 5% down payment and can qualify to buy a second owner-occupant property to move in, they convert the previous one to a rental… this time a short-term rental with improved cash flow.

Using Income from Short-Term Rentals To Qualify For The Next Mortgage

The only real “fly in the ointment” of this strategy is qualifying for the next property. Unlike converting properties to long-term rentals with year-long leases where most lenders will allow them to use that income to offset the mortgage and other expenses on the property they’re converting to a rental, with short-term rentals many lenders will want to see a year of history of income from the short-term rental to be able to use that income to help qualify for the new mortgage.

If  Norm and Norma

Norm and Norma

For the sake a simplicity in this episode and modeling, we have assumed they were able to find a lender that would allow them to use the income from their short-term rental to be able to qualify for their next Nomad™ purchase.

Achieving Financial Independence

So, how does  Norm and Norma

Norm and Norma

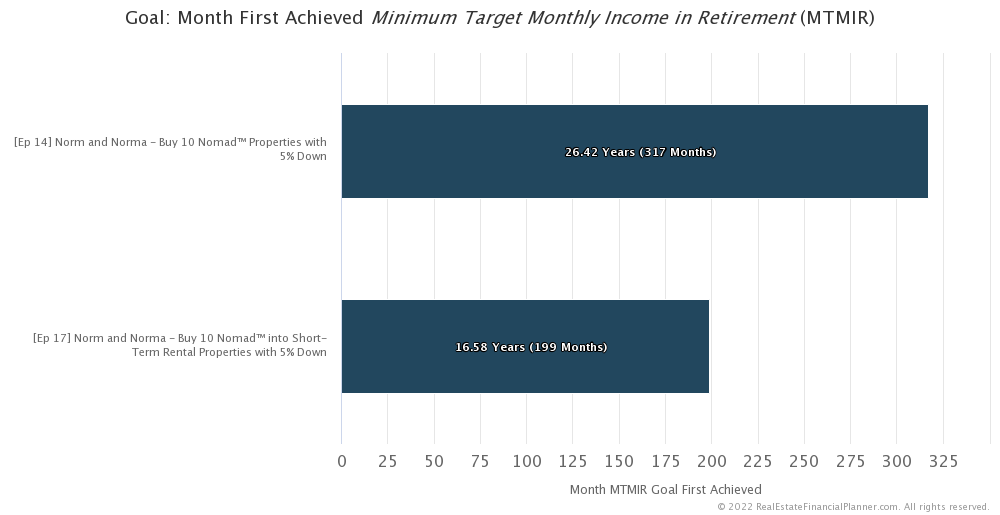

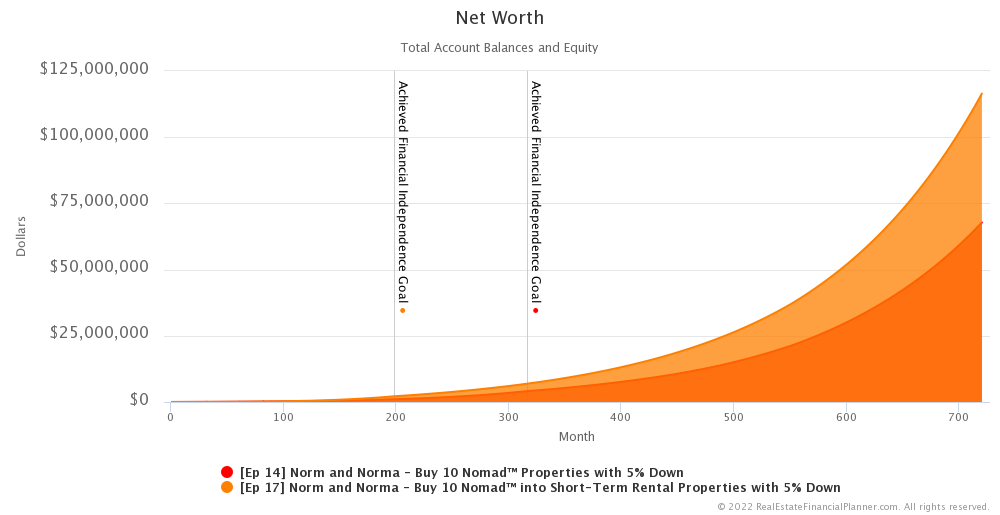

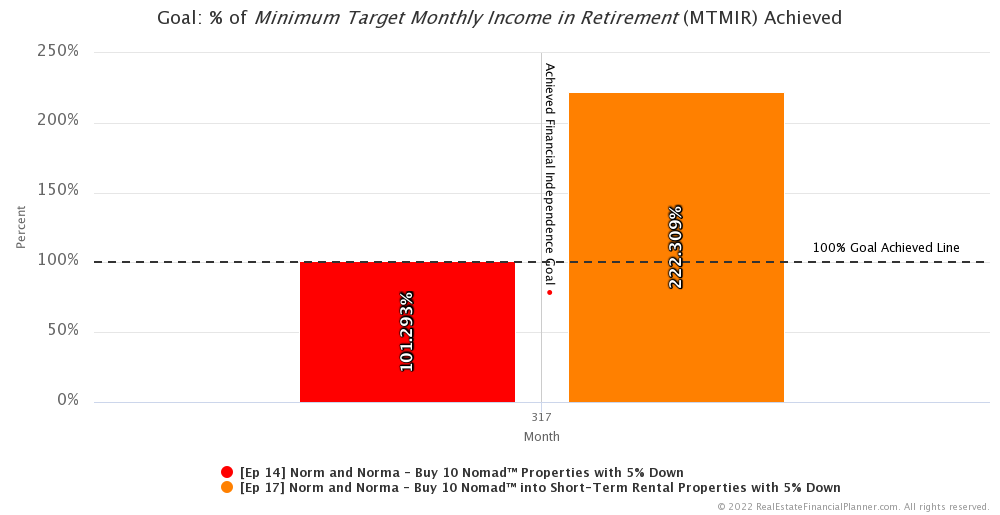

Doing plain-vanilla Nomad™ took 26.42 years from when they start until they’re able to support themselves from their investments without working their jobs anymore.

But, if they do Nomad™ but convert the property they were living in into a short-term rental instead of a long-term rental, it would take them only 16.58 years. That’s almost 10 years faster.

Think back to Episode 12 when  Norm and Norma

Norm and Norma

And that was a really impressive time to achieve financial independence.

Heck, it is still about 2 years faster than doing traditional plain-vanilla Nomad™… which is amazingly fast.

However, combining Nomad™ with short-term rentals improves the speed to financial independence by about 8 years at the cost of having to move into 10 properties.

Norm and Norma

Norm and Norma

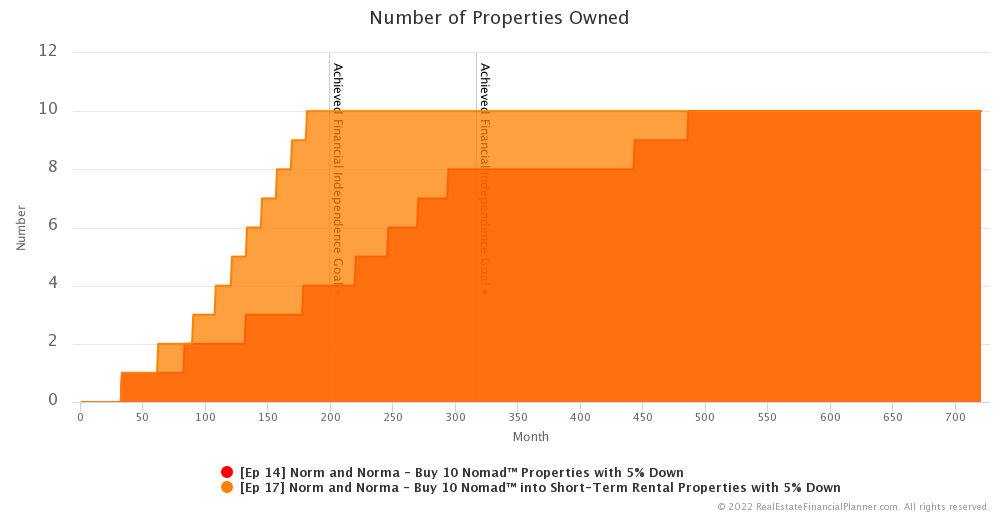

Number of Properties Owned

Back to our story about  Norm and Norma

Norm and Norma

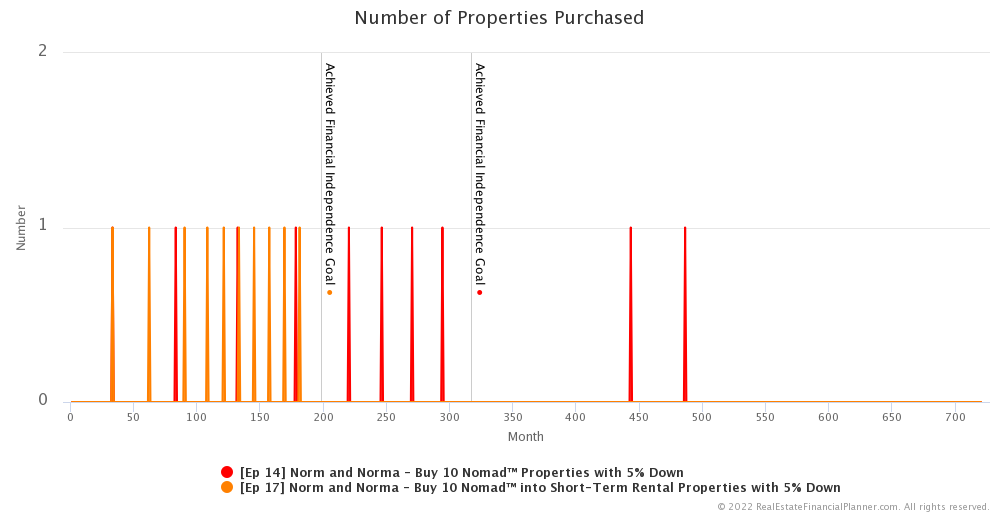

The extra income from the short-term rentals helps them in two important ways.

First, it allows them to save up for down payments faster. So, if the limiting factor in them buying properties was down payments this helps.

Second, it allows them to have higher income when calculating debt-to-income. So, if the limiting factor in them being able to buy properties was their debt-to-income to qualify for loans, this also helps there as well.

That means they’re able to acquire their 10 properties considerably faster.

Once they own the properties, they’ve locked in their mortgage payment… the principal and interest expenses on the property… and they then get the benefit of increasing rents over time with a large portion of their expenses fixed.

Of course, their taxes, insurance and maintenance on the properties do creep up with inflation just like rents do, but they are a relatively small part of the overall expenses on the properties. Having the mortgage payment… which is a large part of their expenses on the property be fixed, they get a leveraged benefit from increasing rents on their cash flow.

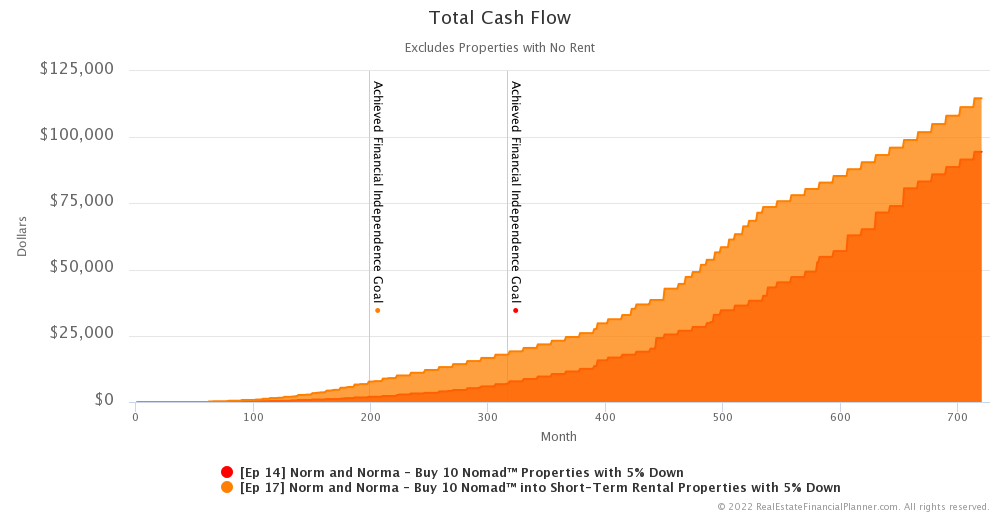

Cash Flow

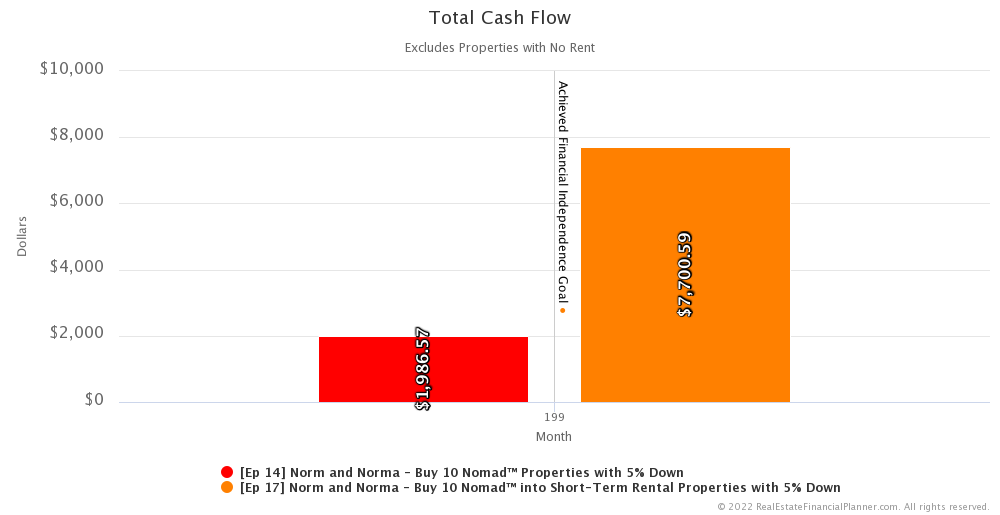

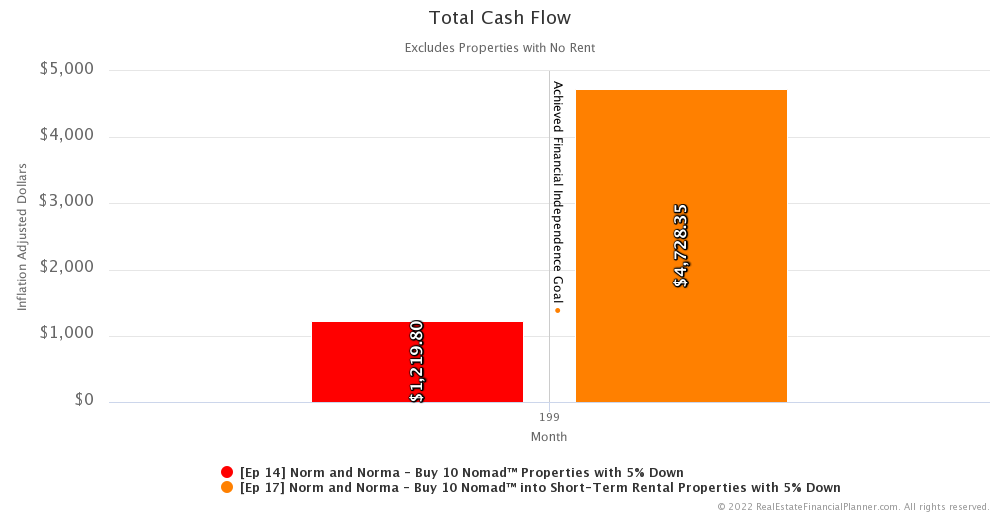

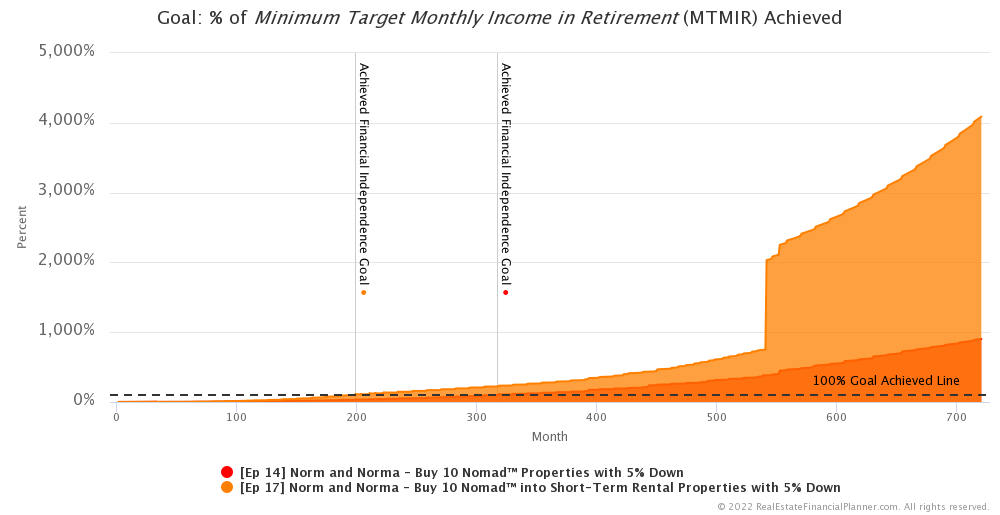

In fact, by the time they’re financially independent doing the Nomad™ to short-term rental properties strategy in month 199, the difference in cash flow is significant.

They are generating over $7,700 in monthly net cash flow after all expenses on all their rental properties. Compare that to less than $2,000 with traditional plain-vanilla Nomad™. I can’t help but defend traditional Nomad™ though… it is still an amazing strategy… especially compared to many of the other strategies that  Norm and Norma

Norm and Norma

Now, that $7,700 and $2,000 in cash flow is in future, inflated dollars. If we adjust back to today’s dollars, it is about $4,700 per month and about $1,200 respectively.

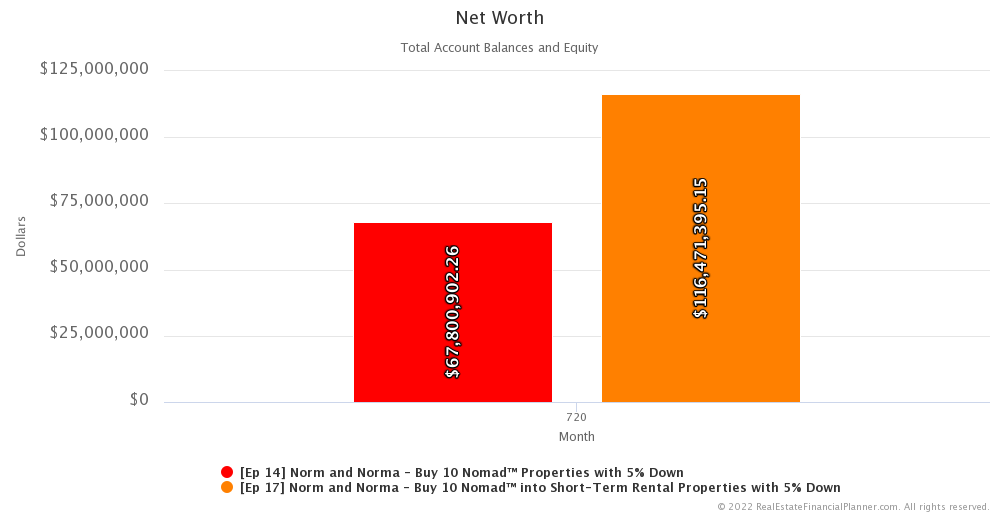

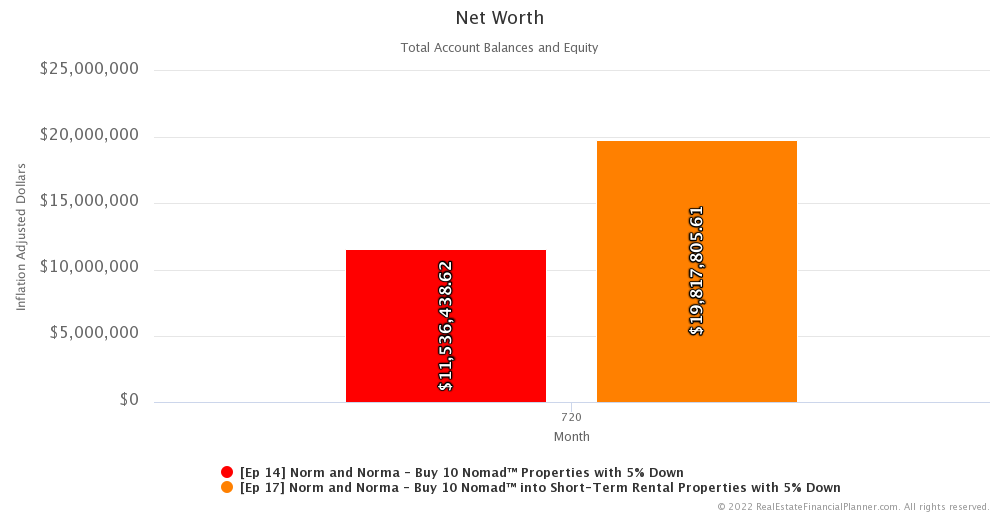

Net Worth

Cash flow is important, but it is not everything. What about net worth?

Is it better for  Norm and Norma

Norm and Norma

Yup. Sure is.

By the end of our modeling in year 60, they’d have just under $67 million doing plain-vanilla Nomad™ but if they add in short-term rentals, they end up with over $116 million.

That’s in future, inflated dollars. If we adjust back to today’s dollars, traditional Nomad™ is about $11.5 million in net worth compared to about $19.8 million if they add short-term rentals. That’s about $8.3 million dollars more by doing the extra work of short-term rentals.

Standard of Living

Those net worth numbers assume they maintain their same frugal standard of living for the entire 60-year period.

I think most people would… at some point… let their lifestyle creep up a little bit.

What if we just looked at what standard of living they could support from their investments?

Let’s look at when they finally achieve financial independence with the traditional Nomad™ strategy in month 317.

In month 317, they’re finally about to generate about $5,000 per month in today’s dollars with traditional Nomad™… enough to replace what they were earning and living on from their job.

But at that same month if they opted to convert their Nomad™ properties to short-term rentals instead of long-term rentals, they’d be living at more than two times their standard of living. Instead of earning about 100% of what they were earning, they’re earning over 220% of what they were earning from their investments… that’s about $12,000 per month instead of $5,000 per month in today’s dollars.

That’s pretty significant.

Risk

But, what about risk. Is it riskier to do short-term rentals than to do long-term rentals?

Normally when we consider risk, there are a few go to metrics we like to look at:

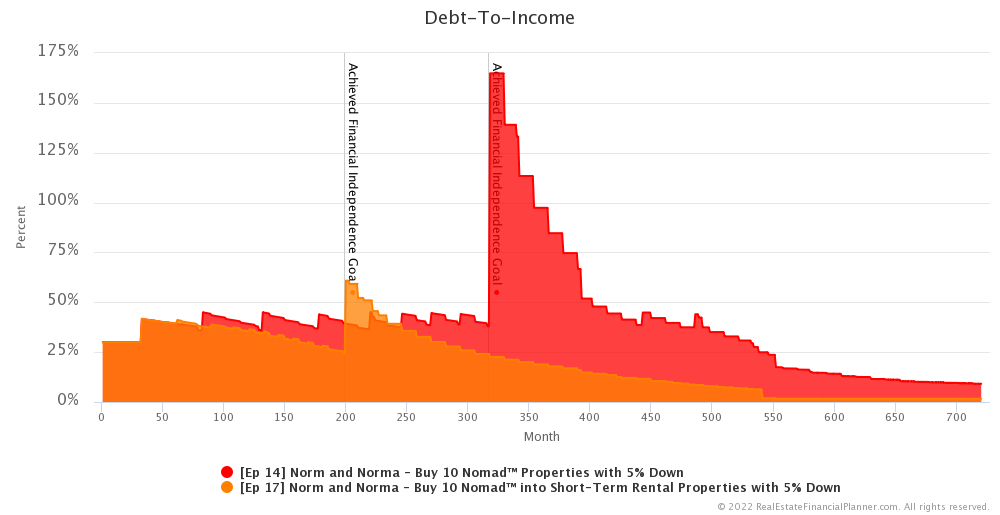

- Debt-To-Income – Or, what is the ratio of their debt payments compared to how much their earning.

- Rent Resiliency™ – Or, how much can rents drop before they’d have negative cash flow.

- Debt to Net Worth – How much debt they have compared to what their overall net worth is.

- Debt to Liquid Net Worth (also called Debt to Account Balances) – How much debt they have compared to money in their accounts.

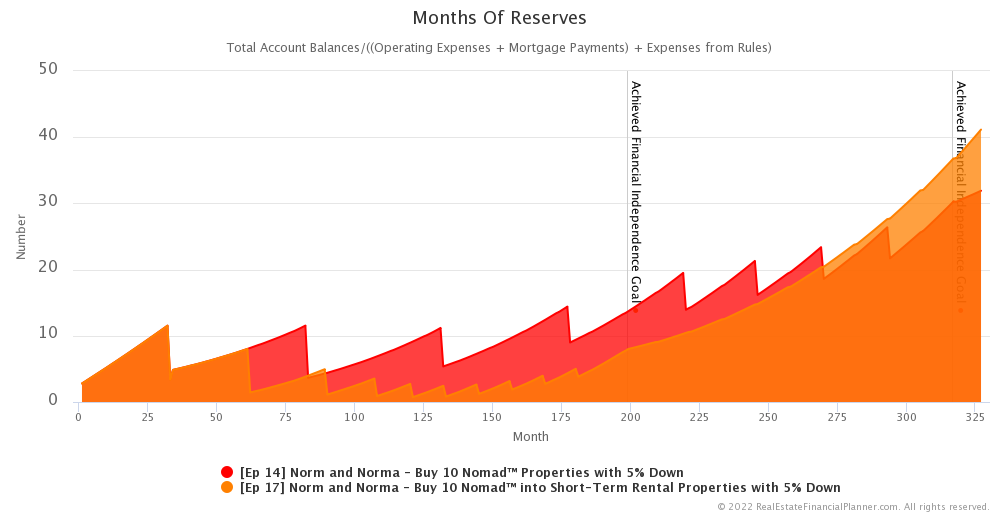

- Months of Reserves – How many months of reserves they have in their accounts.

Let’s run through each of these quickly.

Debt-To-Income

Let’s start with debt-to-income. We talked about this briefly earlier.

Higher income from short-term rentals overall helps with debt-to-income.

So, from a debt-to-income perspective, utilizing short-term rentals seems to have a lower risk profile compared to traditional Nomading™.

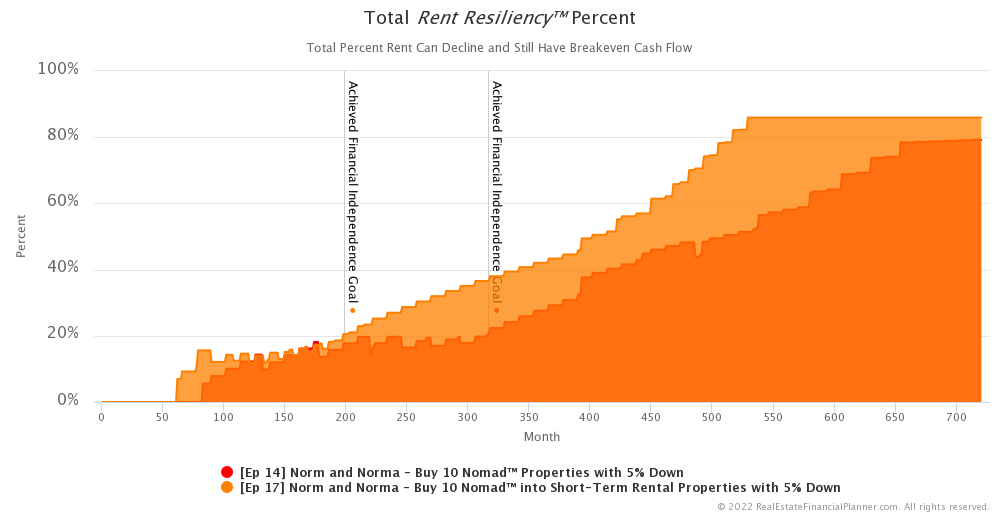

Rent Resiliency™

How about Rent Resiliency™?

Well, higher income on the rentals by doing short-term rentals helps here as well.

By having higher income on the properties, it means that rents can drop more before they’d have negative cash flow.

So, from a Rent Resiliency™ perspective it looks like doing short-term rentals gives them a lower risk profile as well.

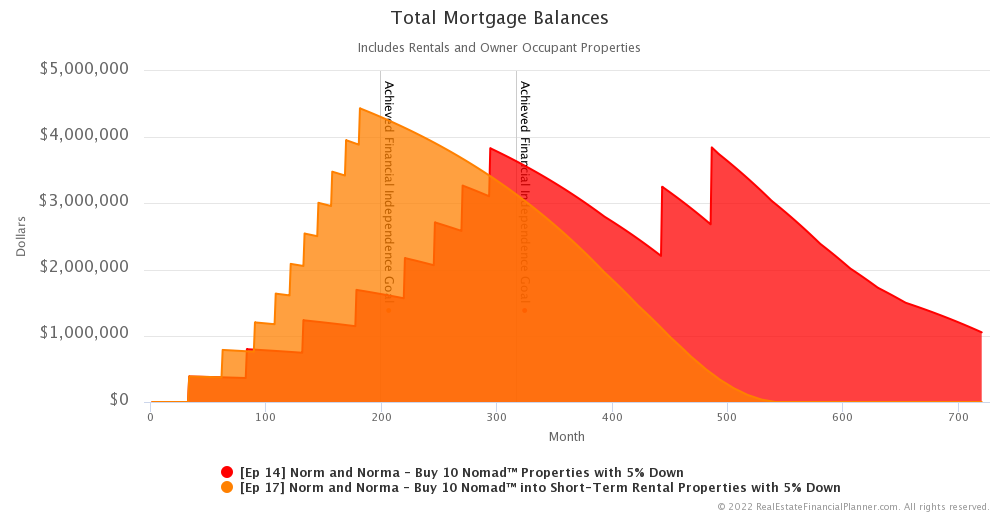

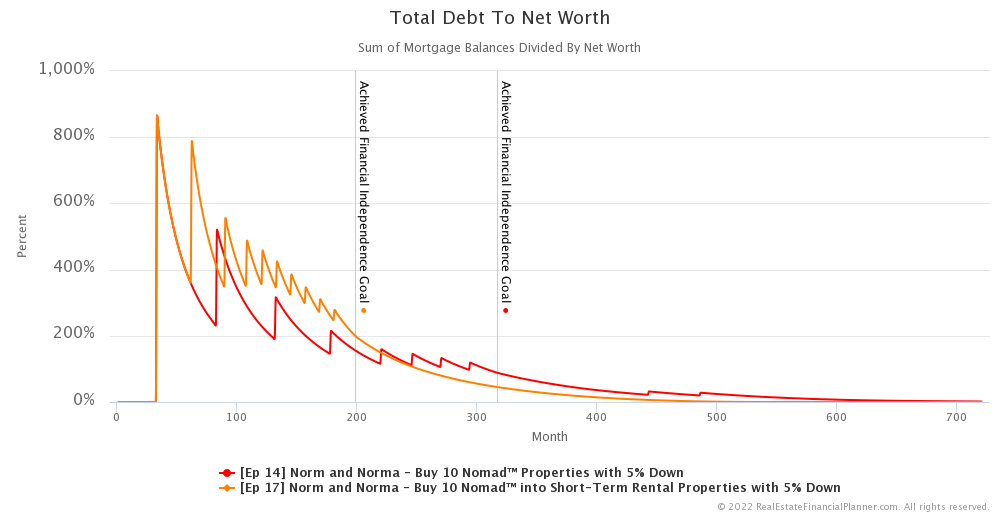

Debt To Net Worth

That’s two for two so far, but how about debt to net worth?

Well, acquiring more properties sooner means they take on more debt sooner.

That means that they have a much higher debt load when using short-term rentals.

Higher debt with a limited increase in net worth means their risk… as measured by Total Debt to Net Worth is higher when doing short-term rentals.

That is until after about year 20. By year 20 they acquired all their properties when doing short-term rentals but they are still acquiring properties with traditional Nomad™. With each new property acquired with a high loan-to-value loan, they are increasing their debt to net worth. So, by acquiring properties later they keep their debt to net worth higher longer.

So, for the first 20 years, from a total debt to net worth perspective, it is riskier for them to utilize short-term rentals, but for the remaining 40-years after year 20, it is riskier to do traditional Nomad™ with long-term rentals.

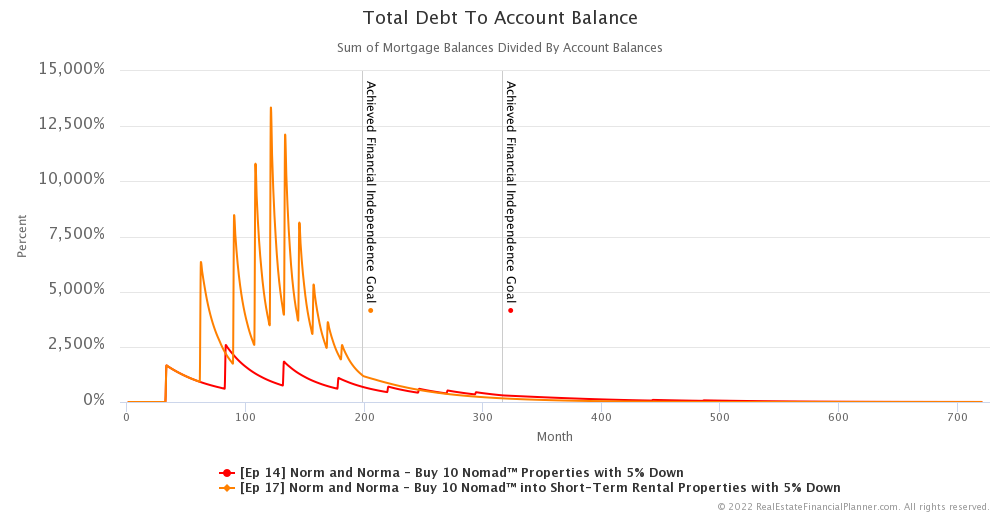

Total Debt to Account Balances

But what about measuring their debt compared to their liquid net worth or what we call total debt to account balance?

That’s even more extreme than total debt to net worth. Utilizing the money in their accounts to acquire rentals faster means they’re keeping less liquid money in their accounts.

This is true for the first 20 years until it switches for similar reasons that we just discussed with total debt to net worth.

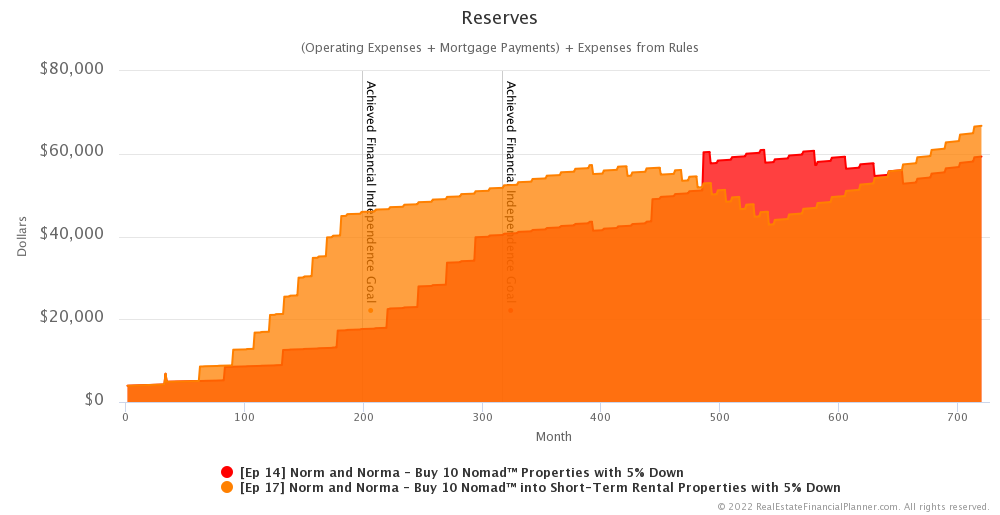

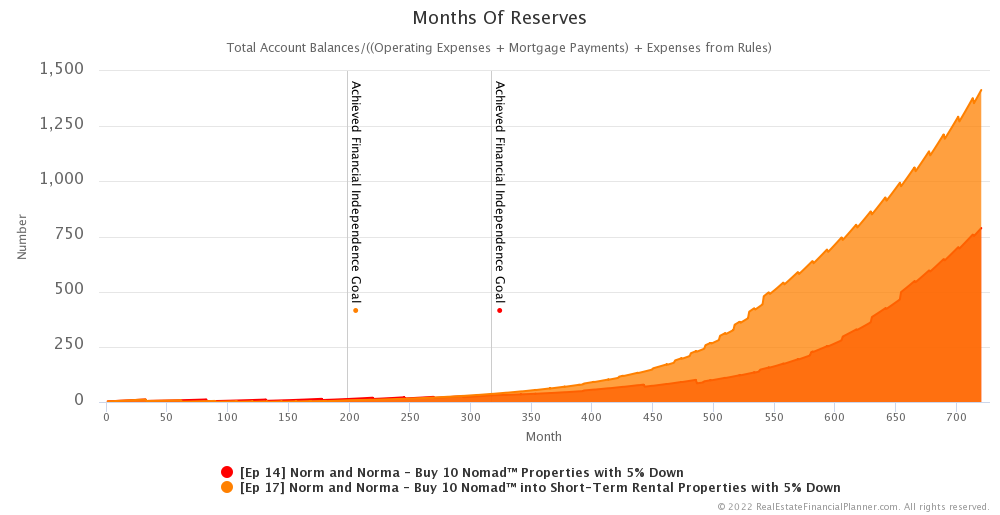

Reserves

We’re tied up at 2 measures of risk in favor of short-term rentals and 2 measures of risk in favor of long-term rentals. Let’s use reserves as a tie-breaker.

Acquiring more rentals faster with short-term rentals means that  Norm and Norma

Norm and Norma

And… eventually… the extra cash flow from short-term rentals means they have more months of reserves set aside.

However, in the short-term, being able to have the income and debt-to-income to buy properties faster and not mandating that they keep a minimum number of months of reserves before being able to buy the next property means that are operating dangerously low on reserves.

If  Norm and Norma

Norm and Norma

This would slow down their acquisition speed, but could reduce their risk considerably.

Of course, we could use a similar rule for traditional Nomad™ too… requiring… let’s say… 6 months of reserves for that too.

If we have the same rule that requires 6 months of reserves in either case, couldn’t we say that these could have similar risk profiles during the acquisition phase?

In each scenario they would have a full 6 months of reserves for their personal expenses, all their rentals including the one they were about to buy.

Conclusion

In conclusion, utilizing short-term rentals combined with the Nomad™ strategy can significantly improve their speed of achieving financial independence over Nomading™ into long-term rentals.

It can also give them a higher standard of living and/or a higher overall net worth.

From a risk perspective, they benefit from improved cash flow, but suffer from an increase in their debt load early on.

And, while the way we modeled it, they are living on the edge in terms of months of reserves, the risk from reserves could be the same regardless of whether they do long-term rentals or short-term rentals if we set the rule to only buy properties when they have the same number of months of reserves for both scenarios.

Overall, Nomading™ into short-term rentals could be a good option for  Norm and Norma

Norm and Norma

Next Episode

But,  Norm and Norma

Norm and Norma

Also, be sure to check out the Advanced Real Estate Financial Planner™ Podcast to see how having variable property appreciation rates and rent appreciation rates, variable mortgage interest rates, variable inflation rate and variable stock market rates of return impacts  Norm and Norma

Norm and Norma

I hope you have enjoyed this episode about  Norm and Norma

Norm and Norma

Get unprecedented insight into  Norm

Norm Norma’s

Norma’s Scenario with dozens of detailed, interactive charts.

Scenario with dozens of detailed, interactive charts.

Compare Nomading™ to Nomading™ into Short-Term Rentals.

Compare Short-Term Rentals with 15%, 20% and 25% Down to Nomading™ into Short-Term Rentals.

Inside the Numbers

Watch the Inside the Numbers video to see exactly how we set up their  Scenario

Scenario

Nomad™

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 14 Norm and Norma - Buy 10 Nomad™ Properties with 5% Down with 2

Ep 14 Norm and Norma - Buy 10 Nomad™ Properties with 5% Down with 2  Accounts, 1

Accounts, 1  Property, and 6

Property, and 6  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Nomad™ into Short-Term Rentals

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 17 Norm and Norma - Buy 10 Nomad™ into Short-Term Rental Properties with 5% Down with 2

Ep 17 Norm and Norma - Buy 10 Nomad™ into Short-Term Rental Properties with 5% Down with 2  Accounts, 1

Accounts, 1  Property, and 6

Property, and 6  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Previous Short-Term Rental Scenarios

Look at the previous Scenarios from Episode 12 with 15%, 20%, 25% down payment as non-owner-occupant (investor) financing.

15% Down Payment Short-Term Rentals

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 12 Norm and Norma - Buy 15% Down-Payment Short-Term Rentals with 2

Ep 12 Norm and Norma - Buy 15% Down-Payment Short-Term Rentals with 2  Accounts, 1

Accounts, 1  Property, and 6

Property, and 6  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

20% Down Payment Short-Term Rentals

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 12 Norm and Norma - Buy 20% Down-Payment Short-Term Rentals with 2

Ep 12 Norm and Norma - Buy 20% Down-Payment Short-Term Rentals with 2  Accounts, 1

Accounts, 1  Property, and 6

Property, and 6  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

25% Down Payment Short-Term Rentals

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 12 Norm and Norma - Buy 25% Down-Payment Short-Term Rentals with 2

Ep 12 Norm and Norma - Buy 25% Down-Payment Short-Term Rentals with 2  Accounts, 1

Accounts, 1  Property, and 6

Property, and 6  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Podcast Episodes

The following are the podcast episodes for variations of  Norm

Norm Norma’s

Norma’s

More posts: Norm Episode