Pro Tip: Listen to the podcast below and while you’re listening follow along with the charts below. Then, when you’re done, copy the  Scenario

Scenario

Welcome to the Real Estate Financial Planner™ Podcast. I am your host, James Orr. This is Episode 18.

Today we’re going to take a small tangent with  Norm and Norma’s

Norm and Norma’s

In the last episode,  Norm and Norma

Norm and Norma

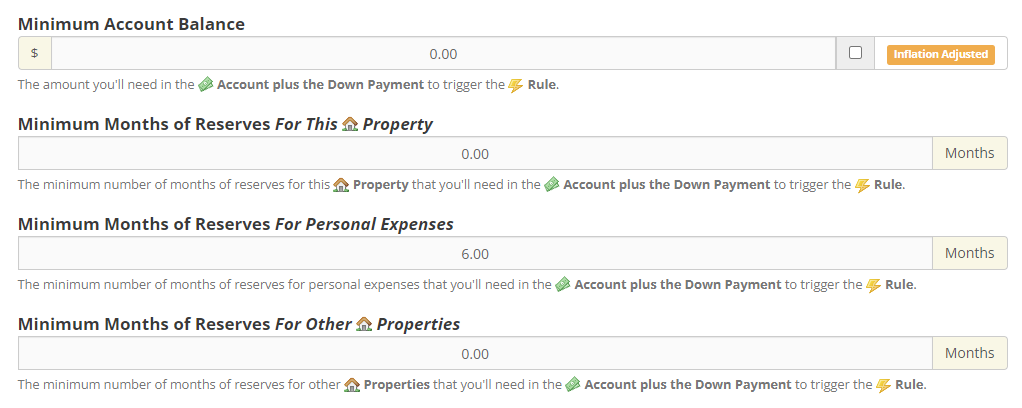

Specifically, to “qualify” to buy the next property they needed to have enough for the down payment and closing costs plus just 6 months of their own personal expenses.

We did not require that they had any reserves for the property they were about to buy and we certainly did not require they had to have any reserves for any of the previous properties they purchased.

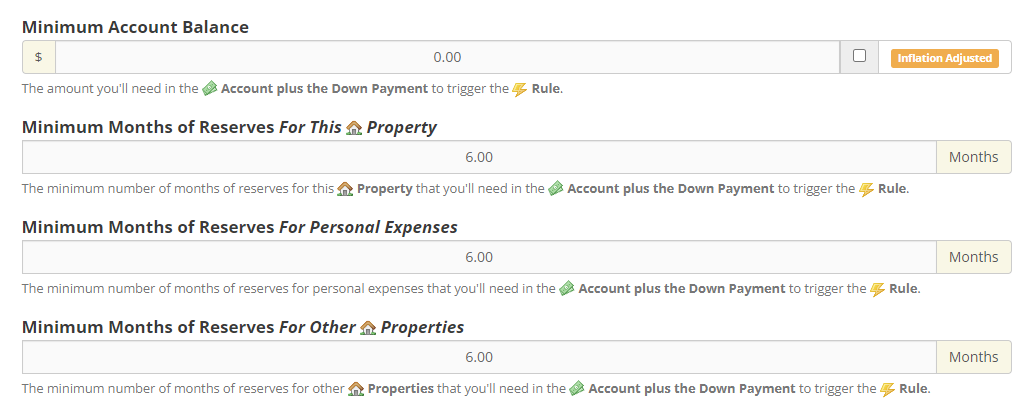

I mentioned in the episode that if they really were going to utilize the short-term rental strategy combined with the Nomad™ strategy that we should rerun their plan requiring that they keep… let’s say… at least 6 months of reserves for their personal expenses and each of their rentals before being able to buy the next property.

I said it would slow down their acquisition speed, but could reduce their risk considerably.

So, before I jumped ahead and discussed a different strategy, I thought I might take a moment to go off on a tangent and show you what the difference would be for  Norm and Norma

Norm and Norma

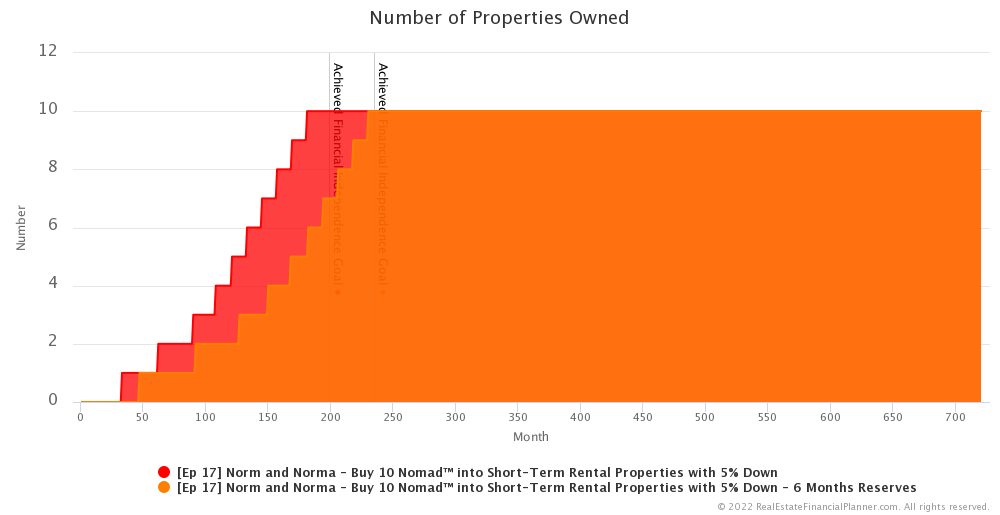

Slower Speed of Acquiring Properties

Let’s start by discussing how much slower they’re able to buy properties.

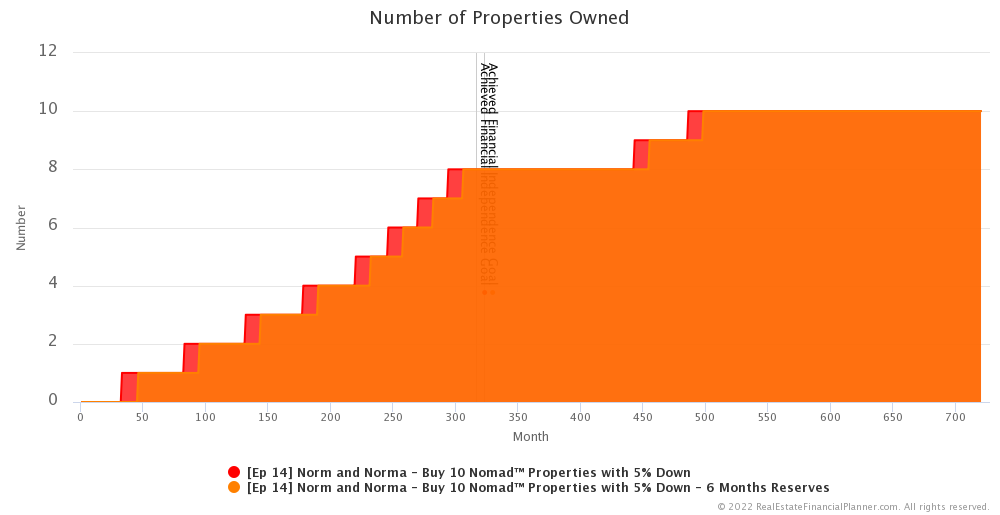

By requiring a full 6 months of reserves for all rentals they own and the property they’re about to purchase, they end up buying properties at a much slower pace.

Without having a full 6 months of reserves for all properties, they bought their tenth property by month 181… just over 15 years into our modeling.

However, when we require they have a full 6 months of reserves for every property plus 6 months of personal expenses in reserves, it takes them 230 months… or just over 19 years to buy the same 10 properties. That’s 4 years longer.

If it takes 4 years longer to acquire the same 10 properties, how will that impact their ability to be financially independent?

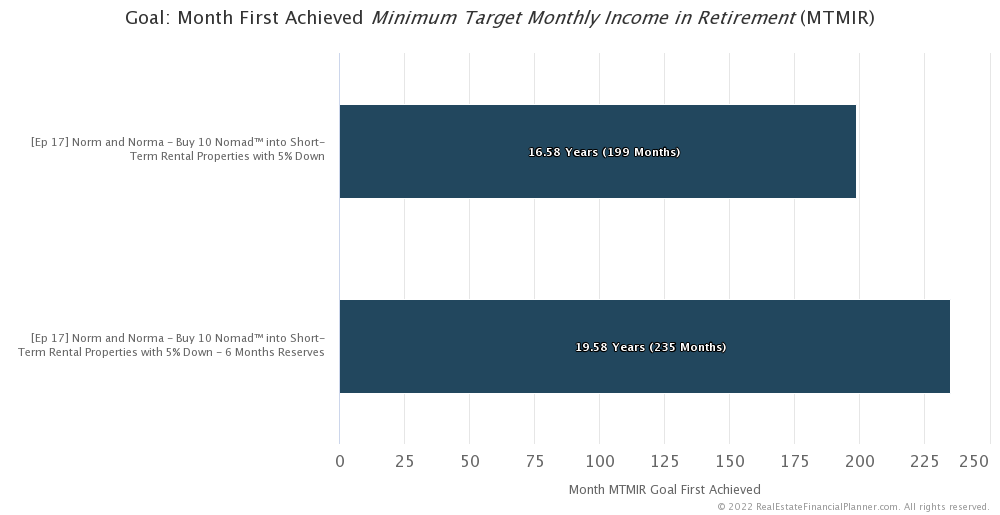

Financial Independence

Well, previously it took a little more than 16 and a half years to have their investments provide enough income to replace the $5,000 per month they were living on from their jobs.

But, when we require a full 6 months of reserves for every property including the one they’re buying and 6 months of reserves for their personal expenses, it takes 3 years longer… a little more than 19 and a half years or 235 months.

So, the extra safety of having more robust reserves, costs them about 3 years longer to be financially independent. That’s an increase in time of about 18%.

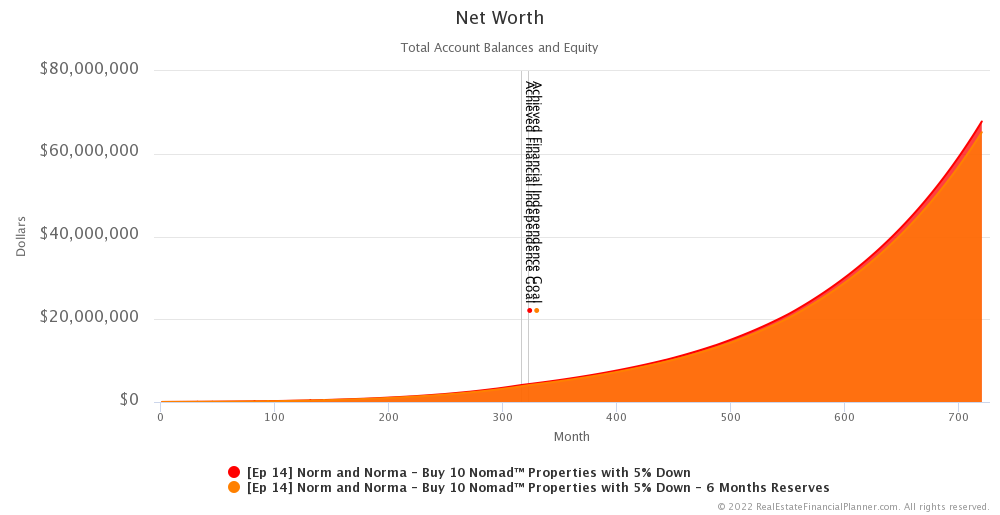

Traditional Nomad™

You know, even way back in Episode 14—when we first started talking about  Norm and Norma

Norm and Norma

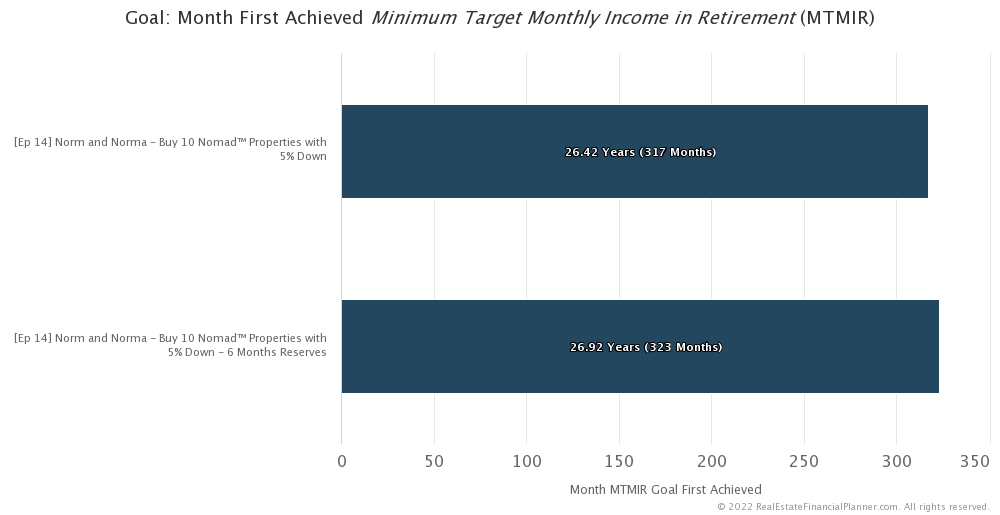

What if we compared the traditional Nomad™ strategy from that episode where they did not have 6 months of reserves for each property to them now requiring a full 6 months of reserves for all properties?

Well, when we do that… the impact of keeping the extra reserves with the traditional Nomad™ is not as significant.

It took them 40.5 years to acquire all 10 properties without keeping 6 months of reserves compared to 41.5 years if they do keep a full 6 months of reserves for all properties. That’s a mere 1 year more.

And while it took a full year longer to buy the same 10 properties keeping a full 6 months of reserves, it only delayed them being financially independent by 6 months… half a year.

It went from 26.42 years to 26.92 years… that’s a little less than 2% longer.

So, not that significant.

Net Worth

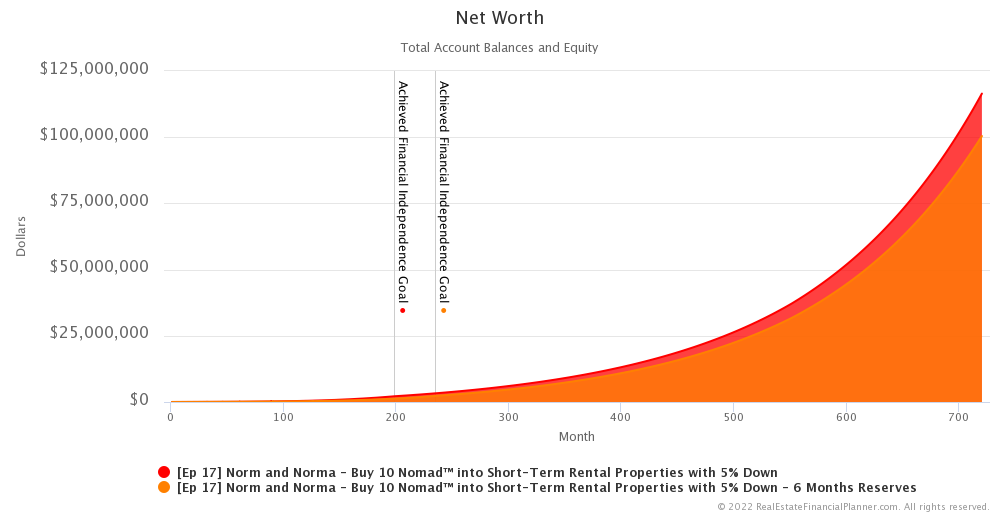

But time to achieve financial independence isn’t the only measure of success.

What about net worth?

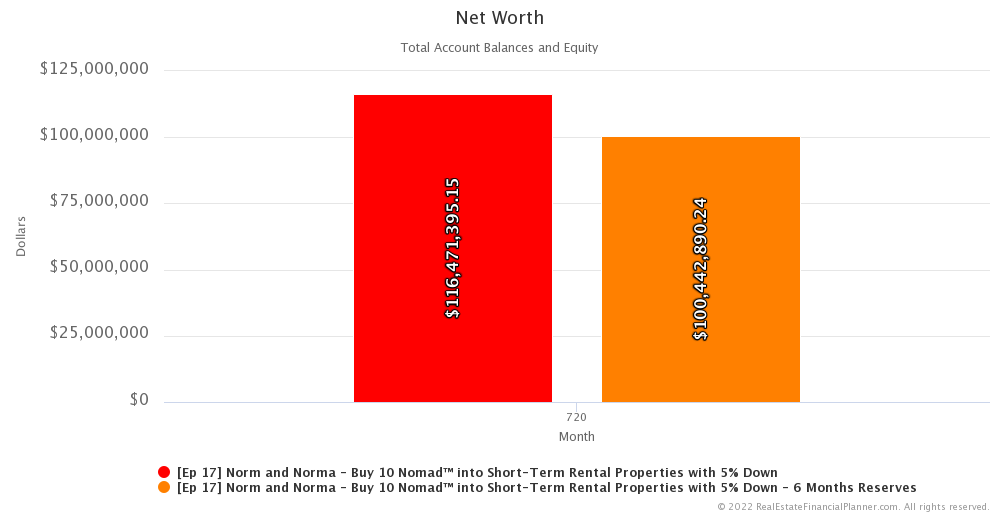

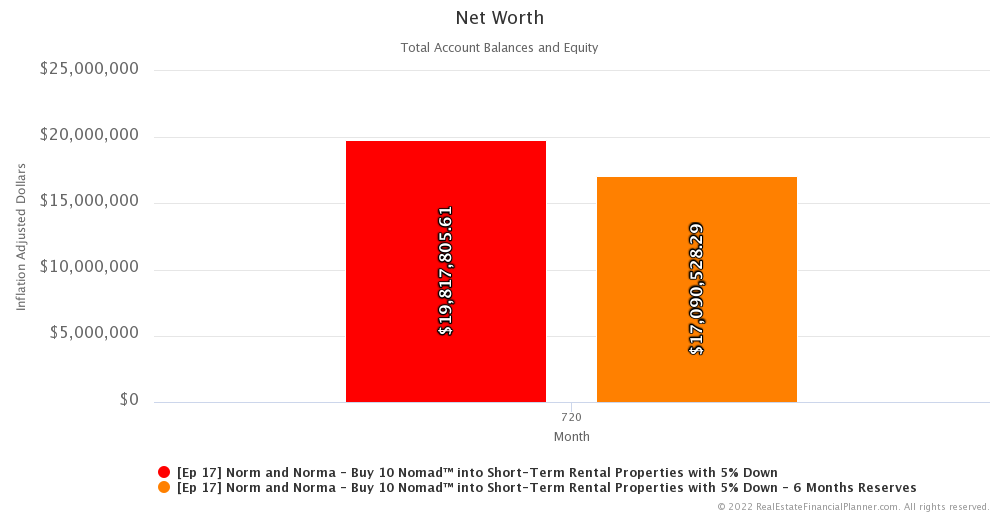

Nomad™ to Short-Term Rentals

Well, let’s return to the discussion of the Nomading™ into short-term rentals first.

Keeping more in reserves means they end up with less net worth.

How much less?

Well, by the end of our modeling… 60 years in the future… they end up with $116.47 million if they skimp on reserves and only $100.44 million if they require full reserves before buying the next property.

But those are in future, inflated dollars 60 years in the future.

If we adjust back to today’s dollars, doing Nomad™ to short-term rentals for  Norm and Norma

Norm and Norma

That’s still about $2.7 million dollars more in net worth… or almost 16% more in net worth.

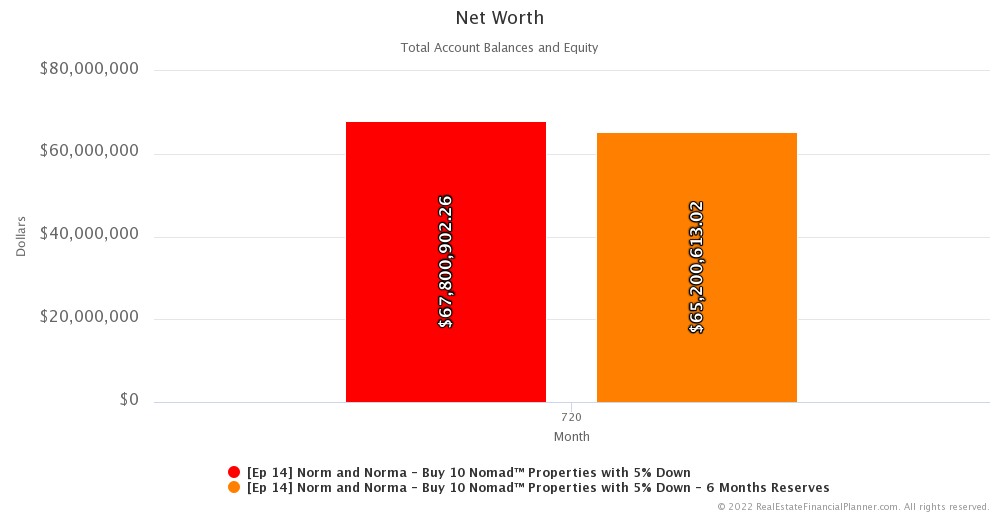

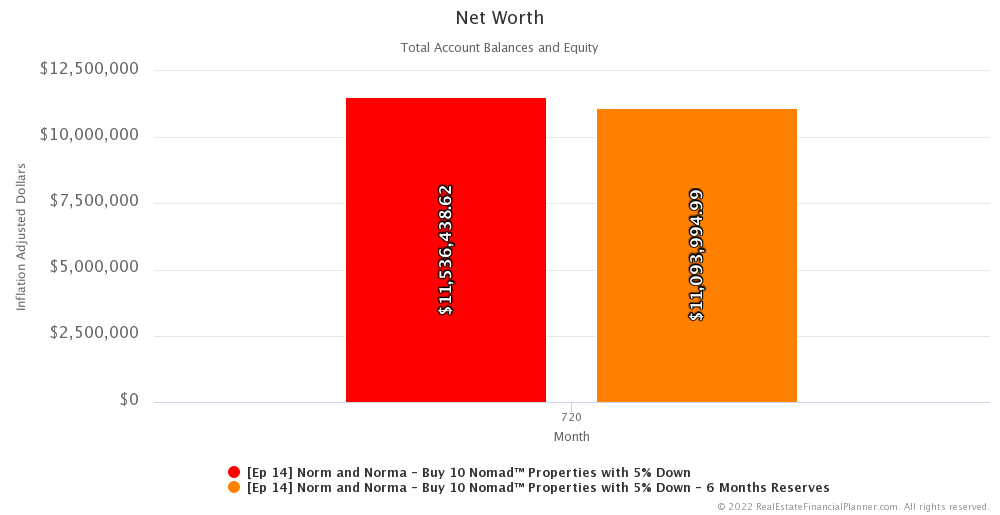

Traditional Nomad™

But, what about net worth for traditional Nomad™?

Again, requiring a full 6 months of reserves does mean they have less net worth after 60 years.

But the difference is not nearly as extreme. Even in future inflated dollars, we’re talking about the difference between $67.8 million and $65.2 million dollars.

If we adjust back to today’s dollars, not requiring reserves beyond 6 months of personal expenses results in a net worth of $11.54 million compared to $11.09 million… or a difference of a little over $400,000.

$400,000 is not nothing, but it is only premium of about 4% more for the security and peace of mind of having a full 6 months of reserves on every property and personal expenses.

Conclusion

In conclusion, there is an impact to slowing down a bit and requiring a full 6 months of reserves for personal expenses, all previously purchased properties and the property  Norm and Norma

Norm and Norma

- It slows down how quickly they can acquire properties.

- It slows down how quickly they can achieve financial independence.

- And it lowers their overall net worth.

But it does all this by adding in a significant additional margin of safety.

A margin of safety that could be even more important when putting just 5% down to buy properties versus putting 20% or 25% down.

Next Episode

In the last episode I promised you that we’d look at  Norm and Norma

Norm and Norma

Also, be sure to check out the Advanced Real Estate Financial Planner™ Podcast to see how having variable property appreciation rates and rent appreciation rates, variable mortgage interest rates, variable inflation rate and variable stock market rates of return impacts  Norm and Norma

Norm and Norma

I hope you have enjoyed this episode about the impact of reserves on  Norm and Norma

Norm and Norma

Get unprecedented insight into  Norm

Norm Norma’s

Norma’s Scenario with dozens of detailed, interactive charts.

Scenario with dozens of detailed, interactive charts.

Compare Nomading™ to Nomading™ with 6 Months of Reserves.

Compare Nomading™ into Short-Term Rentals to Nomading™ into Short-Term Rentals with 6 Months of Reserves.

Inside the Numbers

Watch the Inside the Numbers video to see exactly how we set up their  Scenario

Scenario

Nomad™

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 14 Norm and Norma - Buy 10 Nomad™ Properties with 5% Down with 2

Ep 14 Norm and Norma - Buy 10 Nomad™ Properties with 5% Down with 2  Accounts, 1

Accounts, 1  Property, and 6

Property, and 6  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Nomad™ with 6 Months of Reserves

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 14 Norm and Norma - Buy 10 Nomad™ Properties with 5% Down - 6 Months Reserves with 2

Ep 14 Norm and Norma - Buy 10 Nomad™ Properties with 5% Down - 6 Months Reserves with 2  Accounts, 1

Accounts, 1  Property, and 6

Property, and 6  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Nomad™ into Short-Term Rentals

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 17 Norm and Norma - Buy 10 Nomad™ into Short-Term Rental Properties with 5% Down with 2

Ep 17 Norm and Norma - Buy 10 Nomad™ into Short-Term Rental Properties with 5% Down with 2  Accounts, 1

Accounts, 1  Property, and 6

Property, and 6  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Nomad™ into Short-Term Rentals with 6 Months of Reserves

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 17 Norm and Norma - Buy 10 Nomad™ into Short-Term Rental Properties with 5% Down - 6 Months Reserves with 2

Ep 17 Norm and Norma - Buy 10 Nomad™ into Short-Term Rental Properties with 5% Down - 6 Months Reserves with 2  Accounts, 1

Accounts, 1  Property, and 6

Property, and 6  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Podcast Episodes

The following are the podcast episodes for variations of  Norm

Norm Norma’s

Norma’s

More posts: Norm Episode