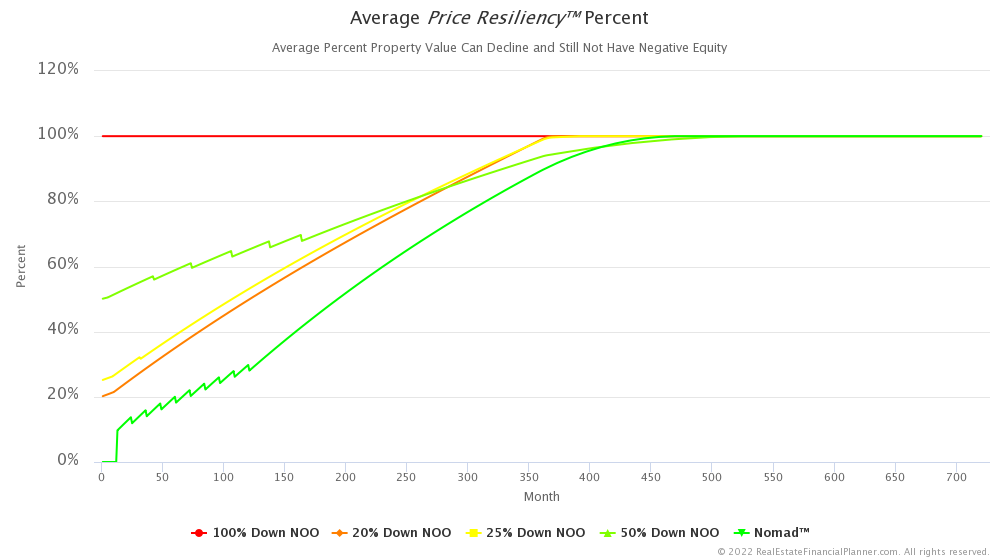

Price Resiliency™ is the amount property values (price) can decline before you’re underwater, upside down or have negative equity on rental properties.

Similar to Rent Resiliency™, we can measure Price Resiliency™ in terms of dollars or in terms of percent.

In other words, we can ask:

- How many dollars can property values (price) decline before I’d have negative equity?

- Or, what percent can property values (price) decline before I’d have negative equity?

When we talk about Price Resiliency™ in dollars, what we’re really talking about is Equity.

That’s because Equity is the amount of dollars that property values can decline before you’d have negative equity.

But, the idea of Price Resiliency™ as a percent does not have an equivalent. It is a unique way to measure risk in your real estate investments. There are many other ways to measure risk as well, but Price Resiliency™ is one way.

Price Resiliency™ is a chart you can view for any  Property

Property

Or, you can view Price Resiliency™ for the entire  Scenario

Scenario