Pro Tip: Listen to the podcast below and while you’re listening follow along with the charts below. Then, when you’re done, copy the  Scenario

Scenario

Welcome to the Real Estate Financial Planner™ Podcast. I am your host, James Orr. This is Episode 9.

Today we’re going to continue with

Norm and Norma

Norm and Norma

If you recall from last episode, they decided to rent themselves but save up for 20% down payments to buy 10 rental properties to rent out to others. They were relying primarily on the cash flow from these properties to eventually be able to provide them with their minimal target monthly income in retirement so they could stop working their tech jobs.

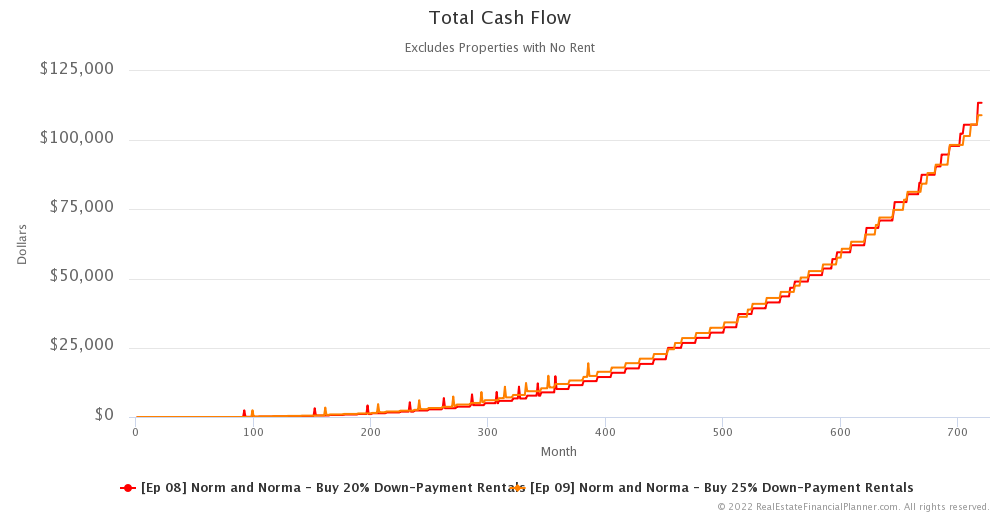

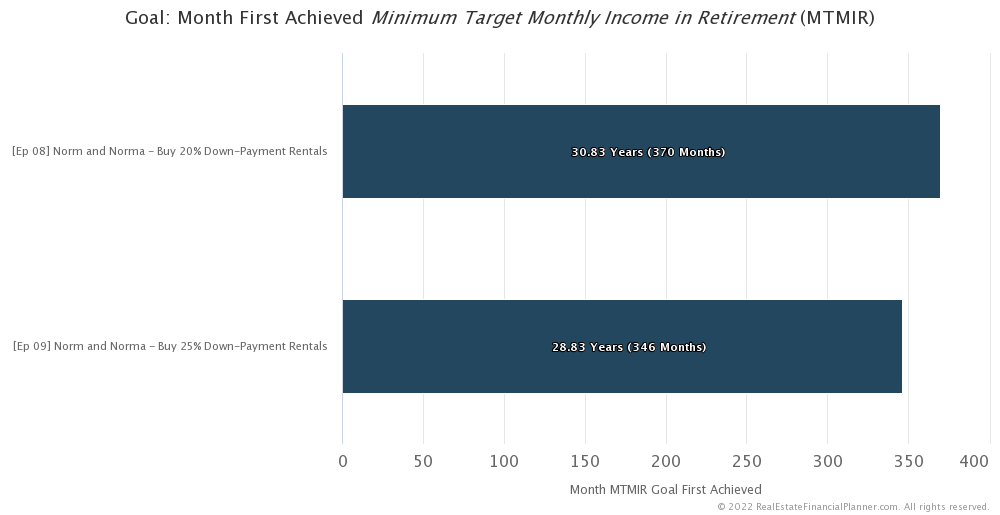

By investing in 20% down payment rentals they were able to achieve financial independence in just under 31 years… 370 months.

What difference will it make by putting 25% down when they buy their rentals? Will it allow them to achieve financial independence faster or will it be slower?

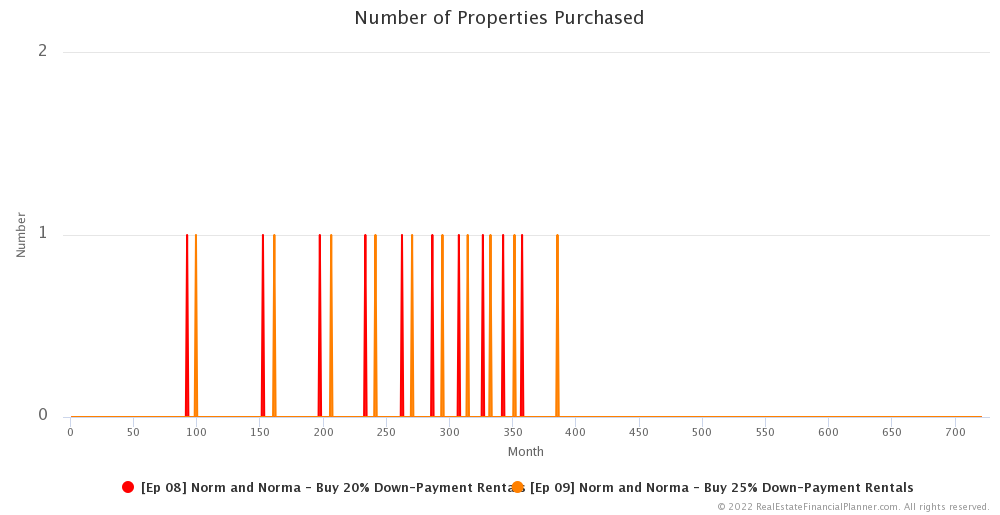

Number of Properties Purchased

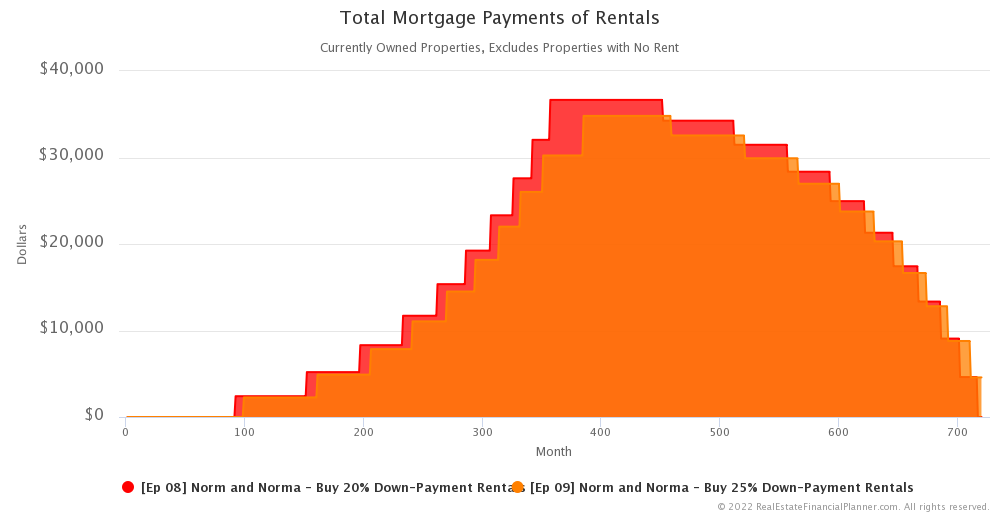

Saving up 25% down payments will take longer than saving up 20% down payments.

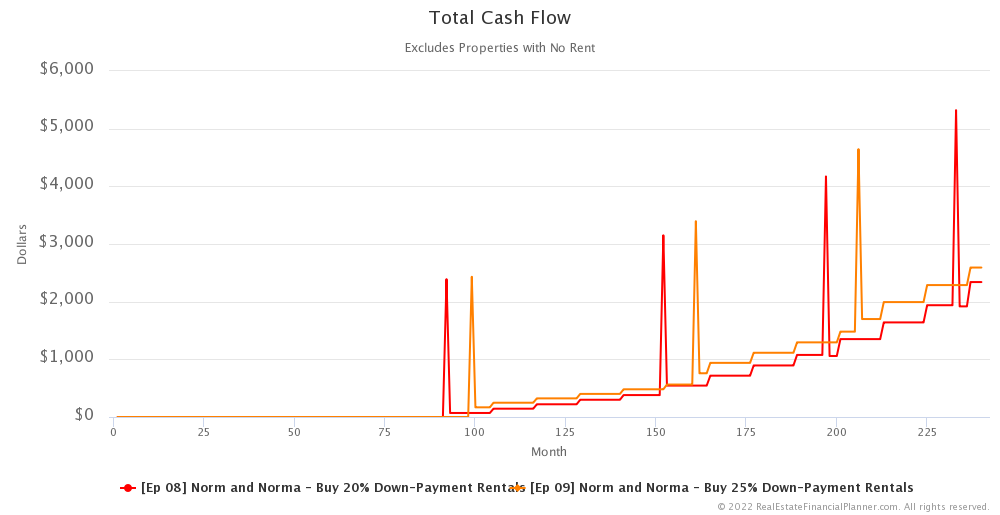

For example, they’re able to buy their first rental property in month 92 when saving up for 20% down payments but it takes 7 months more for them to save up the extra down payment required for a full 25% down payment plus closing costs and reserves in both scenarios.

This pattern repeats itself for buying each subsequent property. Saving up for 25% down payment takes a bit longer than saving up for 20% down payments.

You might be wondering if this delay would lead to  Norm and Norma

Norm and Norma

Well, not so fast.

Benefits of 25% Down Payments Over 20% Down Payments

What are the benefits of putting 25% down when buying rental properties over putting 20% down?

Borrowing Less

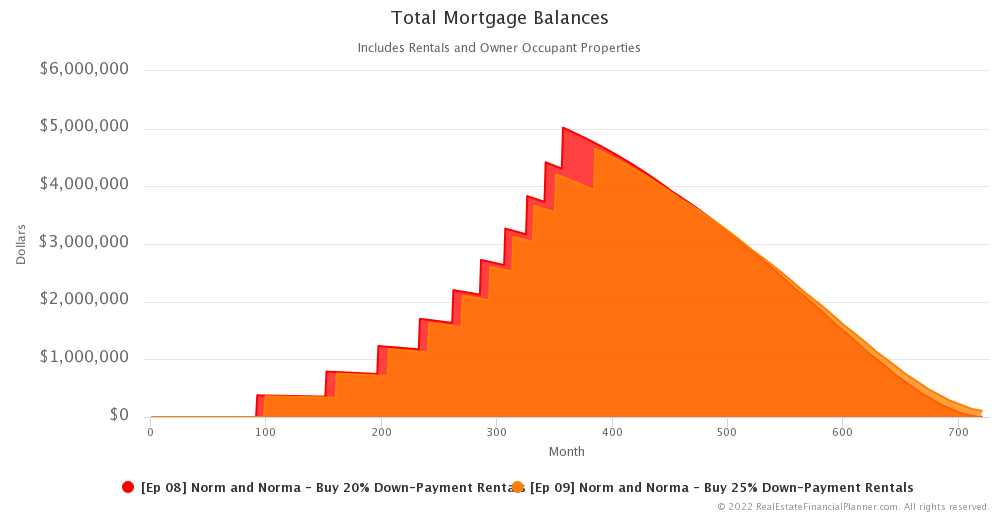

Well, there’s the obvious… by putting more down, they are borrowing less.

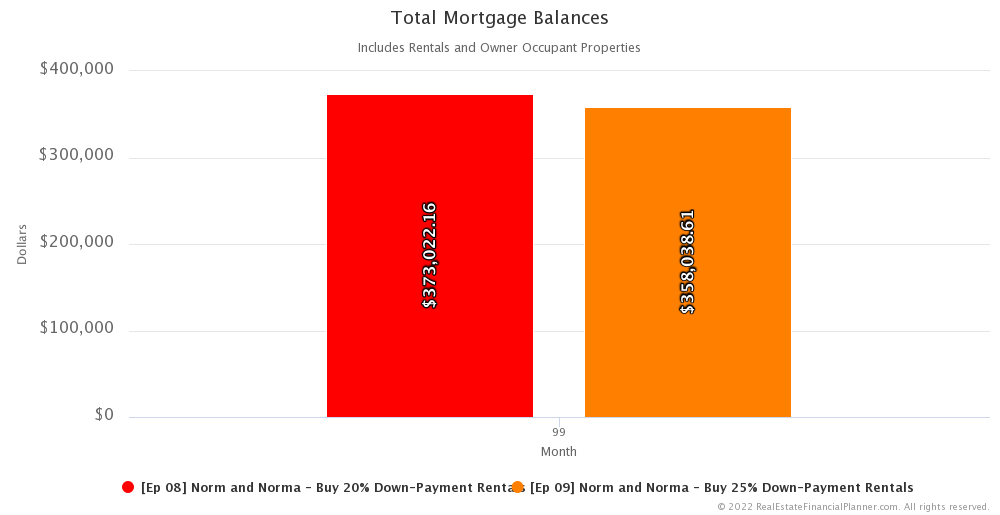

For example, let’s look at the first rental they buy in both scenarios. And, let’s look at month 99… the first month they own the 25% down payment rental. The mortgage balance of the property they put 20% down payment on… the one they’ve owned for about 7 months at this point… has a mortgage balance of about $373K. The property they just bought with 25% down has a mortgage balance of about $358K. That’s a difference of about $15K.

I will admit by purchasing the property a little later it does give the property a little time to appreciate which means the loan amount is higher than it would have been if they could buy it 9 months early. But the property values are going up 3% per year and we’re talking less than a year of appreciation compared to putting an additional 5 percentage points down. So, borrowing less… at least in this case… is still a benefit of putting 25% down.

But that’s not the only benefit of putting 25% down over putting 20% down.

Better Mortgage Interest Rates

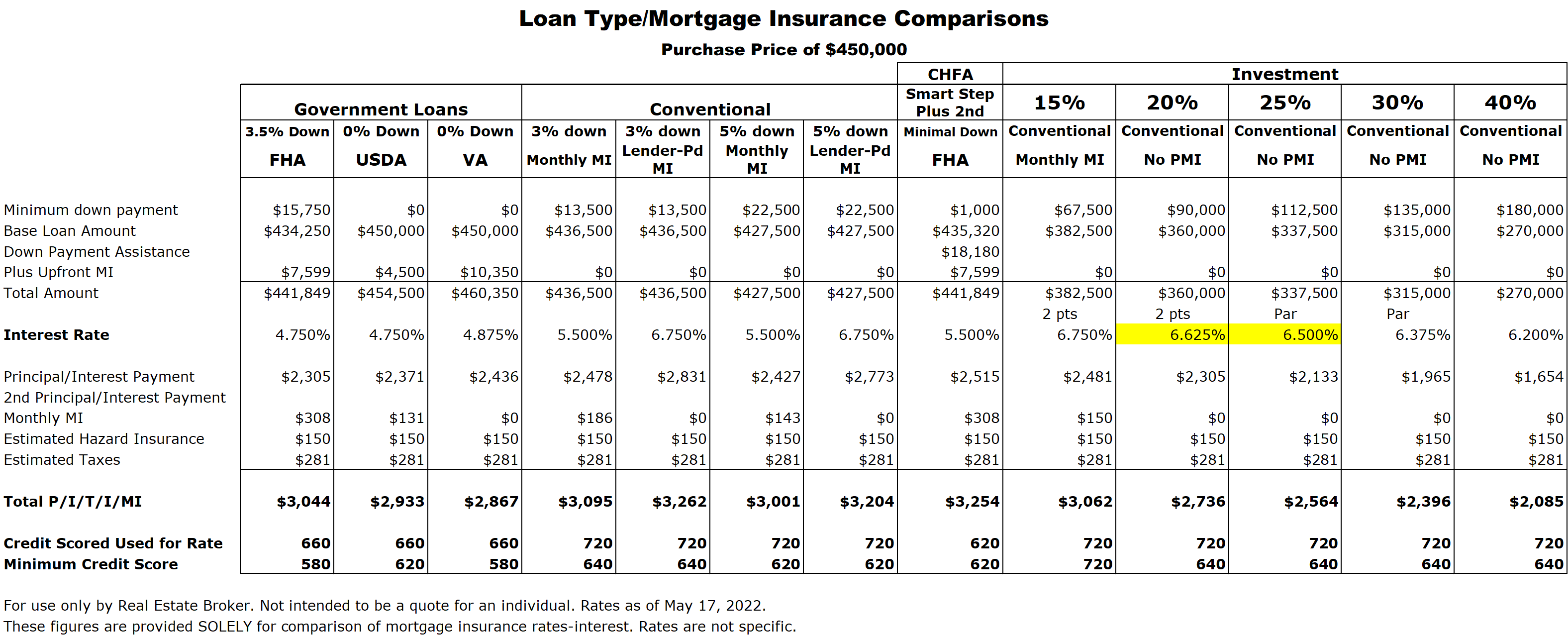

Typically, you get a better mortgage interest rate when you put 25% down than when you put 20% down.

For example, when  Norm and Norma

Norm and Norma

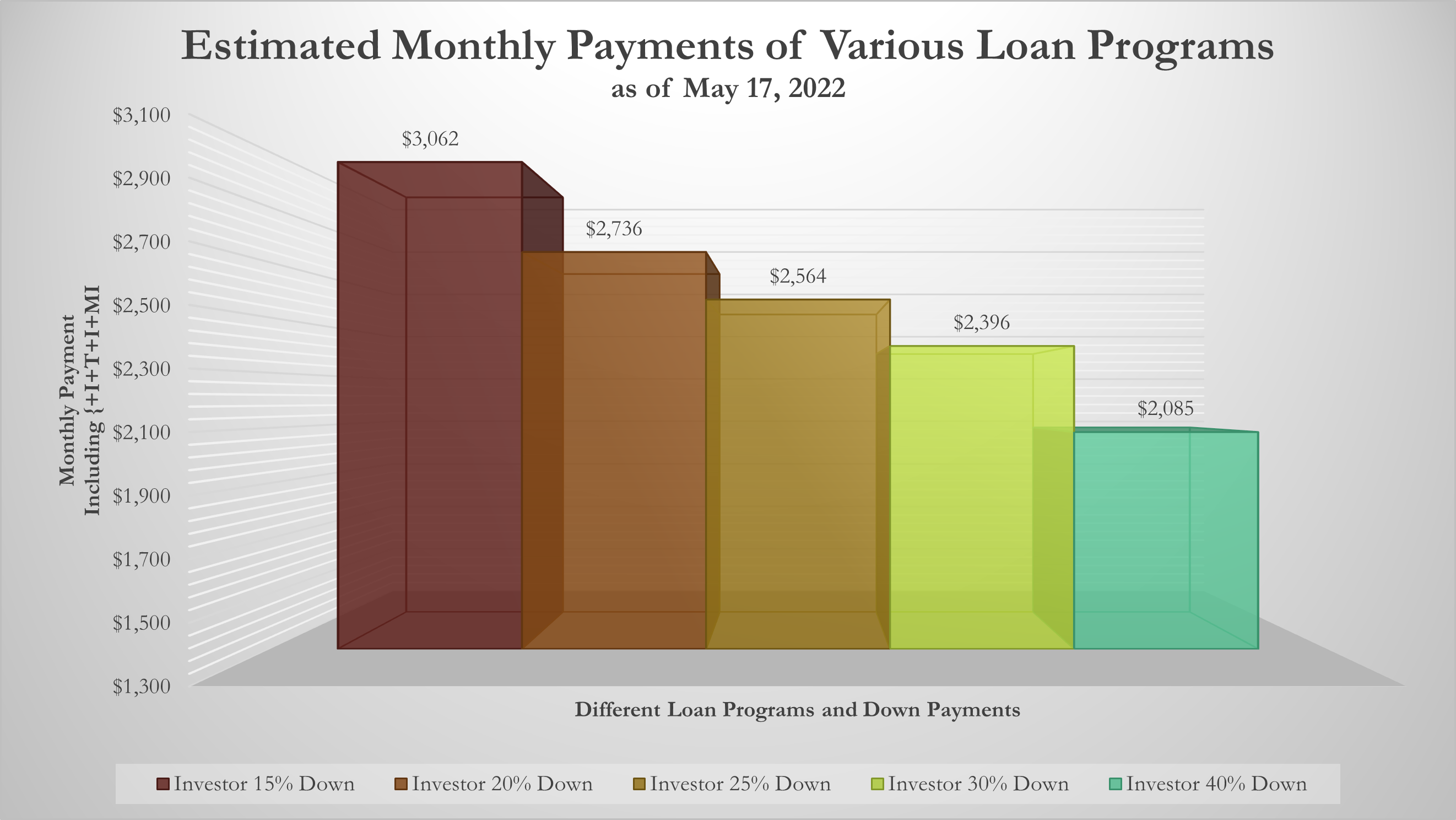

Lower Mortgage Payment

Having a lower mortgage interest rate… especially combined with borrowing less by putting more down… means that their monthly payment is lower.

Having lower mortgage payments has several very practical benefits.

Better Cash Flow

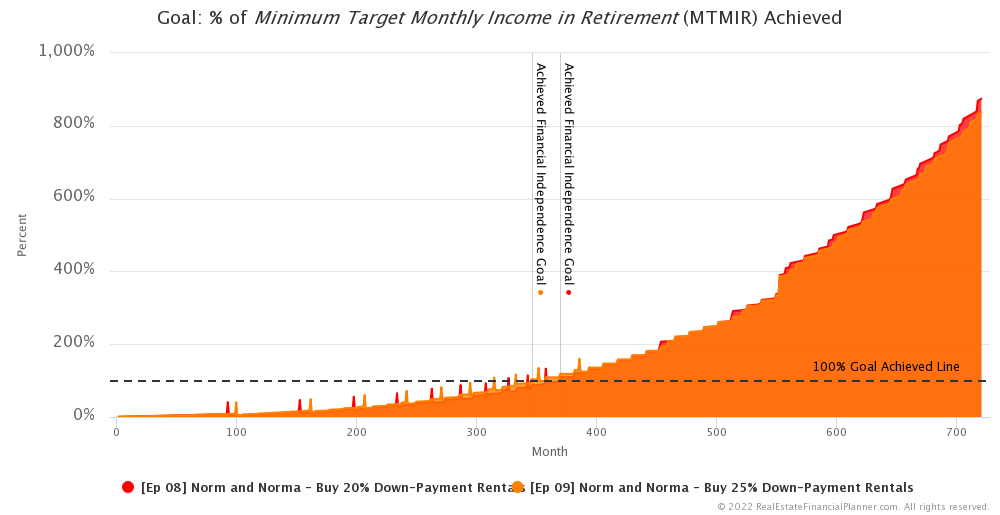

First, lower mortgage payments means better cash flow. Does this better cash flow help them achieve financial independence enough to make it faster than putting 20% down? We’ll see shortly.

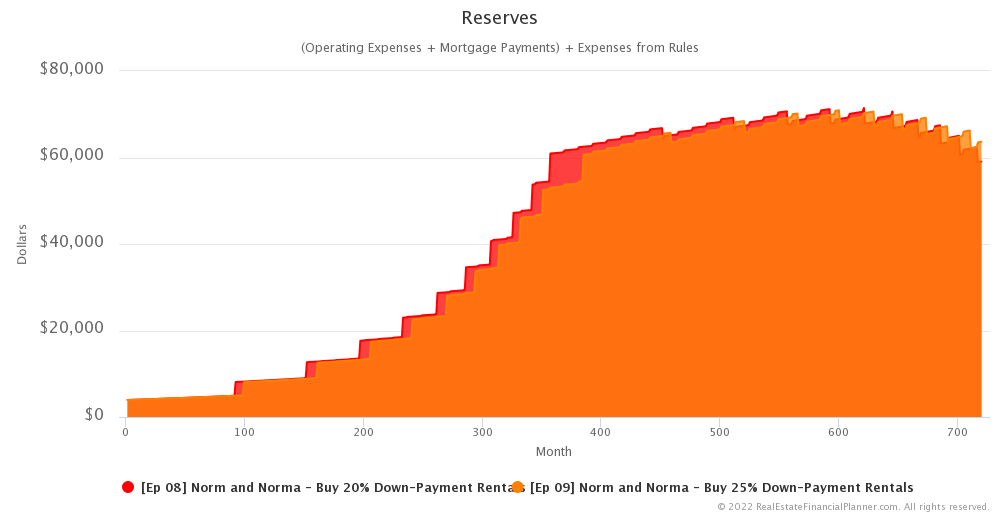

Lower Reserve Requirement

But, having lower mortgage payments also means they have a slightly lower reserve requirement. If they’re committed to keeping 6 months of all expenses as reserves, having a slightly lower mortgage payment means that they need to keep slightly less in reserves to still have 6 months of reserves.

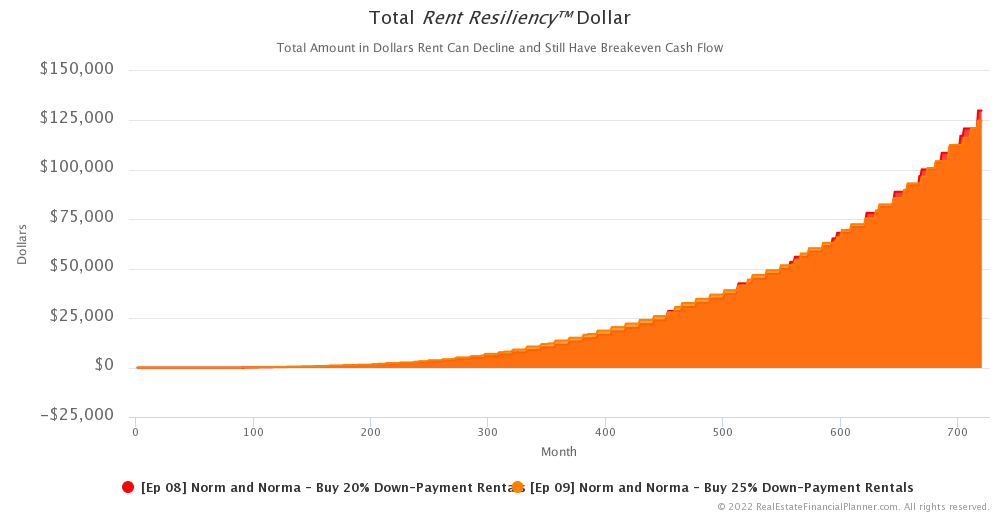

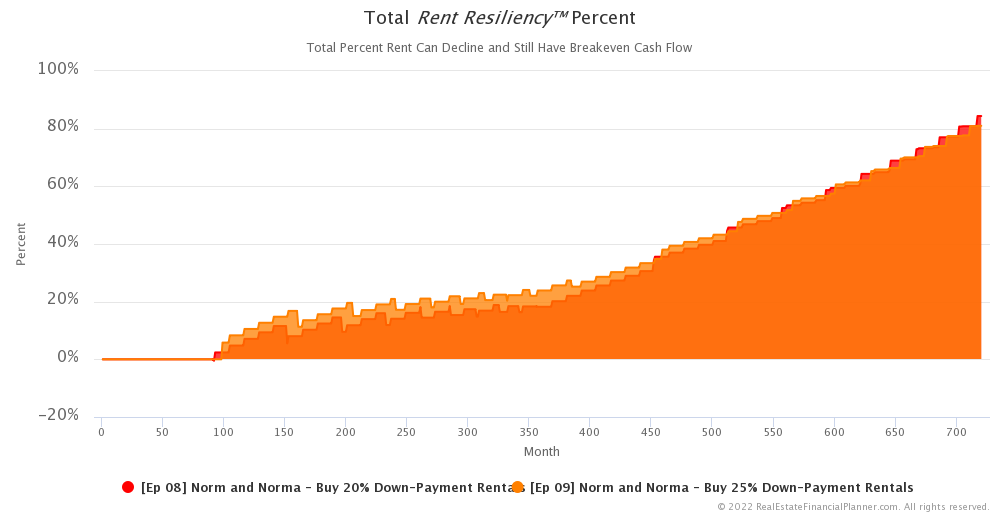

More Resilient to Rent and Price Declines

One way that we measure risk is how resilient they are if rents go down before having negative cash flow. Improved cash flow, makes them more resilient to rents dropping. They could weather a decline in rents better with 25% down than someone who put 20% down on the same property.

A similar thing could be said about price declines. They are more resilient to being upside down with their mortgage if prices decline by putting 25% down instead of 20% down.

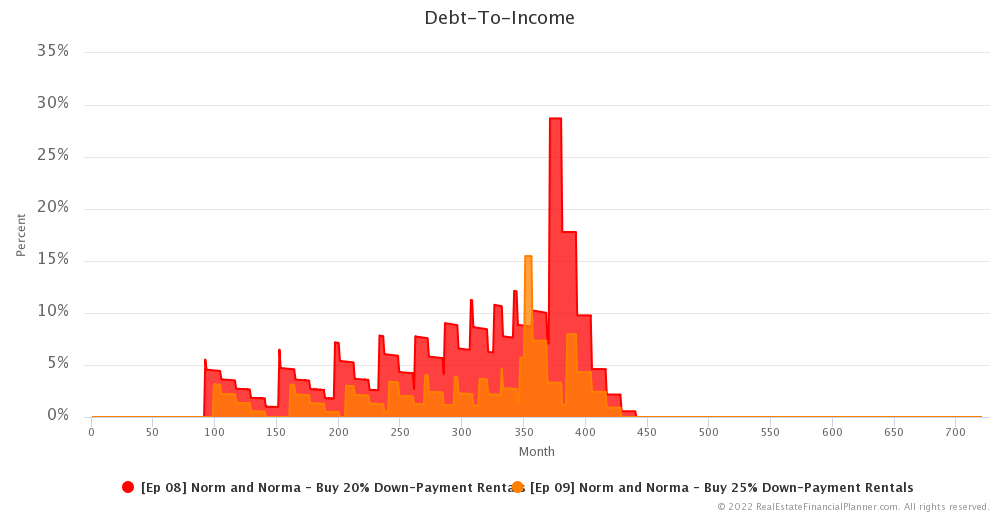

Improved Debt-To-Income

But wait… there’s more… with improved cash flow and lower mortgage payments, their debt-to-income is improved as well.

If their rental property acquisitions were being limited by debt-to-income this could be an even more significant benefit. Fortunately, regardless of whether they put 20% or 25% down they were not really pushing their debt-to-income ratio anywhere near their qualification limit.

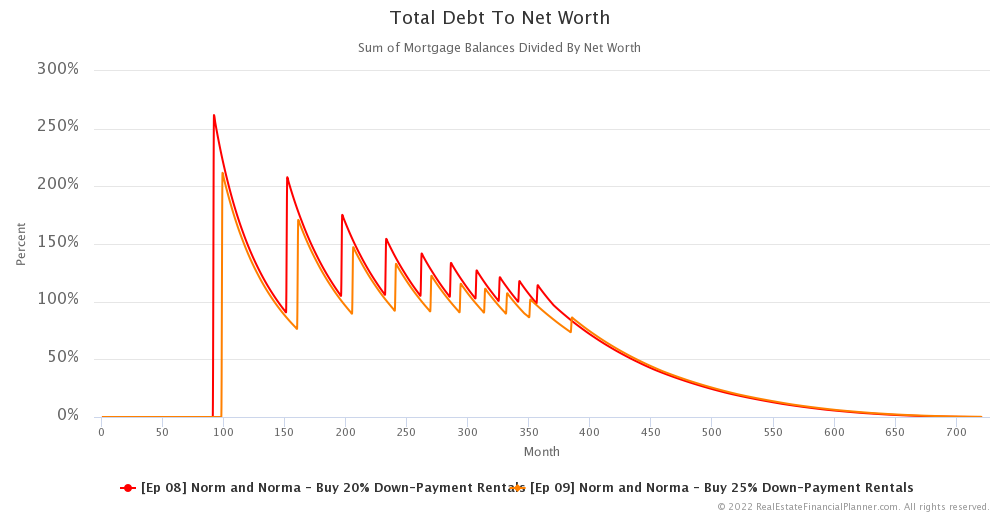

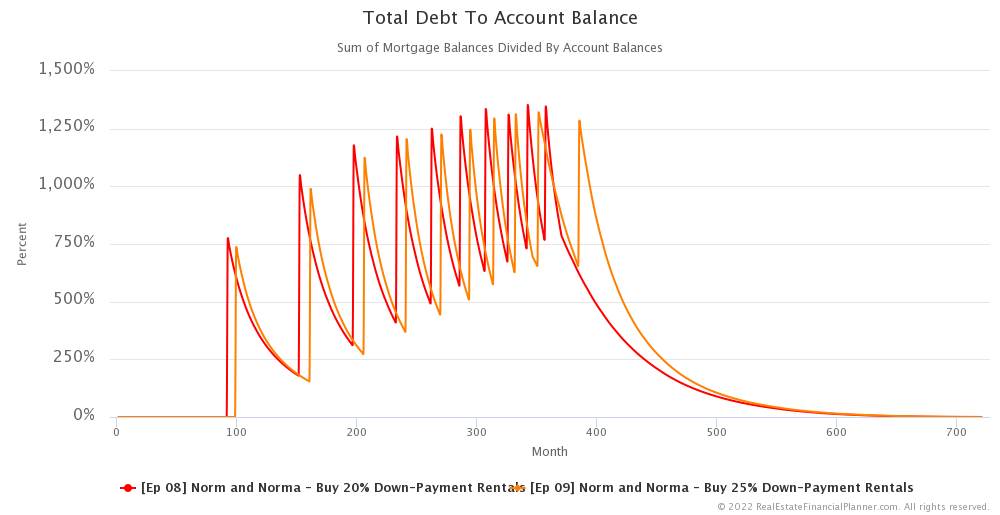

Lower Risk When Measuring Debt

And finally, putting 25% down means they have less overall debt. That means that some of the other ways we like to measure risk… like debt to net worth is better when they put more down. That means it is less risky to put 25% down.

A similar case can be made when we measure debt to their liquid net worth which we call debt to account balances. Putting more down means they have lower debt and therefore lower overall risk.

Financial Independence

If these were the only benefits of putting 25% down instead of 20% down and they achieved financial independence even a little bit later than putting 20% down, one could make an argument to put the extra money down and accept the slight delay in achieving financial independence.

Fortunately, they don’t have to make that choice because it turns out that it is faster achieving financial independence putting 25% down.

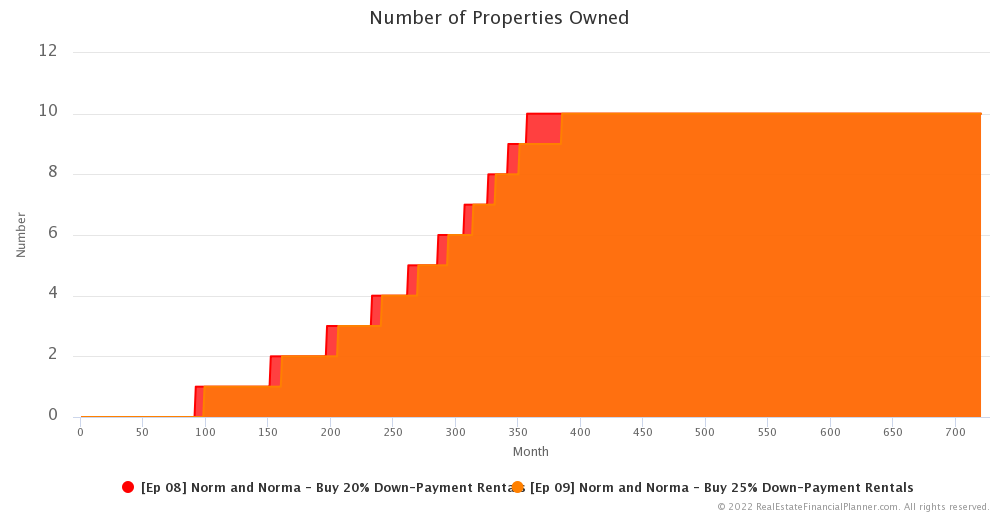

They achieve financial independence 2 years faster by putting an extra 5 percentage points down… 25% versus 20%. They’re financially independent in 346 months… a little shy of 29 years with 25% down compared to 370 months or a little shy of 31 years with 20% down.

And, because they’re buying 10 rentals in both scenarios, their standard of living is very similar in both cases. Putting 25% down gives them a slightly better standard of living earlier and 20% has a slightly better standard of living later.

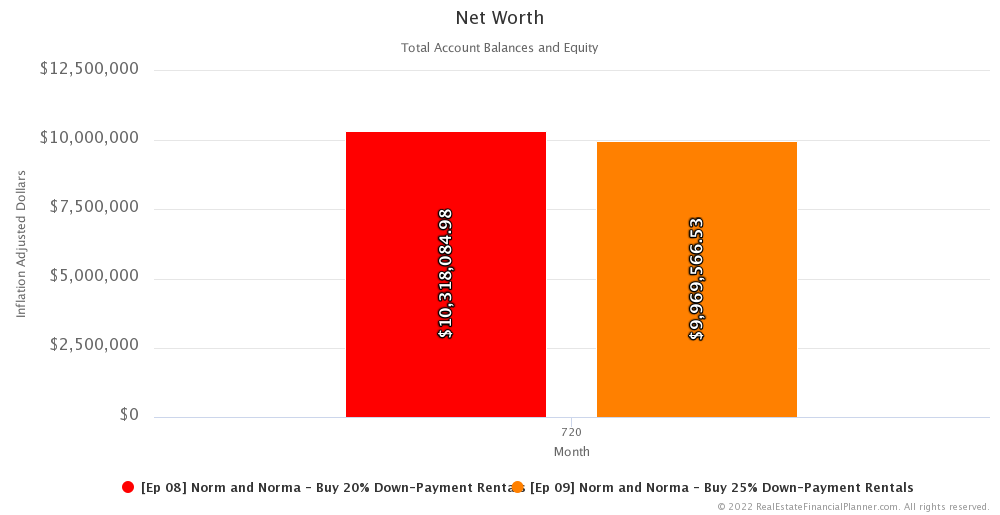

Net Worth

With 20% down payments, they end up with a net worth of about $60.64 million after 60 years in inflated dollars. Compare that to about $58.59 million when putting 25% down. So, about $2 million more in net worth in inflated, future dollars.

If we adjust back to today’s dollars, that’s like $10.3 million to $9.97 or about $350,000 difference.

Next Episode

Could being able to buy rentals with 15% down payment non-owner-occupant loans sooner make a big enough difference for it to be faster for  Norm and Norma

Norm and Norma

Norm and Norma

Norm and Norma

Also, be sure to check out the Advanced Real Estate Financial Planner™ Podcast to see how having variable property appreciation rates and rent appreciation rates, variable mortgage interest rates, variable inflation rate and variable stock market rates of return impacts  Norm and Norma

Norm and Norma

I hope you have enjoyed this Episode about  Norm and Norma

Norm and Norma

Get unprecedented insight into  Norm

Norm Norma’s

Norma’s Scenario with dozens of detailed, interactive charts.

Scenario with dozens of detailed, interactive charts.

Inside the Numbers

Watch the Inside the Numbers video to see exactly how we set up their  Scenario

Scenario

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 08 Norm and Norma - Buy 20% Down-Payment Rentals with 2

Ep 08 Norm and Norma - Buy 20% Down-Payment Rentals with 2  Accounts, 1

Accounts, 1  Property, and 6

Property, and 6  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 09 Norm and Norma - Buy 25% Down-Payment Rentals with 2

Ep 09 Norm and Norma - Buy 25% Down-Payment Rentals with 2  Accounts, 1

Accounts, 1  Property, and 6

Property, and 6  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Podcast Episodes

The following are the podcast episodes for variations of  Norm

Norm Norma’s

Norma’s

More posts: Norm Episode