Pro Tip: Listen to the podcast below and while you’re listening follow along with the charts below. Then, when you’re done, copy the  Scenario

Scenario

Welcome to the Real Estate Financial Planner™ Podcast. I am your host, James Orr. This is Episode 19.

Today we’re going to continue with  Norm and Norma’s

Norm and Norma’s

In the last episode, we went on a tangent and discussed the impact of requiring more reserves before buying additional properties for  Norm and Norma

Norm and Norma

In this episode, we’re going to talk about house hacking.

EverythingHouseHacking.com defines house hacking as:

So,  Norm and Norma

Norm and Norma

They could have decided to buy a duplex, triplex or fourplex and rented out the other units while they lived in one of the units.

However, to keep our modeling as close to an apples-to-apples comparison as possible… even though we’re literally discussing different investing strategies and so it is NOT an apples-to-apples comparison… we opted to have them buying the same properties they were buying when Nomading™ and get roommates.

In fact, these are exactly the same properties.

The only difference when we model  Norm and Norma

Norm and Norma

Depending on how many roommates they get, they receive $650 per month per roommate.

So, house hacking really just appears as if they’re getting side hustle that brings in either $650 per month, $1,300 per month or $1,950 per month. The amount depends on whether they have 1, 2 or 3 roommates.

If they got a side hustle and made that same amount of money they would end up in the same place financially.

In all the cases with roommates, once they move out of their property, they bring the roommates with them to the next property and convert the previous property to a rental like they did in Episode 14 where they did Traditional Nomad™.

The advantages of house hacking… or getting a side hustle for that matter… are:

- They can save up for down payments to buy the next property a little faster, and

- Their debt-to-income (DTI) is a little better for qualifying for the next loan.

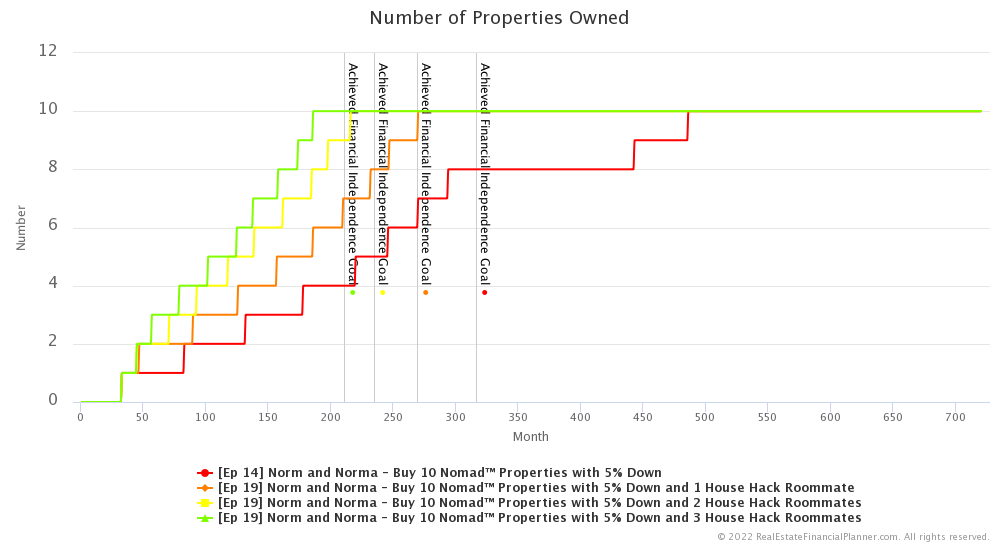

Number of Properties Owned

When  Norm and Norma

Norm and Norma

2 roommates is second fastest.

Having 1 roommate where they make an extra $650 per month is faster than doing traditional Nomad™.

Basically, instead of earning $6,000 per month from their jobs and saving $1,000 per month they earn $6,650 per month and save $1,650 per month. And, that’s with just one roommate.

With 3 roommates, instead of earning $6,000 per month from their jobs and saving $1,000 per month they’re earning $7,950 per month and saving $2,950 per month.

That’s a pretty significant increase in their income and especially their savings rates.

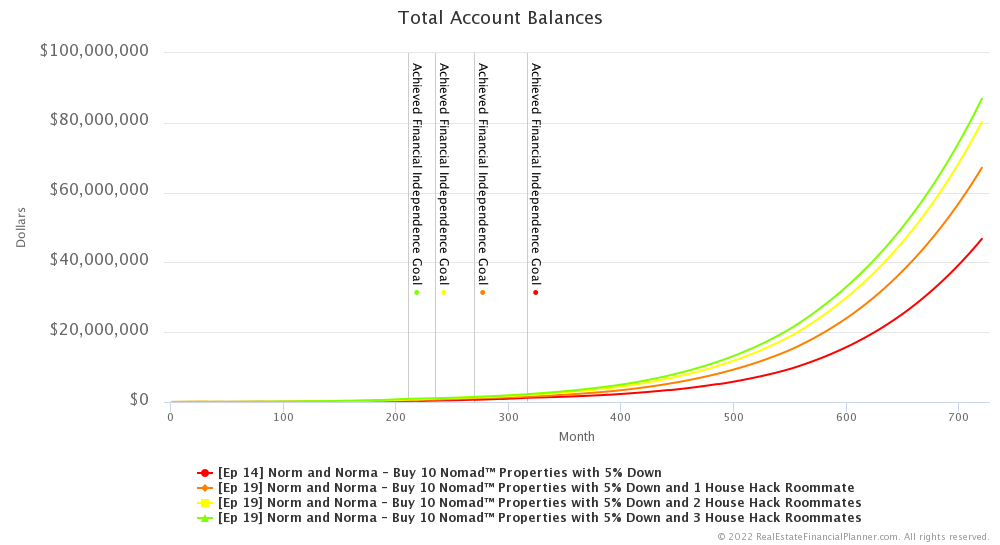

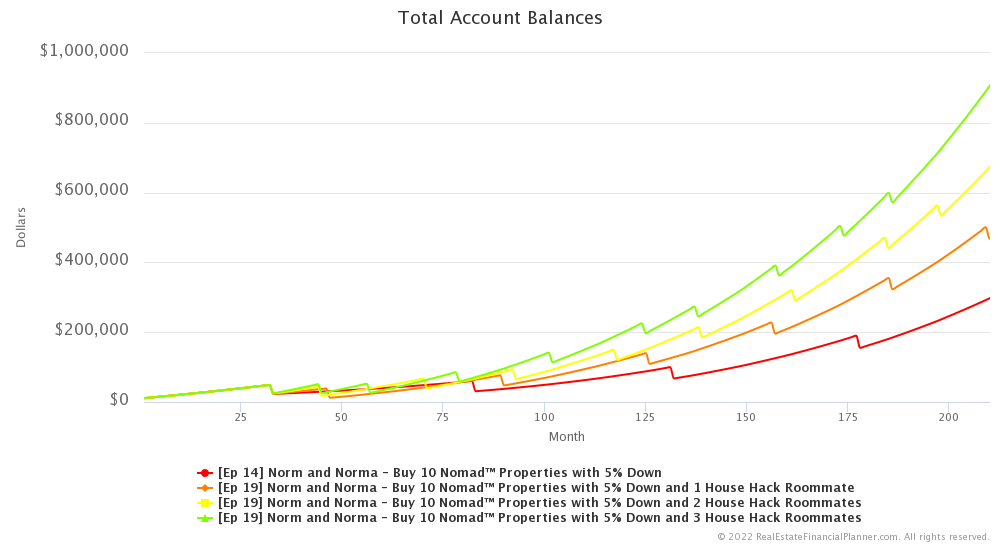

Account Balances

That results in higher account balances overall and especially higher account balances early on.

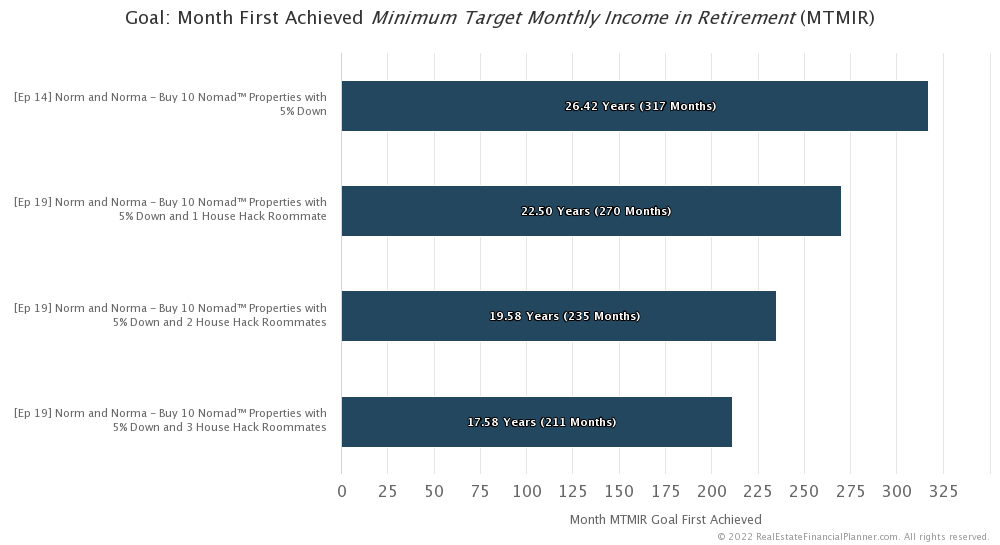

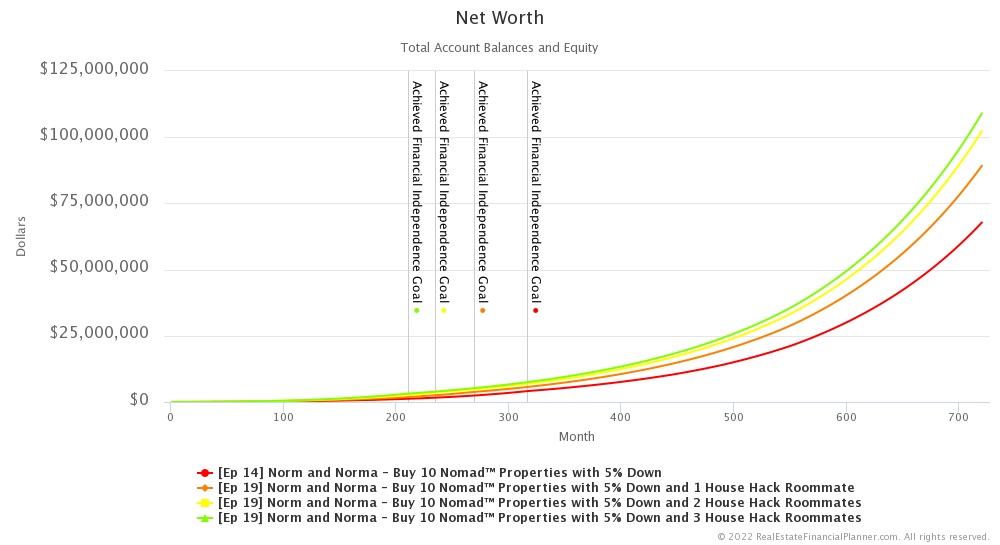

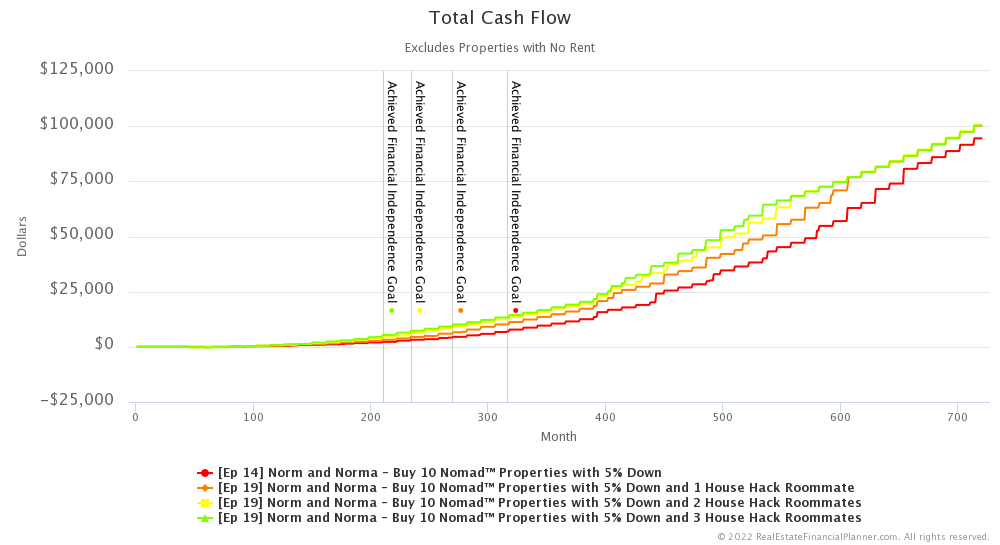

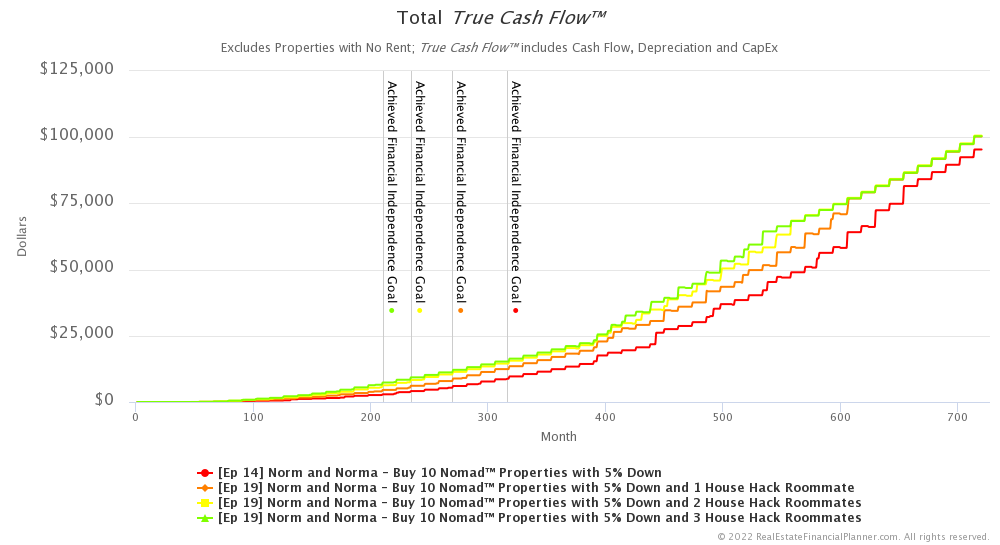

Financial Independence

Being able to buy properties sooner, means they can get to the point where the income from the rentals is enough to replace the $5,000 per month they need to support themselves and be financially independent.

And, out of an abundance of clarity, they stop house hacking and having roommates once they achieve financial independence. So, the income from their rentals is net income after all expenses and specifically excludes the income from their house hacking roommates.

So, when do they achieve financial independence?

When they do traditional Nomading without house hacking roommates, it takes them just under 26.5 years.

If they get just one roommate for $650 per month, it speeds up their ability to be financially independent by about 4 years. Instead of it taking 26.5 years, it takes 22.5 years.

What if they get two roommates for $650 per month each?

Well, that speeds up them being financially independent by almost another 3 years.

And if they get a third roommate for yet another $650 per month, that means they can be financially independent 2 years faster than having 2 roommates.

So, if they do traditional Nomad™ without roommates it would take about 26.5 years but if they get 3 roommates it only takes a little over 17.5 years. So, by getting 3 roommates they’re able to speed up their ability to retire by a little under 9 years.

That’s approximately 30% faster.

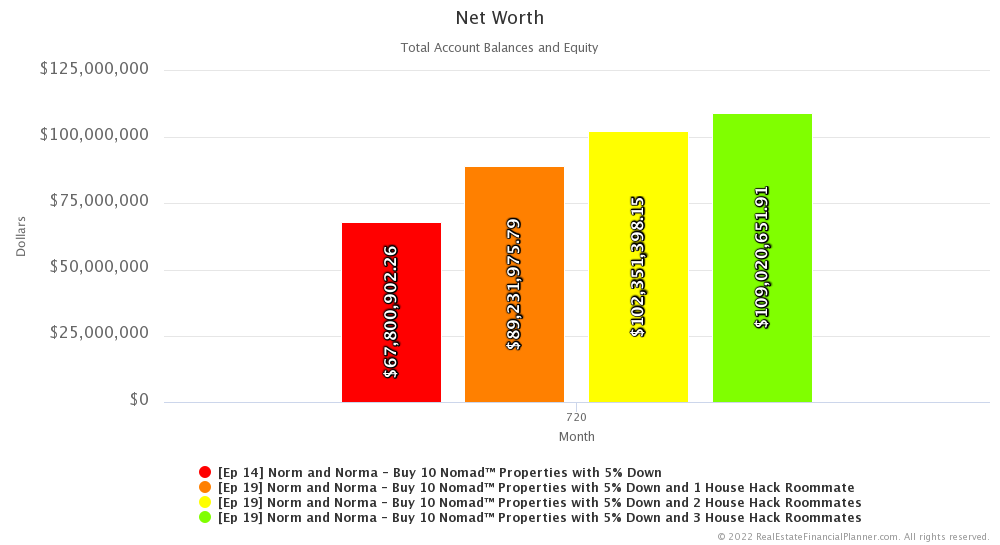

Net Worth

But certainly, the speed to being financially independent isn’t everything.

What about net worth?

Well, having more roommates means a higher net worth too.

In fact, by the end of our modeling in year 60, house hacking with 3 roommates until they’re financially independent then not having roommates from then on… results in  Norm and Norma

Norm and Norma

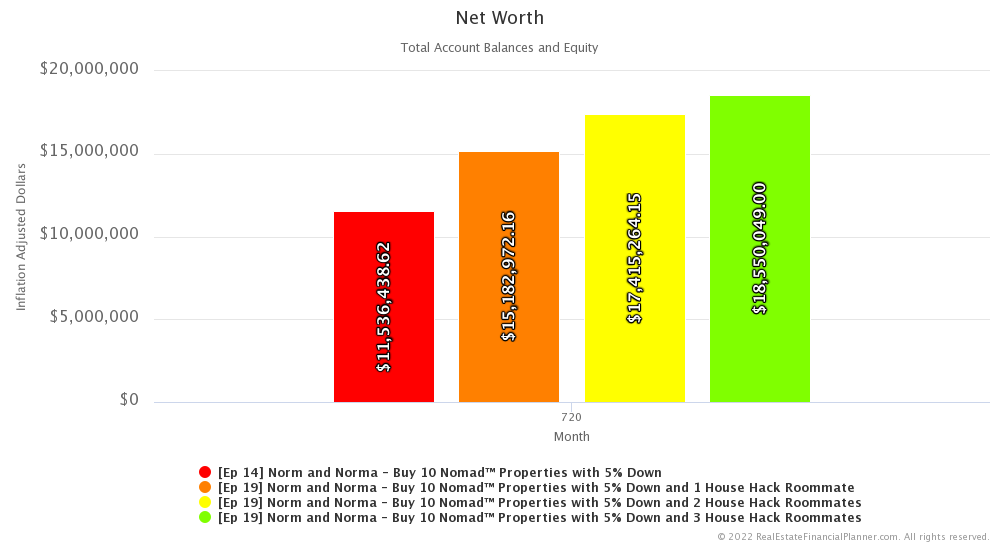

But those numbers are in future inflated dollars. What if we adjust back to today’s dollars?

Well, traditional Nomad™ is like them having $11.5 million in today’s dollars but 60 years from now.

If they Nomad™ but get 1 roommate for the property they’re living in, they end up with about $3.7 million dollars more… about $15.2 million dollars versus $11.5 million.

If they get 2 roommates, they end up with $2.2 million more than they had with just 1 roommate.

And 3 roommates is another $1.1 million more than 2 roommates.

That’s non-trivial.

The difference between not having any roommates and just doing traditional Nomading™ versus getting 3 roommates is about $7 million dollars or about 60% higher net worth.

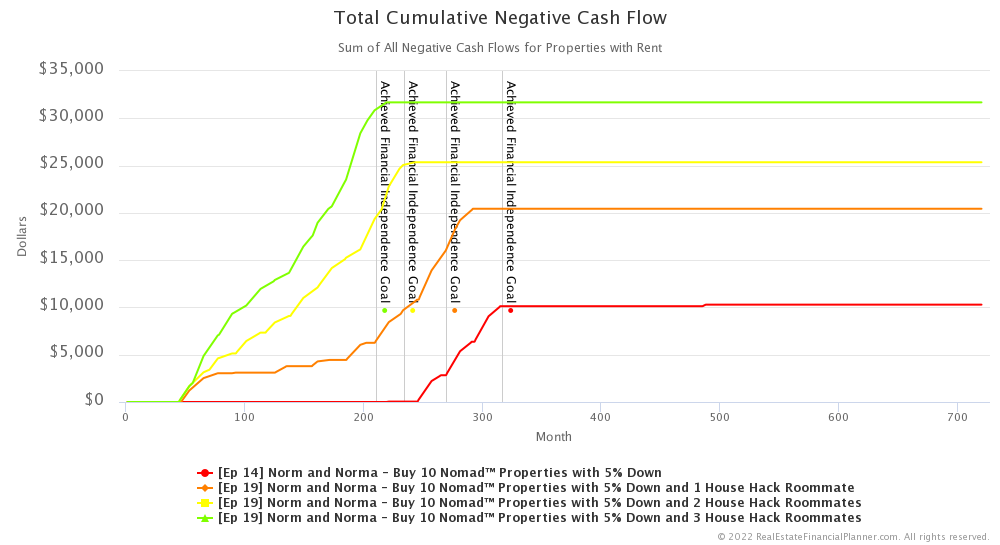

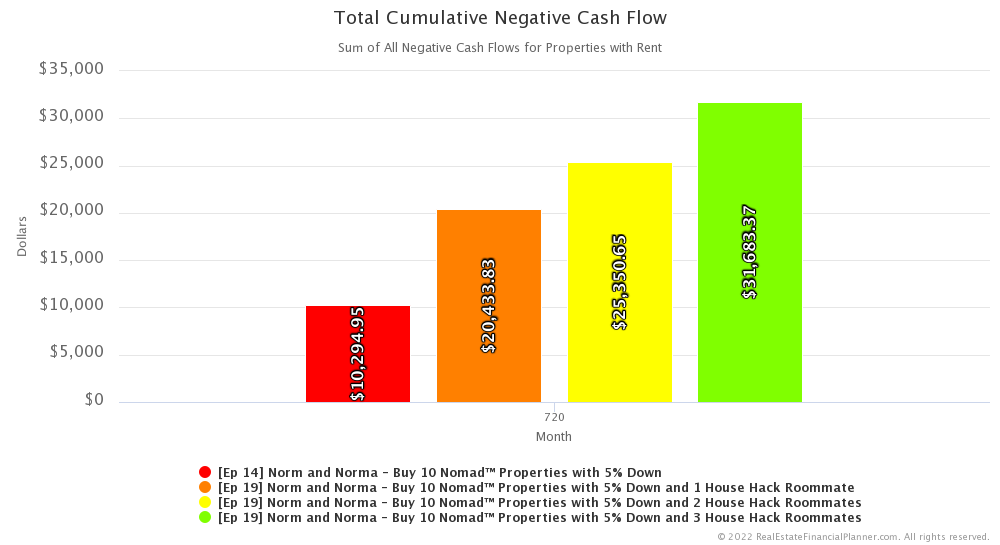

Cumulative Negative Cash Flow

But not everything is better when they house hack.

Let’s consider how much negative cash flow they have.

When they are doing traditional Nomad™ and it takes them longer to save up for down payments, the property they’re living in has time for rents to increase while they own them. This means that cash flow is better when they finally convert it from living in the property to a rental.

That means they’re much less likely to have negative cash flow and if they do, it typically is a smaller amount.

But, when they have the ability to buy properties quicker when the extra money from their house hacking roommates, they may only need to stay in the property for the 1 year minimum required by the lender for it being an owner-occupant loan.

That means they’re much more likely to have negative cash flow when they buy properties faster.

If we add up the total amount of negative cash flow… for every property and for the entire period we modeled, with traditional Nomad™  Norm and Norma

Norm and Norma

However, buying properties faster with 1 house hack roommates, it is over $20,000. Again, that’s the cumulative total for all 10 properties over the entire 60-year period.

With 2 roommates, the total is just over $25,000 and with 3 roommates, it is just over $31,000.

Now, to be clear… this isn’t to say that their whole portfolio was negative… this is looking to see if any property was negative by itself and counting that if it was.

Cash Flow

In fact, since some of the early properties they buy have cash flow that will often offset any negative cash flow they have on buying later properties.

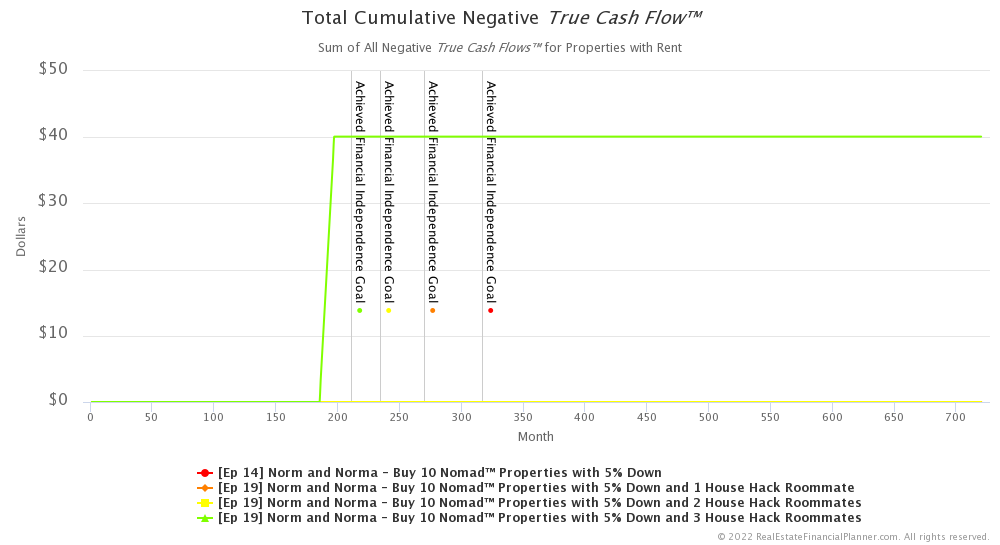

True Cash Flow™

Furthermore, if we take into account the benefits they get from depreciation on rental properties in the form of Cash Flow from Depreciation™ it all but completely offsets any negative cash flow they would have.

If we look at the total cumulative negative True Cash Flow™ for all properties over the entire 60-year modeling period, the only negative True Cash Flow™ is when they have 3 house hacking roommates and it is about $40.

That’s $40 total for all properties across all 60 years. That’s so small, it could be offset by even a slight change between reality and what we modeled.

And, we already know that by buying the properties sooner they have more money in their accounts to offset these possibly negative cash flows by having house hacking roommates.

Of course, as we discussed in the last episode on our tangent about the impact of reserves, we’re still using a pretty aggressively small amount of reserves to be able to buy the next property. If they really wanted to do this strategy we might recommend they use a more conservative amount for reserves.

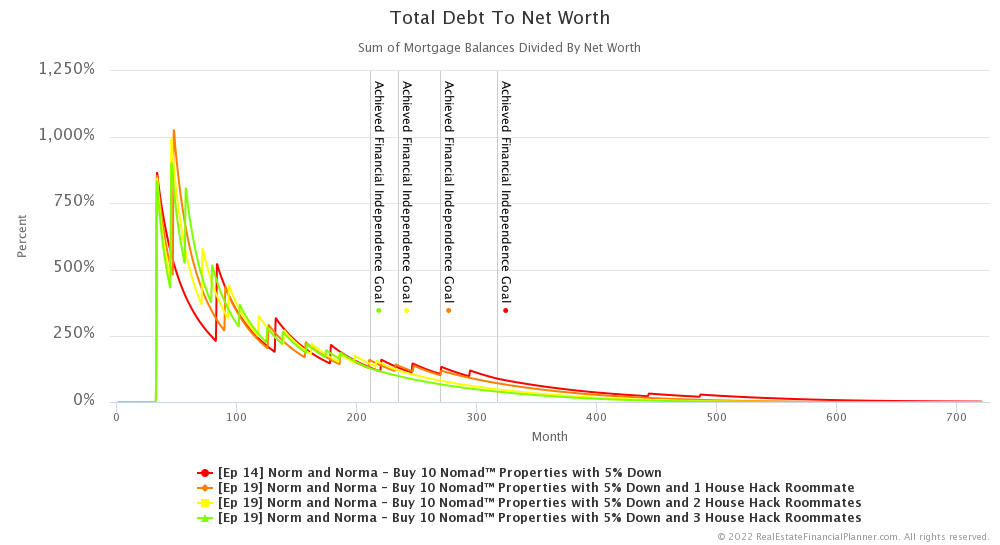

Total Debt To Net Worth

One way we like to measure risk is to look at the total amount of debt they have with a strategy compared to their net worth.

I just started to summarize this measurement by looking at the average measure of total debt to net worth over the entire 60-year period.

The average when they do traditional Nomad™ is 104%.

It is the same 104% risk level if they have one house hack roommate.

But the average risk for the entire scenario is slightly lower at 101% with 2 roommates and even a little bit lower at 97% with 3 roommates.

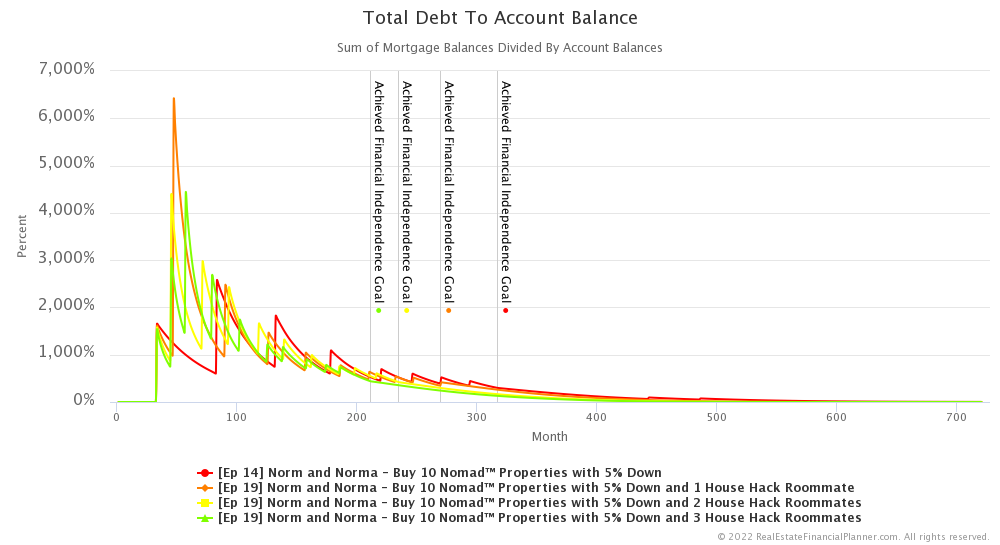

Total Debt to Account Balance

Another way we measure risk though is to take the total debt and divide that by their liquid net worth… what we call their account balance. It gives us total debt to account balance.

If we take the average of total debt to account balance for the entire 60-year period, it gives us a feel for what the average measure of this risk is. And then we can use that average to quickly compare one scenario to another.

With traditional Nomading™, it has an average total debt to account balance of 381%.

If they get 1 roommate, that actually increases and becomes more risky at 424% on average.

However, it drops back down to be closer to traditional Nomading… but still slightly more risky… with 2 roommates at 391% on average.

Finally, by getting 3 roommates, it is actually less risky… on average… for this specific measure of risk… total debt to account balance… with an average of 362%.

Conclusion

In conclusion, house hacking is financially like getting a side hustle.

The more roommates the more they make from the house hacking side hustle.

With more money, they can buy houses faster which leads to a higher net worth and faster journey to financial independence.

Some people would say that it comes at the cost of the inconvenience of having roommates. Others find they like having roommates. And, having roommates isn’t forever… it is only until they achieve financial independence.

But it seems it is slightly less risky overall when measuring risk as total debt to net worth with more roommates.

But, when we measure risk in terms of total debt to liquid net worth aka total debt to account balances… it is riskiest to get 1 roommate and the lowest risk to get 3 roommates. With 2 roommates and traditional Nomading™ very similar and in the middle.

If  Norm and Norma

Norm and Norma

Next Episode

Buying 10 properties as a Nomad™ over a relatively short period of time will certainly make them one of the better clients for their real estate agent.

They wonder if maybe they should consider getting their real estate licenses. By getting their real estate license, maybe they could choose to get a discount equal to the commission they would have earned by representing themselves when buying or get no discount but get a rebate on their down payment in the form of a commission by representing themselves.

When real estate agents utilize the Nomad™ real estate strategy, I call this the Ultimate Real Estate Agent Retirement Plan™ and that’s what we’ll discuss for  Norm and Norma

Norm and Norma

Also, be sure to check out the Advanced Real Estate Financial Planner™ Podcast to see how having variable property appreciation rates and rent appreciation rates, variable mortgage interest rates, variable inflation rate and variable stock market rates of return impacts  Norm and Norma

Norm and Norma

I hope you have enjoyed this episode about  Norm and Norma

Norm and Norma

Get unprecedented insight into  Norm

Norm Norma’s

Norma’s Scenario with dozens of detailed, interactive charts.

Scenario with dozens of detailed, interactive charts.

Compare traditional Nomading™ to getting 1, 2 or 3 roommates:

- Nomading™ to Nomading™ with 1 House Hacking Roommate

- Nomading™ to Nomading™ with 2 House Hacking Roommates

- Nomading™ to Nomading™ with 3 House Hacking Roommates

Compare Nomading™ to Nomading™ with 1, 2, and 3 House Hacking Roommates. This can be a little cluttered showing all 4 on the same charts.

Inside the Numbers

Watch the Inside the Numbers video to see exactly how we set up their  Scenario

Scenario

Nomad™

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 14 Norm and Norma - Buy 10 Nomad™ Properties with 5% Down with 2

Ep 14 Norm and Norma - Buy 10 Nomad™ Properties with 5% Down with 2  Accounts, 1

Accounts, 1  Property, and 6

Property, and 6  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Nomad™ with 1 House Hacking Roommate

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 19 Norm and Norma - Buy 10 Nomad™ Properties with 5% Down and 1 House Hack Roommate with 2

Ep 19 Norm and Norma - Buy 10 Nomad™ Properties with 5% Down and 1 House Hack Roommate with 2  Accounts, 1

Accounts, 1  Property, and 7

Property, and 7  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Nomad™ with 2 House Hacking Roommates

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 19 Norm and Norma - Buy 10 Nomad™ Properties with 5% Down and 2 House Hack Roommates with 2

Ep 19 Norm and Norma - Buy 10 Nomad™ Properties with 5% Down and 2 House Hack Roommates with 2  Accounts, 1

Accounts, 1  Property, and 7

Property, and 7  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Nomad™ with 3 House Hacking Roommates

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 19 Norm and Norma - Buy 10 Nomad™ Properties with 5% Down and 3 House Hack Roommates with 2

Ep 19 Norm and Norma - Buy 10 Nomad™ Properties with 5% Down and 3 House Hack Roommates with 2  Accounts, 1

Accounts, 1  Property, and 7

Property, and 7  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Podcast Episodes

The following are the podcast episodes for variations of  Norm

Norm Norma’s

Norma’s

More posts: Norm Episode