Pro Tip: Listen to the podcast below and while you’re listening follow along with the charts below. Then, when you’re done, copy the  Scenario

Scenario

Welcome to the Real Estate Financial Planner™ Podcast. I am your host, James Orr. This is Episode 14.

Today we’re going to continue with  Norm and Norma’s

Norm and Norma’s

Norm and Norma

Norm and Norma

In the last 8 episodes,  Norm and Norma

Norm and Norma

- In Episode 6, they considered investing in stocks with no real estate… not even a place for them to live in themselves.

- In Episode 7, they considered buying a home to live in and otherwise investing in stocks.

- In Episode 8, they considered renting themselves but buying ten 20% down payment rental properties.

- In Episode 9, they considered renting themselves but buying ten 25% down payment rental properties this time.

- In Episode 10, they considered renting themselves but buying ten 15% down payment rental properties with private mortgage insurance.

- In Episode 11, they considered buying a home for themselves to live in then buying ten rental properties. And, we covered 15% down with PMI, 20% down and 25% down all in one episode.

- In Episode 12, they considered renting themselves but buying ten short-term rentals with more rent than traditional year-long leases. And, we covered the 3 down payment options in that episode: 15% down with PMI, 20% down and 25% down.

- In the last episode, Episode 13, they considered buying a home to live in with 5% down and then buying ten short-term rentals. Again, we covered 3 different down payment options for this too.

Except for the first couple episodes where they invested in stocks, I’d consider the other 6 episodes to all be examples of utilizing the traditional buy and hold real estate investing strategy.

Now, we’re going to switch strategies again and  Norm and Norma

Norm and Norma

Nomad™ Real Estate Investing Strategy

So, what is the Nomad™ real estate investing strategy and why would they even want to consider it as a possible means to achieving the end of financial independence?

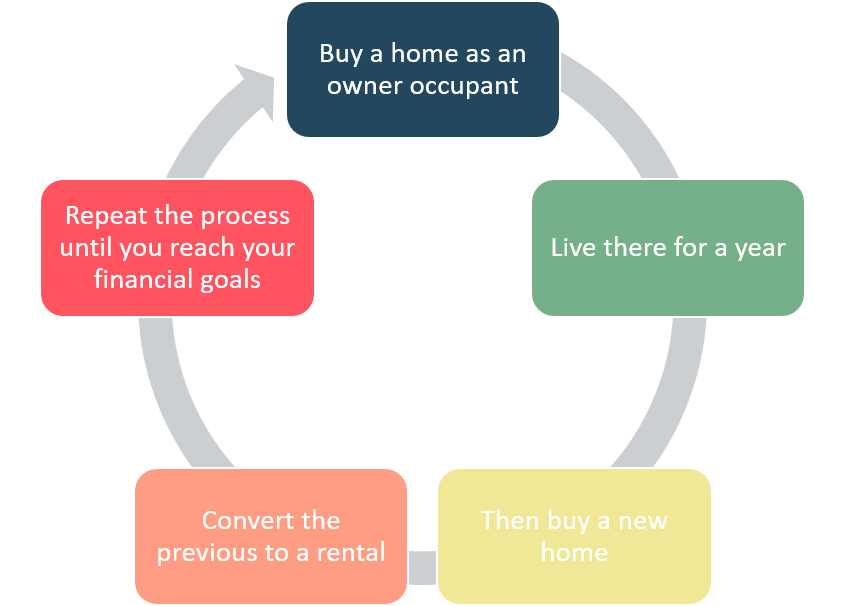

The Nomad™ strategy in its most basic form is:

- Buy a home as an owner-occupant.

- This is usually done with little or nothing down using traditional owner-occupant financing (like getting a nothing down USDA loan, a nothing down VA loan, a 3% conventional loan, a 3.5% FHA loan or a 5% down conventional loan).

- In most cases, they will have private mortgage insurance (PMI) because they put less than 20% down.

- But, they also tend to get much better interest rates on the loans… even taking into account the private mortgage insurance… then you could putting 20% down as a non-owner-occupant because they are buying the properties as an owner-occupant and moving in to the property for a year.

- Live there for a year.

- To get that very attractive owner-occupant financing with the lower down payment amounts and lower interest rates, they must move into the property. Usually, the lender requires you move into the property for a year and they will require you sign a form at closing when you get the loan with you agreeing to do this as a condition of you being able to get the loan.

- There are some very unusual exceptions to the requirement to live in the property for a year, but

Norm and Norma

Norm and Norma - They could get roommates while living in the property… what we might call house hacking… but we’ll discuss that in a future episode.

- After living in the property for a year as an owner-occupant, they buy another home to live in.

- Usually, they can use the rent on a signed lease that they’re getting from the property they’re moving out of to help them qualify for the new purchase.

- If there is a positive cash flow (as defined by the lender), it actually helps them qualify.

- If there is negative cash flow (as defined by the lender), they will need to use income from other sources like their job to qualify for the new property and cover the negative cash flow.

- They move into the new home, move out of the home they lived in for a year and convert it to a rental property.

- They will usually need to move into the new property within 60 days to have it qualify as an owner-occupant property.

- Repeat this process until they acquire as many rental properties as they desire.

- While there are limits on how many conventional loans you can have when buying a non-owner-occupant investment property… usually 10… you can always get another owner-occupant property provided you can qualify with your debt-to-income.

And, that’s it. Those 5 simple steps are the basics of the Nomad™ real estate investing strategy.

For  Norm and Norma

Norm and Norma

So, they’ll end up with 9 rental properties and an owner-occupant property.

Each property they’ve lived in for at least a year.

Each property they purchased with a 5% down owner-occupant loan with private mortgage insurance.

Comparing Properties

In previous episodes, just like in this episode, it took  Norm and Norma

Norm and Norma

So, even to save up enough for a 5% down payment property, it takes 33 months for them to save up enough to buy their first property.

Plus, they’re not immediately renting any owner-occupant properties they buy right away… for the Nomad™ property, they don’t rent the first property until they’ve bought the second property.

But, if they could buy a 5% down payment property as an owner-occupant and rent it out right away, how would that compare to them buying a non-owner-occupant rental property?

Let’s take a look and see.

Appreciation

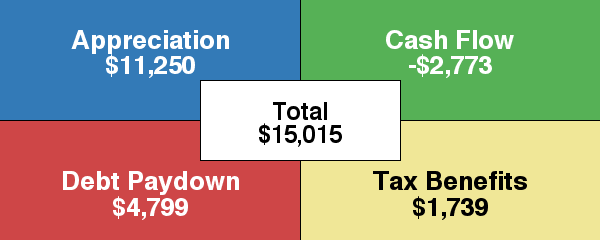

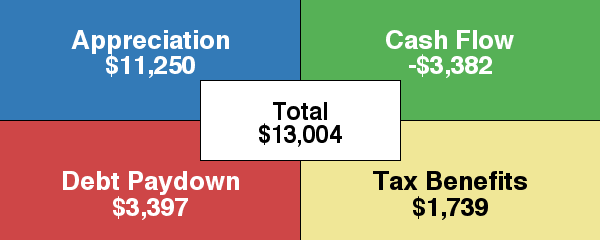

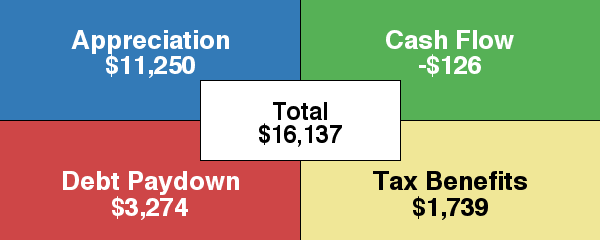

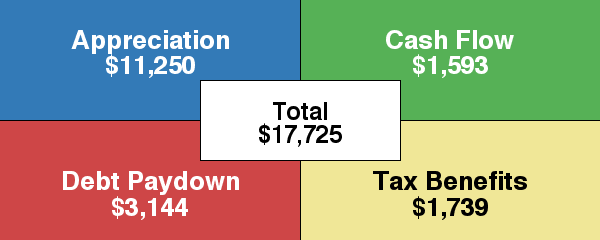

First, let’s look at how much each of the properties appreciates in the first year by looking at the Return in Dollars Quadrants™.

Since the properties are all the same, all 4 of them… regardless of down payment go up in value the same dollar amount: $11,250.

If you looked at Return on Investment Quadrants™, they’d have different numbers since each one had a different down payment amount and slightly different closing costs, but as far as the number of dollars that each one went up in value… it is the same regardless of down payment.

Cash Flow

How about we discuss cash flow next?

If  Norm and Norma

Norm and Norma

So, by buying the property with a very small down, they have almost $2,800 in negative cash flow for the year.

If they had bought it as an investment with 15% down, they would have had even more negative cash flow. Instead of $2,800 with 5% down, they’d have $3,382 with 15% down.

So, even though the put down 10% of the purchase price less… the difference between 5% down and 15% down, they actually have almost $600 per year better cash flow.

That’s pretty interesting to  Norm and Norma

Norm and Norma

Of course, if they put 20% down they’d have almost break-even cash flow. Actually… it is $126 per year negative or about $10.50 per month negative with 20% down.

But, in order to have essentially break-even cash flow, they had to come up with 15% more of the purchase price as a down payment… the difference between 5% down and 20% down.

In other words, and this is really important, they could save up about $56,250 more and have essentially no negative cash flow or they could not come up with $56,250 and have about $2,800 per year negative cash flow until rents inch up enough to not have negative cash flow.

How many years could they pay the $2,800 in negative cash flow… well it is actually $2,773… but how many years could they pay that in negative cash flow before they’ve spent $56,250?

It turns out it is just over 20 years.

I’ll pause to let that sink in… they could afford to pay that $2,773 per year in negative cash flow for over 20 years before they got to the same point where they spent $56,250.

Now, some of you would argue: “But James, they’re different: in one case you still have that money in equity and the other one you paid in negative cash flow.”

And I might ask a couple questions in response:

First, what do you gain by being able to purchase the property earlier?

The answer to that first question is: you get any returns from appreciation, from paying down the debt on the property and the tax benefits of owning the rental in the form of depreciation… all those minus the negative cash flow.

So, for the 5% down payment property… that’s about $15,000 net in the first year… even after you take into account the negative cash flow. So, while they’ve got some negative cash flow, they’re probably up net $15,000 in year 1 and every year that continues.

And, the second question I might also ask is: is the negative cash flow of $2,773 going to remain that forever?

And, the answer to the second question is: probably not.

As rents inch up a little bit each year, that negative cash flow goes down.

For example, if rents just kept pace with a long-term estimate for inflation of 3% per year, by the second year the property that was renting for $2,600 would be renting for 3% more or about $78 more per month.

$78 more per month is $936 per year… so the negative cash flow of $2,773 in the first year is more like negative cash flow of $1,837 in the second year. It is less than $1,000 in year 3 and it isn’t even negative by the 4th year.

So, instead of having to come up with $56,250… instead  Norm and Norma

Norm and Norma

Now, they do need to be able to cover the negative cash flow, but fortunately, it is not even as bad as the $2,773 per year that I made it out to be. Why?

Cash Flow from Depreciation™

It is not as bad as the negative $2,773 because of the tax benefits they get by owning a rental property.

I am not a tax professional, so check with your tax professional to get the more technical version of how depreciation works, but here’s my layman’s explanation.

The government allows  Norm and Norma

Norm and Norma

What does that mean?

If they bought the property for $375,000 and we estimate the value of the land that the property is on as worth about 15% of the purchase price, that means they can depreciate the cost of the building… which is about 85% of the purchase price or about $318,750 over 27.5 years. In other words, they can depreciate about $11,590 per year.

OK, you got that, but what does that mean?

It means they can reduce the income they need to pay taxes on by that amount.

For example, instead of paying taxes on the $72,000 that they earn from their jobs that year, they pay taxes on $72,000 minus the $11,590 in depreciation on the one rental property. Of course this would apply to additional rental properties as well.

So, they’re really paying taxes on $60,410 instead of paying taxes on $72,000.

But, what does that mean in terms of actual dollars they save in taxes? It is $11,590 times whatever the tax bracket that would have been in… typically their highest bracket. I’ll be a little more conservative and estimate it using their effective tax rate instead of the highest… so if they were paying taxes at an effective tax rate of 17.85% that means by owning this rental property they get to keep an extra $2,069 in what we call Cash Flow from Depreciation™.

We call it Cash Flow from Depreciation™ because it is cash flow they get to take in the form of not paying taxes on their income from their paycheck each pay period that they get from depreciation on the rental properties. Or, if they choose not take it as a reduction in taxes paid from their paychecks from their jobs, they would get it back as a refund at the end of the year when they file their tax return.

What does that mean? It means that instead of having $2,773 in negative cash flow… really what they have is $2,773 in negative cash flow minus the $2,069 they are getting in tax benefits… so really, they need to come up with about $704 in the first year or about $59 per month.

SIDE NOTE: The Return in Dollar Quadrants™ are using a 15% estimated effective tax rate for calculating the Cash Flow from Depreciation™ whereas for the example, I used an effective tax rate of 17.85% for  Norm and Norma

Norm and Norma

Debt Paydown

So, we’ve talked about appreciation… or the tendency for property values to increase over time.

We’ve talked about cash flow or negative cash flow… which we also call deferred down payment… depending on the down payment amount.

We’ve talked about the tax benefits of Cash Flow from Depreciation™.

But, there’s one more area of return: debt paydown.

Each month that they make a mortgage payment with a 30-year amortizing loan, a bit of the amount they owe is paid back. So, each month that they make a payment, they owe a little bit less.

If we add up all the amounts that they paid off in the first year, they paid off about $4,799 in the first year with 5% down.

The more they borrow the more that gets paid down each month.

And, the lower the interest rate the more that gets paid down each month.

Since the 5% down payment loan is both the highest balance… remember they borrowed 95% of the purchase price… and has the lowest mortgage interest rate… remember it is an owner-occupant loan… that means that the 5% down payment loan has the most paid off in the first year.

Instead of about $4,800 for the 5% down loan, the 15% down loan paid off about $1,400 less… about $3,400 total in the first year.

The 20% down payment loan about $123 less than the 15% down loan.

And, finally the 25% down payment loan about $130 less than the 20% down.

So, really the 5% down loan really gets the largest debt paydown benefit of all 4 loan types.

Totals

If we add up the appreciation, cash flow, tax benefits and debt paydown and compare the sum of all of those for each of the different purchase options, we can see that the worst dollar amount of return is from the 15% down payment loan with about $13,000 net profit total in the first year.

The 5% down Nomad™ purchase… again if they could really rent the property in year 1… which they can’t technically do… but if they could… the 5% down Nomad™ purchase compared to the 20% down payment option are pretty close… about $1,122 difference.

In other words, the 20% down payment option makes about $1,122 more from all 4 areas of return combined (appreciation, cash flow, depreciation and debt paydown) than the 5% down payment option but with about $56,250 less invested.

Instead of making $16,137 in the first year with the 20% down payment rental, by putting 5% down they’d be making about $15,015 instead.

Putting 25% down does make the most… about $17,725.

Financial Independence

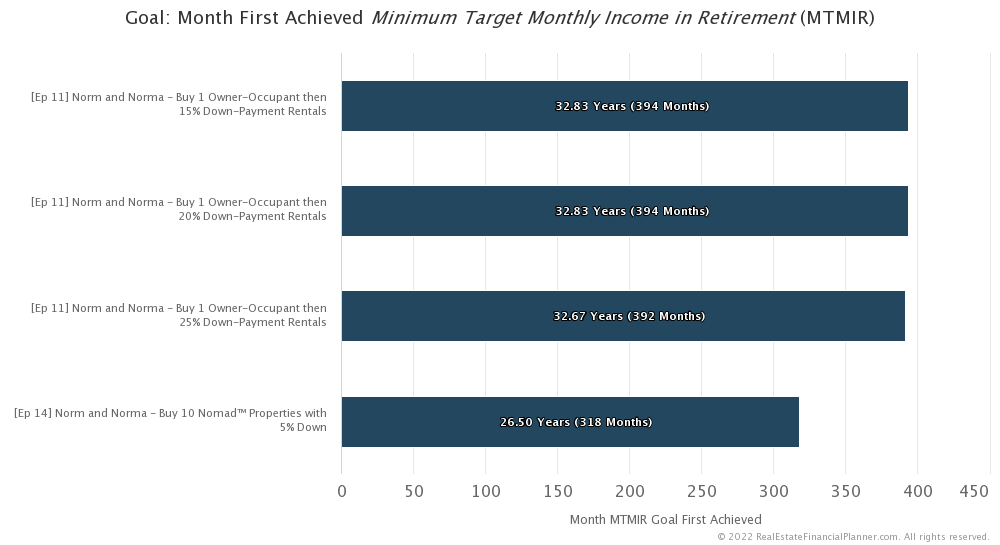

But, you know seeing that the return by purchasing a Nomad™ property is not that much worse than putting an extra $56,250 down won’t really mean that much if it doesn’t allow  Norm and Norma

Norm and Norma

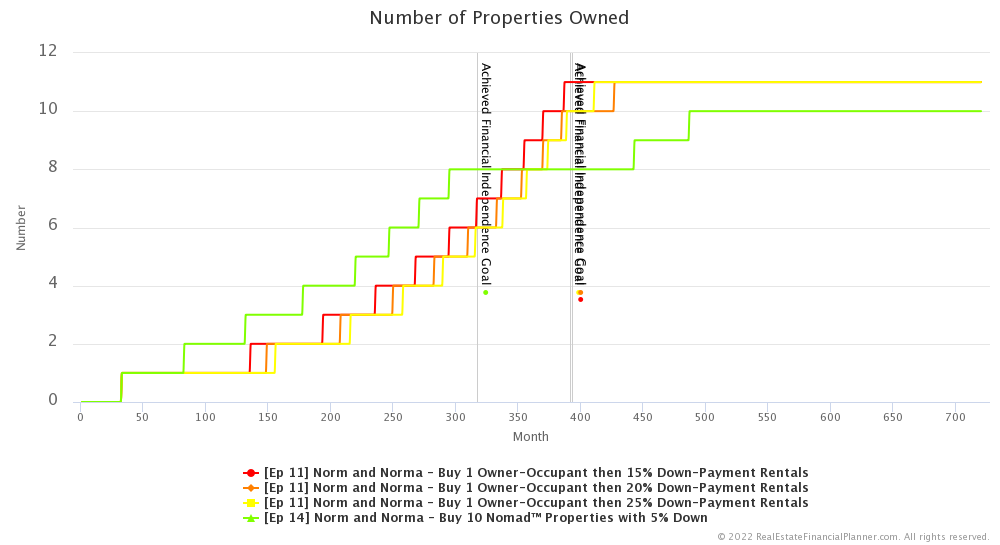

Well, the good news is that Nomad™ strategy is faster to their goal of financial independence. It is a little over 6 years faster in fact… it only takes them 26.50 years compared to almost 33 years if they just buy an owner-occupant property and then 10 rentals properties with 15%, 20% or 25% down as we discussed in Episode 11.

Conclusion

In conclusion,  Norm and Norma

Norm and Norma

It seems to be significantly faster than buying an owner-occupant property then buying 10 rentals with 15%, 20% or 25% down.

Is being able to retire 6 years faster worth moving 10 times? Only they can answer that question.

You can look at the additional charts linked below to see how the risk profiles compare but Nomad™ turns out to be remarkably resilient to drops in rent because each property is held for at least a year before it is converted to a rental property.

And, even though buying Nomad™ properties is riskier earlier on with the 5% down payment and higher loan-to-value loans, when we look at a couple of measures of risk dealing with debt, you will find that the risk is ultimately reduced faster and lower over time making it lower risk later on than the other strategies.

Next Episode

Norma is especially handy and feels like she could take a property that needs a little work and while they were living in it, fix it up and capture some sweat equity. What is the impact of buying a little fixer upper property that  Norm and Norma

Norm and Norma

Also, be sure to check out the Advanced Real Estate Financial Planner™ Podcast to see how having variable property appreciation rates and rent appreciation rates, variable mortgage interest rates, variable inflation rate and variable stock market rates of return impacts  Norm and Norma

Norm and Norma

I hope you have enjoyed this episode about  Norm and Norma

Norm and Norma

Get unprecedented insight into  Norm

Norm Norma’s

Norma’s Scenario with dozens of detailed, interactive charts.

Scenario with dozens of detailed, interactive charts.

Compare “owning and buying rentals versus Nomading™” in pairs by down payment:

- Compare 15% Down Payment to Nomad™

- Compare 20% Down Payment to Nomad™

- Compare 25% Down Payment to Nomad™

Or, compare all of them together. Please be aware that with 4 variations on the same chart, they can be a bit cluttered and harder to interpret.

Inside the Numbers

Watch the Inside the Numbers video to see exactly how we set up their  Scenario

Scenario

Owning and Buying Rental Properties

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 11 Norm and Norma - Buy 1 Owner-Occupant then 15% Down-Payment Rentals with 2

Ep 11 Norm and Norma - Buy 1 Owner-Occupant then 15% Down-Payment Rentals with 2  Accounts, 2

Accounts, 2  Properties, and 7

Properties, and 7  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 11 Norm and Norma - Buy 1 Owner-Occupant then 20% Down-Payment Rentals with 2

Ep 11 Norm and Norma - Buy 1 Owner-Occupant then 20% Down-Payment Rentals with 2  Accounts, 2

Accounts, 2  Properties, and 7

Properties, and 7  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 11 Norm and Norma - Buy 1 Owner-Occupant then 25% Down-Payment Rentals with 2

Ep 11 Norm and Norma - Buy 1 Owner-Occupant then 25% Down-Payment Rentals with 2  Accounts, 2

Accounts, 2  Properties, and 7

Properties, and 7  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Nomad™

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 14 Norm and Norma - Buy 10 Nomad™ Properties with 5% Down with 2

Ep 14 Norm and Norma - Buy 10 Nomad™ Properties with 5% Down with 2  Accounts, 1

Accounts, 1  Property, and 6

Property, and 6  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Podcast Episodes

The following are the podcast episodes for variations of  Norm

Norm Norma’s

Norma’s

More posts: Norm Episode