Pro Tip: Listen to the podcast below and while you’re listening follow along with the charts below. Then, when you’re done, copy the  Scenario

Scenario

Welcome to the Real Estate Financial Planner™ Podcast. I am your host, James Orr. This is Episode 20.

Today we’re going to continue with  Norm and Norma’s

Norm and Norma’s

Over the last few episodes,  Norm and Norma

Norm and Norma

Buying 10 properties that quickly will definitely make them one of the better clients for the real estate agent they opt to work with. Which gets them wondering: maybe one of them should get their real estate license?

Of course, getting a real estate license means they could earn extra money helping other folks buy and sell real estate.

And, even if they’re unwilling or unable to help others directly, they could refer their friends and family to a great real estate agent they know and earn a referral fee.

Getting a real estate license would cost them some time and money upfront. And, it does have some costs to maintain over time.

But, they could recoup most of that money by doing a very small number of transactions… in some markets… maybe just one transaction.

In this episode, we won’t really be considering the cost for them to get or maintain their real estate license or any extra money they could earn by having a real estate license.

I have magically assumed that they’ve done exactly enough extra transactions or referrals to cover the cost of them getting and maintaining their real estate license. So, we did not give them any extra income benefit of having their real estate license and did not penalize them with the cost of getting and maintaining their real estate license.

The Ultimate Real Estate Agent Retirement Plan™

However, they did utilize what I refer to as The Ultimate Real Estate Agent Retirement Plan™.

So, what is The Ultimate Real Estate Agent Retirement Plan™?

The Ultimate Real Estate Agent Retirement Plan™ is primarily when someone with a real estate license utilizes the Nomad™ real estate investing strategy.

There are really two significant flavors:

- Earning a commission on each property they buy, or

- Taking a commission-sized discount on each property they buy.

Earn Commission

For example with  Norm and Norma

Norm and Norma

So, they put up a 5% down payment plus closing costs to buy the property but at closing… if the real estate commission was 3% of the purchase price… they might get 3% back as a commission that looks like a rebate of their 5% down payment.

Effectively, they put up 5% and then get 3% back, so they really end up putting down 2% net as a down payment plus whatever closing costs they needed to pay.

They still need to come up with the full 5% down payment and the closing costs, but they get a good portion of that back because they’re the licensed real estate agent earning the commission representing themselves when they buy.

That’s one of The Ultimate Real Estate Agent Retirement Plan™ variations.

Discount

The other variation is instead of getting the commission back as a rebate, they instead ask the seller… as part of their offer to purchase the property… to reduce the price of their purchase by the amount they were going to pay as a commission. So, if the seller was going to pay a 3% commission, they’d instead ask for a 3% discount.

In that case, they’d be buying the property at a 3% discount. They’d need to come up with 5% down payment based on the discounted purchase price… the 5% down payment would be slightly less, but they’d be buying the property with about 3% of instant equity from the discount.

Their mortgage payment would be a little bit lower and so cash flow would be slightly better.

Buying Properties

So, how would this work out for  Norm and Norma

Norm and Norma

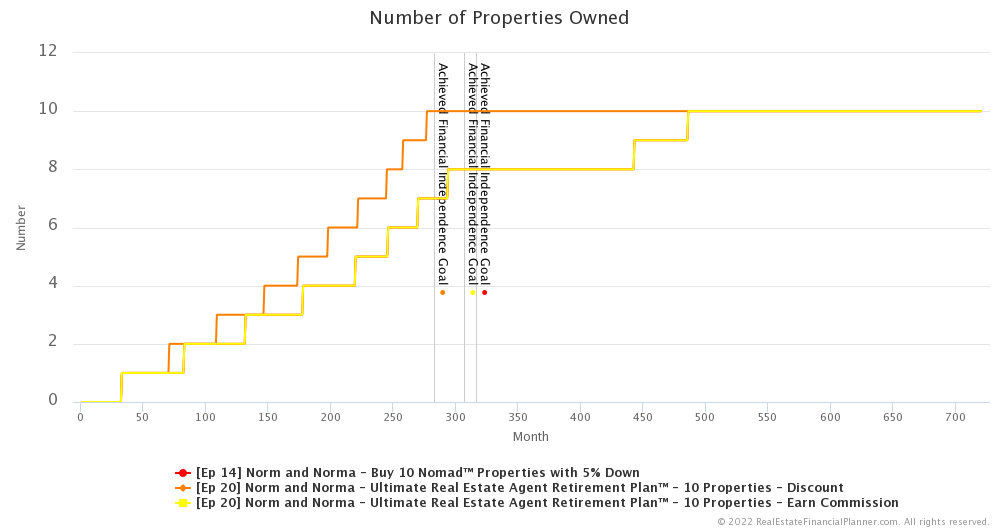

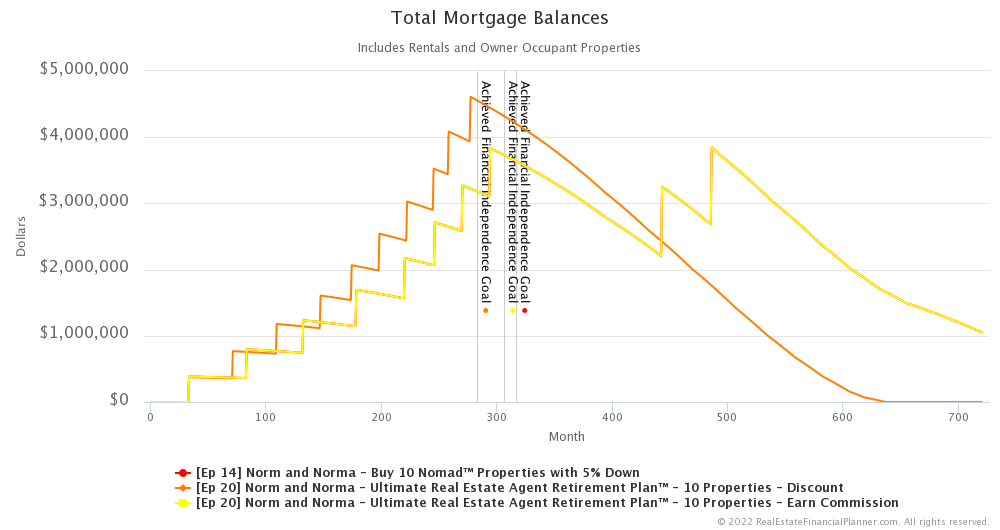

Let’s first look at how it might impact the speed at which they could acquire properties.

If  Norm and Norma

Norm and Norma

However, if they choose to take a commission-sized discount on the purchase price instead, they are able to acquire all 10 properties considerably faster.

For example, when acquiring property #8 of 10, they are able to buy that property in month 245 (about 20 and a half years in) versus month 294 (about 24 and a half years in). That’s about 4 years faster to acquiring 8 properties. That’s pretty significant.

Financial Independence

But, what about when they achieve financial independence? Does getting a real estate license while Nomading™ speed up when  Norm and Norma

Norm and Norma

Well, I’m glad you asked.

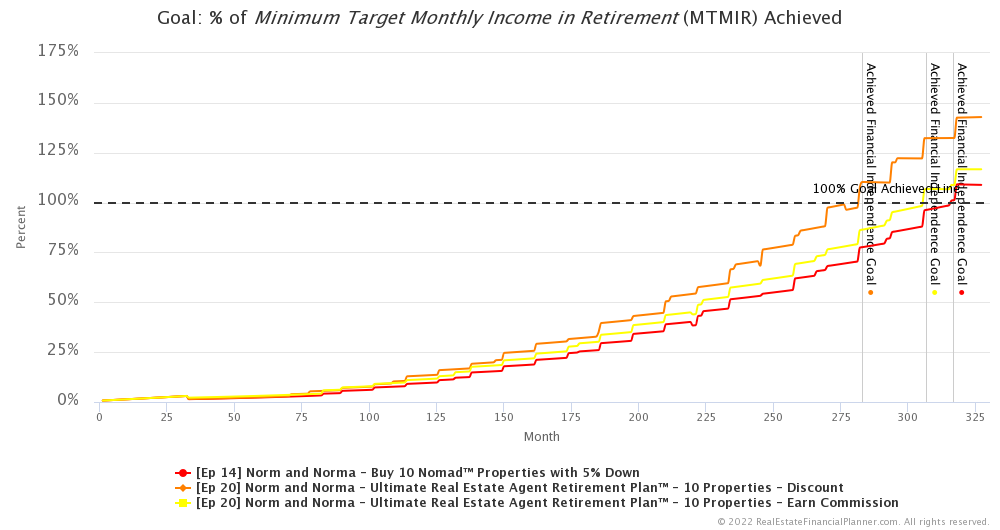

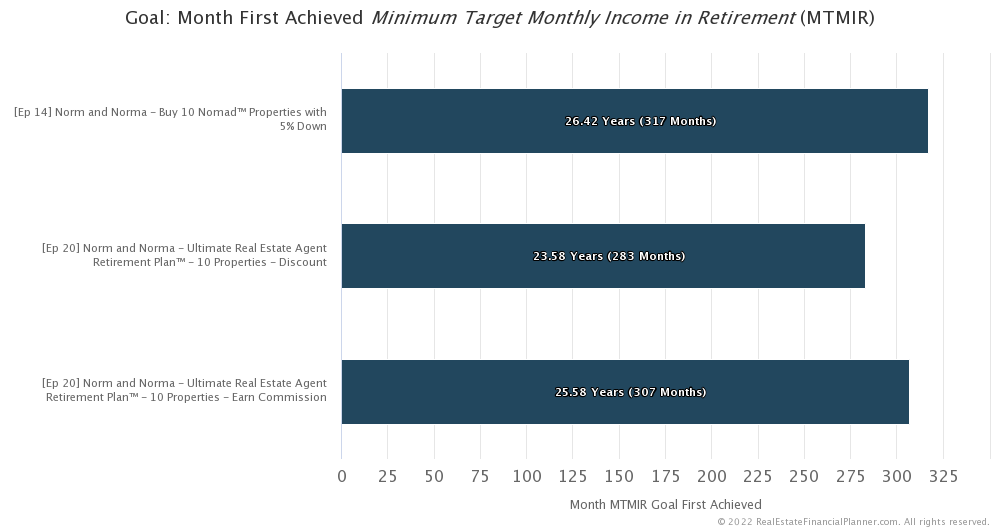

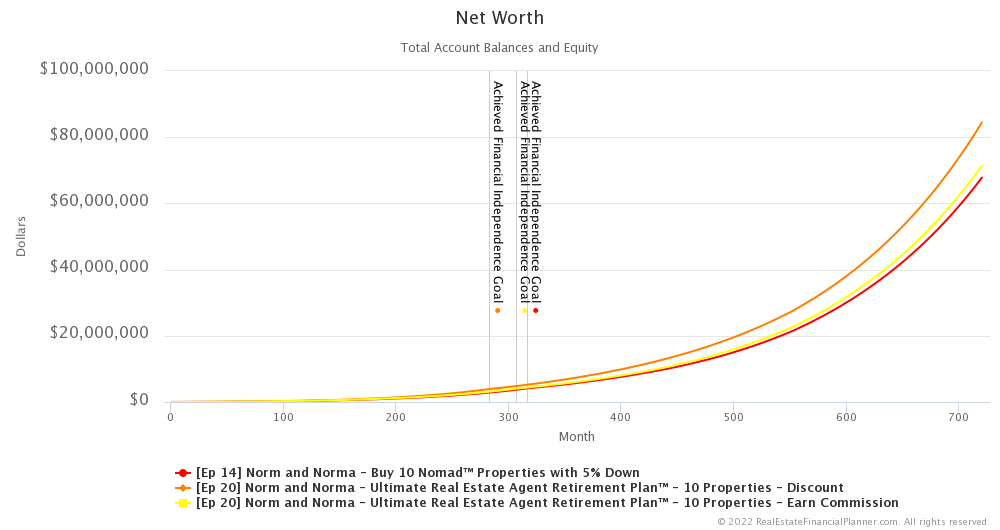

If  Norm and Norma

Norm and Norma

If they do get a real estate license and opt to get a rebate of their commission with each property they Nomad™ into, it speeds up their ability to be financially independent by about 10 months. So, they’re able to stop working a little under 1 year faster.

But, if they opt to take their real estate commission as a discount instead of getting it as a rebate, they’re able to be financially independent in 283 months… or about 23.58 years. That’s just shy of 3 years faster than traditional Nomad and a full 2 years faster than taking their commission as a rebate.

Net Worth

But the speed at which they achieve financial independence isn’t the other consideration. What about net worth?

As you’d expect, getting a real estate license to utilize The Ultimate Real Estate Agent Retirement Plan™ results in a higher overall net worth too.

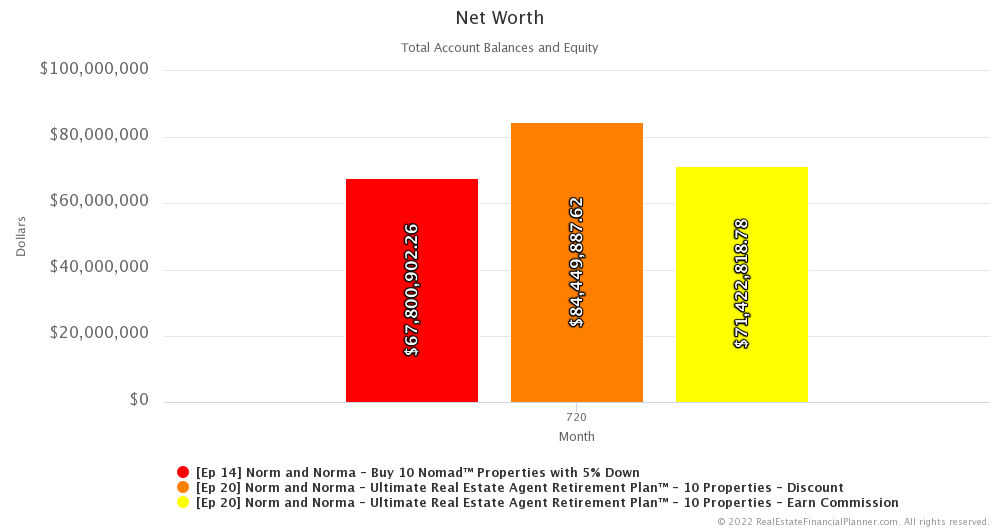

If we look at the end of our modeling… 60 years in the future… in month 720,  Norm and Norma

Norm and Norma

However, if they take their commission as a rebate they end up with $71.4 million.

And, if they take the commission as a discount off the price, it works out to be $84.4 million.

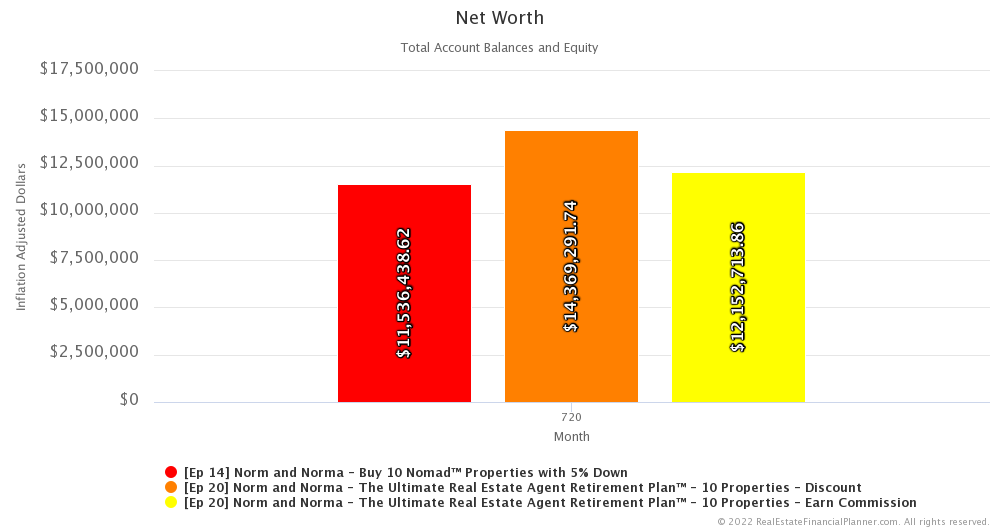

But, thinking in terms of inflated dollars that far out in the future is really tough.

What if we adjust that net worth back for inflation to what that would be worth in today’s dollars?

For traditional Nomad™ it’s like having a net worth of about $11.5 million in today’s dollars.

If they take their commission in the form of a rebate on their down payment, it is $12.1 million dollars… or about $600K more in today’s dollars.

If they take their commission as a discount from the purchase price, it is $14.4 million dollars. That’s almost $3 million more than traditional Nomad™.

These are still numbers from 60 years in the future, but we’ve adjusted them back to account for inflation into what they would be like in today’s dollars. But almost $3 million more is pretty significant.

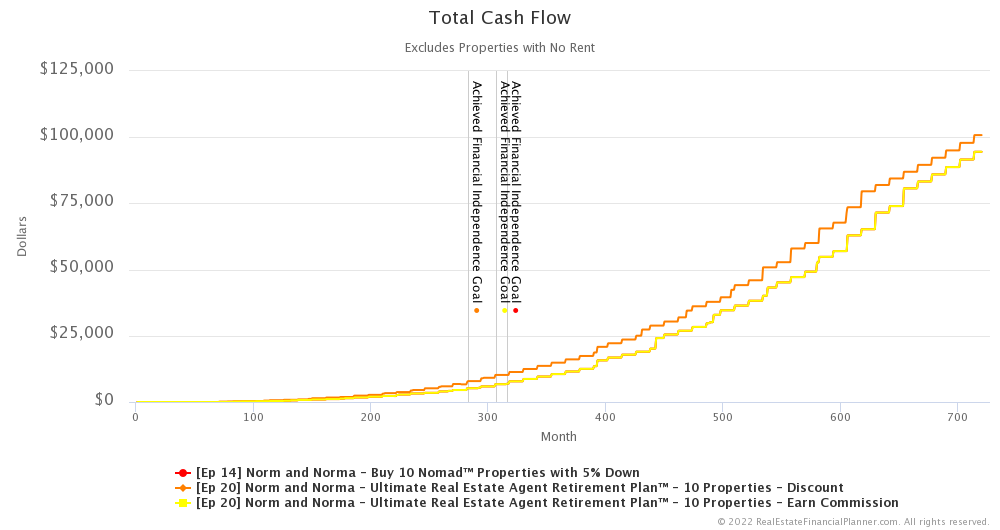

Cash Flow

But enough about net worth; let’s talk about cash flow.

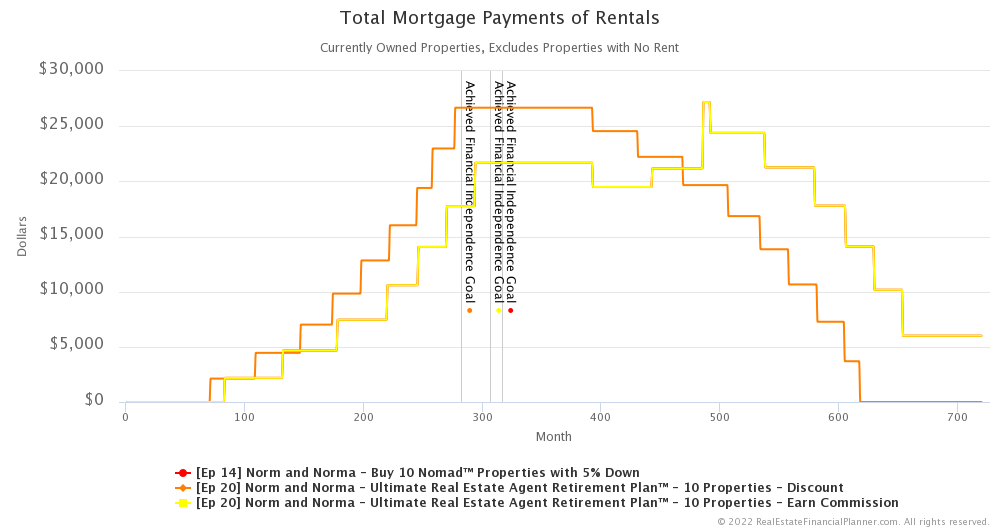

Taking a commission-sized discount means they’re borrowing slightly less.

That means they have a slightly lower mortgage payment.

That means they have a slightly improved cash flow versus either traditional Nomad™ or taking their commission as a rebate.

If we look at the properties they’re buying at the beginning of modeling… before they ever buy 1 and well before they ever convert it to a rental themselves… the cash flow difference by getting a 3% discount is a little more than $700 per year. In fact, it is about $64 per month.

Since the discount they’re getting would be about $11,250… 3% of a $375,000 purchase price if they were buying immediately… which they’re not… but just stick with me for a moment so I can make a point.

Since the discount they’re getting would be about $11,250… if we calculate what the monthly payment would be on that amount at 5.5% for 30 years… it’s just about $64 per month.

That’s largely where that extra cash flow is coming from.

And that’s per property they buy.

This is what helps  Norm and Norma

Norm and Norma

Risk

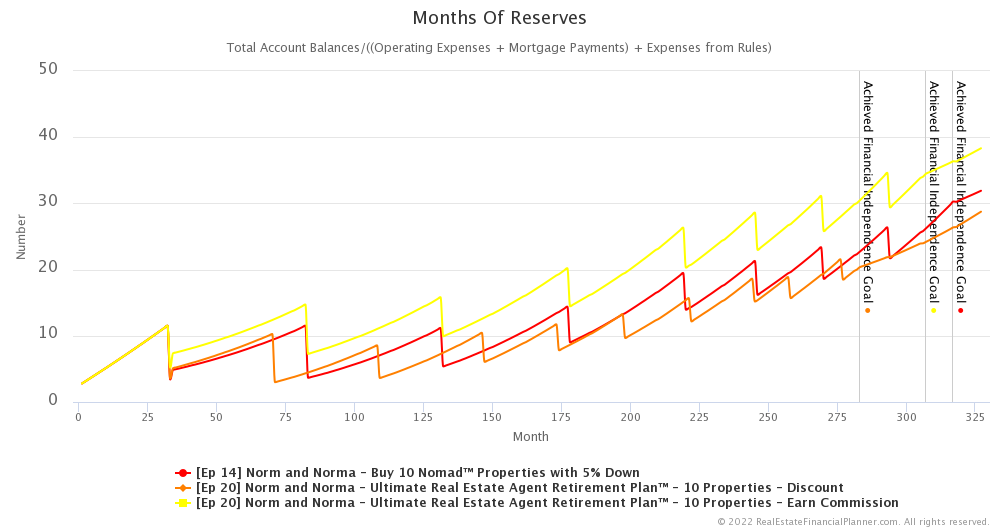

But, is there any reason for them to consider taking their commission as a rebate instead of as a discount?

You’re full of good questions today.

It turns out, yes there are good reasons to consider the rebate versus the discount.

First, if what really was holding them back was being able to save the down payment for the next property then getting 3% back when you purchase is a huge jump start on saving for the next property.

But, there’s also another reason that may be less obvious to some people: risk.

How would you like it if you every time you bought a property, you immediately got $11,250 to put in reserves to help handle anything came up on that property… or any other property you might have. That’s really what’s happening.

Each time  Norm and Norma

Norm and Norma

Now, the extra cash flow they get by taking the discount ultimately gives them more reserves overall for the entire modeling period, but in terms of short-term reserves… taking a commission as a rebate is a real plus for reducing risk.

This is a concept I sometimes talk about with investors when discussing how much to put down… in some ways, it is less risky to put less down and to have more in reserves than it is to put more down but leave yourself vulnerable to the cash requirements of owning rentals.

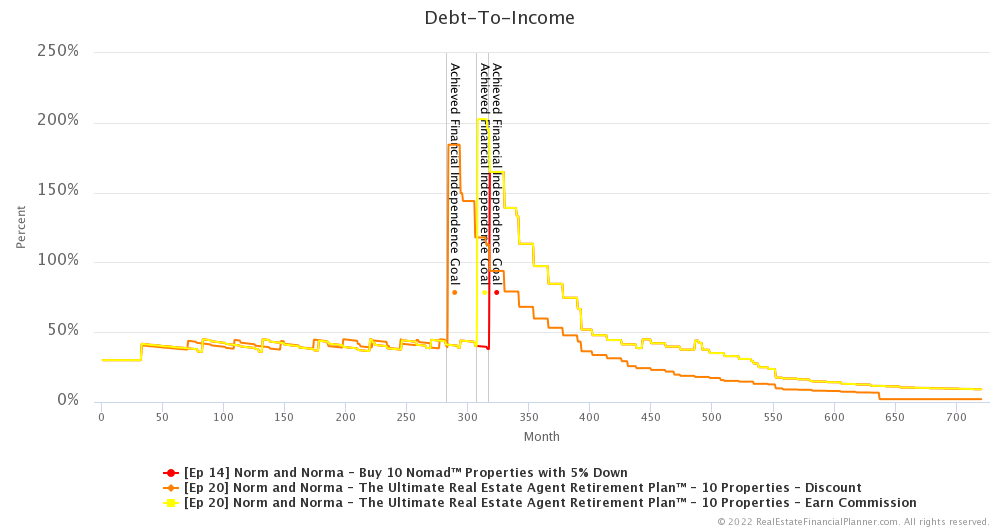

Debt-To-Income

Let’s look at a couple common measures of risk for these three options for  Norm and Norma

Norm and Norma

First, let’s look at debt-to-income.

In terms of average debt-to-income for the entire 60-year scenario, the riskiest strategy is to take the commission as a rebate. That has an average debt-to-income of 42% over the entire 60 years.

But traditional Nomad™ is up there too at 40% average for the same period. So, taking the commission as a rebate is just 2 percentage points higher on average.

Taking their commission as a discount gives them the lowest debt-to-income… an average of 35% for the 60 years. That’s 5 percentage points lower than traditional Nomad™ and 7 percentage points lower than taking their commission as a rebate.

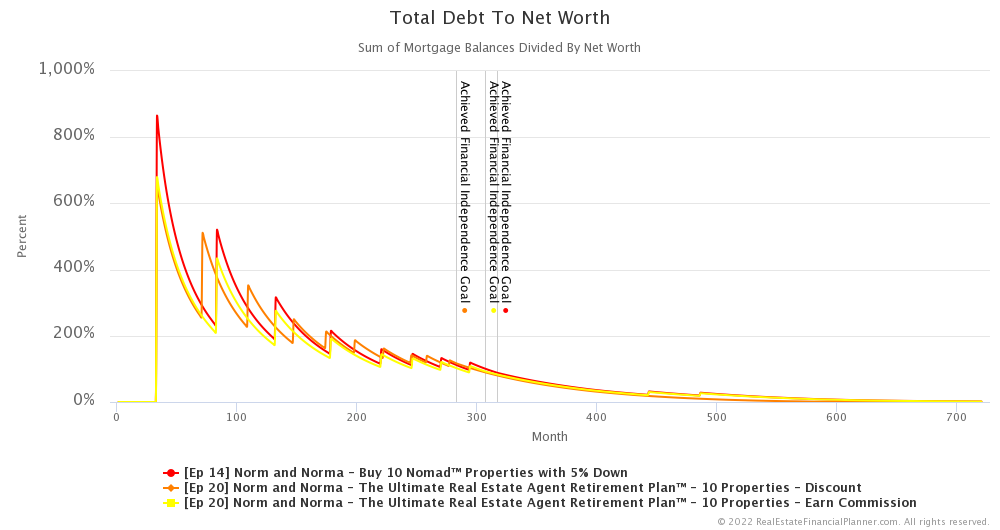

Total Debt to Net Worth

But what about measuring risk in terms of debt to net worth?

If we look at how much debt they have compared to their overall net worth, traditional Nomad™ is the riskiest with an average total debt to net worth for the entire 60-year scenario of 104%.

If they choose to take a discount when buying that’s the next riskiest at 96% average for the entire 60 years.

And, the least risky is for them to get a rebate with an average total debt to net worth of 92% for the 60 years.

So, in this one particular measure of risk, taking the rebate is less risky than taking the discount.

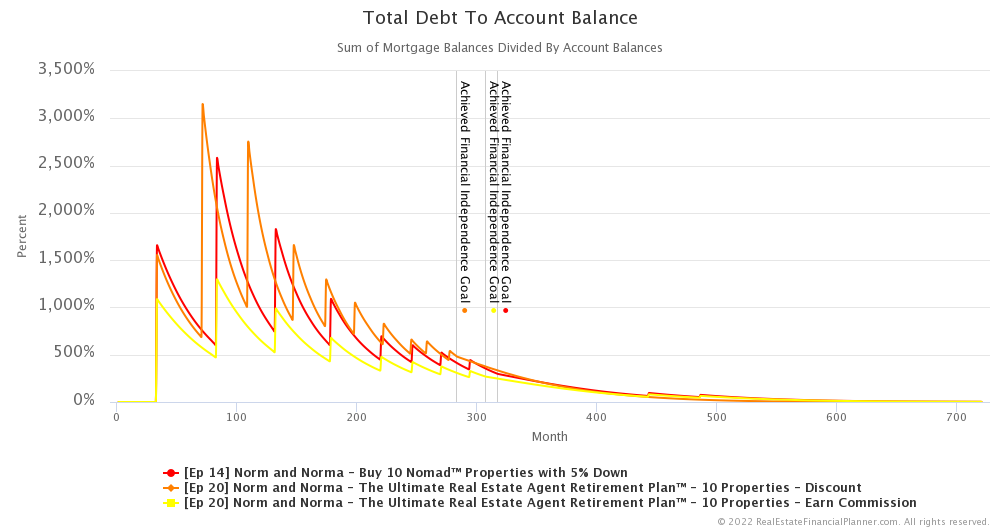

Total Debt to Account Balance

What about a measure of their liquidity compared to how much debt they have? What we might call total debt to account balance.

If we measure risk with that metric then the riskiest strategy is for them to take the discount. Taking a commission-sized discount has them buying properties faster which means more debt and not getting a commission back as a rebate means less liquid cash on hand to handle stuff if things go sideways.

By taking a commission-sized discount, their average total debt to account balances for the 60-year period is 437%.

Heck, traditional Nomad™ is better with an average of 381% over the same 60 years.

And, the least risky strategy is to take a commission-sized rebate in cash at closing to boost your cash reserves. That has an average total debt to account balance of only 259%… significantly better than the other two options in this one measure of risk.

Conclusion

In conclusion, Norm or Norma could get a real estate license. This may open up additional opportunities to earn money in the form of commissions and/or referral fees. But, we did not model the cost of getting or maintaining a license nor did we model any extra income they could make helping others buy or sell homes or referring friends and family to another real estate professional to share in the commission.

However, we did look at what having a real estate license could mean to them in terms of either getting a discount on the properties they’re already buying for themselves or earning a commission… sort of like a rebate on the down payment they’re putting up when buying their own properties while Nomading™.

When they get a real estate license and do Nomad™ I call this The Ultimate Real Estate Agent Retirement Plan™. Why? Because it is amazing to combine the two.

Of the two variations: getting a discount or a rebate… in many ways getting a discount would work out better for them. But, getting a rebate could be helpful if they’re struggling with saving for down payments and also to reduce risk in some ways like with reserves and total debt to account balance.

Is it worth the extra effort? Only  Norm and Norma

Norm and Norma

Next Episode

But before, they can really consider the question, they spot something shiny and new… what is this? Another interesting real estate investing strategy? Yes, it is… what if they were able to find a property that they could buy a rental property at a discount that needed work and then refinance the property to leave little or… ideally no money in the deal. What if they could buy, rehab, rent, refinance and repeat this to acquire several properties. We call that the BRRRR strategy and that’s what we will cover in the next episode.

Also, be sure to check out the Advanced Real Estate Financial Planner™ Podcast to see how having variable property appreciation rates and rent appreciation rates, variable mortgage interest rates, variable inflation rate and variable stock market rates of return impacts  Norm and Norma

Norm and Norma

I hope you have enjoyed this episode about  Norm and Norma

Norm and Norma

Get unprecedented insight into  Norm

Norm Norma’s

Norma’s Scenario with dozens of detailed, interactive charts.

Scenario with dozens of detailed, interactive charts.

Compare traditional Nomading™ to two variations of The Ultimate Real Estate Agent Retirement Plan™:

- Nomading™ to Earning a Commission When Nomading™

- Nomading™ to Taking a Commission-Sized Discount When Nomading™

Compare Nomading™ to both variations of The Ultimate Real Estate Agent Retirement Plan™. This can be a little cluttered showing all 3 on the same charts.

Inside the Numbers

Watch the Inside the Numbers video to see exactly how we set up their  Scenario

Scenario

Nomad™

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 14 Norm and Norma - Buy 10 Nomad™ Properties with 5% Down with 2

Ep 14 Norm and Norma - Buy 10 Nomad™ Properties with 5% Down with 2  Accounts, 1

Accounts, 1  Property, and 6

Property, and 6  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

The Ultimate Real Estate Agent Retirement Plan – Earning a Commission When Nomading™

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 20 Norm and Norma - The Ultimate Real Estate Agent Retirement Plan™ - 10 Properties - Earn Commission with 2

Ep 20 Norm and Norma - The Ultimate Real Estate Agent Retirement Plan™ - 10 Properties - Earn Commission with 2  Accounts, 1

Accounts, 1  Property, and 6

Property, and 6  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

The Ultimate Real Estate Agent Retirement Plan – Taking a Discount When Nomading™

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

Ep 20 Norm and Norma - The Ultimate Real Estate Agent Retirement Plan™ - 10 Properties - Discount with 2

Ep 20 Norm and Norma - The Ultimate Real Estate Agent Retirement Plan™ - 10 Properties - Discount with 2  Accounts, 1

Accounts, 1  Property, and 6

Property, and 6  Rules.

Rules.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Podcast Episodes

The following are the podcast episodes for variations of  Norm

Norm Norma’s

Norma’s

More posts: Norm Episode