Primary Resources

Welcome to Our Treasure Trove of Real Estate Wisdom

Greetings, fellow real estate enthusiasts! I’m James, and if you’re on a quest to deepen your understanding of real estate investing, you’ve struck gold. Below, you’ll find the entrance to our labyrinth of knowledge, a collection we fondly refer to as our Primary Resources. These aren’t just any articles; they are our most critical, most comprehensive, most insightful, and most valuable resources on real estate investing. Each piece is a cornerstone, laying the foundation for your journey towards mastery in the real estate realm.

Why are these resources so vital, you ask? They’re the culmination of years of experience, learning, and teaching in the real estate market. Whether you’re a beginner looking to make your first investment or a seasoned investor aiming to expand your portfolio, these resources are designed to guide you through the complexities of real estate investing with clarity and confidence.

As you embark on this exciting journey, remember that these Primary Resources are more than just articles; they are your toolkit for success in the real estate market. Dive in, absorb the knowledge, and let it guide you to your real estate goals. Happy investing!

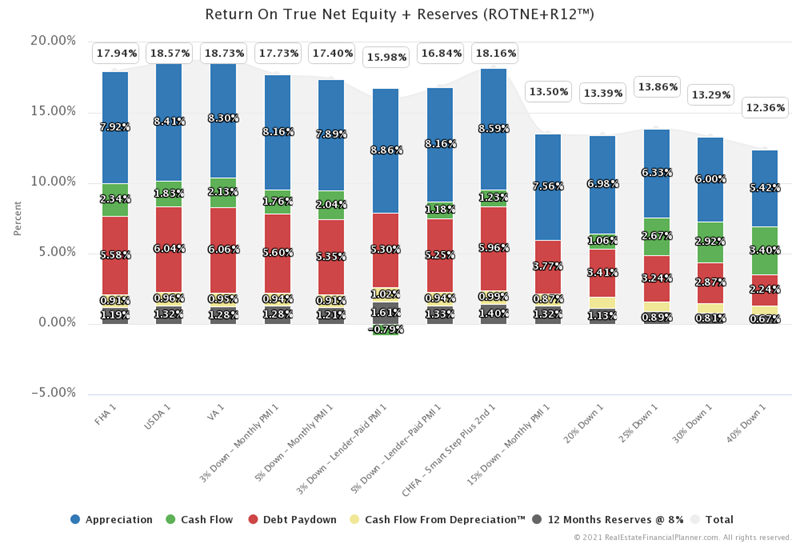

Are FHA Loans for Suckers?

In this class James discusses the pros and cons of using FHA loans. Are FHA Loans For Suckers? Their equivalent of Private Mortgage Insurance (PMI)–Mortgage Insurance Premium for FHA loans—is usually higher compared to PMI on conventional loans Their Private Mortgage Insurance never goes away You got to sell or refinance into a different loan to get rid of it Mortgage Interest Rates can be higher than for jumbo loans or VA loans There are lower down payment programs than just 3.5% down like conventional 3% down payment, VA and USDA nothing down loan programs as just a couple examples … Read more

Overcoming Hurdles to Real Estate Investing

I’ve broken this class up into 6 parts. Topics discussed include: Part 1 of 6: Introduction What’s preventing you from achieving your real estate goals? For this class, I break it down into 5 major categories Coming up with Down Payments (including closing costs and reserves) Overcoming Negative Cash Flow Qualifying for Loans Finding What’s Missing Inner Game Many of these topics have been their own 2-hour classes by themselves (and I’m sure I’ll revisit them in the future) Riddle of the farmer, chicken, bag of grain and fox: sometimes the solution to your challenges are not linear or obvious … Read more

Rent and Price Resiliency for Real Estate Investors

Topics discussed include: What is resiliency? What is Price Resiliency™? What is Rent Resiliency™? The two flavors of resiliency: dollars and percent. Measuring resiliency on the individual property basis or the entire portfolio Measuring resiliency as a snapshot in time or over time Examples using over-simplified math: What happens when rents go up 10%, down 10% in two different portfolios? What happens when prices go up 10%, down 10% in two different portfolios? Resiliency is largely about leverage Thought experiment: what is more risky… 0% or 10% down payment? The 7 Ways to Measure Risk in Real Estate Investments How … Read more

Real Estate Investing Shocks!

Topics discussed include: What are real estate investing shocks? Dan Sullivan says: If you’ve got enough money to solve the problem, you don’t have the problem. Maybe these shouldn’t be shocks… Your Shoe is Untied and How to Deal With Your Real Estate Investing Shocks Reverse Shocks – How Some Shocks Can Be Pleasant Surprises General Mitigation Principles for Dealing with Shocks The Importance of Reserves When Investing in Real Estate The Importance of a Wise Advisor to Guide You The Importance of Studying History for Real Estate Investors The Importance of Having a Backup Plan The Importance of Evaluating … Read more

Marketing to Find Off-Market Deals

Topics discussed include: How real estate investors find deals from The Millionaire Real Estate Investor book by Gary Keller et al Why Motivated Sellers? Creative Transactions and Fixer Upper Properties. Where are we in the Real Estate Investor Daily Checklist? 1-Step versus 2-Step Marketing The Importance of Being on the Right Side of the Desk Answering Service Questions and how to make an offer on the first call (to your answering service) How Much to Spend on Marketing Tests? Marketing Beliefs Sifting and Sorting to find the best deals Staying out of the Feast and Famine cycle Looking inside and … Read more

The Ultimate Guide to Real Estate Partnerships

Welcome, fellow real estate enthusiasts! If you’re on a quest to amplify your real estate game, partnering up might just be the rocket fuel you need. Let’s embark on a journey to uncover the secrets of successful real estate partnerships. Fasten your seatbelts; it’s going to be an exciting ride! Why Partner Up? Two Heads Are Better Than One: With a partner, you get to pool resources, share risks, and double your creative brainstorming power. It’s like having a real estate buddy who’s as invested in your success as you are in theirs. Access More Capital: More capital means more … Read more

The Ultimate Guide to Creative Financing and Real Estate Entrepreneurship

Welcome to the thrilling world of real estate entrepreneurship, where creativity not only applies to finding and flipping properties but also to the innovative financing methods that can make or break your deals. Whether you’re a seasoned investor or a budding entrepreneur, understanding the spectrum of creative financing options is crucial. Let’s dive into some of the most powerful tools in your arsenal for building a successful real estate portfolio. 1. Owner Financing Owner financing emerges as a beacon of hope for those who may not qualify for traditional bank loans. This method involves the property seller acting as the … Read more

Free Real Estate Investing Classes 2024

Are you dreaming of financial independence through real estate investing? Whether you’re a seasoned investor or just starting, our comprehensive suite of free real estate investing classes is your golden ticket to mastering the art of real estate investment. With a curriculum designed to cover every nook and cranny of the investing landscape, we’ve got you covered from A to Z. Let’s take a sneak peek at what you can expect from our treasure trove of knowledge. A Wealth of Topics Tailored for Every Investor Maximizing Returns with Smart Insurance Choices: Discover 8 crucial tips to save money and reduce … Read more

Should I Sell My Rental Property?

There are the non-mathematical reasons for selling your rental property and then there are the mathematical considers. We will cover both, but first let’s start with the non-math based considerations. Should I Sell My Rental Property? The following is based on my Should I Sell My Rental Property Checklist which I cover in detail in the Should I Sell My Rental? ROTNEQ+R™ class. You need to ask yourself: how do you know when the right time to sell is? It partially depends on a number of factors: Your personal situation… if you NEED the money, you NEED the money. The … Read more