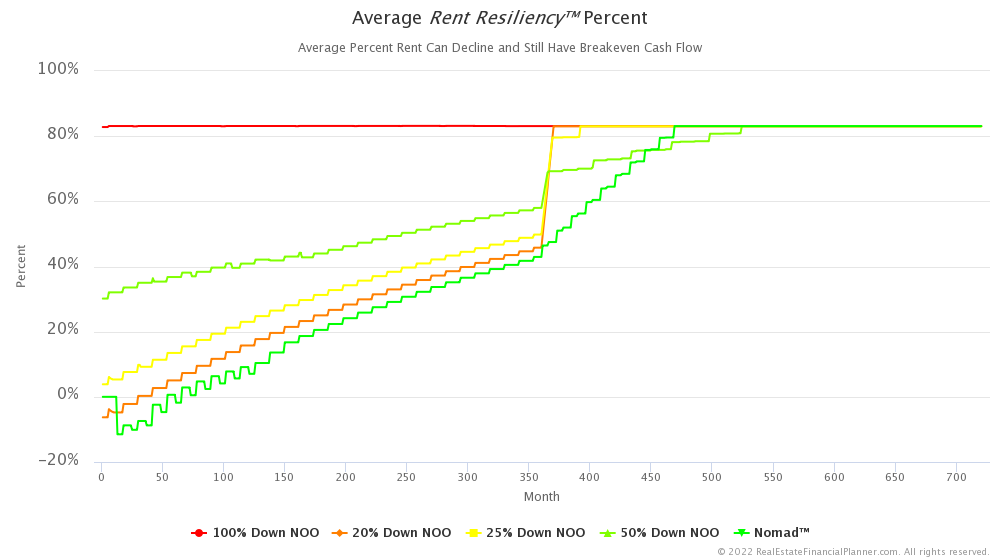

Rent Resiliency™

Rent Resiliency™ is the amount rent can decline before you have negative cash flow on rental properties. We can measure it in terms of dollars or in terms of percent. In other words, we can ask: How many dollars can rent decline before I’d have negative cash flow? Or, what percent can rent decline before I’d have negative cash flow? When we talk about Rent Resiliency™ in dollars, what we’re really talking about is Cash Flow. That’s because Cash Flow is the amount of dollars that rent can decline before you’d have negative cash flow. But, the idea of Rent … Read more