In this class James discusses the pros and cons of using FHA loans.

Are FHA Loans For Suckers?

- Their equivalent of Private Mortgage Insurance (PMI)–Mortgage Insurance Premium for FHA loans—is usually higher compared to PMI on conventional loans

- Their Private Mortgage Insurance never goes away

- You got to sell or refinance into a different loan to get rid of it

- Mortgage Interest Rates can be higher than for jumbo loans or VA loans

- There are lower down payment programs than just 3.5% down like conventional 3% down payment, VA and USDA nothing down loan programs as just a couple examples

- So, are FHA loans for suckers?

- Well, not so fast… let’s look a little closer at these issues AND some of the other benefits of FHA loans…

Private Mortgage Insurance Primer

- Since a hefty part of the discussion of FHA loans involves Private Mortgage Insurance (PMI) I’ll give you a very brief introduction about PMI here

- I’ve taught 2-hour classes just on PMI and will probably do another episode about them soon

- What is it?

- Insurance you pay for to benefit the lender to protect them in case you default

- Often can be paid up-front, monthly or both

- How much is it?

- Lots of factors determine the rate.

- Except with FHA loans they are usually standardized for everyone but can vary depending on the term of the loan you choose and the amount you put down.

- When do you typically need to pay it?

- Less than 20% down

- Some exceptions like VA

- 3 choices: monthly, lender-paid or one-time up-front

- Can increase the interest rate and pre-pay it upfront.

- Often call this “Lender-Paid PMI”

- For FHA, there is both a one-time up-front payment and an on-going monthly premium payment

- They call the one-time up-front payment an “Up-Front Mortgage Insurance Premium” and the monthly Private Mortgage Insurance Premium a “Mortgage Insurance Premium” or MIP for short

- The Up-Front Mortgage Insurance Premium is usually 1.75% of the loan amount.

- Can finance this into the loan.

- The monthly Mortgage Insurance Premium is usually .85% of loan balance when putting 3.5% down with a 30-year loan.

- It can change if you do a 15-year loan or put more than 3.5% down

Might Be Different

- Things change over time and from lender to lender

- Always check with your lender to verify what I am telling you

- Just because one lender you talk to says it can’t be done, it does not necessarily mean that it can’t be done

- Different lenders have different loan programs

- Different lenders look at things differently and may be willing to do something that all other lenders won’t

- We’ll primarily be discussing what I believe most lenders will do

- Sometimes lenders have overlays or internal policies that are more restrictive than what the loan program requires

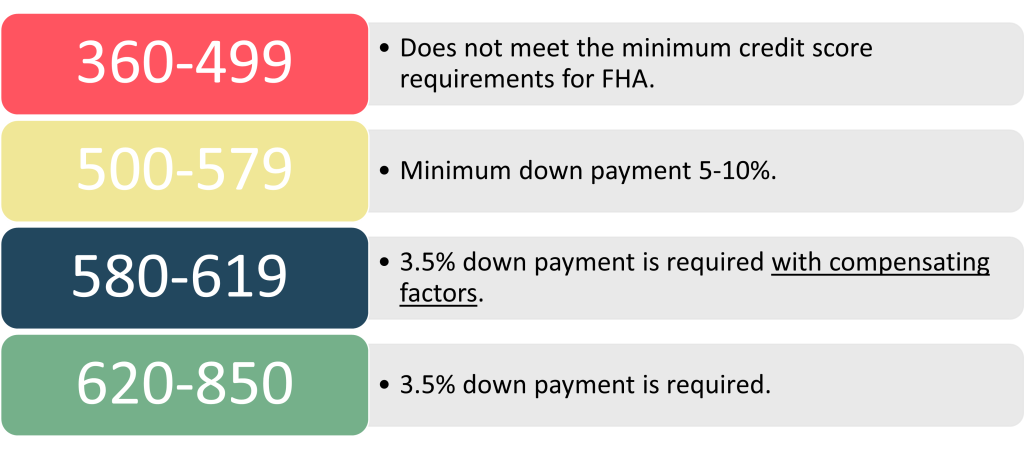

- For example, the FHA loan program may require a credit score of 640 but the lender may have an overlay that says that they’re not going to originate FHA loans unless the borrower has a credit score of 660.

- If you went to another lender, they may be willing to originate the loan with the program minimum of 640.

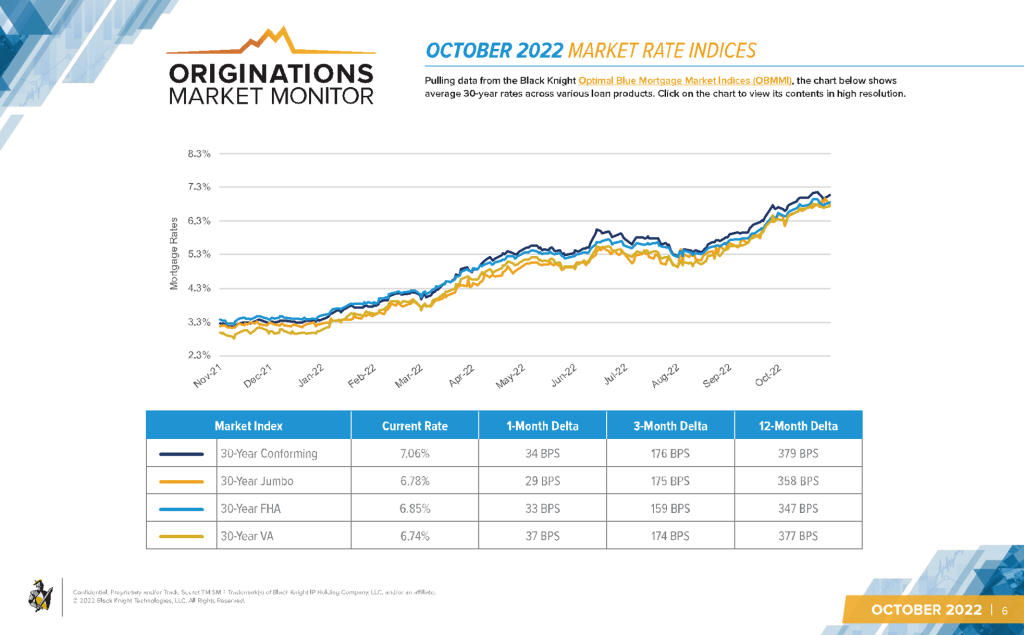

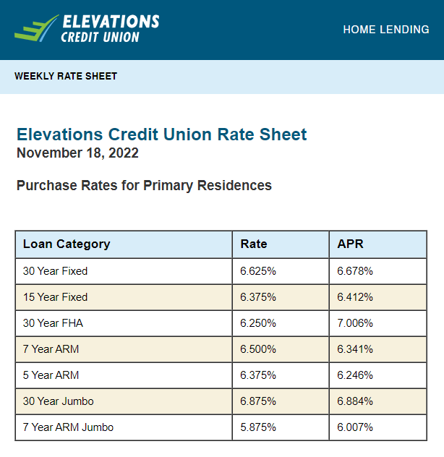

Interest Rates Comparison of Various Loan Products

Mortgage Interest Rates

- I’ll show you an email I received from a credit union (local to where I live)

- This is not an offer of that rate to you

- Rates can vary

- Over time (and even throughout any given day)

- Based on the loan product

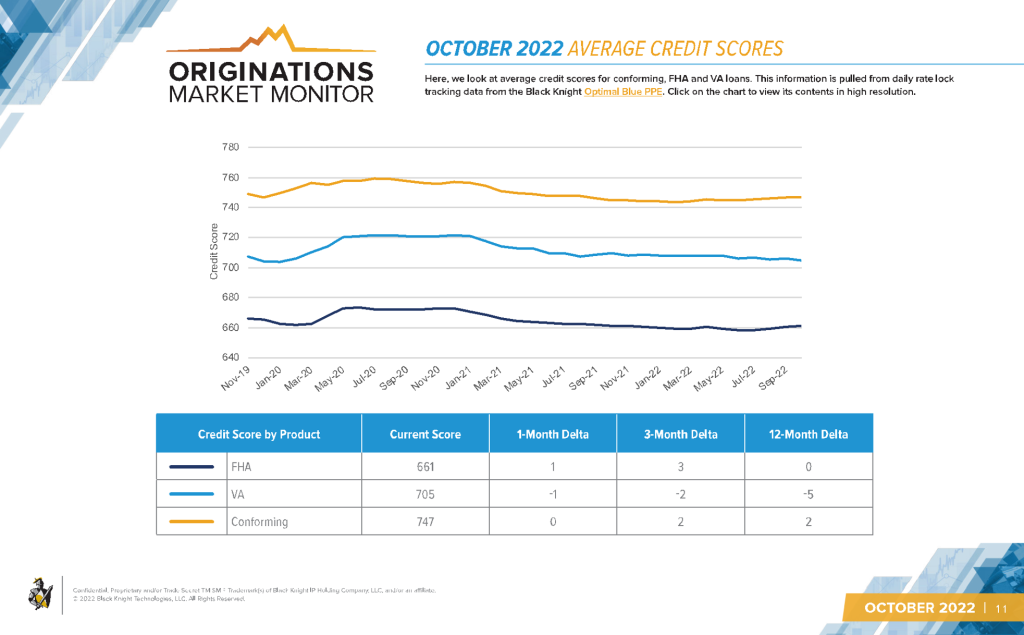

- Your credit score… although typically FHA rates do not vary based on credit score

- This does NOT include the monthly Private Mortgage Insurance/MIP premium

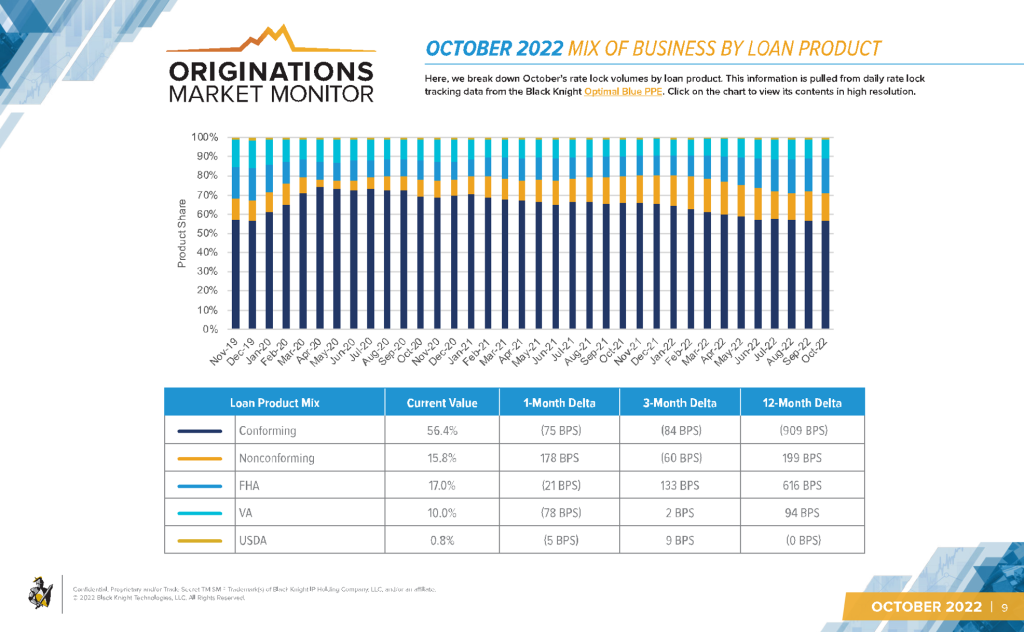

Mix of Loan Types

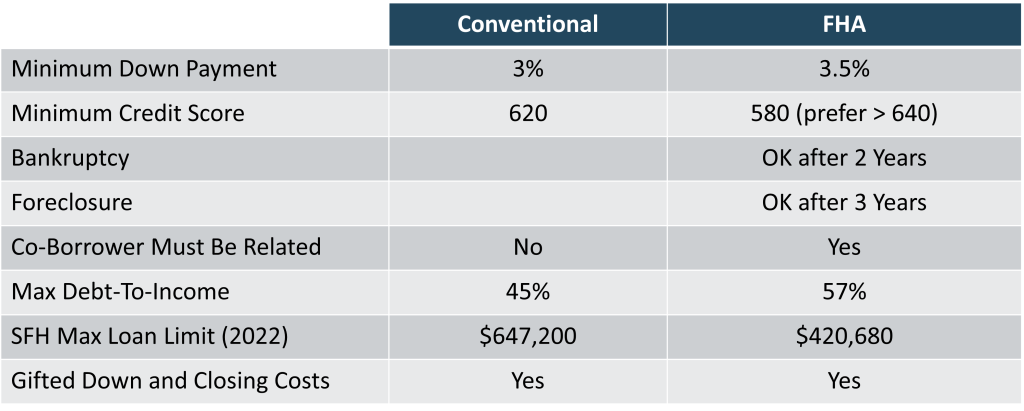

FHA Easier to Qualify For

FHA Credit Scores

Average Credit Scores

Allows You To Buy Multi-Family Properties

- One of the advantages of using FHA loans is that it allows you buy duplexes, triplex or fourplexes in addition to single family homes with just 3.5% down

- As of the time of creating this presentation there is not a conventional loan option that allows you to buy a duplex, triplex or fourplex as an owner-occupant for less than 15% down (and that’s for duplexes only).

- To buy a triplex or fourplex as an owner-occupant where you move into one of the units with conventional financing you’re looking at 20% down payment.

- To buy a duplex, triplex, or fourplex as an investment (where you don’t move into one of the units) is 25% down

- So, being able to buy a duplex, triplex, or fourplex as an owner-occupant with as little as 3.5% is amazing.

- Maybe… just maybe… FHA loans are not for suckers after all, right?

PMI Lasts Forever

- Typically, if you get a conventional loan (not an FHA loan) and put less than 20% down, you’d be required to pay Private Mortgage Insurance.

- If you opted to pay that monthly, the monthly PMI payments last until you have 20% equity in the property then you no longer pay the monthly PMI payment.

- However, that’s not the case with FHA loans.

- If you’re doing an FHA loan with 3.5% down, the monthly Mortgage Insurance Premium (MIP) never goes away even when you’ve paid down the loan and property values have gone up such that you have more than 20% equity in the property.

- If you put more than 10% down, MIP goes away after 11 years

One FHA Loan At A Time

- There are exceptions, but typically you can only have one FHA loan at a time

- So, it will be hard to Nomad™ with more than one FHA loan

- Making it hard to buy more than one multi-family property as a Nomad™ without also being able to use VA financing or alternating purchases with your spouse.

- Also, some underwriters will not approve of you buying a multi-family property after you’ve been living in a single-family home

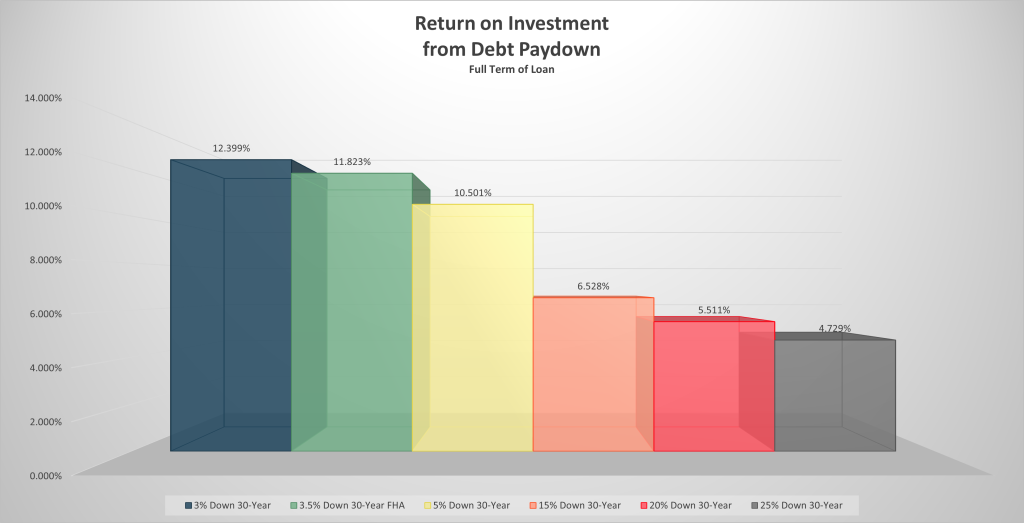

Return on Investment from Debt Paydown

So, are FHA loans for suckers?

Cons

- Higher PMI

- Lower than 3.5% down payment options available with other loan products

- Up-Front and monthly PMI (MIP)

- No benefit for higher credit score for PMI

- PMI lasts for the life of the loan

- Sometimes higher effective interest rate (when PMI is included)

- Can typically only have 1 FHA loan at a time

- Must owner-occupy

Pros

- Multi-family properties with just 3.5% down (without VA benefits)

- Duplexes, triplexes, fourplexes

- Huge plus for House Hackers and Nomads™

- Lower credit score required

- Higher Debt-To-Income allowed

- Easier to get with bankruptcy or foreclosure

- This is often the loan combined with down payment assistance programs

- If available in your market

Resources Mentioned

In this presentation James mentions the following resources:

- The Ultimate Guide to Private Mortgage Insurance – A full class on Private Mortgage Insurance.