In this special, first-time-ever class, James shares the two-hour version of the stuff he wishes he could share with every client that is about to make an offer on a property.

This class was taught on March 24, 2021.

Premise of the Class

If I could have the following two-hour conversation* with everyone right before they make an offer: that would be ideal.

*Plus, the reference materials/classes.

Here’s the library of real estate investor classes by year (for those that don’t know).

Resale versus New Construction

I am primarily referring to buying a resale property.

New construction has its own set of challenges. Check out the entire class we did on buying new construction properties.

Have You Read The Contract?

Have you read the Contract to Buy and Sell Real Estate?

Did you highlight it as you read with questions for:

- Real estate, general or procedural questions for your Real Estate Broker?

- Legal Questions for Your Attorney?

- Tax Questions for Your CPA?

Did you schedule time to ask your Attorney, CPA and Real Estate Broker the questions you have?

I took the time to walk you through the entire contract in Contract to Buy and Sell Real Estate in Detail. Note that the contract has change a little bit since we taught this class, but not enough for me to do a completely new class.

Earnest Money

- Do you know how Earnest Money works?

- Do you know how much it is?

- Do you have it available?

- Do you understand in what situations you’d lose your Earnest Money?

- Do you understand Earnest Money disputes and how it might prevent you from making other offers if there is a dispute?

- Do you understand how it counts toward your down payment?

- See entire class I did called The Ultimate Guide to Earnest Money.

RE: Earnest Money Email Template

This is a SAMPLE excerpt of what Tammy typically sends out when you make your first offer with us:

The version you get may be slightly different based on your situation.

Down Payment

Do you have your down payment?

Have you discussed the source of your down payment with your lender to make sure they’re OK with the source?

See Down Payment classes for more info:

Seller Concessions

Do you know what Seller Concessions are?

Do you know specifically what they can be used for and what they can’t be used for? They CAN’T be used for down payment.

From the Contract to Buy and Sell Real Estate:

In hot markets, you’re extremely unlikely to get a contract accepted asking for Seller Concessions.

If you do raise the price to get Seller Concessions, you introduce additional potential appraisal issues.

You may get them later in the negotiation during inspection, but you may not. Getting them later, means you need less to close giving you that money (in theory) to do the repairs from the inspection.

If you need “help” with closing costs: save more money and/or consider a loan program that you can voluntarily take a higher interest rate and get a credit at closing to help offset costs.

Some (not all) new construction may also allow you to ask for Seller Concessions. If the property does not appraise, you’re not getting Seller Concessions.

Loan Approval

Are you fully approved with a Lender? Should really do this BEFORE looking at properties.

Do you have a lender letter? With your ideal loan amount and your max? You will need this before you make an offer. Not all Lenders work weekends and evenings so you might not be able to get this quickly if you need it. Better to get it in advance.

Have you submitted all your documentation to the Lender and been approved by underwriting? Not all Lenders offer this.

Have you gotten a more accurate estimate of closing costs from your Lender?

Can Lender Hit Deadlines?

The contract is between you and the Seller. The Lender is not a party to the contract.

You need to make sure the Lender you choose can perform and meet the dates on the contract (before contract and agreeing to dates). The Seller is NOT required to give you extensions.

- Can the Lender hit the appraisal deadlines?

- Can the Lender hit the new loan deadline?

- Can the Lender show up with the money for closing?

Remember, the consequence for your Lender not meeting their deadline may be default for you (loss of Earnest Money or Specific Performance).

See Financing Classes for additional information:

Timing Inspection and Appraisal

Challenges with short periods for inspection and long wait times for appraisals. You’re going to pay for the inspection (whether you move forward or terminate).

PRO TIP: Get this done ASAP!

Lender, to hit their deadline, may need to order appraisal before you’ve negotiated your inspection.

WARNING: This timing can be tricky!

Ideally the appraiser starts the appraisal after you’re satisfied with inspection (and, if applicable, inspection negotiations).

Discuss with your Lender what happens if you cancel the contract after the appraisal is done

Check out classes on appraisals, inspections and contract to close.

Private Mortgage Insurance

If you’re putting down less than 20%, you’re likely to have Private Mortgage Insurance.

Watch The Ultimate Guide to Private Mortgage Insurance class for more info and then discuss options with your Lender.

Comps and Rent Comps

If you’ve been looking at properties and have a feel for value, you probably won’t need comps.

Comps are NOT an appraisal and not an official opinion of value. Comps will NOT tell you definitively if a property will appraise or not.

A small percentage of clients will request we pull recent comparable sales so they can evaluate them before making an offer.

Check out our class on Real Estate Appraisals for Real Estate Investors and Comparable Sales 101.

Many clients will ask us to pull rent comps. Check out The Ultimate Guide to Rent Comps for more information.

Strengthening Your Offer

If you’re in a competitive offer situation, you may want to strengthen your offer through:

- Price

- Timing (Contract and Post-Closing Occupancy)

- Loan Type

- Inspection

- Appraisal

- Home Sale Contingency

- All the other little things

See Making Strong Offers That Get Accepted class for details.

Escalation Clauses (Also Known as Trump Clauses)

Do you know what they are? A tool in the toolbox for strengthening offers.

Some agents and Sellers do NOT like them. We always ask before use them. Sometimes better to use highest and best.

There are variations of escalation clauses each with its own pros and cons.

Appraisal Waiver/Gap

Limits your ability to object or terminate based on appraisal value.

If the appraisal comes in low, you must bring the difference to closing. You are likely buying a property for more than it is currently worth. Will it go up in value? There is no guarantee that property values will increase. Property values can go up and down.

Lender will only lend based on the appraised value or Purchase Price (whichever is LOWER).

WARNING: You may need to bring your down payment AND the difference between the appraised value and Purchase Price (plus closing costs) to closing.

There are a variety ways of writing an appraisal waiver/gap (each with its own nuances). It can entirely eliminate the ability to object or terminate based on appraisal value (WAIVER) or it ensures a minimum amount that can’t be objected to (GAP).

You cannot use the loan termination deadline to terminate when it really is appraisal.

From the Contract to Buy and Sell Real Estate:

Conditional Sale/Home Sale Contingency

If you have a house to sell (to be able to buy this property).

We need to disclose this and put in a deadline in the contract. We prefer to put in Additional Provisions more info about the current status to strengthen your offer.

It is harder to get an offer like this accepted—especially in hot markets.

Taking Title To Property

- Just you: probably Severalty

- An LLC or other entity (even with more than one member or owner or beneficiary): probably Severalty

- Multiple buyers (including multiple LLCs):

- Joint Tenants, or

- Tenants in Common

See article from title company about this: https://RealEstateFinancialPlanner.com/co-owners

PRO TIP: Get advice from your attorney about your specific situation.

Improvement Location Certificates/Surveys

We prefer to preserve your right to get an Improvement Location Certificate (ILC)/Survey in the contract. Usually if you want one (or need one) you pay for it.

They can change this policy, but in many cases the title company won’t require one for a property whose legal address is “lot and block”. Some title companies may require one for purchasing Owner’s Extended Coverage (OEC).

And, they can change this policy, but most lenders won’t require one unless the title company does.

If you have specific concerns about property boundaries, fences, sheds (or other out-buildings) definitely consider paying for one. You can get valuable information from buying an ILC and/or survey.

Usually survey is required for commercial multi-family (5+ units).

For more information on ILCs/Surveys:

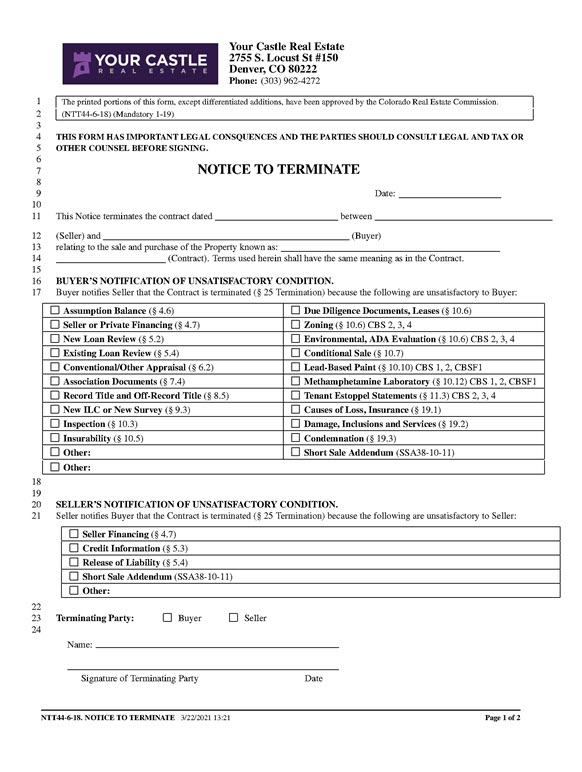

Terminating

- Notice to Terminate – unilateral

- Earnest Money Release – bilateral

Must still have the right in the contract and the deadline must not have passed.

WARNING: There is NOT a “changed my mind” clause or law.

See Contract to Close classes.

Good Faith

From Contract to Buy and Sell Real Estate:

Some examples:

- You can’t cancel for one thing when it really is another thing

- You can’t cancel if you find something else you like better

- You can’t make an offer knowing you can’t perform

- You can’t object on inspection to stuff you knew about when you made your offer

The Cost of Going Under Contract

Immediately:

- Earnest Money (counts toward down payment)

- Inspection (sunk costs): inspector, sewer scope, radon test and possible others

- Appraisal (usually a sunk cost once it happens)

- Any attorney, CPA, professional advice

Before Closing:

- Down Payment and Closing Costs

- Some lenders need to see all money used for down payment “seasoned”

Flexible Expenses:

- Moving

- Inspection Items/Rent Ready Costs

- New Construction: Items Not Included With Purchase

Fees Negotiated in Contract

These are boxes/blanks in the Contract to Buy and Sell Real Estate.

Amounts can vary widely, but I wanted to give you orders of magnitude idea of amount.

There are other closing costs (usually associated with your loan and pre-paying insurance and taxes).

- Seller Concessions – $0 – $5K

- Appraisal – $600-$800 – Almost always Buyer pays

- ILC/Survey – $500-$3K

- Title Insurance

- Owner’s Policy – ($1K-$2.5K based on property value) – Negotiated but more commonly paid by Seller

- Lender’s Policy – ($450-$600 based on loan amount) – Always paid by Buyer (or Seller Concessions)

- Owner’s Extended Covered – $75 – Negotiated

- Closing Services Fee – $350-$500 – Negotiated but most commonly split with Buyer and Seller

- Buyer typically always pays Loan Closing Fee separately if there is a loan (or use Seller Concessions if you negotiated them)

- HOA Status Letter Fee – $0-$300 – Negotiated but most commonly Buyer

- HOA Change of Record Fee (aka Transfer Fee) – $300-$1K – Negotiated by most commonly Buyer

- Sometimes there are TWO HOAs for one property, so the HOA fees may be doubled

- Working Capital – $300-$1K – Not Typically Negotiated in Contract (no blank/checkbox) But Typically Paid By Buyer

- Miscellaneous Transfer Taxes/Fees – Most Won’t Apply in NoCo

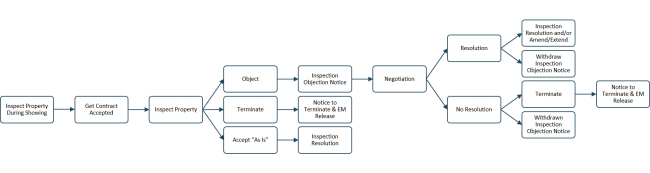

Objecting to Inspection

Limited inspection or waiving inspection to make a stronger offer.

See Negotiating Win-Win Inspections for Maximum Benefit – 2020 Edition class for more detailed information about the entire inspection process.

Objecting to Appraisal

May not apply to you if you’ve added language for an Appraisal Waiver or Appraisal Gap to make a stronger offer.

If property does not appraise for Purchase Price, you can object before the deadline.

Seller does NOT need to lower price.

Before Appraisal Resolution Deadline:

- You can negotiate to see if you can agree to new price/terms

- You can choose to withdraw objection and continue with purchase

See Contract to Close Classes for more details.

Title Commitment

Usually provided by Title Company within 5-7 days of contract execution. It is usually a dense, legal document.

First source of answers: ask the Title Company. They are selling you the policy and should be able to answer BASIC questions.

However, if you need legal advice or clarity, some Buyers will prefer to hire an attorney.

Real Estate Brokers (and especially me/Tammy) are NOT QUALIFIED to give you any advice on Title Commitment. I receive zero training on them. I don’t know what I don’t know.

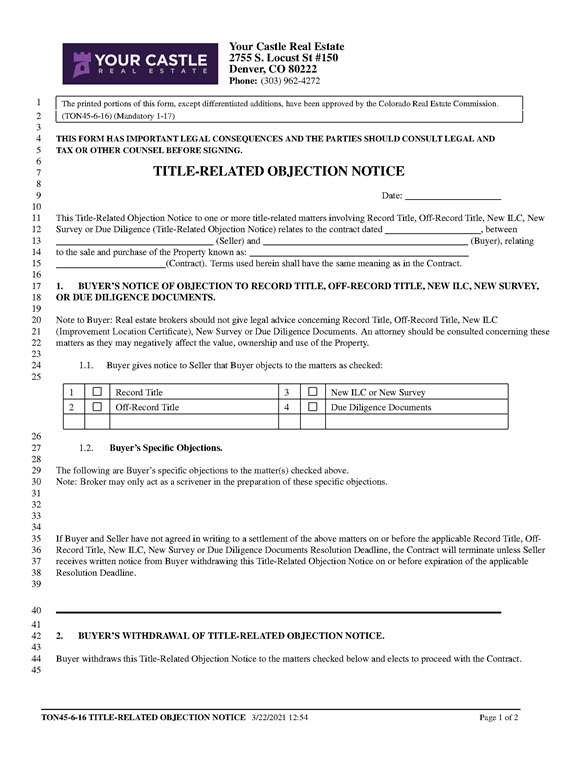

Objecting to Title, ILC/Survey, Due Diligence

You’ll want an Attorney; we (as Real Estate Brokers) are not qualified to give you advice on title work.

From Title-Related Objection Notice:

Due Diligence

Only request what is necessary. For example:

- Leases

- Security System

- Solar

Do not typically ask for:

- Appliance manuals

- Stuff you can get easily from public record yourself

Solar

Is it a leased versus owned system? Leased will not typically add any value to an appraisal.

If the property has Solar, we have an entire checklist in our process about it. I have also scheduled a class about solar for this summer.

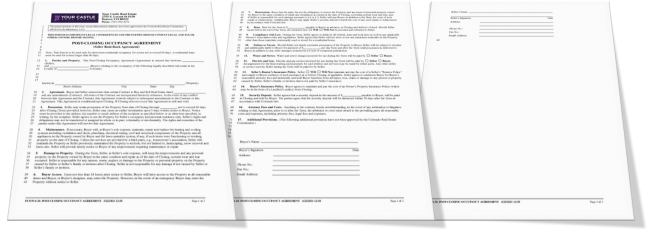

Post-Closing Occupancy Agreement

- Agreement to have a Seller stay in the property after Closing

- Only valid for 60 days – beyond that you should use a lease

- Rent versus no rent discussion

- Security deposit – some Sellers may balk, negotiated

- Repairs and maintenance

- Utilities (and how this will work with pro-rated utilities for Closing)

- Water/Sewer gets transferred at closing

- Failure to vacate or otherwise comply: you might need to hire attorney and/or go to court

- Insurance discussions with your insurance agent since it is rental then your owner-occupant policy

- If you’re considering this: make sure to carefully read the Post-Closing Occupancy Agreement and our special Post-Closing Occupancy Agreement Tips

Inclusions and Exclusions

Do you understand what is included in the sale? Do you understand what is excluded from the sale?

What the Seller is offering to be included and excluded is typically listed as INCLUSIONS and EXCLUSIONS on the MLS sheet. However, it must be in the Contract to Buy and Sell Real Estate.

WARNING: the Contract ultimately determines what is INCLUDED and EXCLUDED!

If something is IMPORTANT to you, double/triple check to make sure it is appropriately listed in the Contract to Buy and Sell Real Estate.

Prorations

Primarily taxes and rents, but there may be others. Covered in Section 16 of the Contract to Buy and Sell Real Estate.

Taxes

In most cases Most Recent Mill Levy and Most Recent Assessed Valuation. Can be tricky with new construction where taxes are still based on vacant land (or something other than full property value).

Rents

Rents Actually Received or Accrued – in many cases we’re using accrued.

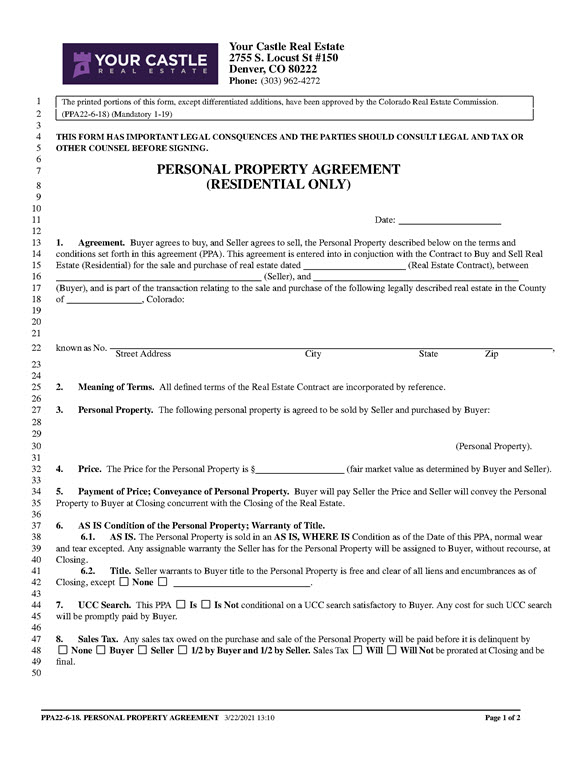

Personal Property Agreement

Unusual and rare, but if you are including personal property with the sale we might need to use this. Avoid loan fraud by documenting the inclusion of personal property.

If there is personal property, we will need to go over this form and information about how it is used in detail. Might need an attorney.