Interesting in learning about house hacking? How about the top 10 tips (plus a couple bonus tips) on house hacking?

Follow James in this special class recorded on March 4, 2021.

House Hacking versus Nomad™

House hacking is different than Nomading™. They can overlap… you can house hack while you Nomad™ or Nomad™ while you’re house hacking, but they are distinctly different.

House hacking has you rent out part of the property you’re living in. That could be buying a duplex, triplex or fourplex as an owner-occupant and renting out the other units. But it can also mean getting roommates. You could buy a single family home and get roommates or buy a a duplex, triplex or fourplex and rent out the other units and, additionally, get roommates in the unit you’re living in.

Or, you could opt to rent out all or part of your property as a short-term-rental (STR).

Since house hacking really is about getting extra income from a property you’re living in. It can also involve creative income sources like renting out an RV pad, a separate garage, an RV that is parked in your backyard, etc.

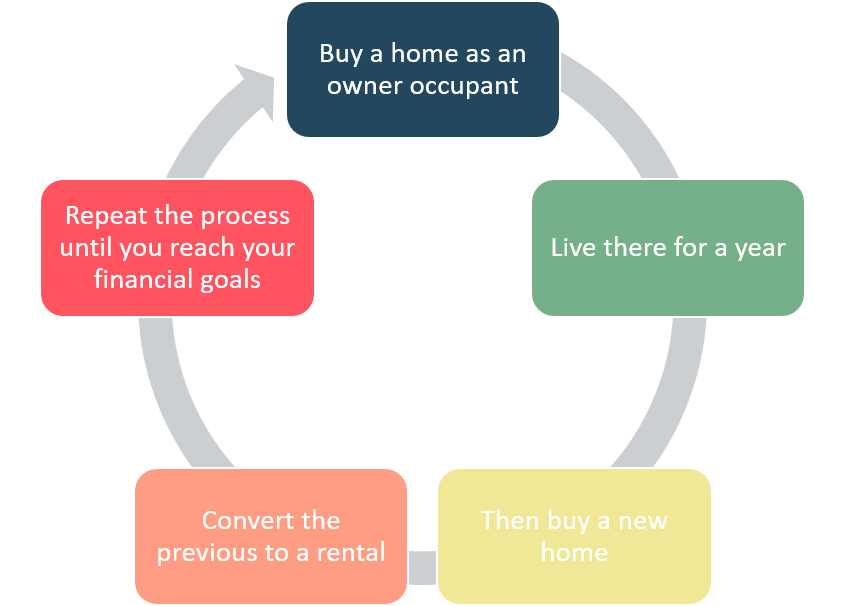

Nomad™, on the other hand, is defined as:

10 House Hacking Tips and Tricks

In the class I covered the following 10 tips (with 2 bonus tips):

- Use an Appropriate Lease/House Rules

- Maximize Cash Flow

- Property Search & Selection

- Analyze Deals

- Maximize Insurance

- Comply With Laws

- Health and Safety

- Optimize Financing

- Repeat via Nomad™

- Pay Taxes

- BONUS: Tenant Selection

- BONUS: Upgraded Finishes/Furnishings

Let’s look at each of these.

Use an Appropriate Lease

- Leasing duplex, triplex or fourplex? – Can use a typical lease with some additional provisions for unique aspects of your units (snow removal, shared yard, etc)

- Leasing to roommates? – You’ll want a roommate specific lease.

- Deals all the other stuff in my $6,000 lease plus included and excluded spaces, utilities.

- You’ll also want written house rules.

Maximize Cash Flow

House hackers are typically trying to maximize cash flow from their owner-occupant property.

Maximizing cash flow is really about minimizing expenses and maximizing income on a property.

We cover both minimizing expenses and maximizing income in the How to Improve Cash Flow Workshop class.

Property Search & Selection

First, let’s talk about the house hacking search process.

Search for your ideal house hack by focusing on the search terms that are likely to lead to the properties you’re most interested in.

For example, you could search for duplexes, triplexes or fourplexes.

However, you may also want to search for keywords like these to uncover less obvious house hacking opportunities and then manually remove false positives.

- Mother-In-Law, In-Law, Suite

- Separate Entrance

- Kitchens

- ADU, Accessory Dwelling Unit, Multi-Generation(al)

- Basement Apartment, Garage Apartment, Cottage, Compound, Pool House, Boat House

- Wet Bar

- RV

- Airbnb, VRBO, Vacation Rental, Short-Term-Rental, STR

- House Hack, Roommate

- Non-Conforming – For example: non-conforming duplex… I wouldn’t recommend violating rules to rent these as separate units, but it could be ideal for a roommate situation.

Next, let’s look at the property selection process for house hackers.

- Be careful waiting for the perfect property

- In a fast-appreciating/rising-interest-rate market, you might give up more than you gain

- If you’re going to Nomad™ and buy sequentially you’re looking for the best property within a reasonable time searching

- Select properties that would be conducive to house hacking and your situation, but doesn’t limit your use (resale, convert to more traditional rental)

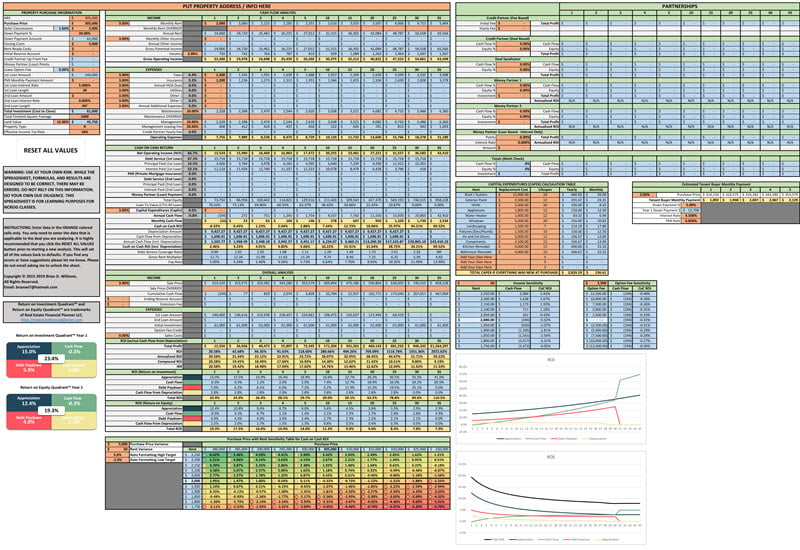

Analyze Your House Hack

Use the The World’s Greatest Real Estate Deal Analysis Spreadsheet™ or the Real Estate Financial Planner™ itself to analyze your deal. Dig into the Return Quadrants™ to better understand the true returns on your investment.

IMPORTANT NOTE: For house hackers with roommates that you utilities, maintenance and vacancy might be higher than what we might use for traditional buy and hold rental properties.

In the class video I discuss types of numbers of what you might expect to see in Northern Colorado for house hackers for duplexes, triplexes, fourplexes (with or without roommates in your unit) and for single family homes.

We have a number of Analyzing Deals Classes for you to dig into on this as well.

Insurance

Make sure you have the correct insurance by talking to your insurance agent. It is likely different than the policy you’d get for just living in the property since you have tenants living with you.

See Asset Protection classes for a lot more detail on this, but you’ll likely want to increase coverages for home, auto and umbrella policies.

And, finally, make sure your roommates have renter’s policies to cover their personal belongings.

Comply With Laws/Rules

Many counties and cities have occupancy limits that limit the number of people that can live in a property.

For example, Fort Collins has the U+2 law. However, it is not just Fort Collins… most cities in Northern Colorado have their own version of this law.

See our House Hacking versus Nomad™ class for details on local occupancy laws in Northern Colorado or ask your local real estate broker to find out about local laws in your area.

Additionally, if you plan to utilize a short-term rental strategy realize that many counties, cities and HOAs have limitations on what you can and cannot do. Be sure to thoroughly research the rules and laws in your area and keep abreast of any changes that may impact what you’re doing as well.

Health and Safety

- Smoke, fire and CO detectors

- Change batteries every 6 months

- Replace detector every 10 years

- Fire extinguishers

- Inspect every six months (replace as needed)

- Replace every 5 years

- Bedroom egress windows

- Make sure you and your tenants have the correct insurance

Financing

I strongly encourage you to watch the detailed classes we have on financing and pay extra attention to the classes that deal with owner-occupant financing (the type of financing you’re most likely to use as a house hacker). However, here are a few big picture tips in the meantime.

- Owner-occupant financing

- Better rates, but must move in within 60 days and live there for at least 1 year

- Down payment

- Nothing down, down payment assistance, 3% down conventional, 3.5% down FHA, 5% conventional or more

- Private Mortgage Insurance less than 20% down payment

- Buy Down Interest Rate

- Could improve cash flow, DTI

- Private Mortgage Insurance (PMI)

- Some loans don’t have PMI (VA or more than 20% down payment)

- 3 options: pay it monthly, pay it up-front in one lump-sum, voluntarily take a higher interest rate and have the lender give you a credit to pay it up-front in one lump-sum (often called lender-paid PMI)

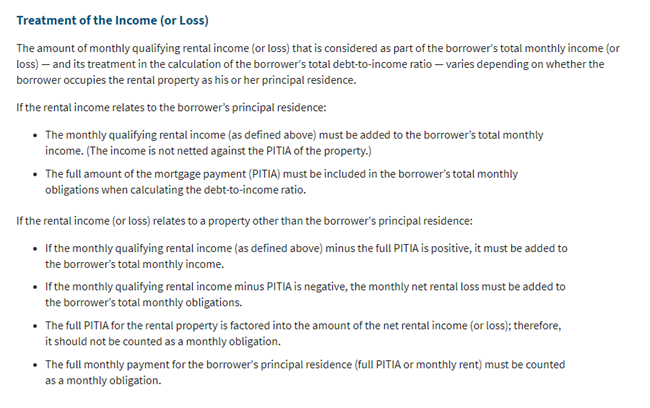

Due to time restrictions I was not able to really dive into how house hacking impacts your debt-to-income calculation, but here are the guidelines from Fannie Mae.

Pay Taxes

This should go without saying, but: Report your income from house hacking rentals

Why?

Well, first because it is the law and tax fraud if you don’t.

Second, because it helps you qualify for future loans (DTI and landlord experience).

Third, because of Cash Flow from Depreciation™.

Fair Housing Prohibitions

In the Sale and Rental of Housing, it is illegal discrimination to take any of the following actions because of race, color, religion, sex, disability, familial status, or national origin:

- Refuse to rent or sell housing

- Refuse to negotiate for housing

- Otherwise make housing unavailable

- Set different terms, conditions or privileges for sale or rental of a dwelling

- Provide a person different housing services or facilities

- Falsely deny that housing is available for inspection, sale or rental

- Make, print or publish any notice, statement or advertisement with respect to the sale or rental of a dwelling that indicates any preference, limitation or discrimination

- Impose different sales prices or rental charges for the sale or rental of a dwelling

- Use different qualification criteria or applications, or sale or rental standards or procedures, such as income standards, application requirements, application fees, credit analyses, sale or rental approval procedures or other requirements

- Evict a tenant or a tenant’s guest

- Harass a person

- Fail or delay performance of maintenance or repairs

- Limit privileges, services or facilities of a dwelling

- Discourage the purchase or rental of a dwelling

- Assign a person to a particular building or neighborhood or section of a building or neighborhood

- For profit, persuade, or try to persuade, homeowners to sell their homes by suggesting that people of a particular protected characteristic are about to move into the neighborhood (blockbusting)

- Refuse to provide or discriminate in the terms or conditions of homeowners insurance because of the race, color, religion, sex, disability, familial status, or national origin of the owner and/or occupants of a dwelling

- Deny access to or membership in any multiple listing service or real estate brokers’ organization

However, and this is a quote from the HUD website:

During the video there was some debate over exactly how the exemption works so I strongly advise you to discuss this with your attorney.

IMPORTANT NOTE: Make sure you have your attorney add a clause that allows you to terminate your lease with roommates with notice.

Upgraded Finishes/Furnishings

You may be able to get higher rent for upgraded finishes and furnishings, but this might also result in higher maintenance costs.

Repeat via Nomad™

Figure out how much income you’d have if you paid off the house hacking property.

Is that enough for Financial Independence for you? See our classes on planning for retirement and specifically on the Phases of Financial Independence™.

If doing it once (with any other sources of income) was not for you to reach your financial goals, consider repeating the process by using the Nomad™ strategy.

Watch the Your Second Nomad™ Property for more information on going from one property to a second for the first time.