Let’s ask James the hardest questions yet about the Nomad™ real estate investing strategy in this special edition of Nomad™ – Ask Me Almost Anything. Recorded on February 24, 2021.

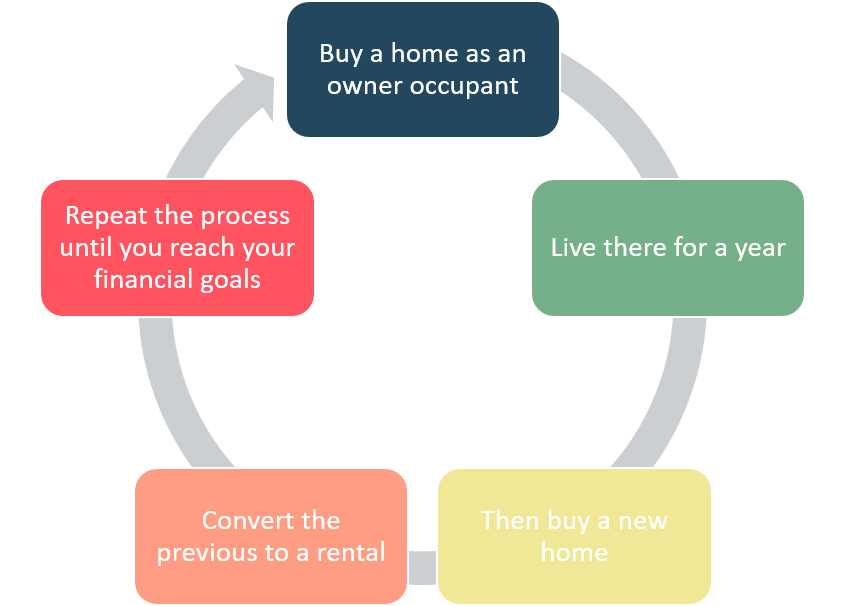

What Is Nomad™?

We started by covering what Nomad™ is:

Questions Answered

First, multi-part question:

“When I run the numbers to convert my NOCO townhome, the numbers look horrible. With a property manager I’m at -15% annual cash flow. Without a property manager I’m at -4%.”

“Without immediate cash flow from depreciation, is this still a good strategy? Is there something else I’m not seeing that would make this a good deal? ” “Thanks so much for the help!”

James takes his time and answer this question in detail.

- This is actually a much more common situation than many folks might think…

- Immediate Depreciation phases out with income over $100K

- Immediate Depreciation completely goes away for people over $150K

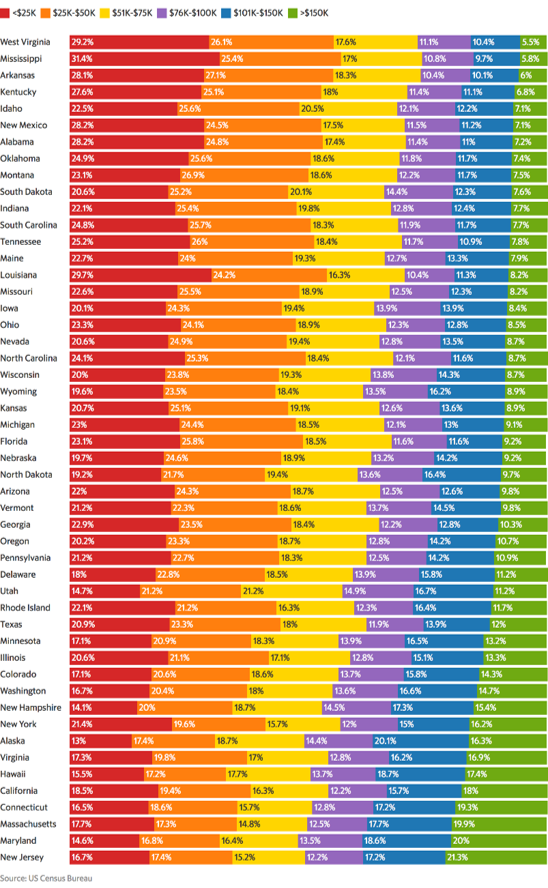

- Let’s look at how many people does this impact in Colorado (and other States)

- 70% Can Take Full Depreciation (< $100K)

- 15.8% Can Take Partial Depreciation ($100K-$150K)

- 14.3% Earn Too Much To Take Depreciation (> $150K)

- So, almost 30% are not able to get the full immediate benefit of Depreciation

- You still get it, just not in the form of Cash Flow from Depreciation™

- Let’s look at more detail…

James goes on to give a non-tax-professional explanation of “suspended losses”.

- Grouping properties for QBI or not

- Safe Harbor of 250 hours (per property or for the group)

- If you DO NOT group them… you can reduce capital gain by accumulated passive loss carryovers for that property

- If you DO group them… You need to wait until you substantially all of the rental enterprise (in the group) to deduct the suspended losses.

- In all cases, you’re still paying depreciation recapture

And, finally James starts to dig into the “horrible” returns.

- First, if it really is horrible… don’t do it

- We only do it if it makes sense

- Returns are not guaranteed (more on this in a bit)

- When I teach deal analysis, I give you rules of thumb for what a good deal looks like (not every property even remotely makes sense to buy as an investment… most don’t)

- And if they did, we’d still want to pick the best options

- For Nomads™ we often make concessions and trade cash flow for things we need in our properties to live in

- The example I am using is one of the better value deals in NoCo right now

- Horrible?! Let’s look at what might be “horrible” and my comments

Remember that “Tax Benefits” are just 1 of the 4 areas of return from the Return Quadrants™.

For one of the best value purchases in Fort Collins at the time of the class, here is what the Return in Dollars Quadrant™ might have looked like if you managed it yourself:

If we divide the dollar returns by the total amount required to purchase the property we get the Return on Investment Quadrant™ version:

If you want to see how the return looks if you don’t count the tax benefits:

Next, let’s look at the difference you might see if you manage it yourself versus having managed by a professional property manager.

Here’s the RIDQ™ (Return in Dollars Quadrant™) with you self managing:

And, here’s the RIDQ™ with professional property manager:

If we look at it from the ROIQ™ (Return on Investment Quadrant™) perspective here are how those look self-managed and professionally managed.

Self-managed first:

And professionally managed:

What if we don’t get any appreciation? This is the ROIQ™ self-managed without appreciation:

And, here’s the ROIQ™ if you hired a professional manager and the property did not appreciate:

At this point, I discuss the following:

- Invest 5% down payment and 1% in closing costs… plus… any negative cash flow to possibly get those returns?

- If you can do that somewhere else, do that…

- When did possible returns over 50% become horrible?!

Even ROIQ+R6™ and ROIQ+R12™ with FULL RESERVES are 49.67% and 40.28% respectively (self-managed) still excluding Tax Benefits.

If you need a detailed refresher on the Return on Investment Quadrant + Reserves™ stuff, check out the Everything You Learned About Deal Analysis is Wrong – ROIQ+R™ class recording where I teach it for the first time.

Let’s look at the quadrants. First, with 6 months of reserves.

And, here’s how it looks if you opt to use 12 months of reserves:

What if we don’t get appreciation? Here’s what the ROIQ+R6™ looks like:

And, no appreciation for the ROIQ+R12™:

Is that horrible?!

And, finally here is what it looks like even if you hire a professional property manager. First, ROIQ+R6™:

And, finally, ROIQ+R12™ with professional property management:

I finish up answering this question with the following comments:

- If you can get better returns elsewhere… do that instead

- Returns are NOT guaranteed (remember the top half of the quadrants are more speculative)

- Mostly likely not guaranteed elsewhere either

- Only you can decide if it is a good strategy for you

- Is this a good deal? That’s up to you to decide.

A Related Question…

“I fell into NOMADING when I upgraded condos for myself and maintained them as rentals but my accountant and said the deperciation chargeback and cap gains would kill me the longer I hold them without the years to appreciate supstatially.”

“I dont want to be managing these at age 75, so I am thinking about selling them and using the proceeds for a reverse mortgage so I can tap the equity more easily without the time restrictions and call features HELOC have. It is more favorable too get into a Reverse Mortgage LOC earlier so the LOC can grow vs. waiting to set it up later down the road.”

First, let me address being “too old to Nomad™”…

- It is true that CASH FLOW from Nomad™ can take time to improve

- However, remember what we just covered with the returns

- If you can take… presumably… a small percent of what you have to invest to support you in retirement and Nomad™ to get higher returns (on that money)… even if that is not cash flowing… it might still help your overall situation

Next, let’s look at the second part of the first paragraph:

- Appreciation does not offset depreciation recapture.

- You get the depreciation benefit as you own the property then when you sell, they ask for it back.

- In the meantime, you get temporary improved cash flow in the form of Cash Flow from Depreciation™.

- Capital gains are a percentage of your gain.

- If you don’t have a gain, you don’t pay capital gains.

- If you do have gain, you just get to keep less of it.

- There is not a “selling early”… you sell when you sell.

- The bigger issue here is cost of sale from real estate commissions, but you overcome that by selling for sale by owner (for example on a lease-option). See our Lease-Option classes for more information on those.

As for depreciation and cap gains killing them the longer they hold it… that’s just not how it works.

Depreciation and Depreciation Recapture

For each year that you own the property:

- You get to depreciate it over 27.5 years

- $325K property (with $50K in land) means you depreciate $10K per year

- You reduce your income by about $10K per year

- So you pay whatever your effective tax rate/highest tax bracket is times $10K per year less in taxes

- $10K times 20% = $2K per year less in taxes

- Every year you get to “borrow” about $2K now…

When you sell:

- You pay back the Depreciation you took later

- $10K per year times your Depreciation Recapture tax rate (max 25%)

- If you’re in a lower tax bracket when you sell (maybe you’re retired and not earning an income) it might be less than what you got

- If you’re earning more when you sell (it could be higher)

- Waiting does not automatically get worse for you

Capital Gains

For each year that you own the property:

- Property value can go up or down

- If it goes up, you increase your POTENTIAL capital gains

- Nothing happens with these until you sell

- There is no penalty for holding it

When you sell:

- You take what you sold it for and subtract out what you bought it for

- You also subtract out the costs of the sale

- You pay long-term capital gains rate of 15% on the gain

- Over-simplified Example:

- We are ignoring debt paydown

- Bought it for $200K

- Many years later you sell it for $400K and it costs you $25K in real estate commission to sell

- You pay 15% capital gains on $400K-$200K-$25K = $175K

- 15% of $175K = $26,250

- So, instead of getting a check for $175K at closing, you get a check for $148,750 (plus whatever you paid down on your loan over that time). In most cases you’ll actually get a check for the full amount and you’ll need to pay your taxes, but you get the idea.

If you have no appreciation, you have no capital gains.

If the property value does not go up and you end up selling for the same amount you bought it for, you don’t have capital gains. You don’t wait “to offset the depreciation charge back and capital gains taxes when you sell to early.”

Reverse Mortgage Question

Technically, this really isn’t a Nomad™ question, but… I do have some comments.

I agree you might not want to be managing your properties at 75 years old. I further agree you might not want to be even managing your property manager at 75. That’s up to you.

You suggested you might sell rental properties and… I am reading into your question… use the proceeds to pay off your primary residence so you can take out a reverse mortgage on it to be able to borrow against your primary residence.

Here are my thoughts on that…

Selling Properties To Pay Off Other Properties

- What you’re really asking if should you sell a property to pay off another mortgage

- Any money you use to pay off a mortgage is earning the return on the mortgage you paid off

- If you use the money to pay off a 3% mortgage, that money is earning 3%. It is a GUARANTEED return of 3% (not directly at risk to market conditions like stocks or property values)

- Do you want to invest that money at 3%?

- If so, go ahead and do that

- When you borrow money from your Reverse Mortgage you will be paying whatever the interest rate is to use that money

- Depending on which type of Reverse Mortgage you opt to get you might or might not have payments but in both cases… if you borrow from it and have a balance you are paying interest on it (it just may be either a monthly payment or accruing)

HELOC Limitations

- You’re right that HELOCs can be called due, can have shorter periods of time for repayment and tend to have more aggressive repayment periods than reverse mortgages

- I personally do not think getting into a Reverse Mortgage earlier is beneficial, but I don’t know your personal situation and for you it might be advisable… I can’t/won’t advise you on that since it is outside my area of expertise.

- But, a lot of this is about the assumptions about the return you can get on your money

- Can you invest somewhere and get a better return than the interest rate on the mortgage you’re paying off? Maybe, maybe not. I believe that I can, but only time will tell if I am right. Returns are NOT guaranteed.

For more information see Line of Credit Magic class.

Legacy Nomad™

Same plan. Two perspectives.

- Either you’re the “kid” or you’re the “adult”.

- Really could be kid, grandkid, uncle, parent, grandparent, rich friend, etc.

- The adult wants to help the kid invest in real estate.

- Could be reverse too like Nomad™ by Proxy where the adult kid helps their parent buy a house

- Adult gifts kid money for down payment.

- If you keep it below the gift level, there is no tax from gift to kid

- Kid buys property, moves in and lives there for at least a year as a Nomad™.

- Adult gets to help their kid and move some money out of their estate.

Nomad™ Without Moving In

“I’m so pleased with myself on this question but now I’m afraid you can really answer it.”

Two other full classes on this:

But, here’s the short answer:

- Flush Nomad™ – Where you have enough down payment money so that you can buy as a non-owner-occupant and not move in to acquire your rentals.

- Creative Nomad™ – Where you buy properties using creative financing like subject to, lease-option, wrap financing, owner financing with small down payments and often benefiting from the seller’s owner-occupant financing.

- Nomad by Proxy™ – Where you have someone else move into the property on your behalf.

How To Get Money For Down Payments?

We have multiple classes on Down Payments as well.

However, here’s a short list from one recent class. See the class itself for details on it.

- “Investment Cards” (aka Credit Cards)

- Security Deposit

- Maintenance Reserves

- Property equity

- Depreciation

- Retirement Account

- Family Members (Legacy Nomad™)

- Sell stuff you don’t need or want

- Saving

- From regular job, part-time, extra job, business to fund your retirement (or build your fortune)

- Partnering

- Rents (including House Hacking)

- Lease-Option Fees

A related down payment question:

- There is no rule or law that says you need to Nomad™ every 12 months

- It is true you can’t (with a few very unusual exceptions) Nomad™ faster than once every 12 months

- However, if it takes you 16, 18, 24, 36, 60 or more months between Nomading™ that’s totally fine

- You set the pace!

- If you wait long enough, you may be able to use the equity in your current property to fund the next down payment with a cash out refinance/HELOC

- IMPORTANT NOTE: This could add some additional risk since you’re “borrowing” your down payments

- If you want to increase speed, see some of our classes on speeding up Nomad™ where people use side hustles to increase or the class on how to come up with down payments

- Could use lease-options

Negative Cash Flow

- In our market, Northern Colorado, with 5% down and running real numbers you’re very likely to have negative cash flow (excluding tax benefits/Cash Flow from Depreciation™)

- With Cash Flow from Depreciation™ we’re very close to break-even

- Other markets may be very different (better or worse)

- How to Improve Cash Flow Workshop class recording

- Planning/Money Management

- Plan for it – look at total negative cash flow (Cumulative Negative Cash Flow in REFP) and set this aside in addition to reserves

Negative Cash Flow and Your Next Loan

- Lenders typically look at 75% of your rental income – expenses

- Unless you have strong income and low expenses, many clients will need to rent out previous property to qualify for next loan

- Timing can be tricky… another question about this later

- If this is positive, the rentals HELP you qualify for qualifying for loans and purchasing future properties

- If this is negative, you need income from elsewhere to help you qualify

- Different loans have different Debt-To-Income ratios required to qualify (talk to your lender)

- A common one is 45% debt-to-income meaning that all your monthly debt payments divided by your gross monthly income

What’s typically included in a Debt-To-Income calculation:

- Monthly mortgage payments (or rent)

- Escrowed real estate taxes

- Escrowed homeowner’s insurance

- Escrowed private mortgage insurance

- Monthly car payments

- Monthly student loan payments

- Minimum monthly credit card payments

- Monthly time share payments

- Monthly personal loan payments

- Monthly child support payment

- Monthly alimony payment

- Any co-signed loan monthly payments

What’s typically NOT included in a Debt-To-Income calculation:

- Monthly utilities like water, garbage, electricity or gas bills

- Car Insurance expenses

- Cable bills

- Cell phone bills

- Health Insurance costs

- Groceries/food

- Entertainment expenses

Lenders Asking Questions

- For the first property: nope.

- For the second property: probably not.

- After the second property… I think there is a high chance they might ask.

- Tell the truth.

Sketchy… Loan Fraud

- Always work within the rules of the lender.

- I am NOT suggesting you do anything even remotely gray.

- Fully comply with all lending rules and regulations.

- For the first purchase, you’re just buying an owner-occupant property to live in. This is exactly the same as any other home buyer. It is not unique to Nomad™.

- You MUST occupy the property within 60 days.

- You MUST occupy the property for a full year to comply with the lender requirements.

- If lenders change rules, we will immediately begin teaching the new rules and insisting you comply with those rules.

- For the second purchase, you’re buying another owner-occupant property to live in and keeping the previous instead of selling it. It is not unique to Nomad™.

- There is no rule that says you can’t keep the previous property you lived in and convert it to a rental.

- For the third property and beyond, ask what the rules are and make sure you comply.

- Ask if you’re able to keep the previous properties and convert them to rentals. I’ve never had a lender tell me there are rules that would prohibit implementing the Nomad™ plan.

- If you find a rule, let me know.

- We always encourage you to comply with all lending rules.

Nomad™ Doesn’t Work Here

- I’ve heard it said: “live where you want and invest where the numbers make sense”

- If that speaks to you, become an expert at long-distance investing

- You won’t be able to buy long-distance and use the Nomad™ strategy so it will require a different real estate investing strategy

- BRRR, creative financing, traditional 20/25% down, et cetera

- Some markets are cash flow markets, some are appreciation markets… it is rare to have both (see Cash Flow Versus Appreciation class on this)

- Not every market will be ideal for you to Nomad™

- Run the numbers and evaluate whether it makes sense for yourself with your goals and your resources.

- However, if you’re going to live somewhere and could buy a home to live in and it would make sense to convert it to a rental at some point in the future, consider converting it to a rental.

- If you systematically move in, live there for a year (or more) and convert it to a rental when you buy your next property… that is Nomading™.

Nomad™ and Property Managers

Two opposing questions:

and…

- Some people prefer to DIY

- Changing automobile oil, cleaning their house, mowing their lawn, et cetera

- Others prefer to focus on other types of work or “buy time off”

- Whether you choose to hire a property manager or self manage is a personal choice and we provide classes for both (managing your property manager and managing your properties yourself)

- One reminder: managing properties yourself requires you invest time (and money) to make sure you are property trained and educated on the latest laws, rules and best practices

- And, I personally believe that managing your own properties increases your risk (from an asset protection perspective)

And, another note from me: we have a ton of property management classes including ones on how to hire and manage a professional property manager as well as ones on how to manage properties yourself.

Loans on Two Properties

- The income on the property you’re moving out of can HELP you qualify for the next property you’re buying.

- This requires you have a signed lease in place for the property you’re moving out of.

- Most lenders will use 75% of Rent/Income – Expenses

- Ask your lender what they’re using for the calculation

- In some markets, cash flow on the property you’re moving out of can more than cover the expenses and… in some cases… can be more than enough to cover itself by providing a surplus of income

- In our market, Northern Colorado, in many cases you will need additional income to make up for a deficit (negative cash flow) with 5% down

- So, if you’re super close on your ratios (DTI) to qualify, you may need to wait for rents/income to increase enough so you can qualify for your next property

- Can also do things to improve this (PMI, improve cash flow, buy down rate, et cetera)

The Timing of Renting The Property You’re Leaving

- This is one of the bigger challenges of implementing Nomad™

- In many cases it is an unrealistic expectation to:

- Time this perfectly and/or

- Get top of the market rent for the first tenant

- Might model this in the spreadsheet as a “Rent Ready Cost” of purchasing the next property

- Often clients will need a lease in place to qualify for the next purchase – Debt-To-Income

- Timing this can be challenging: a lender may require the lease to qualify for you the loan, but you don’t want to sign the lease until you know the property will be completed and available for you to move into

- Resale – 30 day window, hot markets, not all deals make it to closing (inspection, appraisal)

- New construction – only estimated closing time (and can move on you)