There is a strong argument to be made that when discussing the types of real estate investors you’ll find at a real estate investor group meeting, that I should start with bird dogs and wholesalers, and move on to flippers and buy and hold investors. I’m not going to do that though. I am going to tell you about what I consider to be the absolute very best clients to work with: Nomads.

We made up the term Nomad™ to describe serial investors that buy houses regularly over time.

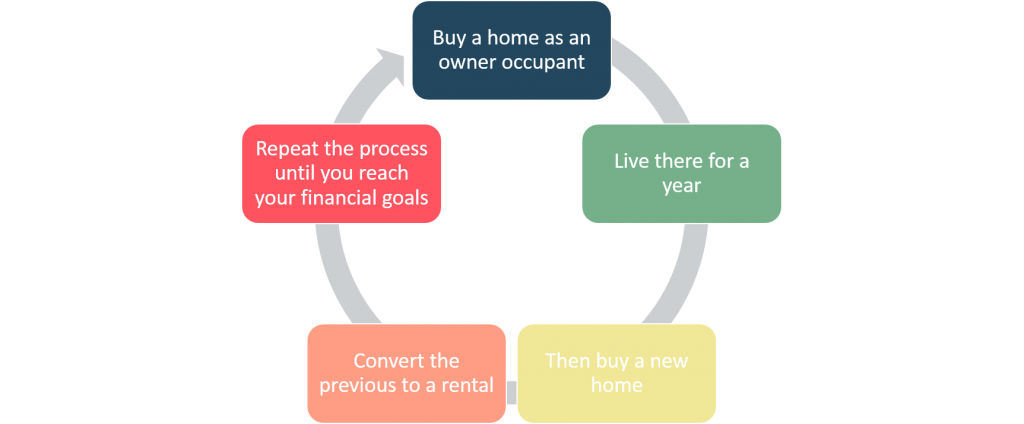

When we originally taught it, we would explain it as:

- Buy a home as an owner occupant

- Live there for a year

- Then buy a new home

- Convert the previous to a rental

- Repeat the process until you reach your financial goals

Early on, we emphasized the moving into properties component as a key attribute to being a Nomad. We have since expanded the definition and added variations of the Nomad model to include ones where you don’t need to move in (which was probably the most common objection to the model), but you’re still buying a series of rental properties.

One of the biggest mistakes real estate agents make is putting in the effort to find one-off clients… buyers or sellers that are going to do one, maybe two deals with you every 5-10 years. For 2016 the National Association of REALTORS® shows that normal Sellers are staying in their homes for 10 years on average. That means even if you got the buy side and the sell side, that’s still only averaging one transaction every 5 years if they’re now taking, on average, 10 years before they sell and move.

If you’re focused on working with these types of traditional clients, you’re opting into mining for business with the equivalent of low grade ore. Ore that will produce just one commission every 5 years on average. Compare that to working with Nomads where, with the most basic plan, our clients will be buying a new home every year and converting the previous to a rental. Now, over a 10 year period we’ve helped them buy 10 homes… not 2. That’s 500% better for us as real estate agents and an order of magnitude (10 times better) for your clients since they now own 10 properties instead of just 1 (after they sold one and bought a replacement).

Doesn’t it make sense that if you’re going to spend any time (and/or money) on attracting a specific type of client to you, that you should really focus on clients that represent multiple commissions?

Nomads are looking for nice, bread-and-butter homes in nice neighborhoods. In most cases they’re going to be living in the property for a year or so before converting it to a rental so they tend to be properties in the second quartile of home prices. Not the bottom 25% of homes by price where you get all the really rough homes. Not the top 50% where you get all the homes priced above the median in your market. Instead, the sweet spot of homes priced above the 25th percentile and below the median. According to the Gary Keller in “The Millionaire Real Estate Investor” and my own personal experience, this tends to be the sweet spot for rental properties anyway.

One of the many benefits of working with Nomads is that the model does not require them to have much money. In fact, I just finished a book last month called “How to Acquire a Multi-Million Dollar Investment Portfolio While Earning $5,000 Per Month”. In that book, I show how Nomads who have $5,000 in savings and are earning just $5,000 per month as a household, gross, before taxes, can execute the Nomad model and buy enough rental properties to retire very comfortably.

We teach a two hour class on how to finance the Nomad model and show Nomads how to buy their first home with nothing down using USDA, VA, or a local bank that has a nothing down loan program. If they don’t qualify for a nothing down program, there are conventional 1% down loan programs you can use for your first property. So, a Nomad real estate investor can get started with less than $5,000 in savings in my market. For many of them, that might mean just waiting for their tax refund to add to a little savings.

We teach a variation of the Nomad strategy where they can use the first house to provide the down payment for the next house or, they can choose to use the 3% conventional loan program for their next 2 loans. That means with less than 7% down payment, they’ve now bought 3 houses from you and converted two of them to rentals.

I’d strongly encourage you to adopt the win-win or no deal philosophy in your business. So, it is clearly good for you; you probably earned more in commission (at 3% per house they purchased) than they put down to buy the three houses. But, is it good for the Nomads? Emphatically, yes! They now have two rental properties that will help fund their retirement and we show them the math, in excruciating detail… outlining the four areas of return on investment properties: cash flow, appreciation, depreciation, and debt pay-down.

After their third property, they will use the 5% down payment conventional loan program for buying the rest of their properties. If they go and buy 10 properties total using this strategy over 10 or more years, they’ll have paid in less than 2.5 down payments had they decided to put 20% down to acquire rental properties.

Another advantage of working with Nomads is that we often recommend that for their first property they buy a duplex, triplex, or fourplex if we can find one that makes sense and use either VA nothing down or FHA 3.5% down payment financing for the purchase. This allows the Nomad to jump start their cash flowing rental properties with their first purchase and many, but not all, Nomads are attracted to this idea. One of the advantages for us as real estate agents is that when a Nomad decides they’d like to buy a duplex, triplex, or fourplex these are often larger purchases than a single family home.

In our investor group, we tend to teach a lot of Nomad related classes for several reasons. A primary reason: I want more Nomad clients. They’re amazingly appreciative, genuine, great, respectful clients to work with. If I treat them right and provide them excellent service, some of them will end up buying 10 or more properties from me over the next decade or so. That’s means they’re a $100,000 client to me and I should treat them like the VIP clients they are. You don’t need many of these Nomad clients to have a very nice business; hence the title of the book: “Fewer Clients, More Money”. By the way, I do treat my Nomad clients very well. Treating them amazingly well further attracts them to me.

Do you think they want just any old real estate agent to help them buy their Nomad properties or someone that is teaching a couple dozen classes a year on the exact strategy they’re implementing? By focusing on Nomad clients, you establish yourself as an expert in helping them and make yourself more immune to them calling another agent. Now, I think you should return phone calls within 1 business day, but with Nomads that you’re educating via your real estate investor group, you don’t have to return a call within 10 minutes or risk them calling another agent. You can have lunch in peace. You can stop looking at your phone when you’re out with other clients or at your kids play or sporting event. You can go see a movie with your spouse and not stress that you’re losing business. It totally changes your business.

Most Nomads buy properties from the MLS. They want the best selection of homes because they are looking for a home where they feel good about living in and one that will also make a good rental when they move out. Their primary selection criteria is not biggest discount (like wholesalers and flippers) and not purely cash flow (like the wholesalers and buy and hold investors). They want nice properties, in nice areas that would ultimately make reasonable rentals. That means that your Nomads are not having to low ball offers or find highly unusual properties. In fact, many of my Nomad clients willingly pay above asking price (in strong Seller’s markets) to get the right property. When you’re holding a property forever (never intending to sell it), Warren Buffet’s advice applies, “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” I’d say: it is far better to buy a wonderful Nomad property at a fair price than a fair Nomad property at a wonderful price. It is the same idea and another reason why Nomads are great to work with.