Before we dive deep into why you should work with real estate investors, it is important for you to realize that not all real estate investors are the same. There are different types of real estate investors. Some are much better clients for us as real estate agents than others.

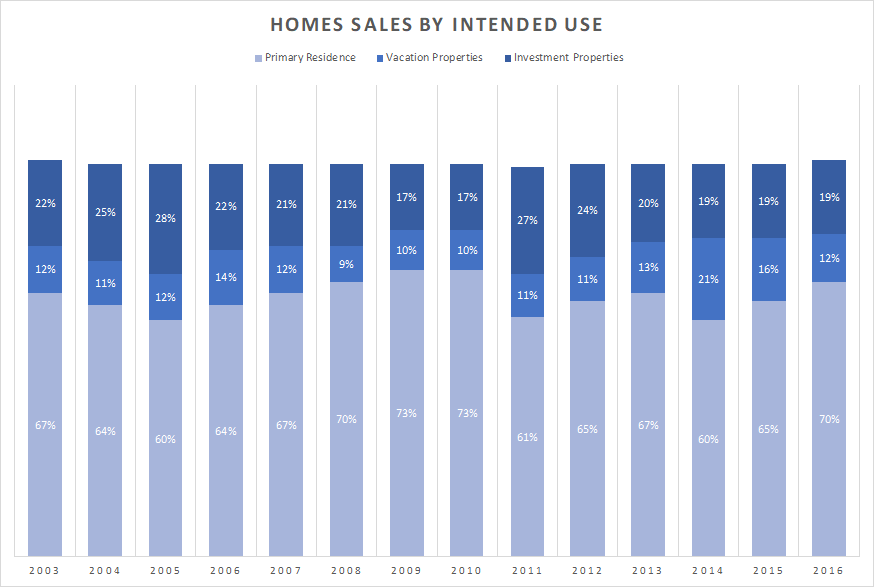

According to the National Association of REALTORS®, investment properties make up between 17% and 28% of all sales depending on which year of data you’re looking at. That means that about a fifth to as much as a quarter of all sales are to investors. If you’re not working with investors, you’re not working with a large part of the real estate market.

Most real estate investors are looking for a real estate agent that specializes in working with real estate investors. In book 2 and 3 of this trilogy on how to start and run real estate investor groups, we will go over how to create and provide on-going valuable resources to demonstrate your commitment to and specialization in working with real estate investors. This will help you capture a disproportionately large percent of real estate investor transactions.

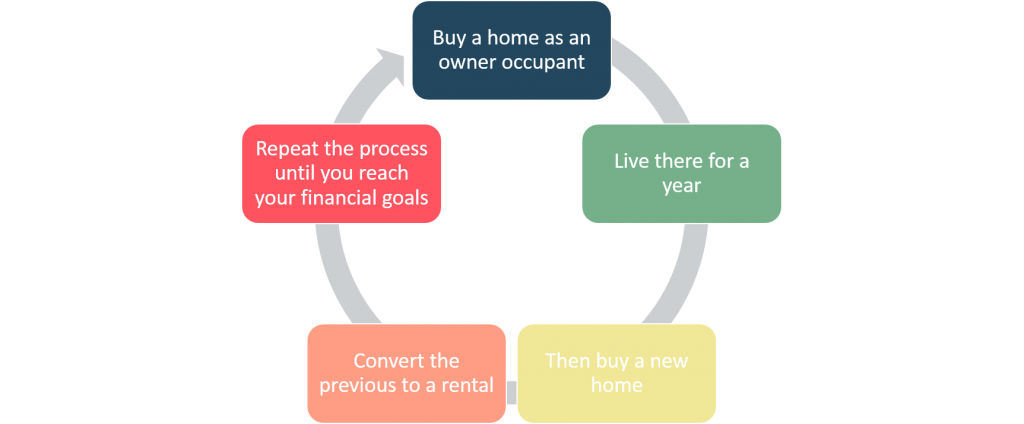

Furthermore, as I will demonstrate when we discuss working with a special real estate investor type we call Nomads, I will show you that these real estate investors actually buy properties as owner occupants with the intention that later, after they’ve satisfied the owner occupancy requirement of the lender, they will convert the property they’re living in to a rental property. This means that a percentage of your business won’t even be investment properties, but owner occupant properties that will eventually become investment rental property.

In my personal brokerage business, which I will share details about later, approximately 80% of the 42 transactions we did last year were real estate investors from our real estate investing club. Since our real estate investor transactions sometimes include a few multi-family property transactions, it is probably closer to 90% when you calculate the percentage of our income that came from real estate investors from our real estate investing group.

For now, let’s go through the different types of real estate investors together and why you may want to work with each type.